| January 2024 Tomorrow’s Precision Antibody Therapeutics Powered by Machine Learning |

| 2 Forward-looking Statements Certain statements in this presentation constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Words such as "may," "might," "will," "should," "believe," "expect," "anticipate," "estimate," "continue," "predict," "forecast," "project," "plan," "intend" or similar expressions, or statements regarding intent, belief, or current expectations, are forward-looking statements. These forward-looking statements are based upon current estimates. While iBio, Inc., a Delaware corporation (including its consolidated subsidiaries, “iBio,” the “Company,” “we,” “us” or “our”) believes these forward-looking statements are reasonable, undue reliance should not be placed on any such forward-looking statements, which are based on information available to us on the date of this presentation. These forward-looking statements are subject to various risks and uncertainties, many of which are difficult to predict that could cause actual results to differ materially from current expectations and assumptions from those set forth or implied by any forward-looking statements. Important factors that could cause actual results to differ materially from current expectations include, among others, the Company’s ability to obtain regulatory approvals for commercialization of its product candidates, or to comply with ongoing regulatory requirements, regulatory limitations relating to its ability to promote or commercialize its product candidates for specific indications, acceptance of its product candidates in the marketplace and the successful development, marketing or sale of products, its ability to attain license agreements, the continued maintenance and growth of its patent estate, its ability to establish and maintain collaborations, its ability to obtain or maintain the capital or grants necessary to fund its research and development activities, competition, its ability to retain its key employees or maintain its NYSE American listing, and the other factors discussed in the Company’s most recent Annual Report on Form 10-K and the Company’s subsequent filings with the SEC, including subsequent periodic reports on Forms 10-Q and 8-K. The information in this presentation is provided only as of today, and we undertake no obligation to update any forward-looking statements contained in this presentation on account of new information, future events, or otherwise, except as required by law. This presentation, and any oral statements made in connection with this presentation, shall not constitute an offer to sell, or the solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other securities of the Company, nor, in connection with any securities offering by the Company, will there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction. |

| * U.S. Patent No. 11,545,238 3 We are developing antibodies for the next generation of difficult targets and modes of action with the goal of engineering high developability and enhanced safety into our molecules |

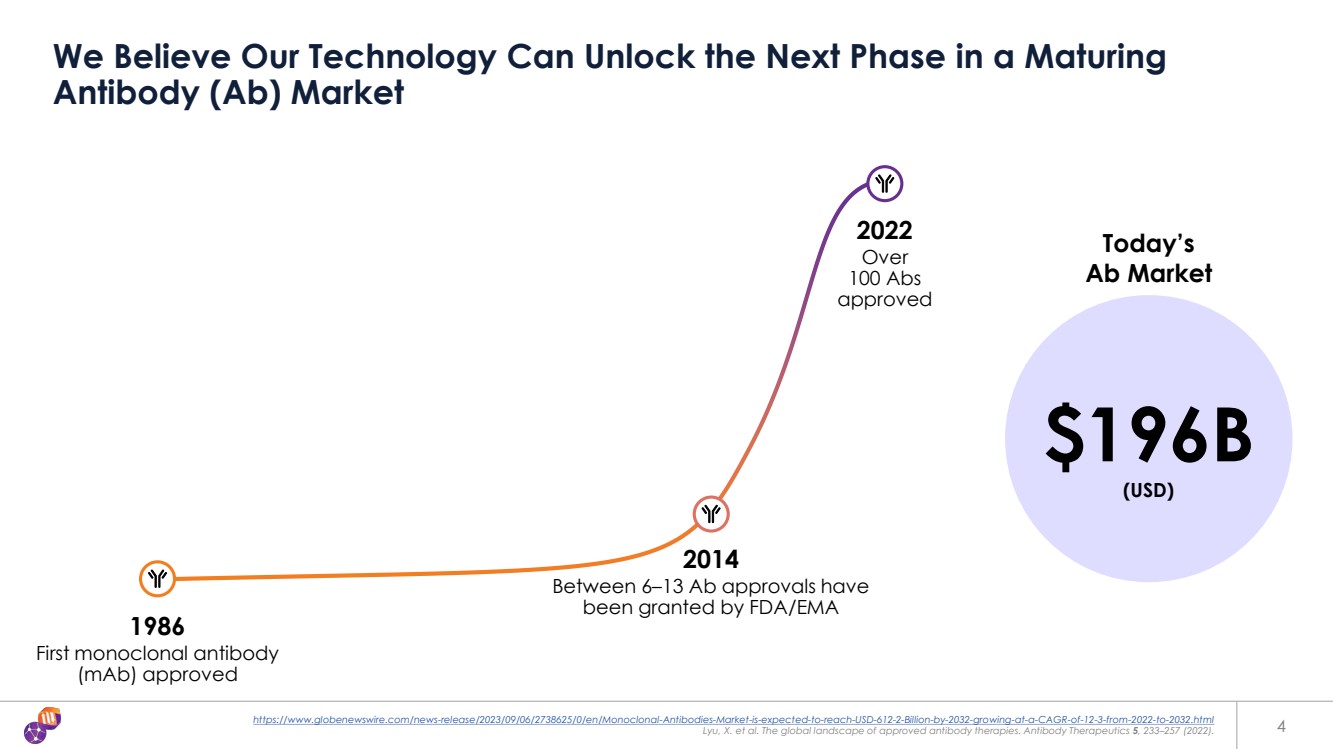

| https://www.globenewswire.com/news-release/2023/09/06/2738625/0/en/Monoclonal-Antibodies-Market-is-expected-to-reach-USD-612-2-Billion-by-2032-growing-at-a-CAGR-of-12-3-from-2022-to-2032.html Lyu, X. et al. The global landscape of approved antibody therapies. Antibody Therapeutics 5, 233–257 (2022). 4 We Believe Our Technology Can Unlock the Next Phase in a Maturing Antibody (Ab) Market 1986 First monoclonal antibody (mAb) approved 2022 Over 100 Abs approved 2014 Between 6–13 Ab approvals have been granted by FDA/EMA $196B (USD) Today’s Ab Market |

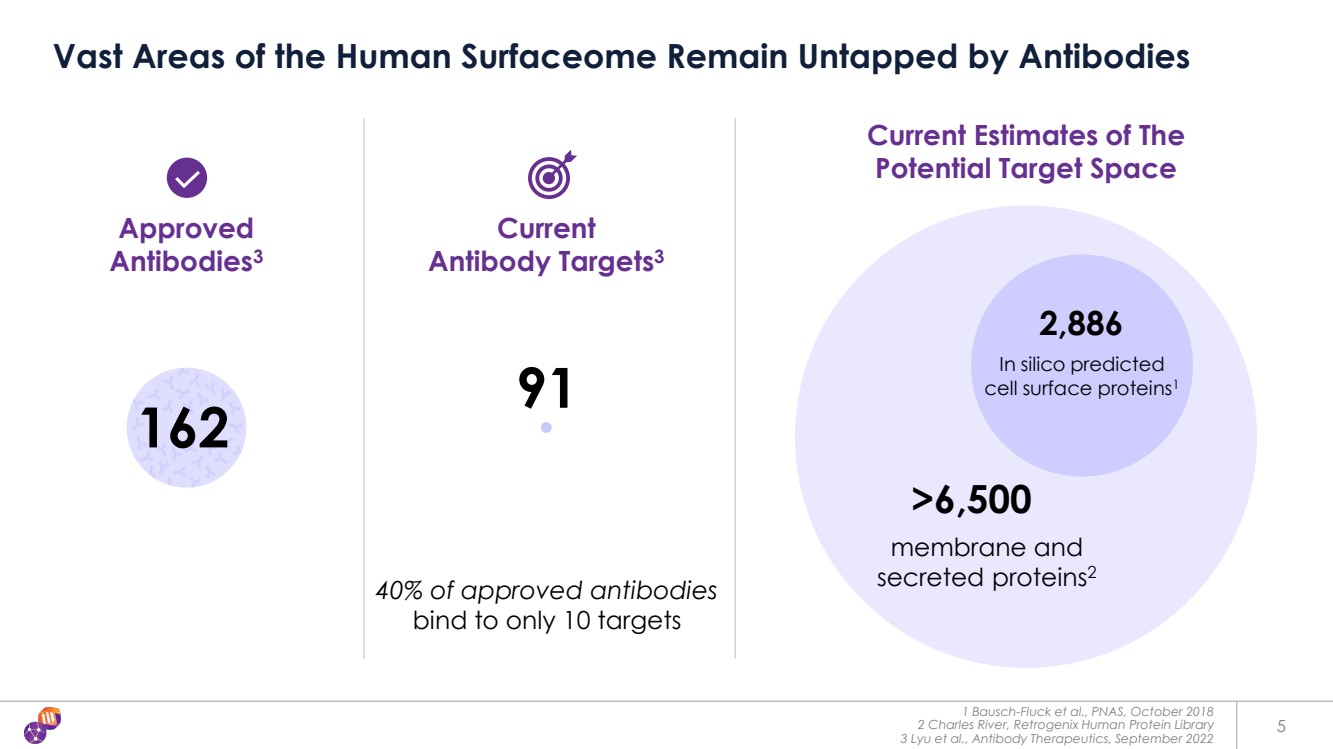

| 1 Bausch-Fluck et al., PNAS, October 2018 2 Charles River, Retrogenix Human Protein Library 3 Lyu et al., Antibody Therapeutics, September 2022 5 Vast Areas of the Human Surfaceome Remain Untapped by Antibodies 91 Approved Antibodies3 2,886 >6,500 In silico predicted cell surface proteins1 membrane and secreted proteins2 Current Antibody Targets3 Current Estimates of The Potential Target Space 162 40% of approved antibodies bind to only 10 targets |

| The era of low-hanging fruit is over-saturated Existing techniques do not address increasing target complexity and modes of actions ADCs and bispecifics have proven successful but revealed off-tissue safety concerns Antibody developability has surfaced as critical hurdles 6 Today’s Ab Market Challenge: Complex Targets, Safety & Developability Issues |

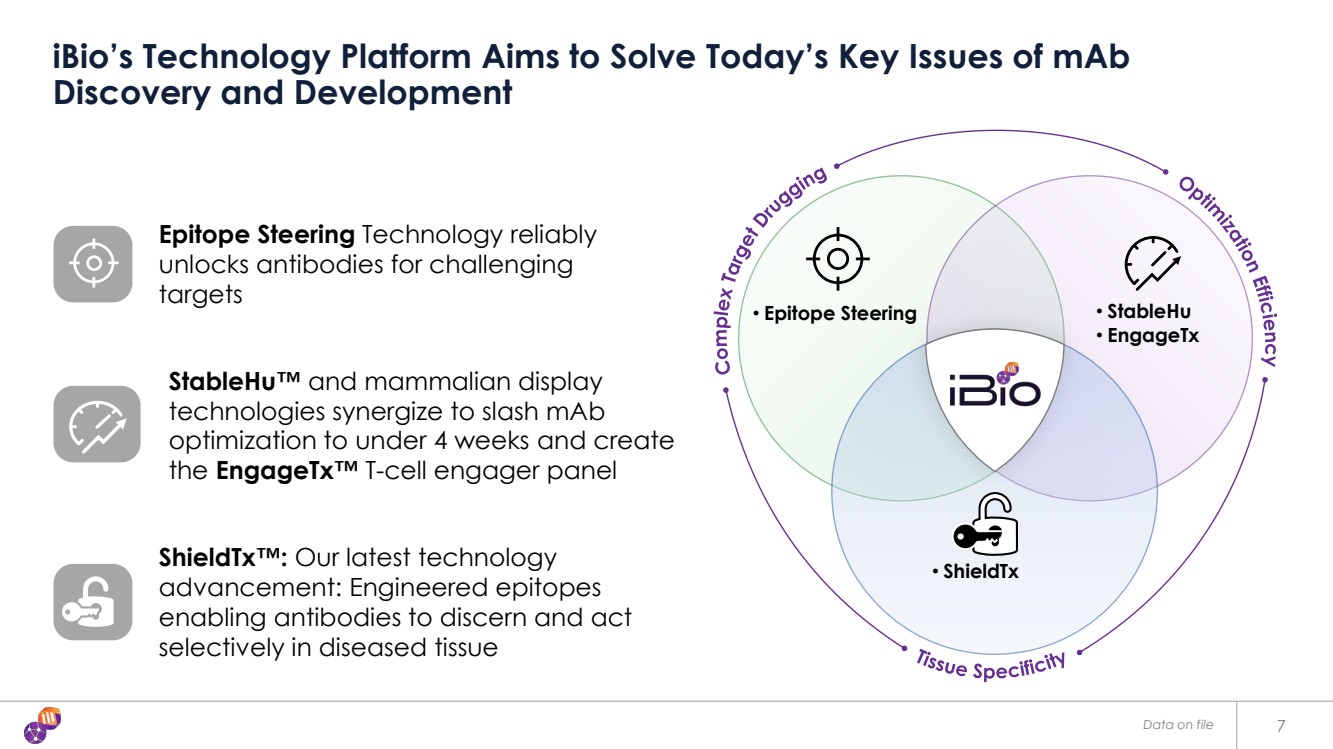

| 7 iBio’s Technology Platform Aims to Solve Today’s Key Issues of mAb Discovery and Development Epitope Steering Technology reliably unlocks antibodies for challenging targets StableHu™ and mammalian display technologies synergize to slash mAb optimization to under 4 weeks and create the EngageTx™ T-cell engager panel ShieldTx™: Our latest technology advancement: Engineered epitopes enabling antibodies to discern and act selectively in diseased tissue Optimization Efficie n c y C o m plex Target Drugging Tissue Specificity • Epitope Steering • StableHu • EngageTx • ShieldTx Data on file |

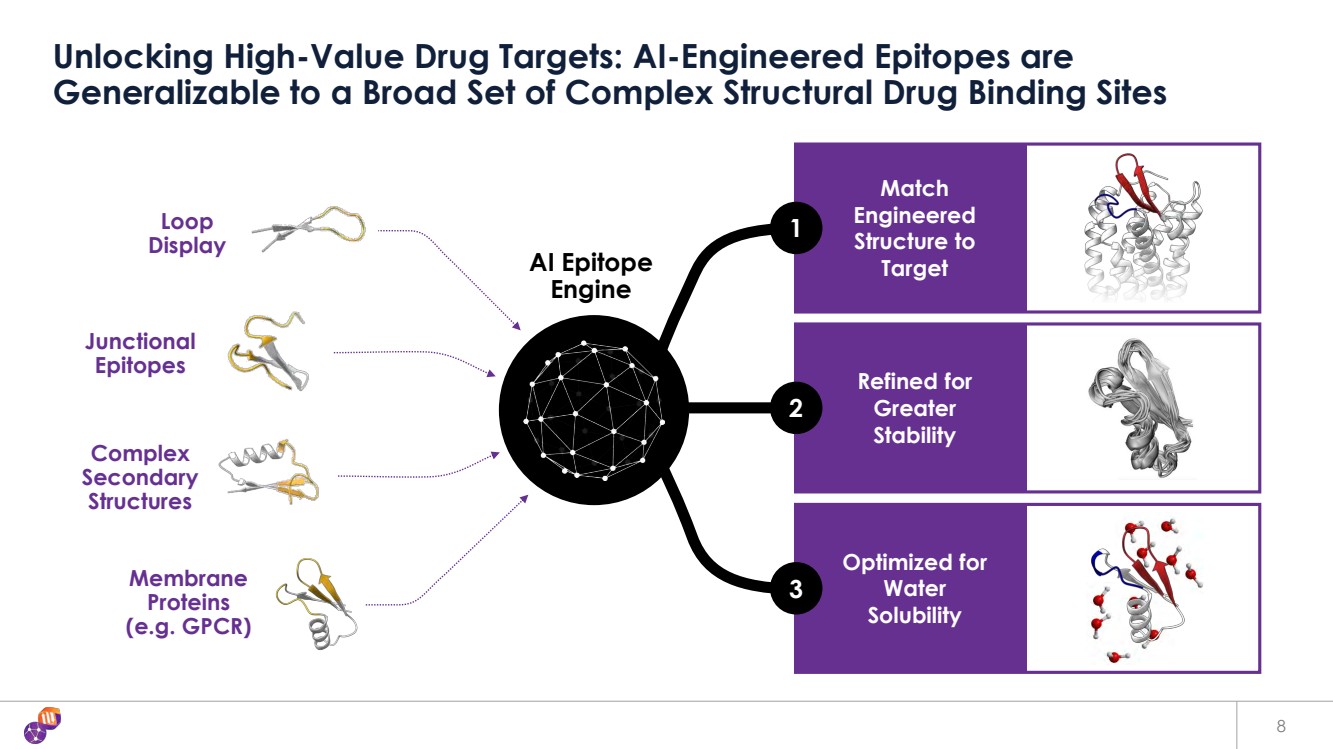

| Match Engineered Structure to Target Refined for Greater Stability Optimized for Water Solubility Unlocking High-Value Drug Targets: AI-Engineered Epitopes are Generalizable to a Broad Set of Complex Structural Drug Binding Sites Junctional Epitopes Complex Secondary Structures Membrane Proteins (e.g. GPCR) Loop Display 1 2 3 AI Epitope Engine 8 |

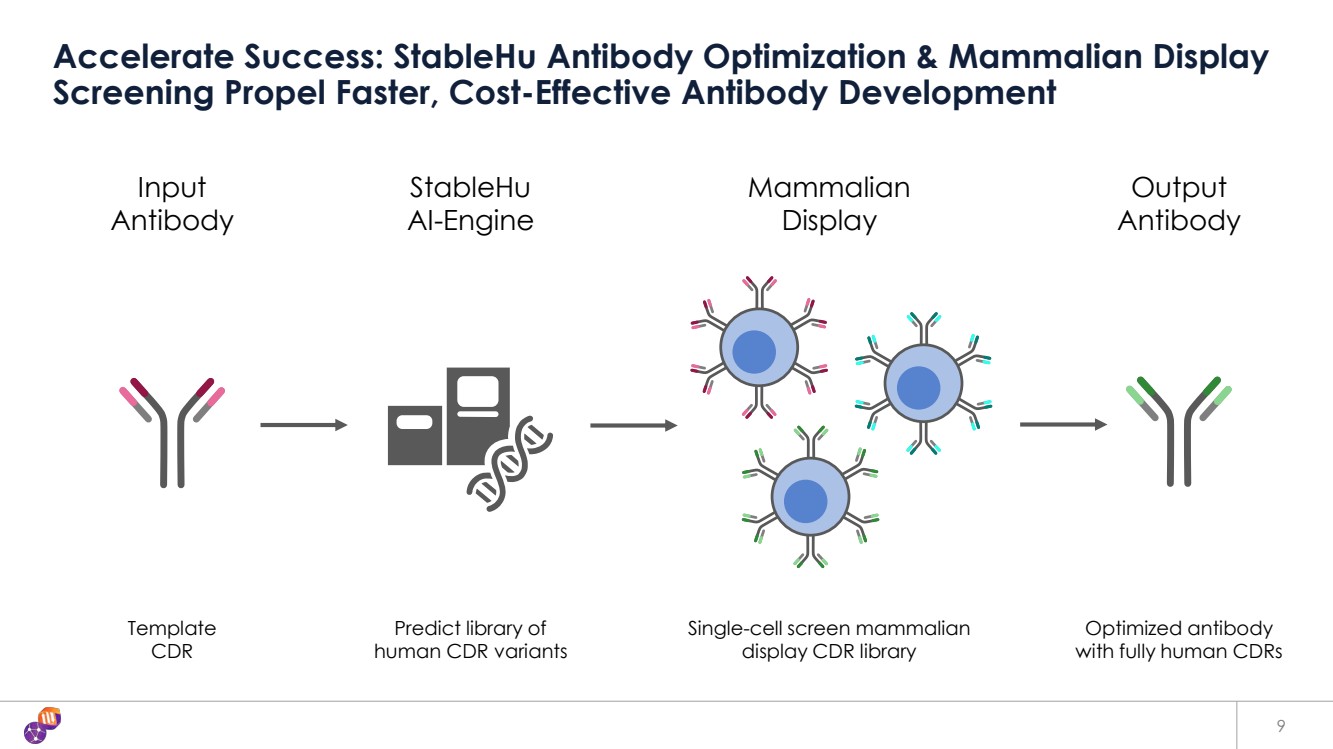

| Input Antibody StableHu AI-Engine Mammalian Display Output Antibody Template CDR Predict library of human CDR variants Single-cell screen mammalian display CDR library Optimized antibody with fully human CDRs Accelerate Success: StableHu Antibody Optimization & Mammalian Display Screening Propel Faster, Cost-Effective Antibody Development 9 |

