As filed with the Securities and Exchange Commission on August 4, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

iBio, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 26-279813 | ||

|

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

8800 HSC Parkway

Bryan, Texas 77807

(858) 925-8215

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Martin Brenner, Ph.D.

Chief Executive Officer and

Chief Scientific Officer

8800 HSC Parkway

Bryan, Texas 77807

(858) 925-8215

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Leslie Marlow, Esq.

Patrick J. Egan, Esq.

Hank Gracin, Esq.

Blank Rome LLP

1271 Avenue of the Americas

New York, New York 10020

Telephone: (212) 885-5000

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the Securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering: ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering: ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering: ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer x | Smaller reporting company x |

| Emerging Growth Company ¨ |

If an emerging growth company, indicate by checkmark if the registrant has not elected to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholder may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED AUGUST 4, 2023 |

Up to 4,474,945 Shares

Common Stock

This prospectus relates to the offer and resale, from time to time, of up to 4,474,945 shares of our common stock, par value $0.001 per share, by Lincoln Park Capital Fund, LLC, which we refer to in this prospectus as “Lincoln Park” or the “Selling Stockholder”. The shares of common stock to which this prospectus relates includes (i) up to 4,051,998 shares that we may sell to Lincoln Park, from time to time after the date of this prospectus, in our sole discretion, pursuant to a purchase agreement between us and Lincoln Park dated August 4, 2023, which we refer to in this prospectus as the “Purchase Agreement”, (ii) 211,473 shares we committed to issued to Lincoln Park in consideration for its commitment to purchase shares of our common stock at our direction under the Purchase Agreement, and (iii) 211,474 shares that we may issue to Lincoln Park as additional consideration for its commitment to purchase shares of our common stock at our direction under the Purchase Agreement, at such time as we have received an aggregate of $5,000,000 in cash proceeds from Lincoln Park from sales of shares to Lincoln Park, if any, that we elect to make from time to time after the date of this prospectus, in our sole discretion, pursuant to the Purchase Agreement.

We are not selling any securities under this prospectus and will not receive any of the proceeds from any resales of our common stock by Lincoln Park under this prospectus. However, we may receive up to $10 million in aggregate proceeds from sales of our common stock, if any, that we may, in our sole discretion, elect to sell to Lincoln Park pursuant to the Purchase Agreement, from time to time after the date of this prospectus and after satisfaction of other conditions in the Purchase Agreement, based on market prices of our common stock at or prior to the time we elect to make such sales to Lincoln Park.

Lincoln Park may sell the shares of common stock described in this prospectus in a number of different ways and at varying prices. See “Plan of Distribution” on page 18 for more information about how Lincoln Park may sell the shares of common stock being registered for resale by Lincoln Park under the registration statement that includes this prospectus. Lincoln Park is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended, or the “Securities Act”.

We will pay the expenses incurred in registering under the Securities Act the common stock to which this prospectus relates for resale by Lincoln Park, including legal and accounting fees. Lincoln Park will pay all commissions and other fees and expenses of all broker-dealers engaged by Lincoln Park to effectuate resales, if any, of our common stock that Lincoln Park has or will purchase or acquire from us pursuant to the Purchase Agreement.

Our common stock trades on the NYSE American LLC, or the “NYSE American” under the symbol “IBIO”. On August 3, 2023, the last reported sales price of our common stock on the NYSE American was $0.495 per share.

Investing in our common stock involves a high degree of risk. These risks are described in the section titled “Risk Factors” beginning on page 9 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023.

TABLE OF CONTENTS

We have not authorized anyone to provide you with information different from that contained or incorporated by reference in this prospectus. The Selling Stockholder may offer to sell, and seek offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of common stock.

In this prospectus, the “Company,” “we,” “us,” “our” and “iBio” refer to iBio, Inc.

i

This prospectus is part of a registration statement on Form S-1 that we filed with the U.S. Securities and Exchange Commission (the “SEC”). Under this registration process, the selling securityholder may, from time to time, sell the securities offered by them described in this prospectus. We will not receive any proceeds from the sale by the selling stockholder of the securities offered by them described in this prospectus.

We may also file a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part that may contain material information relating to these offerings. The prospectus supplement or post-effective amendment may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. Before purchasing any securities, you should carefully read this prospectus, any post-effective amendment, and any applicable prospectus supplement, together with the additional information described under the heading “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference.”

Neither we nor the Selling Stockholder have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus, any post-effective amendment, or any applicable prospectus supplement prepared by or on behalf of us or to which we have referred you. We and the Selling Stockholder take no responsibility for and can provide no assurance as to the reliability of any other information that others may give you. We and the Selling Stockholder will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus, any post-effective amendment and any applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus contains, and any post-effective amendment or any prospectus supplement may contain, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. We believe this information is reliable as of the applicable date of its publication, however, we have not independently verified the accuracy or completeness of the information included in or assumptions relied on in these third-party publications. In addition, the market and industry data and forecasts that may be included in this prospectus, any post-effective amendment or any prospectus supplement may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in this prospectus, any post-effective amendment and the applicable prospectus supplement. Accordingly, investors should not place undue reliance on this information.

The Selling Stockholder is offering the Shares only in jurisdictions where such issuances are permitted. The distribution of this prospectus and the issuance of the Shares in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the issuance of the Shares and the distribution of this prospectus outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, the shares of common stock offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

We own or have rights to trademarks, trade names and service marks that we use in connection with the operation of our business. In addition, our name, logos and website name and address are our trademarks or service marks. Solely for convenience, in some cases, the trademarks, trade names and service marks referred to in this prospectus are listed without the applicable ®, ™ and SM symbols, but we will assert, to the fullest extent under applicable law, our rights to these trademarks, trade names and service marks. Other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find Additional Information.”

Smaller Reporting Company – Scaled Disclosure

Pursuant to Item 10(f) of Regulation S-K promulgated under the Securities Act, as indicated herein, we have elected to comply with the scaled disclosure requirements applicable to “smaller reporting companies,” including providing two years of audited financial statements.

ii

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference into this prospectus include forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, that relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Words such as, but not limited to, “anticipate,” “aim,” “believe,” “contemplate,” “continue,” “could,” “design,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “predict,” “poise,” “project,” “potential,” “suggest,” “should,” “strategy,” “target,” “will,” “would,” and similar expressions or phrases, or the negative of those expressions or phrases, are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Although we believe that we have a reasonable basis for each forward-looking statement contained in this prospectus and incorporated by reference into this prospectus, we caution you that these statements are based on our projections of the future that are subject to known and unknown risks and uncertainties and other factors that may cause our actual results, level of activity, performance or achievements expressed or implied by these forward-looking statements, to differ. The section in this prospectus entitled “Risk Factors” and the sections in our periodic reports, including the Annual Report on Form 10-K for the year ended June 30, 2022 filed with the Securities and Exchange Commission (the “SEC”) on October 11, 2022 (the “2022 Form 10-K”) entitled “Business,” and in the 2022 Form 10-K and the Quarterly Reports on Form 10-Q for the quarter ended September 30, 2022, December 31, 2022 and March 31, 2023 filed with the SEC on November 14, 2023, February 14, 2023, as amended on May 19, 2023 and May 15, 2023, respectively, entitled “Risk Factor” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as other sections in this prospectus and the documents or reports incorporated by reference into this prospectus, discuss some of the factors that could contribute to these differences.

