| April 2023 |

| Forward-looking Statements Certain statements in this presentation constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Words such as "may," "might," "will," "should," "believe," "expect," "anticipate," "estimate," "continue," "predict," "forecast," "project," "plan," "intend" or similar expressions, or statements regarding intent, belief, or current expectations, are forward-looking statements. These forward-looking statements are based upon current estimates. While iBio, Inc., a Delaware corporation (including its consolidated subsidiaries, “iBio,” the “Company,” “we,” “us” or “our”) believes these forward-looking statements are reasonable, undue reliance should not be placed on any such forward-looking statements, which are based on information available to us on the date of this presentation. These forward-looking statements are subject to various risks and uncertainties, many of which are difficult to predict that could cause actual results to differ materially from current expectations and assumptions from those set forth or implied by any forward-looking statements. Important factors that could cause actual results to differ materially from current expectations include, among others, the Company’s ability to obtain regulatory approvals for commercialization of its product candidates, or to comply with ongoing regulatory requirements, regulatory limitations relating to its ability to promote or commercialize its product candidates for specific indications, acceptance of its product candidates in the marketplace and the successful development, marketing or sale of products, its ability to attain license agreements, the continued maintenance and growth of its patent estate, its ability to establish and maintain collaborations, its ability to obtain or maintain the capital or grants necessary to fund its research and development activities, competition, its ability to retain its key employees or maintain its NYSE American listing, and the other factors discussed in the Company’s most recent Annual Report on Form 10-K and the Company’s subsequent filings with the SEC, including subsequent periodic reports on Forms 10-Q and 8-K. The information in this presentation is provided only as of today, and we undertake no obligation to update any forward-looking statements contained in this presentation on account of new information, future events, or otherwise, except as required by law. This presentation, and any oral statements made in connection with this presentation, shall not constitute an offer to sell, or the solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other securities of the Company, nor, in connection with any securities offering by the Company, will there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction. 2 |

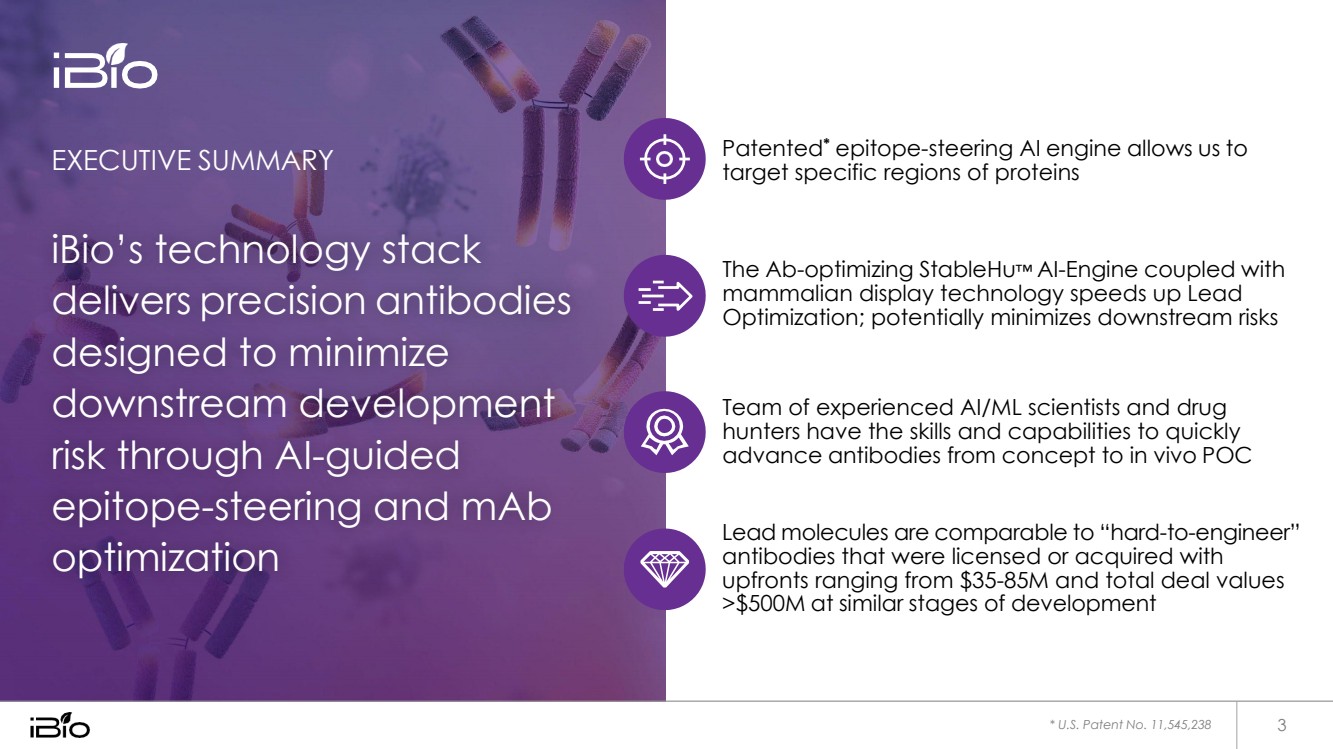

| EXECUTIVE SUMMARY iBio’s technology stack delivers precision antibodies designed to minimize downstream development risk through AI-guided epitope-steering and mAb optimization Patented* epitope-steering AI engine allows us to target specific regions of proteins The Ab-optimizing StableHu™ AI-Engine coupled with mammalian display technology speeds up Lead Optimization; potentially minimizes downstream risks Team of experienced AI/ML scientists and drug hunters have the skills and capabilities to quickly advance antibodies from concept to in vivo POC Lead molecules are comparable to “hard-to-engineer” antibodies that were licensed or acquired with upfronts ranging from $35-85M and total deal values >$500M at similar stages of development * U.S. Patent No. 11,545,238 3 |

| Antibody Engineering is Hard: iBio’s Precision AI Technology Provides 4 Solutions Antibodies are built from stretches of amino acids, which are the words and sentences that make up the natural language of biology. We are using AI to decipher that language with a goal to explore novel biology and create immunotherapies directed toward hard-to-drug targets. AI-powered precision-targeting GEN 3 Greater developability GEN 2 Enabling next-gen formats GEN 1 |

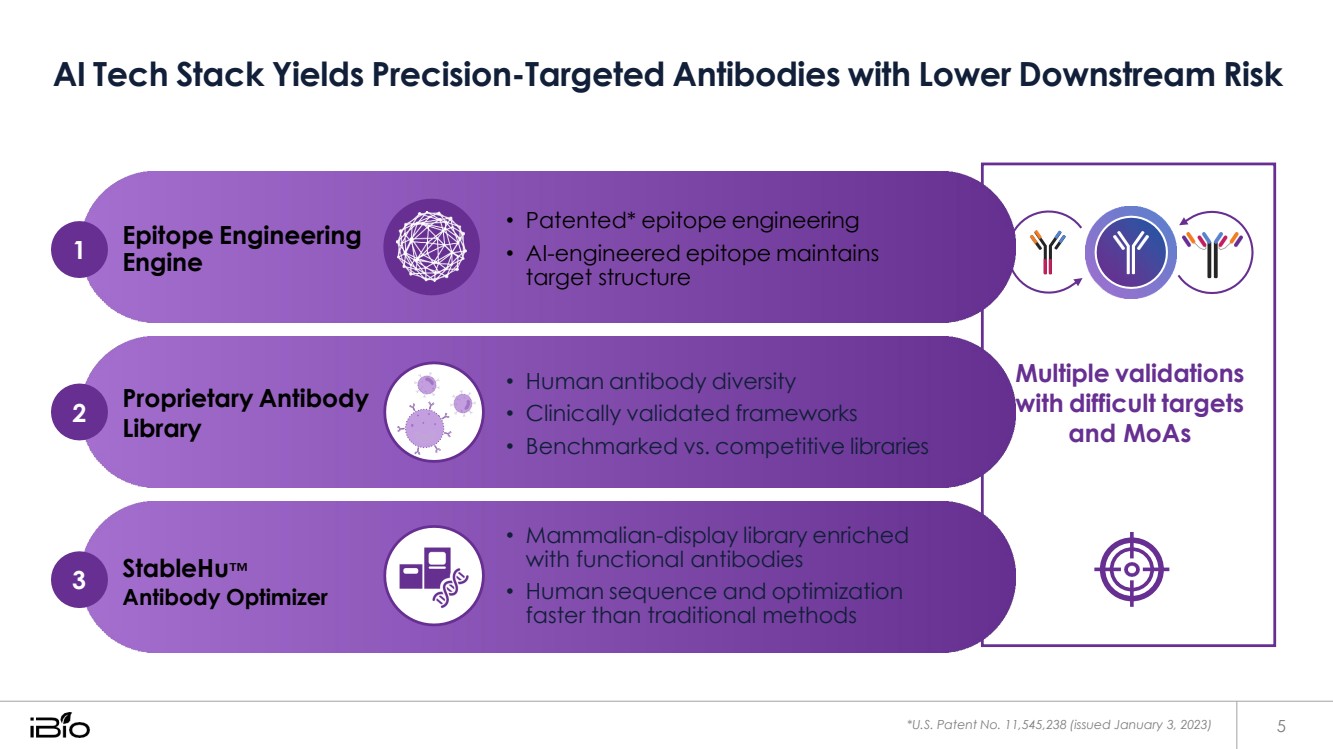

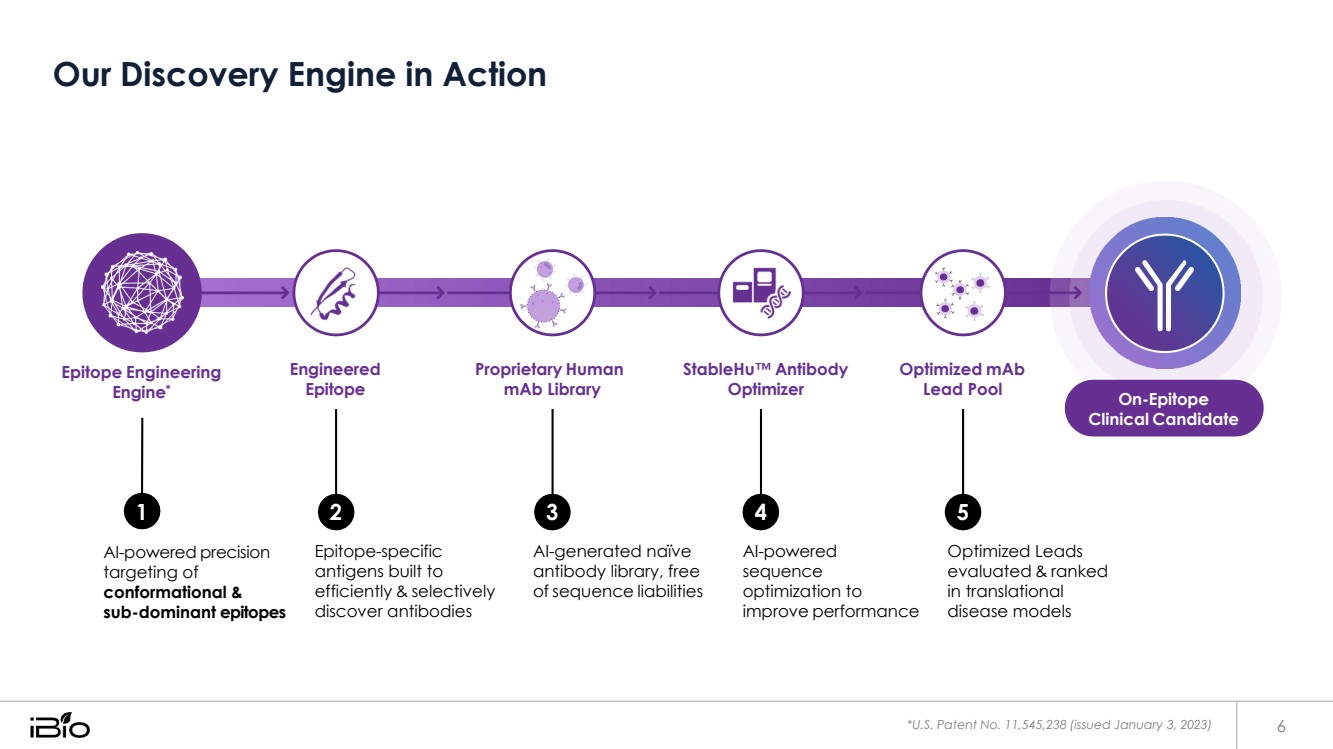

| AI Tech Stack Yields Precision-Targeted Antibodies with Lower Downstream Risk *U.S. Patent No. 11,545,238 (issued January 3, 2023) 5 Epitope Engineering Engine • Patented* epitope engineering • AI-engineered epitope maintains target structure Proprietary Antibody Library 3 StableHu™ Antibody Optimizer • Human antibody diversity • Clinically validated frameworks • Benchmarked vs. competitive libraries • Mammalian-display library enriched with functional antibodies • Human sequence and optimization faster than traditional methods Multiple validations with difficult targets and MoAs 1 2 |

| Our Discovery Engine in Action *U.S. Patent No. 11,545,238 (issued January 3, 2023) 6 1 AI-powered precision targeting of conformational & sub-dominant epitopes Epitope-specific antigens built to efficiently & selectively discover antibodies AI-generated naïve antibody library, free of sequence liabilities AI-powered sequence optimization to improve performance Optimized Leads evaluated & ranked in translational disease models Epitope Engineering Engine* Engineered Epitope Proprietary Human mAb Library StableHu™ Antibody Optimizer Optimized mAb Lead Pool On-Epitope Clinical Candidate 2 3 4 5 |

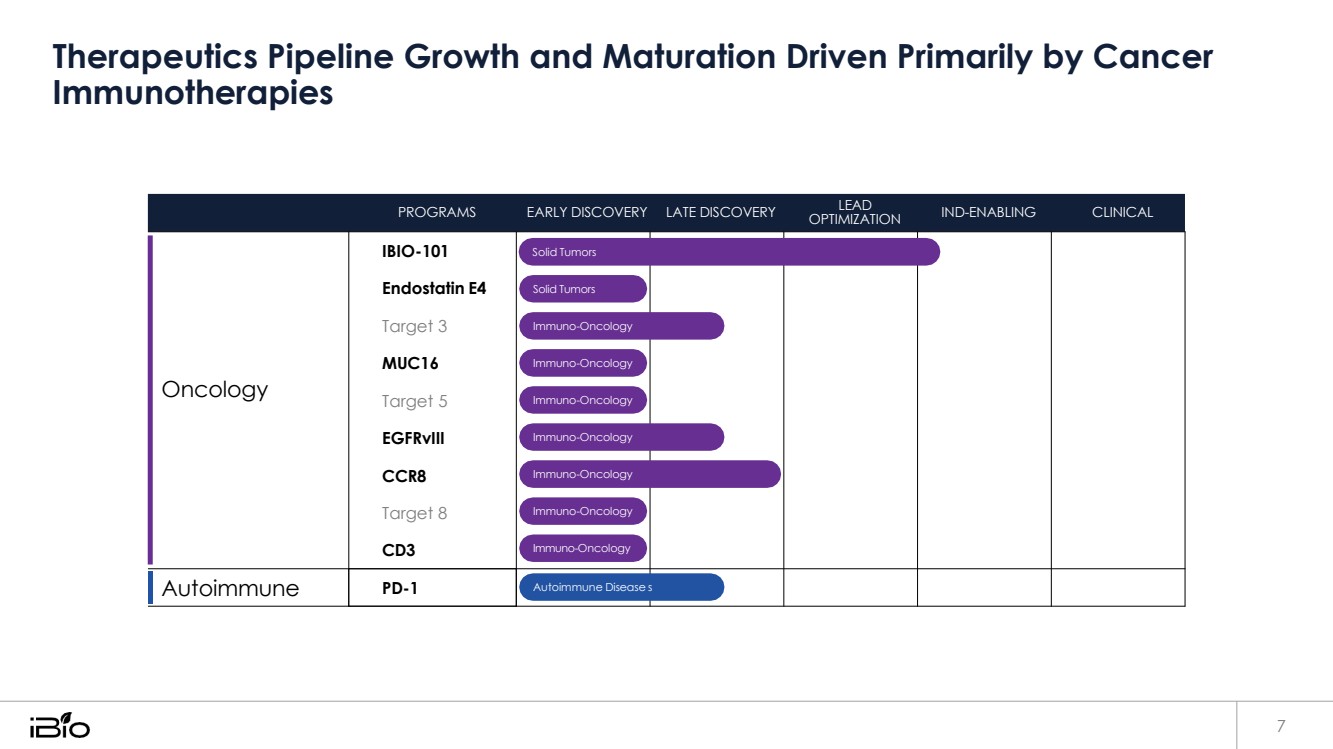

| Therapeutics Pipeline Growth and Maturation Driven Primarily by Cancer 7 Autoimmune PD-1 Autoimmune Disease s Solid Tumors Solid Tumors Immuno-Oncology Immuno-Oncology Immuno-Oncology Immuno-Oncology Immuno-Oncology Immuno-Oncology Immuno-Oncology Oncology OPTIMIZATION Immunotherapies PROGRAMS EARLY DISCOVERY LATE DISCOVERY IBIO-101 Endostatin E4 Target 3 MUC16 Target 5 EGFRvIII CCR8 Target 8 CD3 LEAD IND-ENABLING CLINICAL |