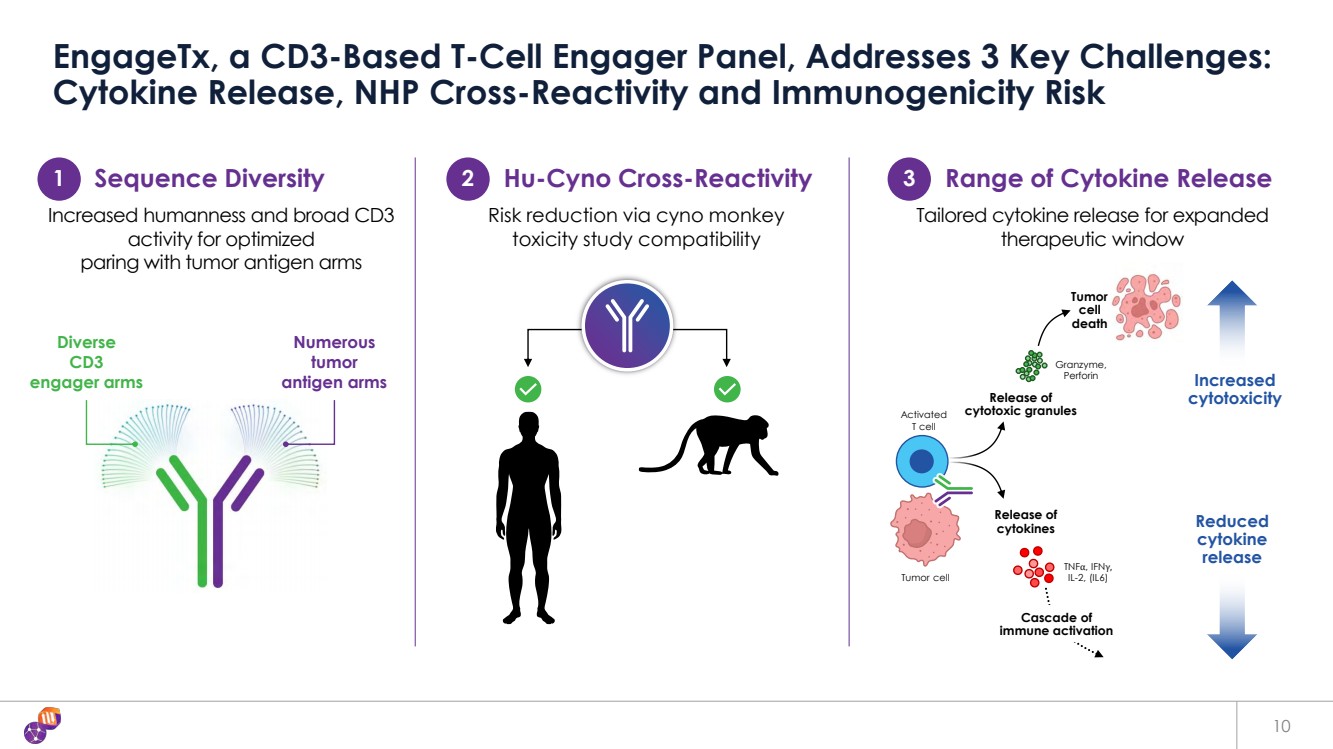

| 10 EngageTx, a CD3-Based T-Cell Engager Panel, Addresses 3 Key Challenges: Cytokine Release, NHP Cross-Reactivity and Immunogenicity Risk Numerous tumor antigen arms Diverse CD3 engager arms 1 Sequence Diversity 2 Hu-Cyno Cross-Reactivity 3 Range of Cytokine Release Increased humanness and broad CD3 activity for optimized paring with tumor antigen arms Risk reduction via cyno monkey toxicity study compatibility Tailored cytokine release for expanded therapeutic window Release of cytokines TNFα, IFNγ, IL-2, (IL6) Increased cytotoxicity Reduced cytokine release Release of cytotoxic granules Granzyme, Perforin Cascade of immune activation Tumor cell death Activated T cell Tumor cell |

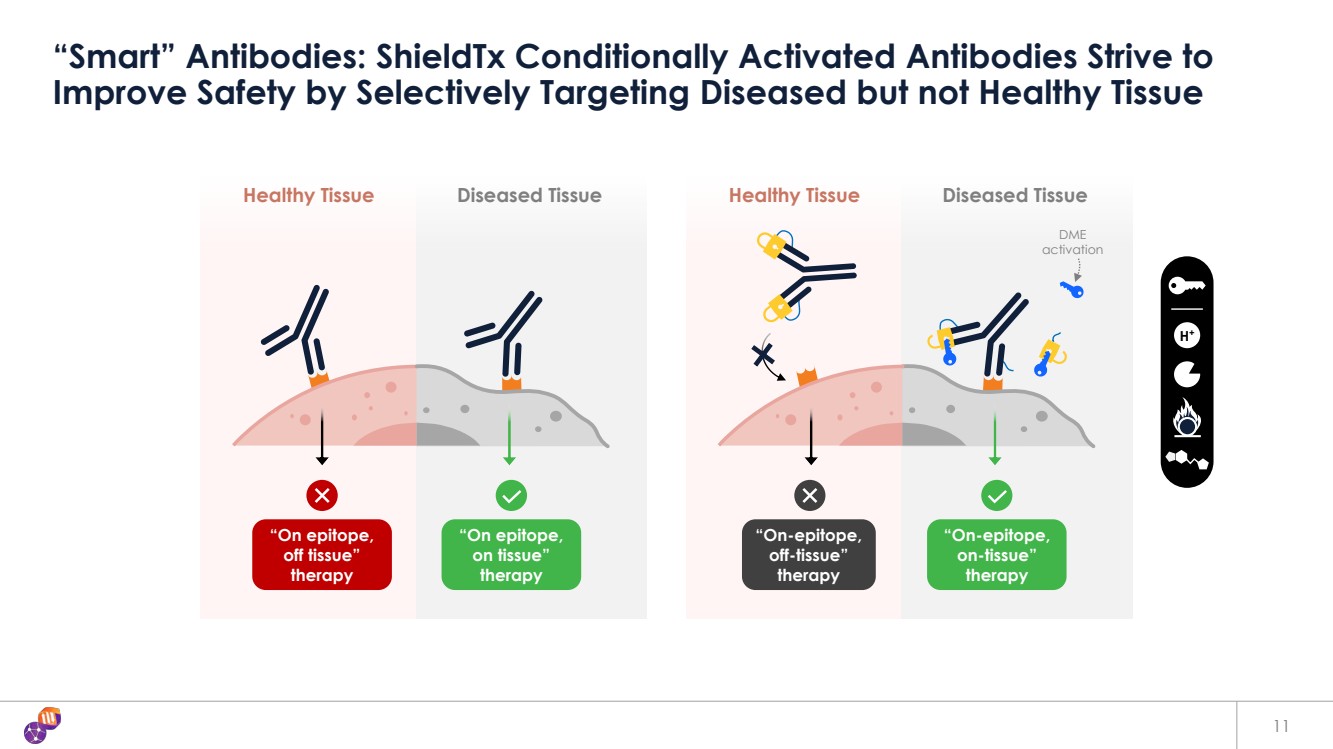

| 11 “Smart” Antibodies: ShieldTx Conditionally Activated Antibodies Strive to Improve Safety by Selectively Targeting Diseased but not Healthy Tissue H+ Diseased Tissue “On-epitope, off-tissue” therapy Healthy Tissue “On-epitope, on-tissue” therapy DME activation Diseased Tissue “On epitope, on tissue” therapy Healthy Tissue “On epitope, off tissue” therapy |

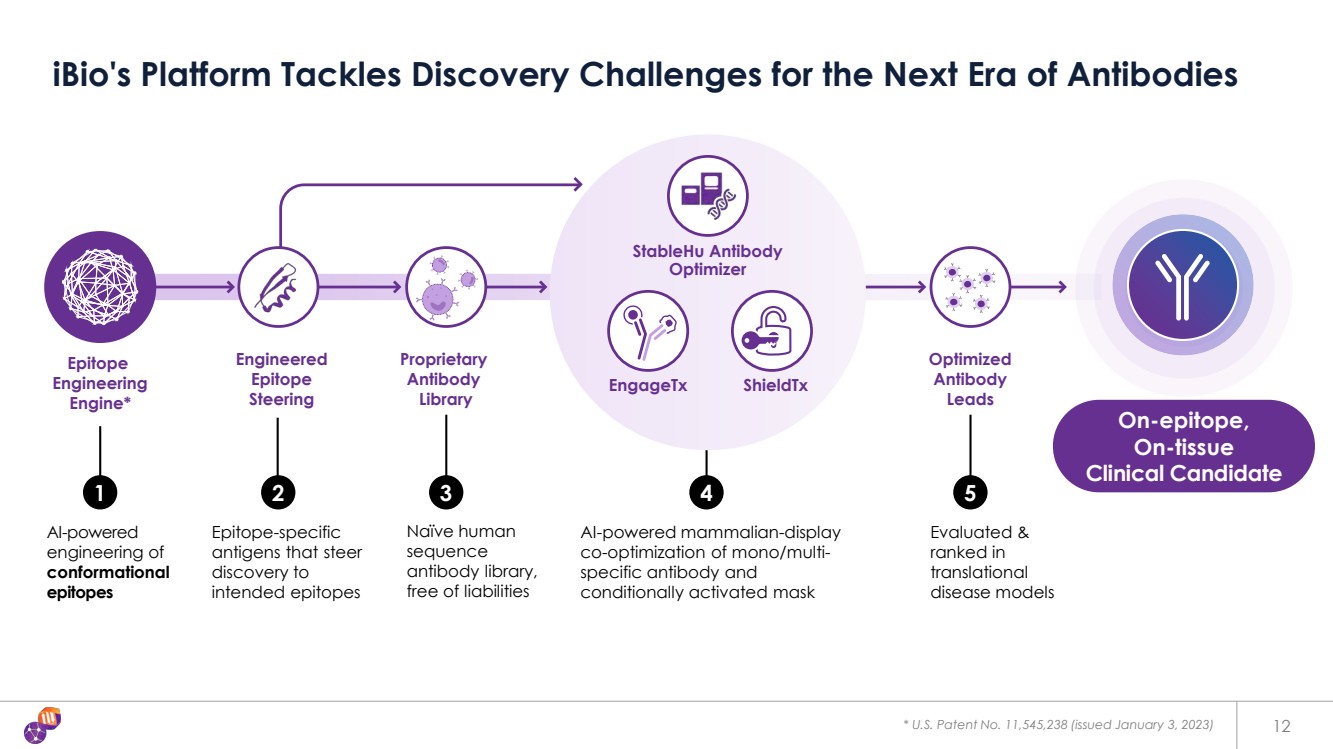

| Epitope Engineering Engine* Proprietary Antibody Library AI-powered mammalian-display co-optimization of mono/multi-specific antibody and conditionally activated mask Engineered Epitope Steering AI-powered engineering of conformational epitopes Epitope-specific antigens that steer discovery to intended epitopes 1 2 3 4 Naïve human sequence antibody library, free of liabilities Optimized Antibody Leads 5 Evaluated & ranked in translational disease models * U.S. Patent No. 11,545,238 (issued January 3, 2023) iBio's Platform Tackles Discovery Challenges for the Next Era of Antibodies EngageTx ShieldTx StableHu Antibody Optimizer On-epitope, On-tissue Clinical Candidate 12 |

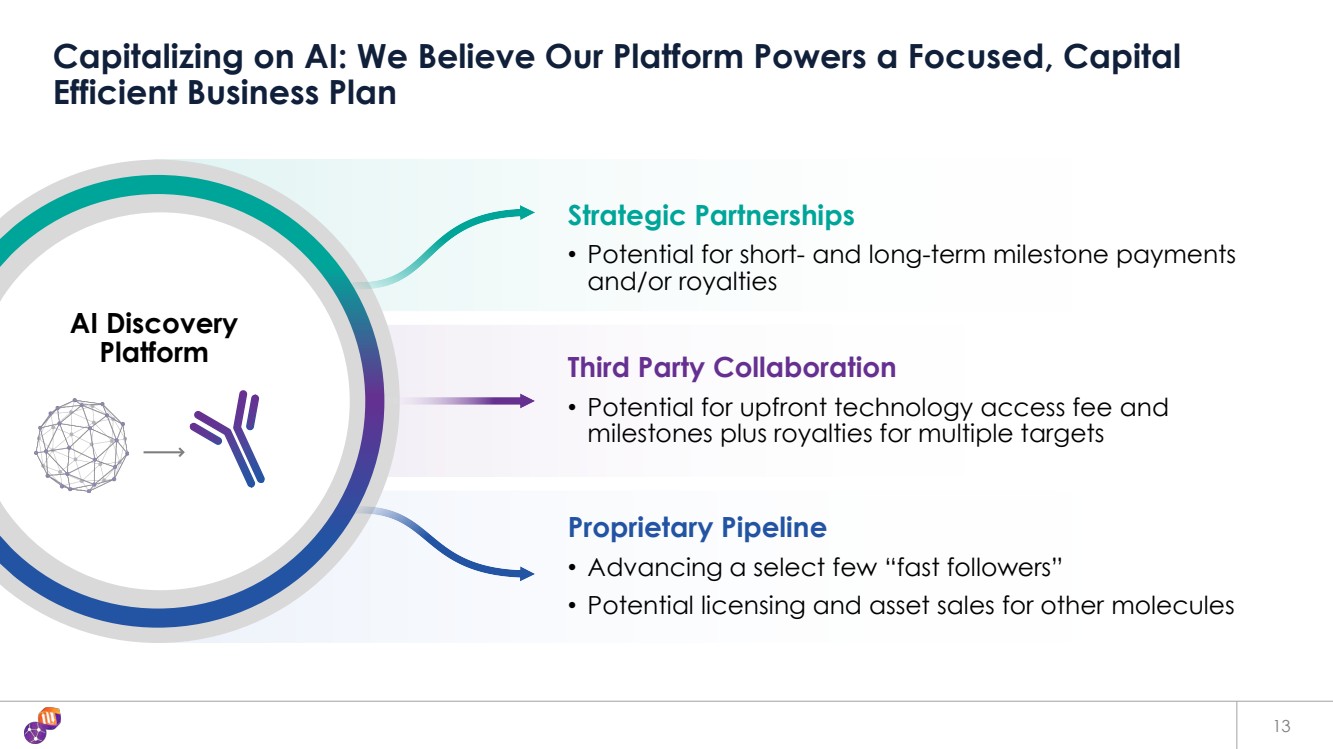

| AI Discovery Platform Proprietary Pipeline • Advancing a select few “fast followers” • Potential licensing and asset sales for other molecules Third Party Collaboration • Potential for upfront technology access fee and milestones plus royalties for multiple targets Capitalizing on AI: We Believe Our Platform Powers a Focused, Capital Efficient Business Plan 13 Strategic Partnerships • Potential for short- and long-term milestone payments and/or royalties |

| Partner existing molecules or discovery projects against new targets Strategic Partnerships 14 Partners and Collaborators Trusting in iBio’s Ability to Solve Today’s Drug Discovery Challenges Exclusive licensing for non-core therapeutic areas to 3rd parties (vaccines, etc.) Third Party Collaborations NIH Eli Lilly Collaborations … and more |

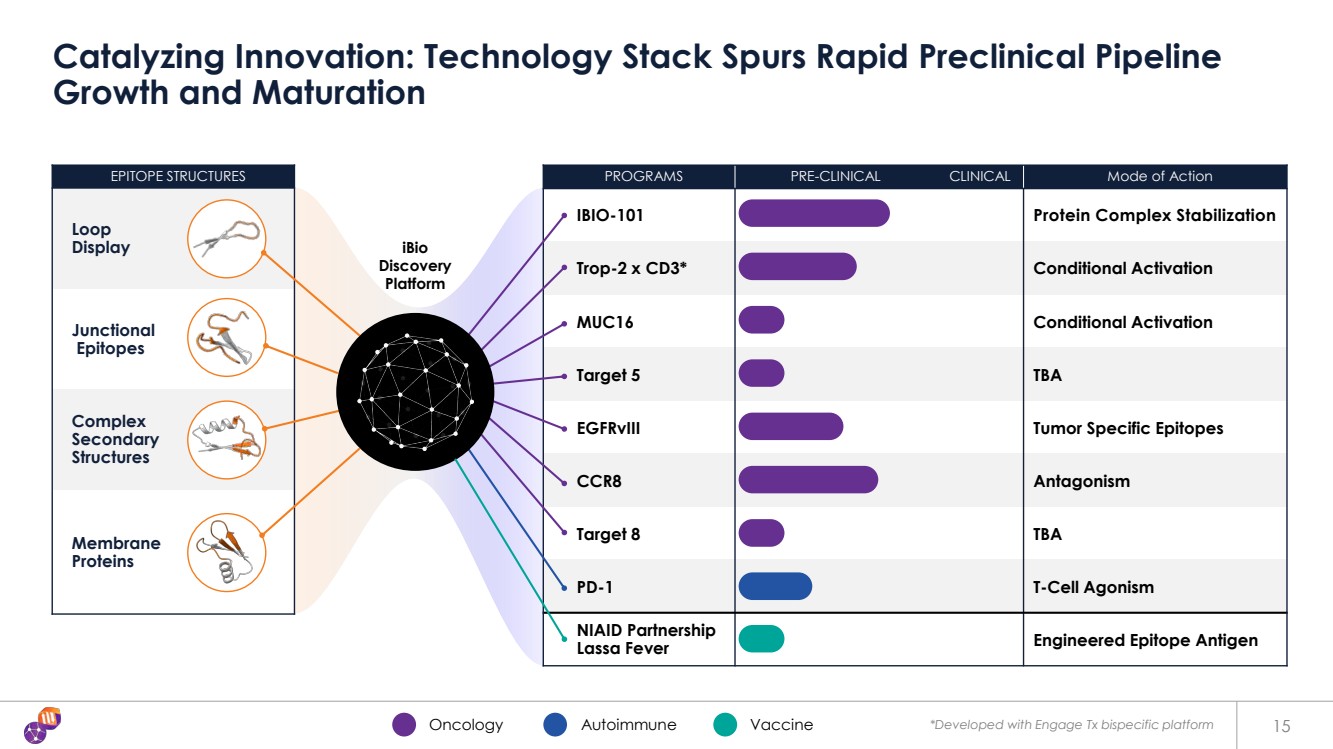

| EPITOPE STRUCTURES Loop Display Junctional Epitopes Complex Secondary Structures Membrane Proteins PROGRAMS PRE-CLINICAL CLINICAL Mode of Action IBIO-101 Protein Complex Stabilization Trop-2 x CD3* Conditional Activation MUC16 Conditional Activation Target 5 TBA EGFRvIII Tumor Specific Epitopes CCR8 Antagonism Target 8 TBA PD-1 T-Cell Agonism NIAID Partnership Lassa Fever Engineered Epitope Antigen 15 Catalyzing Innovation: Technology Stack Spurs Rapid Preclinical Pipeline Growth and Maturation *Developed with Engage Tx bispecific platform iBio Discovery Platform Oncology Autoimmune Vaccine |

