Filed Pursuant to Rule 433

Registration No. 333-233504

Issuer Free Writing Prospectus dated October 10, 2019

Relating to Preliminary Prospectus dated October 10, 2019

Enabling Next - Gen Biologics with the FastPharming System TM • CDMO : Rapid delivery of eco - friendly, high - quality biologics for biotech, biopharm , academic and government clients • Therapeutics/Vaccines : Proprietary product development using FastPharming Technologies

Enabling Next - Gen Biologics • Issuer Free Writing Prospectus Issued Pursuant to SEC Rule 433 • This issuer free writing prospectus amends and replaces the free writing prospectus filed by iBio , Inc . (the “Company”) with the Securities and Exchange Commission on September 17 , 2019 and is being filed in order to correct an incorrect disclosure with respect to the allocation of recovery, if any, as described on slide 19 . • This free writing prospectus relates to the proposed public offering of shares of common stock, shares of Series C Convertible Preferred Stock and warrants to purchase common stock of the Company all of which are being registered on a Registration Statement on Form S - 1 , as amended (No . 333 - 233504 ) (the “Registration Statement”) . This free writing prospectus should be read together with the preliminary prospectus dated October 10 , 2019 included in that Registration Statement, which can be accessed through the following link : https://www.sec.gov/Archives/edgar/data/1420720/000114420419042112/tv528322_s - 1.htm • Before you invest, you should read the preliminary prospectus in that registration statement (including the risk factors described therein) and other documents the Company has filed with the SEC for more complete information about the Company and this offering . You may get these documents for free by visiting EDGAR on the SEC Web site at www . sec . gov . Alternatively, the Company, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling : 1 - 800 - 727 - 7922 . Free Writing Prospectus Disclosure 2

Enabling Next - Gen Biologics Forward - Looking Statements 3 STATEMENTS INCLUDED IN THIS PRESENTATION RELATED TO IBIO, INC . MAY CONSTITUTE FORWARD - LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 . SUCH STATEMENTS INVOLVE A NUMBER OF RISKS AND UNCERTAINTIES SUCH AS COMPETITIVE FACTORS, TECHNOLOGICAL DEVELOPMENT, MARKET DEMAND, AND THE COMPANY'S ABILITY TO OBTAIN NEW CONTRACTS AND ACCURATELY ESTIMATE NET REVENUES DUE TO VARIABILITY IN SIZE, SCOPE AND DURATION OF PROJECTS . FURTHER INFORMATION ON POTENTIAL RISK FACTORS THAT COULD AFFECT THE COMPANY'S FINANCIAL RESULTS CAN BE FOUND IN THE COMPANY'S REPORTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION .

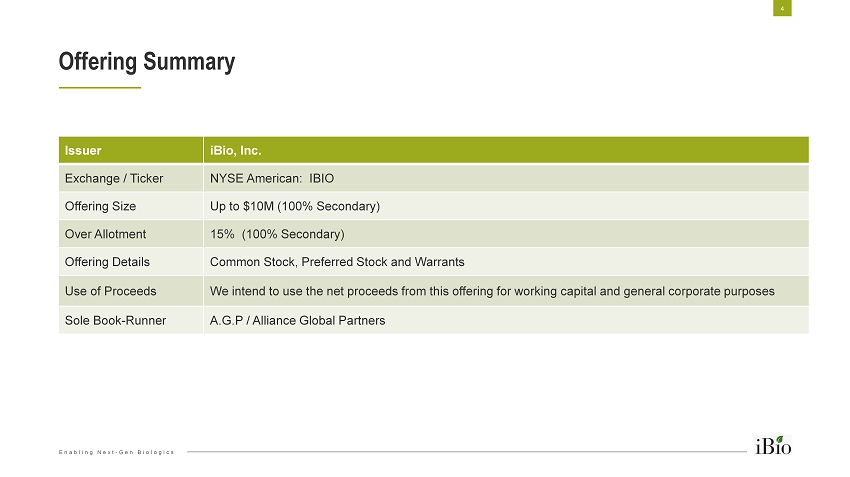

Enabling Next - Gen Biologics Offering Summary 4 Issuer iBio, Inc. Exchange / Ticker NYSE American: IBIO Offering Size Up to $10M (100% Secondary) Over Allotment 15% (100% Secondary) Offering Details Common Stock, Preferred Stock and Warrants Use of Proceeds We intend to use the net proceeds from this offering for working capital and general corporate purposes Sole Book - Runner A.G.P / Alliance Global Partners

