| November 2022 © iBio, Inc., All Right Reserved |

| Forward-looking statements Certain statements in this presentation constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Words such as "may," "might," "will," "should," "believe," "expect," "anticipate," "estimate," "continue," "predict," "forecast," "project," "plan," "intend" or similar expressions, or statements regarding intent, belief, or current expectations, are forward-looking statements. These forward-looking statements are based upon current estimates. While the Company believes these forward-looking statements are reasonable, undue reliance should not be placed on any such forward-looking statements, which are based on information available to us on the date of this presentation. These forward-looking statements are subject to various risks and uncertainties, many of which are difficult to predict that could cause actual results to differ materially from current expectations and assumptions from those set forth or implied by any forward-looking statements. Important factors that could cause actual results to differ materially from current expectations include, among others, the Company’s ability to obtain regulatory approvals for commercialization of its product candidates, including IBIO-101, or to comply with ongoing regulatory requirements, regulatory limitations relating to its ability to promote or commercialize its product candidates for specific indications, acceptance of its product candidates in the marketplace and the successful development, marketing or sale of products, its ability to maintain its license agreements, the continued maintenance and growth of its patent estate, its ability to establish and maintain collaborations, its ability to obtain or maintain the capital or grants necessary to fund its research and development activities, competition, its ability to retain its key employees or maintain its NYSE American listing, and the other factors discussed in the Company’s most recent Annual Report on Form 10-K and the Company’s subsequent filings with the SEC, including subsequent periodic reports on Forms 10-Q and 8-K. The information in this presentation is provided only as of today, and we undertake no obligation to update any forward-looking statements contained in this presentation on account of new information, future events, or otherwise, except as required by law. This presentation shall not constitute an offer to sell, or the solicitation of an offer to buy, nor will there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction. |

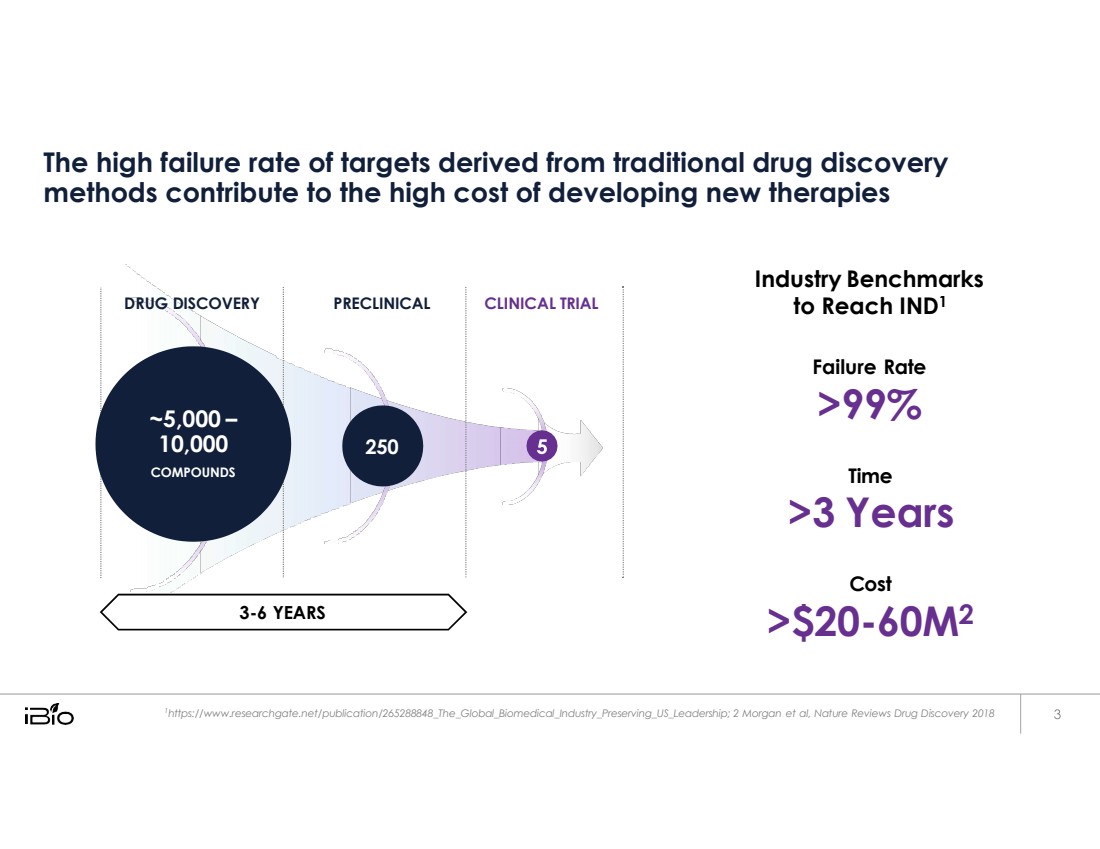

| The high failure rate of targets derived from traditional drug discovery methods contribute to the high cost of developing new therapies Industry Benchmarks to Reach IND1 Failure Rate >99% Time >3 Years Cost >$20-60M2 1 https:// www.researchgate.net/publication/265288848_The_Global_Biomedical_Industry_Preserving_US_Leadership; 2 Morgan et al, Nature Reviews Drug Discovery 2018 DRUG DISCOVERY PRECLINICAL CLINICAL TRIAL ~5,000 10,000 COMPOUNDS 250 3 - 6 YEARS |

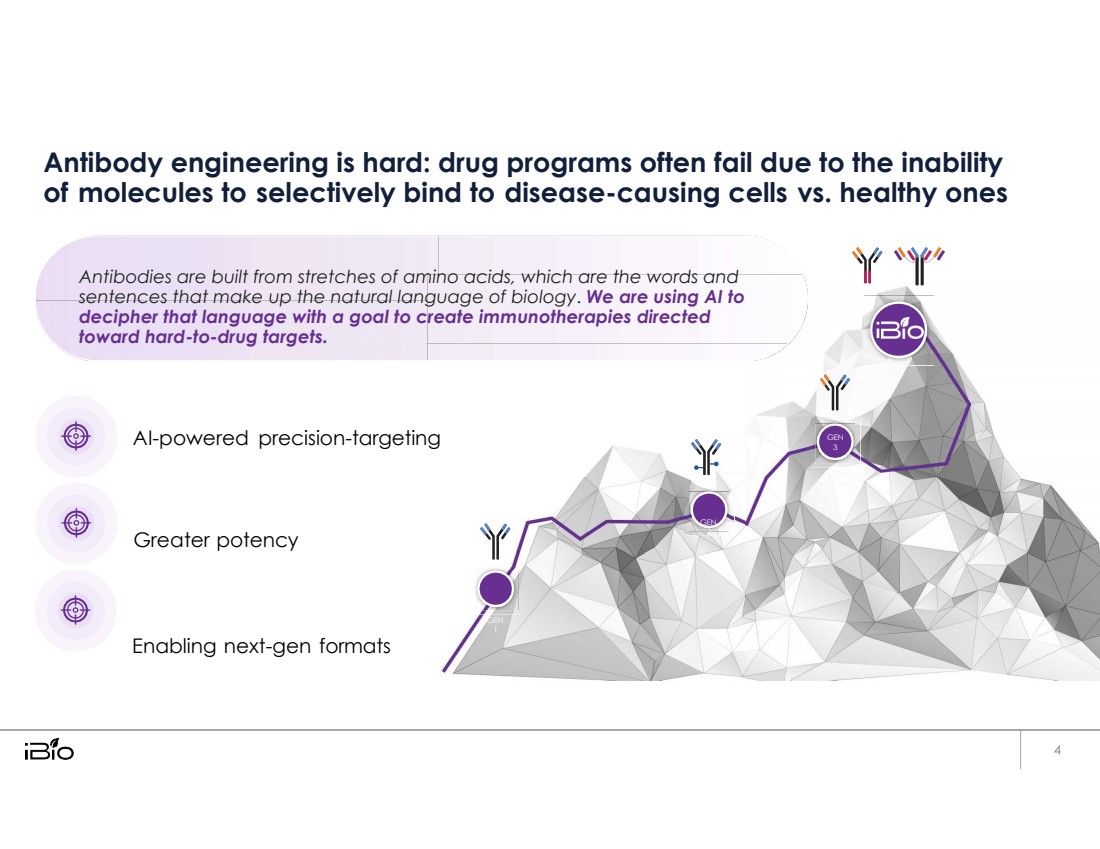

| Antibody engineering is hard: drug programs often fail due to the inability of molecules to selectively bind to disease-causing cells vs. healthy ones Antibodies are built from stretches of amino acids, which are the words and sentences that make up the natural language of biology. We are using AI to decipher that language with a goal to create immunotherapies directed toward hard-to-drug targets. AI-powered precision-targeting GEN 3 Greater potency GEN 2 Enabling next-gen formats GEN 1 |

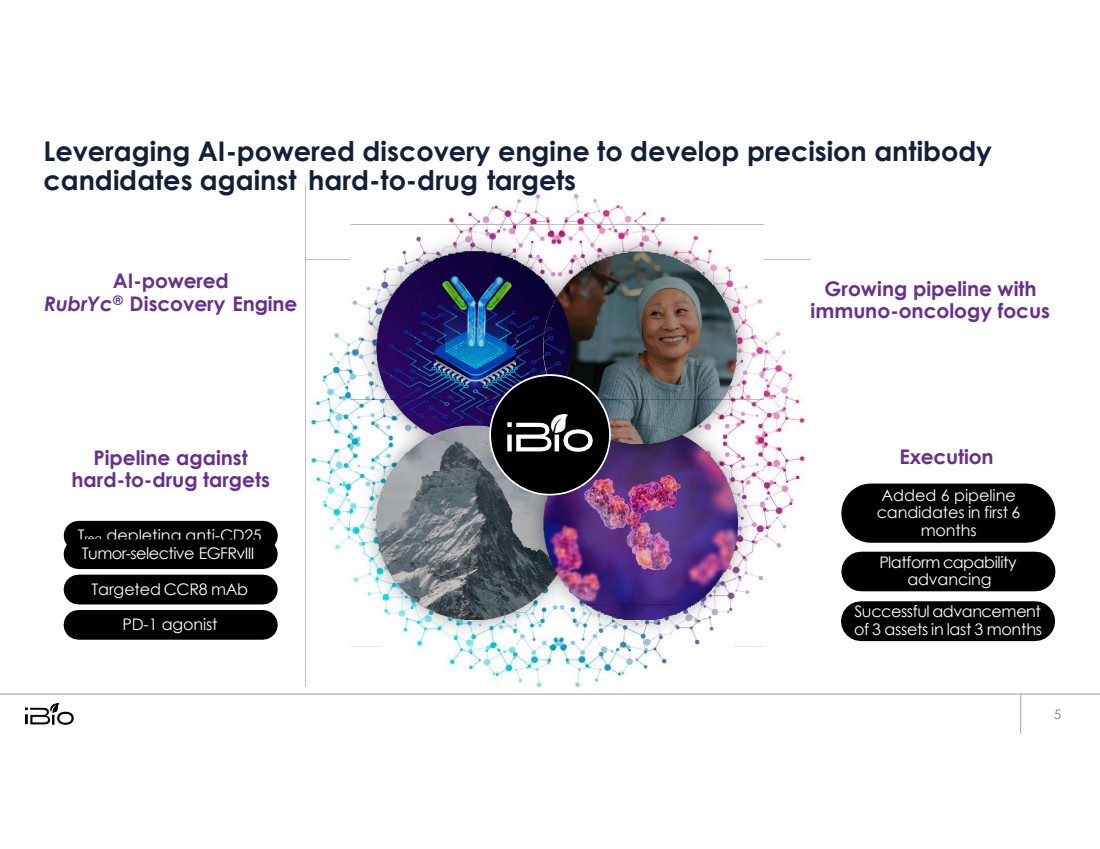

| hard - to - drug targets Leveraging AI-powered discovery engine to develop precision antibody candidates against AI-powered RubrYc® Discovery Engine Pipeline against hard-to-drug targets Growing pipeline with immuno-oncology focus Execution Treg depleting anti-CD25 PD-1 agonist Tumor-selective EGFRvIII Targeted CCR8 mAb Added 6 pipeline candidates in first 6 months Platform capability advancing Successful advancement of 3 assets in last 3 months |