Please consider our forward-looking statements in light of those risks as you read this prospectus and the documents incorporated by reference into this prospectus. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

You should not assume that the information contained in this prospectus is accurate as of any date other than as of the date of this prospectus, or that any information incorporated by reference into this prospectus is accurate as of any date other than the date of the document so incorporated by reference. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements.

If one or more of these or other risks or uncertainties materializes, or if our underlying assumptions prove to be incorrect, actual results may vary materially from what we anticipate. All subsequent written and oral forward-looking statements attributable to us or individuals acting on our behalf are expressly qualified in their entirety by this Note. Before purchasing any shares of common stock, you should consider carefully all of the factors set forth or referred to in this prospectus supplement, the accompanying base prospectus and the documents incorporated by reference that could cause actual results to differ.

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Forward-looking statements should be regarded solely as our current plans, estimates and beliefs. We have included important factors in the cautionary statements included in this document, particularly in the section entitled “Risk Factors” of this prospectus that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements are qualified in their entirety by this cautionary statement. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make. You should read this prospectus and the documents that we have filed as exhibits to this prospectus and incorporated by reference herein completely and with the understanding that our actual future results may be materially different from the plans, intentions and expectations disclosed in the forward-looking statements we make. The forward-looking statements contained in this prospectus are made as of the date of this prospectus and we do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

iii

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes that are incorporated by reference into this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each case included elsewhere in this prospectus. In this prospectus, unless the context otherwise requires, the terms “we,” “us,” “our,” “iBio” and the “Company” refer to iBio, Inc. Except as disclosed in the prospectus, the financial statements and selected historical financial data and other financial information included in, or incorporated by reference into, this prospectus are those of iBio, Inc.

Overview

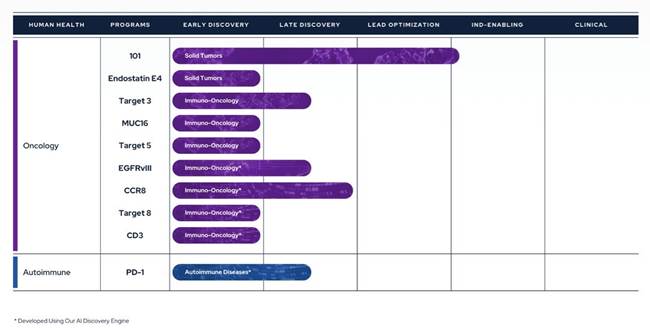

We are an AI-driven innovator of precision antibody immunotherapies. We have a pipeline of innovative primarily immuno-oncology antibodies against hard-to-drug targets where we may face reduced competition and with antibodies that may be more selective. We plan to use our AI-driven discovery platform to continue adding antibodies against hard-to-drug targets or to work with partners on AI-driven drug development.

Therapeutics Pipeline

IBIO-101: an anti-CD25 molecule that works by depletion of immunosuppressive T-regulatory cells (“Tregs”) via antibody-dependent cellular cytotoxicity (“ADCC”), without disrupting activation of effector T-cells (“Teffs”) in the tumor microenvironment. IBIO-101 could potentially be used to treat solid tumors, hairy cell leukemia, relapsed multiple myeloma, lymphoma, or head and neck cancer. IBIO-101 is currently in the Investigational New Drug (“IND”) enabling stage. We have contracted with a contract research organization (“CRO”) to assist with the development of the manufacturing process, which includes but is not limited to process and cell line development for the production of the drug substance and drug product. IBIO-101 is strategically positioned as a fast follower to Hoffman-La Roche’s RG6292 molecule that recently released Phase 1 clinical data. While RG6292 showed signs of efficacy, especially in combination with PD-L1 monoclonal antibody, and was well tolerated, we anticipate additional clinical research will be needed to determine whether different cancer types are more efficacious than others. As a result, we have decided to pause the IND enabling studies until additional data is released on RG6292. This approach will allow us to gather more information, thoroughly evaluate the market potential and optimize our financial resources and the development plan for IBIO-101 to maximize its potential for success.

CCR8: targets depletion of highly immunosuppressive CCR8+ Tregs in the tumor microenvironment via an ADCC mechanism with selective binding to CCR8 over its closely related cousin, CCR4, to avoid off-target effects. A CCR8 program could potentially be broadly applicable in solid tumors and/or as a prospective combination therapy.

EGFRvIII: binds a tumor-specific mutation of EGFR variant III with an afucosylated antibody for high ADCC. Because of its specificity binding to the tumor-specific mutation, it could potentially reduce toxicity and/or expand the therapeutic window compared to simple broad EGFR-targeted alternatives. EGFRvIII is constantly “switched on” which can lead to the development of a range of different cancers. An EGFRvIII antibody could potentially be used to treat glioblastoma, head and neck cancer or non-small cell lung cancer.

1

CD3 antibody panel: provides a range of CD3 affinities with cross-reactivity to non-human primates and increased the humanness of the antibody sequences. The antibody panel is intended to serve as one arm of T-cell-redirecting bispecific antibodies, a new class of therapeutic antibodies designed to simultaneously bind to T-cells via CD3 and to tumor cells via tumor-specific antigens or tumor-associated antigens, inducing T-cell-mediated killing of tumor cells.

MUC16: a highly expressed target on ovarian cancer cells and an attractive tumor associated target for therapeutic antibodies. However, antibodies targeting MUC16 are prone to tumor resistance via epitope shedding and dysregulated glycosylation. Epitope-steered antibodies that bind to an epitope that avoids both of these tumor resistance mechanisms could potentially be used to treat MUC16 positive tumors, particularly those tumors that are resistant to other MUC16 antibodies.

PD-1 Agonist: selectively binds PD-1 to suppress auto-reactive T-cells without PD-L1/PD-L2 blocking. A PD-1 agonist could potentially be used to treat inflammatory bowel disease, systemic lupus erythematosus, multiple sclerosis or other inflammatory diseases.

In addition to the programs described above, the Company also has three additional early discovery programs that have the potential to advance into later stages of preclinical development and are designed to tackle hard-to-drug targets.