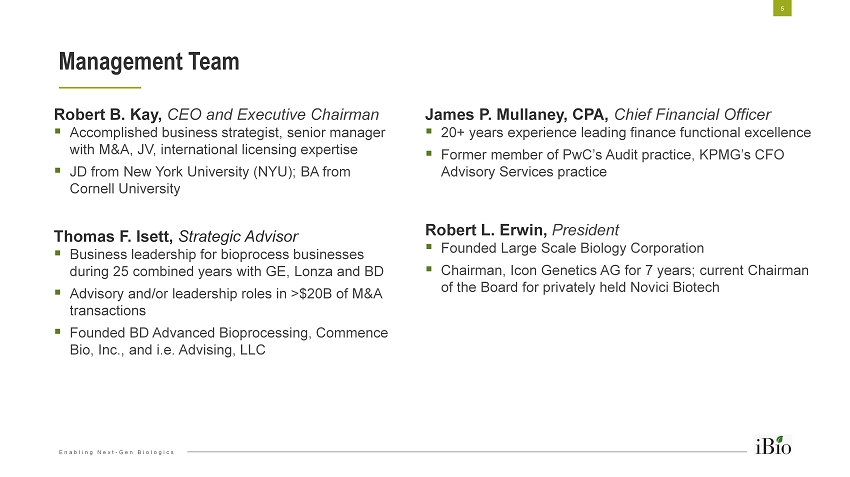

Enabling Next - Gen Biologics Robert B. Kay, CEO and Executive Chairman ▪ Accomplished business strategist, senior manager with M&A, JV, international licensing expertise ▪ JD from New York University (NYU); BA from Cornell University Thomas F. Isett, Strategic Advisor ▪ Business leadership for bioprocess businesses during 25 combined years with GE, Lonza and BD ▪ Advisory and/or leadership roles in >$20B of M&A transactions ▪ Founded BD Advanced Bioprocessing, Commence Bio, Inc., and i.e. Advising, LLC Management Team 5 James P. Mullaney, CPA, Chief Financial Officer ▪ 20+ years experience leading finance functional excellence ▪ Former member of PwC’s Audit practice, KPMG’s CFO Advisory Services practice Robert L. Erwin, President ▪ Founded Large Scale Biology Corporation ▪ Chairman, Icon Genetics AG for 7 years; current Chairman of the Board for privately held Novici Biotech

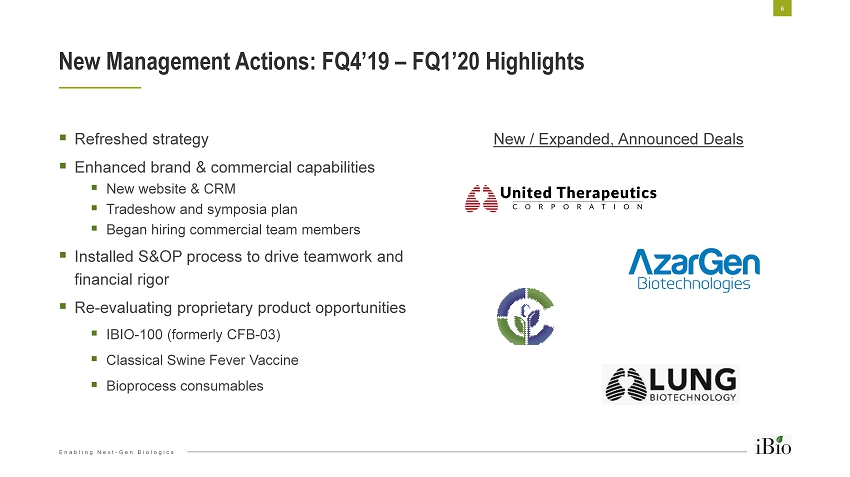

Enabling Next - Gen Biologics ▪ Refreshed strategy ▪ Enhanced brand & commercial capabilities ▪ New website & CRM ▪ Tradeshow and symposia plan ▪ Began hiring commercial team members ▪ Installed S&OP process to drive teamwork and financial rigor ▪ Re - evaluating proprietary product opportunities ▪ IBIO - 100 (formerly CFB - 03) ▪ Classical Swine Fever Vaccine ▪ Bioprocess consumables New Management Actions: FQ4’19 – FQ1’20 Highlights 6 New / Expanded, Announced Deals

