8800 HSC Parkway

Bryan, Texas 77807

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

You are cordially invited to attend the Special Meeting of Stockholders (the “Special Meeting”) of iBio, Inc., a Delaware corporation (the “Company”). The meeting will be held on June 30, 2022 at 8:30 a.m., Central Time, virtually via the internet at www.virtualshareholdermeeting.com/IBIO2022SM. In light of ongoing developments related to coronavirus (COVID-19), after careful consideration, the Company has determined that the Special Meeting will be held in a virtual-only meeting format. You or your proxyholder will be able to attend and vote at the Special Meeting online by visiting www.virtualshareholdermeeting.com/IBIO2022SM and entering the 16-digit control number included on your proxy card, or on the instructions that accompanied your proxy materials. Guests may join the Special Meeting in a listen-only mode, but they will not have the option to vote shares or ask questions during the virtual meeting. Once admitted, you may submit questions, vote or view our list of stockholders during the Special Meeting by following the instructions that will be available on the meeting website. You may log into the meeting platform beginning at 8:20 a.m. Central Time on June 30, 2022. To submit a question before the meeting, visit www.proxyvote.com with your 16-digit control number and select the “Submit a Question for Management” option. To submit a question during the meeting, visit www.virtualshareholdermeeting.com/IBIO2022SM, enter your 16-digit control number and type your question into the “Ask a Question” field and click “Submit.” The purpose of the Special Meeting and the matters to be acted on are stated in this Notice of Special Meeting of Stockholders.

The Special Meeting has been called by the Board of Directors to submit to stockholders for consideration and approval the following matters:

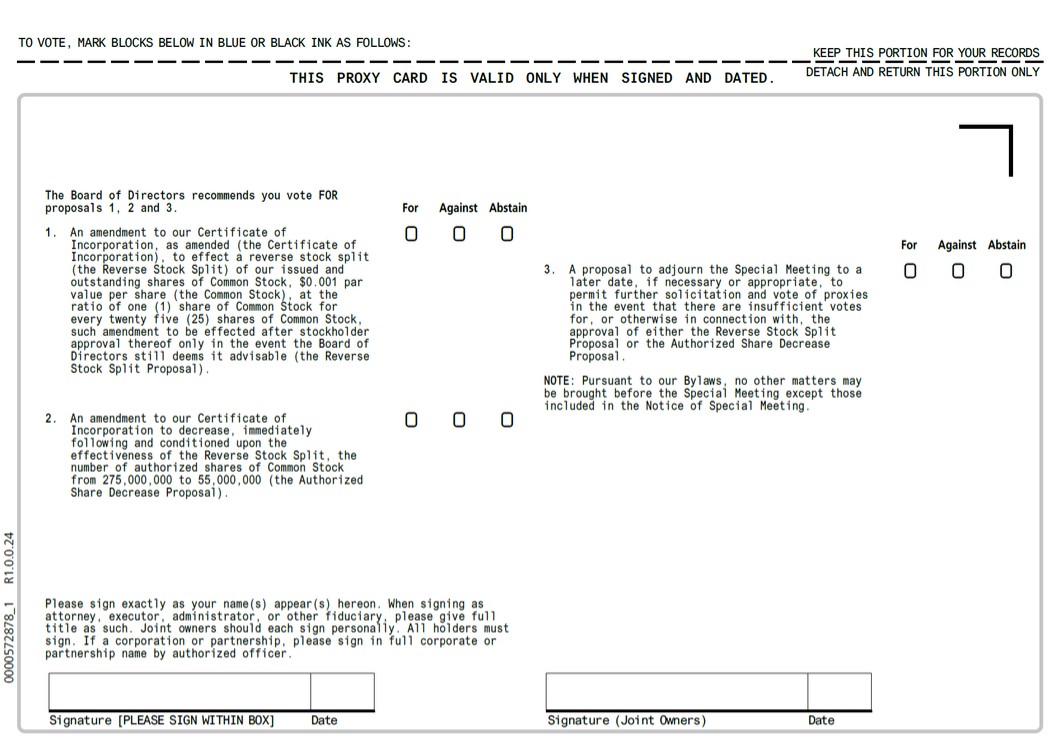

| 1. | an amendment to our Certificate of Incorporation, as amended, to effect a reverse stock split (the “Reverse Stock Split”) of our issued and outstanding shares of Common Stock, $0.001 par value per share (the “Common Stock”), at the ratio of one (1) share of Common Stock for every twenty five (25) shares of Common Stock (the “Reverse Stock Split Ratio”), such amendment to be effected after stockholder approval thereof only in the event the Board of Directors still deems it advisable (the “Reverse Stock Split Proposal”); | |

| | | |

| 2. | an amendment to our Certificate of Incorporation, as amended, to decrease, immediately following and conditioned upon the effectiveness of the Reverse Stock Split, the number of authorized shares of Common Stock (the “Authorized Share Decrease”) from 275,000,000 to 55,000,000 (the “Authorized Share Decrease Proposal”); and | |

| 3. | a proposal to adjourn the Special Meeting to a later date, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of either the Reserve Stock Split Proposal and/or the Authorized Share Decrease Proposal. | |

The matters listed in this Notice of Special Meeting are described in detail in the accompanying Proxy Statement. The Board of Directors has fixed the close of business on May 12, 2022 as the record date (the “Record Date”) for determining those stockholders who are entitled to notice of and to vote at the Special Meeting or any postponement or adjournment of the Special Meeting. Only holders of record of shares of our Common Stock and our Series 2022 Convertible Preferred Stock on the Record Date are entitled to receive notice of the Special Meeting and to vote at the Special Meeting or at any postponement(s) or adjournment(s) of the Special Meeting. The list of the stockholders of record as of the Record Date will be made available for inspection at the Special Meeting and for the ten days preceding the Special Meeting at the Company’s offices located at 8800 HSC Parkway, Bryan, Texas 77807 during ordinary business hours for any purpose germane to the Special Meeting and electronically during the Special Meeting at www.virtualshareholdermeeting.com/IBIO2022SM.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 30, 2022.