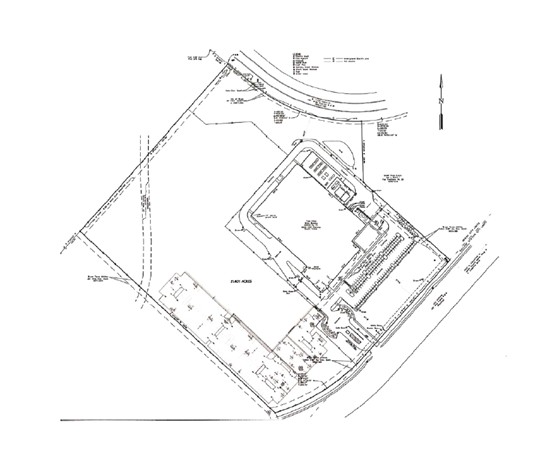

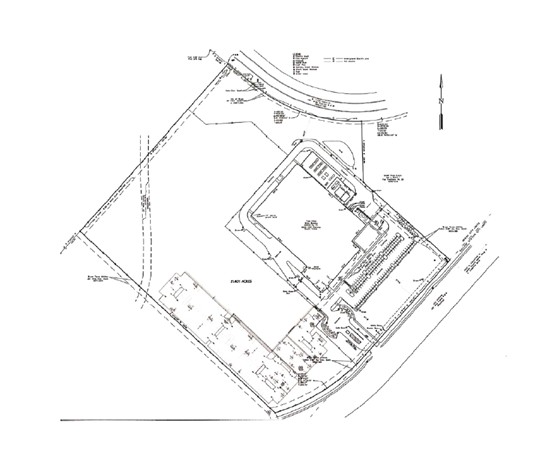

EXHIBIT 3.5.2(ii)

DEPICTION OF TAMU PURCHASE TRACT

Page 2

Exhibit 10.1

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS EXHIBIT MARKED BY [***] HAS BEEN OMITTED BECAUSE IT IS BOTH NOT MATERIAL AND IS THE TYPE OF INFORMATION THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL

PURCHASE AND SALE AGREEMENT

THIS PURCHASE AND SALE AGREEMENT (this “Agreement”), dated as of September 15, 2023 (the “Effective Date”), is made by and between MAJESTIC REALTY CO., a California corporation (“Purchaser”) and IBIO CDMO LLC, a Delaware limited liability company (“Seller”).

A G R E E M E N T S:

NOW, THEREFORE, in consideration of the covenants, promises and undertakings set forth herein, and for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Seller and Purchaser agree as follows:

1.THE PROPERTY.

1.1Description. Subject to the terms and conditions of this Agreement, and for the consideration herein set forth, Seller agrees to sell and transfer, respectively, and Purchaser agrees to purchase and acquire, the following (collectively, the “Property”):

1.1.1The ground leasehold estate and interest under that certain (i) Ground Lease Agreement dated March 8, 2010, as amended by an Estoppel Certificate and Amendment to Ground Lease Agreement dated as of December 22, 2015 (the “Ground Lease”) between Seller (as assignee from College Station Investors LLC) and The Board of Regents of the Texas A&M University System (“Ground Lessor”), relating to the land (the “Land”) more specifically described in Exhibit 1.1.1 located in Brazos County, Texas;

1.1.2The buildings, parking areas, improvements, and fixtures now situated on the Land (the “Improvements”);

1.1.3All of Seller’s assignable and transferable right, title, and interest in and to furniture, personal property, machinery, apparatus, and equipment owned by Seller and currently used in the operation, repair and maintenance of the Land and Improvements and situated thereon (collectively, the “Personal Property”);

1.1.4All of Seller’s assignable and transferable right, title, and interest (if any) in and to all easements, hereditaments, and appurtenances belonging to or inuring to the benefit of Seller and pertaining to the Land or Improvements, if any;

1.1.5[reserved];

1.1.6Subject to Section 3.3, all contracts and agreements relating to the operation or maintenance of the Land, Improvements or Personal Property the terms of which extend beyond midnight of the day preceding the Closing Date (as hereinafter defined) as set forth on Exhibit 1.1.6 (the “Contracts”) except for those Contracts which Purchaser elects not to assume pursuant to Section 3.3 of this Agreement; and

1.1.7To the extent not proprietary and without representation as to whether third party consent is required, and at no cost or liability to Seller, all of Seller’s assignable and transferable right, title, and interest (if any) in and to all intangible assets of any nature relating to any or all of the Land, the Improvements and the Personal Property , including, but not limited to, (i) all guaranties and warranties issued with respect to the Personal Property or the Improvements (if any) including equipment and construction warranties and the roof warranty; (ii) all plans and specifications, drawings and prints describing the Improvements; (iii) trademarks or trade names associated with the Improvements; (iv) all development rights; (v) any governmental permits, entitlements, approvals, licenses and certificates (including any pending applications) including without limitation, those pertaining to zoning, use, occupancy, and signage for the Property; and (vi) all rights and claims of Seller against third parties related to the Property (collectively, the “Intangibles”).

1.2“As-Is” Purchase. The Property is being sold in an “AS IS, WHERE IS” condition and “WITH ALL FAULTS” as of the Effective Date and of Closing, except as expressly set forth in this Agreement including the Exhibits annexed hereto (and incorporated herein by this reference) and/or in the documents to be delivered at Closing (herein collectively referred to as “Seller’s Representations and Warranties”). Except for Seller’s Representations and Warranties, no representations or warranties have been made or are made and no responsibility has been or is assumed by Seller or by any partner, officer, person, firm, agent, attorney or representative acting or purporting to act on behalf of Seller as to (i) the condition or state of repair of the Property; (ii) the compliance or non-compliance of the Property with any applicable laws, regulations or ordinances (including, without limitation, any applicable zoning, building or development codes); (iii) the value, expense of operation, or income potential of the Property; (iv) any other fact or condition which has or might affect the Property or the condition, state of repair, compliance, value, expense of operation or income potential of the Property or any portion thereof; or (v) the environmental condition of the Property, including without limitation whether the Property contains asbestos or harmful or toxic substances or pertaining to the extent, location or nature of same. The parties agree that all understandings and agreements heretofore made between them or their respective agents or representatives are merged in this Agreement and the Exhibits hereto annexed, which alone fully and completely express their agreement, and that this Agreement has been entered into after full investigation, or with the parties satisfied with the opportunity afforded for full investigation, neither party relying upon any statement or representation by the other except for Seller’s Representations and Warranties. Purchaser acknowledges and agrees that (a) Purchaser has, or will have prior to the Due Diligence Deadline, independently examined, inspected, and investigated to the full satisfaction of Purchaser, the physical nature and condition of the Property including, without limitation, its environmental condition, and the income, operating expenses and carrying charges affecting the Property, and (b) except for Seller’s Representations and Warranties, Purchaser, in executing, delivering and performing this Agreement, does not rely upon any statement, offering material, operating statement, historical budget, engineering structural report, any environmental reports, information, or representation to whomsoever made or given, whether to Purchaser or others, and whether directly or indirectly, orally or in writing, made by any person, firm or corporation, and Purchaser acknowledges that any such statement, information, offering material, operating statement,

Page 2

historical budget, report or representation, if any, does not represent or guarantee future performance of the Property.

To the extent now or hereafter applicable, each party hereby waives its rights, if any, under the Deceptive Trade Practices – Consumer Protection Act, Section 17.41 et seq., Texas Business & Commerce Code, a law that gives consumers special rights and protections. After consultation with an attorney of its own selection, each party voluntarily consents to this waiver.

This Section 1.2 shall survive any termination of this Agreement and the Closing.

1.3Agreement to Convey. Subject to the terms and conditions set forth in this Agreement, including but not limited to, Seller’s Representations and Warranties, Seller agrees to convey, and Purchaser agrees to accept, the Property, including Seller’s ground leasehold interest in the Land and Improvements under the Ground Lease pursuant to the Assignment and Assumption of Ground Lease pursuant to Section 9.2.1 below, and title to the Personal Property pursuant to a Bill of Sale and Assignment and Assumption Agreement pursuant to Section 9.2.3 below.

2.PRICE AND PAYMENT.

2.1Purchase Price. Purchaser agrees to pay the sum of Seventeen Million Two Hundred Fifty Thousand Dollars and No cents ($17,250,000.00) (the “Purchase Price”) for the acquisition of the Property, subject to the terms of this Agreement.