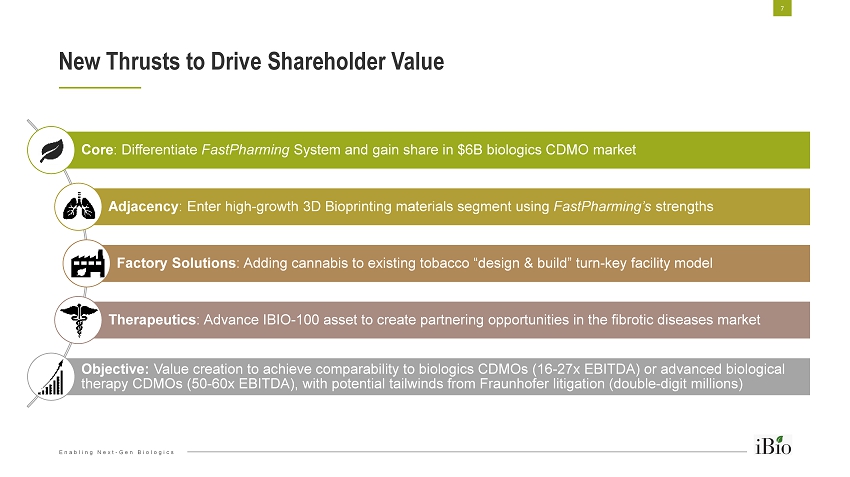

Enabling Next - Gen Biologics Core : Differentiate FastPharming System and gain share in $6B biologics CDMO market Adjacency : Enter high - growth 3D Bioprinting materials segment using FastPharming’s strengths Factory Solutions : Adding cannabis to existing tobacco “design & build” turn - key facility model Therapeutics : Advance IBIO - 100 asset to create partnering opportunities in the fibrotic diseases market Objective: Value creation to achieve comparability to biologics CDMOs (16 - 27x EBITDA) or advanced biological therapy CDMOs (50 - 60x EBITDA), with potential tailwinds from Fraunhofer litigation (double - digit millions) New Thrusts to Drive Shareholder Value 7

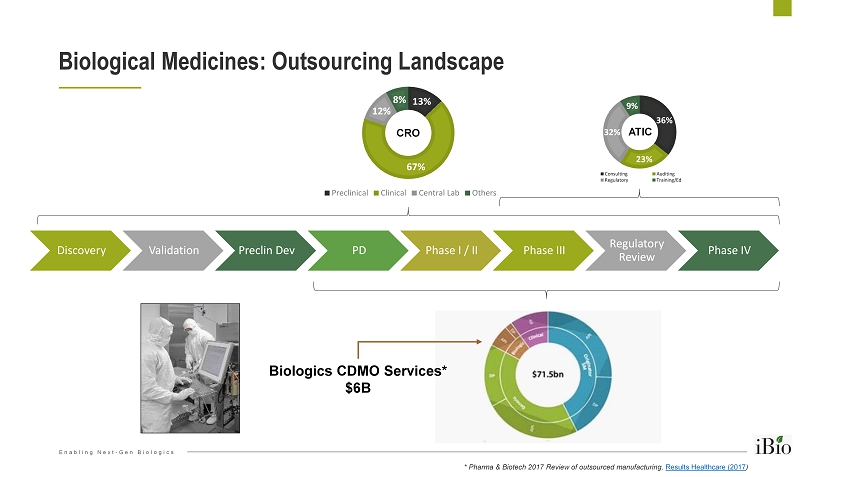

Enabling Next - Gen Biologics Discovery Validation Preclin Dev PD Phase I / II Phase III Regulatory Review Phase IV Biological Medicines: Outsourcing Landscape 13% 67% 12% 8% Preclinical Clinical Central Lab Others 36% 23% 32% 9% Consulting Auditing Regulatory Training/Ed ATIC Biologics CDMO Services* $6B * Pharma & Biotech 2017 Review of outsourced manufacturing, Results Healthcare (2017 ) CRO

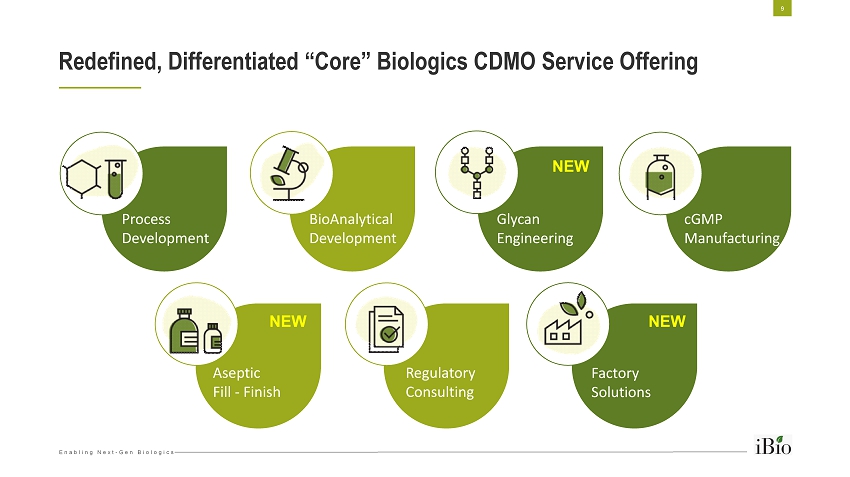

Enabling Next - Gen Biologics Redefined, Differentiated “Core” Biologics CDMO Service Offering 9 Process Development BioAnalytical Development Glycan Engineering cGMP Manufacturing Aseptic Fill - Finish Regulatory Consulting Factory Solutions NEW NEW NEW