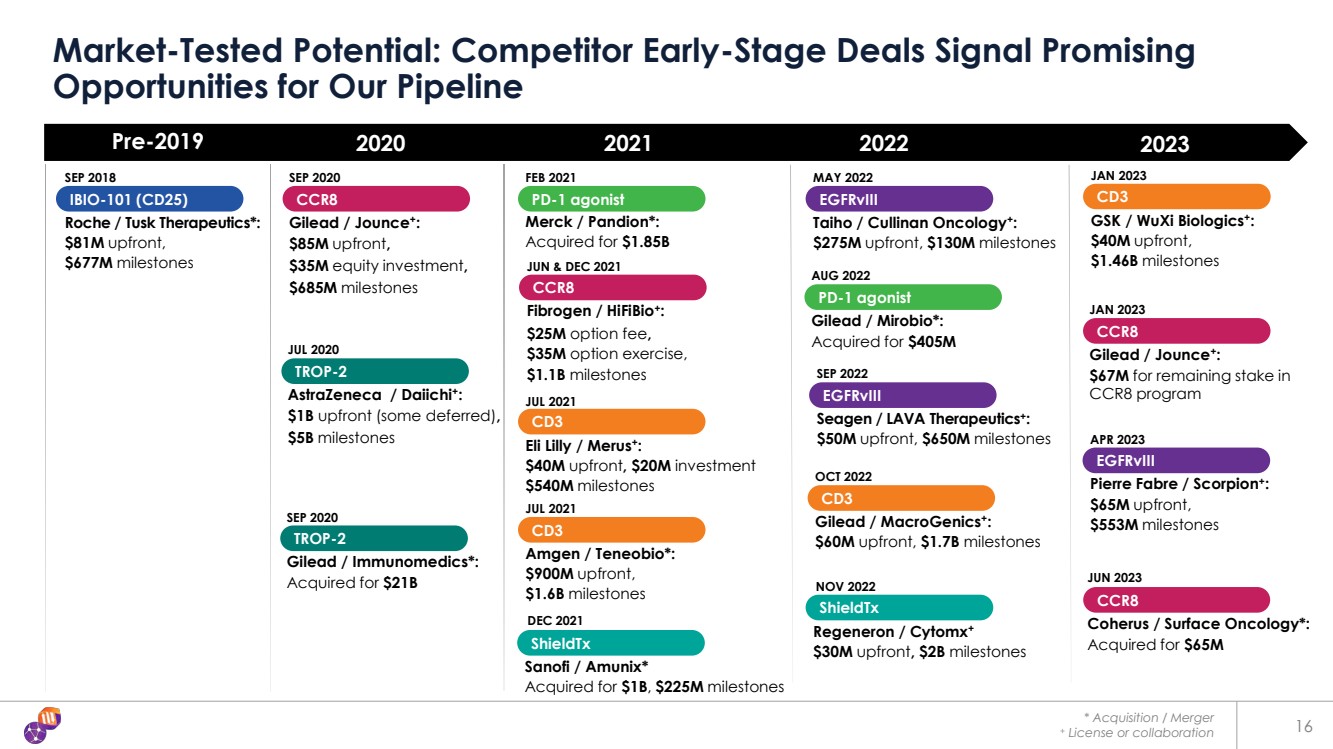

| * Acquisition / Merger + License or collaboration 16 Market-Tested Potential: Competitor Early-Stage Deals Signal Promising Opportunities for Our Pipeline Pre-2019 2020 2021 2022 CCR8 Gilead / Jounce+ : $85M upfront, $35M equity investment, $685M milestones SEP 2020 FEB 2021 PD-1 agonist Merck / Pandion*: Acquired for $1.85B SEP 2018 Roche / Tusk Therapeutics*: $81M upfront, $677M milestones IBIO-101 (CD25) JUN & DEC 2021 CCR8 Fibrogen / HiFiBio+ : $25M option fee, $35M option exercise, $1.1B milestones SEP 2022 EGFRvIII Seagen / LAVA Therapeutics+ : $50M upfront, $650M milestones AUG 2022 PD-1 agonist Gilead / Mirobio*: Acquired for $405M MAY 2022 EGFRvIII Taiho / Cullinan Oncology+ : $275M upfront, $130M milestones OCT 2022 CD3 Gilead / MacroGenics+ : $60M upfront, $1.7B milestones JUL 2021 CD3 Eli Lilly / Merus+ : $40M upfront, $20M investment $540M milestones JUL 2021 CD3 Amgen / Teneobio*: $900M upfront, $1.6B milestones 2023 CCR8 Coherus / Surface Oncology*: Acquired for $65M JUN 2023 JAN 2023 CD3 GSK / WuXi Biologics+ : $40M upfront, $1.46B milestones CCR8 Gilead / Jounce+ : $67M for remaining stake in CCR8 program JAN 2023 TROP-2 Gilead / Immunomedics*: Acquired for $21B SEP 2020 TROP-2 AstraZeneca / Daiichi+ : $1B upfront (some deferred), $5B milestones JUL 2020 APR 2023 EGFRvIII Pierre Fabre / Scorpion+ : $65M upfront, $553M milestones ShieldTx Sanofi / Amunix* Acquired for $1B, $225M milestones DEC 2021 ShieldTx Regeneron / Cytomx+ $30M upfront, $2B milestones NOV 2022 |

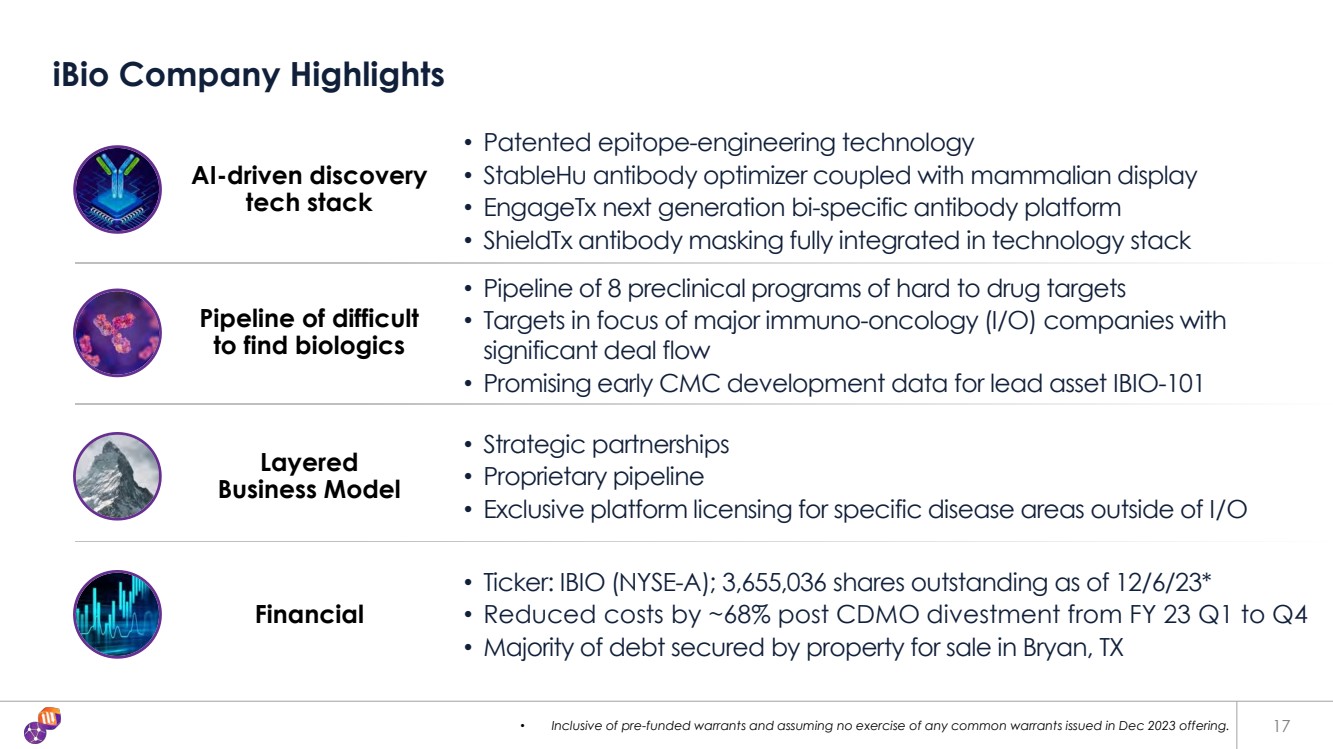

| 17 iBio Company Highlights • Ticker: IBIO (NYSE-A); 3,655,036 shares outstanding as of 12/6/23* • Reduced costs by ~68% post CDMO divestment from FY 23 Q1 to Q4 • Majority of debt secured by property for sale in Bryan, TX Financial AI-driven discovery tech stack • Patented epitope-engineering technology • StableHu antibody optimizer coupled with mammalian display • EngageTx next generation bi-specific antibody platform • ShieldTx antibody masking fully integrated in technology stack Layered Business Model • Strategic partnerships • Proprietary pipeline • Exclusive platform licensing for specific disease areas outside of I/O Pipeline of difficult to find biologics • Pipeline of 8 preclinical programs of hard to drug targets • Targets in focus of major immuno-oncology (I/O) companies with significant deal flow • Promising early CMC development data for lead asset IBIO-101 • Inclusive of pre-funded warrants and assuming no exercise of any common warrants issued in Dec 2023 offering. |

| Technology Platform & Preclinical Pipeline 18 |

| 19 IBIO-101 IL-2 Sparing Anti-CD25 |

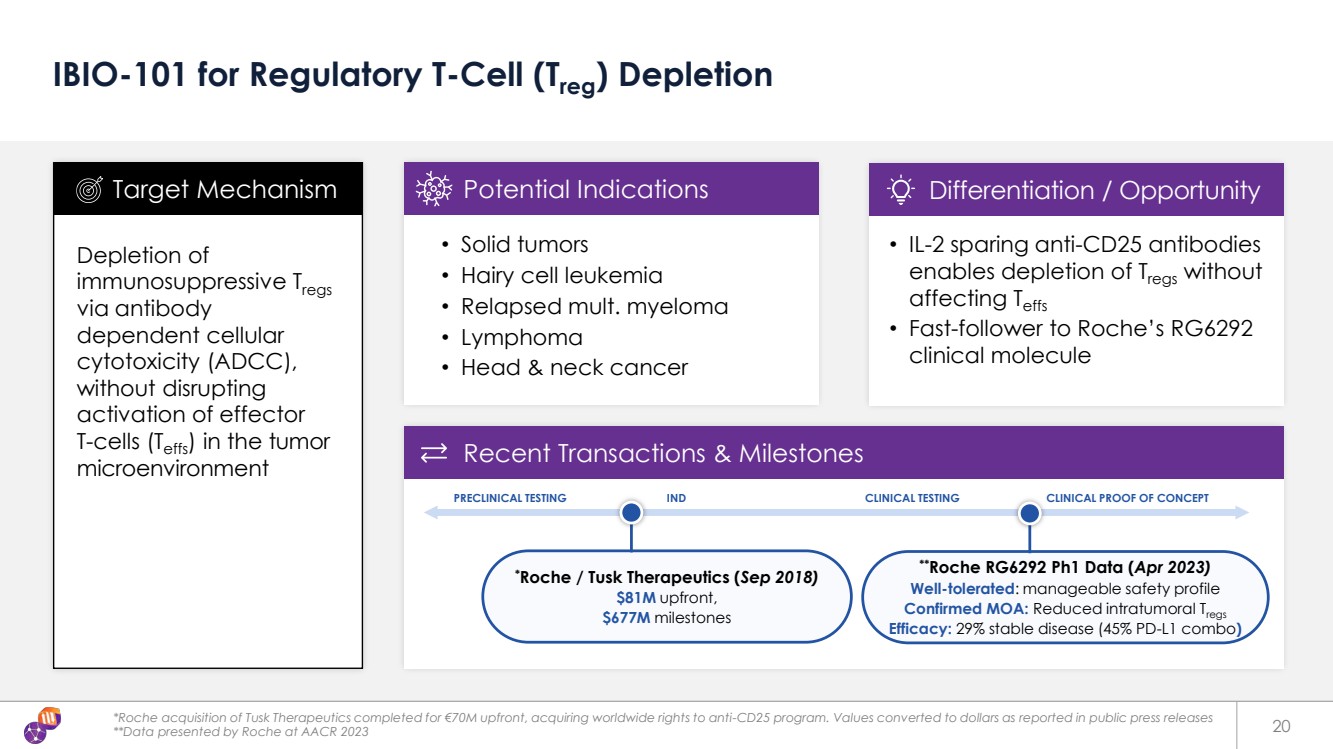

| Recent Transactions & Milestones *Roche acquisition of Tusk Therapeutics completed for €70M upfront, acquiring worldwide rights to anti-CD25 program. Values converted to dollars as reported in public press releases **Data presented by Roche at AACR 2023 20 IBIO-101 for Regulatory T-Cell (Treg) Depletion Depletion of immunosuppressive Tregs via antibody dependent cellular cytotoxicity (ADCC), without disrupting activation of effector T-cells (Teffs) in the tumor microenvironment • Solid tumors • Hairy cell leukemia • Relapsed mult. myeloma • Lymphoma • Head & neck cancer *Roche / Tusk Therapeutics (Sep 2018) $81M upfront, $677M milestones • IL-2 sparing anti-CD25 antibodies enables depletion of Tregs without affecting Teffs • Fast-follower to Roche’s RG6292 clinical molecule Target Mechanism Potential Indications Differentiation / Opportunity PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT **Roche RG6292 Ph1 Data (Apr 2023) Well-tolerated: manageable safety profile Confirmed MOA: Reduced intratumoral Tregs Efficacy: 29% stable disease (45% PD-L1 combo) |

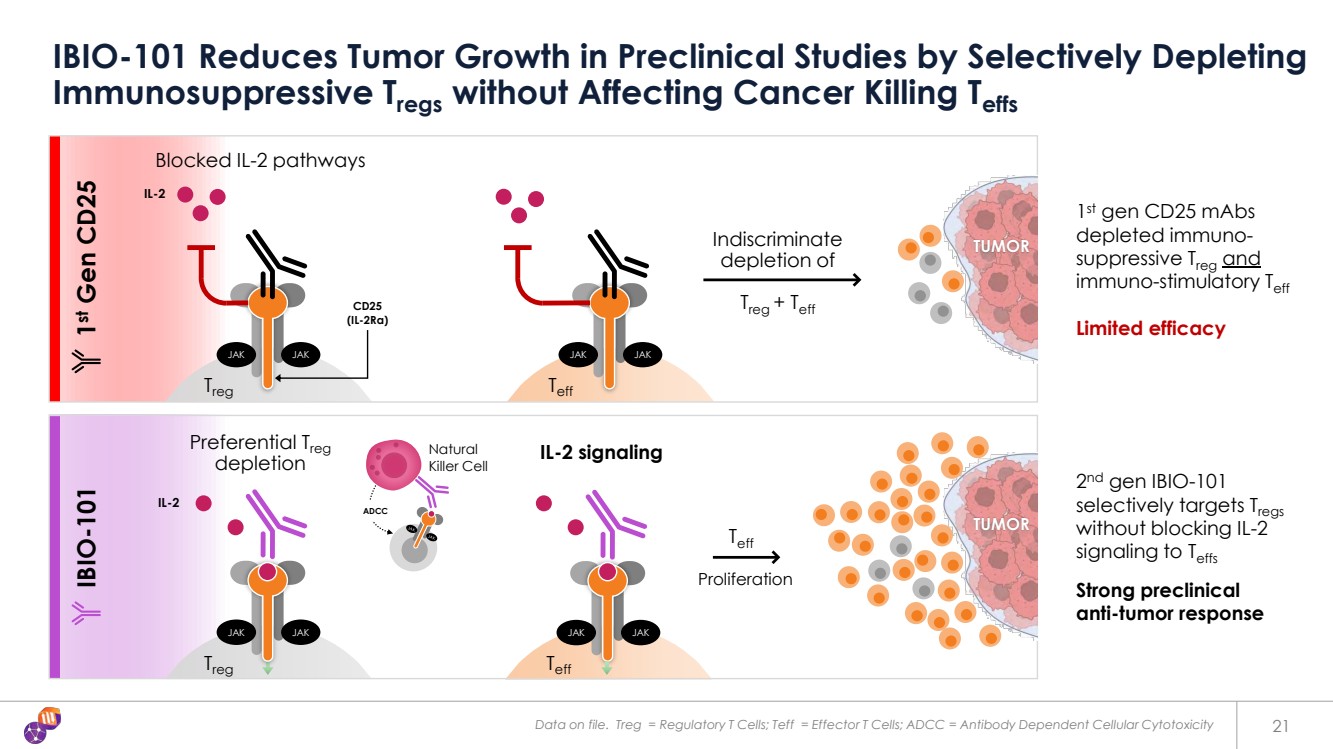

| Data on file. Treg = Regulatory T Cells; Teff = Effector T Cells; ADCC = Antibody Dependent Cellular Cytotoxicity 21 IBIO-101 Reduces Tumor Growth in Preclinical Studies by Selectively Depleting Immunosuppressive Tregs without Affecting Cancer Killing Teffs Indiscriminate depletion of Treg + Teff TUMOR Teff 1 st gen CD25 mAbs depleted immuno-suppressive Treg and immuno-stimulatory Teff Limited efficacy 2 nd gen IBIO-101 selectively targets Tregs without blocking IL-2 signaling to Teffs Strong preclinical anti-tumor response IBIO Proliferation -101 Natural Killer Cell Preferential Treg depletion ADCC 1st Gen CD25 TUMOR IL-2 CD25 (IL-2Rα) JAK JAK Treg JAK JAK Teff JAK JAK Treg JAK JAK Teff IL-2 signaling Blocked IL-2 pathways IL-2 |