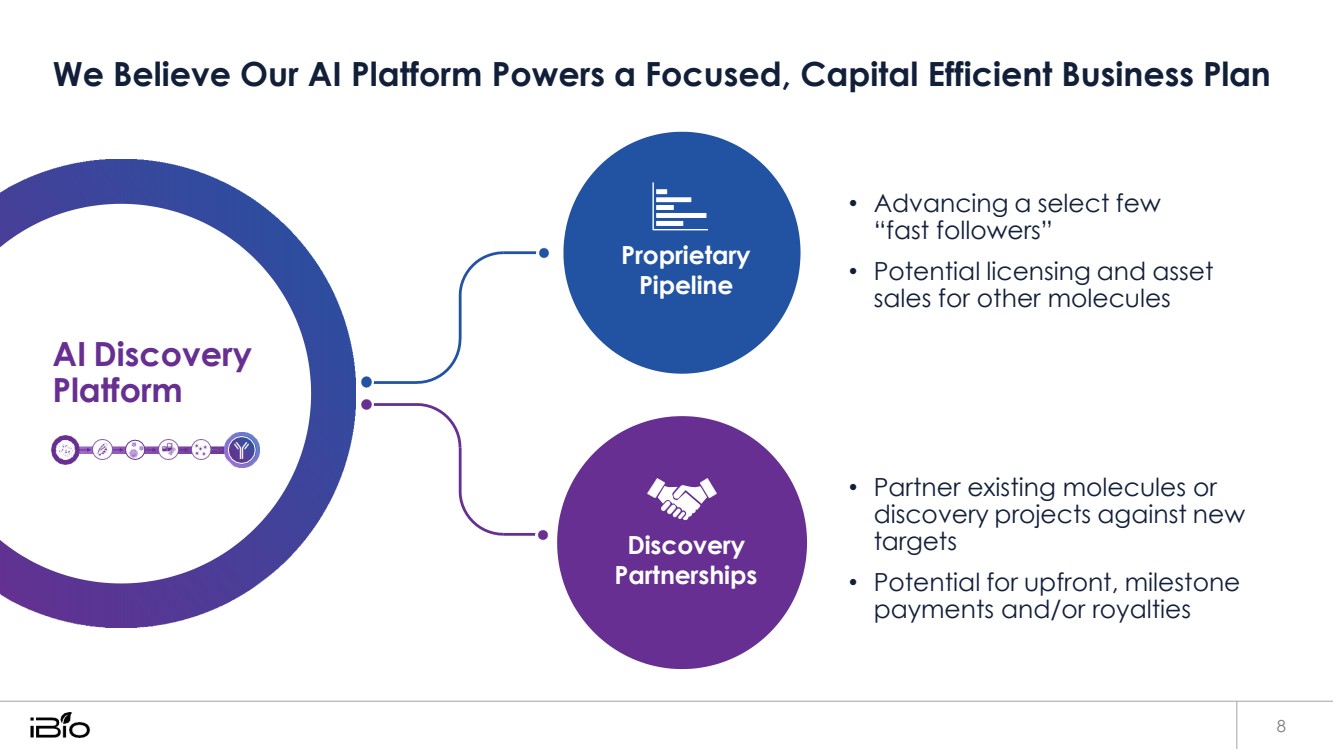

| We Believe Our AI Platform Powers a Focused, Capital Efficient Business Plan 8 • Advancing a select few “fast followers” • Potential licensing and asset sales for other molecules • Partner existing molecules or discovery projects against new targets • Potential for upfront, milestone payments and/or royalties AI Discovery Platform Proprietary Pipeline Discovery Partnerships |

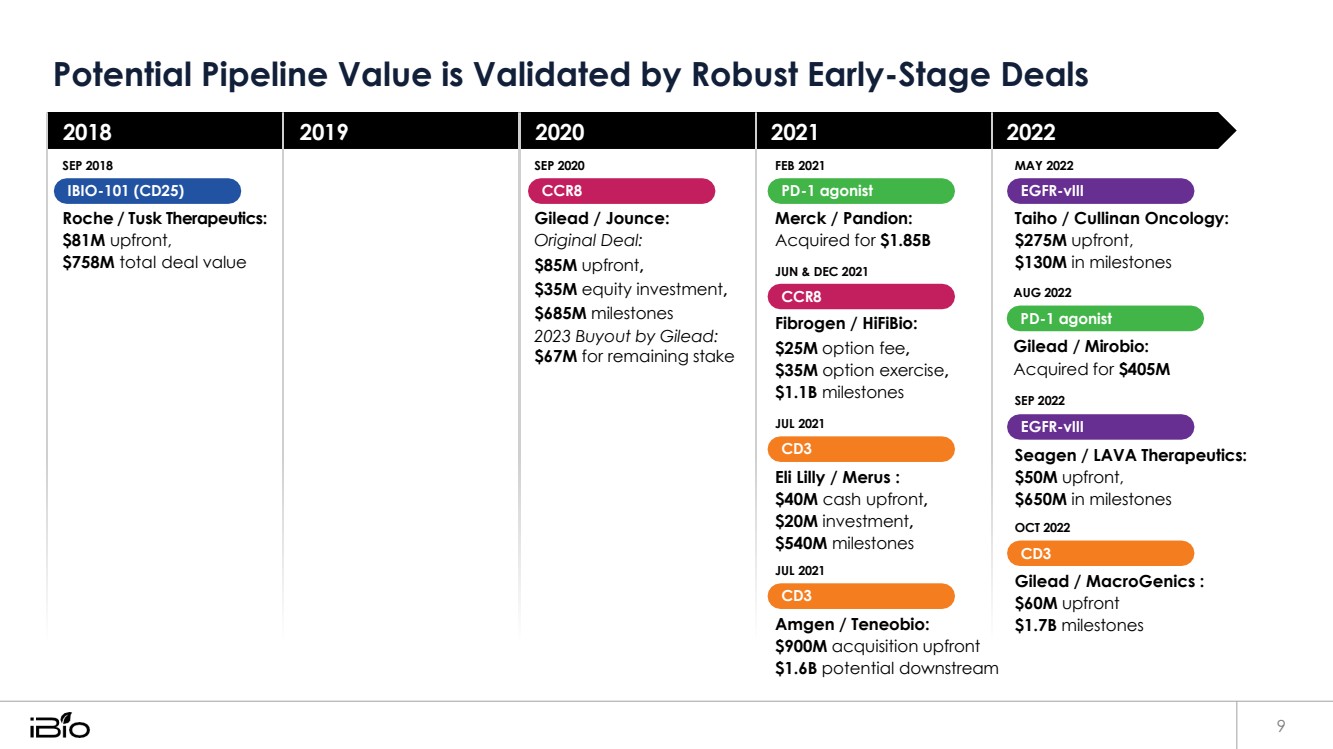

| Potential Pipeline Value is Validated by Robust Early-Stage Deals 9 2018 SEP 2018 IBIO-101 (CD25) Roche / Tusk Therapeutics: $81M upfront, $758M total deal value 2019 2020 SEP 2020 CCR8 Gilead / Jounce: Original Deal: $85M upfront, $35M equity investment, $685M milestones 2023 Buyout by Gilead: $67M for remaining stake 2021 FEB 2021 PD-1 agonist Merck / Pandion: Acquired for $1.85B JUN & DEC 2021 CCR8 Fibrogen / HiFiBio: $25M option fee, $35M option exercise, $1.1B milestones JUL 2021 CD3 Eli Lilly / Merus : $40M cash upfront, $20M investment, $540M milestones JUL 2021 CD3 Amgen / Teneobio: $900M acquisition upfront $1.6B potential downstream 2022 MAY 2022 EGFR-vIII Taiho / Cullinan Oncology: $275M upfront, $130M in milestones AUG 2022 PD-1 agonist Gilead / Mirobio: Acquired for $405M SEP 2022 EGFR-vIII Seagen / LAVA Therapeutics: $50M upfront, $650M in milestones OCT 2022 CD3 Gilead / MacroGenics : $60M upfront $1.7B milestones |

| IBIO-101 IL-2 Sparing Anti-CD25 10 |

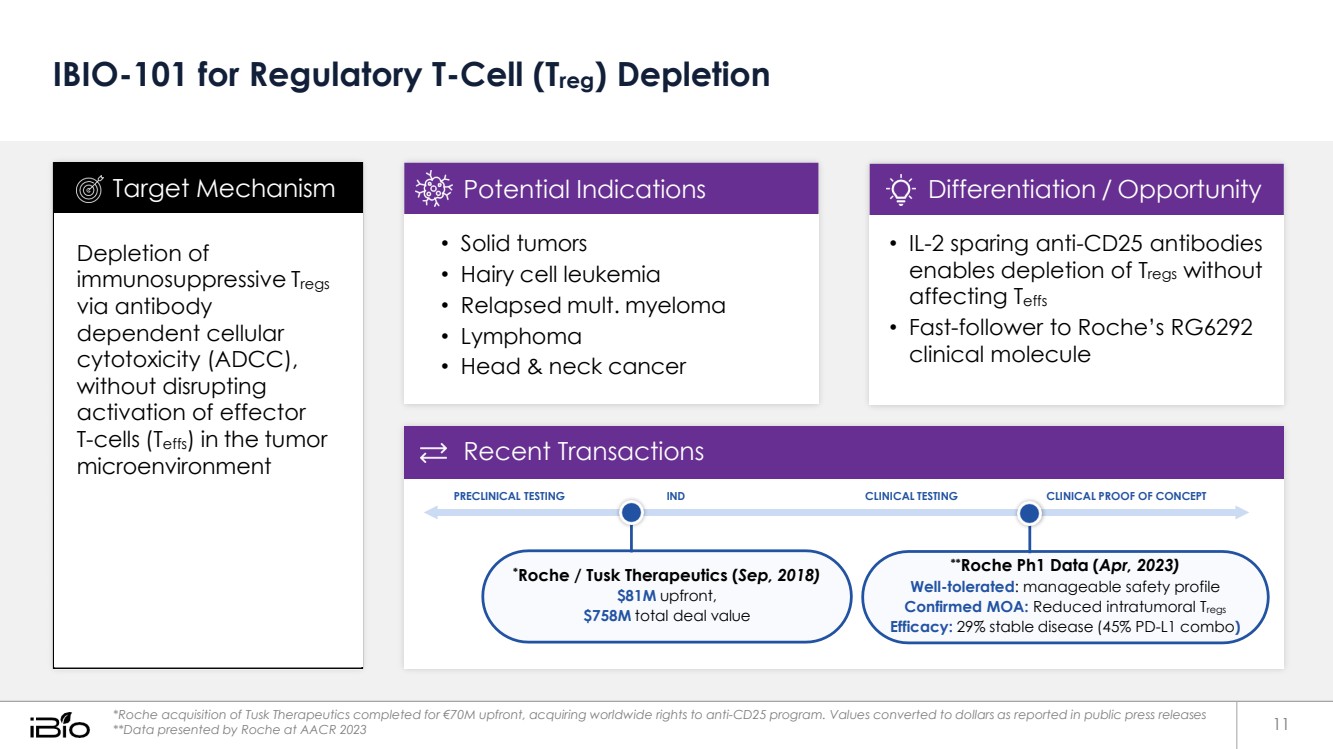

| IBIO-101 for Regulatory T-Cell (Treg) Depletion Recent Transactions PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT *Roche / Tusk Therapeutics (Sep, 2018) $81M upfront, $758M total deal value **Roche Ph1 Data (Apr, 2023) Well-tolerated: manageable safety profile Confirmed MOA: Reduced intratumoral Tregs Efficacy: 29% stable disease (45% PD-L1 combo) *Roche acquisition of Tusk Therapeutics completed for €70M upfront, acquiring worldwide rights to anti-CD25 program. Values converted to dollars as reported in public press releases **Data presented by Roche at AACR 2023 • IL-2 sparing anti-CD25 antibodies enables depletion of Tregs without affecting Teffs • Fast-follower to Roche’s RG6292 clinical molecule Differentiation / Opportunity • Solid tumors • Hairy cell leukemia • Relapsed mult. myeloma • Lymphoma • Head & neck cancer Potential Indications Depletion of immunosuppressive Tregs via antibody dependent cellular cytotoxicity (ADCC), without disrupting activation of effector T-cells (Teffs) in the tumor microenvironment Target Mechanism 11 |

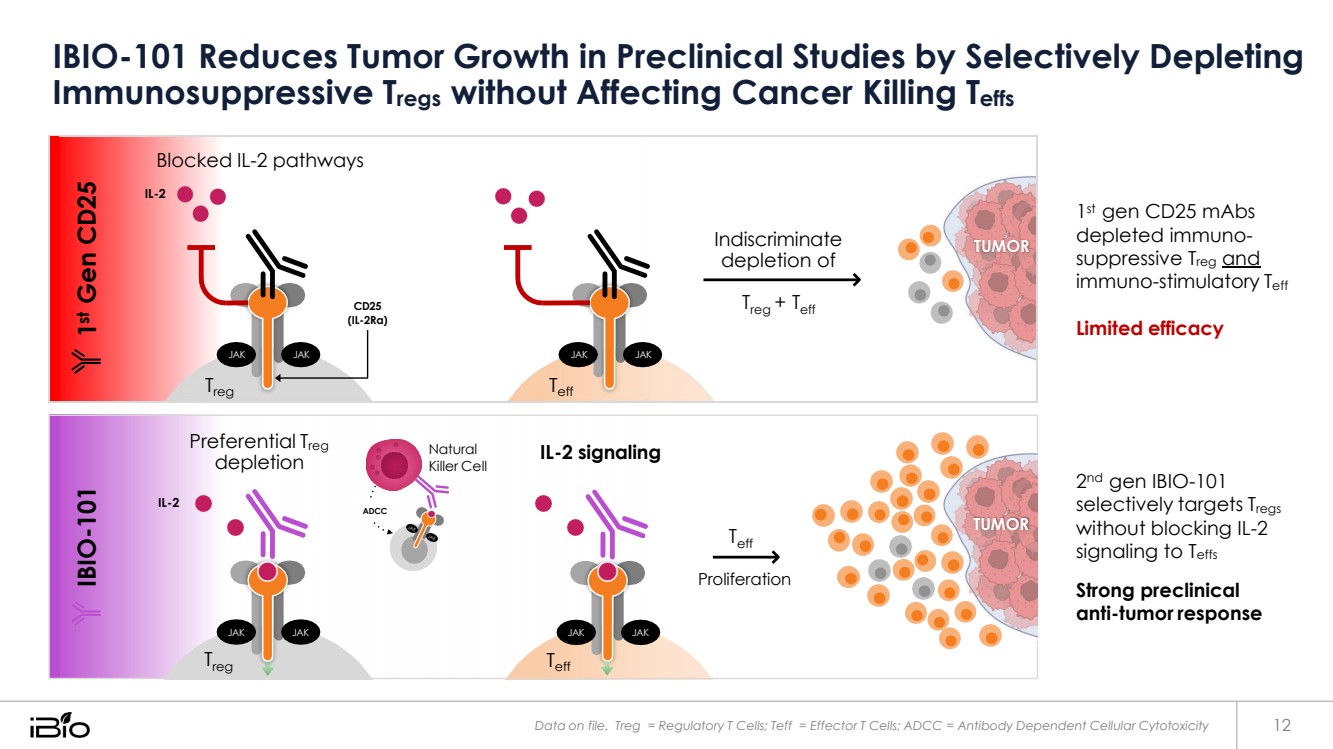

| IBIO-101 Reduces Tumor Growth in Preclinical Studies by Selectively Depleting 1st Gen CD25 Immunosuppressive Tregs without Affecting Cancer Killing Teffs Blocked IL-2 pathways IL-2 CD25 (IL-2Rα) JAK JAK Treg JAK Teff JAK Indiscriminate depletion of Treg + Teff TUMOR 1 st gen CD25 mAbs depleted immuno-suppressive Treg and immuno-stimulatory Teff Limited efficacy 2 nd gen IBIO-101 selectively targets Tregs without blocking IL-2 signaling to Teffs Strong preclinical anti-tumor response Data on file. Treg = Regulatory T Cells; Teff = Effector T Cells; ADCC = Antibody Dependent Cellular Cytotoxicity 12 Teff Treg JAK JAK JAK JAK Proliferation eff TUMOR T ADCC IL-2 Natural IL-2 signaling Killer Cell Preferential Treg depletion IBIO-101 |