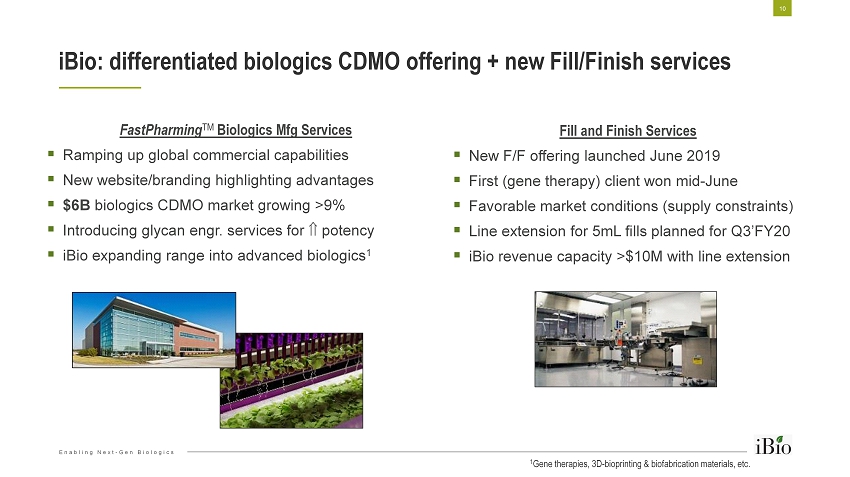

Enabling Next - Gen Biologics Fill and Finish Services ▪ New F/F offering launched June 2019 ▪ First (gene therapy) client won mid - June ▪ Favorable market conditions (supply constraints) ▪ Line extension for 5mL fills planned for Q3’FY20 ▪ iBio revenue capacity >$10M with line extension iBio: differentiated biologics CDMO offering + new Fill/Finish services 10 FastPharming TM Biologics Mfg Services ▪ Ramping up global commercial capabilities ▪ New website/branding highlighting advantages ▪ $6B biologics CDMO market growing >9% ▪ Introducing glycan engr. services for potency ▪ iBio expanding range into advanced biologics 1 1 Gene therapies, 3D - bioprinting & biofabrication materials, etc.

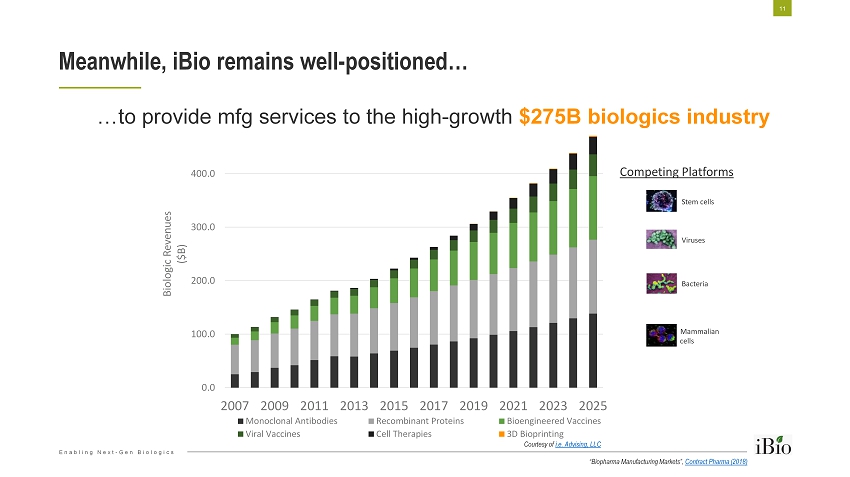

Enabling Next - Gen Biologics Meanwhile, iBio remains well - positioned… 11 0.0 100.0 200.0 300.0 400.0 500.0 2007 2009 2011 2013 2015 2017 2019 2021 2023 2025 Biologic Revenues ($B) Monoclonal Antibodies Recombinant Proteins Bioengineered Vaccines Viral Vaccines Cell Therapies 3D Bioprinting Stem cells Viruses Bacteria Mammalian cells Competing Platforms …to provide mfg services to the high - growth $275B biologics industry Courtesy of i.e. Advising, LLC “Biopharma Manufacturing Markets”, Contract Pharma (2018)

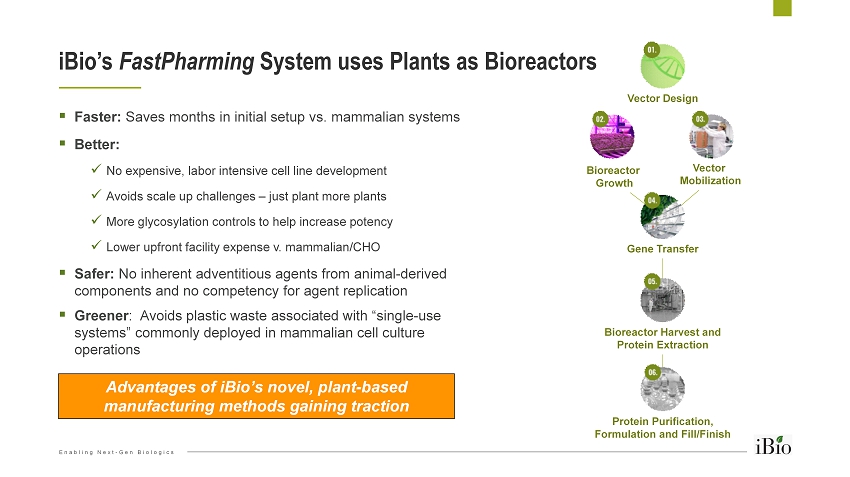

Enabling Next - Gen Biologics ▪ Faster: Saves months in initial setup vs. mammalian systems ▪ Better: x No expensive, labor intensive cell line development x Avoids scale up challenges – just plant more plants x More glycosylation controls to help increase potency x Lower upfront facility expense v. mammalian/CHO ▪ Safer: No inherent adventitious agents from animal - derived components and no competency for agent replication ▪ Greener : Avoids plastic waste associated with “single - use systems” commonly deployed in mammalian cell culture operations iBio’s FastPharming System uses Plants as Bioreactors 12 Vector Design Bioreactor Harvest and Protein Extraction Protein Purification, Formulation and Fill/Finish Bioreactor Growth Vector Mobilization Gene Transfer Advantages of iBio’s novel, plant - based manufacturing methods gaining traction