IBIO-100 and Endostatin E4

Our preclinical anti-fibrotic program, IBIO-100, has been undergoing a review process as part of our ongoing effort to prioritize our resources and focus on the most promising opportunities. The IBIO-100 program design is based upon work by Dr. Carol Feghali-Bostwick, Professor of Medicine at the Medical University of South Carolina and Vice-Chair of the Scleroderma Foundation. Her initial work was conducted at the University of Pittsburgh, and we have licensed the patents relevant for the continued development of the molecule from the university. After careful consideration, in February 2023, we terminated all efforts on IBIO-100 anti-fibrotic program and provided a six (6) month notice of termination of the license agreement to the University of Pittsburgh, as required by the license agreement. Pursuant to termination of the license agreement with the University of Pittsburgh, our financial obligations for the management of the patents under the license will cease on August 14, 2023, and at such time, will transition back to the University of Pittsburgh.

As part of this decision, we are intending to complete the pre-clinical cancer studies we are conducting in collaboration with University of Texas Southwestern using E4 endostatin peptide, which is derived from IBIO-100. After the pre-clinical studies are completed, we will re-assess whether to further pursue the oncology program and have further discussions with the University of Pittsburgh. This approach allows us to gather valuable data and insights that will inform our future decisions regarding the potential of E4 endostatin peptide as an oncology program.

AI Drug Discovery Platform

In September 2022, we purchased substantially all of the assets of RubrYc Therapeutics (for a complete description of the transaction please see Note 6 – Significant Transactions). The AI Drug Discovery platform technology is designed to be used to discover antibodies that bind to hard-to-target subdominant and conformational epitopes for further development within our existing portfolio or in partnership with outside entities. The RubrYc AI platform is built upon three key technologies.

| 1. | Epitope Targeting Engine: A proprietary machine-learning platform that combines computational biology and 3D-modeling to identify molecules that mimic hard-to-target binding sites on target proteins, specifically, subdominant and conformational epitopes. The creation of these small mimics enables the engineering of therapeutic antibody candidates that can selectively bind immune and cancer cells better than “trial and error” antibody engineering and screening methods that are traditionally focused on dominant epitopes. |

| 2. | RubrYcHuTM Library: An AI-generated human antibody library free of significant sequence liabilities that provides a unique pool of antibodies to screen. The combination of the Epitope Targeting Engine and screening with the RubrYcHu Library has been shown to reduce the discovery time from ideation to in vivo proof-of-concept (PoC) by up to four months. This has the potential to enable more, and better, therapeutic candidates to reach the clinic faster. |

| 3. | StableHuTM Library: An AI-powered sequence optimization library used to improve antibody performance. Once an antibody has been advanced to the lead optimization stage, StableHu allows precise and rapid optimization of the antibody binding regions to rapidly move a candidate molecule into the IND-enabling stage. |

On January 3, 2023, the United States Patent and Trademark Office issued U.S. Patent No. 11,545,238, entitled “Machine Learning Method for Protein Modelling to Design Engineered Peptides,” which, among other claims, covers a machine learning model for engineering peptides, including antibody epitope therapeutics. Subject to any potential patent term extensions, the patent will expire on May 13, 2040.

2

Corporate Information

We were incorporated under the laws of the State of Delaware on April 17, 2008, under the name iBioPharma, Inc. We engaged in a merger with InB:Biotechnologies, Inc., a New Jersey corporation on July 25, 2008, and changed our name to iBio, Inc. on August 10, 2009.

Our principal executive offices are located at 8800 Health Science Center Parkway, Bryan, Texas and our telephone number is (979) 446-0027. Our website address is www.ibioinc.com. The information contained on, or accessible through, our website does not constitute part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

Additional Information

For additional information related to our business and operations, please refer to the reports incorporated herein by reference, including our 2022 Form 10-K, our Quarterly Report on Form 10-Q for the quarterly periods ended September 30, 2022, December 31, 2022 and March 31, 2023 as filed with the SEC on November 14, 2022, February 14, 2023, as amended on May 19, 2023 and May 15, respectively and our Current Reports on Form 8-K as filed with the SEC, as described in the section entitled “Incorporation of Certain Information By Reference” in this prospectus.

The Lincoln Park Committed Equity Facility

On August 4, 2023, we entered into the Purchase Agreement with Lincoln Park, pursuant to which Lincoln Park has agreed to purchase from us up to an aggregate of $10 million of our common stock (subject to certain limitations) from time to time over the term of the Purchase Agreement. Also on August 4, 2023, we entered into a registration rights agreement with Lincoln Park, which we refer to in this prospectus as the Registration Rights Agreement, pursuant to which we filed with the Securities and Exchange Commission, or the SEC, the registration statement that includes this prospectus to register for resale under the Securities Act of 1933, as amended, or the Securities Act, the shares of our common stock that have been or may be issued to Lincoln Park under the Purchase Agreement.

This prospectus covers the resale by the selling stockholder of up to 4,474,945 shares of our common stock, comprised of: (i) 211,473 shares of our common stock that we have committed to issue to Lincoln Park as consideration for its commitment to purchase our common stock at our direction under the Purchase Agreement, which we refer to in this prospectus as the Initial Commitment Shares, (ii) 211,474 shares of our common stock that we may issue to Lincoln Park as additional consideration for its commitment to purchase shares of our common stock at our direction under the Purchase Agreement, which we refer to in this prospectus as the Additional Commitment Shares, at such time as we have received an aggregate of $5,000,000 in cash proceeds from Lincoln Park from sales of shares to Lincoln Park, if any, that we elect to make from time to time after the date of this prospectus, in our sole discretion, pursuant to the Purchase Agreement, and (iii) up to 4,051,998 shares of our common stock that we have reserved for sale to Lincoln Park under the Purchase Agreement, which we refer to in this prospectus as the Purchase Shares, if and when we determine, in our sole discretion, to sell shares of our common stock to Lincoln Park, from time to time after the date of this prospectus and after satisfaction of other conditions in the Purchase Agreement.

We do not have the right to commence any sales of our common stock to Lincoln Park under the Purchase Agreement until all of the conditions set forth in the Purchase Agreement have been satisfied, including that the SEC has declared effective the registration statement that includes this prospectus registering under the Securities Act for resale by Lincoln Park the shares of our common stock that have been and may be issued and sold by us to Lincoln Park under the Purchase Agreement, which we refer to in this prospectus as the Commencement. From and after the Commencement, we may, from time to time and at our sole discretion for a period of 24-months, on any business day that we select on which the closing sale price of our common stock on the NYSE American equals or exceeds $0.15 per share, direct Lincoln Park to purchase up to 100,000 shares of our common stock, which amount may be increased depending on the closing sale price of our common stock on the NYSE American at the time of sale, subject to a maximum commitment of $500,000 per purchase, which we refer to in this prospectus as a “Regular Purchase.” The foregoing price and share amounts will be adjusted for any reorganization, recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction occurring after the date of the Purchase Agreement with respect to our common stock in the manner set forth in the Purchase Agreement. The purchase price per share for each such Regular Purchase will be based on market prices of our common stock immediately preceding the time of sale, as determined under the Purchase Agreement.

