UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. __ )

| Filed by the Registrant þ | |

| Filed by a Party other than the Registrant o | |

| Check the appropriate box: | |

| o | Preliminary Proxy Statement |

| o | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Under Rule 14a-12 |

| iBio, Inc. | ||

| (Name of Registrant as Specified in Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||

| þ | No fee required | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| o | Fee paid previously with preliminary materials. | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount previously paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Dear iBio Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of iBio, Inc., a Delaware corporation (“iBio” or the “Company”). The meeting will be held on Thursday, May 4, 2017, at 9:30 a.m. local time at The Stella Hotel, 4250 South Traditions Drive, Bryan, Texas 77807.

At the annual meeting, you will be asked to consider and act upon the following matters:

| 1. | To elect two directors each to serve as Class II directors for a three year term expiring at the 2019 annual meeting of stockholders or until successors have been duly elected and qualified; |

| 2. | To ratify the appointment of CohnReznick LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2017; |

| 3. | To approve an advisory vote on executive compensation (“say on pay”); and |

| 4. | To transact any other business properly brought before the annual meeting. |

These matters are described in detail in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement. A proxy is included along with the Proxy Statement. These materials are being sent to stockholders on or about April 6, 2017. Along with the attached Proxy Statement, we are sending to you our Annual Report on Form 10-K for the fiscal year ended June 30, 2016. Such annual report, which includes our audited financial statements, is not to be regarded as proxy solicitation material.

Your vote is important. Whether or not you plan to attend the annual meeting, I urge you to take a moment to vote on the items in this year’s Proxy Statement. Voting takes only a few minutes, and it will ensure that your shares are represented at the annual meeting.

| Sincerely, | |

| April 6, 2017 |  |

| Robert B. Kay | |

| Executive Chairman and Chief Executive Officer |

iBIO, INC.

600 Madison Avenue, Suite 1601

New York, NY 10022

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS

| Date | Thursday, May 4, 2017 |

| Time | 9:30 a.m. (Central time) |

| Place | The Stella Hotel, 4250 South Traditions Drive, Bryan, Texas 77807 |

| Items of Business | 1. To elect two directors each to serve as Class II directors for a three year term expiring at the 2019 annual meeting of stockholders or until successors have been duly elected and qualified; |

| 2. To ratify the selection of CohnReznick LLP as our independent registered public accounting firm for the current fiscal year ending June 30, 2017; |

| 3. To approve an advisory vote on executive compensation; and | |

| 4. To transact such other business as may properly come before the annual meeting or any adjournment thereof. | |

| Record Date | You are entitled to notice of, and to vote at the annual meeting and any adjournments of that meeting, if you were a stockholder of record at the close of business on April 3, 2017. |

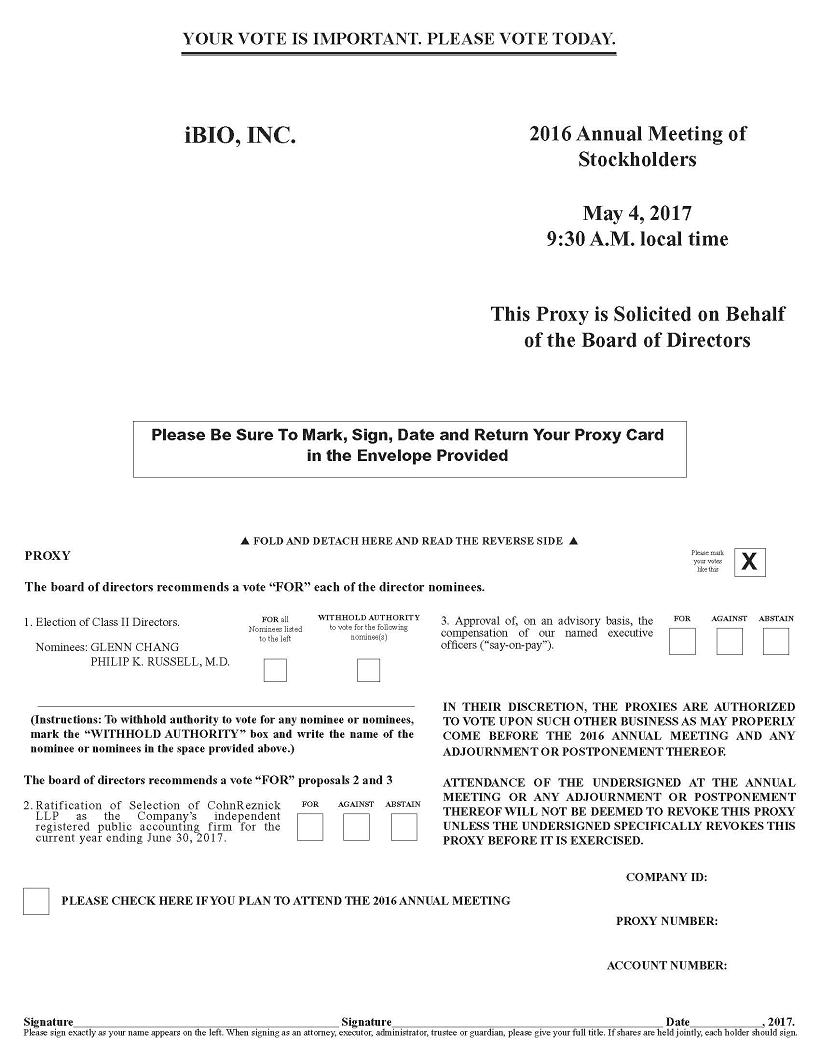

| Voting by Proxy | Please submit the enclosed proxy as soon as possible so that your shares can be voted at the annual meeting in accordance with your instructions. For specific instructions regarding voting, please refer to the Questions and Answers beginning on page 1 of the Proxy Statement and the instructions on your proxy card. |

| Submitting your proxy will not affect your right to attend the meeting and vote. A stockholder who gives a proxy may revoke it at any time before it is exercised by voting in person at the annual meeting, by delivering a subsequent proxy or notifying the inspector of elections in writing of such revocation. |

By Order of the Board of Directors,

|

|

| Elizabeth Moyle, Secretary | |

| New York, New York | |

| April 6, 2017 |

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY CARD AND PROMPTLY MAIL IT IN THE ENCLOSED ENVELOPE IN ORDER TO ASSURE REPRESENTATION OF YOUR SHARES AT THE ANNUAL MEETING. NO POSTAGE NEED BE AFFIXED IF THE PROXY CARD IS MAILED IN THE UNITED STATES. SENDING IN YOUR PROXY WILL NOT PREVENT YOU FROM VOTING YOUR SHARES IN PERSON AT THE ANNUAL MEETING IF YOU DESIRE TO DO SO, AND YOUR PROXY IS REVOCABLE AT YOUR OPTION BEFORE IT IS EXERCISED.

iBIO, INC.

600 Madison Avenue, Suite 1601

New York, NY 10022

PROXY STATEMENT

FOR THE 2016 ANNUAL MEETING OF STOCKHOLDERS

PROXY AND VOTING

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS:

The notice of annual meeting of stockholders, the proxy statement and the Company’s Annual Report on Form 10-K for the year ended June 30, 2016 are available electronically to the Company’s stockholders of record as of the close of business on April 3, 2017 at [http://www.cstproxy.com/ibioinc/2017/.]