Enabling Next - Gen Biologics “Pharming” going mainstream 13 “Compared with proteins derived from mammalian cells, proteins from genetically engineered plants are easy to scale up and synthesize with other proteins, and they remain stable at room temperature for longer periods” WSJ July 19, 2019 “…timelines are constantly being challenged and there are continued calls for faster commercialization…the traditional processing methods [like CHO] are proving to be something of a bottleneck” “Now that plant expression technology has matured and proven its commercial viability, it is increasingly recognized as a valid manufacturing option” BioPharm International June 1, 2019

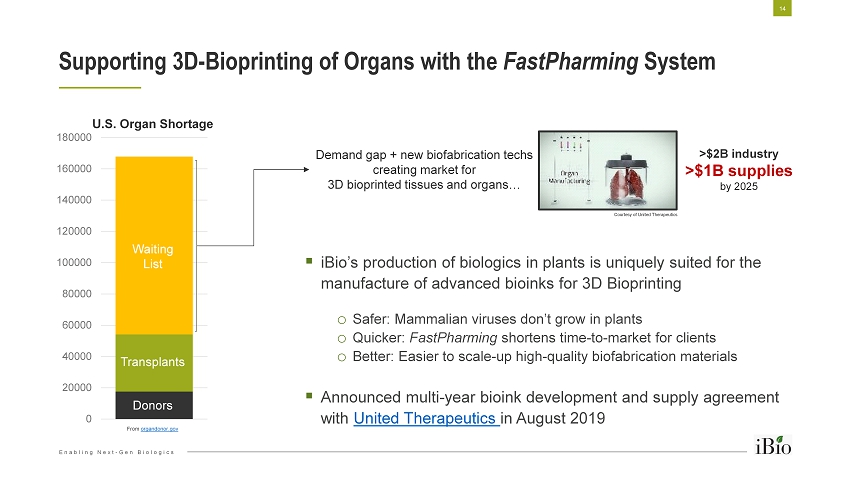

Enabling Next - Gen Biologics 0 20000 40000 60000 80000 100000 120000 140000 160000 180000 Supporting 3D - Bioprinting of Organs with the FastPharming System 14 ▪ iBio’s production of biologics in plants is uniquely suited for the manufacture of advanced bioinks for 3D Bioprinting o Safer: Mammalian viruses don’t grow in plants o Quicker: FastPharming shortens time - to - market for clients o Better: Easier to scale - up high - quality biofabrication materials ▪ Announced multi - year bioink development and supply agreement with United Therapeutics in August 2019 From organdonor.gov Demand gap + new biofabrication techs creating market for 3D bioprinted tissues and organs… >$2B industry >$1B supplies by 2025 Donors Transplants Waiting List U.S. Organ Shortage Courtesy of United Therapeutics

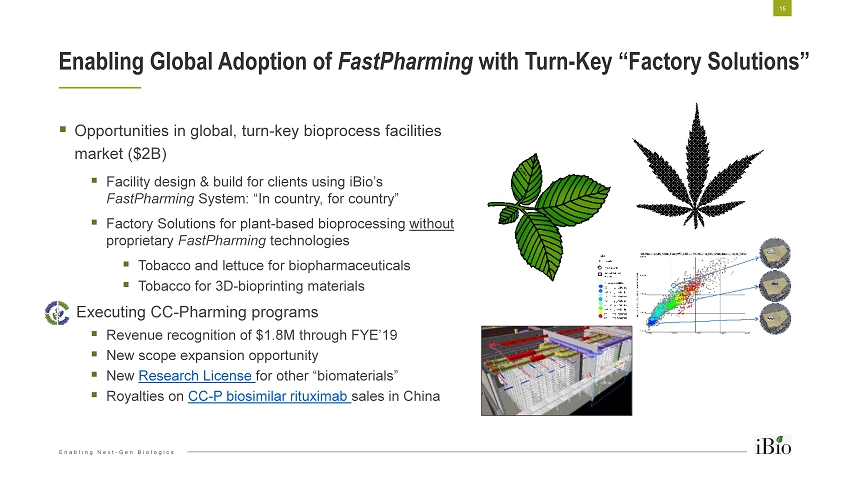

Enabling Next - Gen Biologics ▪ Opportunities in global, turn - key bioprocess facilities market ($2B) ▪ Facility design & build for clients using iBio’s FastPharming System: “In country, for country” ▪ Factory Solutions for plant - based bioprocessing without proprietary FastPharming technologies ▪ Tobacco and lettuce for biopharmaceuticals ▪ Tobacco for 3D - bioprinting materials Executing CC - Pharming programs ▪ Revenue recognition of $1.8M through FYE’19 ▪ New scope expansion opportunity ▪ New Research License for other “biomaterials” ▪ Royalties on CC - P biosimilar rituximab sales in China Enabling Global Adoption of FastPharming with Turn - Key “Factory Solutions” 15