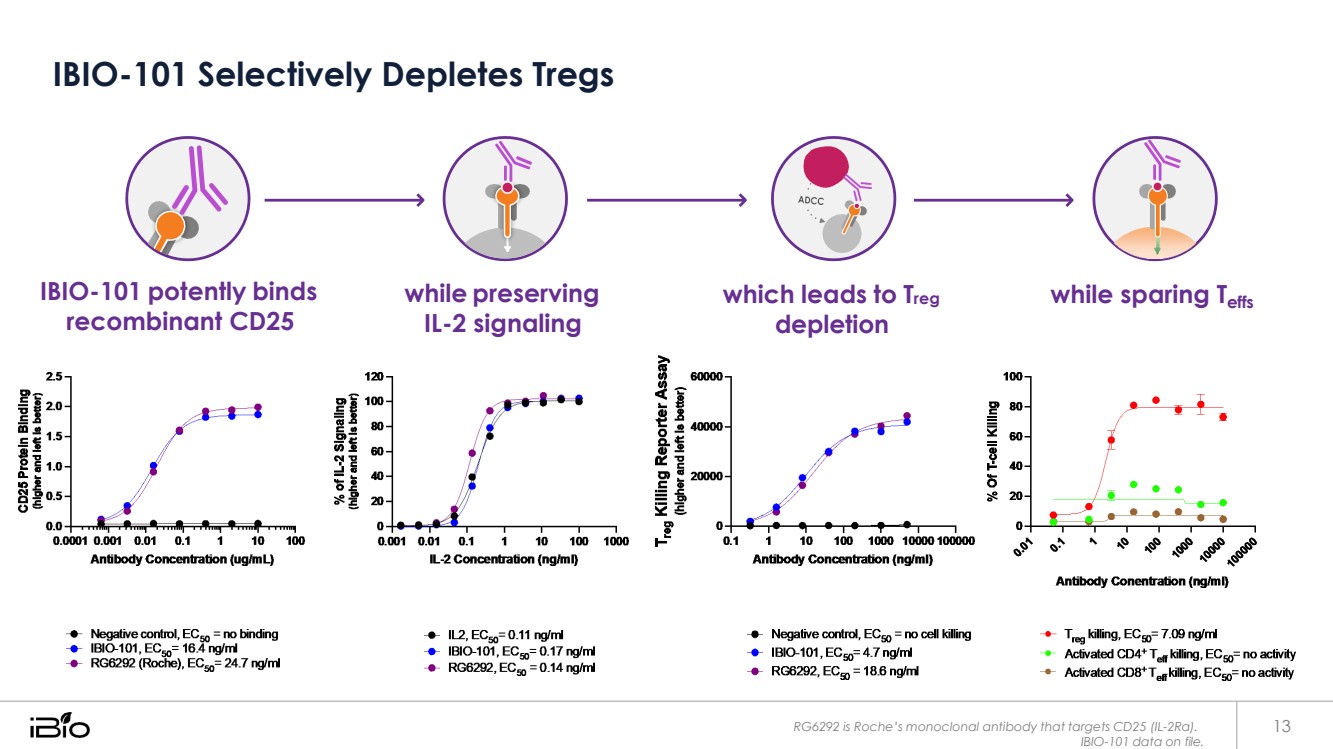

| IBIO-101 Selectively Depletes Tregs IBIO-101 potently binds recombinant CD25 while preserving IL-2 signaling which leads to Treg depletion while sparing Teffs RG6292 is Roche’s monoclonal antibody that targets CD25 (IL-2Rα). 13 IBIO-101 data on file. |

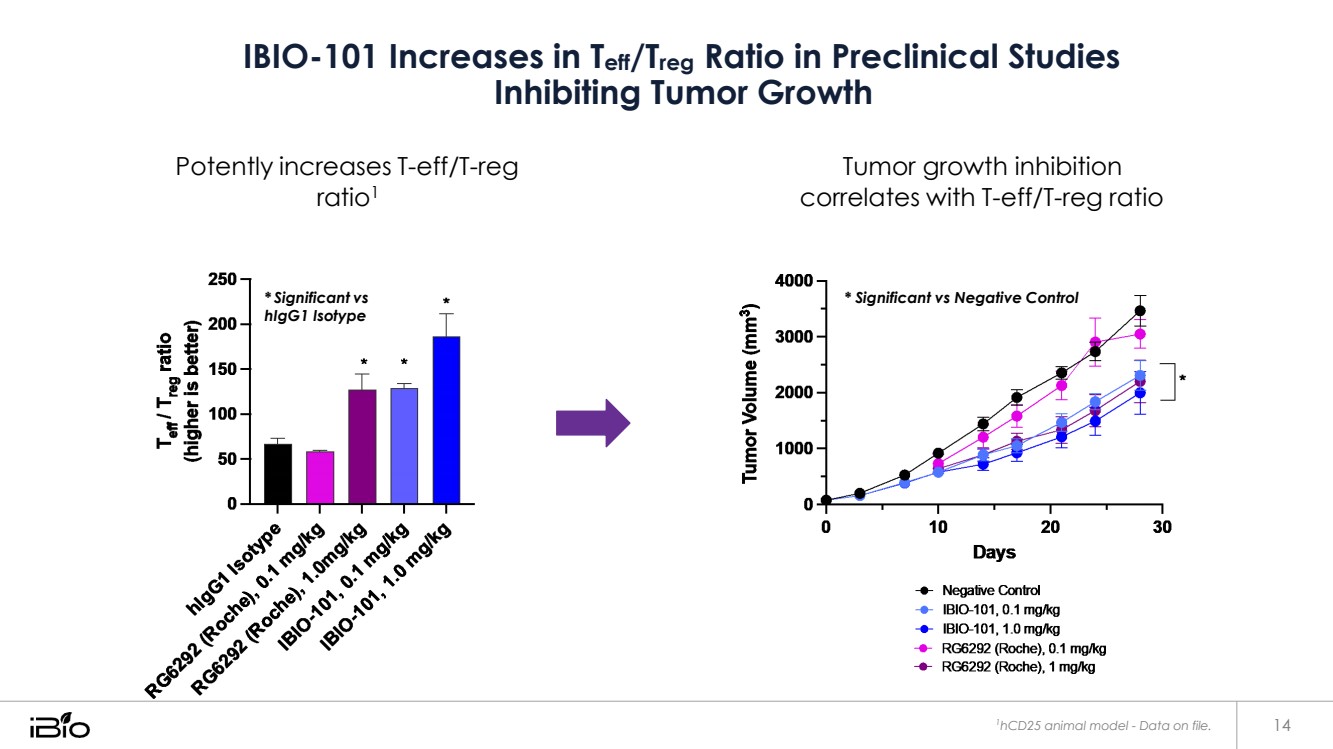

| IBIO-101 Increases in Teff/Treg Ratio in Preclinical Studies Inhibiting Tumor Growth Potently increases T-eff/T-reg ratio1 Tumor growth inhibition correlates with T-eff/T-reg ratio * Significant vs hIgG1 Isotype 1hCD25 animal model - Data on file. 14 * Significant vs Negative Control |

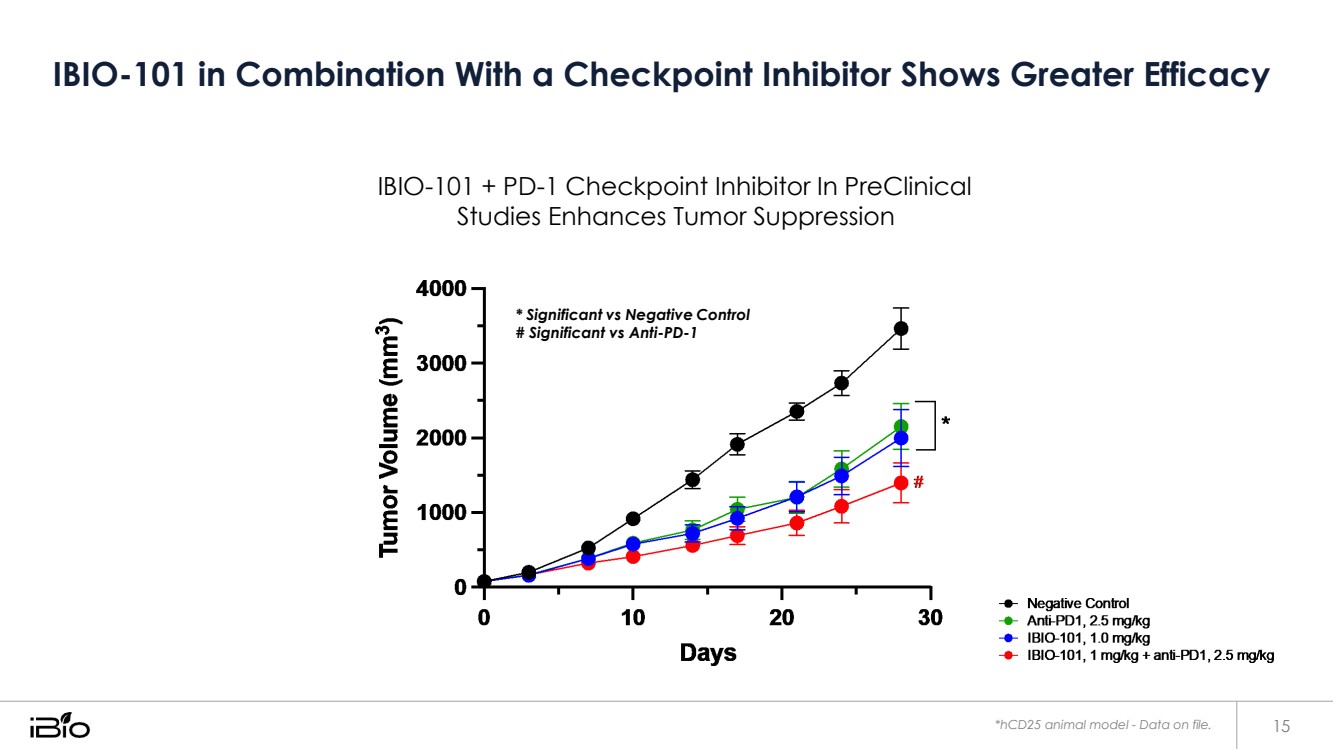

| IBIO-101 in Combination With a Checkpoint Inhibitor Shows Greater Efficacy *hCD25 animal model - Data on file. 15 * Significant vs Negative Control # Significant vs Anti-PD-1 IBIO-101 + PD-1 Checkpoint Inhibitor In PreClinical Studies Enhances Tumor Suppression |

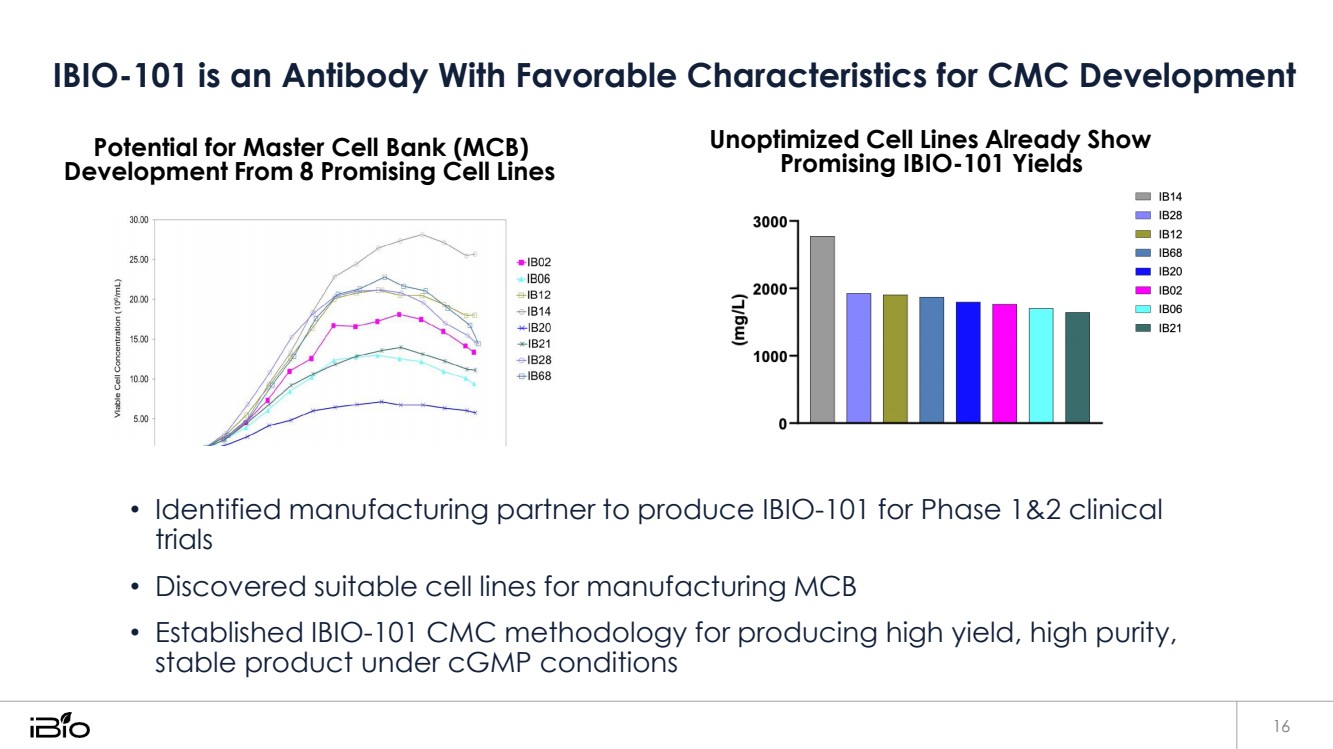

| IBIO-101 is an Antibody With Favorable Characteristics for CMC Development 16 Potential for Master Cell Bank (MCB) Development From 8 Promising Cell Lines Unoptimized Cell Lines Already Show Promising IBIO-101 Yields • Identified manufacturing partner to produce IBIO-101 for Phase 1&2 clinical trials • Discovered suitable cell lines for manufacturing MCB • Established IBIO-101 CMC methodology for producing high yield, high purity, stable product under cGMP conditions |

| Anti-CCR8 High ADCC Anti-CCR8 for the Depletion of T-regulatory Cells 17 |

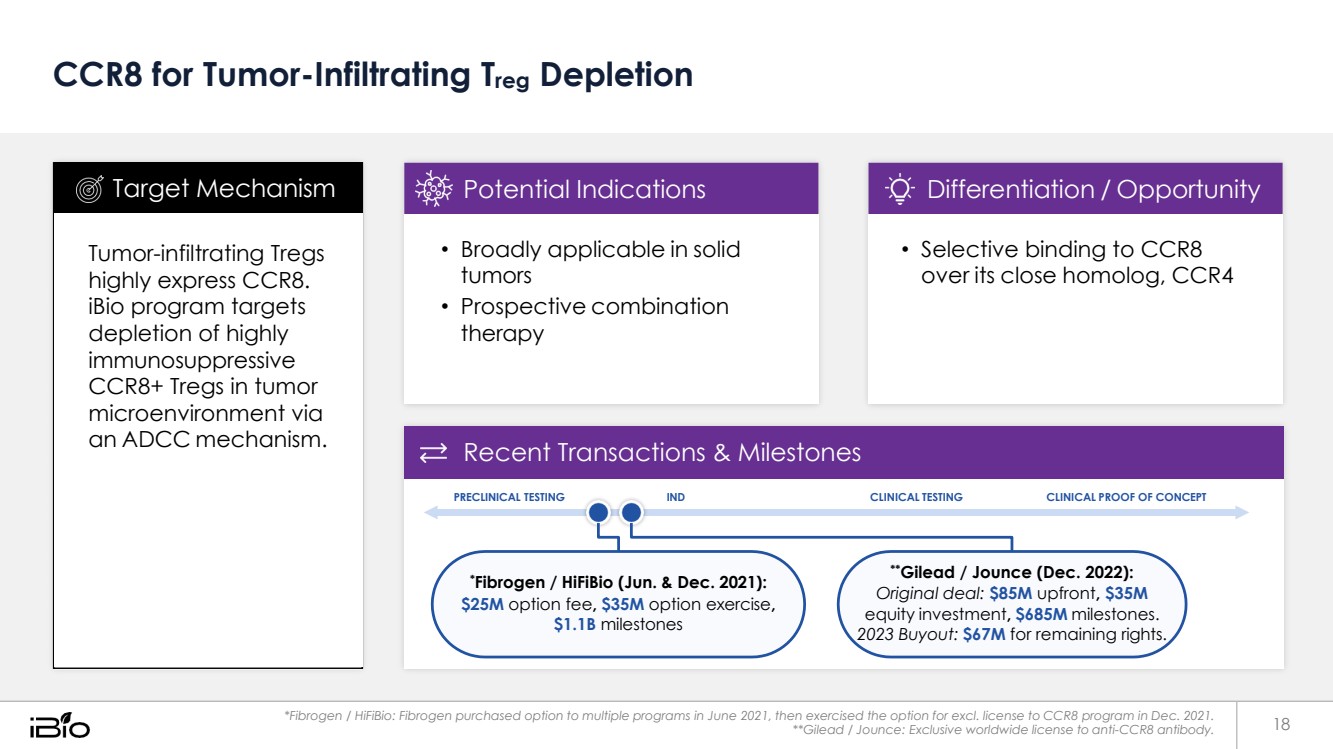

| CCR8 for Tumor-Infiltrating Treg Depletion Recent Transactions & Milestones PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT *Fibrogen / HiFiBio (Jun. & Dec. 2021): $25M option fee, $35M option exercise, $1.1B milestones **Gilead / Jounce (Dec. 2022): Original deal: $85M upfront, $35M equity investment, $685M milestones. 2023 Buyout: $67M for remaining rights. *Fibrogen / HiFiBio: Fibrogen purchased option to multiple programs in June 2021, then exercised the option for excl. license to CCR8 program in Dec. 2021. **Gilead / Jounce: Exclusive worldwide license to anti-CCR8 antibody. • Selective binding to CCR8 over its close homolog, CCR4 Differentiation / Opportunity • Broadly applicable in solid tumors • Prospective combination therapy Potential Indications Tumor-infiltrating Tregs highly express CCR8. iBio program targets depletion of highly immunosuppressive CCR8+ Tregs in tumor microenvironment via an ADCC mechanism. Target Mechanism 18 |