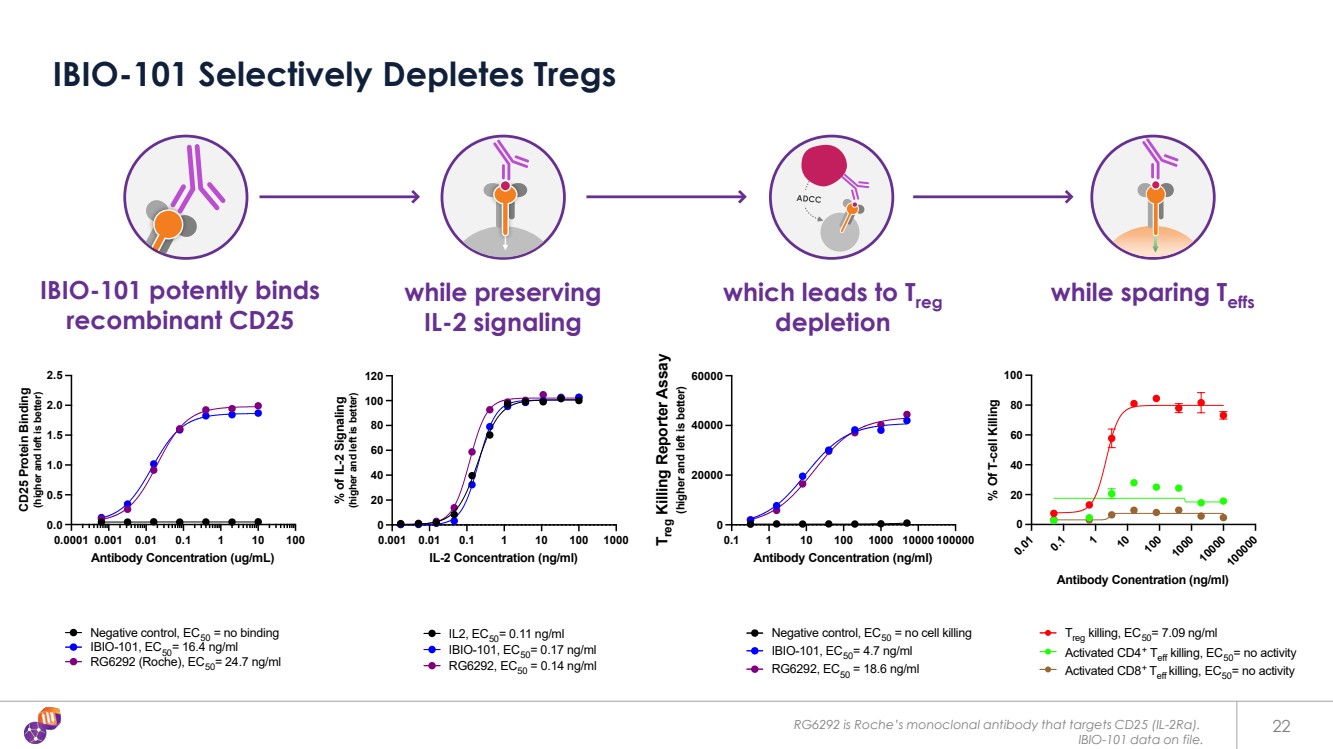

| RG6292 is Roche’s monoclonal antibody that targets CD25 (IL-2Rα). IBIO-101 data on file. 22 IBIO-101 Selectively Depletes Tregs while preserving IL-2 signaling IBIO-101 potently binds recombinant CD25 which leads to Treg depletion while sparing Teffs 0.0001 0.001 0.01 0.1 1 10 100 0.0 0.5 1.0 1.5 2.0 2.5 Antibody Concentration (ug/mL) CD25 Protein Binding (higher and left is better) Negative control, EC50 = no binding IBIO-101, EC50= 16.4 ng/ml RG6292 (Roche), EC50= 24.7 ng/ml 0.1 1 10 100 1000 10000 100000 0 20000 40000 60000 Antibody Concentration (ng/ml) Treg Killing Reporter Assay (higher and left is better) Negative control, EC50 = no cell killing IBIO-101, EC50= 4.7 ng/ml RG6292, EC50 = 18.6 ng/ml 0.001 0.01 0.1 1 10 100 1000 0 20 40 60 80 100 120 IL-2 Concentration (ng/ml) % of IL-2 Signaling (higher and left is better) IL2, EC50= 0.11 ng/ml IBIO-101, EC50= 0.17 ng/ml RG6292, EC50 = 0.14 ng/ml 0.0001 0.001 0.01 0.1 1 10 100 0.0 0.5 1.0 1.5 2.0 2.5 Antibody Concentration (ug/mL) CD25 Protein Binding (higher and left is better) Negative control, EC50 = no binding IBIO-101, EC50= 16.4 ng/ml RG6292 (Roche), EC50= 24.7 ng/ml 0.001 0.01 0.1 1 10 100 1000 0 20 40 60 80 100 120 IL-2 Concentration (ng/ml) % of IL-2 Signaling (higher and left is better) IL2, EC50= 0.11 ng/ml IBIO-101, EC50= 0.17 ng/ml RG6292, EC50 = 0.14 ng/ml 0.1 1 10 100 1000 10000 100000 0 20000 40000 60000 Antibody Concentration (ng/ml) Treg Killing Reporter Assay (higher and left is better) Negative control, EC50 = no cell killing IBIO-101, EC50= 4.7 ng/ml RG6292, EC50 = 18.6 ng/ml 0.01 0.1 1 10 100 1000 10000 100000 0 20 40 60 80 100 Antibody Conentration (ng/ml) % Of T-cell Killing Treg killing, EC50= 7.09 ng/ml Activated CD4+ Teff killing, EC50= no activity Activated CD8+ Teff killing, EC50= no activity 0.01 0.1 1 10 100 1000 10000 100000 0 20 40 60 80 100 Antibody Conentration (ng/ml) % Of T-cell Killing Treg killing, EC50= 7.09 ng/ml Activated CD4+ Teff killing, EC50= no activity Activated CD8+ Teff killing, EC50= no activity |

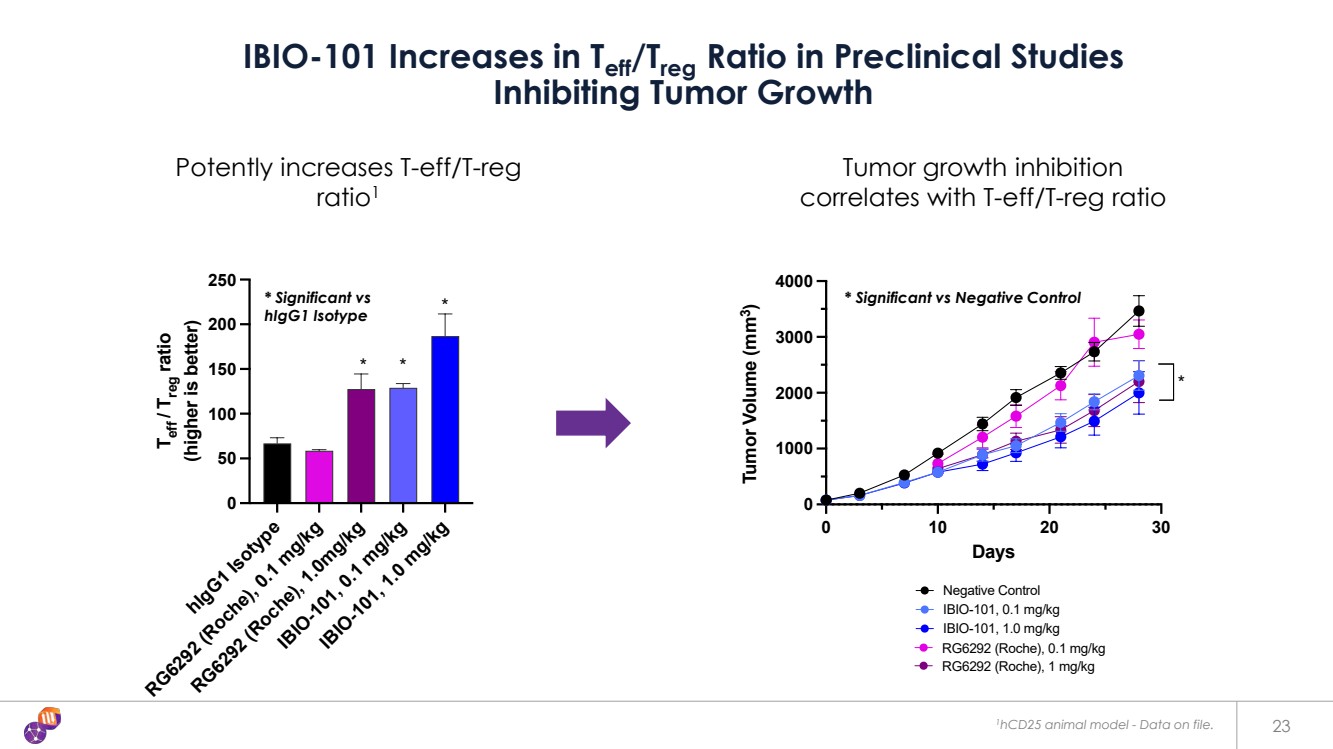

| 23 IBIO-101 Increases in Teff/Treg Ratio in Preclinical Studies Inhibiting Tumor Growth Tumor growth inhibition correlates with T-eff/T-reg ratio Potently increases T-eff/T-reg ratio1 0 10 20 30 0 1000 2000 3000 4000 Days Tumor Volume (mm3 ) Negative Control IBIO-101, 0.1 mg/kg IBIO-101, 1.0 mg/kg RG6292 (Roche), 0.1 mg/kg RG6292 (Roche), 1 mg/kg * 0 10 20 30 0 1000 2000 3000 4000 Days Tumor Volume (mm3 ) Negative Control IBIO-101, 0.1 mg/kg IBIO-101, 1.0 mg/kg RG6292 (Roche), 0.1 mg/kg RG6292 (Roche), 1 mg/kg * hIgG1 Isotype RG6292 (Roche), 0.1 mg/kg RG6292 (Roche), 1.0mg/kg IBIO-101, 0.1 mg/kg IBIO-101, 1.0 mg/kg 0 50 100 150 200 250 Teff / Treg ratio (higher is better) * * * 1hCD25 animal model - Data on file. * Significant vs * Significant vs Negative Control hIgG1 Isotype |

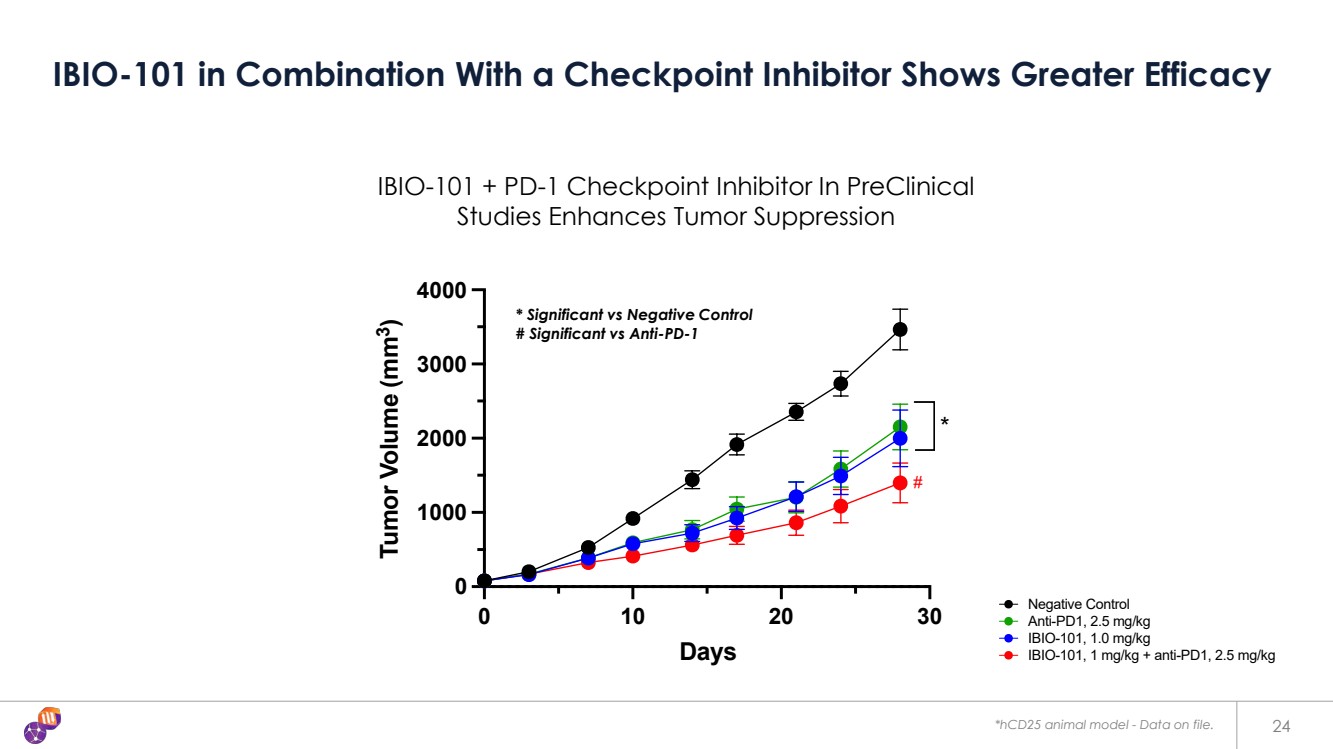

| 24 IBIO-101 in Combination With a Checkpoint Inhibitor Shows Greater Efficacy 0 10 20 30 0 1000 2000 3000 4000 Days Tumor Volume (mm3 ) Negative Control * Anti-PD1, 2.5 mg/kg IBIO-101, 1 mg/kg + anti-PD1, 2.5 mg/kg # IBIO-101, 1.0 mg/kg 0 10 20 30 0 1000 2000 3000 4000 Days Tumor Volume (mm3 ) Negative Control * Anti-PD1, 2.5 mg/kg IBIO-101, 1 mg/kg + anti-PD1, 2.5 mg/kg # IBIO-101, 1.0 mg/kg IBIO-101 + PD-1 Checkpoint Inhibitor In PreClinical Studies Enhances Tumor Suppression *hCD25 animal model - Data on file. * Significant vs Negative Control # Significant vs Anti-PD-1 |

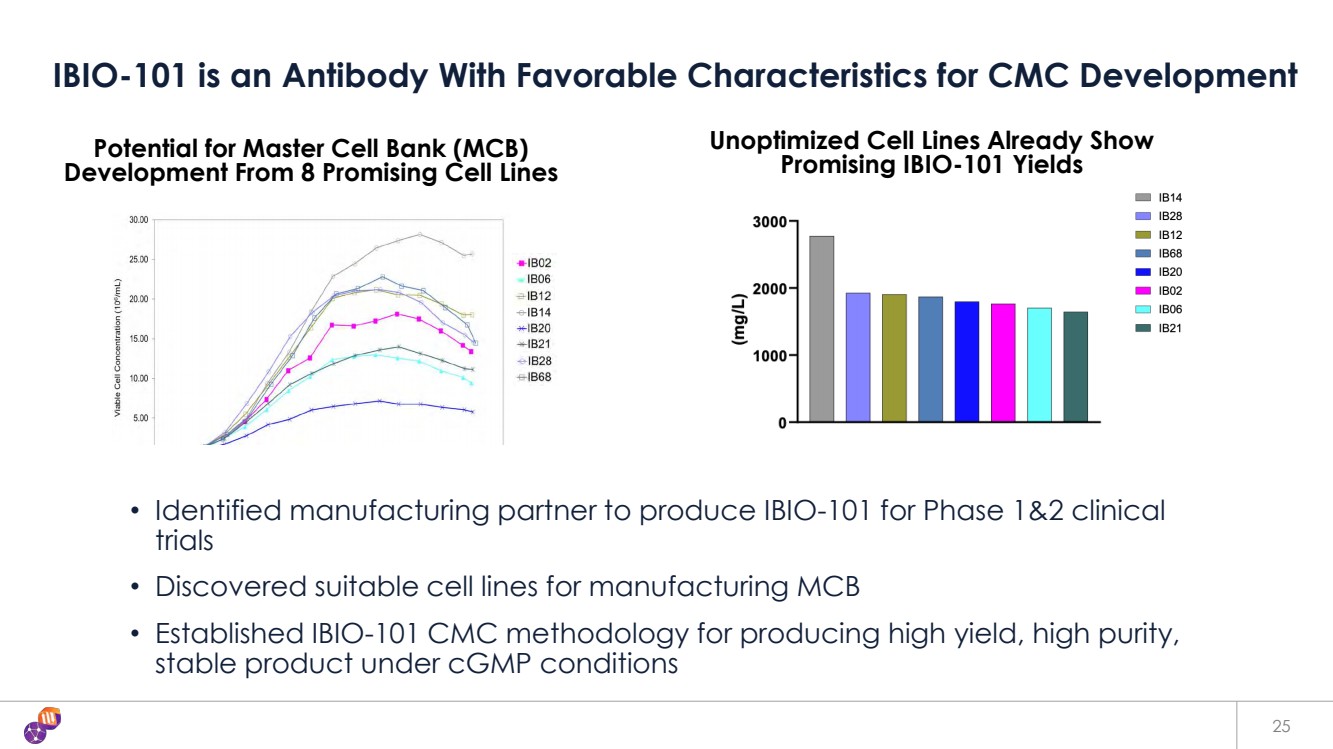

| 25 IBIO-101 is an Antibody With Favorable Characteristics for CMC Development • Identified manufacturing partner to produce IBIO-101 for Phase 1&2 clinical trials • Discovered suitable cell lines for manufacturing MCB • Established IBIO-101 CMC methodology for producing high yield, high purity, stable product under cGMP conditions Potential for Master Cell Bank (MCB) Development From 8 Promising Cell Lines Unoptimized Cell Lines Already Show Promising IBIO-101 Yields |

| 26 Anti-CCR8 High ADCC Anti-CCR8 for the Depletion of T-regulatory Cells |

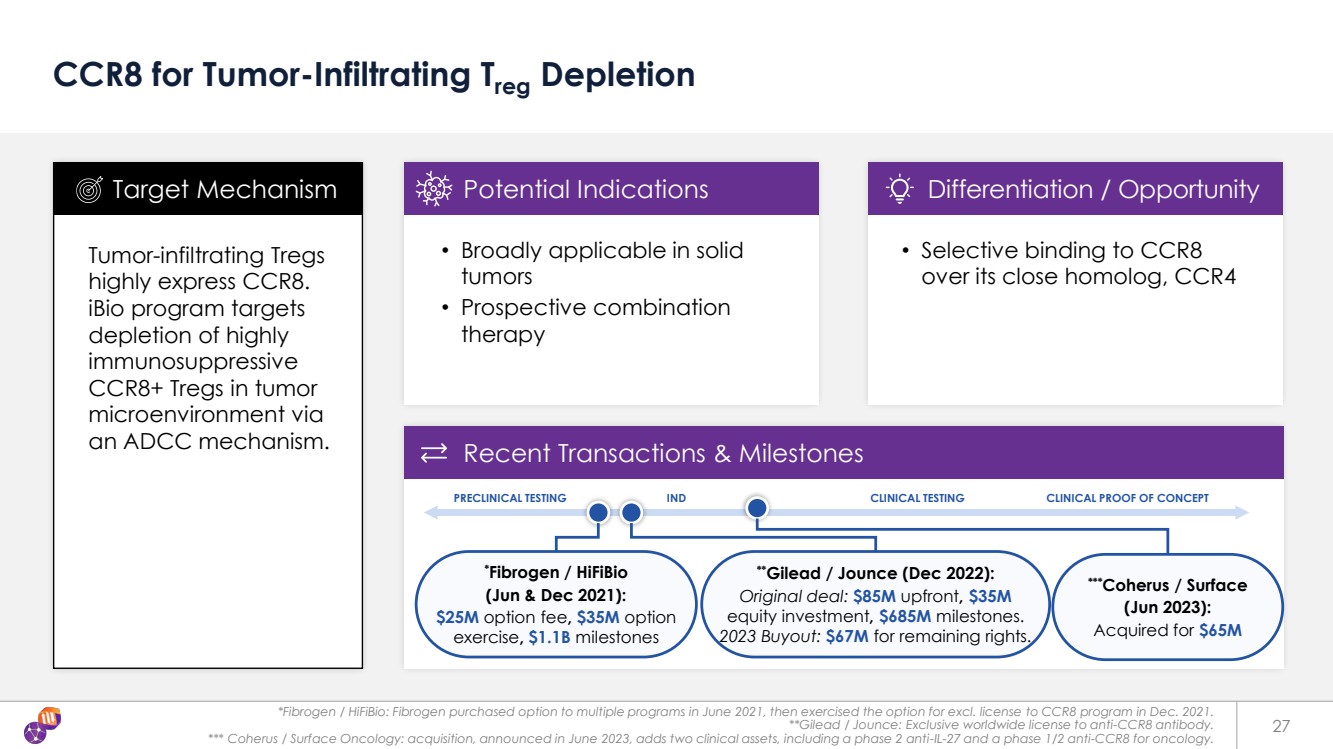

| *Fibrogen / HiFiBio: Fibrogen purchased option to multiple programs in June 2021, then exercised the option for excl. license to CCR8 program in Dec. 2021. **Gilead / Jounce: Exclusive worldwide license to anti-CCR8 antibody. *** Coherus / Surface Oncology: acquisition, announced in June 2023, adds two clinical assets, including a phase 2 anti-IL-27 and a phase 1/2 anti-CCR8 for oncology. 27 CCR8 for Tumor-Infiltrating Treg Depletion Tumor-infiltrating Tregs highly express CCR8. iBio program targets depletion of highly immunosuppressive CCR8+ Tregs in tumor microenvironment via an ADCC mechanism. • Broadly applicable in solid tumors • Prospective combination therapy Target Mechanism Potential Indications Differentiation / Opportunity Recent Transactions & Milestones • Selective binding to CCR8 over its close homolog, CCR4 **Gilead / Jounce (Dec 2022): Original deal: $85M upfront, $35M equity investment, $685M milestones. 2023 Buyout: $67M for remaining rights. *Fibrogen / HiFiBio (Jun & Dec 2021): $25M option fee, $35M option exercise, $1.1B milestones PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT ***Coherus / Surface (Jun 2023): Acquired for $65M |

