8800 HSC Parkway

Bryan, Texas 77807

June 14, 2022

Dear Stockholder:

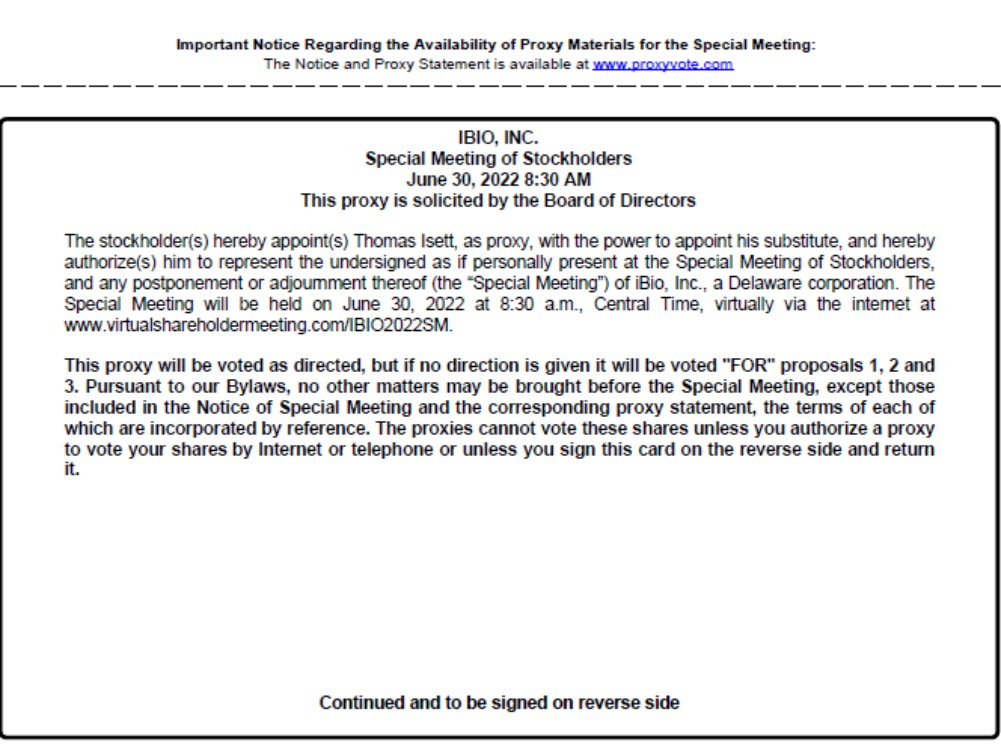

On or about May 31, 2022, iBio, Inc. (the “Company”) furnished or otherwise made available to stockholders a definitive proxy statement describing the matters to be voted upon at our Special Meeting of Stockholders (the “Special Meeting”) to be held at 8:30 a.m., Central time, on June 30, 2022. We refer to such definitive proxy statement, as filed with the Securities and Exchange Commission on May 24, 2022 (the “Proxy Statement”).