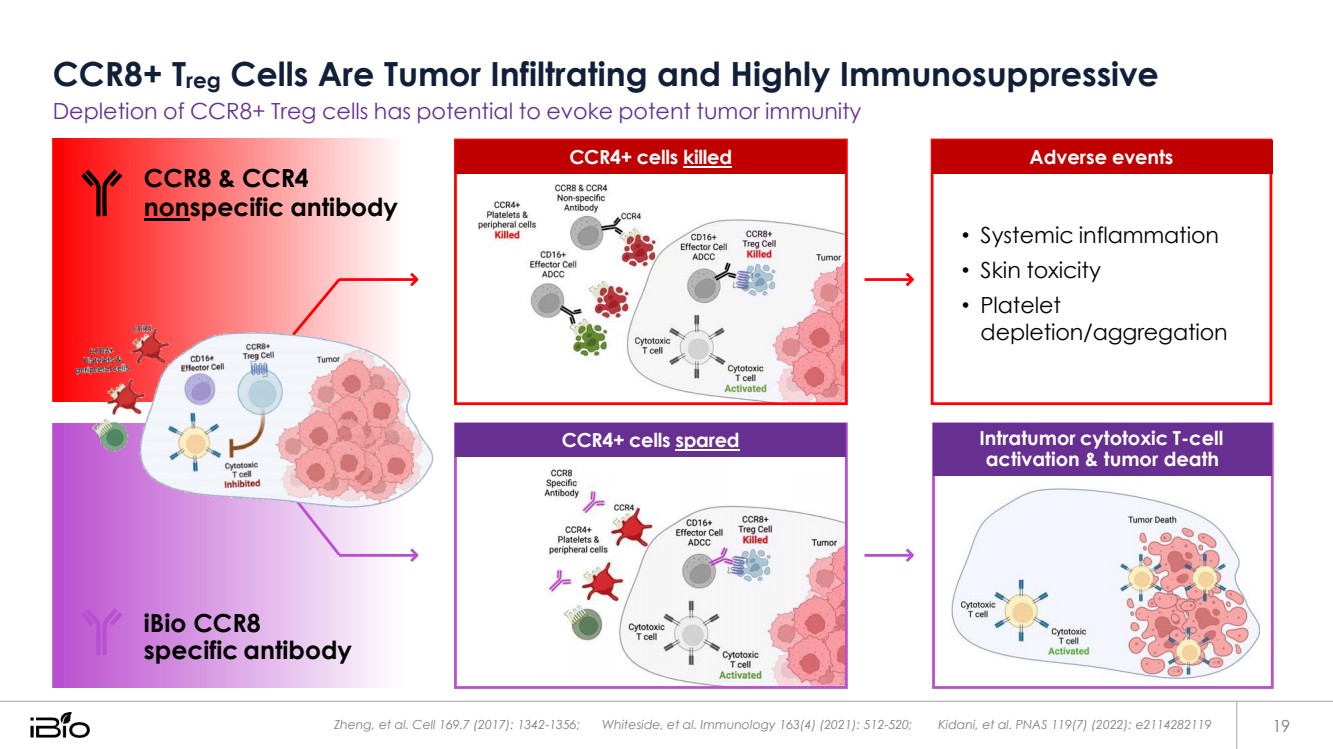

| CCR8+ Treg Cells Are Tumor Infiltrating and Highly Immunosuppressive Depletion of CCR8+ Treg cells has potential to evoke potent tumor immunity Zheng, et al. Cell 169.7 (2017): 1342-1356; Whiteside, et al. Immunology 163(4) (2021): 512-520; Kidani, et al. PNAS 119(7) (2022): e2114282119 19 CCR4+ cells spared Intratumor cytotoxic T-cell activation & tumor death CCR8 & CCR4 nonspecific antibody iBio CCR8 specific antibody • Systemic inflammation • Skin toxicity • Platelet depletion/aggregation CCR4+ cells killed Adverse events |

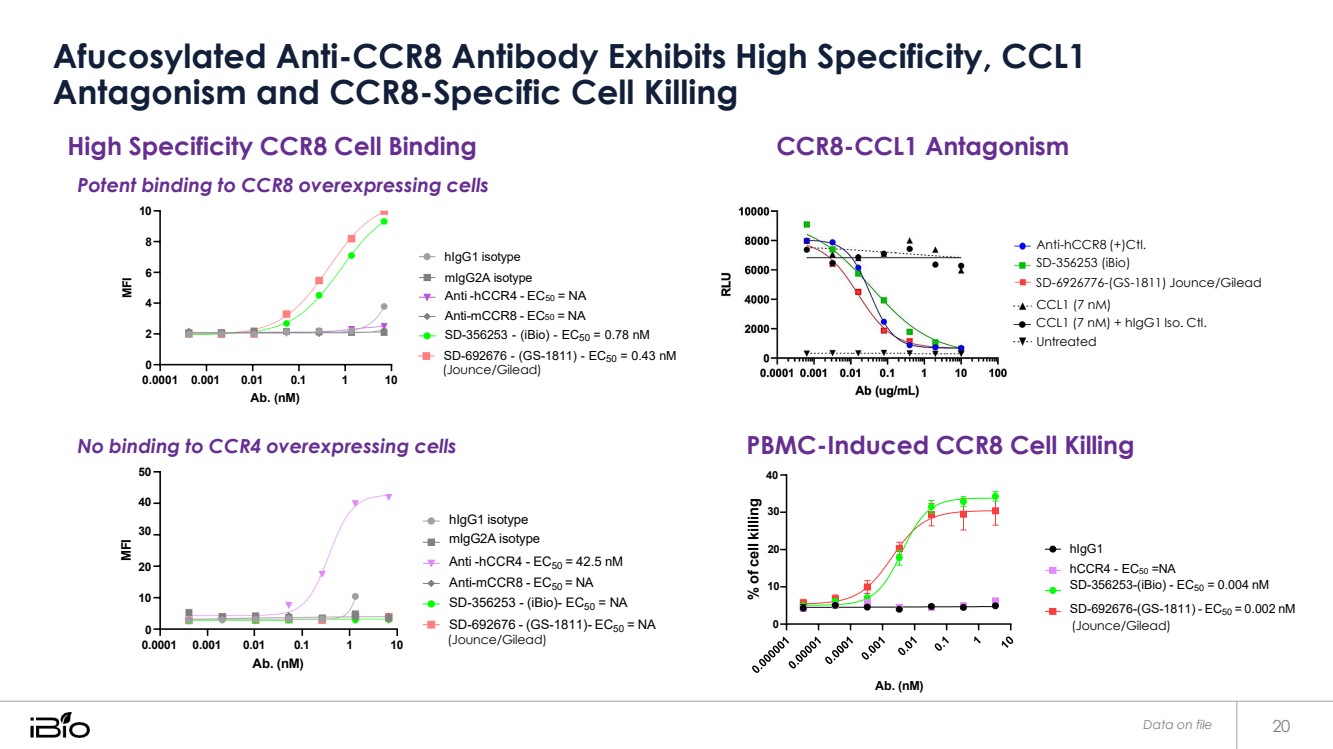

| Afucosylated Anti-CCR8 Antibody Exhibits High Specificity, CCL1 Antagonism and CCR8-Specific Cell Killing Data on file 20 CCR8 overexpressed cell hCCR8 overexpressed cells hCCR4 overexpressed cells % of cell killing High Specificity CCR8 Cell Binding Potent binding to CCR8 overexpressing cells 10 8 hIgG1 isotype CCR8-CCL1 Antagonism Anti-hCCR8 (+)Ctl. SD-356253 (iBio) 6 4 2 0 0.0001 0.001 0.01 0.1 1 10 Ab. (nM) mIgG2A isotype Anti -hCCR4 - EC50 = NA Anti-mCCR8 - EC50 = NA SD-356253 - (iBio) - EC50 = 0.78 nM SD-692676 - (GS-1811) - EC50 = 0.43 nM (Jounce/Gilead) SD-6926776-(GS-1811) Jounce/Gilead CCL1 (7 nM) CCL1 (7 nM) + hIgG1 Iso. Ctl. Untreated No binding to CCR4 overexpressing cells 50 PBMC-Induced CCR8 Cell Killing 40 40 hIgG1 isotype 30 30 mIgG2A isotype 20 20 Anti -hCCR4 - EC50 = 42.5 nM Anti-mCCR8 - EC50 = NA 10 hIgG1 hCCR4 - EC50 =NA SD-356253-(iBio) - EC50 = 0.004 nM 10 SD-356253 - (iBio)- EC50 = NA SD-692676-(GS-1811) - EC50 = 0.002 nM 0 0.0001 0.001 0.01 0.1 1 10 Ab. (nM) SD-692676 - (GS-1811)- EC50 = NA (Jounce/Gilead) 0 Ab. (nM) (Jounce/Gilead) MFI MFI |

| Unlocking the Power of Bi-Specific Antibodies with Our Versatile CD3 mAb Panel Wide Range of Affinities, Non-Human Primate (NHP) Cross Reactivity, High Developability 21 |

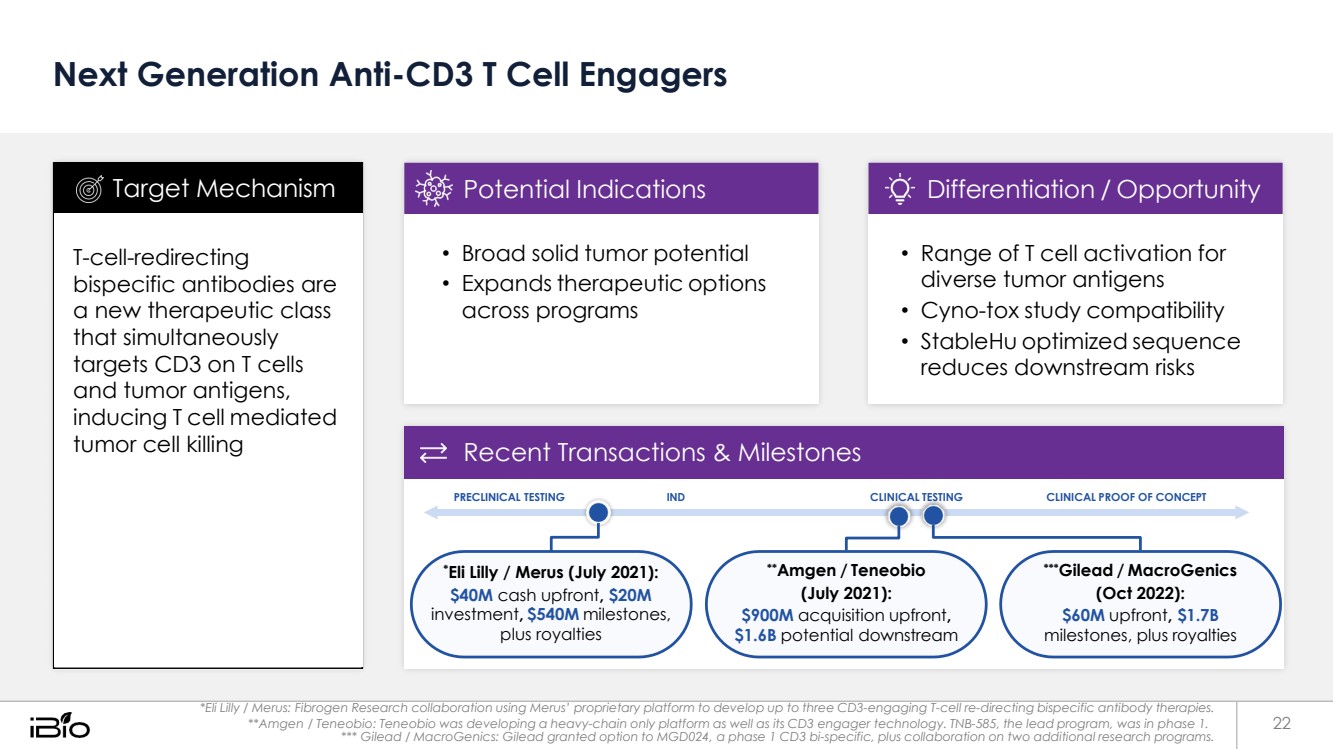

| Next Generation Anti-CD3 T Cell Engagers Recent Transactions & Milestones PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT *Eli Lilly / Merus (July 2021): $40M cash upfront, $20M investment, $540M milestones, plus royalties **Amgen / Teneobio (July 2021): $900M acquisition upfront, $1.6B potential downstream ***Gilead / MacroGenics (Oct 2022): $60M upfront, $1.7B milestones, plus royalties *Eli Lilly / Merus: Fibrogen Research collaboration using Merus’ proprietary platform to develop up to three CD3-engaging T-cell re-directing bispecific antibody therapies. **Amgen / Teneobio: Teneobio was developing a heavy-chain only platform as well as its CD3 engager technology. TNB-585, the lead program, was in phase 1. 22 *** Gilead / MacroGenics: Gilead granted option to MGD024, a phase 1 CD3 bi-specific, plus collaboration on two additional research programs. • Range of T cell activation for diverse tumor antigens • Cyno-tox study compatibility • StableHu optimized sequence reduces downstream risks Differentiation / Opportunity • Broad solid tumor potential • Expands therapeutic options across programs Potential Indications T-cell-redirecting bispecific antibodies are a new therapeutic class that simultaneously targets CD3 on T cells and tumor antigens, inducing T cell mediated tumor cell killing Target Mechanism |

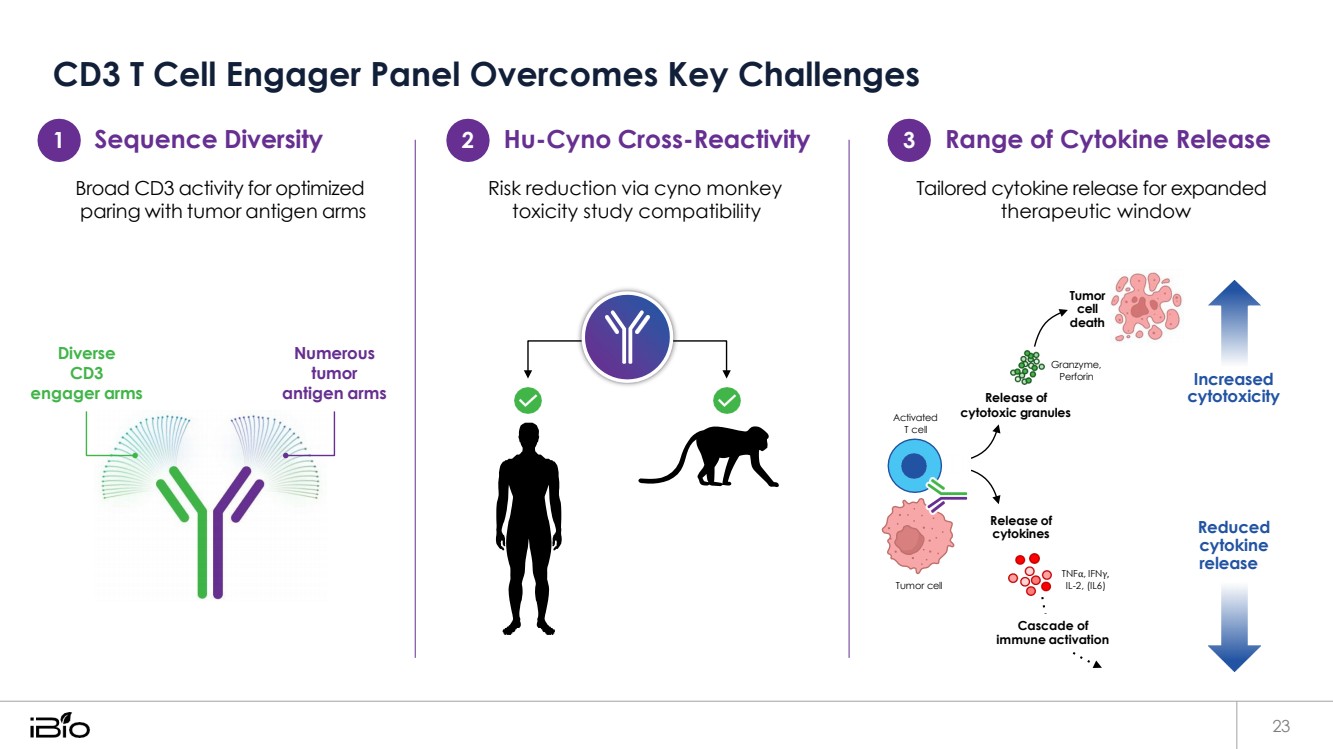

| CD3 T Cell Engager Panel Overcomes Key Challenges 23 Sequence Diversity 2 Hu-Cyno Cross-Reactivity 3 Range of Cytokine Release Broad CD3 activity for optimized paring with tumor antigen arms Risk reduction via cyno monkey toxicity study compatibility Tailored cytokine release for expanded therapeutic window Diverse CD3 engager arms Numerous tumor antigen arms Release of Tumor cell death Granzyme, Perforin Increased cytotoxicity Activated T cell cytotoxic granules Tumor cell Release of cytokines Reduced cytokine release 1 TNFα, IFNγ, IL-2, (IL6) Cascade of immune activation |