QUESTIONS AND ANSWERS ABOUT THIS PROXY STATEMENT AND VOTING

Q. Why am I receiving this proxy statement?

| A. | We have made this proxy statement available to you because the Board of Directors of iBio is soliciting your proxy to vote at the 2016 Annual Meeting of Stockholders. You are invited to attend the annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the annual meeting to vote your shares. Instead, you may vote by proxy by completing and returning the enclosed proxy card. |

| Q. | Who can vote at the annual meeting? |

| A. | Only stockholders of record at the close of business on April 3, 2017, the record date for the annual meeting (the “Record Date”), will be entitled to vote at the annual meeting. On the Record Date, there were 89,109,410 shares of common stock, $0.001 par value per share, outstanding and entitled to vote at the annual meeting. On the Record Date there was one share of the Company’s iBio CMO Preferred Tracking Stock, par value, $0.001 per share (“Preferred Tracking Stock”) outstanding. The Preferred Tracking Stock is not entitled to vote on the proposals described in this proxy statement. |

Stockholder of Record: Shares Registered in Your Name -- If on the Record Date your shares of common stock were registered directly in your name with our transfer agent, Continental Stock Transfer and Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the annual meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to vote by returning the enclosed proxy card to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank -- If on the Record Date your shares of common stock were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker, bank or other agent regarding how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker, bank or other agent.

| Q. | What is a proxy card? |

| A. | The proxy card enables you to appoint Robert B. Kay, our executive chairman, and Robert Erwin, our president, or either of them, as your representatives at the annual meeting. By completing and returning the proxy card, you are authorizing Messrs. Kay and Erwin to vote your shares at the meeting as you have instructed on the proxy card. If you do not specify on the proxy card how your shares should be voted, your shares will be voted as recommended by our Board of Directors. By returning the proxy card to us, you can vote your shares whether or not you attend the meeting. |

4

| Q. | How many votes do I have? |

| A. | On each matter to be voted upon, you have one vote for each share of common stock you own as of the Record Date. |

| Q. | What is the quorum requirement? |

| A. | A quorum will be present if stockholders holding a majority of the outstanding shares of common stock on the Record Date are present at the annual meeting in person or represented by proxy. On the Record Date, there were 89,109,410 shares of common stock outstanding and entitled to vote. |

Your shares will be counted towards the quorum only if you submit a valid proxy vote or vote at the annual meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of the shares present in person or represented by proxy at the annual meeting may adjourn the meeting to another date.

| Q. | What am I voting on? |

A. There are three matters scheduled for a vote:

| · | The election of two directors each to serve as Class II directors for a three year term expiring at the 2019 annual meeting of stockholders or until their respective successors have been duly elected and qualified; |

| · | The ratification of CohnReznick LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2017; and |

| · | The approval of an advisory vote on the compensation of our named executive officers (“say-on-pay”). |

As of the date of this proxy statement, we are not aware of any business expected to come before or be transacted at the annual meeting other than the matters described above.

Q. How do I vote?

| A. | For Proposal 1, you may either vote “FOR” all the nominees for director or you may abstain from voting for any nominee you specify. For Proposals 2 and 3, you may vote “FOR” or “AGAINST” or you may abstain from voting. The procedures for voting are fairly simple: |

Stockholder of Record: Shares Registered in Your Name -- If you are a stockholder of record, you may vote in person at the annual meeting or you can vote by returning the enclosed proxy card. Whether or not you plan to attend the annual meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the annual meeting and vote in person even if you have already voted by proxy.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or other agent -- If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received this proxy statement from that organization rather than from iBio. Simply follow the voting instructions provided by that organization. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact your broker, bank or other agent to request a proxy form.

5

| Q. | What if I return a proxy card but do not make specific choices? |

| A. | If you properly submit your proxy and do not revoke it, the proxy holders will vote your shares in accordance with your instructions. If your properly completed proxy gives no instructions, the proxy holders will vote your shares in the following manner: |

| · | FOR the election of each of the two directors as Class II directors, |

| · | FOR the selection of CohnReznick LLP as our independent registered public accounting firm, and |

| · | FOR the “say on pay” proposal. |

In their discretion on any other matters that properly come before the annual meeting.

| Q. | How may I change or revoke my vote after submitting my proxy? |

| A. | You may change or revoke your proxy at any time before the annual meeting. You may revoke your proxy in any one of three ways: |

| · | You may submit another properly completed proxy with a later date. Only the most recently dated proxy will be counted. |

| · | You may send written notice in time for receipt by us prior to the annual meeting that you are revoking your proxy. Such notice should be sent us c/o of our Secretary, iBio, Inc., 600 Madison Avenue, Suite 1601, New York, NY 10022. |

| · | You may attend the annual meeting, request that your proxy be revoked and vote in person as instructed above. Simply attending the meeting will not, by itself, revoke your proxy. You must specifically request such revocation. |

| Q. | What does it mean if I receive more than one notice of annual meeting? |

| A. | If you receive more than one notice of annual meeting, your shares are registered in more than one name or are registered in different accounts. You should submit a proxy for each name and account to ensure that all of your shares are voted. |

| Q. | What are broker non-votes? |

| A. | Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions as to how to vote to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can vote the shares with respect to matters that are “discretionary” items but cannot vote the shares with respect to “nondiscretionary” items (resulting in a “broker non-vote”). |

If your shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker non-votes. The ratification of the selection of CohnReznick LLP is a “discretionary” item. All the other matters being acted upon and put to a vote at the annual meeting are “non-discretionary” items.

6

| Q. | How many votes are needed to approve each proposal? |

| A. | For the approval of Proposal 1 (the election of directors), the two nominees receiving the most “FOR” votes from the holders of shares present in person or represented by proxy and entitled to vote on the election of directors will be elected, regardless of whether that number represents a majority of the votes cast. Abstentions and broker non-votes will have no effect on the outcome of the election of directors. |

To be approved, Proposals 2 and 3 (ratifying the selection of CohnReznick LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2017 and approving the “say on pay” proposal) must receive “FOR” votes from the holders of a majority of shares present at the annual meeting, either in person or by proxy. Abstentions and broker non-votes will have the same effect as a vote against the proposal, because passage of Proposals 2 and 3 requires the affirmative vote of a majority of the votes present, in person or by proxy, at the annual meeting.

| Q. | Am I entitled to dissenter’s rights? |

| A. | No. Delaware General Corporation Law does not provide for dissenter’s rights in connection with the proposals being voted on at the Annual Meeting. |

| Q. | Where may I find the results of the voting at the annual meeting? |

| A. | Preliminary voting results will be announced at the annual meeting. Final voting results will be published in a Current Report on Form 8-K within four business days following the annual meeting. |

| Q. | Who is paying for this proxy solicitation? |

| A. | Our board of directors is soliciting the proxy accompanying this proxy statement. The Company will bear the cost of soliciting proxies. Such cost will include charges by brokers and other custodians, nominees and fiduciaries for forwarding proxies and proxy materials to the beneficial owners of our common stock. Solicitation may also be made personally by telephone or by email by the Company’s directors, officers and regular employees without additional compensation. |

7

PROPOSAL 1 -- ELECTION OF DIRECTORS

The Company’s board of directors is currently composed of seven (7) directors divided into three classes of directors, Class I, II and III, with each class serving staggered 3-year terms. The current term of office for each Class II director expires at the annual meeting. The class and current term of each director is as follows:

| Class and Term Expiration | Directors | |

| Class I | Robert B. Kay | |

| (2018) | General James T. Hill | |

| Arthur Y. Elliott, Ph.D. | ||

| Class II | Glenn Chang | |

| (2016) | Philip K Russell, M.D. | |

| Class III | John D. McKey, Jr. | |

| (2017) | Seymour Flug |

At our annual meeting, our stockholders will consider and vote upon the re-election of Glenn Chang and Philip K Russell, M.D. to serve as Class II directors. If re-elected, these nominees will serve for a three year term that will expire at the 2019 annual meeting of stockholders. Our board of directors believes that all of our current directors, including the two nominees for election, possess personal and professional integrity, good judgment, a high level of ability and business acumen. Our board of directors also believes that Mr. Chang and Dr. Russell have performed exceptionally well in their respective time served as directors.

Each nominee has agreed to serve if elected and we have no reason to believe that any nominee will be unable to serve. If any nominee becomes unavailable for election as a result of an unexpected occurrence, proxies will be voted for the election of a substitute nominee proposed by our board of directors or for election of only the remaining nominees.

Unless authority to do so is withheld, shares represented by executed proxies will be voted for the election of Mr. Chang and Dr. Russell. Proxies cannot be voted for a greater number of persons than the number of nominees standing for election. Since two directors are to be elected at the annual meeting, the two nominees for director who receive the highest number of affirmative votes for election will be elected as Class II directors.