If we direct Lincoln Park to purchase the maximum number of shares of common stock that we may sell to Lincoln Park in a Regular Purchase on a business day on which the closing price of the common stock is equal to or greater than $0.20, then in addition to such Regular Purchase, and subject to certain conditions and limitations in the Purchase Agreement, we may direct Lincoln Park to purchase additional shares of common stock in “accelerated purchases” and “additional accelerated purchases,” including multiple additional accelerated purchases on the same trading day, as provided in the Purchase Agreement. The purchase price per share for each accelerated purchase and additional accelerated purchase will be based on market prices of our common stock on the applicable purchase date for such accelerated purchases and such additional accelerated purchases. Lincoln Park has no right to require us to sell any common stock to Lincoln Park, but Lincoln Park is obligated to make purchases as we may direct, subject to conditions and limitations set forth in the Purchase Agreement.

3

Under applicable NYSE American rules, in no event may we issue or sell to Lincoln Park under the Purchase Agreement shares of our common stock (including the Initial Commitment Shares and Additional Commitment Shares) in excess of 4,474,945 shares, which number of shares equals 19.9% of the shares of our common stock outstanding immediately prior to the execution of the Purchase Agreement, which limitation we refer to the “Exchange Cap,” unless we obtain stockholder approval to issue shares of our common stock in excess of the Exchange Cap. In any event, the Purchase Agreement specifically provides that we may not issue or sell any shares of our common stock under the Purchase Agreement if such issuance or sale would breach any applicable rules or regulations of the NYSE American.

In addition, the Purchase Agreement prohibits us from directing Lincoln Park to purchase any shares of our common stock if those shares, when aggregated with all other shares of our common stock then beneficially owned by Lincoln Park and its affiliates, would result in Lincoln Park having beneficial ownership of more than 4.99% of the outstanding shares of our common stock, as calculated pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and Rule 13d-3 thereunder, which limitation we refer to as the “Beneficial Ownership Cap.”

We may at any time in our sole discretion terminate the Purchase Agreement without fee, penalty or cost upon one business day’s notice to Lincoln Park. There are no restrictions on future financings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement or Registration Rights Agreement, other than a prohibition on our entering into certain types of transactions that are defined in the Purchase Agreement as “Variable Rate Transactions.” Lincoln Park may not assign or transfer its rights or obligations under the Purchase Agreement. Lincoln Park has agreed that neither it nor any of its affiliates shall engage in any direct or indirect short-selling or hedging of our common stock during any time prior to the termination of the Purchase Agreement.

As of August 4, 2023, there were 22,612,126 shares of our common stock outstanding, of which 22,502,390 shares of our common stock were held by non-affiliates, including the 211,473 Initial Commitment Shares that we have committed to issue to Lincoln Park on August 4, 2023. Although the Purchase Agreement provides that we may sell up to an aggregate of $10 million of our common stock to Lincoln Park, only 4,474,945 shares of our common stock, which number of shares is equal to the Exchange Cap, are being registered for resale by Lincoln Park under the registration statement that includes this prospectus, which includes (i) the 211,473 Initial Commitment Shares (ii) the 211,474 Additional Commitment Shares, and (iii) up to 4,051,998 Purchase Shares that we have reserved for sale to Lincoln Park under the Purchase Agreement, if and when we elect to sell Purchase Shares to Lincoln Park under the Purchase Agreement, from time to time after the Commencement. Depending on the market prices of our common stock at the time we elect to sell shares of our common stock to Lincoln Park under the Purchase Agreement, if any, we may need to register for resale under the Securities Act additional shares of our common stock in order to receive aggregate gross proceeds equal to the $10 million total purchase commitment available to us under the Purchase Agreement. If all of the 211,473 Initial Commitment Shares and all 211,474 Additional Commitment Shares and all of the 4,051,998 Purchase Shares that may we may issue and sell to Lincoln Park in the future under the Purchase Agreement that are being registered for resale hereunder were issued and outstanding as of August 4, 2023, such shares of our common stock, would represent approximately 19.99%% of the total number of shares of our common stock outstanding and approximately 20.09%% of the total number of outstanding shares of our common stock held by non-affiliates, in each case as of August 4, 2023 prior to the issuance of the Initial Commitment Shares and the Additional Commitment Shares. If we elect to issue and sell to Lincoln Park under the Purchase Agreement more than the 4,474,945 shares of our common stock being registered for resale by Lincoln Park under this prospectus, which we have the right, but not the obligation, to do, we must first obtain stockholder approval to issue shares of our common stock in excess of the Exchange Cap and also register for resale under the Securities Act any such additional shares of our common stock, which could cause additional substantial dilution to our stockholders. The number of shares of our common stock ultimately offered for resale by Lincoln Park is dependent upon the number of shares of our common stock we ultimately decide to sell to Lincoln Park under the Purchase Agreement.

Issuances of our common stock to Lincoln Park under the Purchase Agreement will not affect the rights or privileges of our existing stockholders, except that the economic and voting interests of each of our existing stockholders will be diluted as a result of any such issuance. Although the number of shares of our common stock that our existing stockholders own will not decrease, the shares of our common stock owned by our existing stockholders will represent a smaller percentage of our total outstanding shares of our common stock after any such issuance of shares of our common stock to Lincoln Park under the Purchase Agreement.

4

Risks Associated with this Offering

Our business and our ability to implement our business strategy are subject to numerous risks, as more fully described in the section of this prospectus entitled “Risk Factors” and under similarly titled headings of the documents incorporated herein by reference. You should read these risks before you invest in our common stock. We may be unable, for many reasons, including those that are beyond our control, to implement our business strategy. In particular, risks associated with our business and this offering include:

| ● | It is not possible to predict the actual number of shares we will sell under the Purchase Agreement to the Selling Stockholder, or the actual gross proceeds resulting from those sales. | |

| ● | Investors who buy shares in this offering at different times will likely pay different prices. | |

| ● | The issuance of common stock to the Selling Stockholder may cause substantial dilution to our existing stockholders and the sale of such shares acquired by the Selling Stockholder could cause the price of our common stock to decline. | |

| ● | Our need for future financing may result in the issuance of additional securities, which will cause investors to experience dilution. | |

| ● | We have additional securities available for issuance, which, if issued, could adversely affect the rights of the holders of our common stock. | |

| ● | Future sales of our common stock could cause the market price for our common stock to decline. | |

| ● | Because we will not declare cash dividends on our common stock in the foreseeable future, stockholders must rely on appreciation of the value of our common stock for any return on their investment. | |

| ● | Our management will have broad discretion over the use of the net proceeds from our sale of the Shares to Lincoln Capital, you may not agree with how we use the proceeds and the proceeds may not be invested successfully. |