2.2Payment. Payment of the Purchase Price is to be made in cash as follows:

2.2.1Within two (2) business days of the execution of this Agreement, Purchaser shall deliver, as an earnest money deposit with Chicago Title Insurance Company, 23929 Valencia Blvd., Suite 304, Valencia, CA 91355, Attn: Maggie G. Watson; Telephone: (661) 753-5701; Email: Maggie.Watson@ctt.com (the “Title Company” or “Escrow Holder”, the sum of $200,000.00 (the “Deposit”).

2.2.2The Deposit will be placed with and held in escrow by the Title Company, in immediately available funds in an interest-bearing account at a mutually acceptable banking institution. Any interest earned by the Deposit shall be considered as part of the Deposit. Except as otherwise provided in this Agreement, the Deposit will be applied to the Purchase Price at Closing.

2.2.3Notwithstanding anything herein to the contrary, upon any return of the Deposit to Purchaser, there shall first be deducted and delivered to Seller an amount equal to One Hundred Dollars ($100) (the “Independent Consideration”), which amount Purchaser and Seller bargained for and agreed to as consideration for Seller’s execution, delivery and performance of this Agreement and the right of Purchaser to terminate this Agreement as provided herein. The Independent Consideration is in addition to and independent of any other consideration or payment provided in this Agreement.

Page 3

2.2.4At Closing, Purchaser shall pay the balance of the Purchase Price, subject to adjustment for the prorations as provided herein, to the Title Company for disbursement to Seller via wire transfer in immediately available funds.

2.3Closing. Payment of the Purchase Price and the closing hereunder (the “Closing”) will take place pursuant to an escrow closing on, time being of the essence, December 1, 2023, or such later date as may be mutually agreed upon in writing by the parties (the “Closing Date”), provided Purchaser does not terminate this Agreement prior to such date in accordance with this Agreement. The Closing will take place at the offices of the Title Company at 4:00 p.m. local time or at such other time and place as may be agreed upon in writing by Seller and Purchaser. Closing shall occur through an escrow with the Title Company. Funds shall be deposited into and held by the Title Company in a closing escrow account with a bank satisfactory to Purchaser and Seller. Upon satisfaction or completion of all closing conditions and deliveries, the parties shall direct the Title Company to immediately record and deliver the closing documents to the appropriate parties and make disbursements according to the closing statements executed by Seller and Purchaser.

3.INSPECTIONS AND APPROVALS.

3.1Inspections.

3.1.1Commencing on the Effective Date through the Closing Date, so long as this Agreement remains in effect, Seller agrees to allow Purchaser and Purchaser’s engineers, architects, employees, agents and representatives (collectively, “Purchaser’s Agents”) reasonable access, during normal business hours, to the Property and to the records, if any, maintained by Seller or maintained for Seller by the Property Manager. Such access shall be solely for the purposes of (i) reviewing records relating to construction, repair, maintenance and operating expenses; and (ii) inspecting the physical condition of the Property and conducting non-intrusive physical or environmental inspections of the Property. Purchaser shall not conduct or allow any testing or air samples at the Property or any physically intrusive testing of, on or under the Property without first obtaining Seller’s written consent as to the timing and scope of work to be performed and entering into an access agreement in form and substance satisfactory to Seller in its sole discretion; provided, however, for the avoidance of doubt, Purchaser shall be entitled to conduct a customary Phase I Environmental Assessment. Except as expressly set forth in this Agreement, all documents furnished to Purchaser pursuant to this Agreement are provided for information only, and without representation or warranty of any nature, and Purchaser shall be solely responsible for verifying the information contained therein. Purchaser shall not file or cause to be filed any application or make any request (other than inquiries into public records and existing violations) with any governmental or quasi-governmental agency (other than TAMU) which would or could lead to a hearing before any governmental or quasi-governmental agency or which would or could lead to a note, notice or violation of law or municipal ordinance, order or requirement imposed by such an agency, at the Property or any change in zoning, parcelization, licenses, permits or other entitlements or any investigation or restriction on the use of the Property, or any part thereof.

Page 4

3.1.2Purchaser agrees that, in making any physical or environmental inspections of the Property, Purchaser shall carry, or cause Purchaser’s Agents to carry insurance in form and substance consistent with the requirements set forth on Exhibit 3.1.2, naming Seller and, if required under the Ground Lease, Ground Lessor, as additional insureds and Purchaser will provide Seller with written evidence of same prior to entry on the Property.

3.1.3Purchaser agrees that in exercising its right of access hereunder, Purchaser will use and will cause Purchaser’s Agents to use their commercially reasonable efforts not to interfere with the activity of tenants or any persons occupying or providing service at the Property. Purchaser shall, at least forty-eight (48) hours prior to inspection, give Seller notice, which may be verbal, of its intention to conduct any inspections, so that Seller shall have an opportunity to have a representative present during any such inspection, and Seller expressly reserves the right to have such a representative present. Seller agrees that [***] will be Seller’s contact person for scheduling such inspections. Upon request by Seller, Purchaser shall furnish Seller with copies of any final reports relating to the inspections performed by Purchaser or Purchaser’s Agents; provided, however, that such reports will be delivered without representation or warranty of any kind, express or implied, as to the accuracy or completeness thereof. If Purchaser fails to purchase the Property, upon request by Seller, all such final reports shall become the property of Seller. Upon request by Seller, Purchaser agrees to cooperate with Seller (at no additional cost to Purchaser) and the preparer of the reports to have such reports assigned to Seller.

3.1.4Purchaser shall, at its sole cost and expense and in strict accordance with all requirements of applicable law, promptly restore any physical damage or alteration of the physical condition of the Property (reasonable wear and tear excepted) which results from any inspection or activity conducted by Purchaser or any Purchaser’s Agent; provided, however, Purchaser shall have no obligation to restore any pre-existing environmental or other pre-existing conditions in, on or under the Property, except to the extent such conditions are exacerbated by Purchaser or any Purchaser’s Agents. The provisions of this Section 3.1.4 shall survive any termination of this Agreement.

3.1.5Except for Seller’s Representations and Warranties or as otherwise provided for elsewhere in this Agreement or the documents to be delivered at Closing, Seller makes no representations or warranties as to the truth, accuracy, completeness, methodology of preparation or otherwise concerning any engineering or environmental reports or any other materials, data or other information supplied to Purchaser in connection with Purchaser’s inspection of the Property (e.g., that such materials are complete, accurate or the final version thereof, or that such materials are all of such materials as are in Seller’s possession). In making its own examination and determination prior to the Due Diligence Deadline (defined below) as to whether it wishes to purchase the Property, except for Seller’s Representations and Warranties, Purchaser shall rely exclusively on its own independent investigation and evaluation of every aspect of the Property and not on any materials supplied by Seller.

3.1.6PURCHASER AGREES (WHICH AGREEMENT SHALL SURVIVE CLOSING OR TERMINATION OF THIS AGREEMENT) TO INDEMNIFY, DEFEND, AND HOLD SELLER HARMLESS FROM ANY LIABILITIES, LOSS, INJURY, DAMAGE,

Page 5

CLAIM, LIEN, COST OR EXPENSE, INCLUDING ATTORNEYS’ FEES AND COSTS (COLLECTIVELY, “CLAIMS”), TO THE EXTENT THE SAME HAS RESULTED FROM THE EXERCISE BY PURCHASER OR PURCHASER’S AGENTS OF THE RIGHT OF ACCESS ON THE PROPERTY, INCLUDING WITHOUT LIMITATION ARISING OUT OF INJURY OR DEATH TO PERSONS OR DAMAGE TO PROPERTY (COLLECTIVELY, “PURCHASER’S INDEMNITY OBLIGATIONS”); PROVIDED, HOWEVER, THAT PURCHASER’S INDEMNITY OBLIGATIONS SHALL NOT INCLUDE (i) ANY CLAIMS ARISING OUT OF THE DISCOVERY OF ANY PRE-EXISTING ENVIRONMENTAL OR OTHER CONDITION AT THE PROPERTY, EXCEPT TO THE EXTENT THE SAME HAS BEEN EXACERBATED BY PURCHASER OR PURCHASER’S REPRESENTATIVES; AND (ii) ANY CLAIMS (AS DEFINED ABOVE) TO THE EXTENT OF THE NEGLIGENCE OR WILLFUL MISCONDUCT OF SELLER OR ANY OF THE OTHER SELLER RELEASED PARTIES. THIS SECTION 3.1.6 SHALL SURVIVE CLOSING OR THE TERMINATION OF THIS AGREEMENT. Purchaser hereby waives, releases and forever discharges Seller, its affiliates, subsidiaries, officers, directors, shareholders, employees, independent contractors, partners, representatives, agents, successors and assigns, and each of them (the “Seller Released Parties”), from any and all causes of action, claims, assessments, losses, damages (compensatory, punitive or other), liabilities, obligations, reimbursements, costs and expenses of any kind or nature, actual, contingent, present, future, known or unknown, suspected or unsuspected, including, without limitation, interest, penalties, fines, and attorneys’ and experts’ fees and expenses, arising out of Purchaser’s access or the inspections under Section 3 of this Agreement, except to the extent of the negligence or willful misconduct of Seller or any of the other Seller Released Parties. This Section 3.1.6 shall survive the termination of this Agreement.