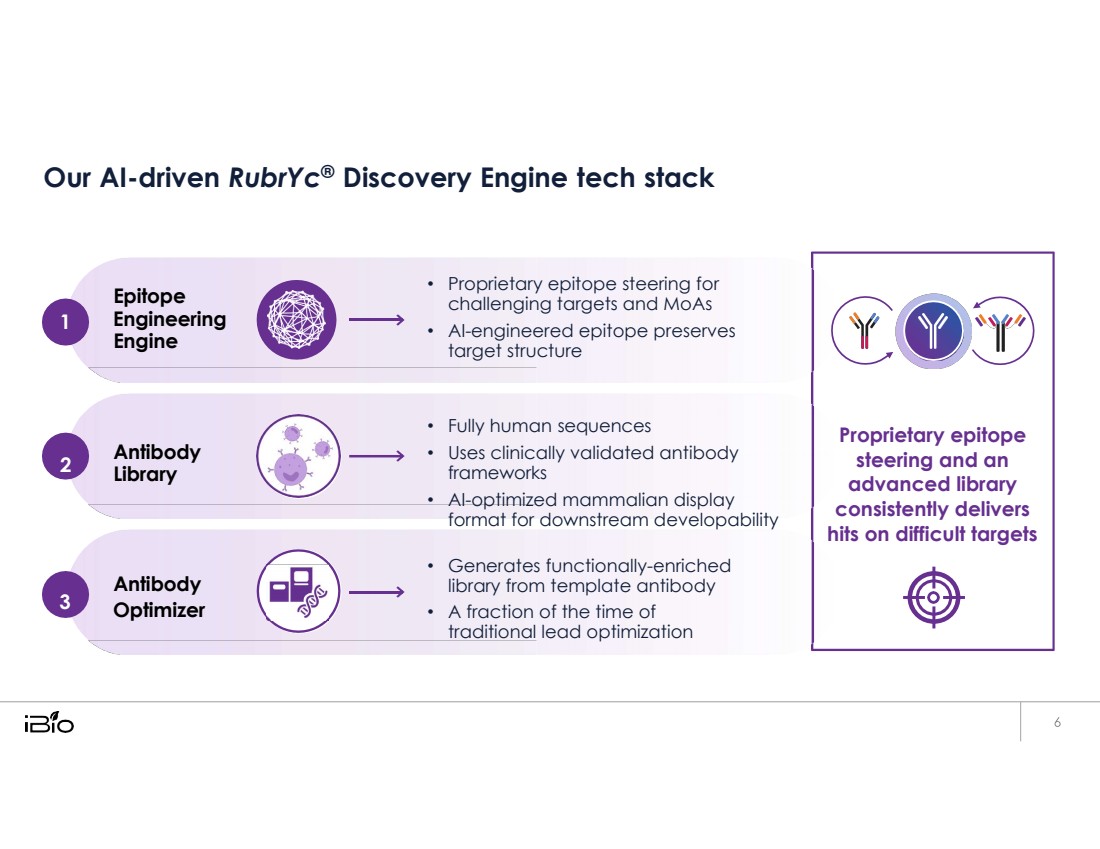

| Our AI-driven RubrYc® Discovery Engine tech stack Epitope 1 Engineering Engine • Proprietary epitope steering for challenging targets and MoAs • AI-engineered epitope preserves target structure Antibody Library Antibody 3 Optimizer • Fully human sequences • Uses clinically validated antibody frameworks • AI-optimized mammalian display format for downstream developability • Generates functionally-enriched library from template antibody • A fraction of the time of traditional lead optimization Proprietary epitope steering and an advanced library consistently delivers hits on difficult targets 2 |

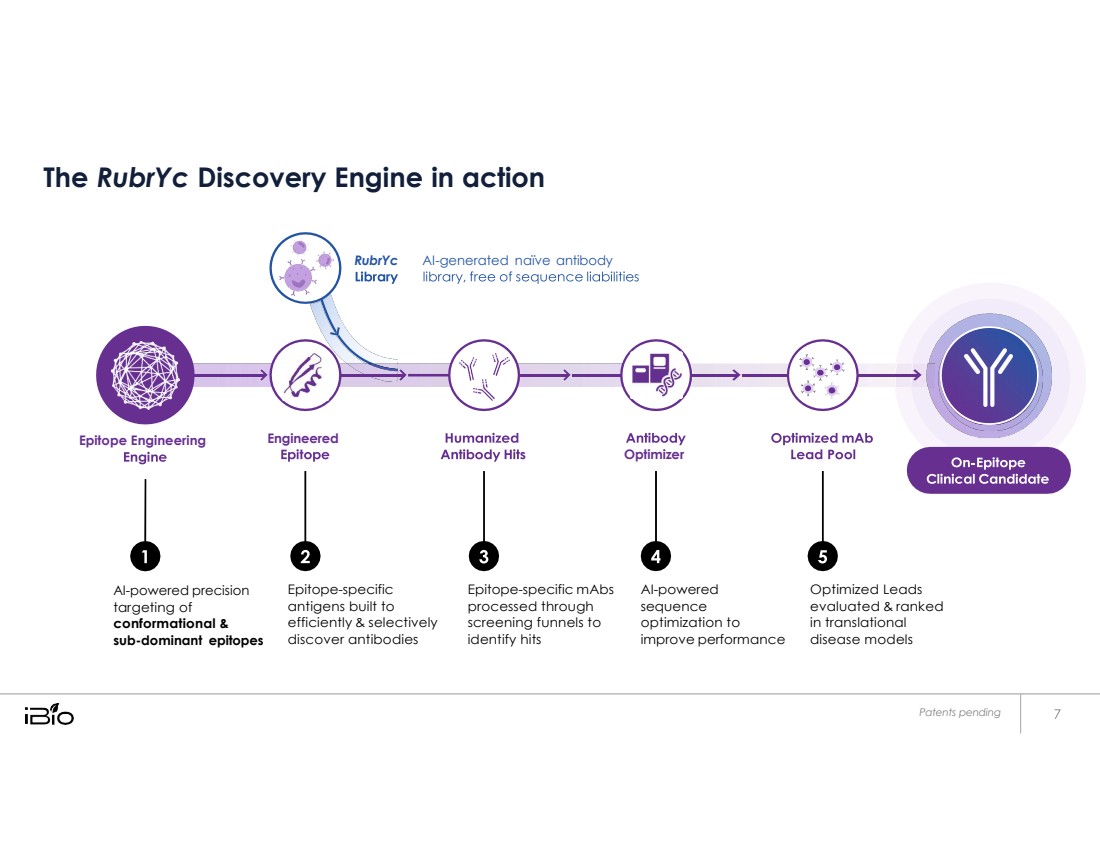

| RubrYc AI - generated naïve antibody Epitope Engineering Engineered Optimizer The RubrYc Discovery Engine in action AI-powered precision targeting of conformational & sub-dominant epitopes Epitope-specific antigens built to efficiently & selectively discover antibodies Epitope-specific mAbs processed through screening funnels to identify hits AI-powered sequence optimization to improve performance Optimized Leads evaluated & ranked in translational disease models Patents pending |

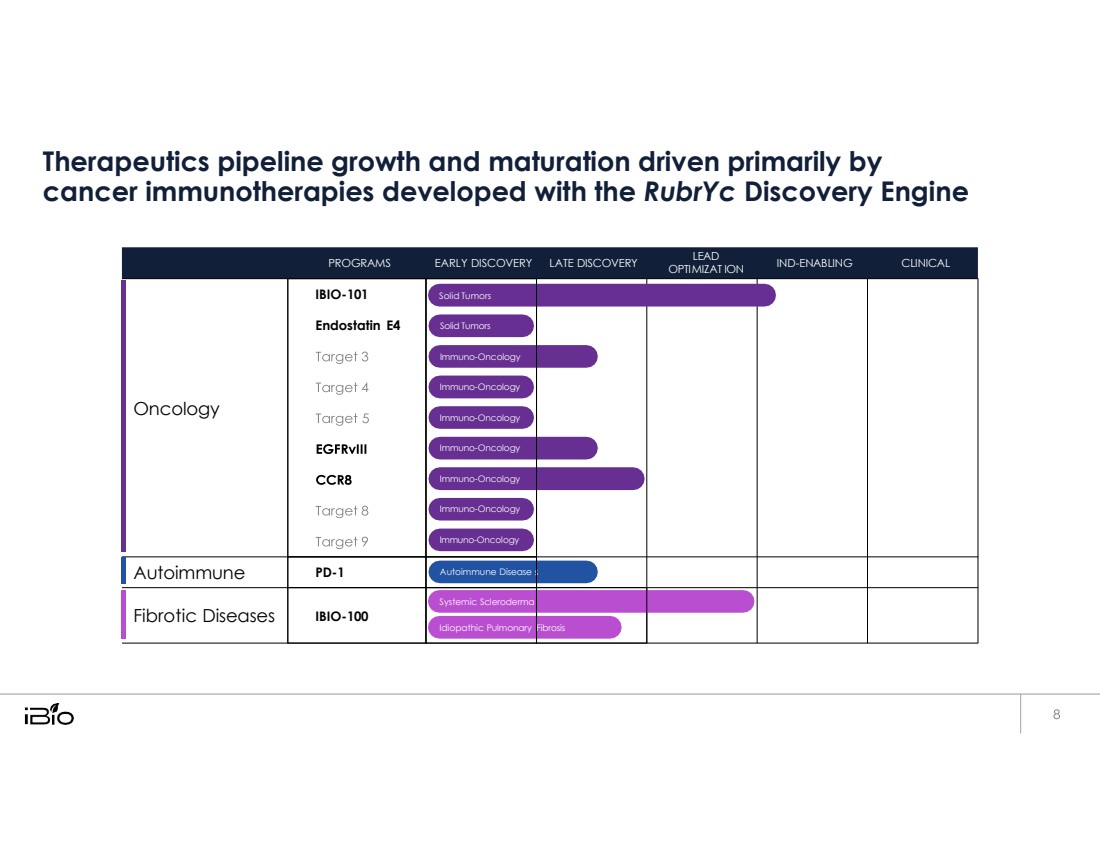

| Therapeutics pipeline growth and maturation driven primarily by cancer immunotherapies developed with the RubrYc Discovery Engine Fibrosis Systemic Scleroderma Idiopathic Pulmonary IBIO-100 Fibrotic Diseases Autoimmune Disease PD-1 Autoimmune Solid Tumors Solid Tumors Immuno-Oncology Immuno-Oncology Immuno-Oncology Immuno-Oncology Immuno-Oncology Immuno-Oncology Immuno-Oncology IBIO-101 Endostatin E4 Oncology CLINICAL IND - ENABLING MIAT LEAD OPTI ION EARLY DISCOVERY LATE DISCOVERY PROGRAMS |