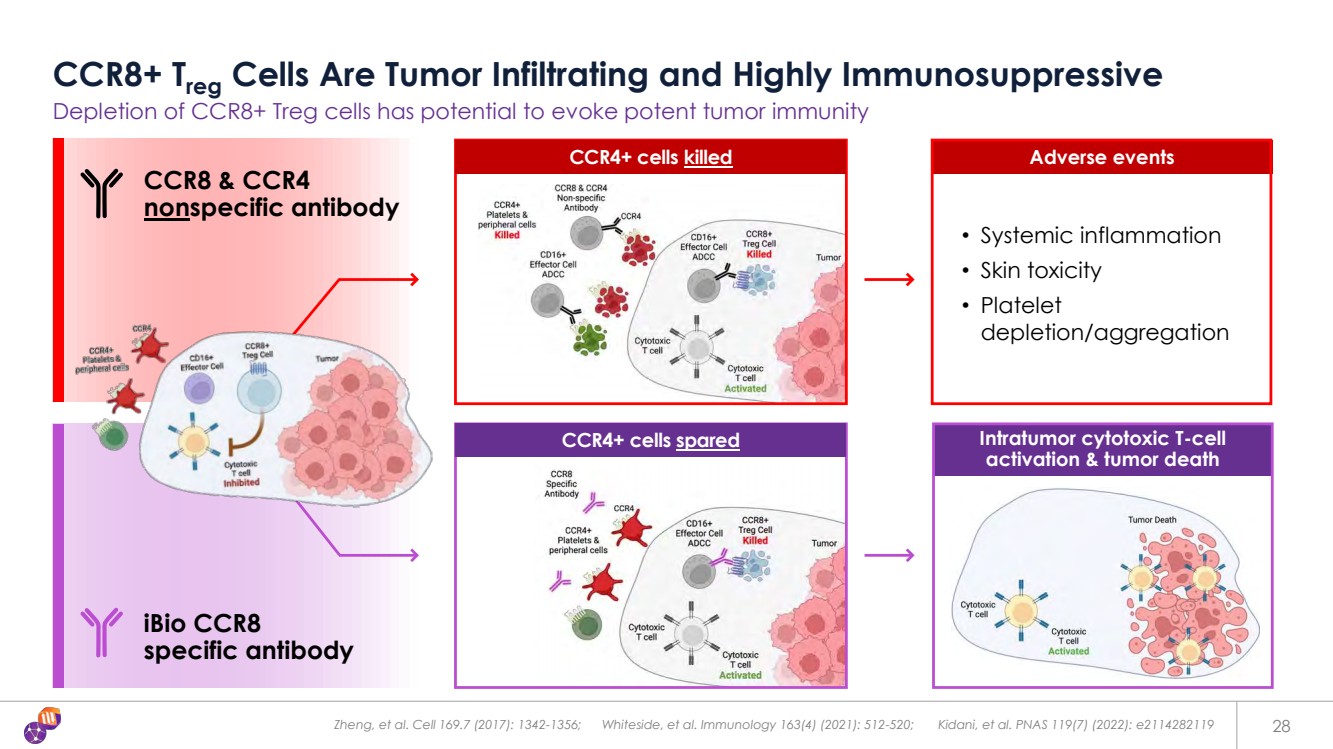

| Zheng, et al. Cell 169.7 (2017): 1342-1356; Whiteside, et al. Immunology 163(4) (2021): 512-520; Kidani, et al. PNAS 119(7) (2022): e2114282119 28 CCR8+ Treg Cells Are Tumor Infiltrating and Highly Immunosuppressive Depletion of CCR8+ Treg cells has potential to evoke potent tumor immunity • Systemic inflammation • Skin toxicity • Platelet depletion/aggregation Intratumor cytotoxic T-cell activation & tumor death Adverse events iBio CCR8 specific antibody CCR8 & CCR4 nonspecific antibody CCR4+ cells killed CCR4+ cells spared |

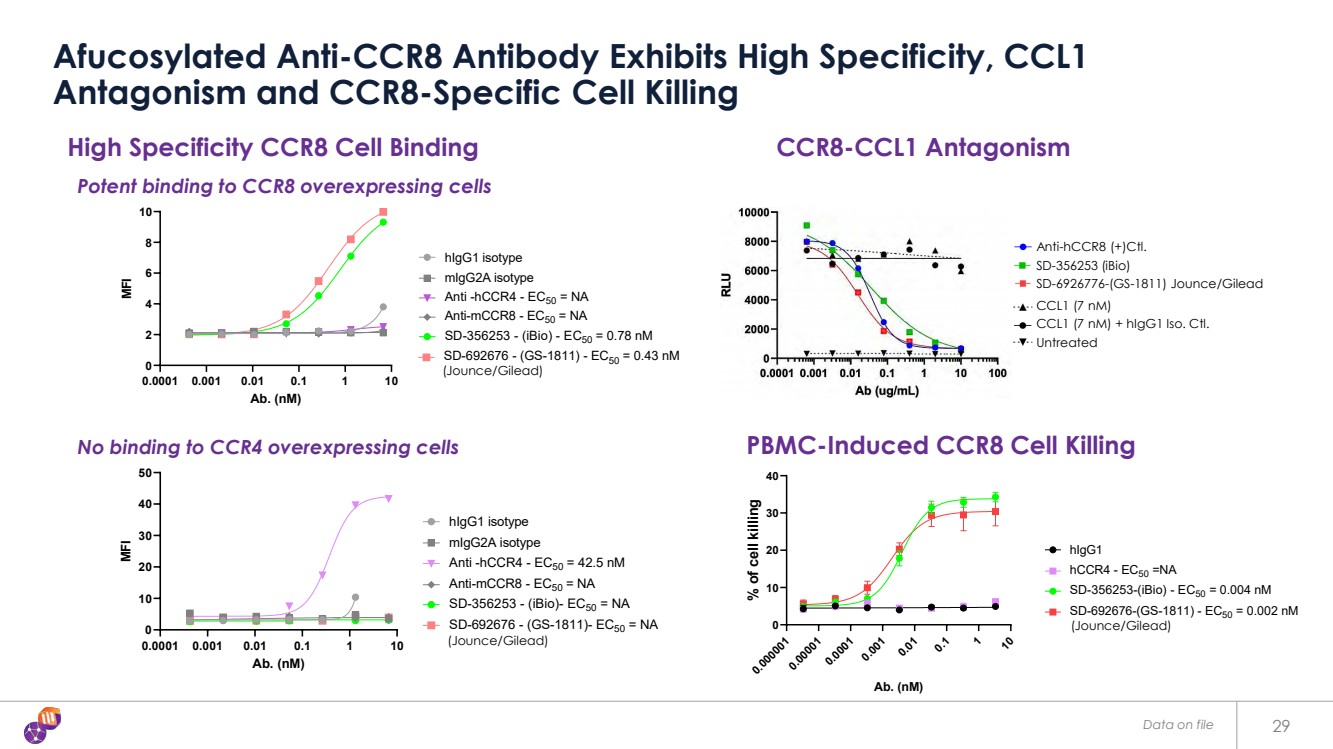

| Data on file 29 Afucosylated Anti-CCR8 Antibody Exhibits High Specificity, CCL1 Antagonism and CCR8-Specific Cell Killing High Specificity CCR8 Cell Binding 0.0001 0.001 0.01 0.1 1 10 0 2 4 6 8 10 hCCR8 overexpressed cells Ab. (nM) MFI hIgG1 isotype mIgG2A isotype Anti -hCCR4 - EC50 = NA Anti-mCCR8 - EC50 = NA SD-356253 - (iBio) - EC50 = 0.78 nM SD-692676 - (GS-1811) - EC50 = 0.43 nM 0.0001 0.001 0.01 0.1 1 10 0 10 20 30 40 50 hCCR4 overexpressed cells Ab. (nM) MFI hIgG1 isotype mIgG2A isotype Anti -hCCR4 - EC50 = 42.5 nM Anti-mCCR8 - EC50 = NA SD-356253 - (iBio)- EC50 = NA SD-692676 - (GS-1811)- EC50 = NA 0.000001 0.000010.00010.0010.01 0.1 1 10 0 10 20 30 40 CCR8 overexpressed cell Ab. (nM) % of cell killing hIgG1 hCCR4 - EC50 =NA SD-356253-(iBio) - EC50 = 0.004 nM SD-692676-(GS-1811) - EC50 = 0.002 nM PBMC-Induced CCR8 Cell Killing Potent binding to CCR8 overexpressing cells No binding to CCR4 overexpressing cells (Jounce/Gilead) (Jounce/Gilead) (Jounce/Gilead) Untreated CCL1 (7 nM) CCL1 (7 nM) + hIgG1 Iso. Ctl. Anti-hCCR8 (+)Ctl. SD-6926776-(GS-1811) Jounce/Gilead SD-356253 (iBio) CCR8-CCL1 Antagonism |

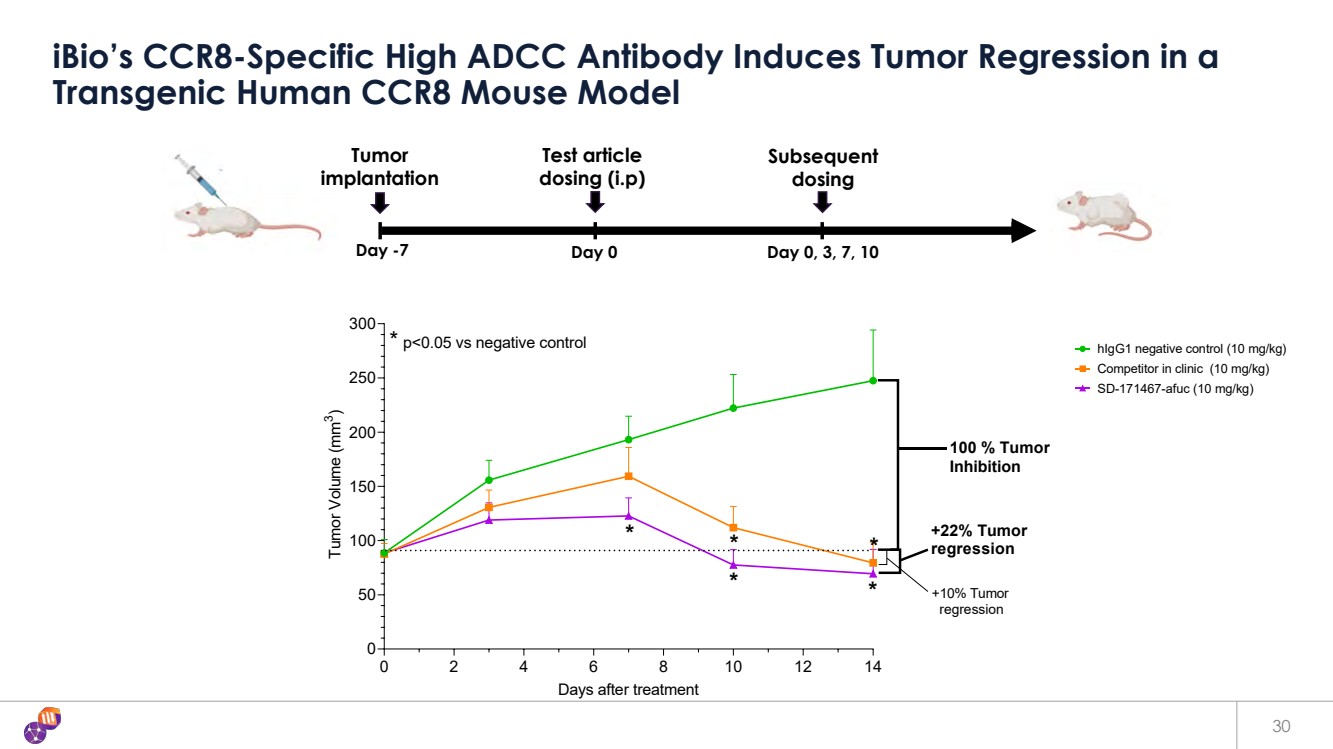

| 30 iBio’s CCR8-Specific High ADCC Antibody Induces Tumor Regression in a Transgenic Human CCR8 Mouse Model Day -7 Day 0 Day 0, 3, 7, 10 Tumor implantation Subsequent dosing Test article dosing (i.p) 0 2 4 6 8 10 12 14 0 50 100 150 200 250 300 Days after treatment Tumor Volume (mm 3 ) hIgG1 negative control (10 mg/kg) Competitor in clinic (10 mg/kg) SD-171467-afuc (10 mg/kg) * * * * p<0.05 vs negative control * * +22% Tumor regression +10% Tumor regression 100 % Tumor Inhibition 0 2 4 6 8 10 12 14 0 50 100 150 200 250 300 Days after treatment Tumor Volume (mm 3 ) hIgG1 negative control (10 mg/kg) Competitor in clinic (10 mg/kg) SD-171467-afuc (10 mg/kg) * * * * p<0.05 vs negative control * * +22% Tumor regression +10% Tumor regression 100 % Tumor Inhibition |

| 31 Unlocking the Power of Bi-Specific Antibodies with EngageTx, Our Versatile CD3 mAb Panel Wide Range of Affinities, NHP Cross Reactivity, High Developability |

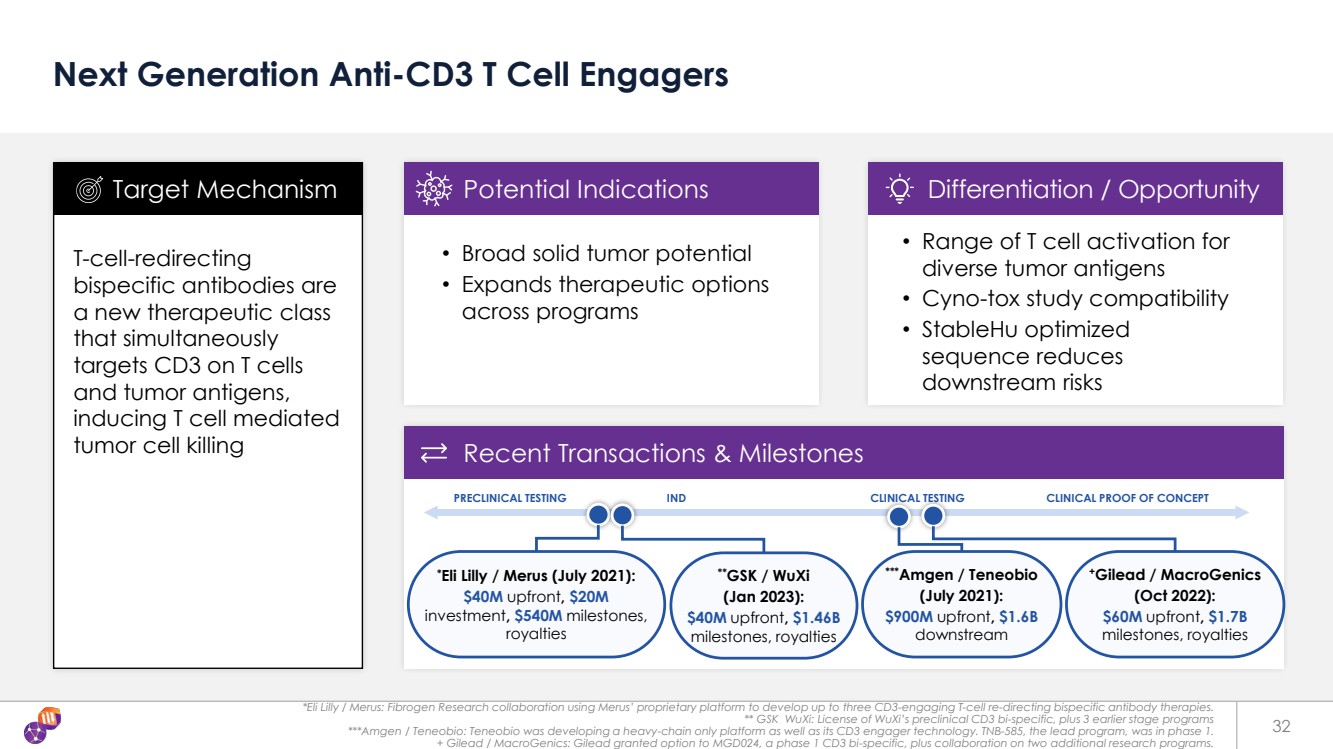

| *Eli Lilly / Merus: Fibrogen Research collaboration using Merus’ proprietary platform to develop up to three CD3-engaging T-cell re-directing bispecific antibody therapies. ** GSK WuXi: License of WuXi’s preclinical CD3 bi-specific, plus 3 earlier stage programs ***Amgen / Teneobio: Teneobio was developing a heavy-chain only platform as well as its CD3 engager technology. TNB-585, the lead program, was in phase 1. + Gilead / MacroGenics: Gilead granted option to MGD024, a phase 1 CD3 bi-specific, plus collaboration on two additional research programs. 32 Next Generation Anti-CD3 T Cell Engagers T-cell-redirecting bispecific antibodies are a new therapeutic class that simultaneously targets CD3 on T cells and tumor antigens, inducing T cell mediated tumor cell killing • Broad solid tumor potential • Expands therapeutic options across programs Target Mechanism Potential Indications Differentiation / Opportunity Recent Transactions & Milestones • Range of T cell activation for diverse tumor antigens • Cyno-tox study compatibility • StableHu optimized sequence reduces downstream risks *Eli Lilly / Merus (July 2021): $40M upfront, $20M investment, $540M milestones, royalties PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT ***Amgen / Teneobio (July 2021): $900M upfront, $1.6B downstream +Gilead / MacroGenics (Oct 2022): $60M upfront, $1.7B milestones, royalties **GSK / WuXi (Jan 2023): $40M upfront, $1.46B milestones, royalties |