3.1.7Any and all work with respect to Purchaser’s inspections shall be at Purchaser’s sole cost and expense and all activities undertaken by Purchaser in connection therewith shall fully comply with applicable laws and regulations. Purchaser shall keep the Property free from any liens arising out of any work performed, materials furnished, or obligations incurred by or on behalf of Purchaser or Purchaser’s Agents with respect to any inspection or testing of the Property. If any such lien at any time shall be filed, Purchaser shall cause the same to be discharged of record within ten (10) days following Purchaser’s receipt of written notice of such lien by satisfying the same or, if Purchaser, in its discretion and in good faith determines that such lien should be contested, by recording a bond. Failure by Purchaser to discharge such lien shall be a material breach of this Agreement. Purchaser agrees to keep confidential and not to disseminate to any third party, except to its Representatives (defined below), and to cause its Representatives to keep confidential and not disseminate to any third party, any information Purchaser (and/or its Representatives) obtains as a result of the Inspections, except (i) to the extent disclosure is required by law or court order (subject to the provisions of Section 11.7 below) or (ii) with respect to information that (a) is already in the receiving party’s possession prior to receipt from the disclosing party, (b) becomes generally available to the public other than as a result of a disclosure by the receiving party, or (c) becomes available to the receiving party on a non-confidential basis from a source not known by the receiving party to be bound by a confidentiality agreement with or other obligation of secrecy to the disclosing party.

Page 6

3.1.8Purchaser understands that any financial statements and data, including, without limitation, gross rental income, operating expenses and cash flow statements, which may be made available by Seller to Purchaser, will be unaudited financial statements and data not prepared or reviewed by independent public accountants, and that Seller makes no representation as to the accuracy or completeness thereof, except for Seller’s Representations and Warranties.

3.2Title and Survey.

3.2.1Within 3 days following the Effective Date, Seller shall order for Purchaser a commitment for title insurance on the Land, together with copies of all items shown as exceptions to title therein, issued by the Title Company on behalf of Chicago Title Insurance Company (the “Title Commitment”), and a copy of Seller’s existing survey of the Land (the “Survey”). Purchaser shall have until October 12, 2023 (the “Title Approval Date”) to provide written notice to Seller of any matters shown by the Title Commitment or Survey which are not satisfactory to Purchaser, which notice (the “Title Notice”) must specify the reason such matter(s) are not satisfactory and the curative steps necessary to remove the objections stated in the Title Notice (collectively, the “Title Objections”).

3.2.2In the event Seller is unable or unwilling to eliminate or modify all of the Title Objections, Seller shall so notify Purchaser in writing on or before such date that is two (2) business days following receipt of the Title Notice, and Purchaser may (as its sole and exclusive remedy) terminate this Agreement by delivering written notice thereof to Seller not later than the Due Diligence Deadline (defined below). Except for Seller Cure Matters (as defined below), which Seller shall be obligated to remove or cure at or prior to Closing, Seller shall have no obligation whatsoever to expend or agree to expend any funds, to undertake or agree to undertake any obligations or otherwise to cure or agree to cure any Title Objections.

3.2.3Except as provided herein, Purchaser’s sole right with respect to any Title Objection (other than Seller Cure Matters) shall be to elect on or before the Due Diligence Deadline (defined below) to terminate this Agreement, other than continuing obligations under Sections 3.1.4 and 3.1.6 that survive the Closing or termination of this Agreement) (herein called the “Surviving Obligations”) and to receive a refund of the Deposit.

3.2.4Except for Seller Cure Matters, all matters shown on the Title Commitment and/or Survey and any update of such Survey (an “Updated Survey”) with respect to which Purchaser fails to give a Title Notice on or before the last date for so doing, or with respect to which a timely Title Notice is given but Seller fails to respond or declines to cure shall be deemed to be approved by Purchaser and a “Permitted Encumbrance” as provided in Section 3.4 hereof, subject, however, to Purchaser’s termination right provided in Section 3.5 hereof. In no event shall any Seller Cure Matters constitute a Permitted Encumbrance and Purchaser shall have no obligation to raise any such Seller Cure Matters in any Title Notice.

3.2.5Seller shall be obligated to cure and remove (or procure title insurance over to the reasonable satisfaction of Purchaser) all of the following (“Seller Cure Matters”), if any: (a) the liens of any mortgage, trust deed, deed of trust and financing statements evidencing or

Page 7

securing an indebtedness owed by Seller or other lien securing the payment of monetary obligation voluntarily created by Seller or consented to in writing by Seller after the date hereof; (b) tax liens for delinquent ad valorem real estate taxes or other assessments or governmental charges due from Seller affecting all or any portion of the Property that are delinquent or that will be delinquent as of the Closing Date; and (c) any recorded encumbrances or restrictions against the Property caused by Seller after the Effective Date without Purchaser’s prior written consent.

3.2.6If any update to the Title Commitment after the effective date of the Title Commitment or to the Survey after the date of the Survey set forth in the Title Notice discloses any new title exception or matter not disclosed in the Title Commitment, the Survey and/or in the Title Notice which, in each case (other than with respect to Required Cure Matters, which Seller shall be obligated to cure), has a material and adverse effect on the Property (a “New Exception”), then provided that any such New Exception was not created by or through Purchaser, Purchaser shall have a period of three (3) Business Days after delivery of such update to review and notify Seller in writing of Purchaser’s disapproval of such New Exception, if any. Upon the expiration of said three (3) Business Day period, except for Purchaser’s timely submitted objection to any such New Exception, Purchaser shall be deemed to have accepted each such New Exception, if any. Seller may respond to Purchaser’s timely submitted objection to any New Exception within three (3) Business Days after receipt thereof. If Seller fails to respond within such three (3) Business Day period, Seller shall be deemed to have delivered Seller’s election to not cure or remove any of Purchaser’s objections to any New Exception. If Seller elects (or is deemed to have elected) to not cure or remove to the reasonable satisfaction of Purchaser any New Exception (other than with respect to Seller Cure Matters) prior to Closing (as may be extended), Purchaser may, in its sole and absolute discretion, within three (3) Business Days after notice (or deemed notice) of Seller’s intent to not cure or remove any New Exception, deliver written notice to Seller of Purchaser’s decision to (i) terminate this Agreement, whereupon the entire Deposit (less the independent consideration) shall be returned to Purchaser and this Agreement shall terminate without any further liability on the part of either party, except for the Surviving Obligations, or (ii) waive its objections in which event Closing will take place the later of the Closing Date and three (3) business days after notice (or deemed notice) per this Section 3.2.6.

3.2.7Seller shall be entitled to one or more adjournments of the Closing for a period not to exceed twenty (20) days beyond the scheduled date for Closing in order to remove or satisfy any lien, encumbrance, defect, encroachment or objection which is not a Permitted Encumbrance and that Seller is required (in the case of Required Cure Matters) or has agreed to remove or satisfy.

3.3Contracts. On or before the Fee Purchase Agreement Deadline (defined below), Purchaser shall notify Seller in writing if Purchaser elects not to assume at Closing any of the service, maintenance, supply or other contracts relating to the operation of the Property which are identified on Exhibit 1.1.6 attached hereto. If Purchaser does not exercise its right to terminate this Agreement on or before the Fee Purchase Agreement Deadline, Seller shall give notice of termination of such disapproved contract(s) provided the same are terminable, except Seller shall have no obligation to terminate, and Purchaser hereby agrees to accept and assume all Contracts

Page 8

(including those specified in Purchaser’s notice) which cannot be terminated by Seller (i) without cause, (ii) upon thirty (30) days’ notice or less, or (iii) without payment of a premium or penalty. Purchaser’s failure to timely deliver notice pursuant to the preceding sentence shall be deemed Purchaser’s election to accept and assume all of the Contracts. Notwithstanding the foregoing, Seller shall terminate any existing property management agreement and any leasing agreements at or prior to the Closing Date and shall terminate any other Contracts that are terminable, and that Purchaser elects not to assume as of the Closing Date, in each case at no cost to Purchaser.