5

THE OFFERING

| Shares of common stock offered by the Selling Stockholder | Up to 4,474,945 shares of our common stock consisting of: | |

| · 211,473 Initial Commitment Shares we committed to issue to Lincoln Park as consideration for its commitment to purchase our common stock at our direction under the Purchase Agreement. We did not and will not receive any cash proceeds from the issuance of the Initial Commitment Shares to Lincoln Park; and | ||

| · 211,474 Additional Commitment Shares that we may issue to Lincoln Park as additional consideration for its commitment to purchase shares of our common stock at our direction under the Purchase Agreement, at such time as we have received an aggregate of $5,000,000 in cash proceeds from Lincoln Park from sales of our common stock to Lincoln Park, if any, that we elect to make from time to time after the Commencement, in our sole discretion, pursuant to the Purchase Agreement. We will not receive any cash proceeds from the issuance of these Additional Commitment Shares, if we are ever required to do so under the Purchase Agreement; and | ||

| · up to 4,051,998 Purchase Shares that we have reserved for sale to Lincoln Park under the Purchase Agreement, if and when we elect to sell Purchase Shares to Lincoln Park under the Purchase Agreement, from time to time after the Commencement. |

| Shares of Common Stock outstanding before this offering | 22,612,126 shares (which includes the 211,473 Initial Commitment Shares we have committed to issue to Lincoln Park). | |

| Shares of Common Stock Outstanding after This offering | 26,875,598 (which assumed the issuance of all 4,474,945 shares of our common stock being registered in this offering) | |

| Selling Stockholder | Lincoln Park Capital Fund, LLC. See “Selling Stockholder” on page 17 of this prospectus. |

| Use of Proceeds | We will receive no proceeds from the sale of shares of common stock by Lincoln Park in this offering. We may receive up to $10 million in aggregate proceeds from sales of our common stock, if any, that we may, in our sole discretion, elect to sell to Lincoln Park pursuant to the Purchase Agreement, from time to time after the Commencement. Any proceeds we receive, we intend to use for general corporate and working capital purposes and repayment of outstanding debt. See “Use of Proceeds” for additional information. |

| Risk factors | You should carefully read the “Risk Factors” and the other information included in this prospectus for a discussion of factors you should consider carefully before deciding to invest in our common stock. |

| NYSE American symbol for our Common Stock | “IBIO” |

The number of shares of our common stock outstanding as of August 2, 2023 set forth above excludes:

| · | 5,871,374 shares of common stock issuable upon exercise of our warrants outstanding as of August 2, 2023, with a weighted-average exercise price of $1.33; |

| · | 292,085 shares of common stock issuable upon exercise of options outstanding as of August 2, 2023, with a weighted-average exercise price of $19.16 per share; |

| · | 237,064 shares of common stock issuable upon vesting of restricted stock units outstanding as of August 2, 2023, with a weighted-average exercise price of $1.95 per share; and |

| · | any additional shares that we may issue to Lincoln Park pursuant to the Purchase Agreement dated August 2, 2023, should we elect to sell shares to Lincoln Park but includes the Initial Commitment Shares that were issued to Lincoln Park on August 4, 2023. |

6

Investing in our securities involves a high degree of risk. Prior to making a decision about investing in our securities, you should carefully consider the specific risk factors discussed in the sections entitled “Risk Factors” contained in our Annual Report on Form 10-K for the fiscal year ended June 30, 2022 under the heading “Item 1A. Risk Factors,” and as described or may be described in any subsequent quarterly report on Form 10-Q under the heading “Item 1A. Risk Factors,” as well as in any applicable prospectus supplement or post-effective amendment and contained or to be contained in our filings with the SEC and incorporated by reference in this prospectus, together with all of the other information contained in this prospectus, or any applicable prospectus supplement or post-effective amendment. For a description of these reports and documents, and information about where you can find them, see “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference.” If any of the risks or uncertainties described in our SEC filings or any prospectus supplement or any additional risks and uncertainties actually occur, our business, financial condition and results of operations could be materially and adversely affected. In that case, the trading price of our securities could decline and you might lose all or part of the value of your investment.

Risks Related to This Offering

The sale or issuance of our common stock to Lincoln Park may cause dilution and the sale of the shares of common stock by Lincoln Park that it acquires pursuant to the Purchase Agreement, or the perception that such sales may occur, could cause the price of our common stock to decrease.

On August 4, 2023, we entered into the Purchase Agreement with Lincoln Park, pursuant to which Lincoln Park has committed to purchase up to $10.0 million of our common stock. The Purchase Agreement, requires that we issue 211,473 Commitment Shares to Lincoln Park as a fee for its commitment to purchase shares of our common stock under the Purchase Agreement and we agreed to issue the 211,474 Additional Commitment Shares concurrent with Lincoln Park’s purchase of Shares having aggregate gross purchase price of $5.0 million pursuant to all Regular Purchases, Accelerated Purchases and Additional Accelerated Purchases (each as defined in the Purchase Agreement). The remaining shares of our common stock that may be issued under the Purchase Agreement may be sold by us to Lincoln Park at our sole discretion from time to time over a 24-month period commencing after the satisfaction of certain conditions set forth in the Purchase Agreement. The purchase price for the shares that we may sell to Lincoln Park under the Purchase Agreement will fluctuate based on the trading price of our common stock. Depending on market liquidity at the time, sales of such shares may cause the trading price of our common stock to decrease. We generally have the right to control the timing and amount of any future sales of our shares to Lincoln Park. Additional sales of our common stock, if any, to Lincoln Park will depend upon market conditions and other factors to be determined by us. We may ultimately decide to sell to Lincoln Park all, some or none of the additional shares of our common stock that may be available for us to sell pursuant to the Purchase Agreement. If and when we do sell shares to Lincoln Park, after Lincoln Park has acquired the shares, Lincoln Park may resell all, some or none of those shares at any time or from time to time in its discretion. Therefore, sales to Lincoln Park by us could result in substantial dilution to the interests of other holders of our common stock. Additionally, the sale of a substantial number of shares of our common stock to Lincoln Park, or the anticipation of such sales, could make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect sales.

Our management team may invest or spend the proceeds it receives from Lincoln Park in ways with which you may not agree or in ways which may not yield a significant return.

Our management will have broad discretion over the use of proceeds it receives from Lincoln Park. We intend to use the net proceeds, if any, from this offering for general corporate purposes, which may include, among other things, working capital, repayment of outstanding debt and funding research and development, and capital expenditures including clinical program progression. Our management will have considerable discretion in the application of the net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. The net proceeds may be used for corporate purposes that do not increase our operating results or enhance the value of our common stock.

The terms of the Purchase Agreement limit the amount of share of common stock we may issue to Lincoln Park, which may limit our ability to utilize the arrangement to enhance our cash resources.