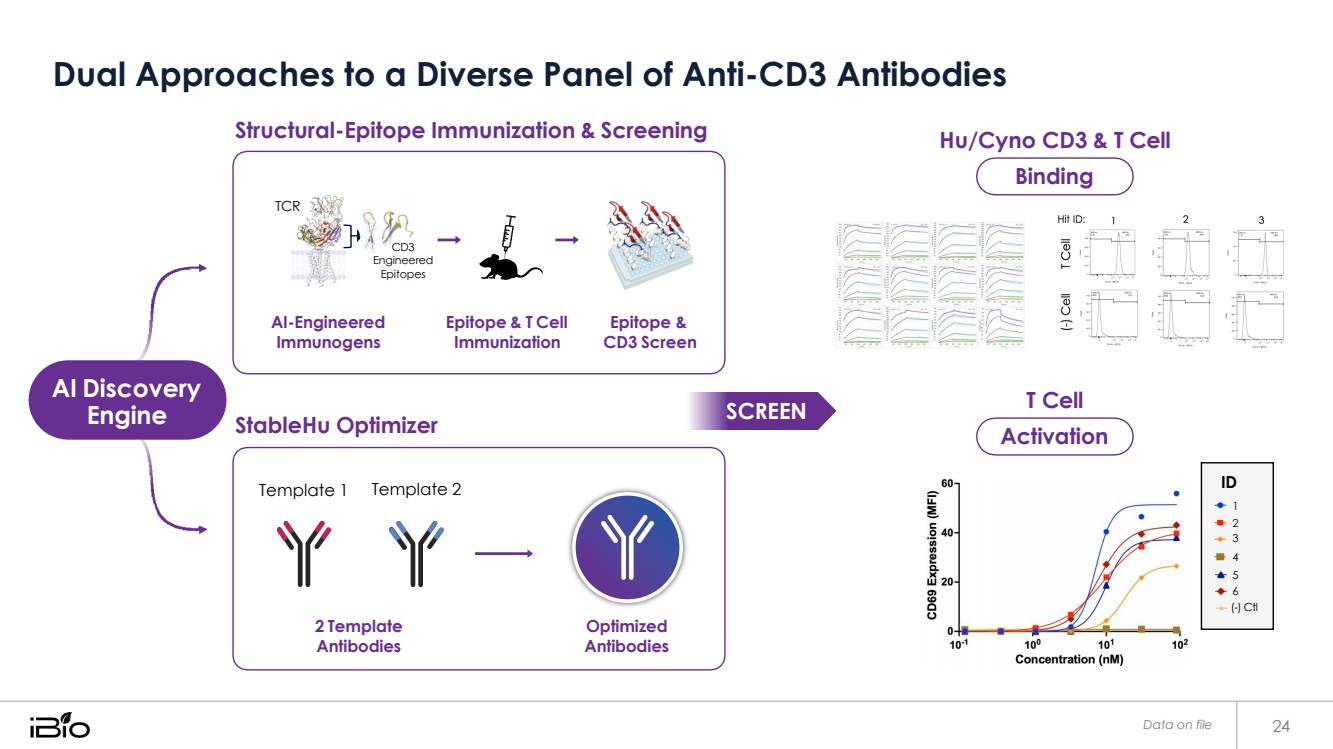

| Dual Approaches to a Diverse Panel of Anti-CD3 Antibodies Data on file 24 Activation Binding Structural-Epitope Immunization & Screening StableHu Optimizer Hu/Cyno CD3 & T Cell T Cell ID 1 2 3 4 5 6 (-) Ctl Template 1 Template 2 2 Template Antibodies Optimized Antibodies TCR CD3 Engineered Epitopes AI-Engineered Immunogens Epitope & T Cell Immunization Epitope & CD3 Screen AI Discovery Engine SCREEN |

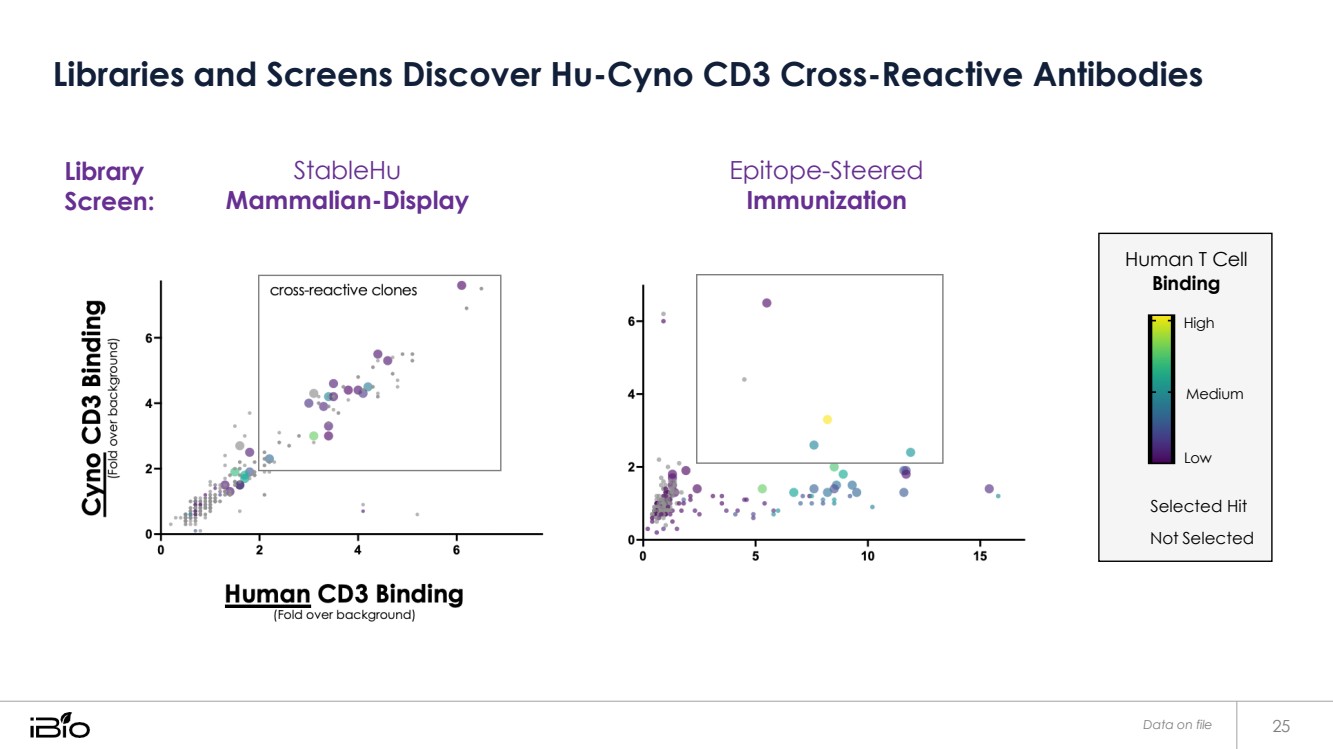

| Libraries and Screens Discover Hu-Cyno CD3 Cross-Reactive Antibodies Data on file 25 Library Screen: StableHu Mammalian-Display Epitope-Steered Immunization Human T Cell Binding High Medium Low Selected Hit Not Selected |

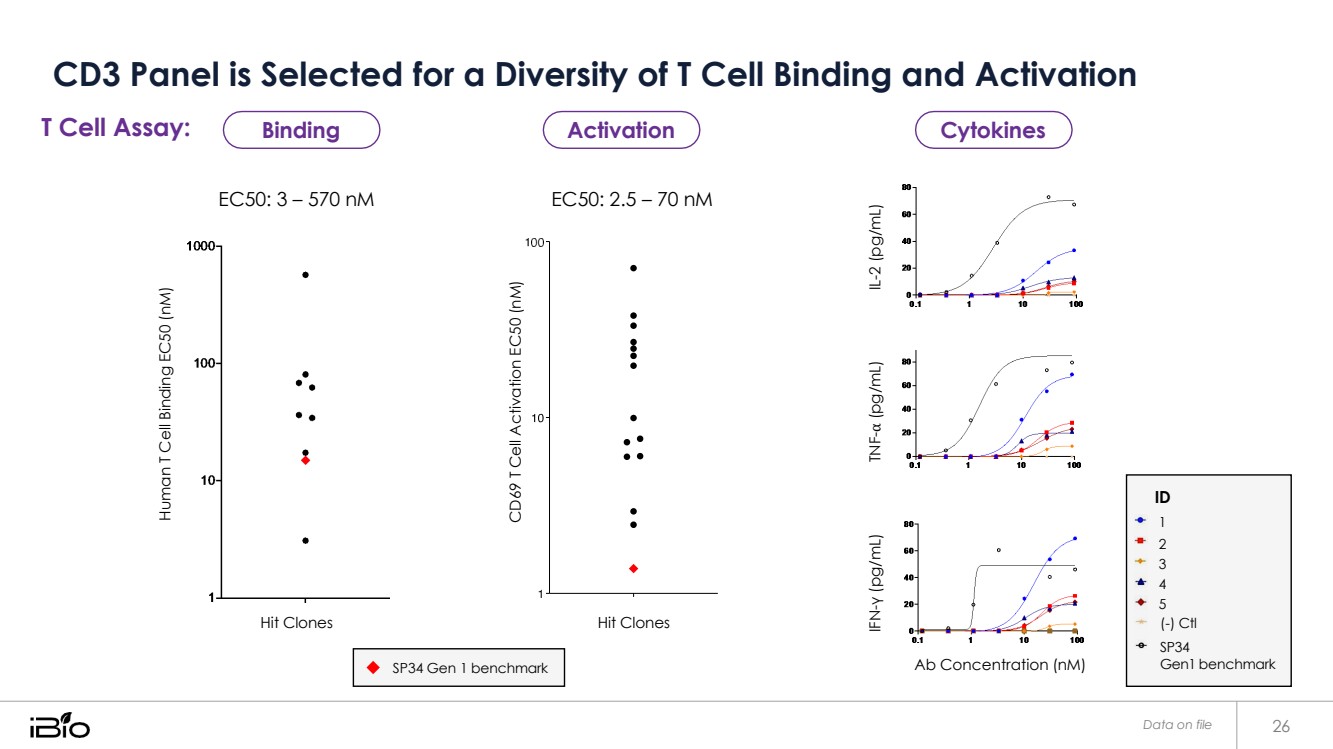

| CD3 Panel is Selected for a Diversity of T Cell Binding and Activation Data on file 26 T Cell Assay: EC50: 3 – 570 nM EC50: 2.5 – 70 nM Hit Clones Hit Clones Ab Concentration (nM) ID 1 2 3 4 5 (-) Ctl SP34 Gen1 benchmark SP34 Gen 1 benchmark Binding Activation Cytokines Human T Cell Binding EC50 (nM) CD69 T Cell Activation EC50 (nM) IFN-γ (pg/mL) TNF-⍺ (pg/mL) IL-2 (pg/mL) |

| Anti-EGFRvIII High ADCC mAb Against Tumor-Specific EGFRvIII Cells 27 |

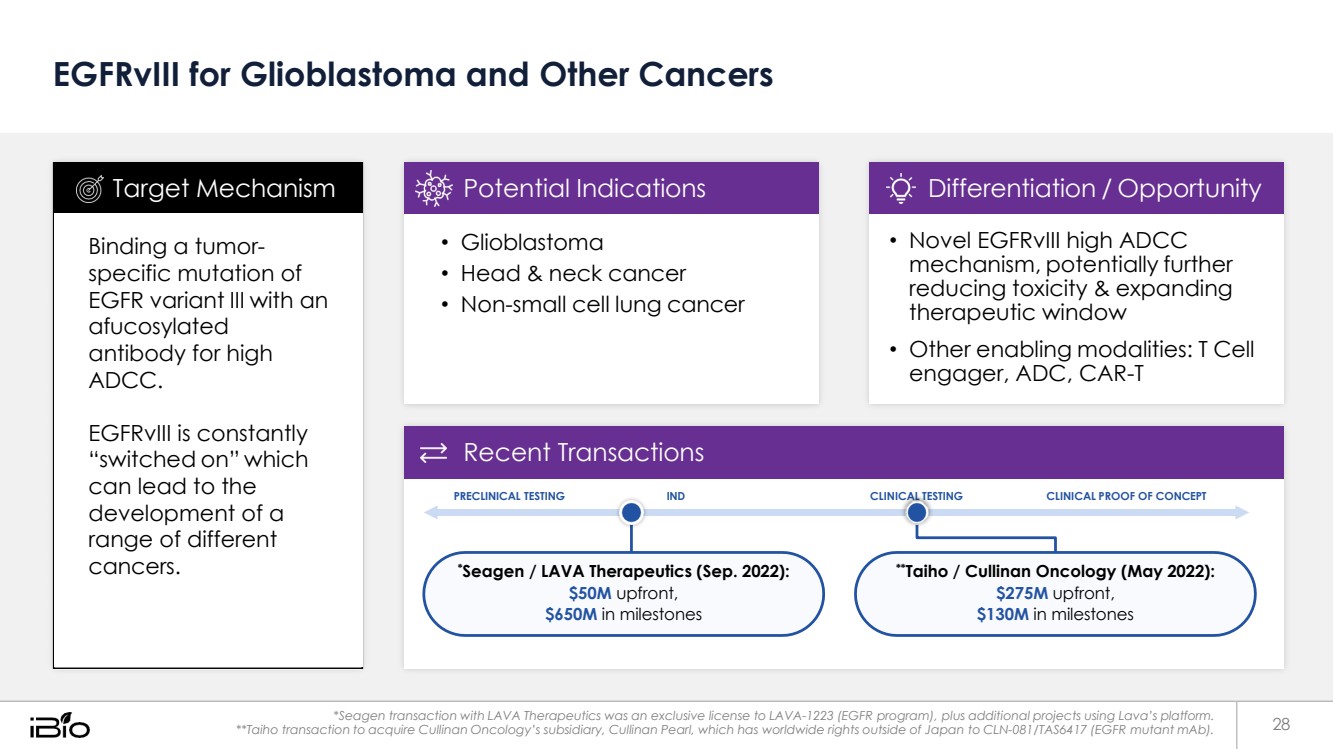

| EGFRvIII for Glioblastoma and Other Cancers Recent Transactions PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT *Seagen / LAVA Therapeutics (Sep. 2022): $50M upfront, $650M in milestones **Taiho / Cullinan Oncology (May 2022): $275M upfront, $130M in milestones *Seagen transaction with LAVA Therapeutics was an exclusive license to LAVA-1223 (EGFR program), plus additional projects using Lava’s platform. **Taiho transaction to acquire Cullinan Oncology’s subsidiary, Cullinan Pearl, which has worldwide rights outside of Japan to CLN-081/TAS6417 (EGFR mutant mAb). • Novel EGFRvIII high ADCC mechanism, potentially further reducing toxicity & expanding therapeutic window • Other enabling modalities: T Cell engager, ADC, CAR-T Differentiation / Opportunity • Glioblastoma • Head & neck cancer • Non-small cell lung cancer Potential Indications Binding a tumor-specific mutation of EGFR variant III with an afucosylated antibody for high ADCC. EGFRvIII is constantly “switched on” which can lead to the development of a range of different cancers. Target Mechanism 28 |