Information with respect to the number of shares of common stock beneficially owned by each nominee for election as a Class II director and each of our other directors appears under the heading “Security Ownership of Certain Beneficial Owners and Management”.

The name, age, years of service on our board of directors, principal occupation and business experience and certain other information for each Class II director nominee is set forth below.

8

| Name and Age | Principal Occupation and Business Experience | Director Since | ||

| Glenn Chang (age 69) | Since February 2014, Glenn Chang serves as Chief Financial Officer of Singer Vehicle Design, a private company in the business of automotive design and restoration. Mr. Chang served as the Chief Financial Officer of Alma Bank, a New York headquartered bank with over $900 million of assets and 13 branches in the New York City Metropolitan area from late 2012 to February 2014. Before joining Alma, from 1999 to 2012, Mr. Chang served as a founder, Director, Chief Financial Officer and consultant to First American International Bank which is the largest locally owned Chinese American Bank. Prior to that he spent 20 years at Citibank, N.A as Vice President. Mr. Chang is a retired Certified Public Accountant. Mr. Chang’s extensive executive and financial leadership in his current and former positions and his training and experience as a Certified Public Accountant adds vital expertise to our board of directors and our Audit Committee in the form of financial understanding, business perspective and audit expertise. Mr. Chang is qualified as an Audit Committee Financial Expert as defined in Regulation S-K Item 407(d)(5)(ii). | August 2008 | ||

| Philip K. Russell, M.D. (age 85) | Major General (retired.) Russell served in the U.S. Army Medical Corps from 1959 to 1990, pursuing a career in infectious disease and tropical medicine research. Following his military service, Dr. Russell joined the faculty of Johns Hopkins University’s School of Hygiene and Public Health and worked closely with the World Health Organization as special advisor to the Children’s Vaccine Initiative. He was founding board member of the International AIDS Vaccine Initiative, and is an advisor to the Bill & Melinda Gates Foundation. He has served on numerous advisory boards of national and international agencies, including the Centers for Disease Control (“CDC”), the National Institutes of Health (“NIH”) and the Institute of Medicine. Dr. Russell is a past Chairman of the Albert B. Sabin Vaccine Institute. Dr. Russell’s extensive experience and expertise in the field of infectious diseases and his association with leading governmental and not-for-profit entities engaged in pioneering work throughout the world provides us with invaluable insights into priorities for these entities and business development opportunities for us. | March 2010 |

9

The board of directors believes that approval of the election of each nominee director named above is in the best interests of our stockholders and therefore recommends a vote “FOR” each nominee.

OTHER DIRECTORS OF THE COMPANY SERVING AS CLASS I AND CLASS III DIRECTORS

The name, age, years of service on our board of directors, principal occupation and business experience and certain other information for each our Class I and Class III directors who will continue to serve on the board of directors and who are not standing for election at this annual meeting is set forth below:

| Name and Age | Principal Occupation and Business Experience | Director Since | ||

|

Robert B. Kay (age 77) |

Mr. Kay is our Executive Chairman and Chief Executive Officer and has served in these capacities since we became a publicly traded company in August 2008. Previously, Mr. Kay was a founder and senior partner of the New York law firm of Kay Collyer & Boose LLP, with a particular focus on mergers and acquisitions and joint ventures. Mr. Kay received his B.A. from Cornell University’s College of Arts & Sciences and his J.D. from New York University Law School.

Mr. Kay oversees every aspect of our business in his role as executive chairman and chief executive officer. Given his years with the company and his prior experience, we believe that Mr. Kay has an excellent understanding of our business and the global markets in which we operate and those in which we anticipate operating in the future. |

August 2008 | ||

| General James T. Hill (retired) (age 70) |

General Hill was the Commander of the 4-Star United States Southern Command, reporting directly to the President and Secretary of Defense at the time of his retirement from active duty. As such he led all U.S. military forces and operations in Central America, South America and the Caribbean, worked directly with U.S. Ambassadors, foreign heads of state, key Washington decision-makers, foreign senior military and civilian leaders, developing and executing United States policy. His responsibilities included management, development and execution of plans and policy within the organization including programming, communications, manpower, operations, logistics and intelligence. General Hill’s experience implementing plans and policies within diverse geographic regions and his insights regarding the conduct of business affairs in Central and South America is a key resource for us. |

August 2008 |

10

| Arthur Y. Elliott, Ph.D (age 81) |

Dr. Elliott serves as a member of the American Association for Advancement of Science, American Society for Microbiology, and American Tissue Culture Association. Prior to retiring, Dr. Elliott spent 16 years with Merck & Co., serving ultimately as Executive Director of Biological Operations, Merck Manufacturing Division, responsible for the bulk manufacture, testing, release and registration of all biological products sold. Dr. Elliott also directed the manufacturing, process development, and other operations of North American Vaccine, Inc. for six years, and most recently served as consultant to Aventis (Sanofi Pasteur) Pharmaceutical Corporation in its design and implementation of new, highly automated manufacturing facilities for influenza vaccines. Dr. Elliott has served with the United States Department of Health and Human Services (“HHS”) in the Avian Influenza Pandemic Preparedness Program in Washington, D.C. as Senior Program Manager for the Antigen Sparing Project since 2006. The program involves the cooperation of three pharmaceutical companies and four government groups (NIH, CDC, United States Food and Drug Administration, and HHS). While at Merck, he worked closely with both Merck Research Laboratories and the Merck Vaccine Division to forecast the timely transfer of technology for new and improved products from the research laboratories through the manufacturing area and into the marketing division for sales introductions. He has served as a biological consultant to the World Health Organization, NIH, and The Bill & Melinda Gates Foundation. Dr. Elliott holds a Ph.D. in Virology from Purdue University, and an M.S. in Microbiology and a B.A. in Biology from North Texas State University.

Dr. Elliot’s extensive experience and expertise with the manufacture of vaccines and therapeutics is particularly relevant to our business and our efforts to manufacture such products which in a key component of our business. |

October 2010 | ||

| John D. McKey, Jr. (age 73) | Since 2003, Mr. McKey serves as of counsel at McCarthy, Summers, Bobko, Wood, Sawyer & Perry, P.A. in Stuart, Florida, and previously was a partner from 1987 through 2003. From 1977 to 1987, Mr. McKey was a partner at Gunster Yoakley in Palm Beach, Florida. Mr. McKey received his B.B.A at the University of Georgia and his J.D. from the University Of Florida College Of Law. Mr. McKey’s extensive experience representing private and public companies operating in varied business sectors brings our board insights and acumen to best corporate practices and implementation of strategic and financial plans. | August 2008 | ||

| Seymour Flug (age 81) | Prior to retiring, Mr. Flug was Chairman of the Board and CEO of Diners Club International and a Managing Director of Citibank. Prior to joining Citibank, Mr Flug served as Senior Vice President of Hess Oil Company. Mr. Flug began his career as Certified Public Accountant at Deloitte & Touche, a predecessor to the firm now known as Deloitte. Mr. Flug received his B.B.A from Baruch College. Mr. Flug’s experience leading a multinational company and his experience as a certified public accountant allow him to offer us unique perspectives on global business opportunities, best business practices and additional audit expertise. Mr. Flug is qualified as an Audit Committee Financial Expert as defined in Regulation S-K Item 407(d)(5)(ii). | December 2012 |

11

INFORMATION REGARDING THE BOARD OF DIRECTORS

AND CORPORATE

GOVERNANCE

Director Compensation

Compensation for our non-employee directors has historically consisted of a grant of stock options vesting over a three-year period and additional cash compensation. We do not have a fixed policy with respect to this compensation, but the compensation is generally equal for each non-employee director except in cases where a director assumes additional responsibilities above and beyond standard board service. Directors who are also our employees receive no additional compensation for their services as directors.