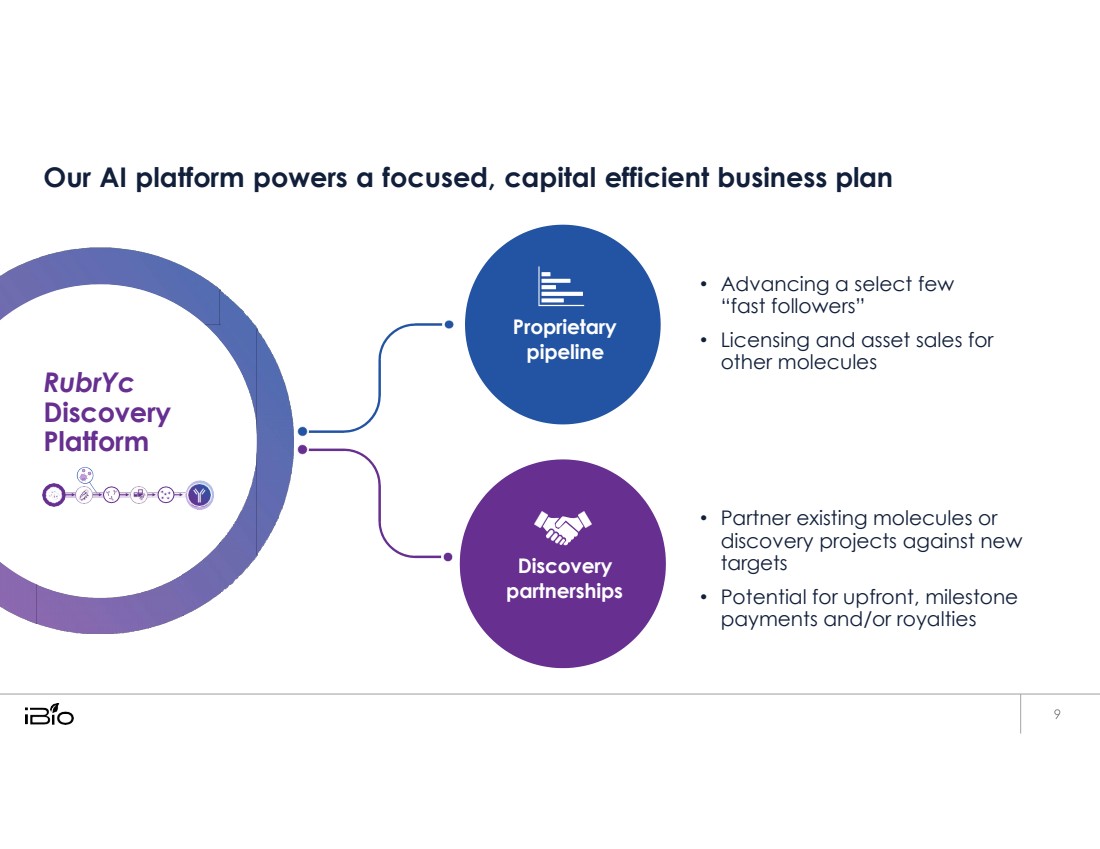

| Our AI platform powers a focused, capital efficient business plan • Advancing a select few “fast followers” • Licensing and asset sales for other molecules • Partner existing molecules or discovery projects against new targets • Potential for upfront, milestone payments and/or royalties Proprietary pipeline RubrYc Discovery Platform Discovery partnerships |

| IBIO-101 IL-2 sparing anti-CD25 10 |

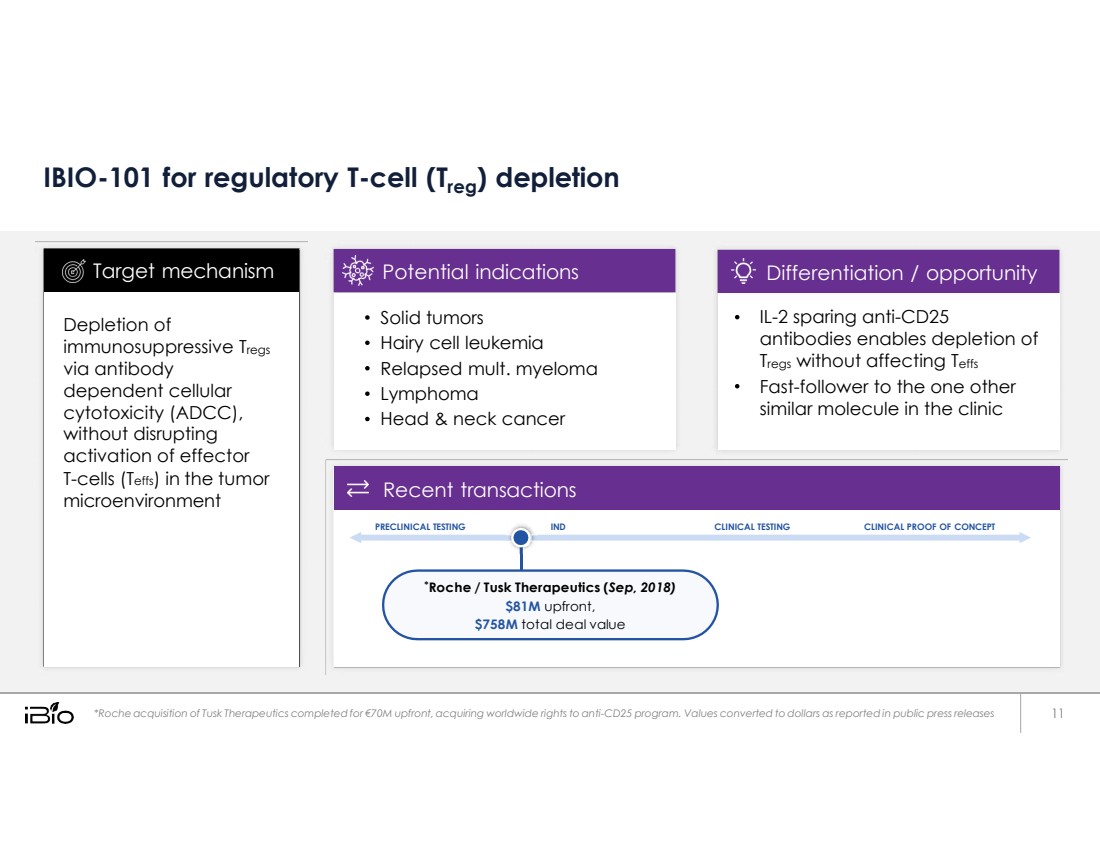

| IBIO-101 for regulatory T-cell (Treg) depletion *Roche acquisition of Tusk Therapeutics completed for €70M upfront, acquiring worldwide rights to anti-CD25 program. Values converted to dollars as reported in public press releases 11 IL-2 sparing anti-CD25 antibodies enables depletion of Tregs without affecting Teffs Fast-follower to the one other similar molecule in the clinic Differentiation / opportunity Solid tumors Hairy cell leukemia Relapsed mult. myeloma Lymphoma Head & neck cancer Potential indications Depletion of immunosuppressive Tregs via antibody dependent cellular cytotoxicity (ADCC), without disrupting activation of effector T-cells (Teffs) in the tumor microenvironment Target mechanism * Roche / Tusk Therapeutics ( Sep, 2018) $81M upfront, $758M total deal value CLINICAL PROOF OF CONCEPT CLINICAL TESTING IND PRECLINICAL TESTING Recent transactions |

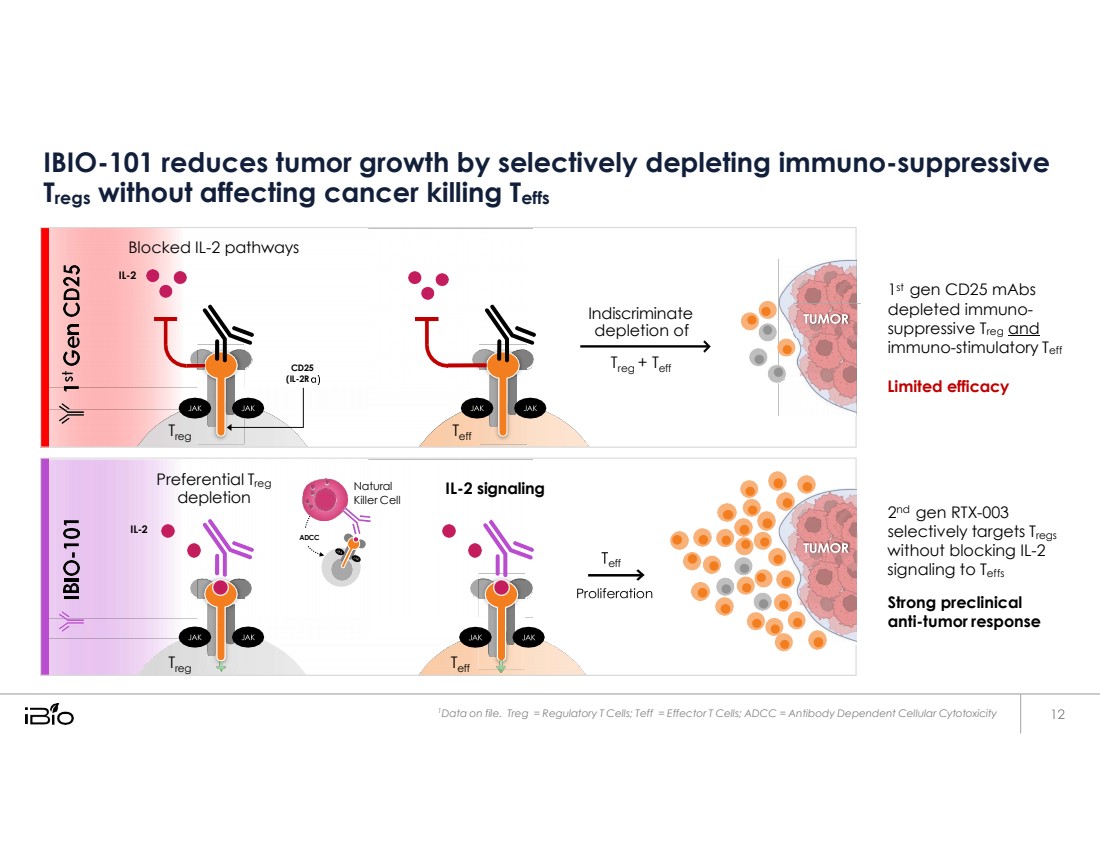

| IBIO-101 reduces tumor growth by selectively depleting immuno-suppressive Tregs without affecting cancer killing Teffs 1st gen CD25 mAbs depleted immuno- suppressive Treg and immuno-stimulatory Teff Limited efficacy 2nd gen RTX-003 selectively targets Tregs without blocking IL-2 signaling to Teffs Strong preclinical anti-tumor response 1 Data on file. Treg = Regulatory T Cells; Teff = Effector T Cells; ADCC = Antibody Dependent Cellular Cytotoxicity Blocked IL - 2 pathways IL - 2 Indiscriminate depletion of CD25 (IL - 2R T reg + T eff T reg T eff Preferential T reg depletion Natural Killer Cell IL - 2 signaling IL - 2 eff T reg T eff ADCC |