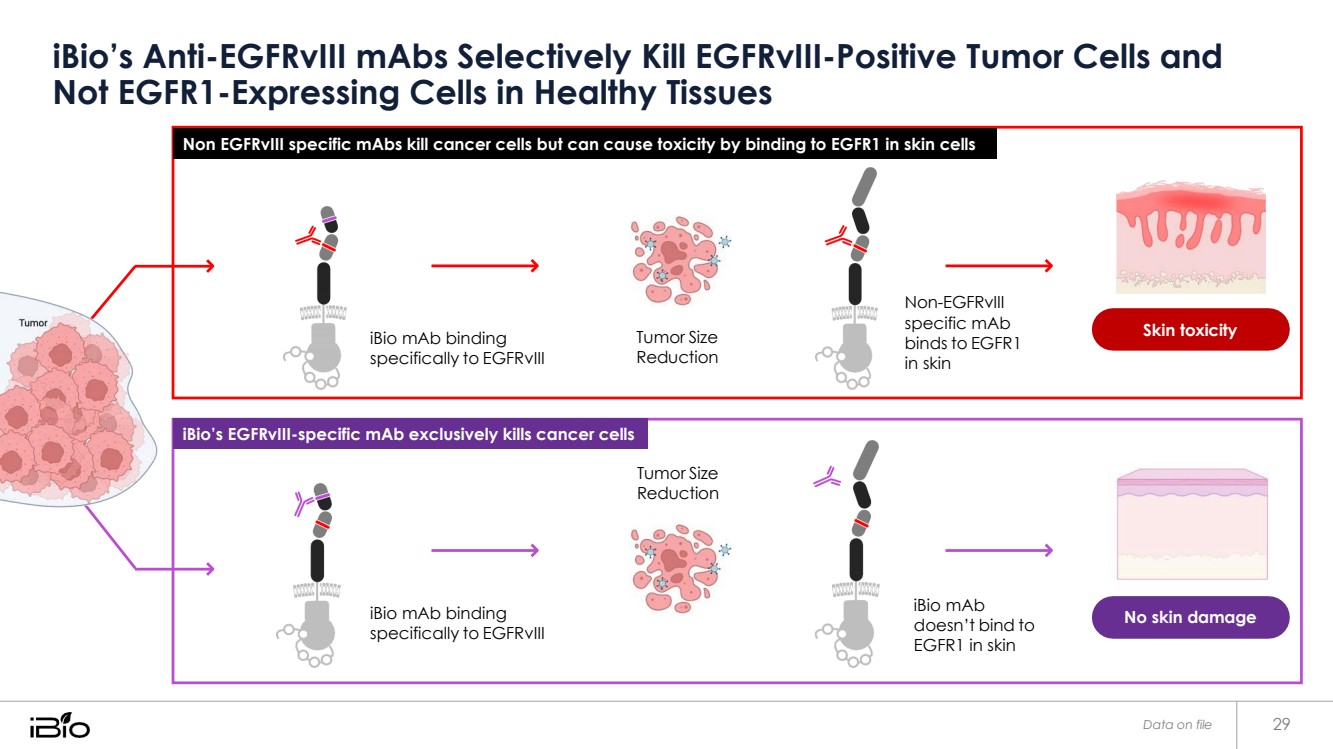

| iBio’s Anti-EGFRvIII mAbs Selectively Kill EGFRvIII-Positive Tumor Cells and Non EGFRvIII specific mAbs kill cancer cells but can cause toxicity by binding to EGFR1 in skin cells Not EGFR1-Expressing Cells in Healthy Tissues iBio mAb binding specifically to EGFRvIII Tumor Size Reduction Non-EGFRvIII specific mAb binds to EGFR1 in skin Skin toxicity Tumor Size Reduction iBio mAb binding specifically to EGFRvIII iBio mAb doesn’t bind to EGFR1 in skin No skin damage Data on file 29 iBio’s EGFRvIII-specific mAb exclusively kills cancer cells |

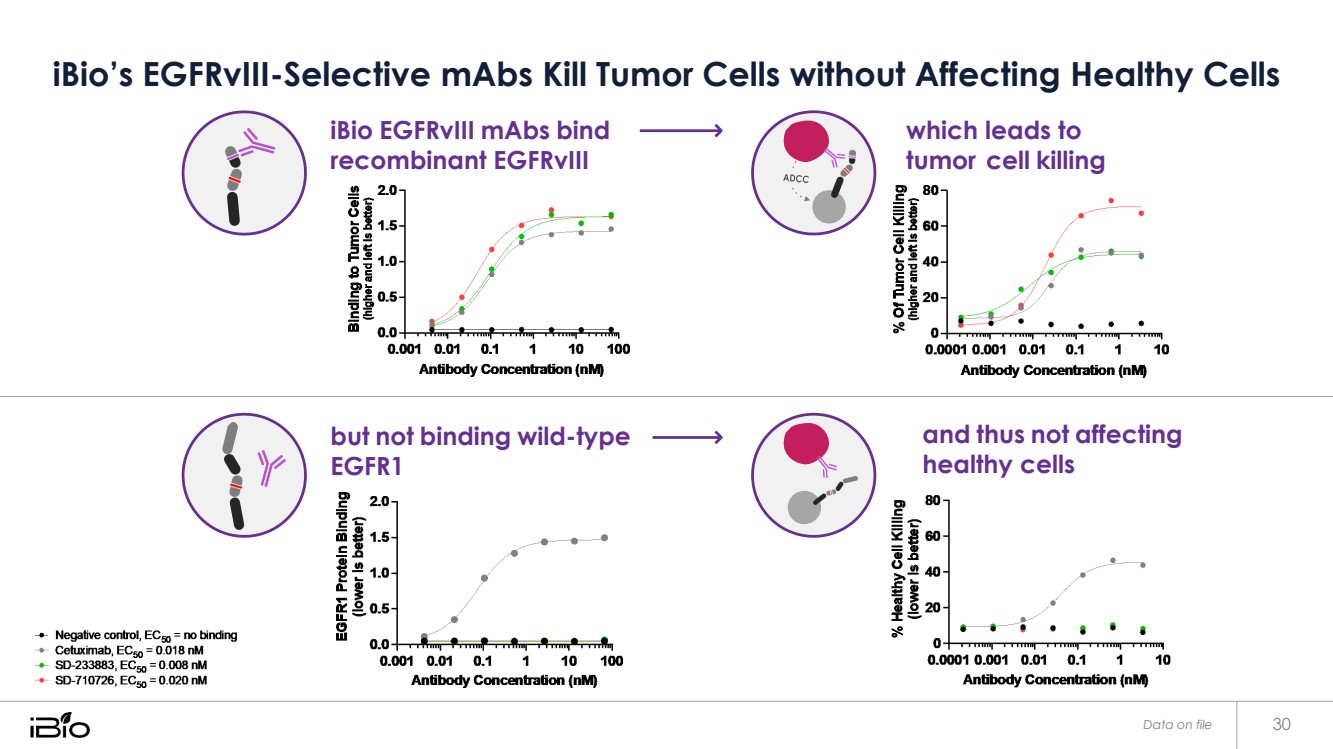

| iBio’s EGFRvIII-Selective mAbs Kill Tumor Cells without Affecting Healthy Cells iBio EGFRvIII mAbs bind recombinant EGFRvIII but not binding wild-type EGFR1 which leads to tumor cell killing and thus not affecting healthy cells Data on file 30 |

| Anti-MUC16 Tumor Associated Epitope Non-Shed Epitope Anti-MUC16 Antibody 31 |

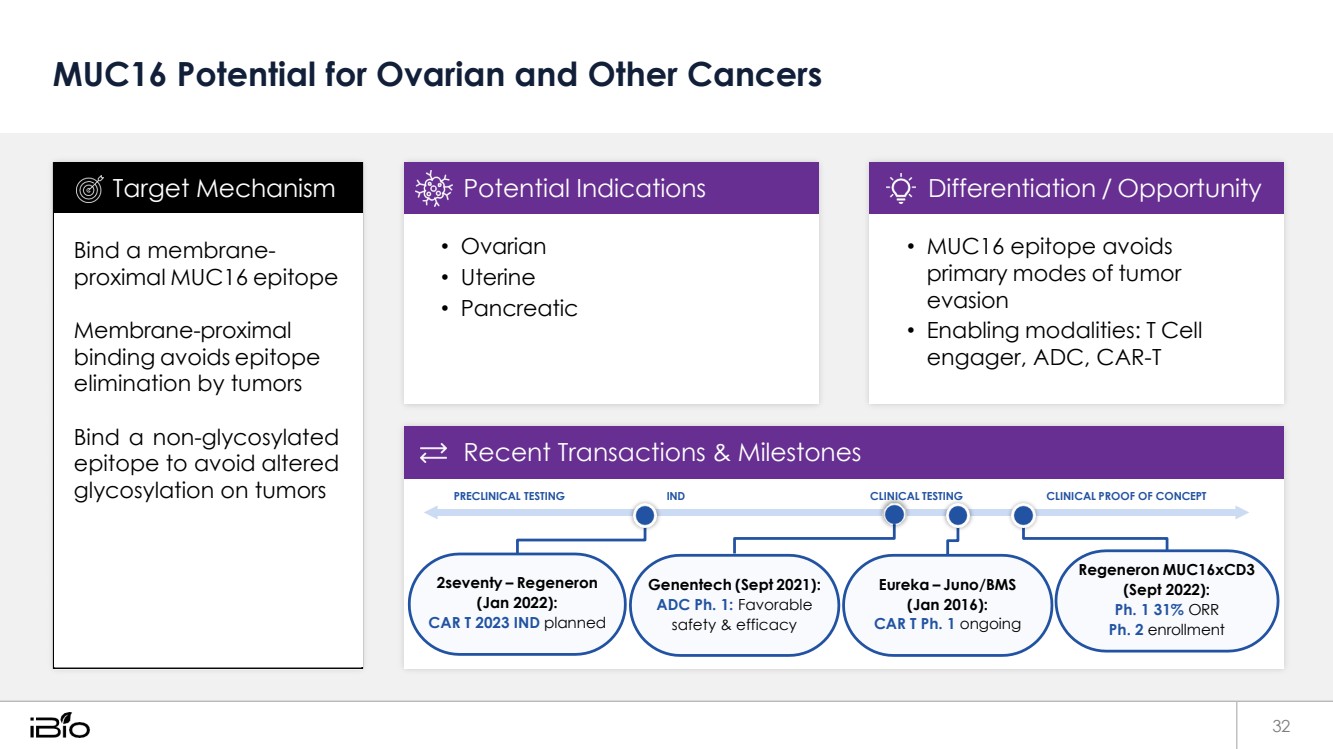

| MUC16 Potential for Ovarian and Other Cancers 32 Recent Transactions & Milestones PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT 2seventy – Regeneron (Jan 2022): CAR T 2023 IND planned Genentech (Sept 2021): ADC Ph. 1: Favorable safety & efficacy Eureka – Juno/BMS (Jan 2016): CAR T Ph. 1 ongoing Regeneron MUC16xCD3 (Sept 2022): Ph. 1 31% ORR Ph. 2 enrollment • MUC16 epitope avoids primary modes of tumor evasion • Enabling modalities: T Cell engager, ADC, CAR-T Differentiation / Opportunity • Ovarian • Uterine • Pancreatic Potential Indications Bind a membrane-proximal MUC16 epitope Membrane-proximal binding avoids epitope elimination by tumors Bind a non-glycosylated epitope to avoid altered glycosylation on tumors Target Mechanism |

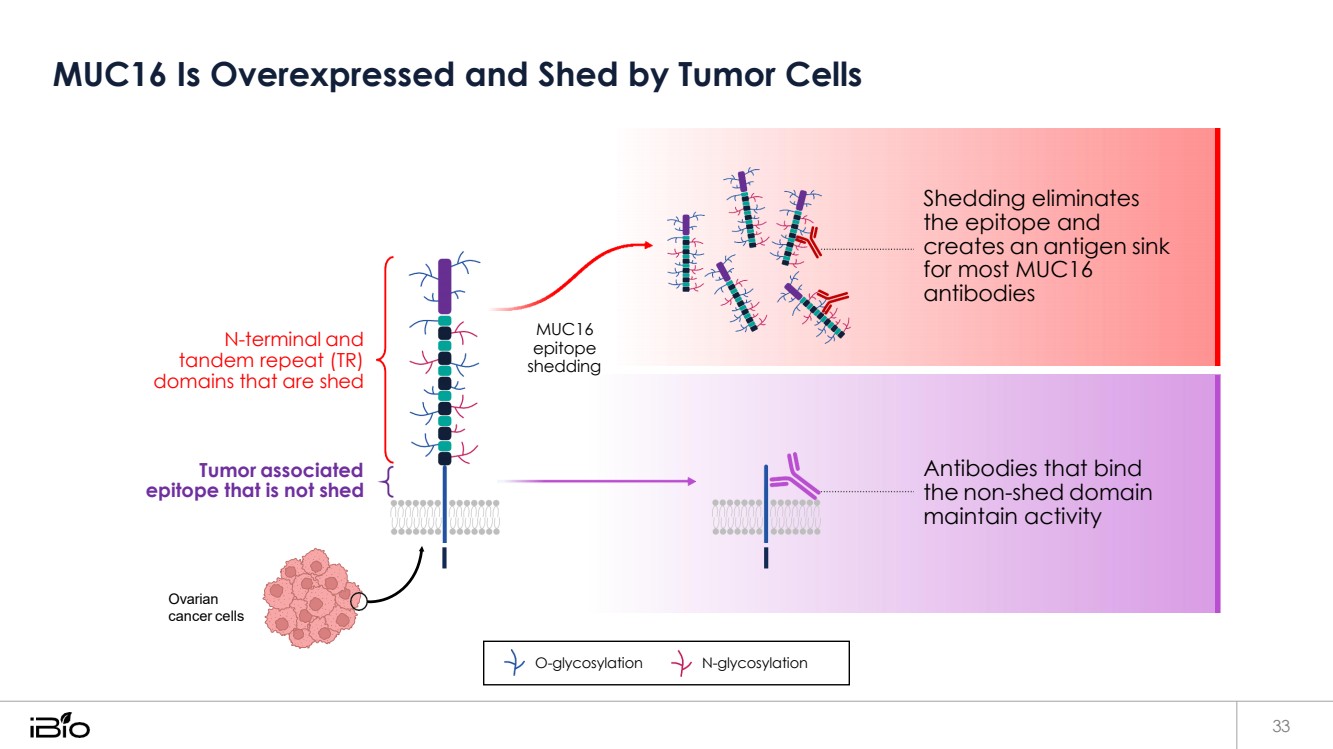

| MUC16 Is Overexpressed and Shed by Tumor Cells 33 O-glycosylation N-glycosylation N-terminal and tandem repeat (TR) domains that are shed Tumor associated epitope that is not shed MUC16 epitope shedding Shedding eliminates the epitope and creates an antigen sink for most MUC16 antibodies Antibodies that bind the non-shed domain maintain activity Ovarian cancer cells |

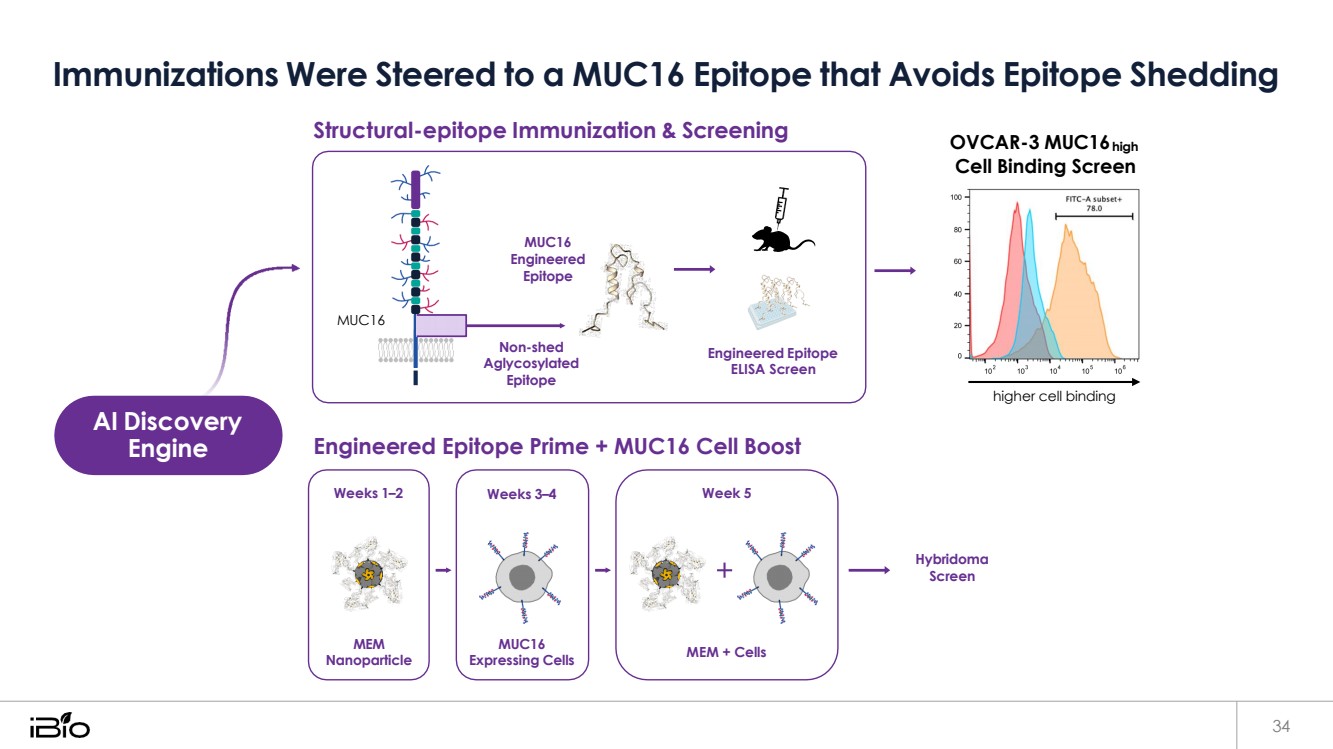

| Immunizations Were Steered to a MUC16 Epitope that Avoids Epitope Shedding 34 Structural-epitope Immunization & Screening OVCAR-3 MUC16high Cell Binding Screen Engineered Epitope Prime + MUC16 Cell Boost higher cell binding Hybridoma Screen Weeks 1–2 MEM Nanoparticle Weeks 3–4 MUC16 Expressing Cells Week 5 MEM + Cells AI Discovery Engine MUC16 Engineered Epitope MUC16 Non-shed Aglycosylated Epitope Engineered Epitope ELISA Screen |