Director Compensation Table

The following table sets forth summary information concerning the total compensation paid to our non-employee directors for services to the Company during the fiscal year ended June 30, 2016:

| Name | Fees Earned or Paid in Cash | Option Awards(1)(2) | Total | |||||||||

| General James T. Hill | $ | 25,000 | $ | 62,733 | $ | 87,733 | ||||||

| Glenn Chang | 10,000 | 62,733 | 72,733 | |||||||||

| John D. McKey | 10,000 | 62,733 | 72,733 | |||||||||

| Philip K. Russell, M.D. | 10,000 | 62,733 | 72,733 | |||||||||

| Arthur Elliot | 10,000 | 62,733 | 72,733 | |||||||||

| Seymour Flug | 10,000 | 62,733 | 72,733 | |||||||||

| 75,000 | 376,398 | 451,398 | ||||||||||

| (1) | Reflects the aggregate grant date fair value computed in accordance with FASB ASC 718. |

| (2) | The aggregate number of stock options outstanding for each non-employee director was as follows: Gen. Hill 490,000, Mr. Chang 490,000, Mr. McKey 590,000, Dr. Russell 400,000, Dr. Elliott 400,000, and Mr. Flug 280,000. |

12

Director Independence

Our board of directors has determined that Messrs. Chang, Flug and McKey, Drs. Elliott and Russell and General Hill are each “independent directors” as such term is defined in Section 803 of the New York Stock Exchange MKT Company Guide.

Board Committees

Our board of directors has the authority to appoint committees to perform certain management and administrative functions. Our board of directors has constituted audit, compensation and nominating committees.

Nominating Committee and Nomination Process

The Nominating Committee was formed to address general governance and policy oversight; succession planning; to identify qualified individuals to become prospective board members and make recommendations regarding nominations for our board of directors; to advise the board with respect to appropriate composition of board committees; to advise the board about and develop and recommend to the board appropriate corporate governance documents and assist the board in implementing guidelines; to oversee the annual evaluation of the board and our chief executive officer, and to perform such other functions as the board may assign to the committee from time to time. The Nominating Committee has a charter which is available on our website at www.ibioinc.com. The Nominating Committee consists of three independent directors: Arthur Y. Elliott, Ph.D., (Nominating Committee Chairman), Glenn Chang and General James T. Hill.

Our directors take a critical role in guiding our strategic direction and oversee the management of our company. Board candidates are considered based upon various criteria, such as their broad-based business and professional skills and experiences, a global business and social perspective, concern for the long-term interests of our stockholders and personal integrity and judgment. In addition, directors must have time available to devote to board activities and to enhance their knowledge of the life sciences industry. Accordingly, we seek to attract and retain highly qualified directors who have sufficient time to attend to their substantial duties and responsibilities.

Our board of directors believes given the diverse skills and experience required to grow our company that the input of all members of the Nominating Committee is important for considering the qualifications of individuals to serve as directors but does not have a diversity policy. Further, the Nominating Committee believes that the minimum qualifications for serving as our director are that a nominee demonstrate, by significant accomplishment in his or her field, an ability to make a meaningful contribution to the board’s oversight of our business and affairs of and have an impeccable record and reputation for honest and ethical conduct in both his or her professional and personal activities. Whenever a new seat or a vacated seat on the board is being filled, candidates that appear to best fit the needs of the board and our company are identified and unless such individuals are well known to the board, they are interviewed and further evaluated by the Nominating Committee. Candidates selected by the Nominating Committee are then recommended to the full board for their nomination to stockholders. The Nominating Committee recommends a slate of directors for election at the annual meeting. In accordance with NYSE MKT LLC rules, the slate of nominees is approved by a majority of the independent directors.

In carrying out its responsibilities, our board will consider candidates suggested by stockholders. If a stockholder wishes to formally place a candidate’s name in nomination, however, he or she must do so in accordance with the provisions of our First Amended and Restated Bylaws. Suggestions for candidates to be evaluated by the Nominating Committee must be sent to Secretary, iBio, Inc., 600 Madison Avenue, Suite 1601, New York, NY 10022-1737.

13

Audit Committee

The Audit Committee of the board of directors makes recommendations regarding the retention of the independent registered public accounting firm, reviews the scope of the annual audit undertaken by our independent registered public accounting firm and the progress and results of their work, reviews our financial statements, and oversees the internal controls over financial reporting and corporate programs to ensure compliance with applicable laws and regulations. The Audit Committee reviews all services performed for us by the independent registered public accounting firm and determines whether they are compatible with maintaining the registered public accounting firm’s independence. The Audit Committee has a charter, which is reviewed annually and as may be required due to changes in industry accounting practices or the promulgation of new rules or guidance documents. The Audit Committee charter is available on our website at www.ibioinc.com. The Audit Committee consists of two independent directors as determined by NYSE MKT LLC listing standards: Glenn Chang (Audit Committee Chairman) and Seymour Flug. Mr. Chang and Mr. Flug are each qualified as an Audit Committee Financial Expert as defined in Regulation S-K Item 407(d)(5)(ii).

Compensation Committee

The Compensation Committee of the Board of Directors reviews and approves executive compensation policies and practices, reviews salaries and bonuses for our senior executive officers, administers our equity incentive plan and other benefit plans, and considers other matters as may, from time to time, be referred to them by our board of directors. The Compensation Committee has a charter which is available on our website at www.ibioinc.com. The members of the Compensation Committee are General James T. Hill (Compensation Committee Chairman), Arthur Y. Elliott, Ph.D. and Philip K. Russell, M.D.

Board Leadership Structure and Role in Risk Oversight

Our chief executive officer also serves as the executive chairman of our board of directors. We do not have a lead independent director. Our executive chairman, when present, presides over all meetings of our board. We believe this leadership structure is appropriate for our Company at this time because (1) of our size, (2) of the size of our board, (3) our chief executive officer is responsible for our day-to-day operation and implementing our strategy, and (4) discussion of developments in our business and financial condition and results of operations are important parts of the discussion at meetings of our board of directors and it makes sense for our chief executive officer to chair those discussions.

Our board of directors oversees our risk management. This oversight is administered primarily through the following:

| · | Our board’s review and approval of our business strategy, including the projected opportunities and challenges facing our business; |

| · | At least quarterly review of our business developments and financial results; |

| · | Our Audit Committee’s oversight of our internal controls over financial reporting and its discussions with management and the independent registered public accountants regarding the quality and adequacy of our internal controls and financial reporting; and |

| · | Our board’s review and recommendations regarding our executive officer compensation and its relationship to our business objectives and goals. |

14

Meetings of the Board of Directors and Committees

During the fiscal year ended June 30, 2016, the board of directors held two meetings in person or by telephone and acted by unanimous written consent on one occasion and the Audit Committee held four meetings in person or by telephone. No meetings in person or by telephone were held and no actions were taken by either the Nominating Committee or Compensation Committee as matters addressable by such committees were considered and approved by the full board. Between meetings, members of the board of the directors are provided with information regarding our operations and are consulted on an informal basis with respect to pending business. Each director attended at least 75% of the aggregate of the total number of meetings of the board and the total number of meetings of the committees on which such director serves. All of our directors attended our 2015 Annual Meeting of Stockholders.

Although we do not have a policy with regard to board members’ attendance at our annual meetings of stockholders, all of the directors are encouraged to attend such meetings.

Stockholder Communications with the Board of Directors

Interested parties may communicate with the board or specific members of the board, including the independent directors and the members of the Audit Committee, by submitting correspondence addressed to the Board of Directors of iBio, Inc. c/o any specified individual director or directors at 600 Madison Avenue, Suite 1601, New York, New York 10022-1737. Any such correspondence will be forwarded to the indicated directors.

Code of Ethics

We have adopted a written code of ethics within the meaning of Item 406 of SEC Regulation S-K, which applies to all of our employees, including our principal executive officer and our chief financial officer, a copy of which can be found on our website at www.ibioinc.com. If we make any waivers or substantive amendments to the code of ethics that are applicable to our principal executive officer or our chief financial officer, we will disclose the nature of such waiver or amendment in a Current Report on Form 8-K in a timely manner. No waivers from any provision of our policy have been granted.