3.4Permitted Encumbrances. In addition, Purchaser shall be deemed to have approved and to have agreed to purchase the Property subject to the following:

3.4.1All exceptions to title shown in the Title Commitment or matters shown on the Survey which Purchaser has approved or is deemed to have approved pursuant to Section 3.2 hereof, except for Seller Cure Matters;

3.4.2The lien of non-delinquent real and personal property taxes and assessments for the year in which the Closing occurs and subsequent years; however, Seller will be responsible for the payment of any so-called “rollback taxes” due and payable prior to the Closing Date for all or any portion of the Property and as a result of a change of use of the Property.

3.4.3Terms and conditions of the Ground Lease.

3.4.4Shortages in area.

3.4.5Any laws, regulations or ordinances presently in effect or which will be in effect on the Closing (including, but not limited to, zoning, building and environmental protection) as to the use, occupancy, subdivision or improvement of the Property adopted or imposed by any governmental body or the effect of any noncompliance with or any violation thereof.

3.4.6Right of any utility company to maintain and operate lines, wires, poles, cables and distribution boxes, in, over and upon the Property.

3.4.7Unpatented mining claims; reservations or exceptions in patents or in acts authorizing the issuance thereof, water rights, claims or title to water, whether or not shown by the public records.

All of the foregoing in Sections 3.4.1 through 3.4.5 are referred to herein collectively as “Permitted Encumbrances.” Notwithstanding the foregoing, the Permitted Encumbrances shall not include the Seller Cure Matters.

3.5Purchaser’s Rights to Terminate.

3.5.1Property Due Diligence Deadline. If, following Purchaser’s due diligence investigations as contemplated in this Section 3.1, Purchaser approves of the condition of the Property in its sole and absolute discretion, then Purchaser shall notify Seller of Purchaser’s

Page 9

election to continue this Agreement in effect by causing a written notice of such election (a “Purchaser’s Property Approval Notice”) to be given to Seller and to Escrow Holder at any time on or before 5:00 p.m. Central time on October 16, 2023 (the “Due Diligence Deadline”). If Purchaser fails to deliver said Purchaser’s Property Approval Notice to Seller and Escrow Holder by the expiration of the Due Diligence Deadline, Purchaser shall be deemed to have elected to terminate this Agreement, in which event the Title Company shall promptly return the Deposit to Purchaser (less the Independent Consideration) and neither party shall have any further liability hereunder except for the Surviving Obligations. If Purchaser’s Property Approval Notice is given prior to the Due Diligence Deadline, Purchaser shall have no further right to terminate this Agreement pursuant to this Section 3.5.1 and the one-half of the Deposit (equal to $100,000.00) (the “Non-Refundable Portion”) shall be non-refundable except as expressly provided in this Agreement. For the avoidance of doubt, the other one-half of the Deposit (equal to $100,000.00) shall be refundable to Purchaser in accordance with the terms of Section 3.5.2.

3.5.2TAMU Approval Deadline. Purchaser shall have until 5:00 p.m. Central time on November 13, 2023 (the “TAMU Approval Deadline”) in order to obtain the approval of the Board of Regents of Ground Lessor (the “TAMU Approval”) to the purchase by Purchaser of the fee interest in that certain approximately 21.401 acres of land and improvements thereon (the “TAMU Purchase Tract,” and described on Exhibit 3.5.2(i) and depicted on Exhibit 3.5.2(ii) attached hereto. If Purchaser obtains the TAMU Approval by the TAMU Approval Deadline, then Purchaser shall notify Seller of Purchaser’s election to continue this Agreement in effect by causing written notice of such election (a “Purchaser’s TAMU Approval Notice”) to be given to Seller and to Escrow Holder prior to the TAMU Approval Deadline. If Purchaser fails to timely deliver Purchaser’s TAMU Approval Notice to Seller and Escrow Holder, Purchaser shall be deemed to have elected to terminate this Agreement, in which event the Title Company shall promptly return one-half of the Deposit to Purchaser (less the Independent Consideration) and deliver the Non-Refundable Portion of the Deposit to Seller and neither party shall have any further liability hereunder except for the Surviving Obligations. If Purchaser’s TAMU Approval Notice is given prior to the TAMU Approval Deadline, Purchaser shall have no further right to terminate this Agreement pursuant to this Section 3.5.2 and the entire the Deposit (equal to $200,000.00) shall be non-refundable except as expressly provided in this Agreement.

3.6Delivery of Title Policy at Closing. As a condition to Purchaser’s obligation to close, the Title Company shall deliver to Purchaser at Closing, a Texas standard form Leasehold Policy of Title Insurance (the “Title Policy”) issued by the Title Company as of the date and time of the recording of the Assignment and Assumption of Ground Lease, in the amount of the Purchase Price, insuring Purchaser as owner of the indefeasible leasehold interest to the Property under the Ground Lease and the Improvements, subject only to the Permitted Encumbrances. Seller shall execute at Closing the form of title affidavit attached hereto as Exhibit 3.6 or otherwise acceptable to Title Company to facilitate the issuance of the Title Policy. The Title Policy may be delivered after the Closing if at the Closing the Title Company issues a currently effective pro forma policy and irrevocably commits in writing to issue the Title Policy in the form of the pro forma policy approved by Purchaser within 10 days after the Closing Date. Purchaser may elect to obtain additional coverage or endorsements to the Title Policy at Purchaser’s sole cost and

Page 10

expense but obtaining such additional coverage or endorsements shall not be a condition precedent to Purchaser’s Closing obligations under this Agreement. Seller shall be responsible for the basic premium payable for Purchaser’s Title Policy (excluding the cost of any extended coverage thereto and the cost of any lender’s policy of title insurance)

4.SELLER’S COVENANTS FOR PERIOD PRIOR TO CLOSING. Until closing, Seller shall:

4.1Insurance. Keep the Property insured under its current or comparable policies against fire and other hazards covered by extended coverage endorsement and commercial general liability insurance against claims for bodily injury, death and property damage occurring in, on or about the Property.

4.2Operation. Operate and maintain the Property substantially in accordance with Seller’s past practices with respect to the Property, normal wear and tear excepted, except that Seller shall have no obligation whatsoever to make any capital expenditures that do not arise out of the acts of Seller. At all times from the Effective Date to the Closing, Seller shall keep and perform all of the obligations to be performed by the tenant under the Ground Lease. Seller may not remove any Personal Property from the Improvements without replacing them with items of like kind (or utility) and quality prior to Closing. Seller shall maintain all insurance policies in effect as required under the Ground Lease. Seller shall give to Purchaser prompt written notice of any casualty or the institution by Seller or receipt of written notice or other knowledge by Seller of any litigation pertaining to the Property and/or any threatened condemnation, or material litigation, arbitration, or administrative hearing affecting the Seller or the Property which could in any way constitute, or have the effect of presently or in the future creating, a lien, encumbrance or claims or obligations in any material respect against the Property or the leasehold estate under the Ground Lease. Seller shall not further encumber any portion of the Property or its leasehold estate under the Ground Lease in any manner without the consent of Purchaser.

4.3New Contracts. Following the Effective Date, Seller shall not enter into any new contract or agreement with respect to the ownership and operation of the Property that would be binding on Purchaser or the Property after the Closing Date, without Purchaser’s prior written approval, not to be unreasonably withheld. Seller shall keep all Warranties in effect in accordance with their terms to the Closing Date.

4.4New Leases. From the Effective Date through the Closing or earlier termination of this Agreement, Seller will not enter into any sublease of any space in the Improvements or terminate or amend any existing sublease without in each case the consent of Purchaser in its sole and absolute discretion.

5.REPRESENTATIONS AND WARRANTIES.

5.1By Seller. Seller represents and warrants to Purchaser as follows:

Page 11

5.1.1Seller is duly organized and validly existing under the laws of the State in which it was organized, is authorized to do business in the State in which the Land is located, has duly authorized the execution and performance of this Agreement, and such execution and performance will not violate any material term of its articles of incorporation or bylaws.

5.1.2Performance of this Agreement will not result in any breach of, or constitute any default under, or result in the imposition of any lien or encumbrance upon the Property under, any agreement to which Seller is a party, including under the Ground Lease.

5.1.3There is no pending litigation with respect to the Property nor, to the best of Seller’s knowledge, have any such actions, suits, proceedings or claims been threatened or asserted in writing, which could have an adverse effect on the Property or Seller’s ability to consummate the transactions contemplated hereby.