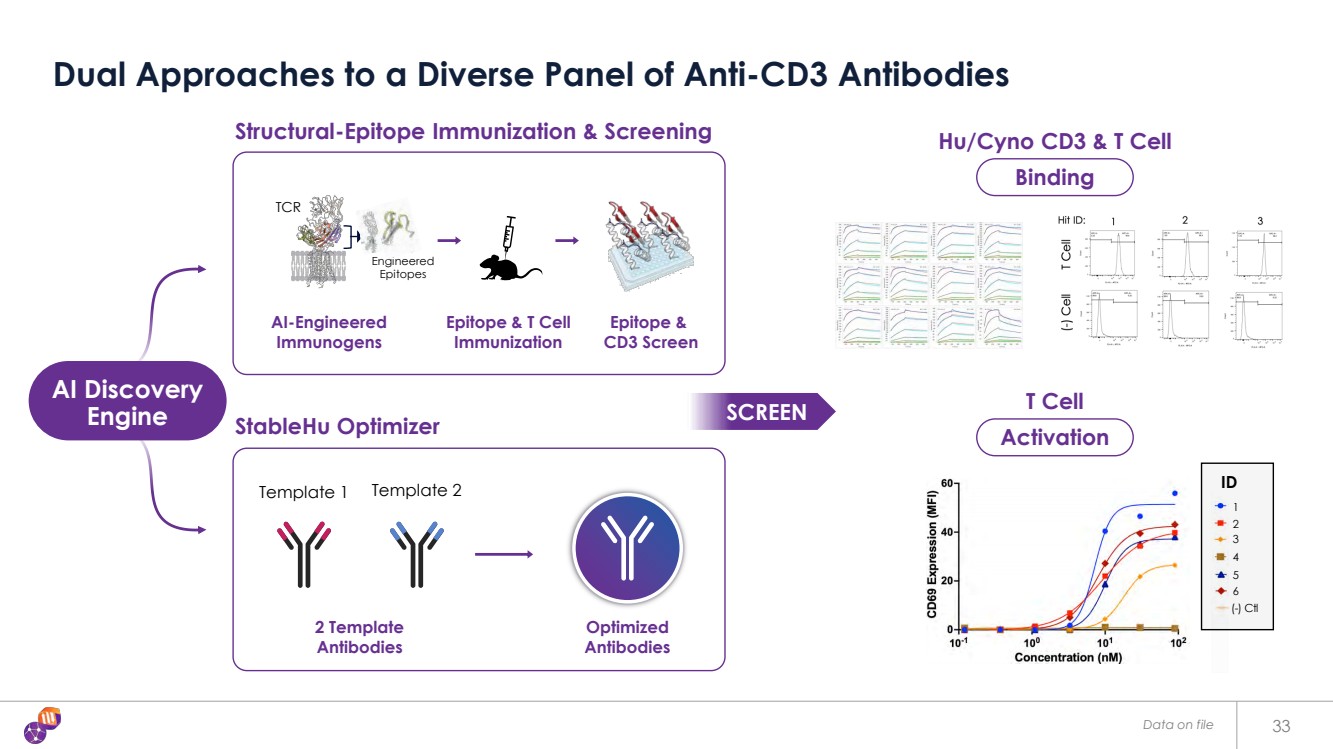

| Data on file 33 Dual Approaches to a Diverse Panel of Anti-CD3 Antibodies Hu/Cyno CD3 & T Cell TCR CD3 Engineered Epitopes T Cell Template 1 Template 2 Structural-Epitope Immunization & Screening StableHu Optimizer AI Discovery Engine AI-Engineered Immunogens Epitope & T Cell Immunization Epitope & CD3 Screen 2 Template Antibodies Optimized Antibodies SCREEN Activation Binding 1 2 3 4 5 6 (-) Ctl ID |

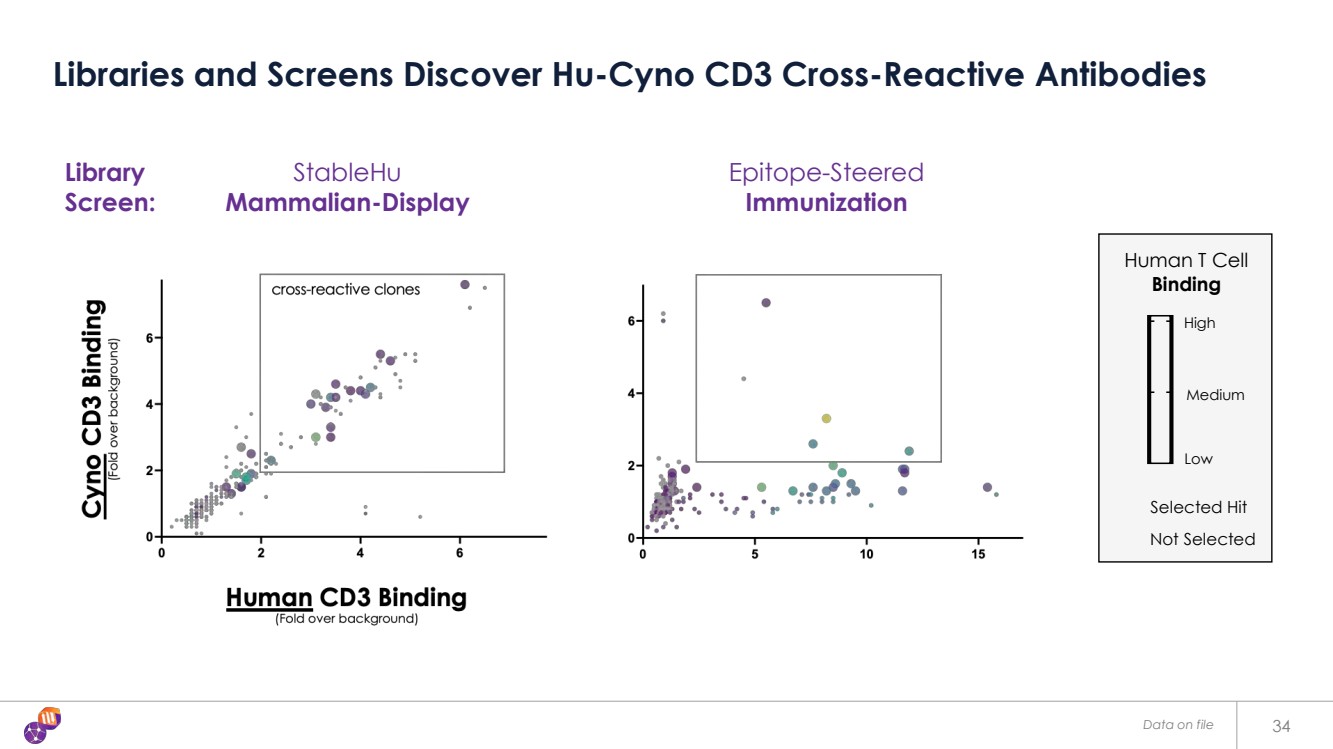

| Data on file 34 Libraries and Screens Discover Hu-Cyno CD3 Cross-Reactive Antibodies Epitope-Steered Immunization 0 5 10 15 0 2 4 6 Human CD3 ELISA FoldChange / Background Cyno CD3 ELISA FoldChange / Background Immunized Library 1 100 200 Human T Cell Binding Fold Change / Background HIT 0 Human T Cell Binding Selected Hit Low Medium High StableHu Mammalian-Display Not Selected Library Screen: |

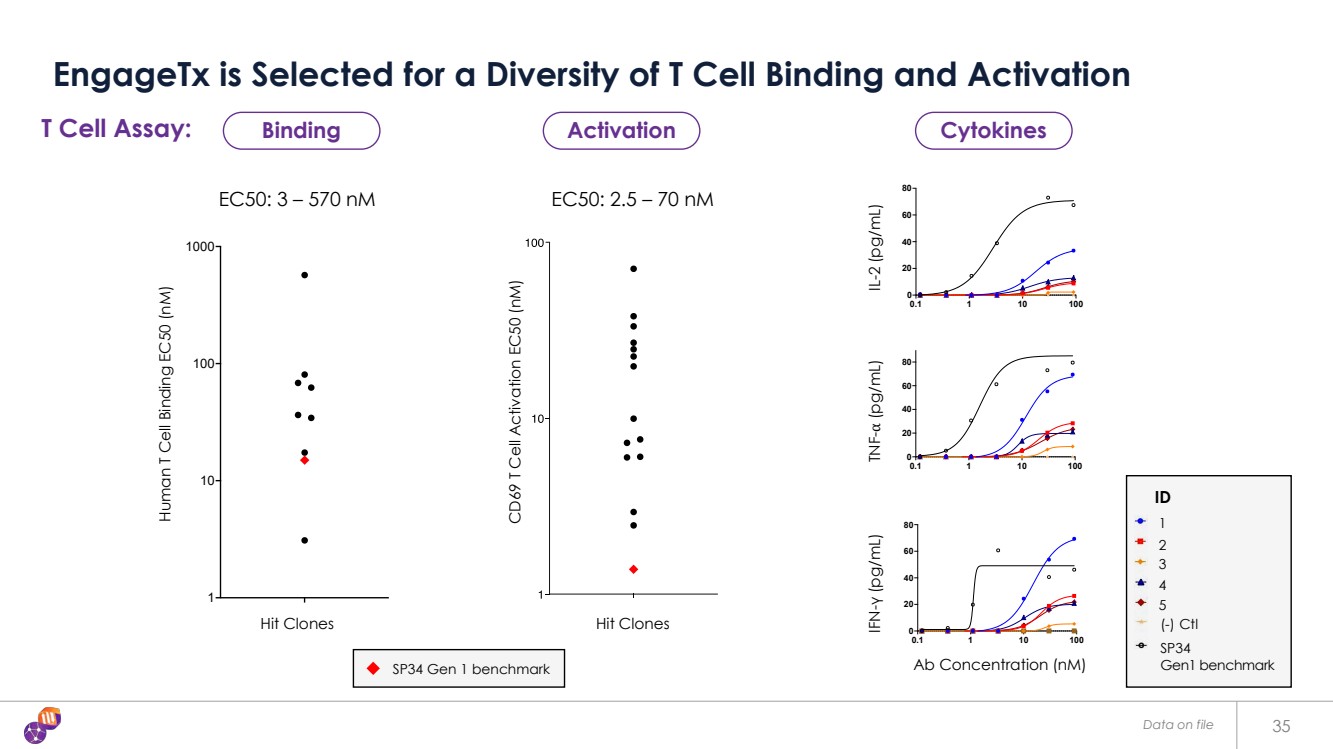

| Data on file 35 EngageTx is Selected for a Diversity of T Cell Binding and Activation EC50: 3 – 570 nM EC50: 2.5 – 70 nM Human T Cell Binding EC50 (nM) 0.1 1 10 100 0 20 40 60 80 Concentration (nM) IL-2 (pg/mL) Human T Cell Activation M80-H1-1 M80-H1-2 M80-H3-1 M80-L1-1 M80-L2-1 IgG1 Isotype (-) Ctl SP34 (+) Control 0.1 1 10 100 0 20 40 60 80 Concentration (nM) TNF-a (pg/mL) Human T Cell Activation M80-H1-1 M80-H1-2 M80-H3-1 M80-L1-1 M80-L2-1 IgG1 Isotype (-) Control SP34 (+) Control 0.1 1 10 100 0 20 40 60 80 Concentration (nM) IFN-g (pg/mL) Human T Cell Activation M80-H1-1 M80-H1-2 M80-H3-1 M80-H3-2 M80-L1-1 M80-L2-1 IgG1 Isotype (-) Control SP34 (+) Control CD69 T Cell Activation EC50 (nM) Hit Clones Hit Clones T Cell CD3 EC50 1 10 100 1000 Human T Cell Binding EC50 (nM) T Cell CD3 EC50 T Cell Assay: Ab Concentration (nM) IFN-γ (pg/mL) TNF-⍺ (pg/mL) IL-2 (pg/mL) ID 1 2 3 5 (-) Ctl 4 SP34 Gen1 benchmark SP34 Gen 1 benchmark Binding Activation Cytokines |

| 36 ShieldTx Antibody masking technology for delivering on-epitope, on-tissue clinical candidates with enhanced safety and developability |

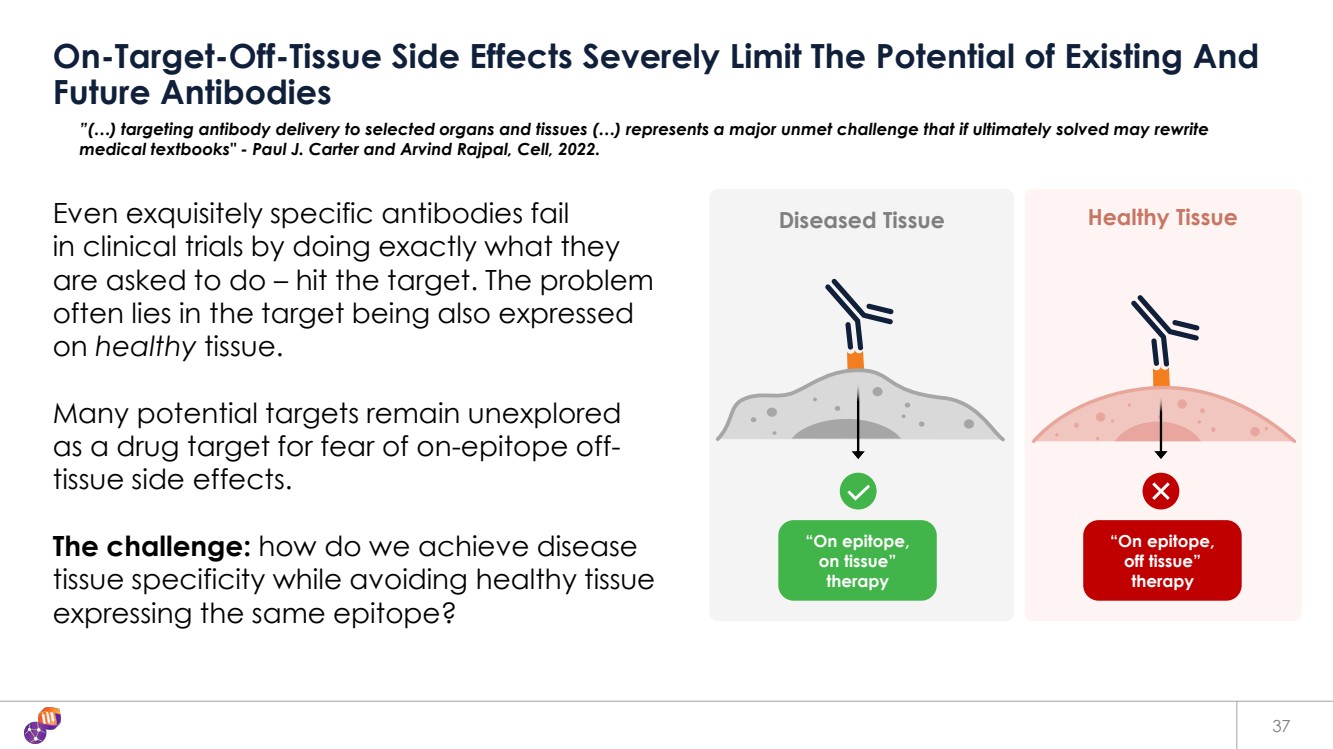

| Diseased Tissue Healthy Tissue 37 On-Target-Off-Tissue Side Effects Severely Limit The Potential of Existing And Future Antibodies Even exquisitely specific antibodies fail in clinical trials by doing exactly what they are asked to do – hit the target. The problem often lies in the target being also expressed on healthy tissue. Many potential targets remain unexplored as a drug target for fear of on-epitope off-tissue side effects. The challenge: how do we achieve disease tissue specificity while avoiding healthy tissue expressing the same epitope? “On epitope, on tissue” therapy “On epitope, off tissue” therapy ”(…) targeting antibody delivery to selected organs and tissues (…) represents a major unmet challenge that if ultimately solved may rewrite medical textbooks" - Paul J. Carter and Arvind Rajpal, Cell, 2022. |

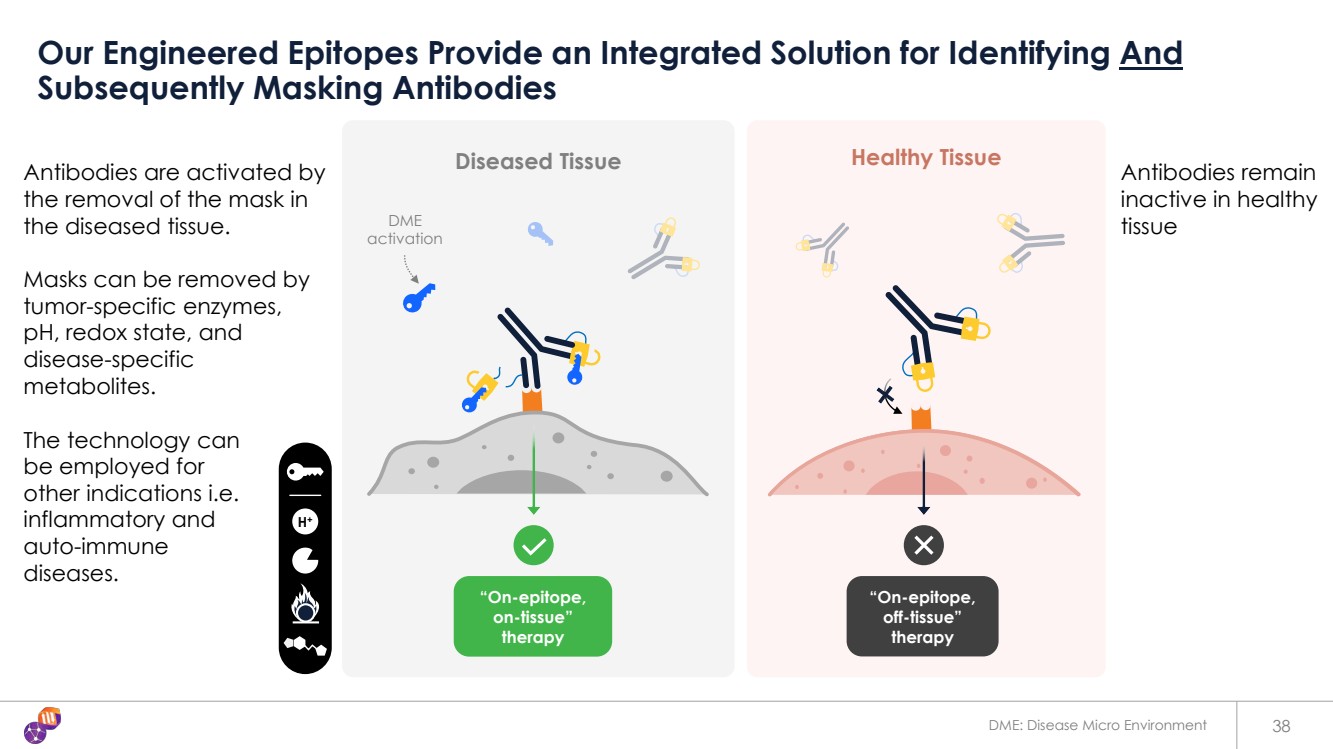

| 38 Our Engineered Epitopes Provide an Integrated Solution for Identifying And Subsequently Masking Antibodies Diseased Tissue “On-epitope, off-tissue” therapy Healthy Tissue DME activation “On-epitope, on-tissue” therapy H+ DME: Disease Micro Environment Antibodies are activated by the removal of the mask in the diseased tissue. Masks can be removed by tumor-specific enzymes, pH, redox state, and disease-specific metabolites. The technology can be employed for other indications i.e. inflammatory and auto-immune diseases. Antibodies remain inactive in healthy tissue |