Available information about iBio

Current reports, quarterly reports, annual reports, and reports under Section 16(a) of the Securities Exchange Act of 1934, as amended (the “1934 Exchange Act”) previously filed with the Securities and Exchange Commission (“SEC”), are available on our website at www.ibioinc.com and in print for any stockholder upon written request to our Secretary.

Executive Officers

The following table sets forth the names, ages and biographical information of our executive officers as of April 3, 2017:

| Name | Age | Position Held With Us | ||

| Robert B. Kay | 77 | Executive Chairman and Chief Executive Officer | ||

| Robert L. Erwin | 63 | President | ||

| James P. Mullaney | 46 | Chief Financial Officer | ||

| Terence Ryan, Ph.D. | 61 | Chief Scientific Officer |

15

The following are brief biographies of each executive officer:

Robert B. Kay has served as our Executive Chairman and Chief Executive Officer since we became a publicly traded company in August 2008. Mr. Kay was a founder and senior partner of the New York law firm of Kay Collyer & Boose LLP, with a particular focus on mergers and acquisitions and joint ventures. Mr. Kay received his B.A. from Cornell University’s College of Arts & Sciences and his J.D. from New York University Law School.

Robert L. Erwin has been our President since we became a publicly traded company in August 2008. Mr. Erwin led Large Scale Biology Corporation from its founding in 1988 through 2003, including a successful initial public offering in 2000, and continued as non-executive Chairman until 2006. He served as Chairman of Icon Genetics AG from 1999 until its acquisition by a subsidiary of Bayer AG in 2006. Mr. Erwin recently served as Managing Director of Bio-Strategic Directors LLC, providing consulting services to the life sciences industry. He is currently Chairman of Novici Biotech, a private biotechnology company and a Director of Oryn Therapeutics. Mr. Erwin’s non-profit work focuses on applying scientific advances to clinical medicine, especially in the field of oncology. He is co-founder, President and Director of the Marti Nelson Cancer Foundation, Oncology. Mr. Erwin received his BS degree with Honors in Zoology and an MS degree in Genetics from Louisiana State University.

James P. Mullaney has served as our Chief Financial Officer since March 2017. He brings extensive finance transformation, strategic development and partnership, internal control and regulatory compliance experience to iBio. He has been a member of Price Waterhouse’s audit practice as well as KPMG’s CFO Advisory practice. Prior to joining iBio, Mr. Mullaney served as Corporate Controller for Citihub Inc., a global, independent IT advisory firm, from September 2011 to February 2017. He is a Certified Public Accountant.

Terence E. Ryan, Ph.D., has been our chief scientific officer since March 2012, and prior to that served as senior vice president since joining the Company in July 2010. Dr. Ryan previously served as assistant vice president, Systems Biology at Wyeth Pharmaceuticals (later Pfizer, Inc.) from 2007 to 2010, and director of Integrative Biology at GlaxoSmithKline from 2003 to 2007. He has also been director, Cell Biology at Celera Genomics from 2000 to 2003 and associate director of Cell Technologies and Protein Sciences at Regeneron Pharmaceuticals, Inc. Dr. Ryan received his A.B. in Biology from Princeton University, his M.S. and Ph.D. in Microbiology from Rutgers University and was a post-doctoral fellow in Molecular Virology at the University of Wisconsin.

Summary Compensation Table

The table below summarizes the total compensation paid or earned by our principal executive officer, principal financial officer and our two other most highly compensated executive officers who were serving as executive officers at June 30, 2016, the end of our last completed fiscal year. We refer to the executive officers identified in this table as our “named executive officers.”

16

| Name and Principal Position | Fiscal Year | Salary | Bonus | Option Awards (1) | Total | |||||||||||||||

| Robert B. Kay | 2016 | $ | 310,732 | $ | 0 | $ | 470,495 | $ | 781,227 | |||||||||||

| Executive Chairman | 2015 | 309,735 | 0 | 238,961 | 548,696 | |||||||||||||||

| Mark Giannone(2) | 2016 | 99,000 | 0 | 94,099 | 193,099 | |||||||||||||||

| Former Chief Financial Officer | 2015 | 48,000 | 0 | 21,263 | 69,263 | |||||||||||||||

| Robert Erwin | 2016 | 230,000 | 0 | 470,495 | 700,495 | |||||||||||||||

| President | 2015 | 230,000 | 0 | 238,261 | 468,261 | |||||||||||||||

| Terence E. Ryan, Ph.D. | 2016 | 200,000 | 0 | 62,733 | 262,733 | |||||||||||||||

| Chief Scientific Officer | 2015 | 200,000 | 0 | 0 | 200,000 | |||||||||||||||

| (1) | Reflects the aggregate grant date fair value computed in accordance with FASB ASC 718. |

| (2) | Mr. Giannone’s employment ended March 1, 2017. James P. Mullaney was appointed as the Company’s Chief Financial Officer on March 1, 2017. |

Outstanding Equity Awards at Fiscal Year-Ending June 30, 2016

The following table shows information regarding unexercised stock options held by our named executive officers as of June 30, 2016.

| Name | Unexercised Options |

Exercise Price |

Expiration Date |

Market Value (1) |

||||||||||

| Robert Kay (2) | 250,000 | $ | 0.20 | 2/13/19 | $ | 130,000 | ||||||||

| Robert Kay (2) | 250,000 | $ | 0.66 | 8/10/19 | $ | 15,000 | ||||||||

| Robert Kay (2) | 300,000 | $ | 1.73 | 8/16/20 | $ | - | ||||||||

| Robert Kay (3) | 500,000 | $ | 3.07 | 12/30/20 | $ | - | ||||||||

| Robert Kay (3) | 500,000 | $ | 3.07 | 12/30/20 | $ | - | ||||||||

| Robert Kay (4) | 300,000 | $ | 1.96 | 10/21/21 | $ | - | ||||||||

| Robert Kay (4) | 300,000 | $ | 1.10 | 7/24/22 | $ | - | ||||||||

| Robert Kay (4) | 300,000 | $ | 0.50 | 7/16/23 | $ | 66,000 | ||||||||

| Robert Kay (5) | 600,000 | $ | 1.00 | 9/5/24 | $ | - | ||||||||

| Robert Kay (5) | 750,000 | $ | 1.72 | 9/4/25 | $ | - | ||||||||

| Robert Erwin (2) | 250,000 | $ | 0.20 | 2/13/19 | $ | 130,000 | ||||||||

| Robert Erwin (2) | 250,000 | $ | 0.66 | 8/10/19 | $ | 15,000 | ||||||||

| Robert Erwin (2) | 300,000 | $ | 1.73 | 8/16/20 | $ | - | ||||||||

| Robert Erwin (4) | 300,000 | $ | 1.96 | 10/21/21 | $ | - | ||||||||

| Robert Erwin (4) | 300,000 | $ | 1.10 | 7/24/22 | $ | - | ||||||||

| Robert Erwin (4) | 300,000 | $ | 0.50 | 7/16/23 | $ | 66,000 | ||||||||

| Robert Erwin (5) | 600,000 | $ | 1.00 | 9/5/24 | $ | - | ||||||||

| Robert Erwin (5) | 750,000 | $ | 1.72 | 9/4/25 | $ | - | ||||||||

| Terence Ryan (6) | 100,000 | $ | 1.38 | 7/14/20 | $ | - | ||||||||

| Terence Ryan (6) | 100,000 | $ | 1.96 | 10/21/21 | $ | - | ||||||||

| Terence Ryan (5) | 100,000 | $ | 1.72 | 9/4/25 | $ | - | ||||||||

| Mark Giannone (5) | 100,000 | $ | 0.58 | 1/24/24 | $ | 14,000 | ||||||||

| Mark Giannone (5) | 50,000 | $ | 0.49 | 9/5/24 | $ | 11,500 | ||||||||

| Mark Giannone (5) | 150,000 | $ | 1.72 | 9/4/25 | $ | - | ||||||||

17

| (1) | The market value for each award is based upon the closing stock price of $0.72 per share of common stock on June 30, 2016, less the exercise price of the option. |

| (2) | Options vested in five equal annual installments on the anniversary date of grant. Options fully vested as of June 30, 2016. |

| (3) | Options vested on the vesting commencement date of the grant. Options fully vested as of June 30, 2016. |

| (4) | Options vest in five equal annual installments on the anniversary date of grant. |

| (5) | Options vest in three equal annual installments on the anniversary date of grant. |

| (6) | Options vested in three equal annual installments on the anniversary date of grant. Options fully vested as of June 30, 2016. |

Employment Agreements

As of June 30, 2016, we did not have any employment contracts or other similar agreements or arrangements with any of our named executive officers.