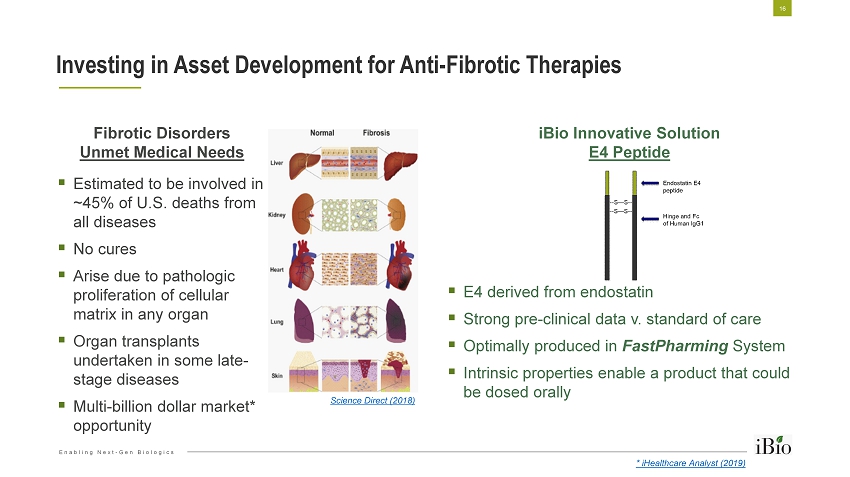

Enabling Next - Gen Biologics Investing in Asset Development for Anti - Fibrotic Therapies 16 iBio Innovative Solution E4 Peptide ▪ E4 derived from endostatin ▪ Strong pre - clinical data v. standard of care ▪ Optimally produced in FastPharming System ▪ Intrinsic properties enable a product that could be dosed orally Fibrotic Disorders Unmet Medical Needs ▪ Estimated to be involved in ~45% of U.S. deaths from all diseases ▪ No cures ▪ Arise due to pathologic proliferation of cellular matrix in any organ ▪ Organ transplants undertaken in some late - stage diseases ▪ Multi - billion dollar market* opportunity Science Direct (2018) * iHealthcare Analyst (2019)

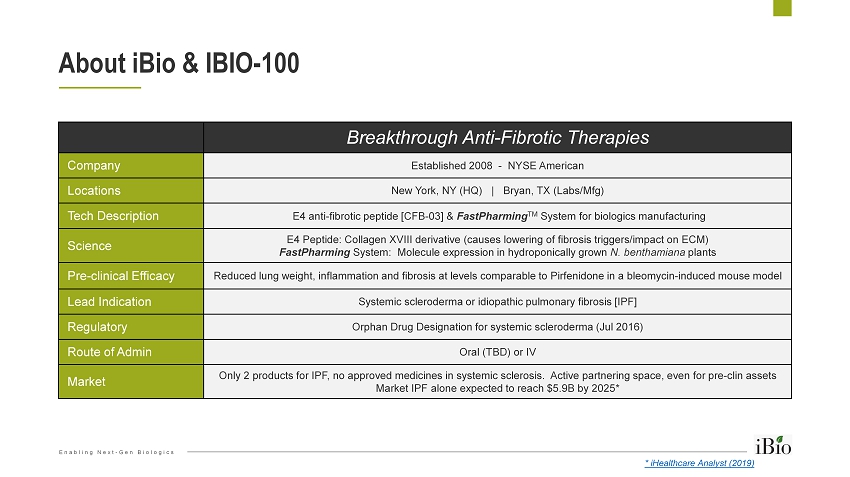

Enabling Next - Gen Biologics Breakthrough Anti - Fibrotic Therapies Company Established 2008 - NYSE American Locations New York, NY (HQ) | Bryan, TX (Labs/Mfg) Tech Description E4 anti - fibrotic peptide [CFB - 03] & FastPharming TM System for biologics manufacturing Science E4 Peptide: Collagen XVIII derivative (causes lowering of fibrosis triggers/impact on ECM) FastPharming System: Molecule expression in hydroponically grown N. benthamiana plants Pre - clinical Efficacy Reduced lung weight, inflammation and fibrosis at levels comparable to Pirfenidone in a bleomycin - induced mouse model Lead Indication Systemic scleroderma or idiopathic pulmonary fibrosis [IPF] Regulatory Orphan Drug Designation for systemic scleroderma (Jul 2016) Route of Admin Oral (TBD) or IV Market Only 2 products for IPF, no approved medicines in systemic sclerosis. Active partnering space, even for pre - clin assets Market IPF alone expected to reach $5.9B by 2025* About iBio & IBIO - 100 * iHealthcare Analyst (2019)

