Game-Changing Technology for the Vaccine

and Therapeutic Biologics Business

Noble Financial Sixth Annual Equity Conference

ONTRACK 2010

This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are not guarantees of future performance and are subject to risks and uncertainties that are difficult to predict and which may cause our actual results and performance to differ materially from those expressed or forecasted in any such forward-looking statements. These risks and uncertainties are discussed in our registration statement on file with the Securities and Exchange Commission. Unless required by law, the company undertakes no obligation to update publicly any forward-looking statements.

SAFE HARBOR STATEMENT

iBioLaunch Platform: Best Technology for New

Influenza Vaccines

Photo from Medicinenet.com

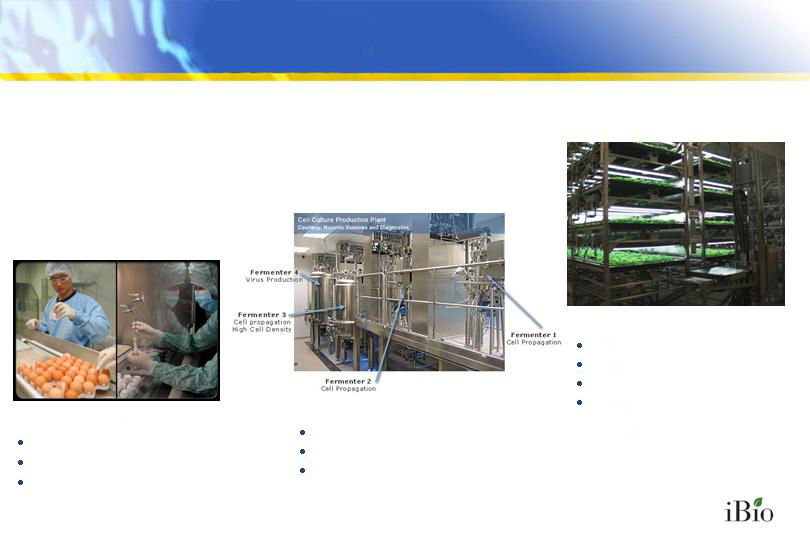

Traditional: Egg Technology

Slow

Expensive

Some Flu Viruses Kill Eggs

Photo from Novartis

Newer: Animal Cell Technology

Expensive Facilities

High Cost of Goods

Contamination Concerns

Best: iBioLaunch Technology

Rapid Production Cycles

Low Capital and COGs

Surge Capacity

No Animal/Human Pathogens

How Will iBio Create Shareholder Value?

High-Reward / Low-Risk Business Strategy

Broadly-sourced license revenue from defined product categories and

geographic regions – corporations & governments

Value-enhancing early-stage development and co-development of products

Based on Disruptive iBioLaunch™ Platform Technology

Significant cost, time, safety and freedom-to-operate advantages

With Substantial Non-dilutive Financing

Over $70 million invested to date by government agencies and NGOs

$15 million pilot plant funded by U.S. government

New third-party commitments of $9.8 million for malaria, $4.4 million for H1N1

flu, and $5.3 million for anthrax-plague

External funding committed for two Phase 1 clinical trials – 2010

A Substantial Business Opportunity:

Address International Needs for a Flexible and

Efficient Vaccine and Protein Manufacturing Platform

“For generations, the United States has neglected to nurture

the technologies and systems needed to respond to

emergencies related to disease. Nowhere has this been more

evident than in the response to H1N1.”

“In six to nine months last year, the United States was able

to identify this new H1N1 virus, make vaccine and begin

distributing it, though in inadequate amounts. There

is no

other disease to which our public health infrastructure could

respond anywhere near as quickly. For most new diseases,

the response time would be more like six to nine years.”

Bob Graham & Jim Talent

Washington Post, January 4, 2010

“Some analysts state that the

availability of more expensive,

state-of-the-art technological

services and

new drugs fuel health

care spending not only because the

development costs

of these products

must be recouped by industry but

also because they generate

consumer demand for more intense,

costly services even if they are not

necessarily cost-effective.”