The Purchase Agreement includes restrictions on our ability to sell shares of our common stock to Lincoln Park, including, subject to specified limitations, (i) if a sale would cause us to issue, in the aggregate, a number shares greater 19.99% of our outstanding common stock immediately prior to the execution of the Purchase Agreement (the “Exchange Cap”), or (ii) if a sale would cause Lincoln Park and its affiliates to beneficially own more than 4.99% of our issued and outstanding common stock (the “Beneficial Ownership Cap”). Accordingly, we cannot guarantee that we will be able to sell all $10.0 million of shares of common stock in this offering. If we cannot sell the full amount of the shares that Lincoln Park has committed to purchase because of these limitations, we may be required to utilize more costly and time-consuming means of accessing the capital markets, which could materially adversely affect our liquidity and cash position.

7

It is not possible to predict the actual number of shares of our common stock that we will sell under the Purchase Agreement to the Selling Stockholder, or the actual gross proceeds resulting from those sales.

Subject to certain limitations in the Purchase Agreement and compliance with applicable law, we have the discretion to deliver notices to Lincoln Park at any time throughout the term of the Purchase Agreement. The actual number of Shares that are sold to Lincoln Park may depend based on a number of factors, including the market price of the common stock during the sales period. Actual gross proceeds may be less than $10.0 million, which may impact our future liquidity. Because the price per share of each share sold to the Selling Stockholder will fluctuate during the sales period, it is not currently possible to predict the number of shares that will be sold or the actual gross proceeds to be raised in connection with those sales.

Investors who buy shares at different times will likely pay different prices.

Investors who purchase Shares in this offering at different times will likely pay different prices, and so may experience different levels of dilution and different outcomes in their investment results. In connection with the Lincoln Capital Transaction, we will have discretion, subject to market demand, to vary the timing, prices, and numbers of Shares sold to Lincoln Capital. Similarly, Lincoln Capital may sell such Shares at different times and at different prices. Investors may experience a decline in the value of the Shares they purchase from the Selling Stockholder in this offering as a result of sales made by us in future transactions to Lincoln Capital at prices lower than the prices they paid.

The issuance of shares of common stock to Lincoln Park may cause substantial dilution to our existing stockholders and the sale of such shares acquired by Lincoln Park could cause the price of our common stock to decline.

We are registering for resale by Lincoln Park up to 4,474,945 shares of common stock, consisting of 211,473 Initial Commitment Shares, 211,474 Additional Commitment Shares, and an additional 4,051,998 shares of common stock that we may issue and sell to Lincoln Park under the Purchase Agreement from time-to-time following Commencement. The number of shares of our common stock ultimately offered for resale by the Lincoln Park under this prospectus is dependent upon the number of shares of common stock issued to the Lincoln Park pursuant to the Purchase Agreement. Depending on a variety of factors, including market liquidity of our common stock, the issuance of Shares to Lincoln Park may cause the trading price of our common stock to decline.

Lincoln Park is irrevocably bound to purchase up to 4,051,998 shares of our common stock being registered for resale hereby provided that the conditions set forth in the Purchase Agreement are met within the limitation set forth in the Purchase Agreement and, following receipt by Lincoln Park of shares of our common stock issued to Lincoln Park under the Purchase Agreement, Lincoln Park may sell all, some or none of such Shares. The sale of a substantial number of shares of our common stock by Lincoln Park in this offering, or anticipation of such sales, could cause the trading price of our common stock to decline or make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise desire.

Our need for future financing may result in the issuance of additional securities, which will cause investors to experience dilution.

Our cash requirements may vary from those now planned, depending upon numerous factors, including the results of future research and development activities. We expect our expenses to increase if and when we initiate and conduct additional clinical trials, and seek marketing approval for our product candidates. In addition, if we obtain marketing approval for any of our product candidates, we expect to incur significant commercialization expenses related to product sales, marketing, manufacturing and distribution. Accordingly, we will need to obtain substantial additional funding in connection with our continuing operations. There are no other commitments by any person for future financing. Our securities may be offered to other investors at a price lower than the price per share offered to current stockholders, or upon terms which may be deemed more favorable than those offered to current stockholders. In addition, the issuance of securities in any future financing may dilute an investor’s equity ownership and have the effect of depressing the market price for our securities. Moreover, we may issue derivative securities, including options and/or warrants, from time to time, to procure qualified personnel or for other business reasons. The issuance of any such derivative securities, which is at the discretion of our board of directors, may further dilute the equity ownership of our stockholders.

Because we will not declare cash dividends on our common stock in the foreseeable future, stockholders must rely on appreciation of the value of our common stock for any return on their investment.

We have never declared or paid cash dividends on our common stock. We currently anticipate that we will retain any future earnings from the development, operation and expansion of our business and will not declare or pay any cash dividends in the foreseeable future. As a result, only appreciation of the price of our common stock, if any, will provide a return to investors in this offering. See “Dividend Policy.”

8

We will not receive any proceeds from the sale of shares of common stock by Lincoln Park in this offering. We may receive up to $10.0 million in gross proceeds that we may sell to Lincoln Park pursuant to the Purchase Agreement from time to time after the date that the registration statement of which this prospectus is a part is declared effective. We estimate that the net proceeds to us from the sale of our common stock to Lincoln Park pursuant to the Purchase Agreement will be up to $9,750,000 million for a period of approximately 24-month, assuming that we sell the full amount of our common stock that we have the right, but not the obligation, to sell to Lincoln Park under the Purchase Agreement, and after other estimated fees and expenses. We may sell fewer than all of the shares offered by this prospectus, in which case our net offering proceeds will be less. Because we are not obligated to sell any shares of our common stock under the Purchase Agreement the actual total offering amount and proceeds to us, if any, are not determinable at this time. See “Plan of Distribution” elsewhere in this prospectus for more information.

We intend to use the net proceeds from sales of Shares to Lincoln Park for repayment or debt and general corporate purposes, which may include, among other things, increasing our working capital and funding research and development and capital expenditures, including clinical program progression.

The amounts and timing of our actual expenditures will depend on numerous factors, including the factors described under “Risk Factors” in this prospectus and in the documents incorporated by reference herein, as well as the amount of cash used in our operations. We may find it necessary or advisable to use the net proceeds for other purposes, and we will have broad discretion in the application of the net proceeds. Pending the uses described above, we plan to invest the net proceeds from this offering in short-and intermediate-term, interest-bearing obligations, investment-grade instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government.

9

We have never declared or paid any cash dividends on our common stock and we do not currently intend to pay any cash dividends on our common stock in the foreseeable future. We expect to retain all available funds and future earnings, if any, to fund the development and growth of our business. Any future determination to pay dividends, if any, on our common stock will be at the discretion of our board of directors and will depend on, among other factors, the terms of any outstanding preferred stock, our results of operations, financial condition, capital requirements and contractual restrictions.