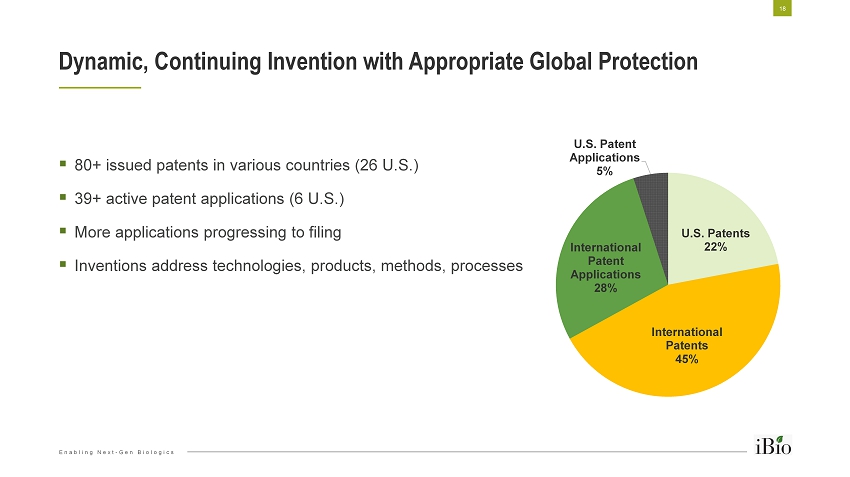

Enabling Next - Gen Biologics U.S. Patents 22% International Patents 45% International Patent Applications 28% U.S. Patent Applications 5% ▪ 80+ issued patents in various countries (26 U.S.) ▪ 39+ active patent applications (6 U.S.) ▪ More applications progressing to filing ▪ Inventions address technologies, products, methods, processes Dynamic, Continuing Invention with Appropriate Global Protection 18

Enabling Next - Gen Biologics ▪ Memorandum opinion in Delaware Court of Chancery (2016) and other developments favor iBio ▪ Depositions expected to finish by October 2019; trial currently scheduled for May 4 - 15, 2020 ▪ Litigation costs and expenses related to current counsel fully funded through appeal ▪ iBio entitled to approximately 60% of any recovery through judgment or settlement after the first $12 million of any recovery (sliding scale) iBio v. Fraunhofer 19

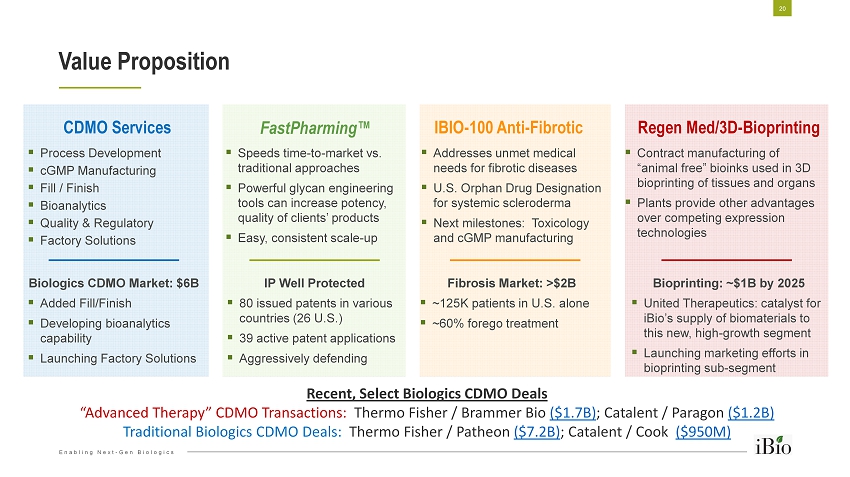

Enabling Next - Gen Biologics ▪ Process Development ▪ cGMP Manufacturing ▪ Fill / Finish ▪ Bioanalytics ▪ Quality & Regulatory ▪ Factory Solutions Value Proposition 20 ▪ Speeds time - to - market vs. traditional approaches ▪ Powerful glycan engineering tools can increase potency, quality of clients’ products ▪ Easy, consistent scale - up ▪ Addresses unmet medical needs for fibrotic diseases ▪ U.S. Orphan Drug Designation for systemic scleroderma ▪ Next milestones: Toxicology and cGMP manufacturing ▪ Contract manufacturing of “animal free” bioinks used in 3D bioprinting of tissues and organs ▪ Plants provide other advantages over competing expression technologies CDMO Services FastPharming ™ IBIO - 100 Anti - Fibrotic Regen Med/3D - Bioprinting Biologics CDMO Market: $6B ▪ Added Fill/Finish ▪ Developing bioanalytics capability ▪ Launching Factory Solutions IP Well Protected ▪ 80 issued patents in various countries (26 U.S.) ▪ 39 active patent applications ▪ Aggressively defending Fibrosis Market: >$2B ▪ ~125K patients in U.S. alone ▪ ~60% forego treatment Bioprinting: ~$1B by 2025 ▪ United Therapeutics: catalyst for iBio’s supply of biomaterials to this new, high - growth segment ▪ Launching marketing efforts in bioprinting sub - segment Recent, Select Biologics CDMO Deals “Advanced Therapy” CDMO Transactions: Thermo Fisher / Brammer Bio ($1.7B) ; Catalent / Paragon ($1.2B) Traditional Biologics CDMO Deals: Thermo Fisher / Patheon ($7.2B) ; Catalent / Cook ($950M)