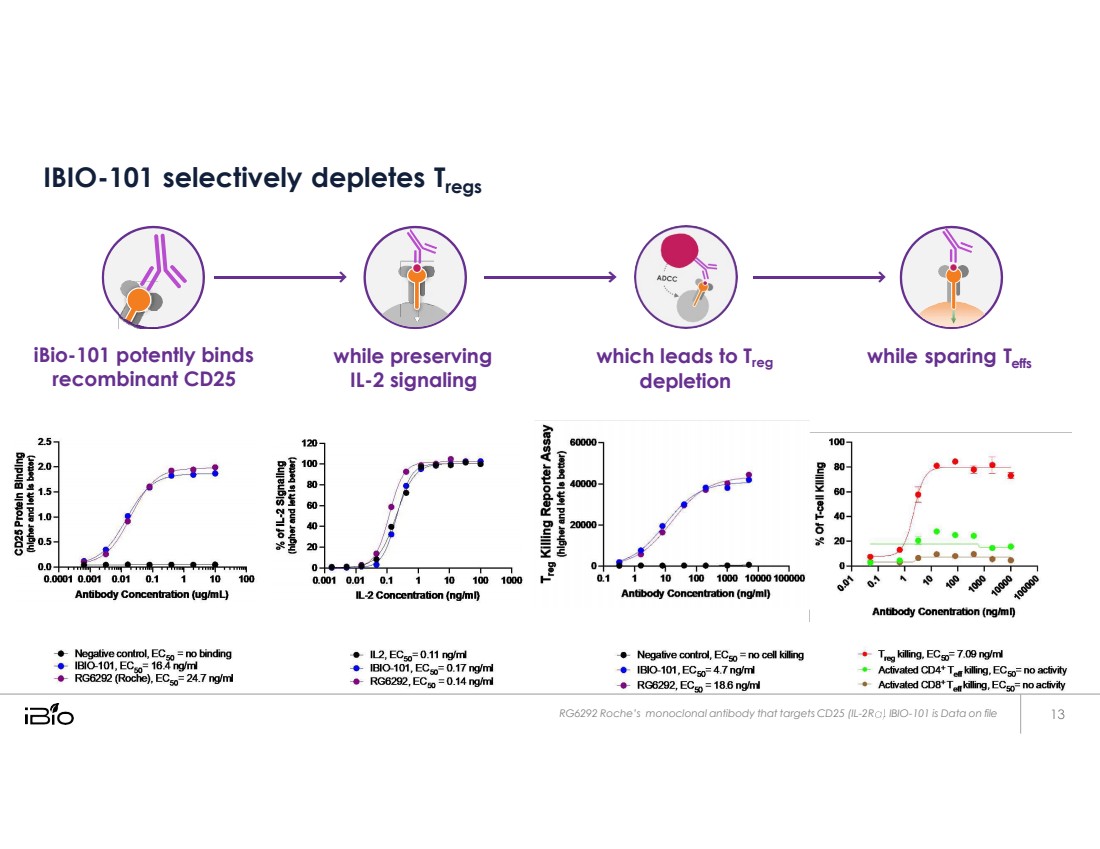

| IBIO-101 selectively depletes Tregs iBio-101 potently binds recombinant CD25 while preserving IL-2 signaling which leads to Treg depletion while sparing Teffs RG6292 Roche’s monoclonal antibody that targets CD25 (IL - 2R .. IBIO - 101 is Data on file |

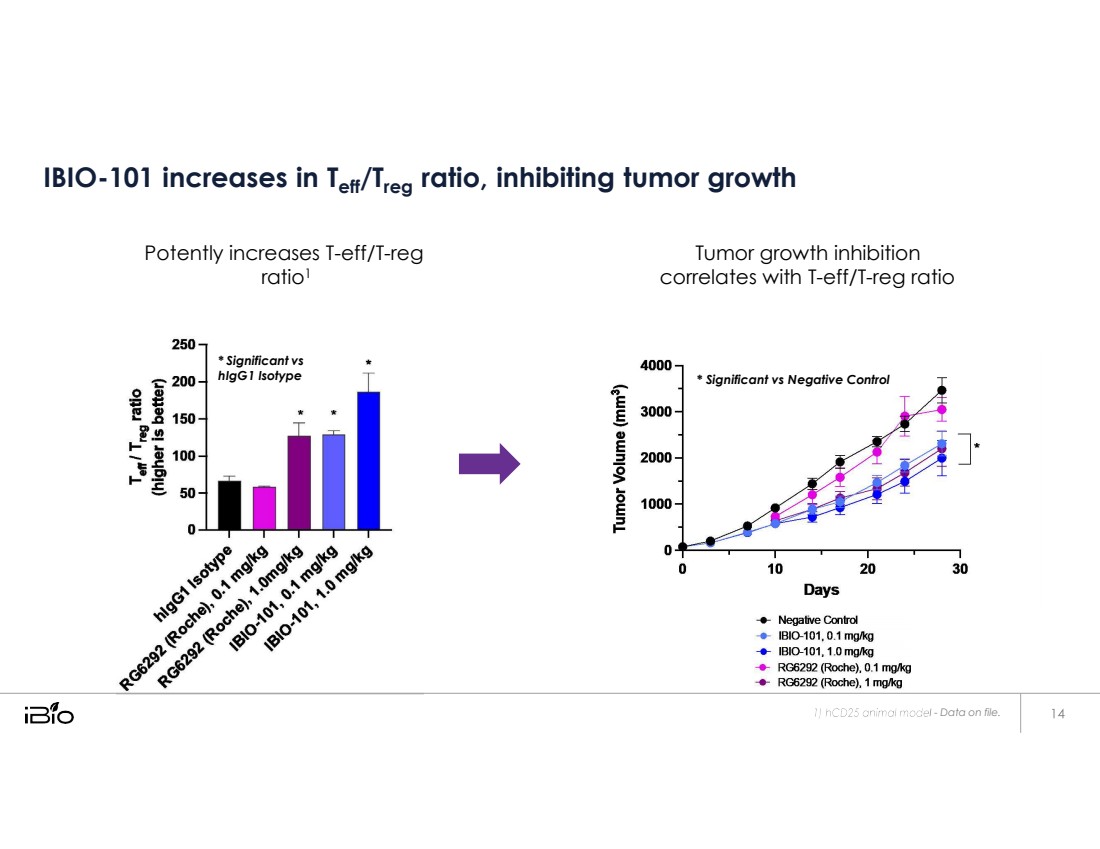

| * Significant vs hIgG1 Isotype - Data on file. IBIO-101 increases in Teff/Treg ratio, inhibiting tumor growth Potently increases T-eff/T-reg ratio1 Tumor growth inhibition correlates with T-eff/T-reg ratio * Significant vs Negative Control |

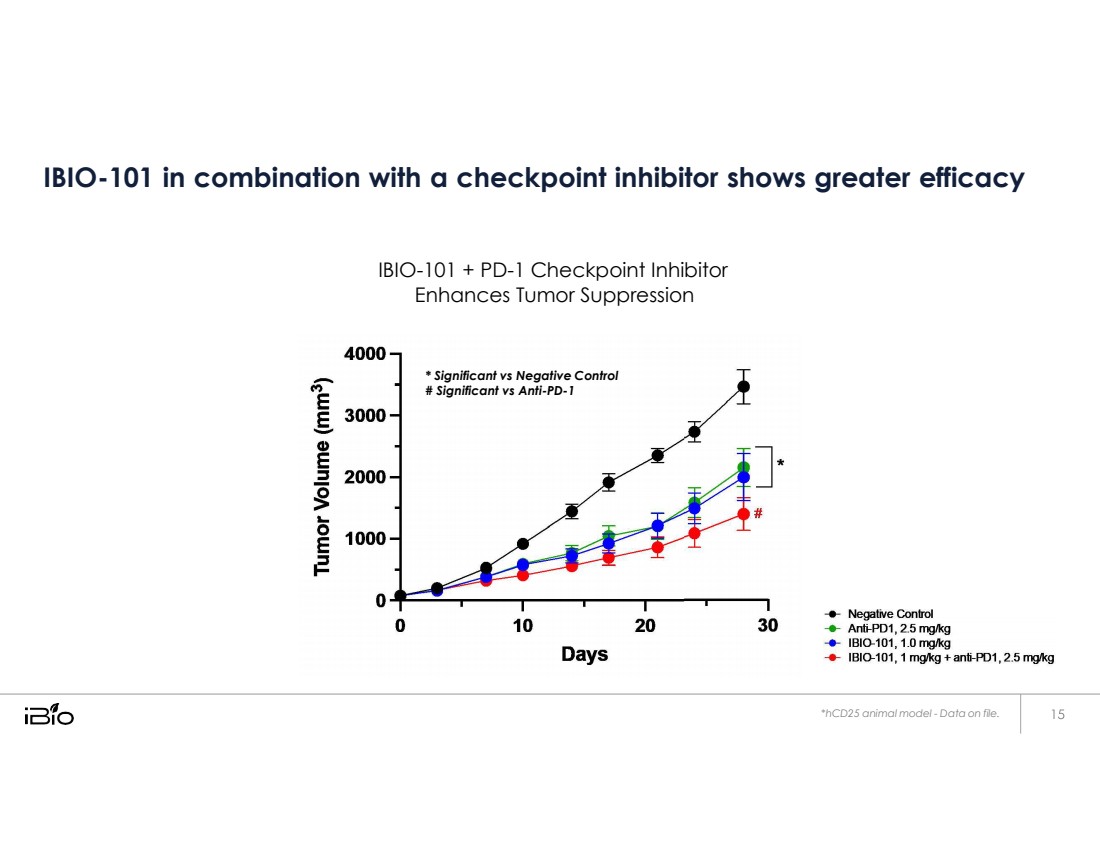

| IBIO-101 in combination with a checkpoint inhibitor shows greater efficacy IBIO-101 + PD-1 Checkpoint Inhibitor Enhances Tumor Suppression *hCD25 animal model - Data on file. * Significant vs Negative Control # Significant vs Anti-PD-1 |