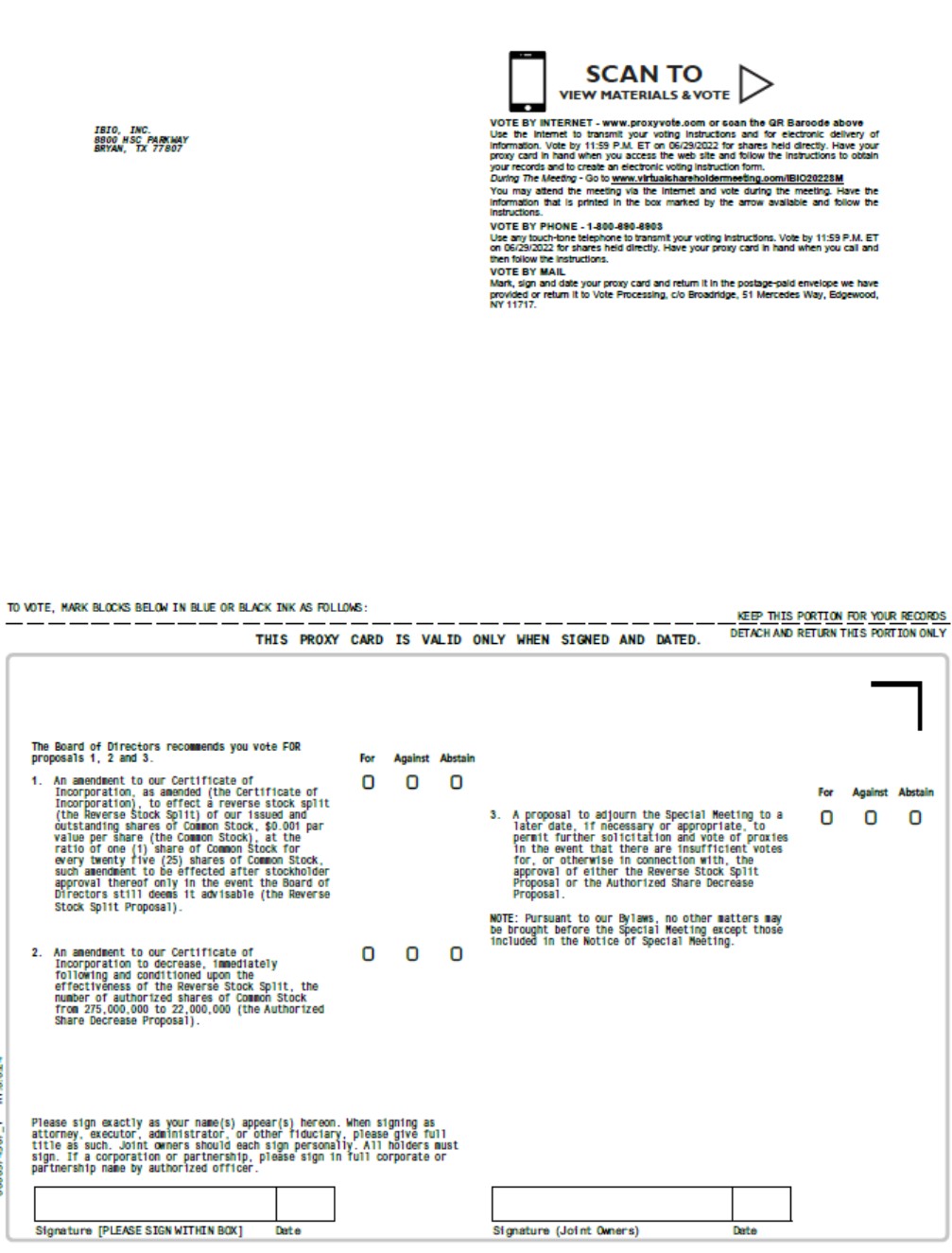

The purpose of this letter is to alert you that our Board of Directors has determined to modify Proposal 2, a proposal included in our Proxy Statement to adopt an amendment to our Certificate of Incorporation, as amended (the “Certificate of Incorporation”), to decrease, immediately following and conditioned upon the effectiveness of the reverse stock split set forth in Proposal 1 in the Proxy Statement (the “Reverse Stock Split”), the number of authorized shares of our common stock (the “Authorized Share Decrease”) from 275,000,000 to 22,000,000. We have enclosed with this letter the Revised Notice of Special Meeting, Amendment No. 1 to the Proxy Statement, a new proxy card, and a return envelope. Amendment No.1 to the Proxy Statement should be read in conjunction with the Proxy Statement.

Amendment No.1 to the Proxy Statement included with this letter modifies the proposed amendment to the Certificate of Incorporation by decreasing the proposed aggregate number of shares of our common stock that would be authorized to be issued from 55,000,000 shares to 22,000,000 shares. As amended, the proposed number of authorized shares represents a decrease in shares of our authorized common stock from the 275,000,000 shares of our common stock currently authorized in the Certificate of Incorporation. The Board of Directors determined that the reduction in the proposed number of authorized shares was advisable and in the best interests of the Company for a number of reasons including, but not limited to, conforming with the requirements of certain entities that make recommendations to stockholders regarding proposals submitted by the Company and to ensure that the Company does not have, following implementation of the Reverse Stock Split, if approved by the stockholders and effected, what some stockholders might view as an unreasonably high number of authorized but unissued shares of common stock.

The Board believes that the approval of Proposal 2 is important and in the best interests of the Company and its stockholders. The Company believes that even with this decrease in the number of authorized shares, the Company will have the ability to issue sufficient additional shares in connection with potential financings, business combinations, incentive awards to attract or retain qualified management and other key personnel or other corporate purposes. The Board further believes that the proposed amendment, as modified, represents a number of authorized shares that is appropriate in light of these corporate objectives.

Please review Amendment No. 1 to the Proxy Statement and the attached Revised Notice of Special Meeting included with this letter for more information regarding the modified proposal and for information about how you can vote or change your vote. If you have not already voted your shares with respect to Proposal 2, we urge that you please do so now.

If you have any questions about the Special Meeting or how to vote, submit a proxy or revoke your proxy, or you need additional copies of this Proxy Statement or voting materials, you can contact our proxy solicitor Okapi Partners LLC toll free: (844) 203-3605.

On behalf of the Board of Directors and the employees of iBio, Inc. we thank you for your continued support and look forward to you joining us at the Special Meeting.

Sincerely,

/s/ Thomas F. Isett

Thomas F. Isett

Executive Chairman, President and Chief Executive Officer