Equity Incentive Plan

On August 12, 2008, the Company adopted the iBioPharma 2008 Omnibus Equity Incentive Plan (the “Plan”) for employees, officers, directors and external service providers. In December 2013 our stockholders approved an amendment to the Plan to increase the number of shares of our common stock authorized for issuance thereunder from 10 million shares to 15 million shares. Under the provisions of the Plan, the Company may grant options to purchase stock and/or make awards of restricted stock up to an aggregate amount of 15 million shares. Stock options granted under the Plan may be either incentive stock options (as defined by Section 422 of the internal Revenue Code of 1986, as amended) or non-qualified stock options at the discretion of the board of directors. Vesting of awards occurs ratably on the anniversary of the grant date over the service period as determined at the time of grant.

The following table provides information regarding the status of the Plan at June 30, 2016:

| Number of Shares of Common Stock to be Issued Upon Exercise of Outstanding Options | Weighted-Average Exercise Price of Outstanding Options | Number of Options Available for Future Issuance Under Equity Compensation Plans (excluding securities reflected in the previous columns) | ||||||||||

| Equity compensation plan approved by stockholders | 12,273,334 | $ | 1.31 | 2,726,666 | ||||||||

| Equity compensation plans not approved by stockholders | — | — | — | |||||||||

| Total | 12,273,334 | $ | 1.31 | 2,726,666 | ||||||||

18

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with respect to the beneficial ownership of our outstanding common stock as of April 3, 2017:

| · | each person who is known by us to be the beneficial owner of 5% or more of our outstanding common stock; |

| · | each of our directors including our chief executive officer; |

| · | each of our other named executive officers; and |

| · | all of our current executive officers and directors as a group. |

Except as otherwise noted in the footnotes below, to our knowledge, each of the persons named in this table has sole voting and investment power with respect to the securities indicated as beneficially owned.

| Number of | Percent of | |||||||

| Shares | Shares | |||||||

| Name and Address of Beneficial Owner(1) | Beneficially | Beneficially | ||||||

| 5% Stockholders | Owned (2) | Owned(2) | ||||||

| Eastern Capital Limited | 33,744,000 | (3) | 37.09 | % | ||||

| E. Gerald Kay | 5,945,695 | (4) | 6.7 | % | ||||

| Carl DeSantis | 5,014,873 | (5) | 5.6 | % | ||||

| Directors | ||||||||

| Robert B. Kay | 4,200,962 | (6) | 4.6 | % | ||||

| Glenn Chang | 415,483 | (7) | 0.5 | % | ||||

| Arthur Y. Elliott, Ph.D. | 313,333 | (8) | 0.4 | % | ||||

| John McKey, Jr. | 989,891 | (9) | 1.1 | % | ||||

| Seymour Flug | 193,333 | (8) | 0.2 | % | ||||

| General James T. Hill | 418,333 | (10) | 0.5 | % | ||||

| Philip K. Russell, M.D. | 313,333 | (8) | 0.4 | % | ||||

| Other Executive Officers | ||||||||

| Robert L. Erwin | 2,170,000 | (8) | 2.4 | % | ||||

| Terence E. Ryan, Ph.D. | 233,333 | (8) | 0.3 | % | ||||

| James P. Mullaney(11) | - | |||||||

| Mark Giannone | 172,834 | (12) | 0.2 | % | ||||

| - | ||||||||

| All current directors and executive officers as a group (10 persons) | 9,248,001 | (13) | 9.6 | % | ||||

| (1) | The address of Eastern Capital Limited (“Eastern”) is Box 31363, Grand Cayman, E9 KY1 1206. The address of E. Gerald Kay is c/o Integrated BioPharma, Inc., 225 Long Avenue, Box 278, Hillside, New Jersey 07205. The address of Carl DeSantis is c/o CDS International Holdings, Inc., 3299 NW 2nd Avenue, Boca Raton, FL 33431. The address of each of our directors and executive officers is c/o iBio, Inc., 600 Madison Avenue, Suite 1601, New York, New York 10022-1737. |

| (2) | Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to shares of our common stock. On April 3, 2017, there were 89,109,410 shares of common stock outstanding. Shares of common stock issuable under stock options that are exercisable within 60 days after April 3, 2017 are deemed outstanding and are included for purposes of computing the number of shares owned and percentage ownership of the person holding the option but are not deemed outstanding for computing the percentage ownership of any other person. |

19

| (3) | Consists of 33,744,000 shares of common stock. This information is based solely on information set forth in a Schedule 13D/A Amendment No. 8 filed with the SEC on February 27, 2017 by Kenneth B. Dart. |

| (4) | Consists of 5,945,695 shares of common stock. This information is based solely on information set for forth in a Schedule 13D filed with the SEC on June 13, 2013 by E. Gerald Kay and EGK, LLC. The number of shares of common stock beneficially owned by these entities may have changed since the filing of the Schedule 13D. |

| (5) | Consists of 5,014,873 shares of common stock. This information is based solely on information set forth in a Schedule 13D/A Amendment No. 3 filed with the SEC on November 18, 2014 by Carl DeSantis, the DeSantis Revocable Trust, and CD Financial LLC. |

| (6) | Includes (i) 211,333 shares of common stock, (ii) 819,629 shares of common stock held by EVJ LLC, of which Mr. Kay is the manager, and (iii) 3,170,000 shares of common stock underlying vested stock options held by Mr. Kay. |

| (7) | Includes (i) 12,150 shares of common stock and (ii) 403,333 shares of common stock underlying vested stock options. |

| (8) | All shares listed are shares of common stock underlying vested stock options. |

| (9) | Includes (i) 486,558 shares of common stock and (ii) 503,333 shares of common stock underlying vested stock options. |

| (10) | Includes (i) 15,000 shares of common stock and (ii) 403,333 shares of common stock underlying vested stock options. |

| (11) | James P. Mullaney was appointed Chief Financial Officer of the Company on March 1, 2017. Pursuant to an offer letter between the Company and Mr. Mullaney, dated December 30, 2016, Mr. Mullaney has been granted an initial option to purchase 150,000 shares of the Company’s common stock, which has not yet vested. The option will vest annually over three years. |

| (12) | Includes (i) 22,834 shares of common stock and (ii) 150,000 shares of common stock underlying vested stock options. Mr. Giannone’s employment ended March 1, 2017. |

| (13) | Includes 7,703,331 shares of common stock underlying vested stock options. |

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

Policies and Procedures for Related Person Transactions

The policy our board of directors is to review with management and our independent registered public accounting firm any related party transactions brought to the board’s attention which could reasonably be expected to have a material impact on our financial statements. The Company’s practice is for management to present to the board of directors each proposed related party transaction, including all relevant facts and circumstances relating thereto, and to update the board of directors as to any material changes to any approved related party transaction. In connection with this requirement, each of the transactions or relationships disclosed below were disclosed to and approved by our board of directors. In addition, transactions involving our directors and their affiliated entities were disclosed and reviewed by our board of directors in its assessment of our directors’ independence requirements.