| Anti-EGFRvIII High ADCC mAb against tumor-specific EGFRvIII cells 16 |

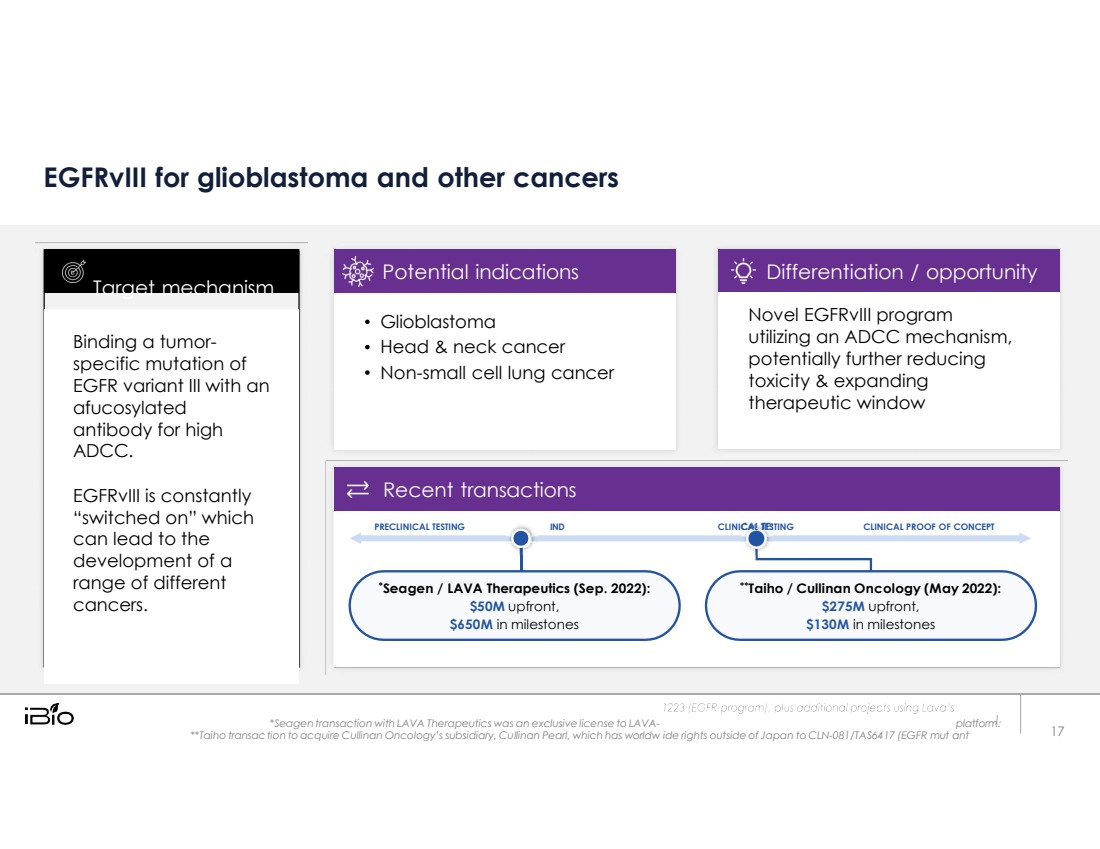

| tion to acquire Cullinan Oncology’s subsidiary, Cu linan Pearl, which has worldw EGFRvIII for glioblastoma and other cancers PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT *Seagen / LAVA Therapeutics (Sep. 2022): $50M upfront, $650M in milestones **Taiho / Cullinan Oncology (May 2022): $275M upfront, $130M in milestones *Seagen transaction with LAVA Therapeutics was an exclusive license to LAVA- platform. **Taiho transac l ide rights outside of Japan to CLN-081/TAS6417 (EGFR mut Binding a tumor- specific mutation of EGFR variant III with an afucosylated antibody for high ADCC. EGFRvIII is constantly “switched on” which can lead to the development of a range of different cancers. Target mechanism ant 17 Glioblastoma Head & neck cancer Non-small cell lung cancer Potential indications Novel EGFRvIII program utiliing an ADCC mechanism, potentially further reducing toxicity & expanding therapeutic window Differentiation / opportunity Recent transactions |

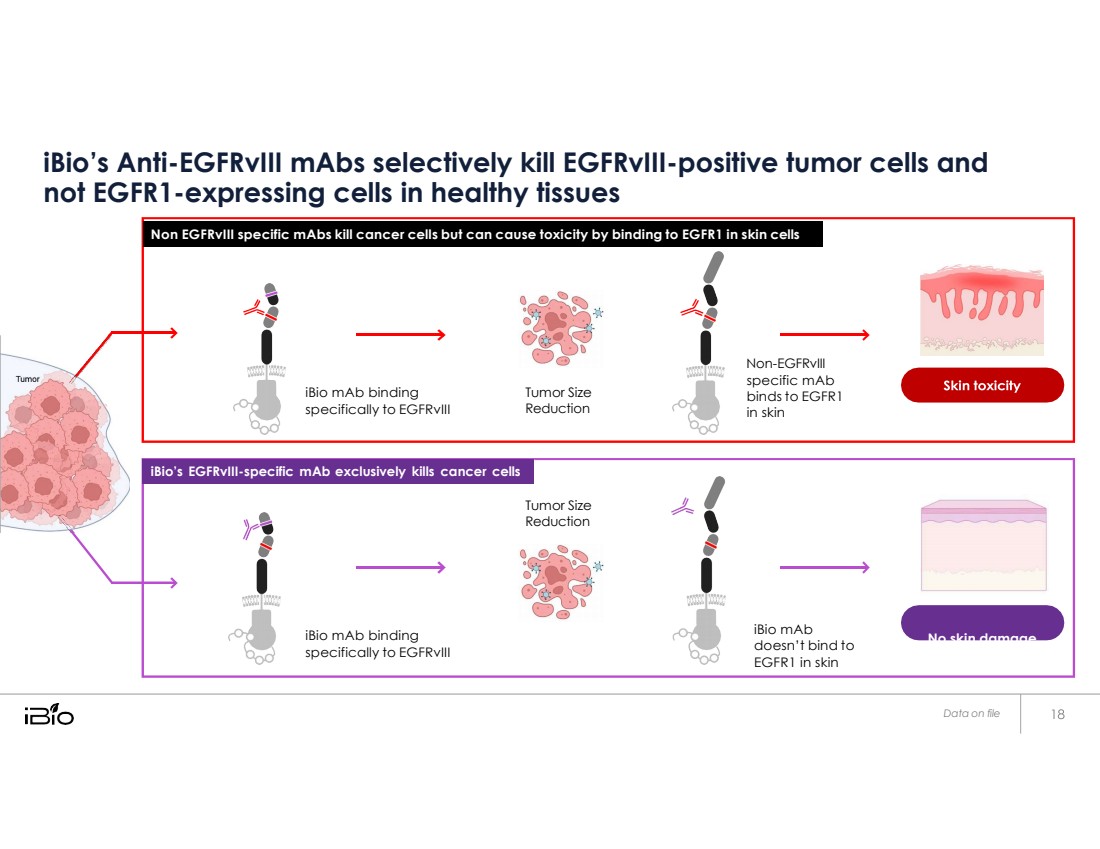

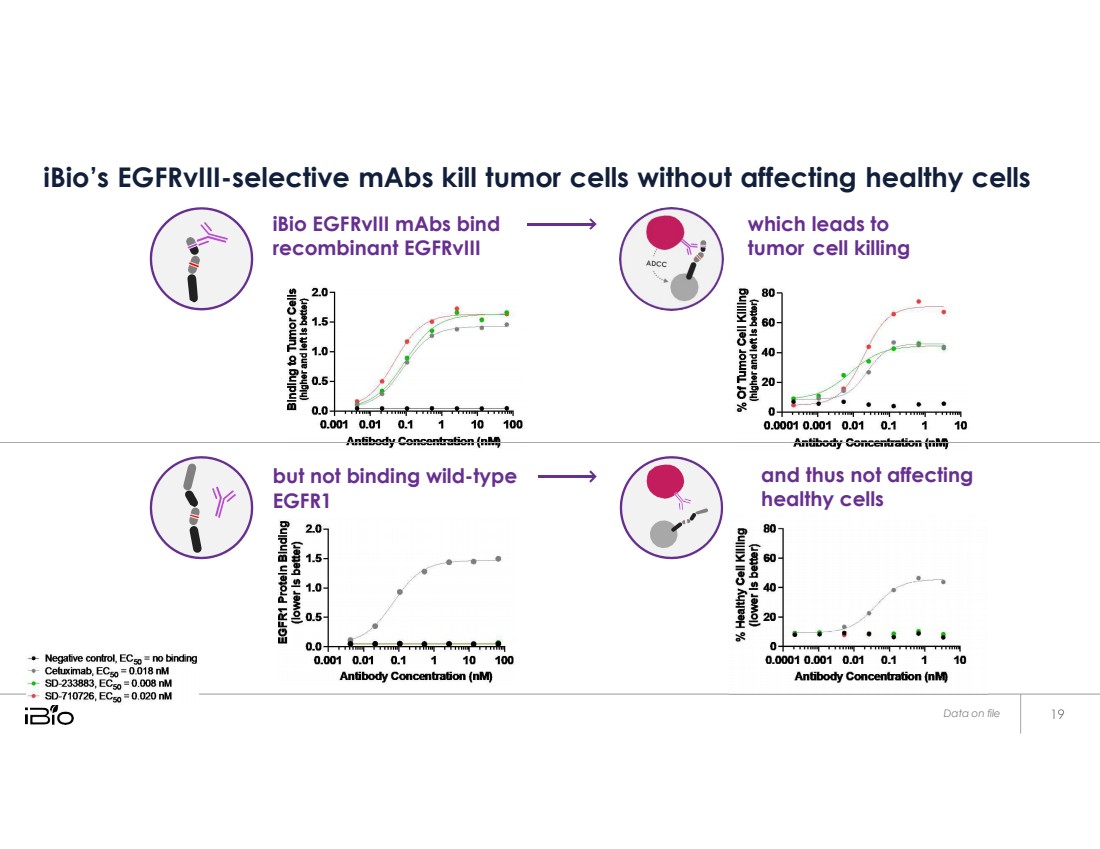

| iBio’s Anti-EGFRvIII mAbs selectively kill EGFRvIII-positive tumor cells and not EGFR1-expressing cells in healthy tissues iBio mAb binding specifically to EGFRvIII Tumor Size Reduction Tumor Size Reduction Non-EGFRvIII specific mAb binds to EGFR1 in skin iBio mAb binding specifically to EGFRvIII iBio mAb doesn’t bind to EGFR1 in skin No skin damage Data on file iBio’s EGFRvIII-specific mAb exclusively kills cancer cells Non EGFRvIII specific mAbs kill cancer cells but can cause toxicity by binding to EGFR1 in skin cells |

| but not binding wild - type EGFR1 and thus not affecting healthy cells Data on file iBio’s EGFRvIII-selective mAbs kill tumor cells without affecting healthy cells iBio EGFRvIII mAbs bind recombinant EGFRvIII which leads to tumor cell killing |