5.1.4Seller has not received any written notice from any Governmental Authority (as hereinafter defined) of a violation of any governmental requirements (including environmental laws) on the Property, which has not been remedied.

5.1.5Seller has not received, with respect to the Property, written notice from any Governmental Authority regarding any change to the zoning classification, any condemnation proceedings or proceedings to widen or realign any street or highway adjacent to the Property.

5.1.6Except for Seller, there are no other parties in possession of, or claiming any possession to, any portion of the Improvements. There are no subleases in place with respect to the Property.

5.1.7As of the Effective Date, neither Seller, nor any affiliate or agent on Seller’s behalf, has entered into an agreement for construction or repair work at the Property that could give rise to any claim for mechanic’s or materialman’s liens.

5.1.8The list of Contracts attached as Exhibit 1.1.6 is true, correct and complete in all material respects as of the date of delivery. Except as shown on Exhibit 1.1.6, there are no Contracts in place with respect to the Property. Seller has provided to Purchaser true, correct and complete copies of each of such Contracts. Seller has not delivered or received any notice of default under any Contract.

5.1.9Seller is not a “foreign person” within the meaning of Sections 1445 and 7701 the Internal Revenue Code of 1986, as amended (hereinafter, the “Code”).

5.1.10Seller represents that neither Seller nor any of its affiliates, nor any of their respective partners, members, shareholders or other equity owners, and none of their respective employees, officers, directors, representatives or agents is, nor will they become, a person or entity with whom United States persons or entities are restricted from doing business under regulations of the Office of Foreign Asset Control (“OFAC”) of the Department of the Treasury (including those named on OFAC’s Specially Designated Nationals and Blocked Persons List) or under any

Page 12

statute, executive order (including the September 24, 2001, Executive Order Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism), or other governmental action and is not and will not engage in any dealings or transactions or be otherwise associated with such persons or entities.

5.1.11No petition in bankruptcy (voluntary or otherwise), assignment for the benefit of creditors, or petition seeking reorganization or arrangement or other action under federal or state bankruptcy laws is pending against or contemplated by Seller.

5.1.12There are no special or other assessments for public improvements or otherwise currently affecting the Property, and Seller has not received notice of (a) any threatened special assessments affecting the Property or (b) any contemplated improvements affecting the Property which may result in special assessments affecting the Property. There are no past due taxes or assessments with respect to the Property.

5.1.13There are no pending real estate tax protests or proceedings affecting the Property. Seller has not retained any person or firm to file any notice of protest against, or to commence any action to review, any real property tax assessment against the Property.

5.1.14There are no agreements in effect with any broker or other agent obligating Seller to pay a commission or other compensation with respect to the leasing or sale of the Property that will survive Closing.

5.1.15The Ground Lease is the only agreement in effect between Seller and the Ground Lessor or its affiliates. The copy of the Ground Lease made available by Seller for review by Purchaser is a true and correct copy of the Ground Lease. The Ground Lease has not been modified or amended and remains in full force and effect. Seller is the sole owner of the lessee’s interest under the Ground Lease and Seller has not been assigned, pledged or otherwise encumbered such interests in the Ground Lease except for matters that will be released at or prior to Closing. Seller has received no written notice nor delivered any written notice that: (i) Seller is in default under the Ground Lease; and (ii) Ground Lessor is alleging that Seller has not complied with any of its obligations under the Ground Lease. Other than the approval of the Ground Lessor in accordance with the Ground Lease, Seller does not need to obtain the consent of any third party to the assignment of the Ground Lease or the consummation of the transaction contemplated hereby.

5.1.16Seller has not granted any option to purchase or right of first refusal or other preferential right with respect to the Property.

5.1.17Seller has made available to Purchaser copies of all environmental assessments, reports or other studies in Seller’s possession or control related to Hazardous Materials in, on, under, or that may be released from the Property and such copies are true, correct and complete. As of the date of this Contract, Seller has not received any written warning, notice, notice of violation, administrative complaint, judicial complaint, or other form or informal notice or request for information alleging that Hazardous Materials have been stored or released at the

Page 13

Property, that conditions at the Property are in violation of any Law, or requesting information regarding the use, storage, release, or potential release of Hazardous Materials at the Property. “Hazardous Materials” shall mean materials, wastes or substances that are (A) included within the definition of any one or more of the terms “hazardous substances”, “hazardous materials”, “toxic substances”, “toxic pollutants” and “hazardous waste” in the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended (42 U.S.C. Sections 9601, et seq.), the Resource Conservation and Recovery Act of 1976 (42 U.S.C. Section 6901, et seq.), the Clean Water Act (33 U.S.C. Section 1251, et seq.), the Safe Drinking Water Act (14 U.S.C. Section 1401, et seq.), the Hazardous Materials Transportation Act (49 U.S.C. Section 1801, et seq.), and the Toxic Substance Control Act (15 U.S.C. Section 2601, et seq.) and the regulations promulgated pursuant to such Laws, (B) regulated, or classified as hazardous or toxic, under federal, state or local environmental Laws or regulations, (C) petroleum, (D) asbestos or asbestos-containing materials, (E) polychlorinated biphenyls, (F) flammable explosives or (G) radioactive materials.

The representations and warranties of Seller set forth in this Section 5.1 are made as of the Effective Date and are remade as of the Closing Date. All of the representations and warranties contained in Section 5.1 shall survive the Closing for nine (9) months following the Closing Date (the “Survival Period”). Each such representation and/or warranty shall automatically be null and void and of no further force and effect after the Survival Period unless, prior to the expiration of the Survival Period, Purchaser shall have commenced a legal proceeding against Seller alleging that Seller was in breach of such representation or warranty when made, and that Purchaser has suffered actual damages as a result thereof (a “Proceeding”). If Purchaser shall have timely commenced a Proceeding, and a court of competent jurisdiction shall, pursuant to a final, non-appealable order in connection with such Proceeding, determine that (1) Seller was in breach of a representation or warranty as of the date made (but accounting for all updates permitted hereunder), (2) Purchaser suffered actual damages (as distinguished from consequential damages) (the “Damages”) by reason of such breach, and (3) that Purchaser did not have actual knowledge of such breach on or prior to Closing, then Purchaser shall be entitled to receive an amount equal to its Damages; provided, however that, notwithstanding the foregoing, in no event shall Purchaser be entitled to sue, seek, obtain or be awarded Damages from Seller, unless and until the aggregate amount of Damages for which Seller is obligated to indemnify Purchaser exceeds the sum of Fifty Thousand and 00/100 Dollars ($50,000.00) (the “Base Amount”), whereupon Seller shall be liable to Purchaser for all Damages related to such Proceeding (i.e., liability shall commence at $0.01 if the Base Amount is surpassed), but in no event will Seller be liable to Purchaser to the extent that the aggregate Damages to Purchaser exceed $2,000,000.00. For the avoidance of doubt, Purchaser shall not have an obligation to prove that it had no knowledge of such breach prior to Closing, but Seller may present evidence of Purchaser’s knowledge as a defense to any Proceeding.

For the purposes of this Agreement the term “to Seller’s knowledge”, and similar terms, shall be limited to the actual knowledge of [***] (the “Seller Knowledge Party”). The knowledge of others shall not be imputed to the Seller Knowledge Party. The parties hereby agree that recourse under this Agreement is limited to Seller and no claim will be made against [***] individually or in his capacity as the Seller Knowledge Party.

Page 14

Notwithstanding the foregoing, to the extent that Purchaser, or Purchaser’s Agents obtains actual knowledge prior to Closing that any of Seller’s representations or warranties were untrue in any material respect when made, or if Seller has delivered to Purchaser information with respect to the Property at any time prior to the Closing Date, and such information is inconsistent in any material respect with any of the representations and warranties herein and/or indicate that any such representations or warranties were not true in any material respect when made, Purchaser shall be deemed to have knowledge of such misrepresentation, and Purchaser’s sole remedy as a result thereof shall be to terminate this Agreement and receive a refund of the Deposit, and thereafter, Purchaser and Seller shall have no further rights or obligations under this Agreement except for those which are expressly provided for in this Agreement to survive the termination hereof; and if, notwithstanding such actual knowledge of such breach of a representation, Purchaser elects to close the transactions contemplated by this Agreement, Purchaser shall be deemed to have waived its rights to recover Damages from Seller following the Closing.