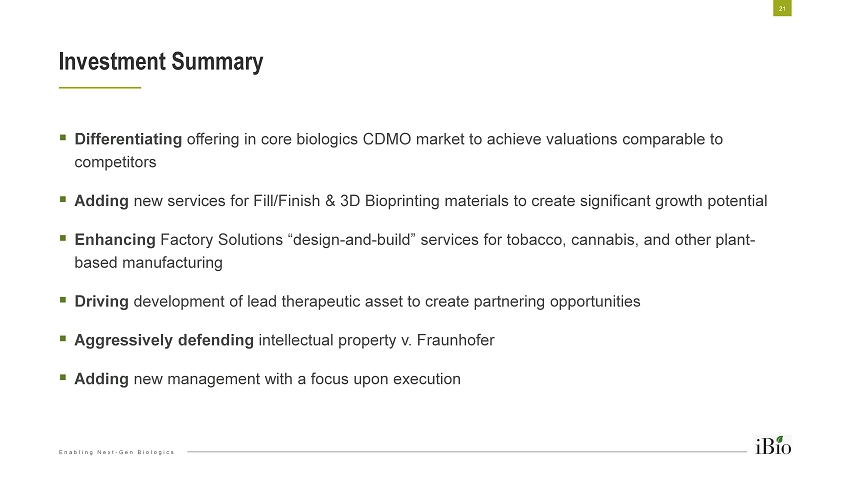

Enabling Next - Gen Biologics ▪ Differentiating offering in core biologics CDMO market to achieve valuations comparable to competitors ▪ Adding new services for Fill/Finish & 3D Bioprinting materials to create significant growth potential ▪ Enhancing Factory Solutions “design - and - build” services for tobacco, cannabis, and other plant - based manufacturing ▪ Driving development of lead therapeutic asset to create partnering opportunities ▪ Aggressively defending intellectual property v. Fraunhofer ▪ Adding new management with a focus upon execution Investment Summary 21

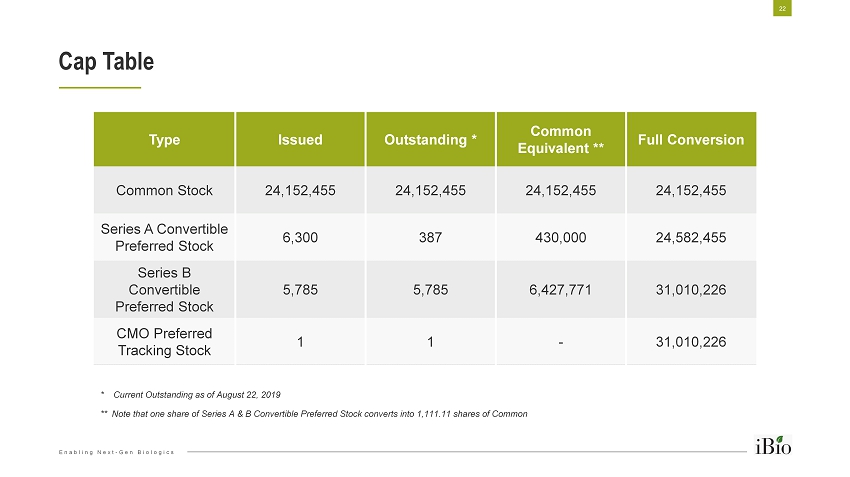

Enabling Next - Gen Biologics Cap Table Type Issued Outstanding * Common Equivalent ** Full Conversion Common Stock 24,152,455 24,152,455 24,152,455 24,152,455 Series A Convertible Preferred Stock 6,300 387 430,000 24,582,455 Series B Convertible Preferred Stock 5,785 5,785 6,427,771 31,010,226 CMO Preferred Tracking Stock 1 1 - 31,010,226 * Current Outstanding as of August 22, 2019 ** Note that one share of Series A & B Convertible Preferred Stock converts into 1,111.11 shares of Common 22

Contact 23 Company: iBio , Inc. Tom Isett: 443 - 955 - 4262 | tisett@ibioinc.com Jim Mullaney: 212 - 399 - 4294 | jmullaney@ibioinc.com Bank: AGP Chris Pravecek: 312 - 392 - 4257 | cp@allianceg.com

Enabling Next - Gen Biologics with the FastPharming System TM • CDMO : Rapid delivery of eco - friendly, high - quality biologics for biotech, biopharm , academic and government clients • Therapeutics : Proprietary product development using FastPharming Tech for anti - fibrotic compounds and vaccines