10

THE LINCOLN PARK COMMITTED EQUITY FACILITY

General

On August 4, 2023, we entered into the Purchase Agreement with Lincoln Park, pursuant to which Lincoln Park has agreed to purchase from us up to an aggregate of $10.0 million of our shares of common stock (subject to certain limitations) from time to time over the term of the Purchase Agreement. In addition, on August 4, 2023, we entered into a Registration Rights Agreement (the “Registration Rights Agreement”), pursuant to which we have filed with the SEC the registration statement that includes this prospectus to register for resale under the Securities Act the shares of our common stock that have been or may be issued to Lincoln Park under the Purchase Agreement.

This prospectus covers the resale by the Lincoln Park of 4,474,945 shares of our common stock, comprised of: (i) 211,473 shares that we have committed to issue to Lincoln Park as the Initial Commitment Shares for making the commitment under the Purchase Agreement, (ii) an additional 211,474 shares that we may be required to issue to Lincoln Park in the future as additional commitment shares (the “Additional Commitment Shares”) and (iii) an additional 4,051,998 shares we may sell to Lincoln Park under the Purchase Agreement from time to time. All sales are at our sole discretion.

Other than the 211,473 Initial Commitment Shares that we have committed to issue to Lincoln Park pursuant to the terms of the Purchase Agreement as consideration for its commitment to purchase shares of our common stock under the Purchase Agreement, we do not have the right to commence any sales of our common stock to Lincoln Park under the Purchase Agreement until all of the conditions set forth in the Purchase Agreement have been satisfied, including that the SEC has declared effective the registration statement that includes this prospectus registering the Shares that will be issued and sold to Lincoln Park (the “Commencement Date”). From and after the Commencement Date, we may, from time to time and at our sole discretion for a period of 24-months, on any business day that we select on which the closing price of our common stock equals or exceeds $0.15 (subject to adjustment for any reorganization, recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction as provided in the Purchase Agreement), direct Lincoln Park to purchase up to 100,000 shares of common stock, which maximum share amount may be increased up to 200,000 shares depending on the market price of our common stock at the time of sale (“Regular Purchases”) and subject to a maximum commitment by Lincoln Park of $500,000 per single Regular Purchase. In addition, at our discretion, Lincoln Park has committed to purchase other “accelerated amounts” in an Accelerated Purchase (as defined below) and/or “additional accelerated amounts” in an Additional Accelerated Purchase (as defined below) under certain circumstances. We will control the timing and amount of any sales of our common stock to Lincoln Park. The purchase price of the Shares that may be sold to Lincoln Park in Regular Purchases under the Purchase Agreement will be based on the market price of our common stock at or immediately prior to the time of sale as computed under the Purchase Agreement. The purchase price per share will be equitably adjusted for any reorganization, recapitalization, non-cash dividend, stock split, or other similar transaction as set forth in the Purchase Agreement. We may at any time in our sole discretion terminate the Purchase Agreement without fee, penalty or cost upon one business day notice. There are no restrictions on future financings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement or Registration Rights Agreement, other than a prohibition on our entering into certain types of transactions that are defined in the Purchase Agreement as “Variable Rate Transactions.” Lincoln Park may not assign or transfer its rights and obligations under the Purchase Agreement.

As of August 4, 2023, there were 22,612,126 shares of our common stock outstanding, including the 211,473 shares that we have committed to issue to Lincoln Park under the Purchase Agreement. Although the Purchase Agreement provides that we may sell up to an aggregate of $10.0 million of our common stock to Lincoln Park, only 4,474,945 shares of our common stock are being offered under this prospectus to Lincoln Park, which represents the 211,473 Initial Commitment Shares that we have committed to issue to Lincoln Park under the Purchase Agreement, the 211,474 Additional Commitment Shares that we will be required to issue to Lincoln Park as commitment shares concurrent with Lincoln Park’s purchase of Shares having aggregate gross purchase price of $5.0 million pursuant to all Regular Purchases, Accelerated Purchases and Additional Accelerated Purchases and 4,051,998 additional shares which may be issued to Lincoln Park in the future under the Purchase Agreement, if and when we sell shares to Lincoln Park under the Purchase Agreement. Depending on the market prices of our common stock at the time we elect to issue and sell shares to Lincoln Park under the Purchase Agreement, we may need to register for resale under the Securities Act additional shares of our common stock in order to receive aggregate gross proceeds equal to the $10.0 million total commitment available to us under the Purchase Agreement. If all of the Shares offered by Lincoln Park under this prospectus were issued and outstanding as of the date hereof, such Shares would represent approximately 19.99% of the total number of shares of our common stock outstanding as of the date hereof. If we elect to issue and sell more than the 4,051,998 Shares offered under this prospectus to Lincoln Park, which we have the right, but not the obligation, to do, we must first register for resale under the Securities Act any such additional shares, which could cause additional substantial dilution to our stockholders. The number of shares ultimately offered for resale by Lincoln Park is dependent upon the number of shares we sell to Lincoln Park under the Purchase Agreement.

Under applicable NYSE American rules, in no event may we issue or sell to Lincoln Park under the Purchase Agreement shares of our common stock in excess of the Exchange Cap of 4,474,945 shares (including the Commitment Shares), which represents 19.99% of the shares of our common stock outstanding immediately prior to the execution of the Purchase Agreement, unless we obtain stockholder approval to issue shares of our common stock in excess of the Exchange Cap. In any event, the Purchase Agreement specifically provides that we may not issue or sell any shares of our common stock under the Purchase Agreement if such issuance or sale would breach any applicable rules or regulations of the NYSE American.

11

The Purchase Agreement also prohibits us from directing Lincoln Park to purchase any shares of common stock if those shares, when aggregated with all other shares of our common stock then beneficially owned by Lincoln Park and its affiliates, would result in Lincoln Park and its affiliates having beneficial ownership, at any single point in time, of more than 4.99% of the then total outstanding shares of our common stock, as calculated pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and Rule 13d-3thereunder, which limitation we refer to as the Beneficial Ownership Cap.

Issuances of our common stock in this offering will not affect the rights or privileges of our existing stockholders, except that the economic and voting interests of each of our existing stockholders will be diluted as a result of any such issuance. Although the number of shares of common stock that our existing stockholders own will not decrease, the shares owned by our existing stockholders will represent a smaller percentage of our total outstanding shares after any such issuance to Lincoln Park.

Purchase of Shares Under the Purchase Agreement

Under the Purchase Agreement, beginning on the Commencement Date, on any business day that we select on which the closing price of our common stock equals or exceeds $0.15 (subject to adjustment for any reorganization, recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction as provided in the Purchase Agreement), we may direct Lincoln Park to purchase up to 100,000 shares of our common stock in a Regular Purchase on such business day, provided, however, that (i) the Regular Purchase may be increased to up to 150,000 shares, provided that the closing sale price of our common stock is not below $1.00 on the purchase date and (ii) the Regular Purchase may be increased to up to 200,000 shares, provided that the closing sale price of our common stock is not below $2.00 on the purchase date (such share amount limitation, the “Regular Purchase Share Limit”). In each case, Lincoln Park’s maximum commitment in any single Regular Purchase may not exceed $500,000.