5.2By Purchaser. Purchaser represents and warrants to Seller as follows:

5.2.1Purchaser is duly organized, validly existing and in good standing under the laws of the State in which it was organized, is authorized to do business in the State in which the Land is located, has duly authorized the execution and performance of this Agreement, and such execution and performance will not violate any material term of its organizational documents.

5.2.2Purchaser is acting as principal in this transaction with authority to close the transaction.

5.2.3No petition in bankruptcy (voluntary or otherwise), assignment for the benefit of creditors, or petition seeking reorganization or arrangement or other action under federal or state bankruptcy laws is pending against or contemplated by Purchaser.

5.2.4Purchaser represents that neither Purchaser nor any of its affiliates, nor any of their respective partners, members, shareholders or other equity owners, and none of their respective employees, officers, directors, representatives or agents is, nor will they become, a person or entity with whom United States persons or entities are restricted from doing business under regulations of the Office of Foreign Asset Control (“OFAC”) of the Department of the Treasury (including those named on OFAC’s Specially Designated Nationals and Blocked Persons List) or under any statute, executive order (including the September 24, 2001, Executive Order Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism), or other governmental action and is not and will not engage in any dealings or transactions or be otherwise associated with such persons or entities.

The representations and warranties of Purchaser set forth in this Section 5.2 are made as of the Effective Date and are remade as of the Closing Date and Section 5.2 shall survive the Closing.

5.3Broker Representation. Each of Seller and Purchaser represents to the other that it has had no dealings, negotiations, or consultations with any broker, representative, employee, agent or other intermediary in connection with the Agreement or the sale of the Property, except

Page 15

for CBRE, Inc., a Delaware corporation, who represents Seller (“Seller’s Broker”) and Jones Lang LaSalle Americas, Inc., a Maryland corporation, who represents Purchaser (“Purchaser’s Broker” and collectively with Seller’s Broker, the “Brokers”). Upon the Closing of the transaction contemplated hereby and not otherwise, Seller shall pay a commission to Seller’s Broker pursuant to a separate written agreement between Seller and Seller’s Broker (and Seller’s Broker shall be responsible to pay Purchaser’s Broker pursuant to a separate written agreement(s) between them). For convenience, the parties agree that at Closing, the Title Company shall cause (a) the portion of the commission payable by Seller’s Broker to be paid directly to Purchaser’s Broker in satisfaction of Seller’s Broker’s obligation to Purchaser’s Broker and (b) the remainder to be paid to Seller’s Broker. Except for the Brokers, Seller and Purchaser agree that each will indemnify, defend and hold the other free and harmless from the claims of any other broker(s), representative(s), employee(s), agent(s) or other intermediary(ies) claiming to have represented Seller or Purchaser, respectively, or otherwise to be entitled to compensation in connection with this Agreement or in connection with the sale of the Property as a result of actions of Seller or Purchaser, respectively. The terms and provisions of this paragraph shall survive Closing hereunder.

6.COSTS AND PRORATIONS.

6.1Purchaser’s Costs. Purchaser shall pay the following costs of closing this transaction:

6.1.1The fees and disbursements of its counsel, inspecting architect and engineer and any other consultants engaged by Purchaser, if any;

6.1.2The Personal Property, if any, is included in this sale without charge and no value is allocated thereto;

6.1.3The cost of any endorsements or extended coverage to the Title Policy required by Purchaser unless related to a Seller Cure Matter or Title Objections;

6.1.4Any and all recording fees to record Purchaser’s mortgage secured by the Property (if applicable);

6.1.5One-half (1/2) of any and all escrow fees or similar charges of Escrow Holder;

6.1.6All costs relating to updating the Survey; and

6.1.7Any other expense(s) incurred by Purchaser or its representative(s) in inspecting or evaluating the Property or closing this transaction.

6.2Seller’s Costs. Seller shall pay the following costs of closing this transaction:

6.2.1The fees and disbursements of Seller’s counsel.

Page 16

6.2.2Any costs to cure the Seller Cure Matters or other Title Objections that Seller expressly agreed to cure in writing;

6.2.3Reserved;

6.2.4The base premium for the Title Policy in the amount of the Purchase Price;

6.2.5One-half (1/2) of any and all escrow fees or similar charges of Escrow Holder;

6.2.6The cost of recording the Deed;

6.2.7The broker commission payable by Seller to Seller’s Broker and Purchaser’s Broker as provided in Section 5.3.

6.3Prorations. The following shall be prorated as of the Closing Date and be adjusted against the Purchase Price due at Closing: (a) Rents and other amounts payable to Ground Lessor under the Ground Lease with any obligations due and payable to Ground Lessor which are due and payable prior to the Closing Date to be paid by Seller and any amounts due and payable after the Closing Date to be paid by Purchaser, including, but not limited to, with respect to reconciliations; and (b) personal property taxes, installment payments of special assessment liens, sewer charges, utility charges (utility charges shall be prorated based on the last reading of meters prior to Closing performed at Seller’s request, which meter reading shall be done the day prior to the Closing Date) and normally prorated operating expenses actually billed or paid as of the Closing Date. Within one hundred eighty (180) days after the Closing, Purchaser and Seller will make a further adjustment for such rents, taxes or charges which may have accrued or been incurred prior to the Closing Date, but not billed or paid at that date; such obligations shall survive the Closing.

6.4Taxes. General real estate and possessory interest taxes and special assessments relating to the Property and/or Seller’s possessory interest under the Ground Lease (collectively, the “Taxes”), if any, payable during the year in which Closing occurs shall be prorated as of the Closing Date. If Closing shall occur before the actual taxes and special assessments payable during such year are known, the apportionment of Taxes shall be upon the basis of Taxes payable during the immediately preceding year, provided that, if the Taxes payable during the year in which Closing occurs are thereafter determined to be more or less than the Taxes payable during the preceding year (after any appeal of the assessed valuation thereof is concluded), Seller and Purchaser shall promptly within thirty (30) days of receipt of the final tax bill for year of Closing (except in the case of an ongoing tax protest) shall adjust the proration of such Taxes, and Seller or Purchaser, as the case may be, shall pay to the other any amount required as a result of such adjustment and this covenant shall not merge with the instruments executed at Closing and delivered hereunder but shall survive the Closing. The provisions of this Section 6.4 shall survive Closing or the termination of this Agreement.

Page 17

6.5In General. Any other costs or charges of closing this transaction not specifically mentioned in this Agreement shall be paid and adjusted in accordance with local custom in the County in which the Land is located. All prorations shall be made on a 365-day calendar year basis, based on the actual number of days in the applicable month. The provisions of this Section 6.5 shall survive Closing or the termination of this Agreement.

6.6Purpose and Intent. Except as expressly provided herein, the purpose and intent as to the provisions of prorations and apportionments set forth in this Section 6 and elsewhere in this Agreement is that Seller shall bear all expenses of ownership and operation of the Property and shall receive all income therefrom accruing through midnight at the end of the day preceding the Closing Date and Purchaser shall bear all such expenses and receive all such income accruing thereafter. The provisions of this Section 6.6 shall survive Closing or the termination of this Agreement.

7.DAMAGE, DESTRUCTION OR CONDEMNATION.

7.1Material Event. If, prior to Closing, the Property is subject to a casualty or a condemnation event which results in (i) [reserved]; (ii) the Improvements being damaged, destroyed or taken under power of eminent domain and the cost of repair exceeds twenty percent (20%) of the Purchase Price (as reasonably determined by Seller and its contractors in consultation with Purchaser), (iii) [reserved]; (iv) any access point used for ingress and egress to the Land rendered permanently or temporarily blocked, (v) the right of Ground Lessor to terminate the Ground Lease, or (vi) damage or destruction which is not insured fully insured (as reasonably determined by Purchaser) and for which Purchaser will not receive a credit in the amount of the uninsured portion of such damage at Closing (collectively, a “Material Event”), then Seller shall promptly notify Purchaser and Purchaser may elect to terminate this Agreement by giving written notice of its election to Seller within seven (7) days after receiving notice of such destruction or taking and the expense to repair, if applicable. If Purchaser does not give such written notice within such seven (7) day period, this transaction shall be consummated on the Closing Date and at the Purchase Price provided for in Section 2, and Seller will assign to Purchaser the casualty insurance proceeds (including any rent loss proceeds relating to the period from and after Closing) payable to Seller, or Seller’s portion of any condemnation award, in both cases, up to the amount of the Purchase Price, and, if an insured casualty, pay to Purchaser the amount of any deductible but not to exceed the amount of the loss. If requested by Purchaser, Seller hereby agrees to bring and use reasonable efforts to prosecute a claim for recovery under Seller’s insurance policies.