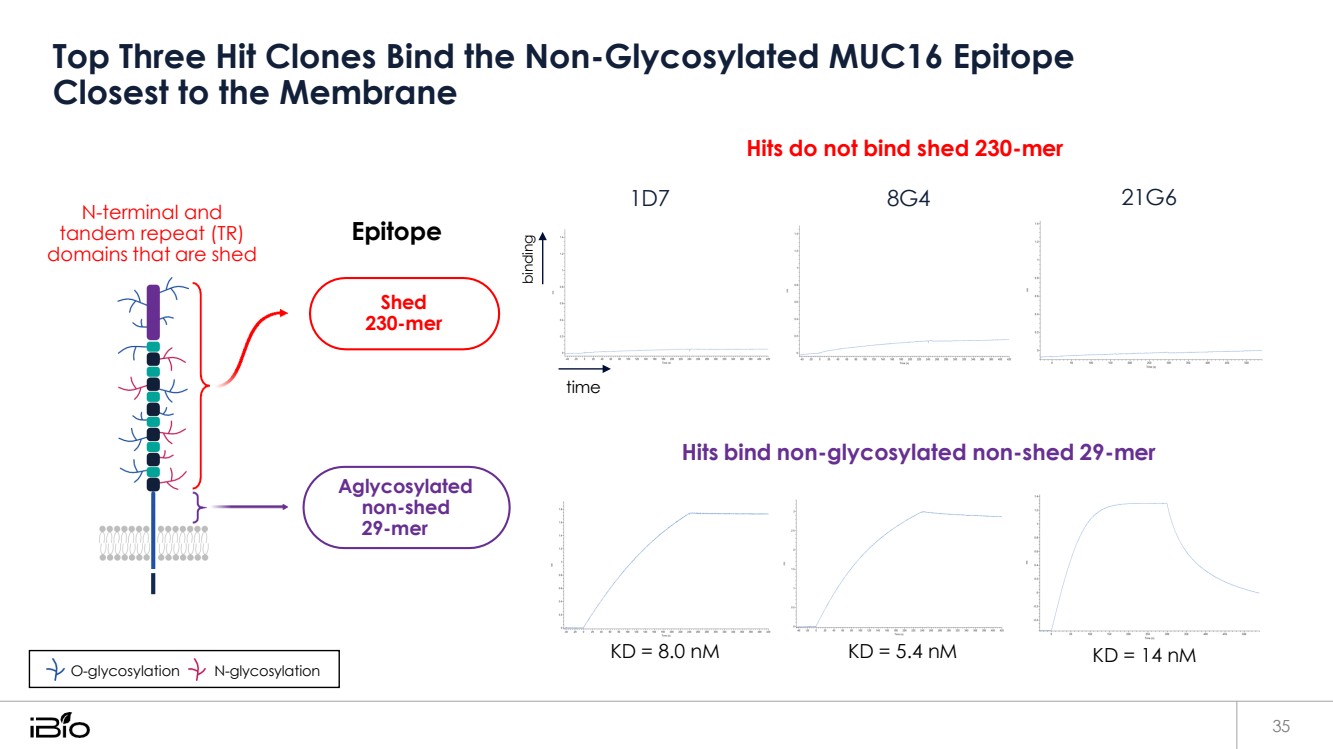

| Top Three Hit Clones Bind the Non-Glycosylated MUC16 Epitope Closest to the Membrane 35 N-terminal and tandem repeat (TR) domains that are shed Epitope time Hits do not bind shed 230-mer 1D7 8G4 21G6 Hits bind non-glycosylated non-shed 29-mer KD = 8.0 nM KD = 5.4 nM KD = 14 nM Aglycosylated non-shed 29-mer O-glycosylation N-glycosylation Shed 230-mer binding |

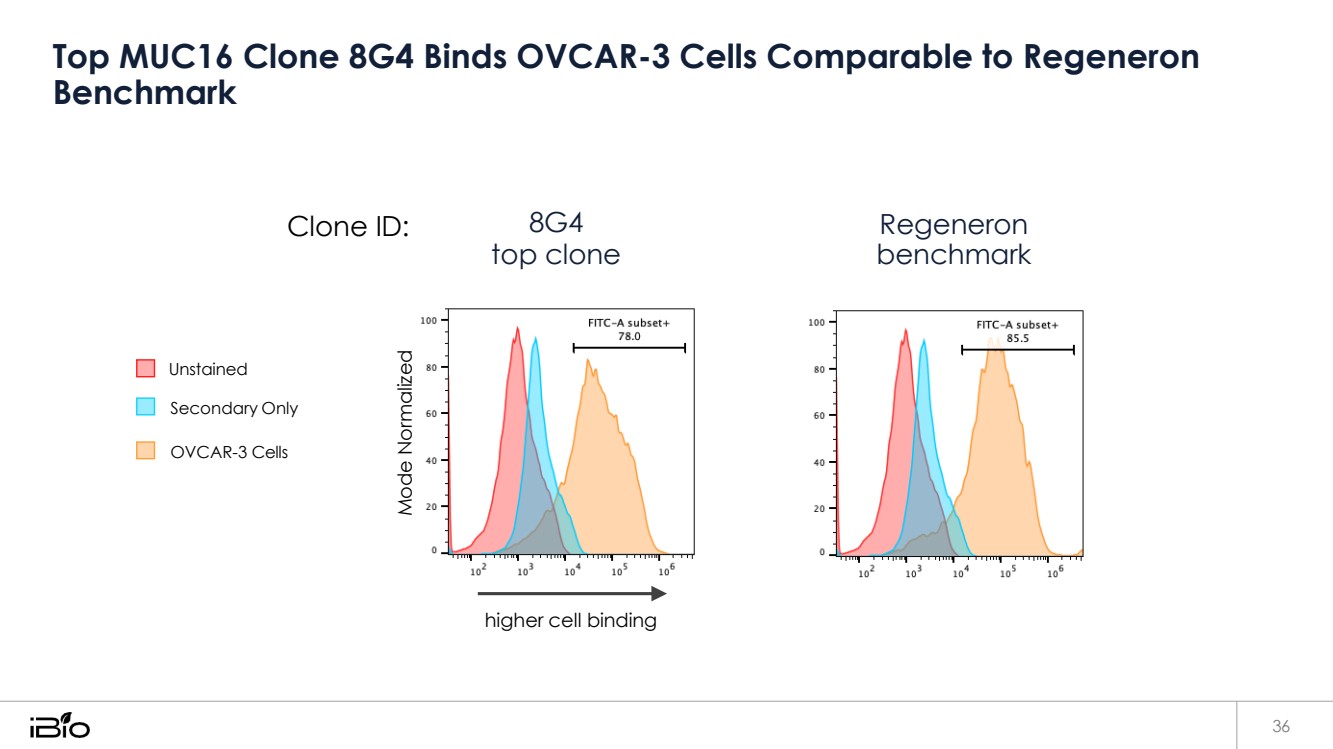

| Top MUC16 Clone 8G4 Binds OVCAR-3 Cells Comparable to Regeneron Benchmark 36 Clone ID: Unstained Secondary Only OVCAR-3 Cells 8G4 top clone higher cell binding Regeneron benchmark Mode Normalized |

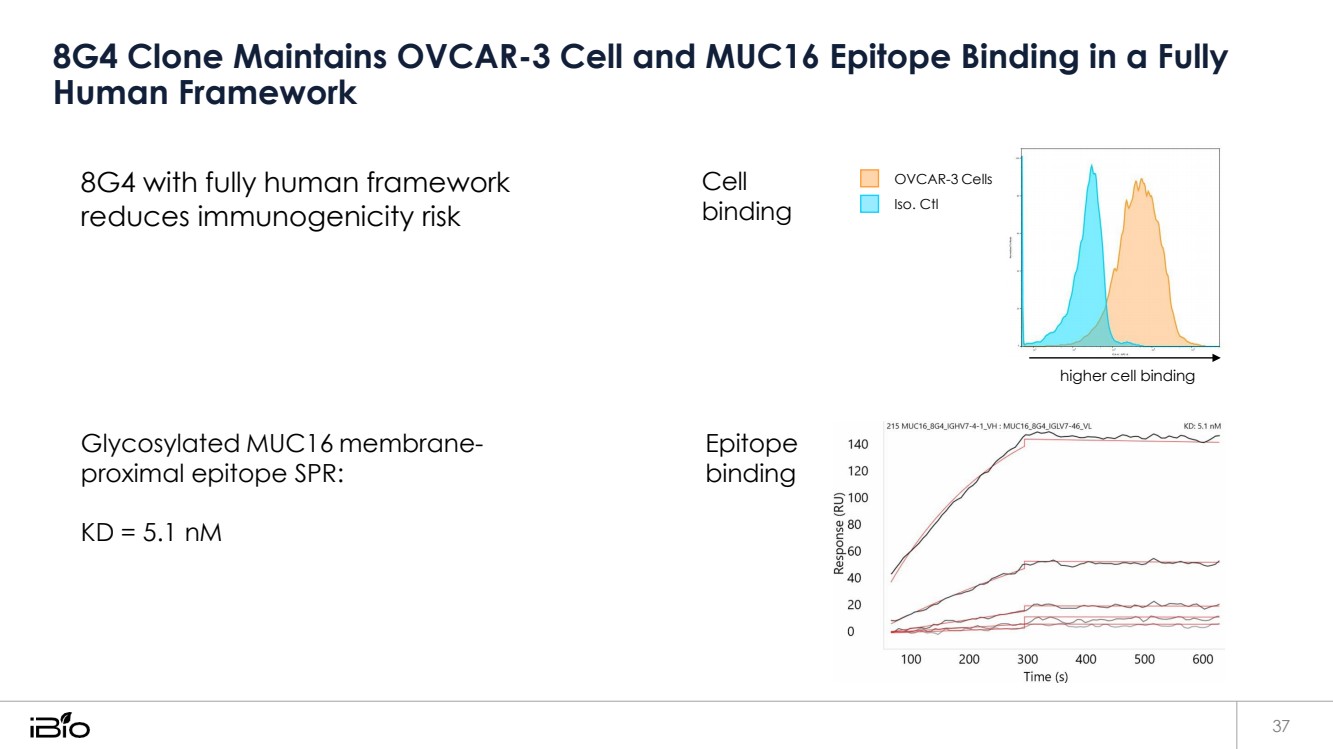

| 8G4 Clone Maintains OVCAR-3 Cell and MUC16 Epitope Binding in a Fully Human Framework 37 8G4 with fully human framework reduces immunogenicity risk Cell binding OVCAR-3 Cells Iso. Ctl higher cell binding Glycosylated MUC16 membrane-proximal epitope SPR: KD = 5.1 nM Epitope binding |

| PD-1 Agonist Supports Restoration of Homeostasis for Inflammatory Diseases 38 |

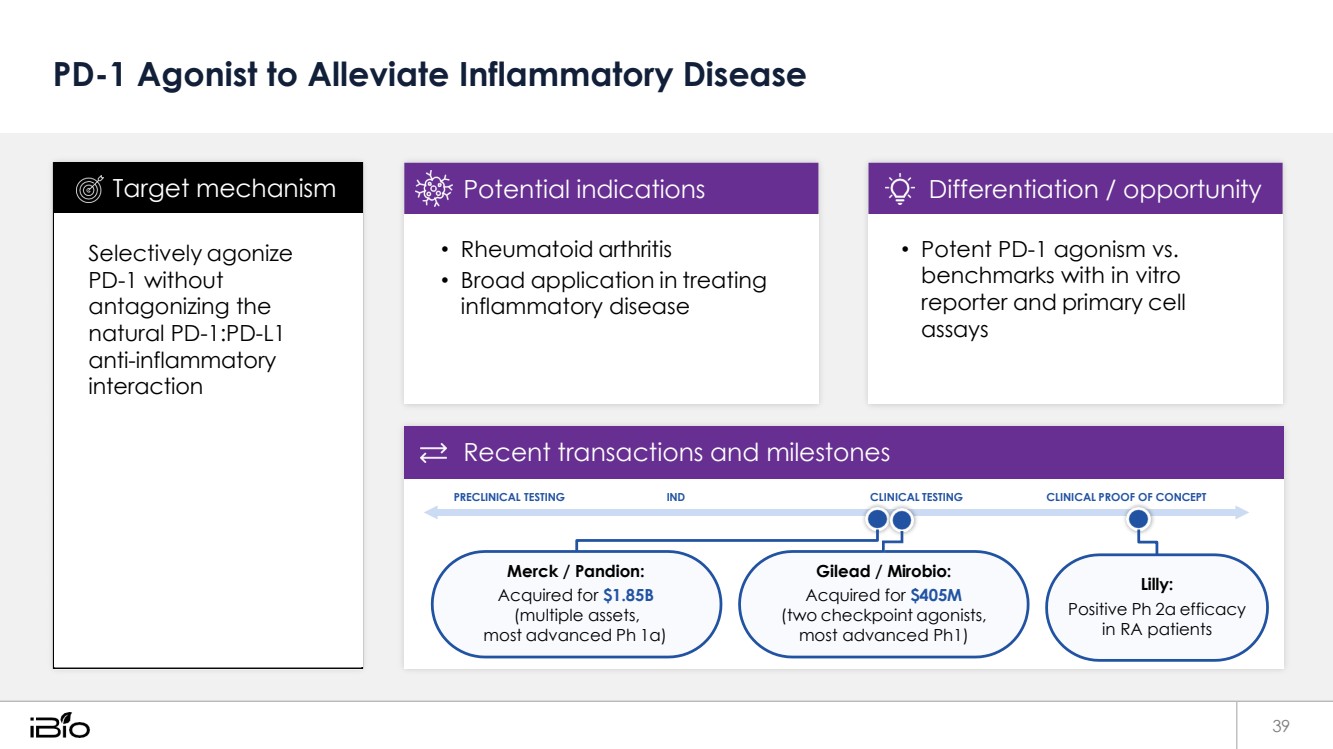

| PD-1 Agonist to Alleviate Inflammatory Disease 39 Recent transactions and milestones PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT Merck / Pandion: Acquired for $1.85B (multiple assets, most advanced Ph 1a) Gilead / Mirobio: Acquired for $405M (two checkpoint agonists, most advanced Ph1) Lilly: Positive Ph 2a efficacy in RA patients • Potent PD-1 agonism vs. benchmarks with in vitro reporter and primary cell assays Differentiation / opportunity • Rheumatoid arthritis • Broad application in treating inflammatory disease Potential indications Selectively agonize PD-1 without antagonizing the natural PD-1:PD-L1 anti-inflammatory interaction Target mechanism |