20

Transactions with Eastern Capital Limited and its Affiliates

On January 13, 2016, we entered into a share purchase agreement with Eastern Capital Limited (“Eastern”), our largest stockholder, which was amended as of February 25, 2016 (as amended, the “6.5M Purchase Agreement”). Pursuant to the 6.5M Purchase Agreement, Eastern agreed to purchase 6,500,000 shares of our common stock (the “Eastern Shares”), for a purchase price of $0.622 per share, subject to the approval of our stockholders. Our stockholders approved the issuance of such shares at our 2015 Annual Meeting.

On the same day that we entered into the 6.5M Purchase Agreement, we also entered into a separate share purchase agreement pursuant to which Eastern agreed to purchase 3,500,000 shares of our common stock (the “3.5M Purchase Agreement”) for a purchase price of $0.622 per share (the “3.5M Purchase Agreement” and together with the 6.5M Purchase Agreement, the “Purchase Agreements”). Stockholder approval was not required for the issuance of the 3,500,000 shares of our common stock pursuant to the 3.5M Purchase Agreement and the sale of those shares was completed on January 25, 2016.

Simultaneously with the issuance of shares under the 3.5M Purchase Agreement, Eastern exercised warrants, dated April 26, 2013, which Eastern acquired previously, to purchase 1,784,000 shares of common stock for a purchase price of $0.53 per share.

Concurrently with the execution of the Purchase Agreements, we entered into a contract manufacturing joint venture with affiliates of Eastern to develop and manufacture plant-made pharmaceuticals through iBio’s recently formed subsidiary, iBio CMO LLC (“iBio CMO”). Bryan Capital Investors LLC (“Bryan Capital Investors”), an affiliate of Eastern, contributed $15.0 million in cash to iBio CMO, for a 30% interest in iBio CMO. iBio retained a 70% equity interest in iBio CMO. iBio contributed to the capital of iBio CMO a royalty bearing license, which grants iBio CMO a non-exclusive license to use the iBio’s proprietary technology, including the iBioLaunch technology, for research purposes and an exclusive U.S. license for manufacturing purposes. iBio retains all other rights in its intellectual property, including the rights to commercialize products based on its proprietary technology. On February 23, 2017, we entered into an Exchange Agreement with Bryan Capital Investors, pursuant to which we issued to Bryan Capital Investors one share of our iBio CMO Preferred Tracking Stock, par value $0.001 per share, in exchange for 29,990,000 units of limited liability company interests of iBio CMO held by Bryan Capital Investors. After giving effect to the transactions contemplated in the Exchange Agreement, we own 99.99% of iBio CMO and Bryan Capital Investors owns 0.01% of iBio CMO. iBio has the right to appoint a majority of the members of the Board of Managers that manages the iBio CMO joint venture. Specified material actions by the joint venture require the consent of iBio and Bryan Capital Investors.

In connection with the joint venture, an affiliate of Eastern (the “Eastern Affiliate”), which controls the subject property as sublandlord, granted iBio CMO a 34-year sublease of a 139,000 square foot Class A life sciences building in Bryan, Texas on the campus of Texas A&M University, designed and equipped for plant-made manufacture of biopharmaceuticals. iBio CMO began operations at the facility on December 22, 2015 pursuant to agreements between iBio CMO and the Eastern Affiliate granting iBio CMO temporary rights to access the facility. These temporary agreements were superseded by the Sublease Agreement, dated January 13, 2016, between iBio CMO and the Eastern Affiliate (the “Sublease”). The 34-year term of the Sublease may be extended by iBio CMO for a ten-year period, so long as iBio CMO is not in default under the Sublease. Under the Sublease, iBio CMO is required to pay base rent at an annual rate of $2,100,000, paid in equal quarterly installments on the first day of each February, May, August and November. The base rent is subject to increase annually in accordance with increases in the Consumer Price Index. The base rent under the Eastern Affiliate’s ground lease for the property is subject to adjustment, based on an appraisal of the property, in 2030 and upon any extension of the ground lease. The base rent under the Sublease will be increased by any increase in the base rent under the ground lease as a result of such adjustments. In addition to the base rent, iBio CMO is required to pay, for each calendar year during the term, a portion of the total gross sales for products manufactured or processed at the facility, equal to 7% of the first $5,000,000 of gross sales, 6% of gross sales between $5,000,001 and $25,000,000, 5% of gross sales between $25,000,001 and $50,000,000, 4% of gross sales between $50,000,001 and $100,000,000, and 3% of gross sales between $100,000,001 and $500,000,000. However, if for any calendar year period from January 1, 2018 through December 31, 2019, iBio CMO’s applicable gross sales are less than $5,000,000, or for any calendar year period from and after January 1, 2020, its applicable gross sales are less than $10,000,000, then iBio CMO is required to pay the amount that would have been payable if it had achieved such minimum gross sales and shall pay no less than the applicable percentage for the minimum gross sales for each subsequent calendar year. iBio CMO is responsible for all costs and expenses in connection with the ownership, management, operation, replacement, maintenance and repair of the property under the Sublease. General and administrative expenses related to the Eastern Affiliate were approximately $565,000 in 2016. Interest expense incurred under the capital lease obligation amounted to $807,000 in 2016.

21

As part of the transactions between Eastern and the Company, Eastern entered into a three year standstill agreement (the “Standstill Agreement”) that restricts additional acquisitions of our common stock by Eastern and its controlled affiliates to limit its beneficial ownership of our outstanding shares of common stock to a maximum of 38%, absent approval by a majority of our Board of Directors. With respect to the Standstill Agreement, our Board of Directors, acting unanimously, invited Bryan Capital Investors to enter into the Exchange Agreement described above and approved the issuance of one share of our Preferred Tracking Stock to Bryan Capital Investors.

Eastern does not have a right to appoint a director designee or any other special rights with respect to our management and affairs aside from its ability to vote the shares of common stock that it owns as it determines. Eastern has not been granted any board, management or special voting rights in connection with the transactions contemplated in the Purchase Agreements.

Research and Development Services Vendor

In January 2012, the Company entered into an agreement with Novici Biotech, LLC (“Novici”) in which iBio’s President is a minority stockholder. Novici performs platform technology development services for iBio, including laboratory feasibility analyses of gene expression, protein purification and preparation of research samples. The transaction has been conducted on an arm’s length basis at market terms. The accounts payable balance includes amounts due to Novici of approximately $200,000 and $153,000 at June 30, 2016 and 2015, respectively. Research and development expenses related to Novici were approximately $1,036,000 and $995,000 for the years ended June 30, 2016 and 2015, respectively.

Operating Lease with Minority Stockholder

Effective January 1, 2015, the Company is leasing office space on a month-to-month basis from an entity owned by a minority stockholder of the Company for approximately $7,500 per month.

Limitation of Liability of Officers and Directors and Indemnification

Our certificate of incorporation, as amended, provides for indemnification of our officers and directors to the extent permitted by Delaware law, which generally permits indemnification for actions taken by officers or directors as our representatives if the officer or director acted in good faith and in a manner he or she reasonably believed to be in the best interest of the corporation.

As permitted under Delaware law, the By-laws contain a provision indemnifying directors against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by them in connection with an action, suit or proceeding if they acted in good faith and in a manner they reasonably believed to be in or not opposed to the best interests of our Company, and, with respect to any criminal action or proceeding, had no reasonable cause to believe their conduct was unlawful.

Historical Relationship with Integrated BioPharma, Inc.

We were a subsidiary of Integrated BioPharma, Inc. (“Integrated BioPharma”) from February 21, 2003 until August 18, 2008. On that date, Integrated BioPharma spun off iBio in a transaction that was intended to be a tax free distribution to Integrated BioPharma and its U.S. stockholders. As part of that transaction, we entered into a number of agreements with Integrated BioPharma including an indemnification and insurance matters agreement and a tax responsibility allocation agreement. Messrs. E. Gerald Kay and Carl DeSantis, affiliates of Integrated BioPharma, were in 2008 and continue to remain beneficial holders of more than 5% of our common stock. The agreements are described below.