| Anti-CCR8 Highly ADCC anti-CCR8 for the depletion of T-regulatory cells 20 |

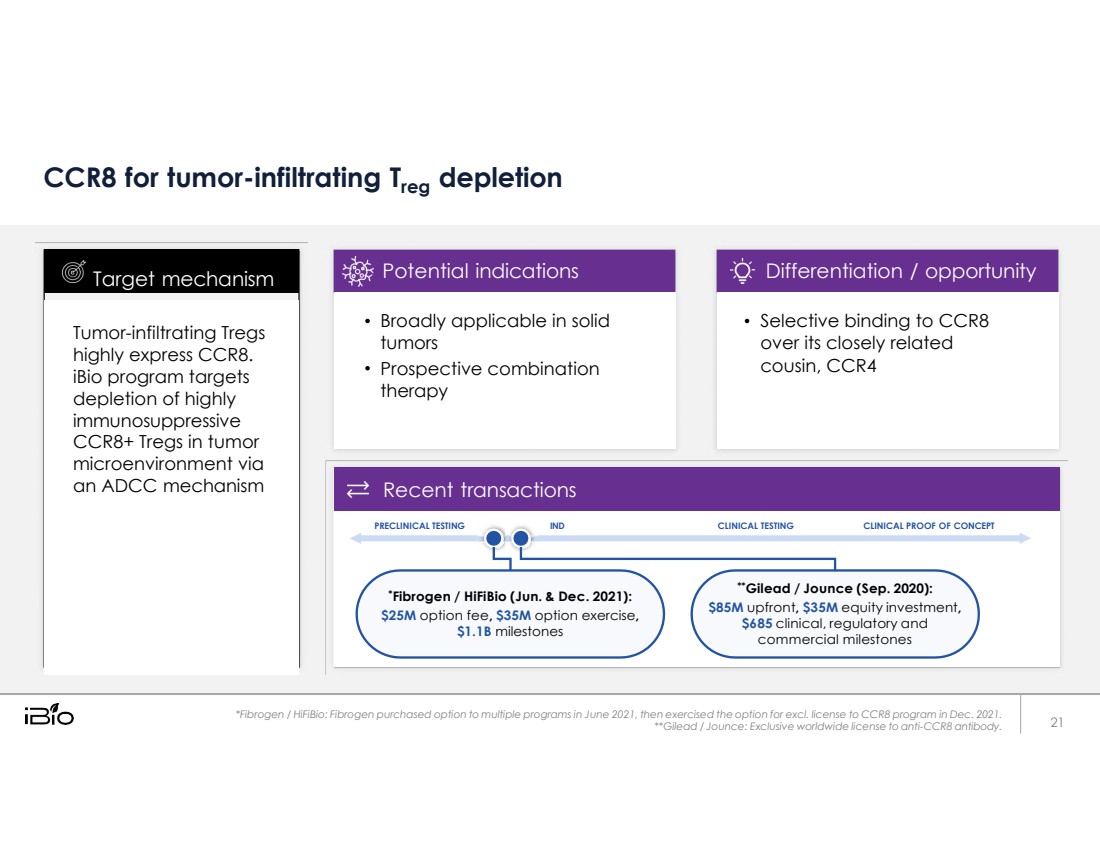

| CCR8 for tumor-infiltrating Treg depletion PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT *Fibrogen / HiFiBio (Jun. & Dec. 2021): $25M option fee, $35M option exercise, $1.1B milestones **Gilead / Jounce (Sep. 2020): $85M upfront, $35M equity investment, $685 clinical, regulatory and commercial milestones *Fibrogen / HiFiBio: Fibrogen purchased option to multiple programs in June 2021, then exercised the option for excl. license to CCR8 program in Dec. 2021. **Gilead / Jounce: Exclusive worldwide license to anti-CCR8 antibody. Tumor-infiltrating Tregs highly express CCR8. iBio program targets depletion of highly immunosuppressive CCR8+ Tregs in tumor microenvironment via an ADCC mechanism Target mechanism 21 Broadly applicable in solid tumors Prospective combination therapy Potential indications Selective binding to CCR8 over its closely related cousin, CCR4 Differentiation / opportunity Recent transactions |

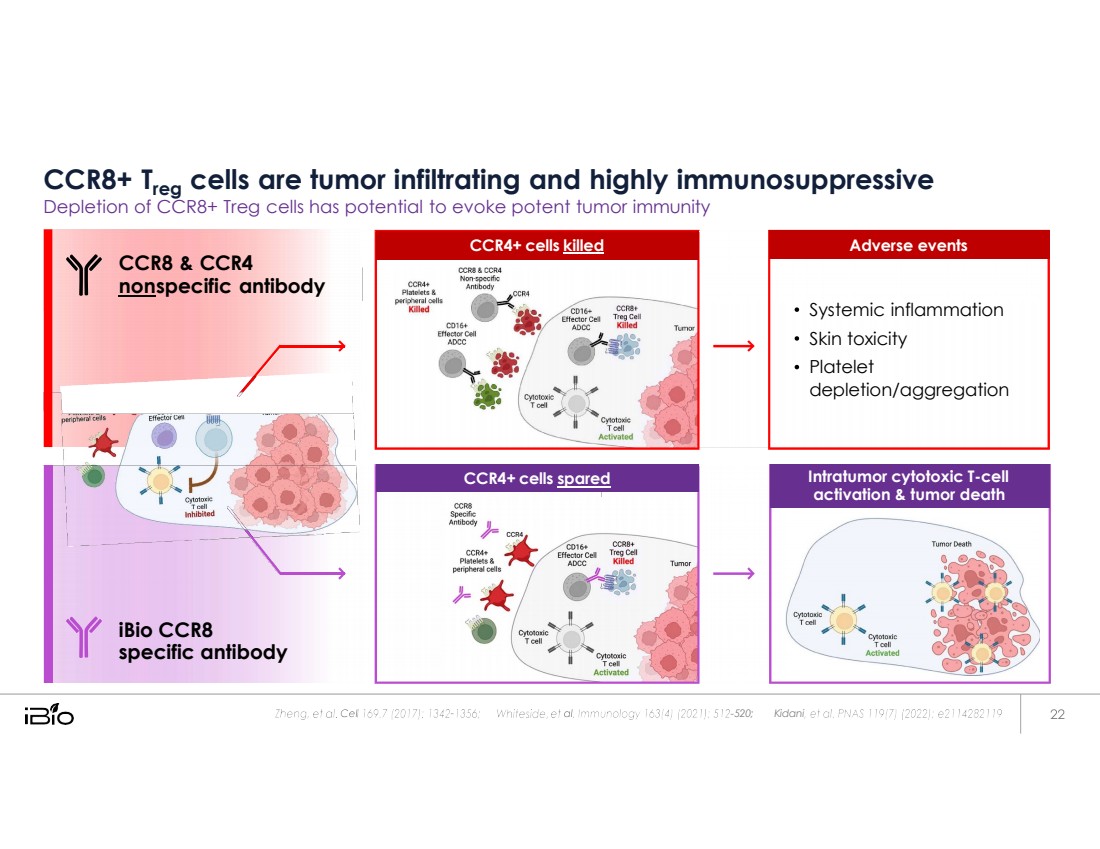

| CCR8+ Treg cells are tumor infiltrating and highly immunosuppressive Depletion of CCR8+ Treg cells has potential to evoke potent tumor immunity - 520; Kidani CCR8 & CCR4 non specific antibody iBio CCR8 specific antibody Intratumor cytotoxic T - cell activation & tumor death CCR4+ cells spared Systemic inflammation Skin toxicity Platelet depletion/aggregation Adverse events CCR4+ cells killed |

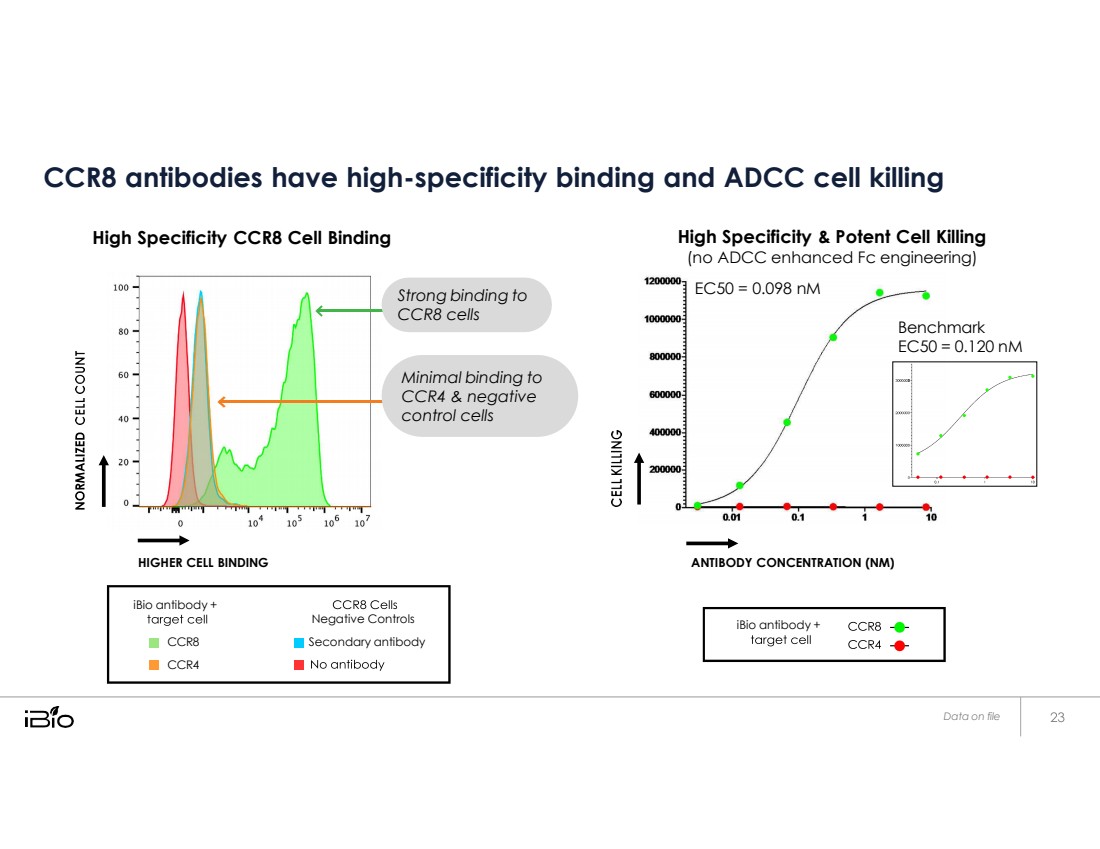

| CCR8 antibodies have high-specificity binding and ADCC cell killing High Specificity CCR8 Cell Binding High Specificity & Potent Cell Killing (no ADCC enhanced Fc engineering) HIGHER CELL BINDING ANTIBODY CONCENTRATION (NM) Data on file EC50 = 0.098 nM Benchmark EC50 = 0.120 nM Strong binding to CCR8 cells Minimal binding to CCR4 & negative control cells iBio antibody + CCR8 CCR4 Negative Controls Secondary antibody iBio antibody + |

| PD-1 agonist Supports restoration of homeostasis for inflammatory diseases 24 |

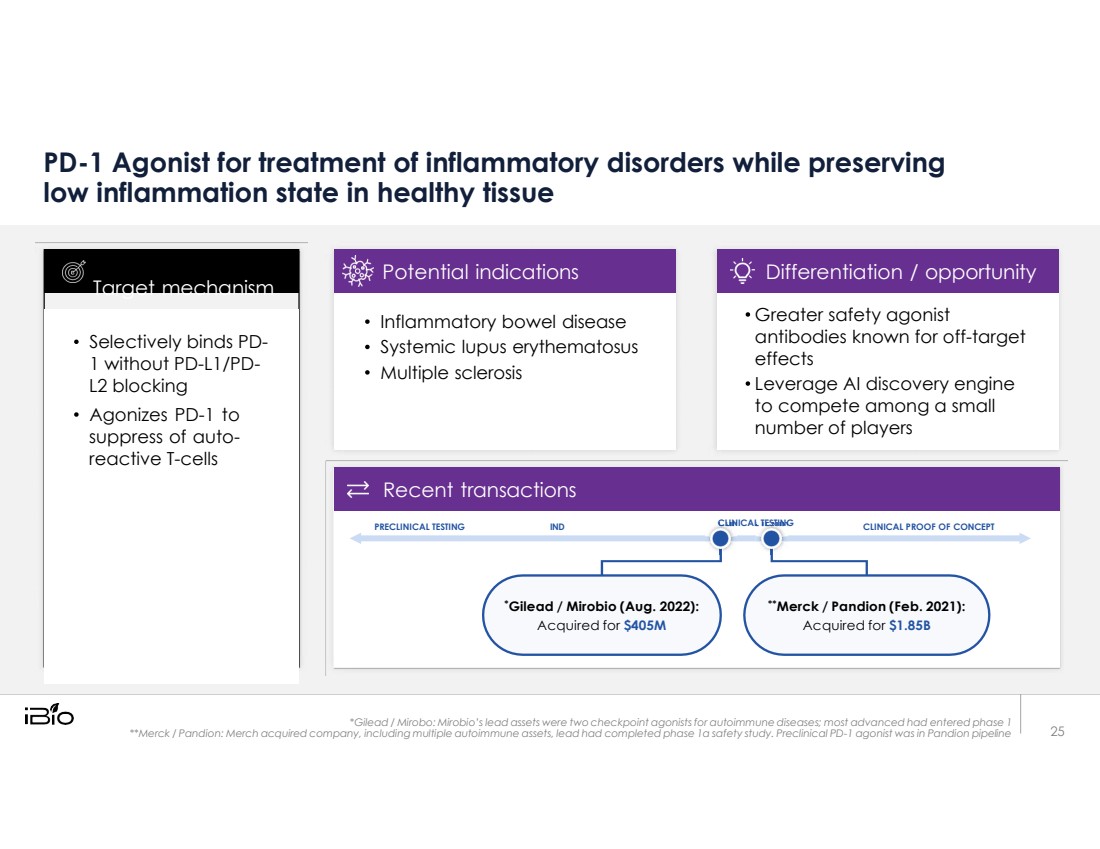

| PD-1 Agonist for treatment of inflammatory disorders while preserving low inflammation state in healthy tissue PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT *Gilead / Mirobio (Aug. 2022): Acquired for $405M **Merck / Pandion (Feb. 2021): Acquired for $1.85B *Gilead / Mirobo: Mirobio’s lead assets were two checkpoint agonists for autoimmune diseases; most advanced had entered phase 1 **Merck / Pandion: Merch acquired company, including multiple autoimmune assets, lead had completed phase 1a safety study. Preclinical PD-1 agonist was in Pandion pipeline Selectively binds PD- 1 without PD-L1/PD- L2 blocking Agonizes PD-1 to suppress of auto- reactive T-cells Target mechanism 25 Inflammatory bowel disease Systemic lupus erythematosus Multiple sclerosis Potential indications Greater safety agonist antibodies known for off-target effects Leverage AI discovery engine to compete among a small number of players Differentiation / opportunity Recent transactions |