7.2Immaterial Event. If, prior to Closing, the Property is subject to a casualty or a condemnation event that is not a Material Event, Purchaser shall close this transaction on the date and at the Purchase Price agreed upon in Section 2, and Seller will assign to Purchaser the physical damage proceeds of any insurance policies payable to Seller, or Seller’s rights to any portion of any condemnation award, in both cases, up to the amount of the Purchase Price and, if an insured casualty, pay to Purchaser the amount of any deductible but not to exceed the amount of the loss. If requested by Purchaser, Seller hereby agrees to bring and use reasonable efforts to prosecute a claim for recovery under Seller’s insurance policies.

Page 18

7.3Termination and Return of Deposit. If Purchaser elects to terminate this Agreement pursuant to this Section 7, Seller shall promptly direct the Title Company to return the Deposit to Purchaser, and neither party shall have any further liability hereunder except for the Surviving Obligations.

8.NOTICES. Any notice required or permitted to be given hereunder shall be given by (i) hand delivery, (ii) overnight express service, or (iii) email provided notice is also sent by (i) or (ii) above, and in any such case addressed to the parties at their respective addresses referenced below. Notices shall be deemed received upon delivery or refusal of same; any notice received on a non-business day or after 5:00 p.m. Central time on a business day shall be deemed received on the next business day.

Page 19

IF TO SELLER: | iBio, Inc. 11750 Sorrento Valley Road, Suite 200 San Diego, CA 92121 Attn: Felipe Duran, CFO Email: felipe.duran@ibioinc.com With Copy to: legal@ibioinc.com |

WITH A COPY TO: | Blank Rome LLP 1271 Avenue of the Americas New York, NY 10020 Attention: Corey Tarzik, Esq. Email: corey.tarzik@blankrome.com |

IF TO PURCHASER: | Majestic Realty Co. 13191 Crossroads Parkway North, 6th Floor City of Industry, California 91746 Attn: John Semcken Email: JSemcken@majesticrealty.com |

WITH A COPY TO: | Seyfarth Shaw LLP 601 South Figueroa Street, Suite 3300 Los Angeles, California 90017 Attention: Dana S. Treister Email: Dtreister@seyfarth.com |

IF TO TITLE COMPANY: | Chicago Title Insurance Company 23929 Valencia Blvd., Suite 304 Valencia, CA 91355 Attn: Maggie G. Watson Email: Maggie.Watson@ctt.com |

or in each case to such other address as either Purchaser or Seller may from time to time designate by giving notice in writing to the other party. Effective notice will be deemed given only as provided above. Notices on behalf of the respective parties may be given by their attorneys and such notices shall have the same effect as if in fact given by the party on whose behalf it is given.

9.CLOSING AND ESCROW.

9.1Escrow Instructions.

9.1.1Instructions. Purchaser and Seller each shall promptly deposit a copy of this Agreement executed by such party (or either of them shall deposit a copy executed by both Purchaser and Seller) with Escrow Holder, and, upon receipt of the Deposit from Purchaser, Escrow Holder shall immediately execute this Agreement where provided below. This

Page 20

Agreement, together with such further instructions, if any, as the parties shall provide to Escrow Holder by written agreement, shall constitute the escrow instructions. If any requirements relating to the duties or obligations of Escrow Holder hereunder are not acceptable to Escrow Holder, or if Escrow Holder requires additional instructions, the parties hereto agree to make such deletions, substitutions and additions hereto as counsel for Purchaser and Seller shall mutually approve, which additional instructions shall not substantially alter the terms of this Agreement unless otherwise expressly agreed to by Seller and Purchaser.

9.1.2Real Estate Reporting Person. Escrow Holder is hereby designated the “real estate reporting person” for purposes of Section 6045 of Title 26 of the United States Code and Treasury Regulation 1.6045-4 and any instructions or settlement statement prepared by Escrow Holder shall so provide. Upon the consummation of the transaction contemplated by this Contract, Escrow Holder shall file Form 1099 information return and send the statement to Seller as required under the aforementioned statute and regulation. Seller and Purchaser shall promptly furnish their federal tax identification numbers to Escrow Holder and shall otherwise reasonably cooperate with Escrow Holder in connection with Escrow Holder’s duties as real estate reporting person.

9.1.3Liability of Escrow Holder. The parties acknowledge that the Escrow Holder shall be conclusively entitled to rely, except as hereinafter set forth, upon a certificate from Purchaser or Seller as to how the Deposit (which, for purposes of this Section 9.1.3 shall be deemed to also include any other escrowed funds held by the Escrow Holder pursuant to this Agreement) should be disbursed. Any notice sent by Seller or Purchaser (the “Notifying Party”) to the Escrow Holder shall be sent simultaneously to the other noticed parties pursuant to Section 8 herein (the “Notice Parties”). If the Notice Parties do not object to the Notifying Party’s notice to the Escrow Holder within ten (10) days after the Notice Parties’ receipt of the Notifying Party’s certificate to the Escrow Holder, the Escrow Holder shall be able to rely on the same. If the Notice Parties send, within such ten (10) days, written notice to the Escrow Holder disputing the Notifying Party’s certificate, a dispute shall exist, and the Escrow Holder shall hold the Deposit as hereinafter provided. The parties hereto hereby acknowledge that Escrow Holder shall have no liability to any party on account of Escrow Holder’s failure to disburse the Deposit if a dispute shall have arisen with respect to the propriety of such disbursement and, in the event of any dispute as to who is entitled to receive the Escrow Holder, disburse them in accordance with the final order of a court of competent jurisdiction, or to deposit or interplead such funds into a court of competent jurisdiction pending a final decision of such controversy. The parties hereto further agree that Escrow Holder shall not be liable for failure to any depository and shall not be otherwise liable except in the event of Escrow Holder’s gross negligence or willful misconduct. The Escrow Holder shall be reimbursed on an equal basis by Purchaser and Seller for any reasonable expenses incurred by the Escrow Holder arising from a dispute with respect to the Deposit. The obligations of Seller with respect to the Escrow Holder are intended to be binding only on Seller and Seller’s assets and shall not be personally binding upon, nor shall any resort be had to, the private properties of any of the partners, officers, directors, shareholders or beneficiaries of Seller, or of any partners, officers, directors, shareholders or beneficiaries of any partners of Seller, or of any of Seller’s employees or agents.

Page 21

9.2Seller’s Deliveries. Seller shall deliver either at the Closing or by making available at the Property, as appropriate, the following original documents, each executed and, if required, acknowledged:

9.2.1An Assignment and Assumption of Ground Lease, in the form attached hereto as Exhibit 9.2.1.

9.2.2Reserved;

9.2.3A Bill of Sale and Assignment and Assumption Agreement in the form attached hereto as Exhibit 9.2.3.

9.2.4The Ground Lease and all books and records at the Property held by or for the account of Seller, including, without limitation, plans and specifications, as available.

9.2.5Copies of all Contracts relating to the Property shown on Exhibit 1.1.5 which Purchaser has elected to assume or which are not terminable by Seller on or before the Closing Date.

9.2.6An affidavit pursuant to the Foreign Investment and Real Property Tax Act in the form attached hereto as Exhibit 9.2.6.

9.2.7An Owner’s Affidavit in substantially the form of Exhibit 3.6 attached hereto.

9.2.8Consent from Ground Lessor to the assignment of the Ground Lease by Seller to Purchaser on such form as Ground Lessor may require.

9.2.9A certificate in form reasonably acceptable to Purchaser restating and reaffirming Seller’s representations pursuant to Section 5.1 hereof, with such changes as shall be necessary to make such representations true, complete, and accurate in all material respects as of the date and time of Closing.

9.2.10Any other documents reasonably required by the Title Company in connection with the Closing.

9.3Purchaser’s Deliveries. At the Closing, Purchaser shall (i) pay Seller the Purchase Price; and (ii) execute the agreements referred to in Sections 9.2.1 and 9.2.3; and (iii) deliver such other documents as reasonably required by the Title Company in connection with the Closing.

9.4Possession. Purchaser shall be entitled to possession of the Property upon conclusion of the Closing, subject to the Ground Lease.

9.5Insurance. Seller shall terminate its policies of insurance as of noon on the Closing Date, and Purchaser shall be responsible for obtaining its own insurance thereafter.