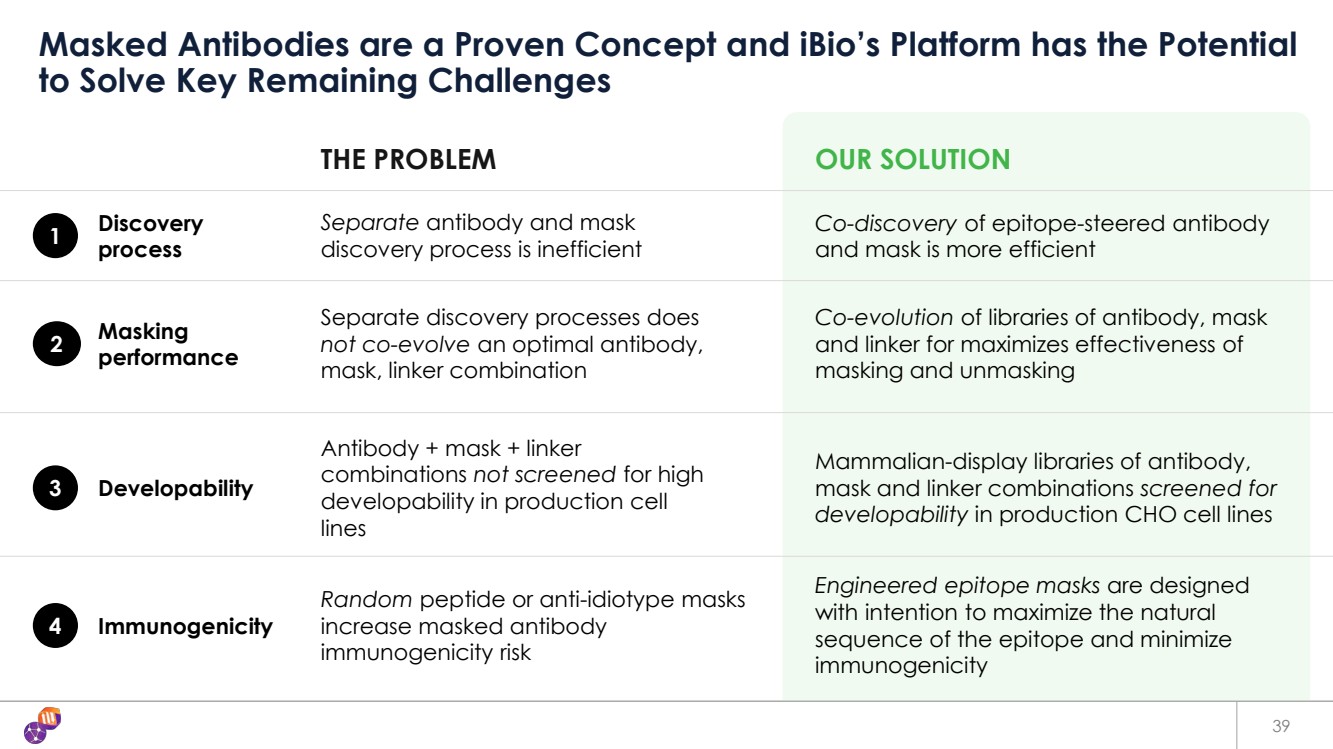

| Masked Antibodies are a Proven Concept and iBio’s Platform has the Potential to Solve Key Remaining Challenges 39 THE PROBLEM OUR SOLUTION 1 Separate antibody and mask discovery process is inefficient Co-discovery of epitope-steered antibody and mask is more efficient Discovery process 2 Separate discovery processes does not co-evolve an optimal antibody, mask, linker combination Co-evolution of libraries of antibody, mask and linker for maximizes effectiveness of masking and unmasking Masking performance 3 Antibody + mask + linker combinations not screened for high developability in production cell lines Mammalian-display libraries of antibody, mask and linker combinations screened for developability in production CHO cell lines Developability 4 Random peptide or anti-idiotype masks increase masked antibody immunogenicity risk Engineered epitope masks are designed with intention to maximize the natural sequence of the epitope and minimize immunogenicity Immunogenicity |

| 40 Conditionally Activated Anti-MUC16 x CD3 Bispecific Antibodies Targeting the Non-Shed MUC16 Region Leveraging iBio’s Epitope Steering, ShieldTx, and EngageTx Technologies |

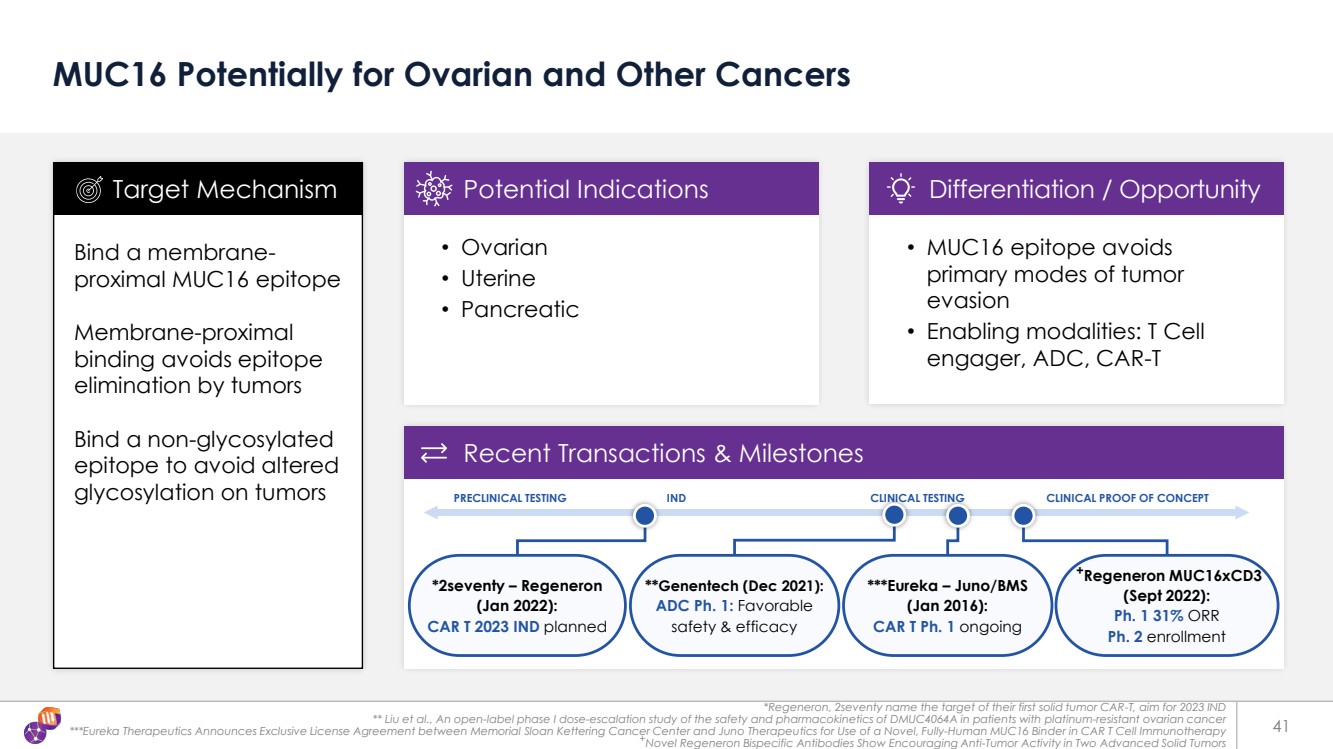

| +Regeneron MUC16xCD3 (Sept 2022): Ph. 1 31% ORR Ph. 2 enrollment 41 MUC16 Potentially for Ovarian and Other Cancers Bind a membrane-proximal MUC16 epitope Membrane-proximal binding avoids epitope elimination by tumors Bind a non-glycosylated epitope to avoid altered glycosylation on tumors • Ovarian • Uterine • Pancreatic Target Mechanism Potential Indications • MUC16 epitope avoids primary modes of tumor evasion • Enabling modalities: T Cell engager, ADC, CAR-T Differentiation / Opportunity Recent Transactions & Milestones PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT ***Eureka – Juno/BMS (Jan 2016): CAR T Ph. 1 ongoing *2seventy – Regeneron (Jan 2022): CAR T 2023 IND planned **Genentech (Dec 2021): ADC Ph. 1: Favorable safety & efficacy *Regeneron, 2seventy name the target of their first solid tumor CAR-T, aim for 2023 IND ** Liu et al., An open-label phase I dose-escalation study of the safety and pharmacokinetics of DMUC4064A in patients with platinum-resistant ovarian cancer ***Eureka Therapeutics Announces Exclusive License Agreement between Memorial Sloan Kettering Cancer Center and Juno Therapeutics for Use of a Novel, Fully-Human MUC16 Binder in CAR T Cell Immunotherapy +Novel Regeneron Bispecific Antibodies Show Encouraging Anti-Tumor Activity in Two Advanced Solid Tumors |

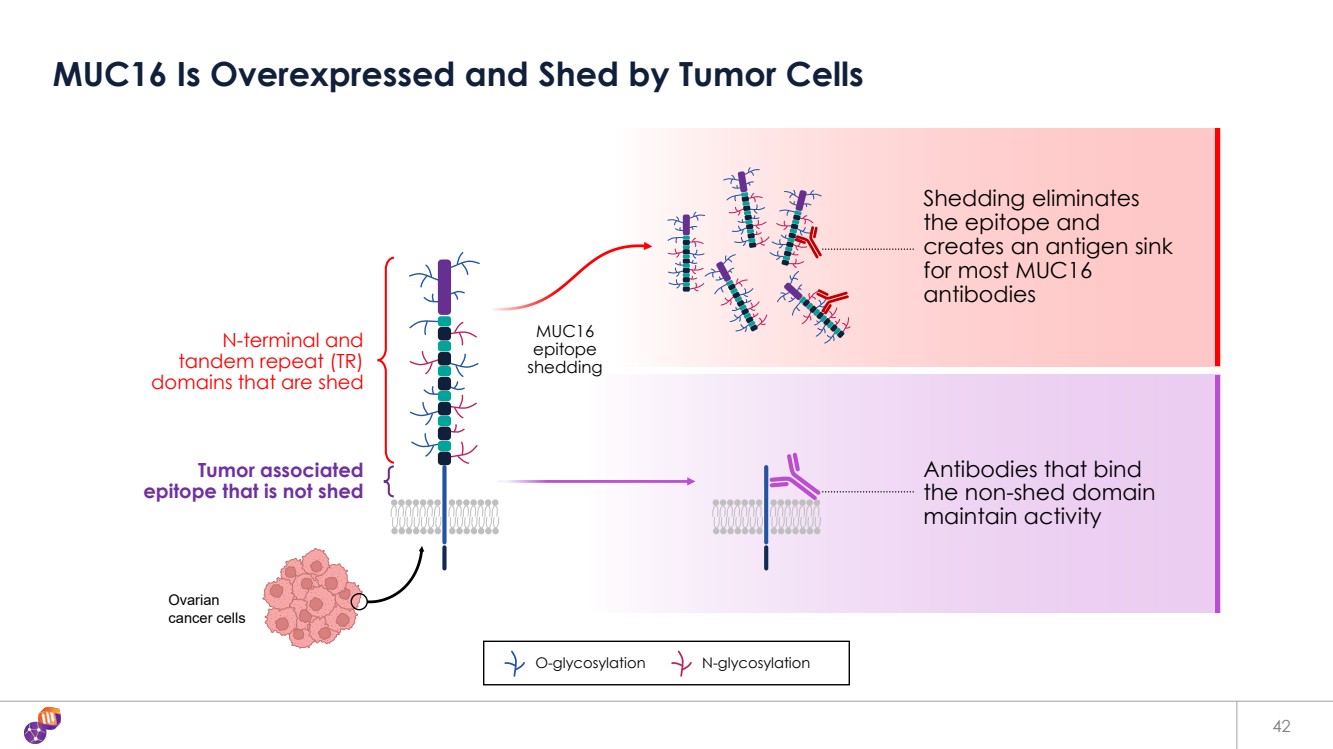

| 42 MUC16 Is Overexpressed and Shed by Tumor Cells O-glycosylation N-glycosylation MUC16 epitope shedding Shedding eliminates the epitope and creates an antigen sink for most MUC16 antibodies Antibodies that bind the non-shed domain maintain activity N-terminal and tandem repeat (TR) domains that are shed Tumor associated epitope that is not shed Ovarian cancer cells |

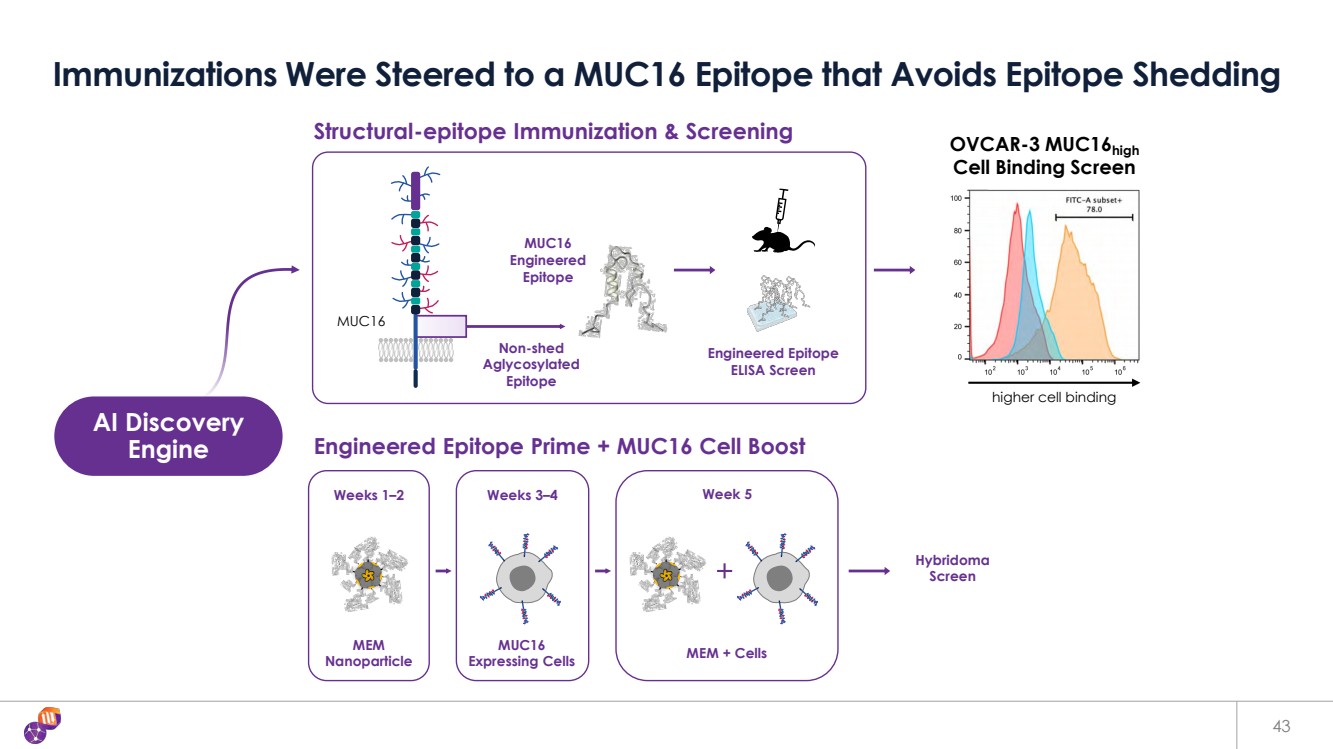

| Weeks 1–2 Weeks 3–4 Week 5 43 Immunizations Were Steered to a MUC16 Epitope that Avoids Epitope Shedding Engineered Epitope Prime + MUC16 Cell Boost AI Discovery Engine MUC16 Engineered Epitope Structural-epitope Immunization & Screening Engineered Epitope ELISA Screen MUC16 OVCAR-3 MUC16high Cell Binding Screen higher cell binding MEM Nanoparticle MUC16 Expressing Cells MEM + Cells Hybridoma Screen Non-shed Aglycosylated Epitope |

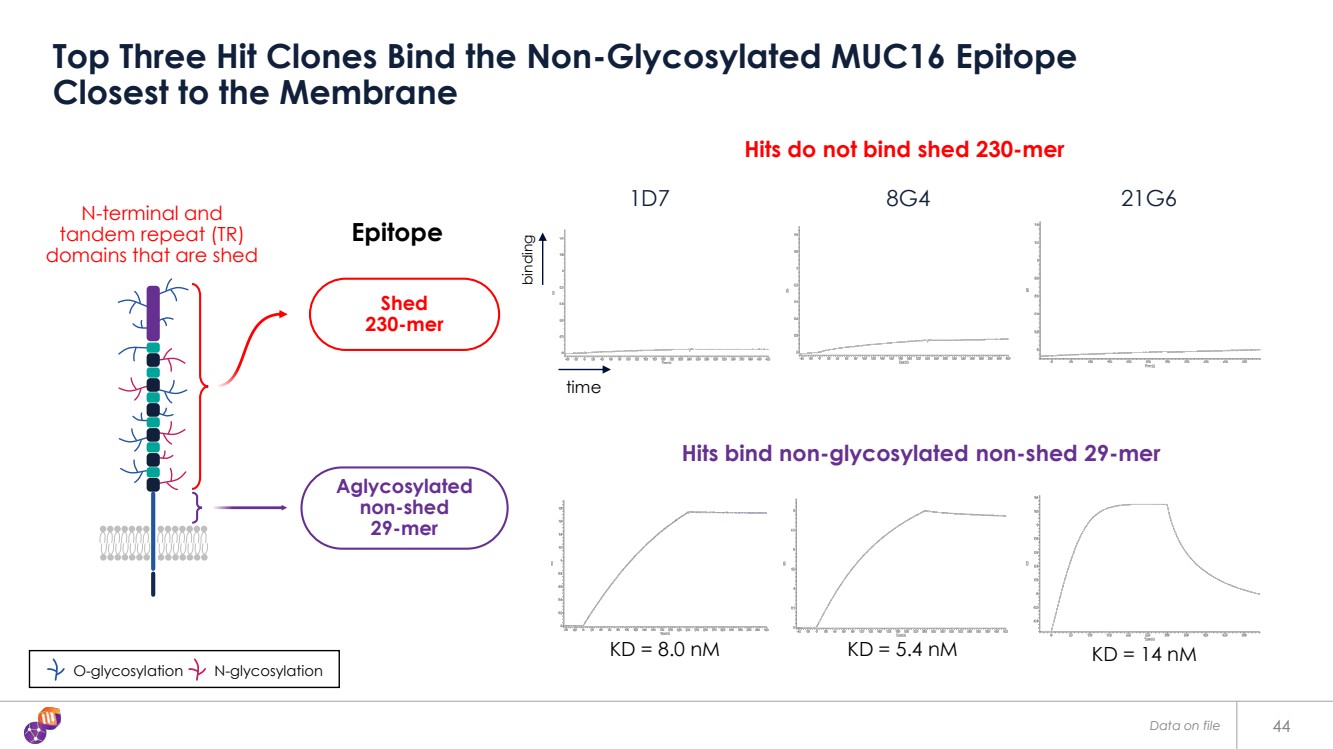

| 44 Top Three Hit Clones Bind the Non-Glycosylated MUC16 Epitope Closest to the Membrane 1D7 8G4 21G6 Hits do not bind shed 230-mer Hits bind non-glycosylated non-shed 29-mer binding time O-glycosylation N-glycosylation N-terminal and tandem repeat (TR) domains that are shed Epitope KD = 8.0 nM KD = 5.4 nM KD = 14 nM Aglycosylated non-shed 29-mer Shed 230-mer Data on file |