The purchase price per share for each such Regular Purchase will be equal to the lower of:

| • | the lowest sale price for our common stock on the purchase date of such shares; and |

| • | the arithmetic average of the three lowest closing sale prices for our common stock during the 10 consecutive business days ending on the business day immediately preceding the purchase date of such shares. |

In addition to Regular Purchases described above, we may also direct Lincoln Park, on any business day on which we have properly submitted a Regular Purchase notice directing Lincoln Park to purchase the maximum number of shares of our common stock that we are then permitted on a business day on which the closing price of the common stock is equal to or greater than $0.20 to include in a single Regular Purchase notice, to purchase on the next following business day an additional amount of our common stock (an “Accelerated Purchase”), not to exceed the lesser of:

| • | 30% of the aggregate shares of our common stock traded during all or, if certain trading volume or market price thresholds specified in the Purchase Agreement are crossed on the applicable Accelerated Purchase date, which is defined as the next business day following the purchase date for the corresponding Regular Purchase, the portion of the normal trading hours on the applicable Accelerated Purchase date prior to such time that any one of such thresholds is crossed, which period of time on the applicable Accelerated Purchase date we refer to as the Accelerated Purchase Measurement Period; and |

| • | three times the number of purchase shares purchased pursuant to the corresponding Regular Purchase. |

The purchase price per share for each such Accelerated Purchase will be equal to 97% of the lower of:

| • | the volume weighted average price of our common stock during the applicable Accelerated Purchase Measurement Period on the applicable Accelerated Purchase date; and |

| • | the closing sale price of our common stock on the applicable Accelerated Purchase Date. |

We may also direct Lincoln Park, not later than 1:00 p.m., Eastern Time, on a business day on which an Accelerated Purchase has been completed and all of the shares to be purchased thereunder (and under the corresponding Regular Purchase) have been properly delivered to Lincoln Park in accordance with the Purchase Agreement prior to such time on such business day, to purchase an additional amount of our common stock on the same business day, which we refer to as an Additional Accelerated Purchase, of up to the lesser of:

| • | 30% of the aggregate shares of our common stock traded during a certain portion of the normal trading hours on such Accelerated Purchase date as determined in accordance with the Purchase Agreement, which period of time we refer to as the Additional Accelerated Purchase Measurement Period; and |

| • | three times the number of purchase shares purchased pursuant to the Regular Purchase corresponding to the Accelerated Purchase that was completed on such Accelerated Purchase date on which an Additional Accelerated Purchase notice was properly received. |

12

We may, in our sole discretion, submit multiple Additional Accelerated Purchase notices to Lincoln Park prior to 1:00 p.m., Eastern time, on a single Accelerated Purchase date, provided that all prior Accelerated Purchases and Additional Accelerated Purchases (including those that have occurred earlier on the same day) have been completed and all of the shares to be purchased thereunder (and under the corresponding Regular Purchase) have been properly delivered to Lincoln Park in accordance with the Purchase Agreement.

The purchase price per share for each such Additional Accelerated Purchase will be equal to 97 % or the lower of:

| • | the volume weighted average price of our common stock during the applicable Additional Accelerated Purchase Measurement Period for such Additional Accelerated Purchase on the applicable Additional Accelerated Purchase date; and |

| • | the closing sale price of our common stock on the applicable Additional Accelerated Purchase date. |

In the case of the Initial Purchase, Regular Purchases, Accelerated Purchases and Additional Accelerated Purchases, the purchase price per share will be equitably adjusted for any reorganization, recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction occurring during the business days used to compute the purchase price.

Other than as described above, there are no trading volume requirements or restrictions under the Purchase Agreement, and we will control the timing and amount of any sales of our common stock to Lincoln Park.

Suspension Events

A suspension event under the Purchase Agreement includes the following:

| • | the effectiveness of the registration statement of which this prospectus forms a part lapses for any reason (including, without limitation, the issuance of a stop order), or any required prospectus supplement and accompanying prospectus are unavailable for the resale by Lincoln Park of our common stock offered hereby, and such lapse or unavailability continues for a period of 10 consecutive business days or for more than an aggregate of 30 business days in any 365-dayperiod; |

| • | suspension by our principal market of our common stock from trading for a period of one business day; |

| • | the delisting of the common stock from the NYSE American (or nationally recognized successor thereto), provided, however, that the common stock is not immediately thereafter trading on the New York Stock Exchange, The NYSE American Global Market, The NYSE American Global Select Market, the NYSE American, the NYSE Arca, the OTC Bulletin Board or OTC Markets (or nationally recognized successor to any of the foregoing); |

| • | the failure of our transfer agent to issue to Lincoln Park shares of our common stock within two business days after the applicable date on which Lincoln Park is entitled to receive such shares; |

| • | any breach of the representations or warranties or covenants contained in the Purchase Agreement or Registration Rights Agreement that has or could have a material adverse effect on us and, in the case of a breach of a covenant that is reasonably curable, that is not cured within five business days; |

| • | any person commences a proceeding against us pursuant to or within the meaning of Title 11, U.S. Code, or any similar federal or state law for the relief of debtors (“Bankruptcy Law”); |

| • | a court of competent jurisdiction enters an order or decree under any Bankruptcy Law that (i) is for relief against us in an involuntary case, (ii) appoints a Custodian for us or for all or substantially all of our property, or (iii) orders the liquidation of us or our subsidiaries; |

| • | if at any time we are not eligible to transfer our common stock electronically as DWAC shares; or |

| • | if at any time after the Commencement Date, the Exchange Cap is reached (to the extent such Exchange Cap is applicable), and stockholder approval has not been obtained in accordance with the applicable rules of the NYSE American. |

Lincoln Park does not have the right to terminate the Purchase Agreement upon any of the suspension events set forth above. During a suspension event, all of which are outside of Lincoln Park’s control, we may not direct Lincoln Park to purchase any shares of our common stock under the Purchase Agreement.

13

Our Termination Rights

We have the unconditional right, at any time, for any reason and without any payment or liability to us, to give notice to Lincoln Park to terminate the Purchase Agreement. In the event of bankruptcy proceedings by or against us, the Purchase Agreement will automatically terminate without action of any party.

No Short-Selling or Hedging by Lincoln Park

Lincoln Park has agreed that neither it nor any of its affiliates shall engage in any direct or indirect short-selling or hedging of our common stock during any time prior to the termination of the Purchase Agreement.

Prohibitions on Variable Rate Transactions

There are no restrictions on future financings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement or Registration Rights Agreement other than a prohibition on entering into a “Variable Rate Transaction,” as defined in the Purchase Agreement.

Effect of Performance of the Purchase Agreement on Our Stockholders