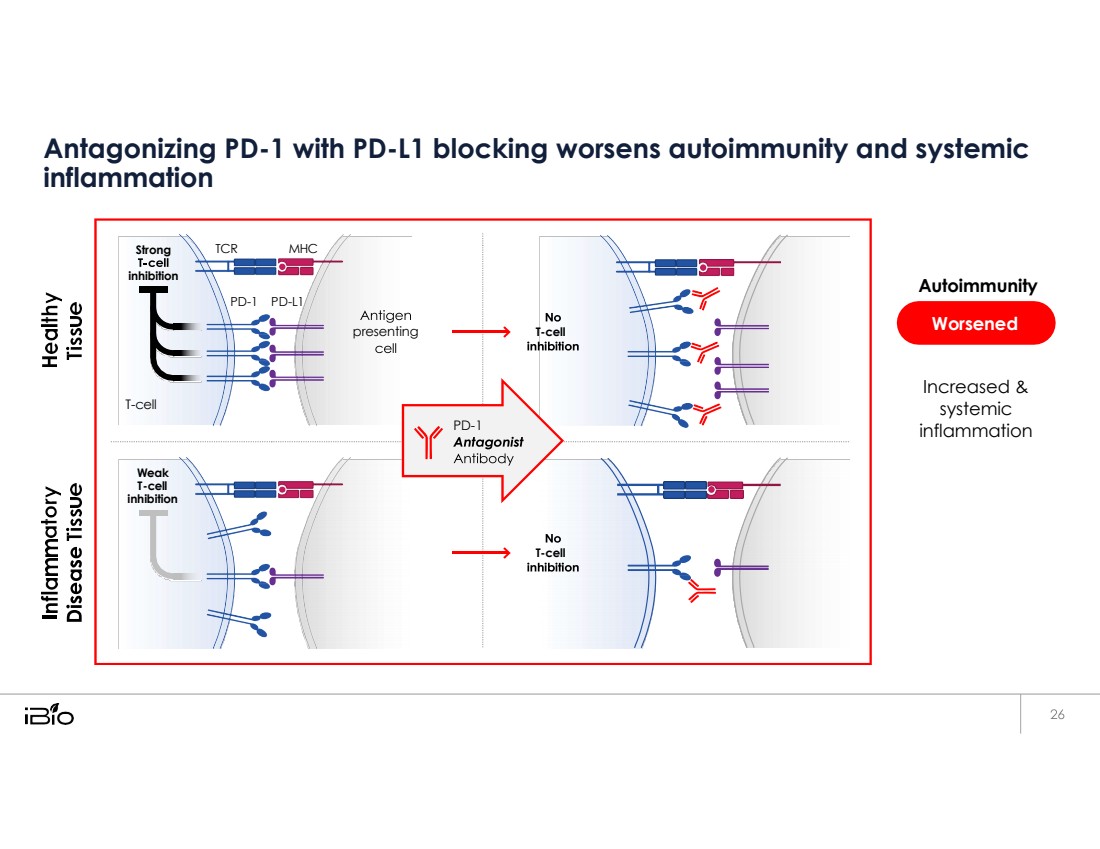

| Antagonizing PD-1 with PD-L1 blocking worsens autoimmunity and systemic inflammation Autoimmunity Increased & systemic inflammation Strong inhibition TCR MHC PD - 1 PD - L1 presenting T-cell T - cell PD - 1 Weak T-cell inhibition T-cell Worsened |

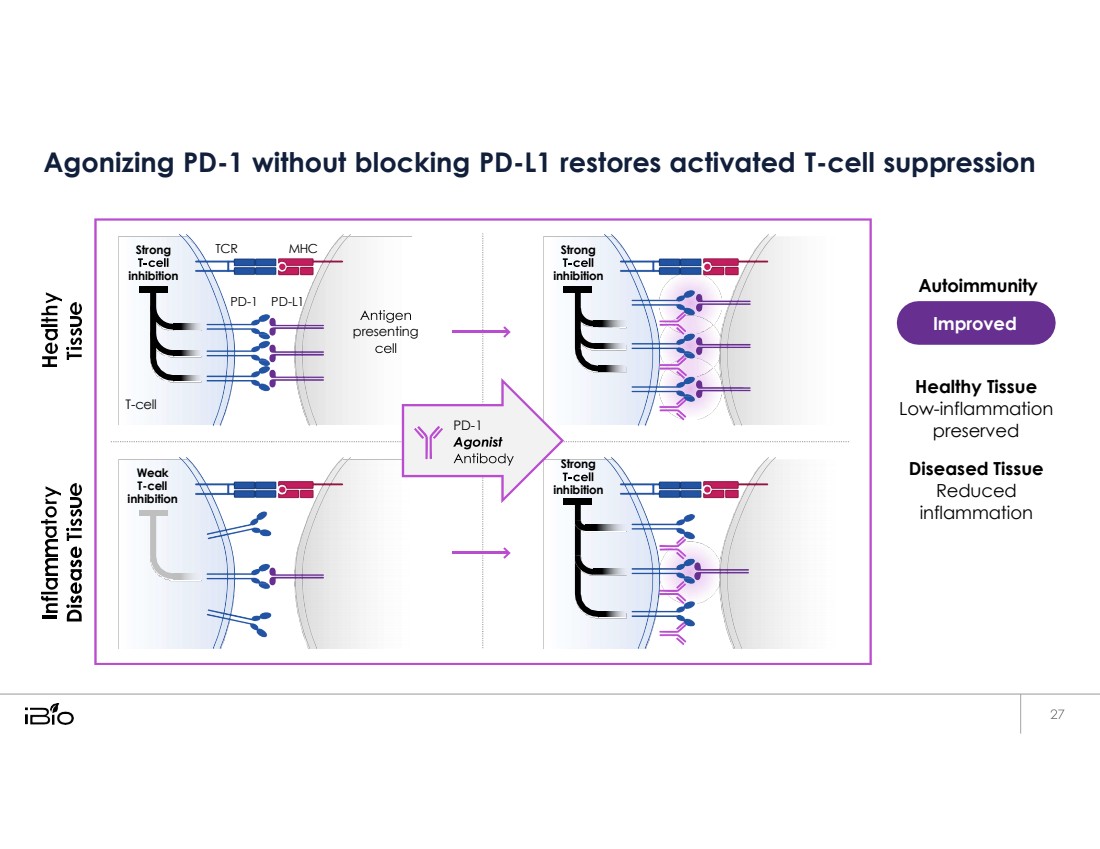

| Agonizing PD-1 without blocking PD-L1 restores activated T-cell suppression Autoimmunity Healthy Tissue Low-inflammation preserved Diseased Tissue Reduced inflammation Strong inhibition TCR MHC Strong inhibition PD - 1 PD - L1 presenting T - cell PD - 1 Weak T-cell inhibition Strong inhibition Improved |

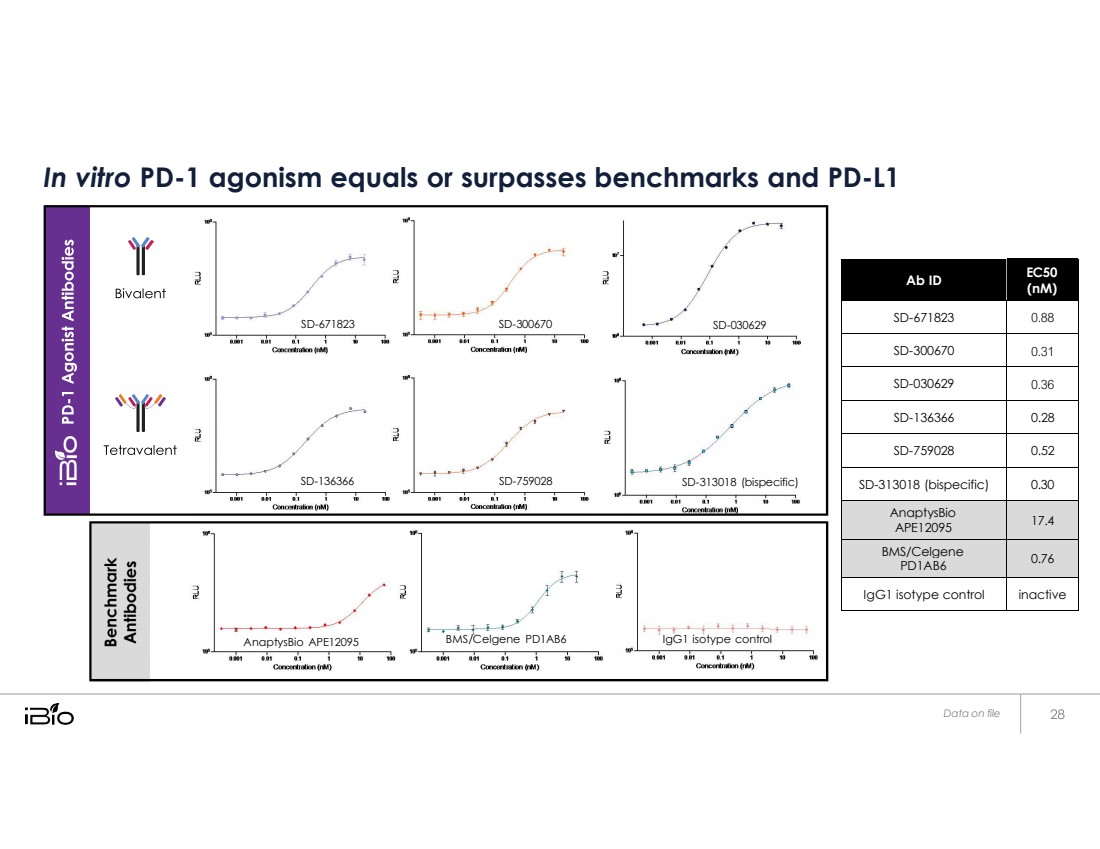

| In vitro PD-1 agonism equals or surpasses benchmarks and PD-L1 Ab ID EC50 (nM) SD-671823 0.88 SD-300670 0.31 SD-030629 0.36 SD-136366 0.28 SD-759028 0.52 SD-313018 (bispecific) 0.30 AnaptysBio APE12095 17.4 BMS/Celgene PD1AB6 0.76 IgG1 isotype control inactive Data on file SD - 1018 (bispecific SD - 759028 SD - 1666 SD - 00670 SD - 67182 SD - 00629 AnaptysBio APE12095 BMS/Celgene PD1AB6 IgG1 isotype control |