Kaiser Family Foundation,

March 2010, citing

Congressional Budget Office

iBio’s Proprietary Technology Enables Flexible and

Efficient Bio-Product Manufacturing

iBio Opportunities: Vaccines and Bio-defense

Corporations seek entry into lucrative vaccine markets

Nations seek regional autonomy for response to outbreaks and/or

bio-defense

iBio Opportunities: Therapeutic Proteins

Corporations seek to enter orphan medical markets

Corporations seek to launch “bio-similar” or “bio-better” products

Problem: Nations Are Poorly Prepared

for Pandemics

“Pandemics are global but political calculation to confront them is decidedly

local,” Yanzhong Huang, YaleGlobal – September 2009

Federal officials predicted that 160 million doses of H1N1 vaccine would be

available by October. In reality, there were fewer

than 30 million by that

time. Former U.S. Senators Bob Graham (D-Florida) and Jim Talent (R-

Missouri) wrote a scathing January 4 editorial blaming the shortage on

U.S.

failure to “nurture the technologies and systems needed.” – CSIS, January

2010

“Recent clinical, epidemiological and laboratory evidence suggests that the

impact of a pandemic caused by the current H5N1 strain would be similar to

that of the 1918-19

pandemic,” Michael T. Osterholm, Ph.D., MPH, Director,

Center for Infectious Disease Research and Policy, 2008

Problem: Bio-Terrorist Attacks Are Inevitable

Washington Post –

December 29, 2004 – “Only a thin

wall of terrorist ignorance and

inexperience now protects us.” -- Richard Danzig,

former Navy Secretary and Pentagon bioterrorism

consultant

CNN – January 26, 2010

– “A commission set up to

assess national security measures on Tuesday

gave the U.S. government a failing grade in

improving response time to a biological attack.”

The iBio Solution

Deployment of the iBioLaunch™ Platform to Produce Vaccines

for Pandemic Outbreaks and Combat Bioterrorism

Dramatic Improvement in Speed of Response

Days and weeks versus months

Location Flexibility and Practical Surge Capacity

Modular design and ease of tech transfer enable regional autonomy or

decentralized manufacturing

Scalability not constrained by biological limitations of fermentation and

cell culture methods, nor by equipment fabrication

times

Substantial Reduction in Capital Requirements for Scale

Less than $100 million

capital investment targets capacity of 1.2 billion

doses per year (U.S. government-sponsored

facility)

Press reports state that a cell-based facility under development will

require

$1 billion for a capacity of only

150 million doses per year

Third Party Investments in iBioLaunch Platform

Vaccine Applications

The Bill & Melinda Gates Foundation and the Sabin Vaccine

Institute - $ 33.3 million for iBioLaunch platform applications

Avian Influenza Vaccine - $ 11.4 million

Malaria Vaccine - $ 13.3 million

Sleeping Sickness Vaccine - $ 8.2 million

Hookworm Vaccine - $ 0.4 million

U.S. Government - $ 37.4 million for iBioLaunch platform

applications

Accelerated Manufacturing Program - $ 14.8 million

H1N1 Influenza Vaccine - $ 4.4 million

Plague-Anthrax Combination Vaccine - $ 18.2 million

iBio Opportunities:

Corporations Entering Vaccine Markets &

Nations Recognizing

Pandemic Disease and Bioterrorism as

National Security Threats

1. iBioLaunch technology superior for recombinant vaccines in comparison to

bioreactor based systems

No animal components or human pathogens

Lower cost of goods

Rapid batch production cycles

Excellent surge capacity

Not dependent on access to culturable pathogens

2. iBioLaunch technology can be rapidly implemented at substantially lower capital

costs than conventional methods for vaccine active ingredient manufacturing

10 to 15 percent in comparison to animal cell / virus culture methods

The Market for New and Expanded Vaccine

and Bio-defense Applications

Global vaccine market projected at $32 billion in 2012

Influenza vaccine market projected > $4 billion in 2010

Bio-defense Vaccines

U.S. spending for 2010 approximately $5 billion

Tropical Diseases

Gates Global Access Agreement

Malaria is endemic in 117 countries (2.5 billion people)

Hookworm infects approximately 700 million people worldwide

iBio is the preferred tech transfer supplier and has right of first refusal to

manufacture

iBio Opportunities:

Corporations Developing Protein Therapeutics

Orphan Medical Products

iBioLaunch technology flexibility makes feasible addressing small population,

high-value proteins

Bio-similar and Bio-better Products

iBioLaunch technology is applicable to all currently marketed biotech

therapeutic proteins

iBioLaunch technology can be used to rapidly evaluate and develop

proprietary and improved derivatives of existing products

Capital and cost of goods advantage over standard methods, making iBio a

partner of choice for new biologics being developed by others

The iBio Solution

Advantages of iBioLaunch™ Technology For Therapeutic Protein

Manufacturing

Best Economy of Production

Reduced cost of materials, More efficient space utilization, Lower process

costs, and Reduced amortization and depreciation expenses

Facility Expansion Efficiency

Time frame to bring new facilities online dramatically shorter than

conventional methods –

12 to 18 months versus 4

to 7 years

Broad Product Applicability

Proven effective for production of monoclonal antibodies

and other classes of therapeutic proteins, both proprietary and generic

Freedom to Operate

Bioreactor & cell line patents do not apply

Safety

Eliminates risk of live virus culture and animal-based components

Achievements of iBioLaunch Technology in

Therapeutic Protein Applications:

Efficient production of monoclonal antibodies, including

proprietary product candidates for influenza and anthrax

Proven applicable to interferons, growth factors, therapeutic

enzymes, insulin, lectins, protease inhibitors, nucleases,

etc.

Functional and structural properties of iBioLaunch-produced

proteins are the same as the native forms

Disulfide linkages

Glycan occupancy

Tissue distribution in animal studies

In vivo activity in animal studies

Immunogenicity (and absence thereof)

Market(s) for iBio Relevant Protein Therapeutics

Orphan Drug Opportunities

Entry enhanced by 50% orphan drug development cost U.S. tax credit

Novartis alone sells over $8 billion in orphan drugs

2,116 orphan drug designations approved by the FDA since 1983

Pfizer – Protalix deal validates big pharma interest

Global market projected at $81 billion next year

Bio-similars and Bio-betters

Biologics market is growing at double the pace of the pharmaceutical industry

This rapid growth is fueling fears regarding affordability

A number of biological drugs are losing patent protection

Companies developing bio-generics are in two main groups

Divisions of established generics manufacturers

Research-based biotech companies

Current market estimated by Deutsche Bank at $26 billion

Intellectual Property

Product Filings (U.S. and International)

Influenza vaccines

HPV vaccines

Influenza monoclonal antibodies

Anthrax vaccines

Plague vaccine

Trypanosomiasis and Malaria vaccines

Technology Filings (U.S. and International)

Virus-induced gene silencing in plants

Activation of transgenes in plants by viral vectors

Production of proteins in plants with launch vector

Transient expression of proteins in plants

Protein expression in seedlings and clonal root cultures

Thermostable carrier molecule

Fraunhofer USA CMB – iBio Relationship

Fraunhofer USA CMB is a not-for-profit R&D organization

Develops plant-based technologies to develop and manufacture vaccines

and therapeutic biologics

Specialists in vaccine development, plant molecular biology, immunology,

and protein engineering

Fraunhofer USA CMB receives grants and contracts from U.S.

DoD, Bill & Melinda Gates Foundation and iBio, Inc.