22

Indemnification. In general, under the indemnification and insurance matters agreement, we agreed to indemnify Integrated BioPharma, its affiliates and each of its and their respective directors, officers, employees, agents and representatives from all liabilities that arise from:

| · | any breach by us of the separation and distribution agreement or any ancillary agreement; |

| · | any of our liabilities reflected on our consolidated balance sheets included in the information statement relating to the spin-off; |

| · | our assets or businesses; |

| · | the management or conduct of our assets or businesses; |

| · | the liabilities allocated to or assumed by us under the separation and distribution agreement, the indemnification and insurance matters agreement or any of the other ancillary agreements; |

| · | various on-going litigation matters in which we are named defendant, including any new claims asserted in connection with those litigations, and any other past or future actions or claims based on similar claims, facts, circumstances or events, whether involving the same parties or similar parties, subject to specific exceptions; |

| · | claims that are based on any violations or alleged violations of U.S. or foreign securities laws in connection with transactions arising after the distribution relating to our securities and the disclosure of financial and other information and data by us or the disclosure by Integrated BioPharma as part of the distribution of our financial information or our confidential information; or |

| · | any actions or claims based on violations or alleged violations of securities or other laws by us or our directors, officers, employees, agents or representatives, or breaches or alleged breaches of fiduciary duty by our board of directors, any committee of our board or any of its members, or any of our officers or employees. |

Integrated BioPharma agreed to indemnify us and our affiliates and our directors, officers, employees, agents and representatives from all liabilities that arise from:

| · | any breach by Integrated BioPharma of the separation and distribution agreement or any ancillary agreement; |

| · | any liabilities allocated to or to be retained or assumed by Integrated BioPharma under the separation and distribution agreement, the indemnification and insurance matters agreement or any other ancillary agreement; |

| · | liabilities incurred by Integrated BioPharma in connection with the management or conduct of Integrated BioPharma’s businesses; and |

| · | various ongoing litigation matters to which we are not a party. |

23

Integrated BioPharma is not obligated to indemnify us against any liability for which we are also obligated to indemnify Integrated BioPharma. Recoveries by Integrated BioPharma under insurance policies will reduce the amount of indemnification due from us to Integrated BioPharma only if the recoveries are under insurance policies Integrated BioPharma maintains for our benefit. Recoveries by us will in all cases reduce the amount of any indemnification due from Integrated BioPharma to us.

Under the indemnification and insurance matters agreement, a party has the right to control the defense of third-party claims for which it is obligated to provide indemnification, except that Integrated BioPharma has the right to control the defense of any third-party claim or series of related third- party claims in which it is named as a party whether or not it is obligated to provide indemnification in connection with the claim and any third-party claim for which Integrated BioPharma and we may both be obligated to provide indemnification. We may not assume the control of the defense of any claim unless we acknowledge that if the claim is adversely determined, we will indemnify Integrated BioPharma in respect of all liabilities relating to that claim. The indemnification and insurance matters agreement does not apply to taxes covered by the tax responsibility allocation agreement.

Offset. Integrated BioPharma is permitted to reduce amounts it owes us under any of our agreements with Integrated BioPharma, by amounts we may owe to Integrated BioPharma under those agreements.

Assignment. We may not assign or transfer any part of the indemnification and insurance agreement without Integrated BioPharma’s prior written consent. Nothing contained in the agreement restricts the transfer of the agreement by Integrated BioPharma.

Tax Responsibility Allocation Agreement

In order to allocate our responsibilities for taxes and certain other tax matters, we and Integrated BioPharma entered into a tax responsibility allocation agreement prior to the date of the distribution. Under the terms of the agreement, with respect to consolidated federal income taxes, and consolidated, combined and unitary state income taxes, Integrated BioPharma will be responsible for, and will indemnify and hold us harmless from, any liability for income taxes with respect to taxable periods or portions of periods ending prior to the date of distribution to the extent these amounts exceed the amounts we have paid to Integrated BioPharma prior to the distribution or in connection with the filing of relevant tax returns. Integrated BioPharma is also responsible for, and will indemnify and hold us harmless from, any liability for income taxes of Integrated BioPharma or any member of the Integrated BioPharma group (other than us) by reason of our being severally liable for those taxes under U.S. Treasury regulations or analogous state or local provisions. Under the terms of the agreement, with respect to consolidated federal income taxes, and consolidated, combined and unitary state income taxes, we are responsible for, and will indemnify and hold Integrated BioPharma harmless from, any liability for our income taxes for all taxable periods, whether before or after the distribution date. With respect to separate state income taxes, we are also responsible for, and will indemnify and hold Integrated BioPharma harmless from, any liability for income taxes with respect to taxable periods or portions of periods beginning on or after the distribution date. We are also responsible for, and will indemnify and hold Integrated BioPharma harmless from, any liability for our non-income taxes and our breach of any obligation or covenant under the terms of the tax responsibility allocation agreement, and in certain other circumstances as provided therein. In addition to the allocation of liability for our taxes, the terms of the agreement also provide for other tax matters, including tax refunds, returns and audits.

24

PROPOSAL 2 -- RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has selected CohnReznick LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2017 and has further directed that management submit the selection of the independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. CohnReznick LLP was engaged as our principal accounting firm in October 2009. Representatives of CohnReznick LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither our Bylaws nor other governing documents or law require stockholder ratification of the selection of CohnReznick LLP as our independent registered public accounting firm. However, the Audit Committee of the Board is submitting the selection of CohnReznick LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee of the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee of the Board in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in our company’s and our stockholders’ best interests.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting will be required to ratify the selection of CohnReznick LLP. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

The board of directors believes that the selection of CohnReznick LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2017 is in our best interest and the best interests of our stockholders and therefore recommends a vote “FOR” this proposal.

25

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS*

The Audit Committee has prepared the following report on its activities with respect to our audited financial statements for the year ended June 30, 2016.

Our management is responsible for the preparation, presentation and integrity of our financial statements and is also responsible for maintaining appropriate accounting and financial reporting practices and policies. Management is also responsible for establishing and maintaining adequate internal controls and procedures designed to provide reasonable assurance that we are in compliance with accounting standards and applicable laws and regulations.

CohnReznick LLP, our independent registered public accounting firm for the year ended June 30, 2016, is responsible for expressing opinions on the conformity of our audited financial statements with accounting principles generally accepted in the United States.

The Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended June 30, 2016 with our management. The Audit Committee has discussed with our independent registered public accounting firm the matters required to be discussed by the Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board (“PCAOB”) in Rule 3200T. The Audit Committee has also received the written disclosures and the letter from our independent registered public accounting firm required by the Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as adopted by the PCAOB in Rule 3600T and has discussed with our independent registered public accounting firm the firm’s independence.

The following table represents aggregate fees billed to us by CohnReznick LLP:

| For the Year Ended June 30, | ||||||||

| 2016 | 2015 | |||||||

| Audit Fees | $ | 138,969 | $ | 88,357 | ||||

| Audit-related Fees | — | — | ||||||

| Tax Fees | — | — | ||||||

| Other Fees | — | — | ||||||

| Total Fees | $ | 138,969 | $ | 88,357 | ||||

In the above table, in accordance with the SEC’s definitions and rules, “audit fees” are fees we paid CohnReznick LLP for professional services for the audit of our financial statements included in our Annual Reports on Form 10-K, review of our financial statements included in our Quarterly Reports on Form 10-Q and services normally provided in connection with statutory and regulatory filings or engagements, consents and assistance with and review of our documents filed with the SEC.

Pre-Approval Policies and Procedures

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally detailed as to the particular service or category of services and is generally subject to a specific budget. The independent registered public accounting firm and management are required to periodically report to the audit committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date. The Audit Committee may also pre-approve particular services on a case-by-case basis. The Audit Committee has determined that the rendering of the services other than audit services by CohnReznick LLP is compatible with maintaining the principal accountant’s independence.

26

Based on the foregoing, the Audit Committee has recommended to the board of directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2016 and selected CohnReznick LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2017.

| From the Audit Committee of iBio, Inc. | |

| Glenn Chang | |

| Seymour Flug |