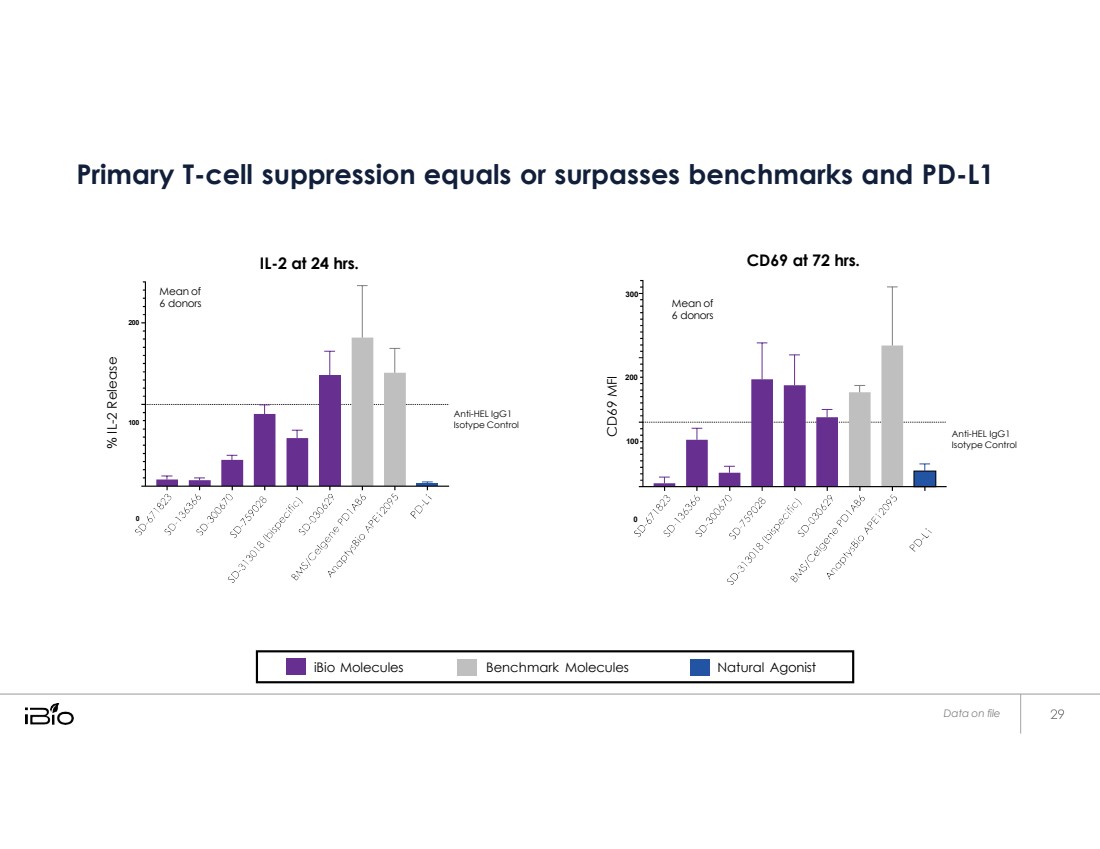

| Primary T-cell suppression equals or surpasses benchmarks and PD-L1 200 Mean of 6 donors IL-2 at 24 hrs. 300 Mean of 6 donors CD69 at 72 hrs. 200 100 Anti-HEL IgG1 Isotype Control 100 Anti-HEL IgG1 Isotype Control 0 0 Data on file % IL - 2 Release CD69 MFI iBio Molecules Benchmark Molecules Natural Agonist |

| In summary 30 |

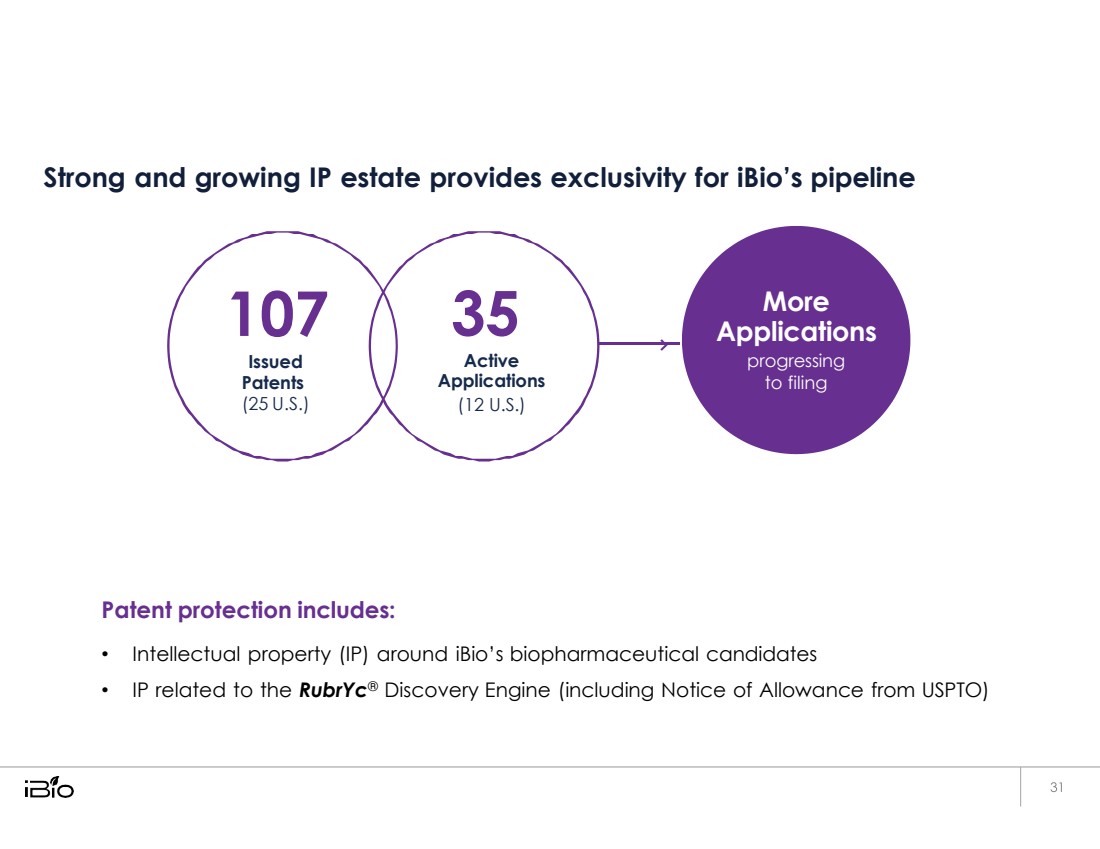

| Strong and growing IP estate provides exclusivity for iBio’s pipeline 107 Issued Patents (25 U.S.) 35 Active Applications (12 U.S.) Patent protection includes: • Intellectual property (IP) around iBio’s biopharmaceutical candidates • IP related to the RubrYc® Discovery Engine (including Notice of Allowance from USPTO) More Applications progressing to filing |

| Our leadership team brings drug development & bioprocessing experience Martin Brenner, DVM, Ph.D. CSO Robert Lutz, MBA CFBO Marc Banjak GC Lisa Middlebrook CHRO Tom Isett CEO |

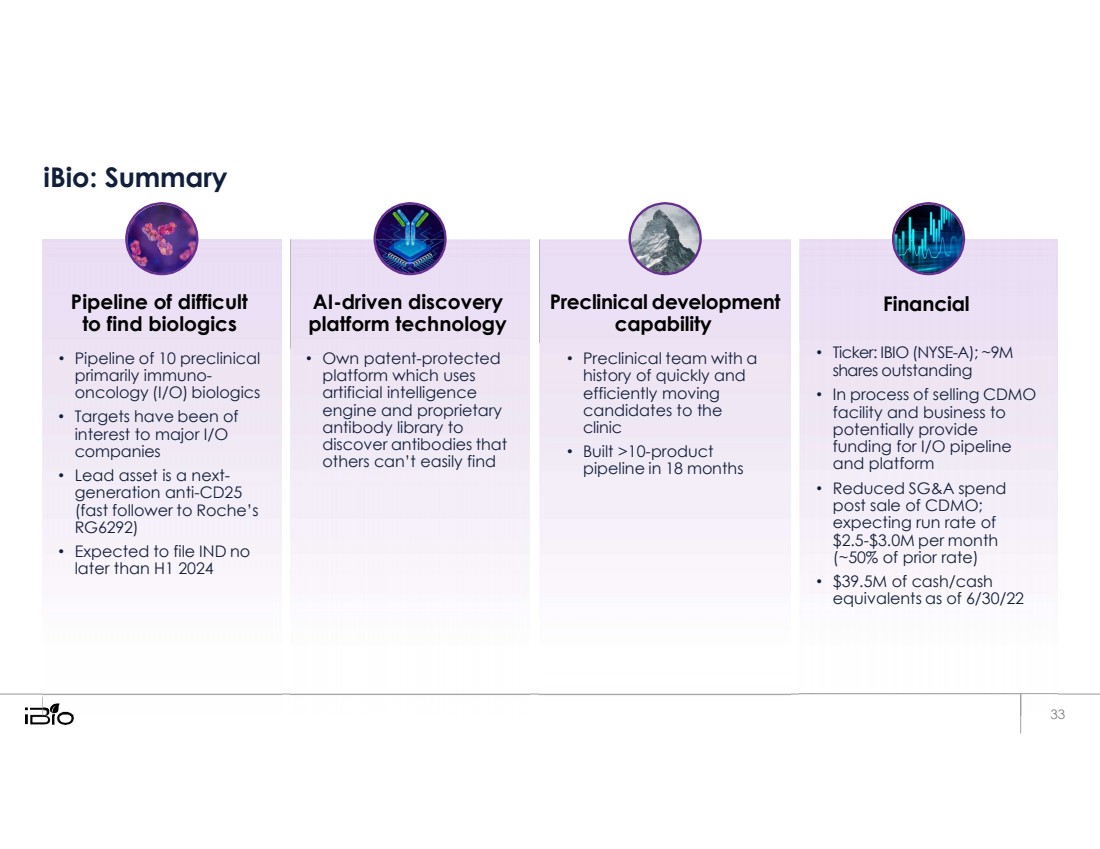

| iBio: Summary Pipeline of difficult to find biologics • Pipeline of 10 preclinical primarily immuno- oncology (I/O) biologics • Targets have been of interest to major I/O companies • Lead asset is a next- generation anti-CD25 (fast follower to Roche’s RG6292) • Expected to file IND no later than H1 2024 AI-driven discovery platform technology • Own patent-protected platform which uses artificial intelligence engine and proprietary antibody library to discover antibodies that others can’t easily find Preclinical development capability • Preclinical team with a history of quickly and efficiently moving candidates to the clinic • Built >10-product pipeline in 18 months Financial • Ticker: IBIO (NYSE-A); ~9M shares outstanding • In process of selling CDMO facility and business to potentially provide funding for I/O pipeline and platform • Reduced SG&A spend post sale of CDMO; expecting run rate of $2.5-$3.0M per month (~50% of prior rate) • $39.5M of cash/cash equivalents as of 6/30/22 33 |