Page 22

9.6Purchaser’s Conditions Precedent to Closing. Purchaser’s obligation to consummate the transaction contemplated by this Agreement will be subject to satisfaction or waiver of each of the following conditions (“Purchaser’s Closing Conditions Precedent”); provided, however, that Purchaser will have the unilateral right to waive any Purchaser’s Closing Condition Precedent, in whole or in part, by written notice received by Seller on or before the Closing Date:

(i)Representations and Warranties of Seller. The representations and warranties of Seller set forth in Section 5.1 hereof, will be true and correct in all material respects; provided, however, Seller shall not be in default hereunder if any such representations or warranties (which were true in all material respects when made) have become untrue in any material respect after the Effective Date due to any reason other than any act or omission of Seller in violation of the express terms of this Agreement.

(ii)Obligations of Seller. Seller will have performed all of the obligations required to be performed by Seller under this Agreement in all material respects.

(iii)Seller’s Closing Documents. Seller shall have executed and delivered all of the documents provided in Section 9.2 above.

(iv)Reserved.

(v)Ground Lessor Consent. Seller shall have delivered to Purchaser the consent from Ground Lessor to the assignment of the Ground Lease by Seller to Purchaser.

(vi)Ground Lease. The Ground Lease shall be in full force and effect and no defaults thereunder shall exist.

(vii)TAMU Approval. Purchaser shall have obtained the TAMU Approval prior to the TAMU Approval Deadline.

(viii)Title Policy. Title Company shall be irrevocably committed to issue the Owner’s Policy showing no exceptions other than the Permitted Encumbrances and containing such endorsements as Purchaser may require.

10.DEFAULT; FAILURE OF CONDITION.

10.1Purchaser Default. If Purchaser shall become in breach of or default in its Closing obligations under this Agreement, as Seller’s sole and exclusive remedy, the entire Deposit shall be retained by Seller as liquidated damages, and both parties shall be relieved of and released from any further liability hereunder except for the Surviving Obligations. Seller and Purchaser agree that the amount of the Deposit is a fair and reasonable amount to be retained by Seller as agreed and liquidated damages in light of Seller’s removal of the Property from the market and the costs incurred by Seller and shall not constitute a penalty or a forfeiture.

Page 23

10.2Seller Default. If Seller shall refuse or fail to convey the Property as herein provided for any reason other than (a) a default by Purchaser or (b) any other provision of this Agreement which permits Seller to terminate this Agreement, Purchaser shall elect as its sole and exclusive remedy hereunder either to (i) terminate the Agreement and recover the Deposit, less the Independent Consideration, and Seller shall reimburse Purchaser for all of Purchaser’s Costs (as hereinafter defined), which reimbursement shall be paid within thirty (30) days following termination and Seller’s receipt of reasonable supporting information for the costs incurred, or; (ii) enforce specific performance and filing suit within the time period required under applicable law. If the remedy if specific performance is not available as a result of Seller’s having conveyed the Property to another entity or encumbered the Property after the Effective Date, then Purchaser shall have all remedies at law or in equity without limitation. For the purposes of this Agreement, the term “Purchaser’s Costs” shall mean all third-party expenses incurred by Purchaser in connection with the Property and this Agreement related to: title examination, due diligence and third-party investigations, studies and reports related to the Property, and reasonable attorneys’ fees incurred by Purchaser in connection the drafting and/or negotiating this Agreement and in connection with the conduct of due diligence by Purchaser; provided, however, that in no event shall Purchaser’s Costs exceed, in the aggregate, the sum of $50,000.

10.3Failure of Condition. In the event a condition to Closing is not satisfied and the reason for such failure of condition is not due to a breach or default by Seller or Purchaser, hereunder, then at the option of the party in whose favor such condition was given shall have the right to terminate this Agreement upon written notice to the other party, in which event the Deposit (less the independent consideration) will be returned to Purchaser and the parties shall have no further obligations under this Agreement except for the Surviving Obligations. If Seller breaches the terms of this Agreement, or if any representation or warranty of Seller contained in this Agreement or was untrue in any material respect when made or is untrue as of the Closing Date due to any act or omission by Seller in violation or breach of this Agreement, then subject to the last paragraph of Section 5.1, Seller shall be in default hereunder and Purchaser shall have the remedies set forth in Section 10.2 above.

11.MISCELLANEOUS.

11.1Entire Agreement. This Agreement, together with the Exhibits attached hereto, all of which are incorporated by reference, is the entire agreement between the parties with respect to the subject matter hereof, and no alteration, modification or interpretation hereof shall be binding unless in writing and signed by both parties.

11.2Severability; Construction. If any provision of this Agreement or application to any party or circumstances shall be determined by any court of competent jurisdiction to be invalid and unenforceable to any extent, the remainder of this Agreement or the application of such provision to such person or circumstances, other than those as to which it is so determined invalid or unenforceable, shall not be affected thereby, and each provision hereof shall be valid and shall be enforced to the fullest extent permitted by law. All dollar amounts stated in this Agreement are U.S. dollar amounts. The normal rule of construction that any ambiguities be resolved against the

Page 24

drafting party shall not apply to the interpretation of this Agreement or any exhibits or amendments hereto.

11.3Applicable Law; Venue. This AGREEMENT and any claim, controversy or dispute arising under or related to this agreement, the relationship of the parties, and/or the interpretation and enforcement of the rights and duties of the parties will be governed by the laws of the State where the Property is located without regard to any conflicts of law principles. THIS AGREEMENT IS PERFORMABLE IN AND EXCLUSIVE VENUE FOR ANY ACTION BROUGHT WITH RESPECT HERETO SHALL LIE IN THE STATE COURT FOR THE COUNTY IN WHICH THE LAND IS LOCATED, OR, IF APPLICABLE, THE UNITED STATES DISTRICT COURT FOR THE DISTRICT IN WHICH THE LAND IS LOCATED, WITHOUT REGARD TO CONFLICTS IN LAW.

11.4Assignability. Except for an assignment to an affiliate of Purchaser, which shall not require the consent of Seller, Purchaser may not assign this Agreement without first obtaining Seller’s written consent. Any assignment in contravention of this provision shall be void. No assignment shall release the Purchaser herein named from any obligation or liability under this Agreement. Any assignee shall be deemed to have made any and all representations and warranties made by Purchaser hereunder, as if the assignee were the original signatory hereto.

11.5Successors Bound. This Agreement shall be binding upon and inure to the benefit of Purchaser and Seller and their respective successors and permitted assigns.

11.6Intentionally Omitted.

11.7No Public Disclosure. Neither Seller nor Purchaser will release or cause or permit to be released any press notices, or publicity or advertising promotion relating to, or otherwise announce or disclose or cause or permit to be announced or disclosed, in any manner whatsoever, the terms, conditions or substance of this Agreement without first obtaining the written consent of the other party; provided, however, that after Closing the foregoing agreement shall be binding on Seller and its Representatives (as defined below), but shall not be binding on Purchaser and its Representatives. The foregoing shall not preclude either party from discussing the substance or any relevant details of such transactions with any of its attorneys, accountants, professional consultants, lenders, partners, investors, or any prospective lender, partner or investor, as the case may be (each a Representative), or prevent either party hereto, from complying with laws, rules, regulations and court orders, including without limitation, governmental regulatory, disclosure, tax and reporting requirements or enforcing its rights under this Agreement. To the extent that Purchaser or any Representative of Purchaser is required to disclose any such confidential information by law, regulation or stock exchange rule or pursuant to a subpoena, court order or other legal proceeding, Purchaser shall notify Seller within one business day of its knowledge of such legally required disclosure. Purchaser shall cooperate with Seller’s counsel in any appeal or challenge to such disclosure made by Seller. If no protective order or similar relief is obtained, Purchaser: (i) may disclose only that portion of the confidential information that it is legally obligated to disclose, (ii) shall exercise reasonable efforts to obtain reliable assurances that the disclosed information will be kept confidential and (iii) shall exercise reasonable efforts to provide

Page 25

Seller with a copy of the information to be disclosed before the same is given to any third party. Each party shall have the right to seek equitable relief, including without limitation injunctive relief or specific performance, against the other party in order to enforce the provisions of this Section 11.7. The provisions of this Section 11.7 shall survive Closing and any termination of this Agreement.

11.8Captions. The captions in this Agreement are inserted only as a matter of convenience and for reference and in no way define, limit or describe the scope of this Agreement or the scope or content of any of its provisions.

11.9Attorneys’ Fees. In the event of any litigation arising out of this Agreement, the prevailing party shall be entitled to reasonable attorneys’ fees and costs.

11.10No Partnership. Nothing contained in this Agreement shall be construed to create a partnership or joint venture between the parties or their successors in interest.

11.11Time of Essence. Time is of the essence in this Agreement.