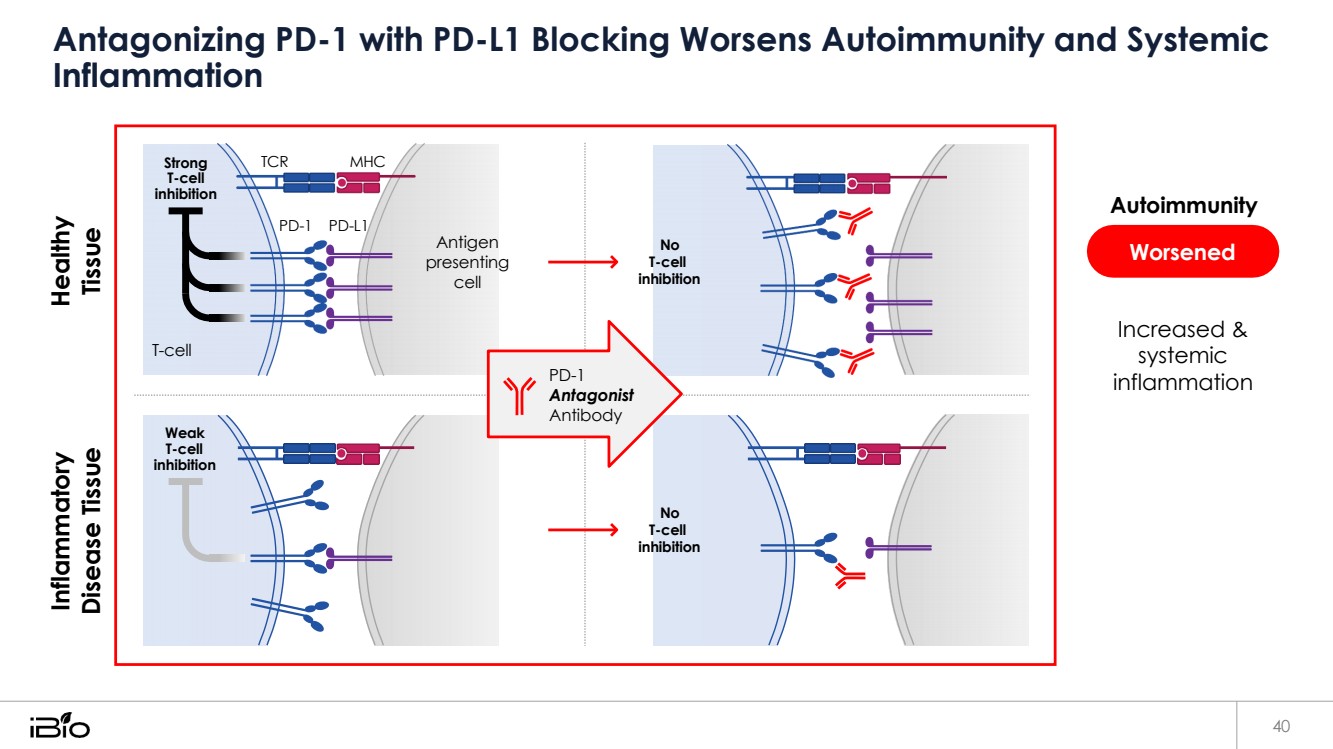

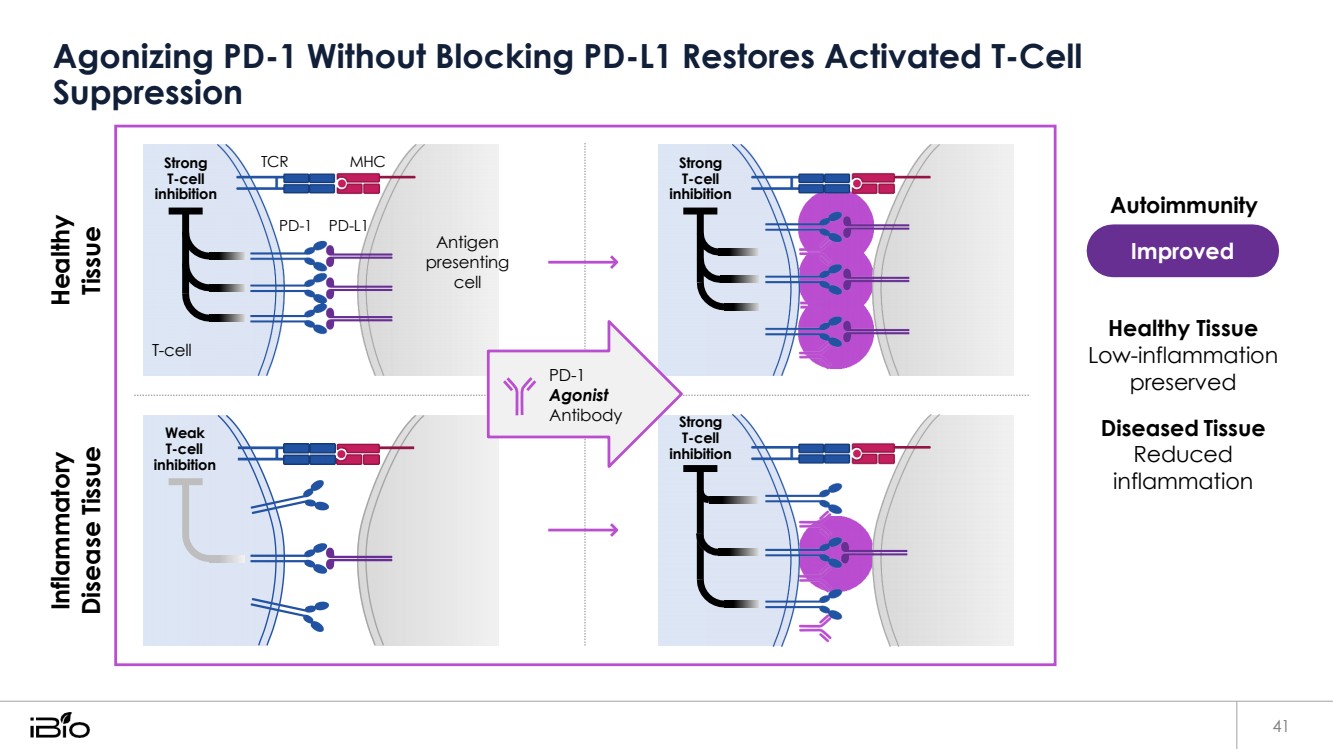

| Antagonizing PD-1 with PD-L1 Blocking Worsens Autoimmunity and Systemic Inflammation 40 Worsened Autoimmunity Increased & systemic inflammation Strong T-cell inhibition TCR MHC PD-1 PD-L1 Antigen presenting cell No T-cell inhibition T-cell PD-1 Antagonist Antibody Weak T-cell inhibition No T-cell inhibition Inflammatory Disease Tissue Healthy Tissue |

| Agonizing PD-1 Without Blocking PD-L1 Restores Activated T-Cell Suppression 41 Improved Autoimmunity Healthy Tissue Low-inflammation preserved Diseased Tissue Reduced inflammation Strong T-cell inhibition TCR MHC Strong T-cell inhibition PD-1 PD-L1 Antigen presenting cell T-cell PD-1 Agonist Antibody Weak T-cell inhibition Strong T-cell inhibition Inflammatory Disease Tissue Healthy Tissue |

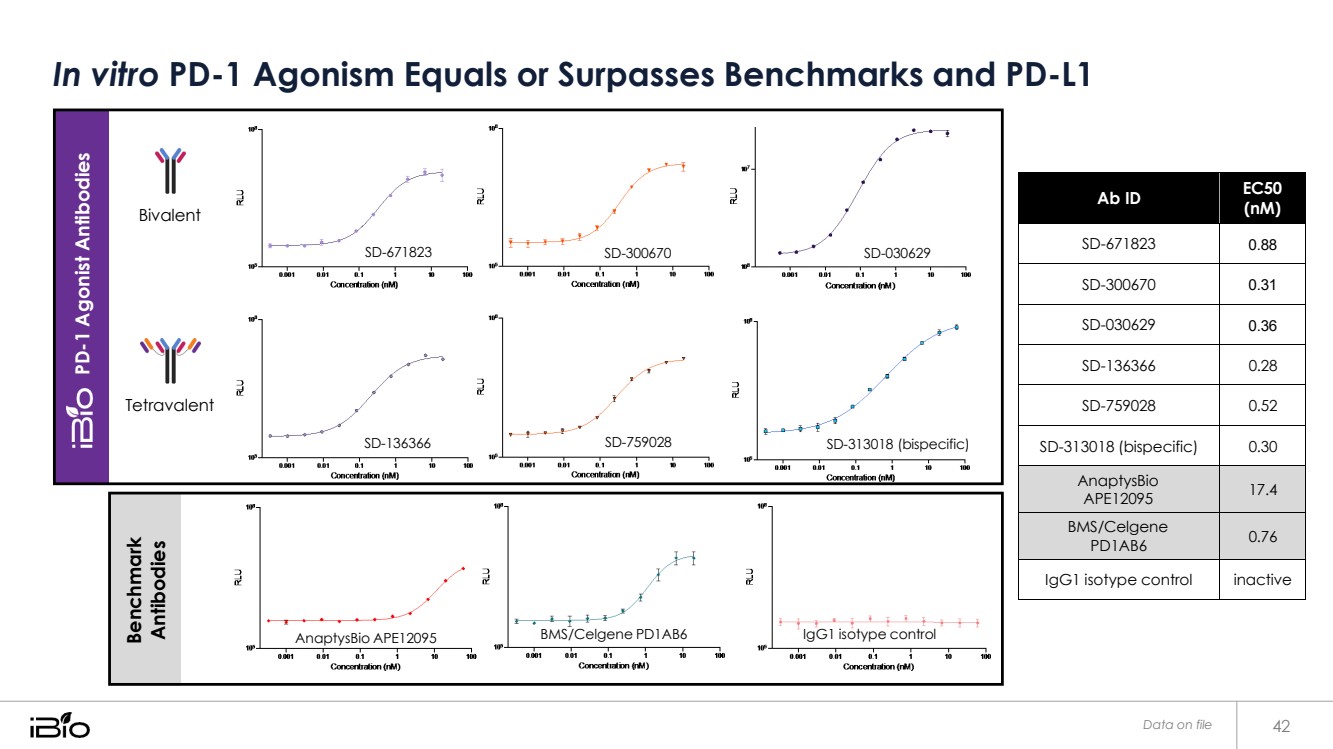

| In vitro PD-1 Agonism Equals or Surpasses Benchmarks and PD-L1 Data on file 42 Ab ID EC50 (nM) SD-671823 0.88 SD-300670 0.31 SD-030629 0.36 SD-136366 0.28 SD-759028 0.52 SD-313018 (bispecific) 0.30 AnaptysBio APE12095 17.4 BMS/Celgene PD1AB6 0.76 IgG1 isotype control inactive AnaptysBio APE12095 BMS/Celgene PD1AB6 IgG1 isotype control SD-136366 SD-759028 SD-313018 (bispecific) Tetravalent SD-671823 SD-300670 SD-030629 Bivalent PD-1 Agonist Antibodies Benchmark Antibodies |

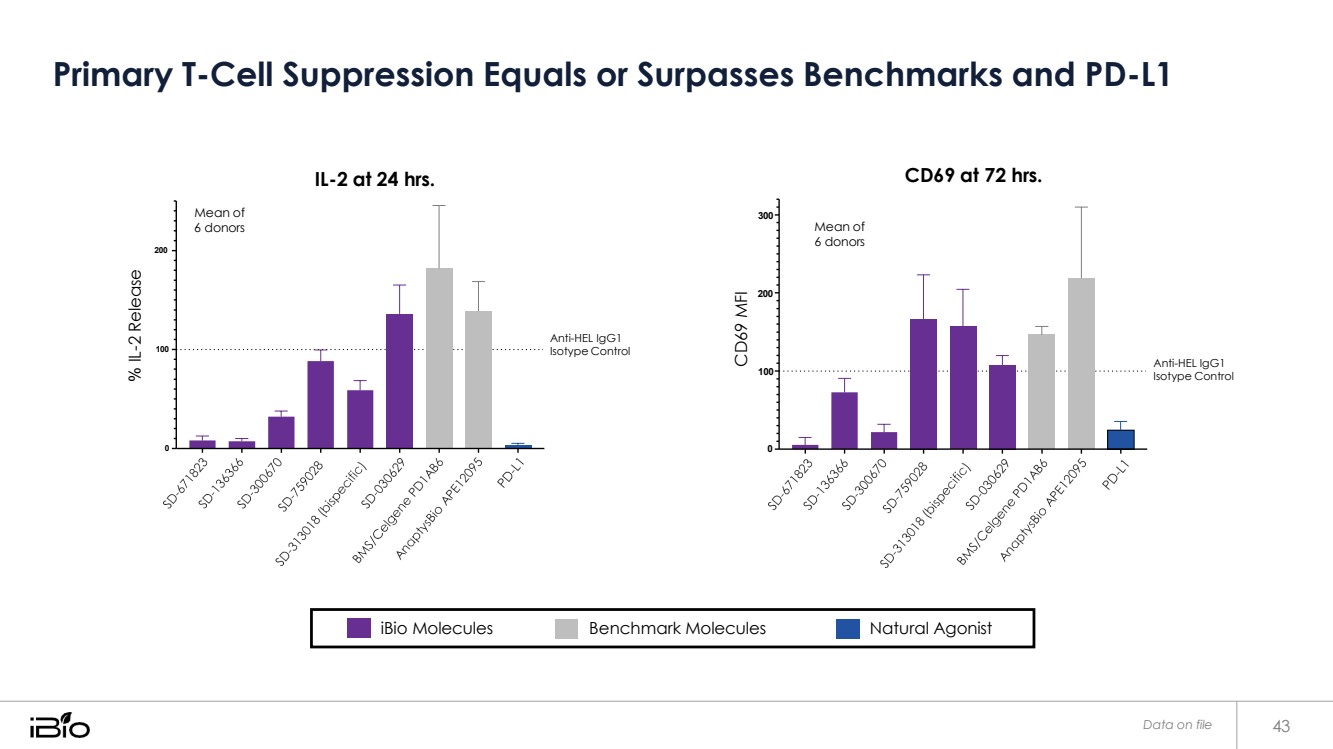

| Primary T-Cell Suppression Equals or Surpasses Benchmarks and PD-L1 Data on file 43 iBio Molecules Benchmark Molecules Natural Agonist Mean of 6 donors IL-2 at 24 hrs. 300 CD69 at 72 hrs. 200 200 100 Anti-HEL IgG1 Isotype Control 100 Anti-HEL IgG1 Isotype Control 0 0 Mean of 6 donors % IL-2 Release CD69 MFI |

| In Summary 44 |

| Our Leadership Team Brings Drug Discovery and Development Experience Martin Brenner, DVM, Ph.D. Interim CEO & CSO Felipe Duran Interim CFO Marc Banjak GC Lisa Middlebrook CHRO 45 |

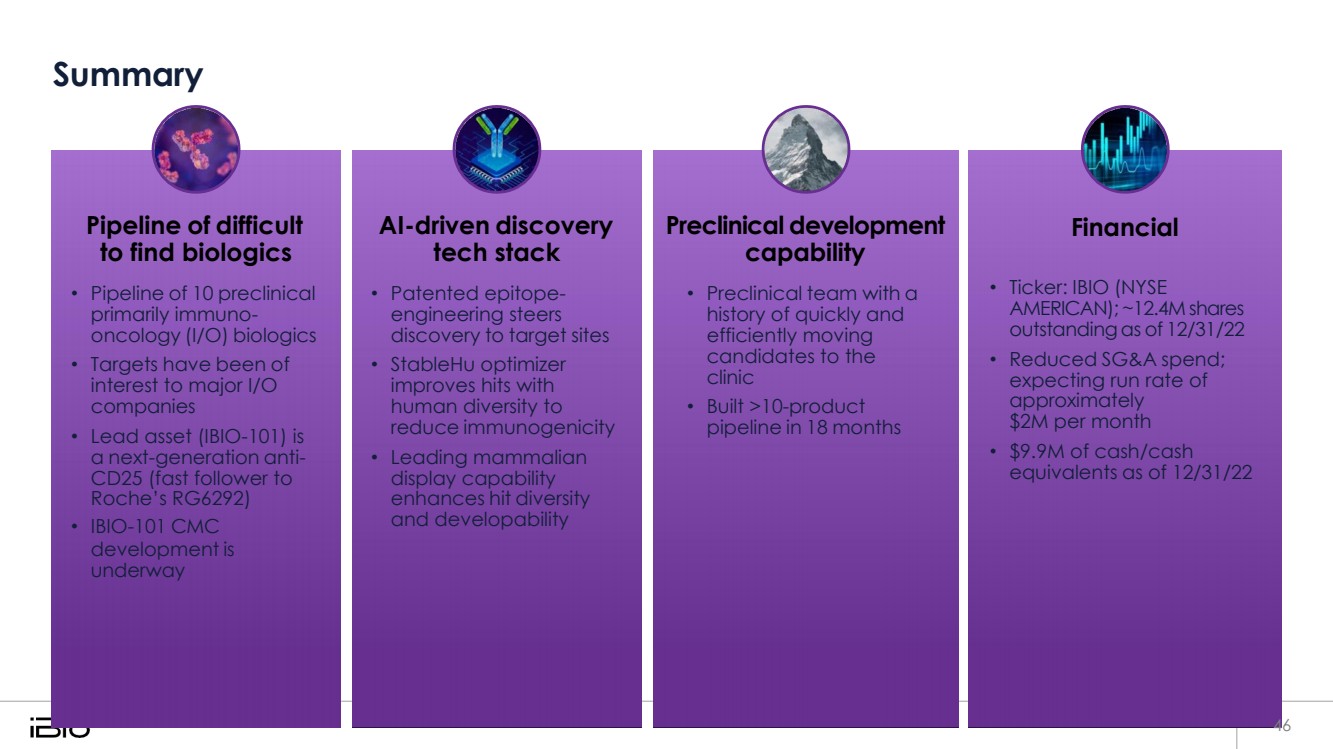

| Summary Pipeline of difficult to find biologics • Pipeline of 10 preclinical primarily immuno-oncology (I/O) biologics • Targets have been of interest to major I/O companies • Lead asset (IBIO-101) is a next-generation anti-CD25 (fast follower to Roche’s RG6292) • IBIO-101 CMC development is underway AI-driven discovery tech stack • Patented epitope-engineering steers discovery to target sites • StableHu optimizer improves hits with human diversity to reduce immunogenicity • Leading mammalian display capability enhances hit diversity and developability Preclinical development capability • Preclinical team with a history of quickly and efficiently moving candidates to the clinic • Built >10-product pipeline in 18 months Financial • Ticker: IBIO (NYSE AMERICAN); ~12.4M shares outstandingas of 12/31/22 • Reduced SG&A spend; expecting run rate of approximately $2M per month • $9.9M of cash/cash equivalents as of 12/31/22 46 |