iBio owns the technology developed with all sources of funding

Worldwide exclusive rights in human healthcare

Cooperation with Gates on “Global Access” in exchange for rights of first

refusal on tech transfer contracts and contract manufacturing

Synergy of iBio-CMB Collaboration

Enhances Rate of Technical Innovation

Non-dilutive and highly accretive

collaboration with Fraunhofer USA CMB

Leveraged funding for technology / product

development >$70 million through 2010

Dec. 2009 - $9.85 million from Bill & Melinda

Gates Foundation for malaria; Ongoing

funding for avian influenza vaccine clinicals

Mar. 2010 - $4.4 million from DARPA for

H1N1 influenza vaccine

Apr. 2010 - $5.3 million from DTRA for

combination anthrax-plague vaccine

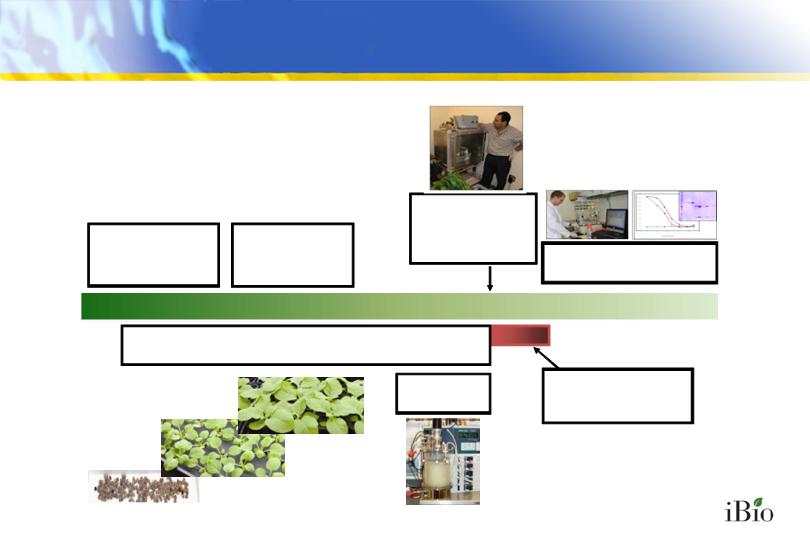

Design &

synthesize

target gene

Clone target gene

into “launch

vector”

Harvest biomass &

recover target protein

Infiltrate with

agrobacteria

containing launch

vectors

Grow plants hydroponically

iBioLaunch™

Accelerated High Capacity

Production of

Pharmaceutical Proteins

Grow

agrobacteria

Target protein

accumulates

in infiltrated plants

Management Team and Directors

Management

Robert B. Kay - CEO & Executive Chairman

Robert Erwin - President

Frederick Larcombe, CPA – Interim CFO

Vidadi Yusibov, Ph.D. - Chief Scientific Officer

Board of Directors

Robert B. Kay – Executive Chairman

Dr. Pamela Bassett – Cantor Fitzgerald

Glenn Chang – First American International Bank

General James T. Hill (ret.) – The J.T. Hill Group

John D. McKey Jr. – McCarthy, Summers, Bobko, Wood, Sawyer & Perry

General (ret.) Philip K. Russell, M.D. – Sabin Institute

iBio Valuation Metrics

Industry Data

Median Upfront Payments in Post-Phase 1 Clinical Development: $20 Million (27 deals -

ReCap)

Product Royalties: Preclinical 0 to 5%; Clinical 5 to 10%, Launched Products 8 to 20%

Platform Royalties: Up to 11.7%

Addressable Markets: Total Approximately $100 Billion

Influenza: $4 billion

Other vaccines: $30 billion

Biogenerics: Top 8 biologics worldwide sales of $26 billion

Orphan Biologics: 50% of orphan drug total of $81 billion: $40 billion

Imputed iBio Value

For each 1% Market Penetration, with just a 5% Average Royalty, iBio Annual Revenues

Would Equal $50 million

(Almost All of Which Would Fall to Bottom Line)

Current PE ratio of exchange-traded biotech basket fund, BBH, is 14X

At PE of 14X, market cap would equal $700 Million per 1% Market Penetration (without

including possible upfront

fees)

Recap: iBio’s Value Proposition

Diversified licensing approach to commercialize proprietary

platform

Less capital required vs. single-product biotech

Non-dilutive financing enhances value

Superior technology with third party validation in hand

Large and growing markets

Early and low-risk revenue

Stock is currently undervalued in comparison to peers

Financial Metrics

Cash and Equivalents: $1.5 million (as of 3/31/10)

No Debt

Stock Price: (OTCBB: IBPM) $1.02 on 5/28/10

Market-Cap: $28.8 Million

Shares Outstanding: 28.3 million

Float: 14.2 million

9 Innovation Way, Suite 100

Newark, DE 19711

www.ibioinc.com

Contact: Investor Contact: Media Contact:

Robert Erwin Jeffrey Benison Melody A. Carey

President Managing Director Co-President

iBio, Inc. Little Gem Life Science Partners Rx Communications Group

302-355-2335 212-334-8709 917-322-2571

rerwin@ibioinc.com jeffrey@littlegem.us mcarey@rxir.com