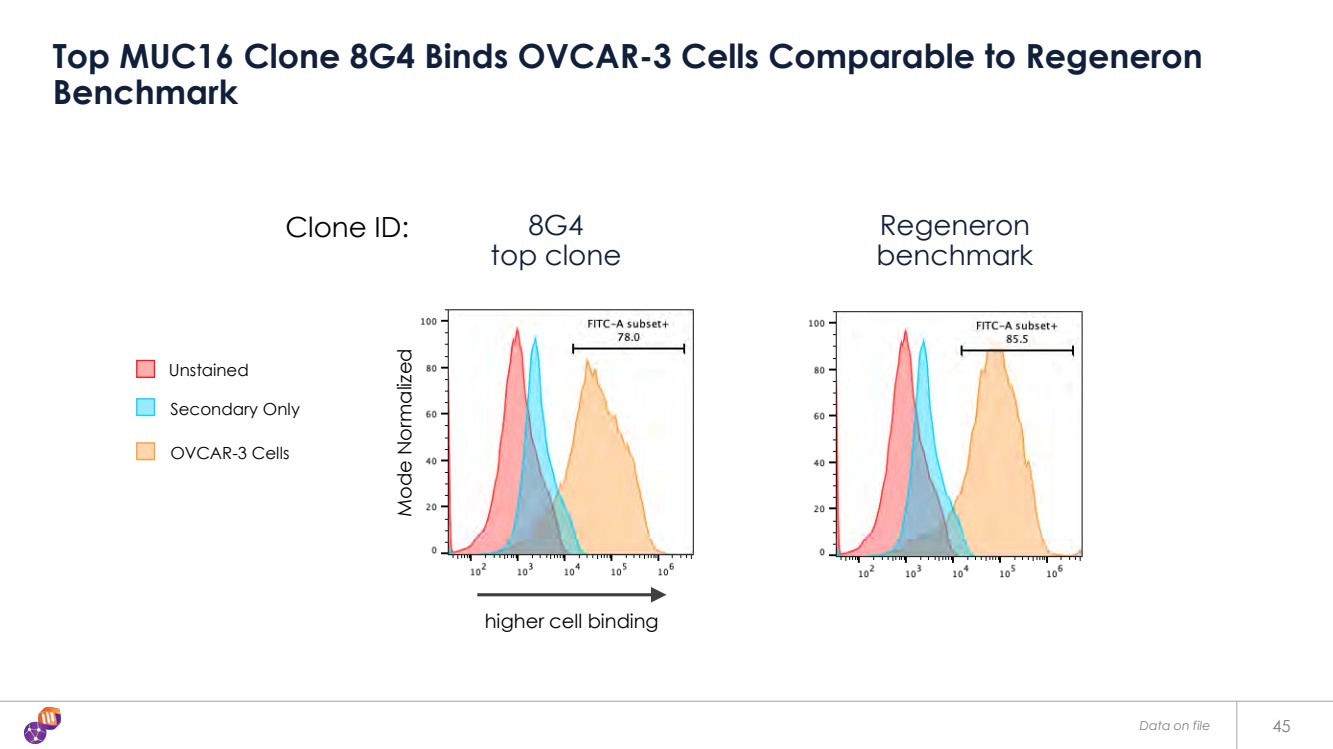

| 45 Top MUC16 Clone 8G4 Binds OVCAR-3 Cells Comparable to Regeneron Benchmark Regeneron benchmark Clone ID: Secondary Only Unstained OVCAR-3 Cells 8G4 top clone higher cell binding Mode Normalized Data on file |

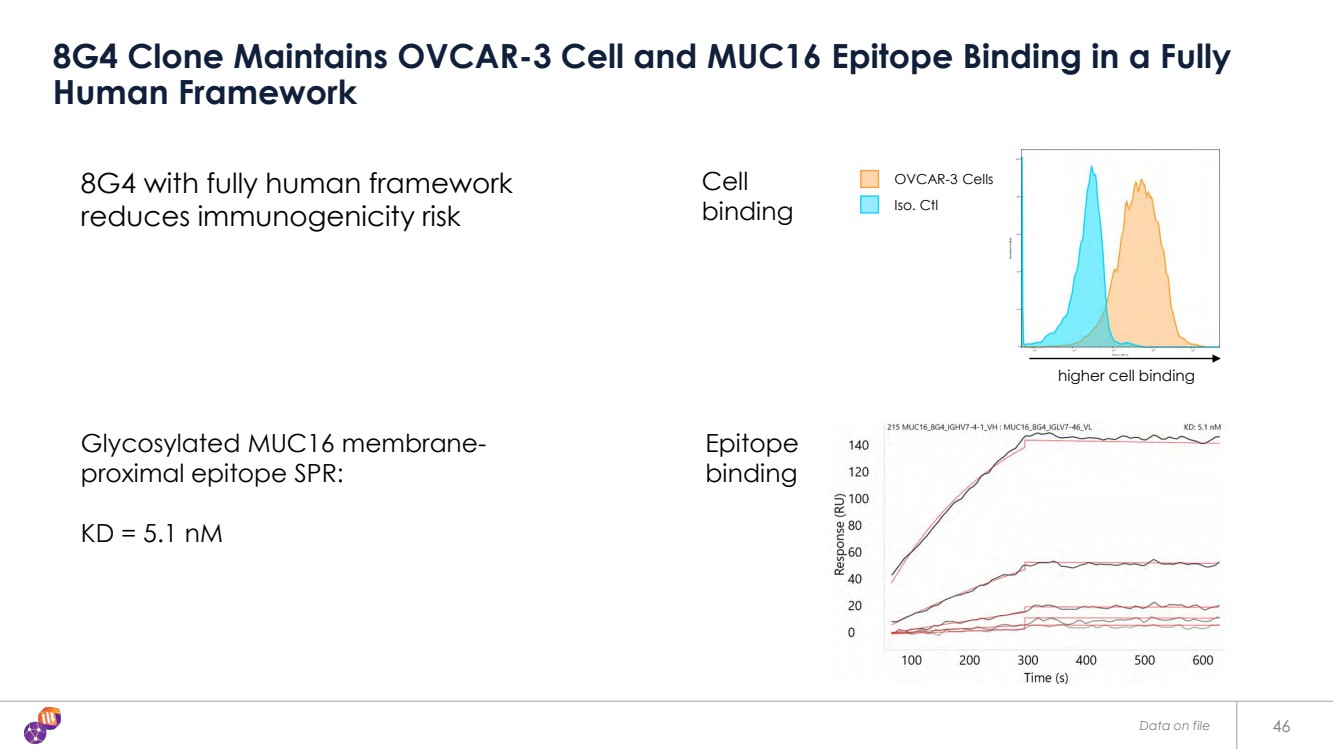

| 46 8G4 Clone Maintains OVCAR-3 Cell and MUC16 Epitope Binding in a Fully Human Framework 8G4 with fully human framework reduces immunogenicity risk Glycosylated MUC16 membrane-proximal epitope SPR: KD = 5.1 nM Iso. Ctl OVCAR-3 Cells Epitope binding Cell binding higher cell binding Data on file |

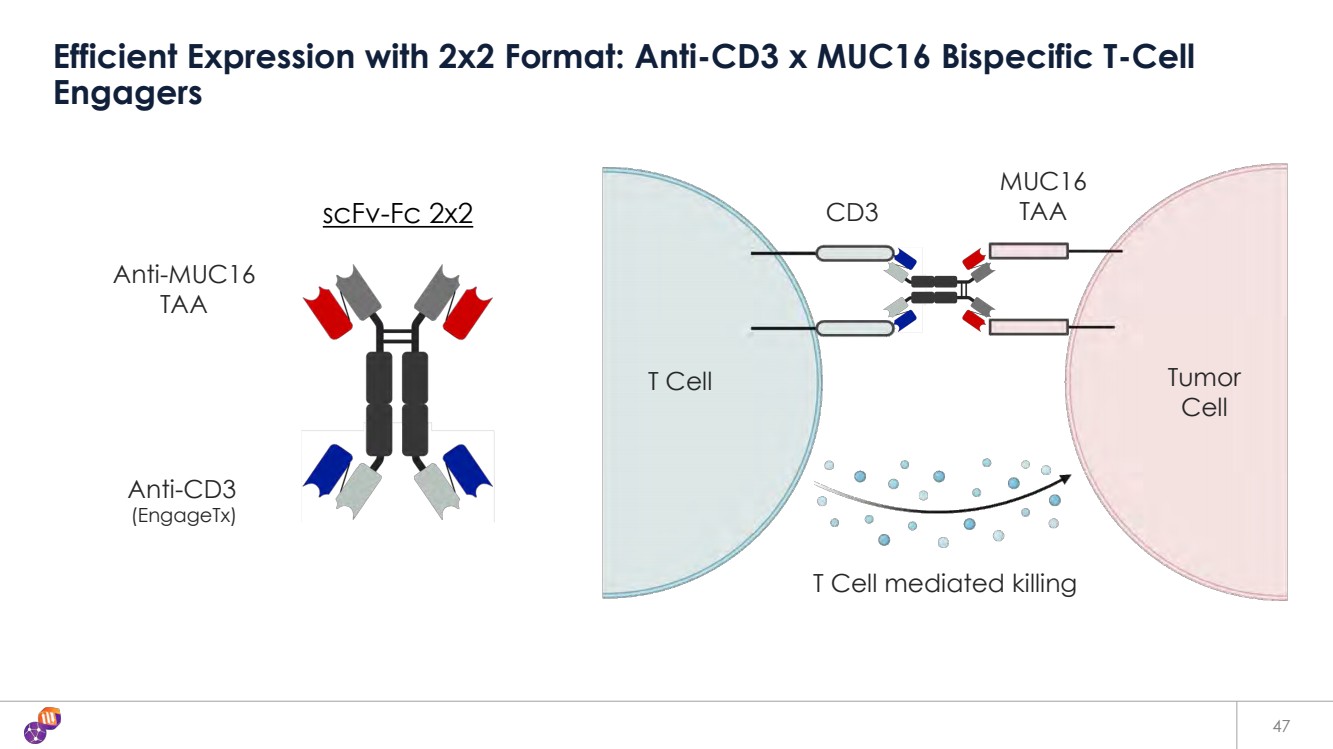

| 47 Efficient Expression with 2x2 Format: Anti-CD3 x MUC16 Bispecific T-Cell Engagers scFv-Fc 2x2 Anti-MUC16 TAA Anti-CD3 (EngageTx) CD3 MUC16 TAA T Cell Tumor Cell T Cell mediated killing |

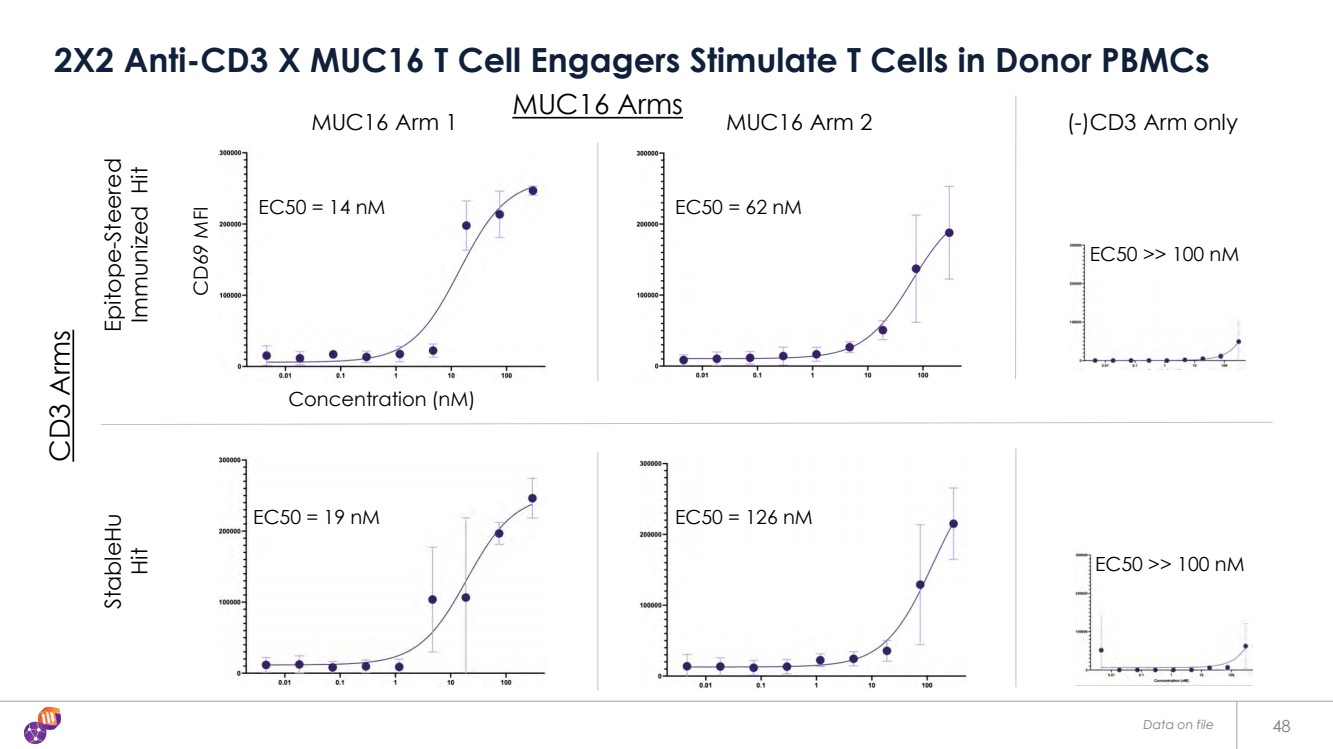

| EC50 = 14 nM EC50 = 62 nM EC50 = 19 nM EC50 = 126 nM Data on file 48 2X2 Anti-CD3 X MUC16 T Cell Engagers Stimulate T Cells in Donor PBMCs EC50 >> 100 nM EC50 >> 100 nM MUC16 Arm 1 (-)CD3 Arm only Epitope-Steered Immunized Hit StableHu Hit CD69 MFI Concentration (nM) MUC16 Arm 2 CD3 Arms MUC16 Arms |

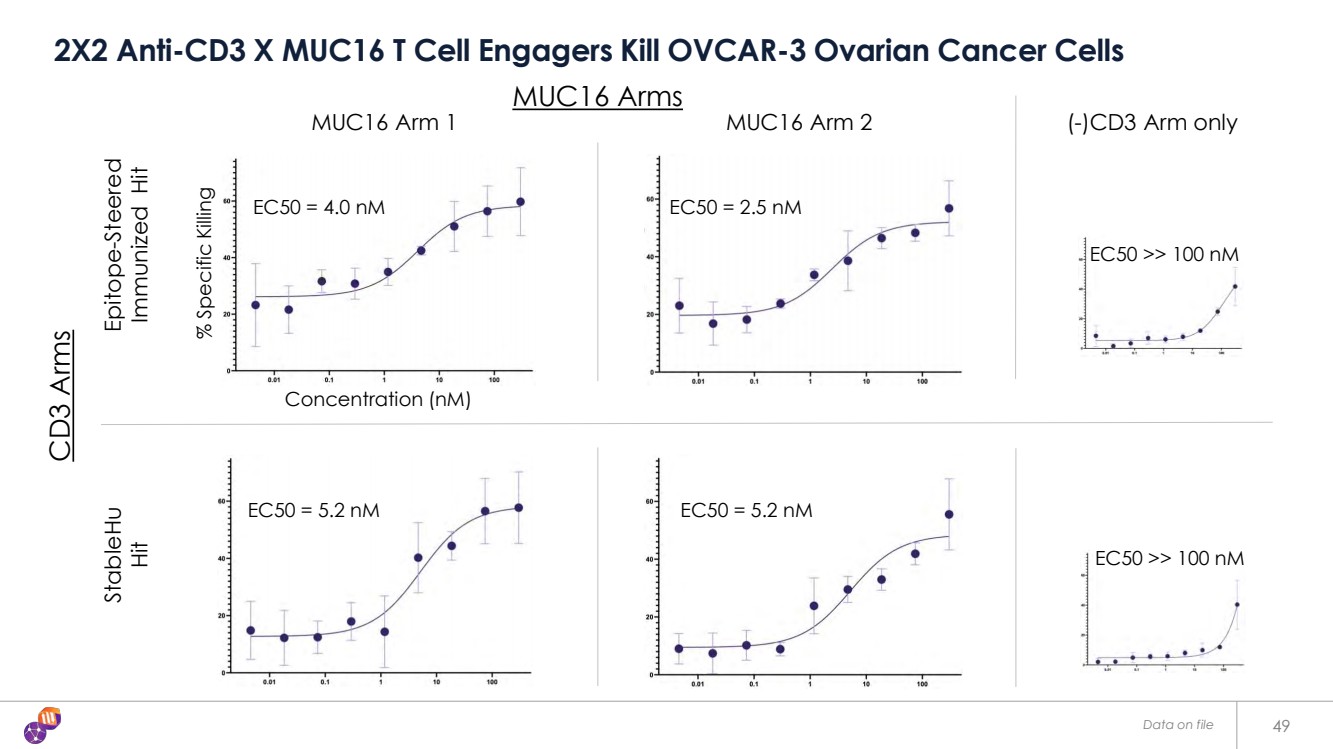

| EC50 = 4.0 nM EC50 = 2.5 nM EC50 = 5.2 nM EC50 = 5.2 nM Data on file 49 2X2 Anti-CD3 X MUC16 T Cell Engagers Kill OVCAR-3 Ovarian Cancer Cells EC50 >> 100 nM EC50 >> 100 nM MUC16 Arm 1 (-)CD3 Arm only Epitope-Steered Immunized Hit StableHu Hit Concentration (nM) MUC16 Arm 2 CD3 Arms MUC16 Arms % Specific Killing |

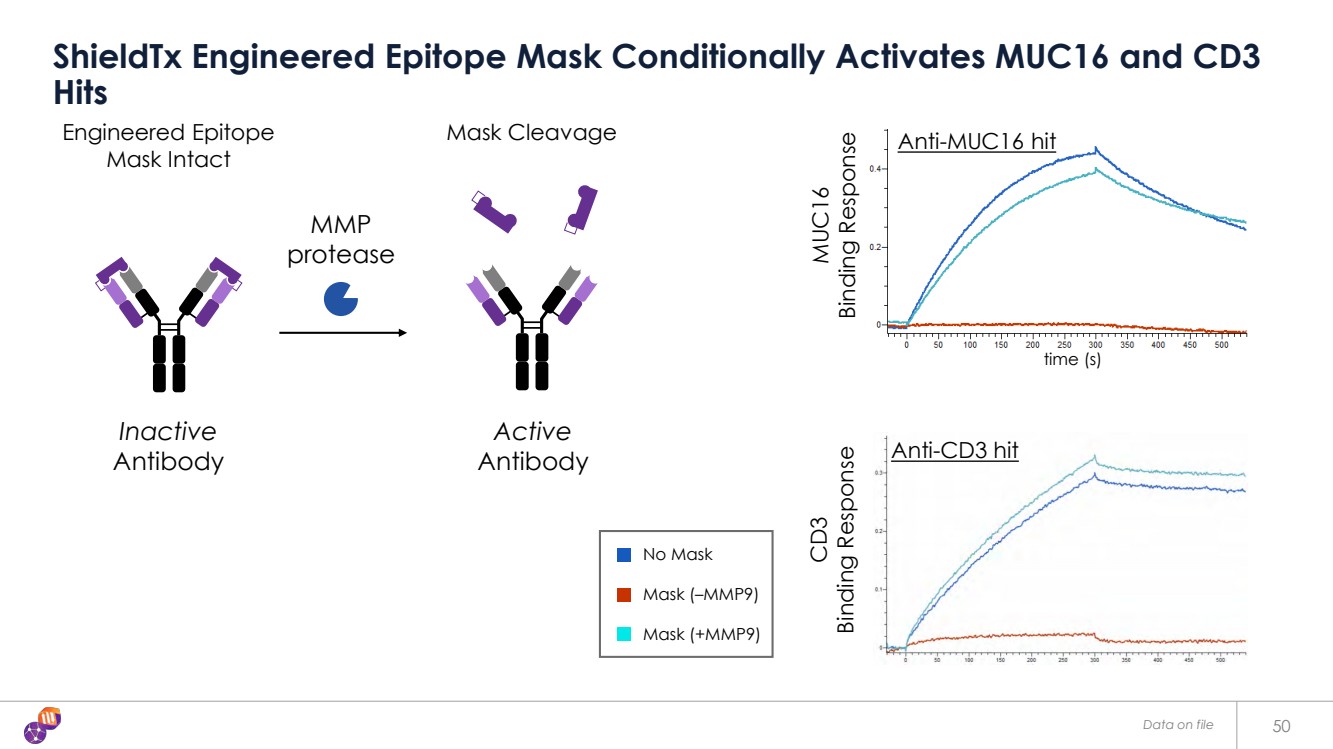

| Data on file 50 ShieldTx Engineered Epitope Mask Conditionally Activates MUC16 and CD3 Hits Mask Cleavage No Mask Mask (–MMP9) Mask (+MMP9) MMP protease Engineered Epitope Mask Intact Inactive Antibody Active Antibody Anti-MUC16 hit Anti-CD3 hit MUC16 Binding Response CD3 Binding Response time (s) |

| 51 Anti-Trop-2 x CD3 Bi-Specific Antibody against Tumor-Specific Trop-2 Cancer Cells |

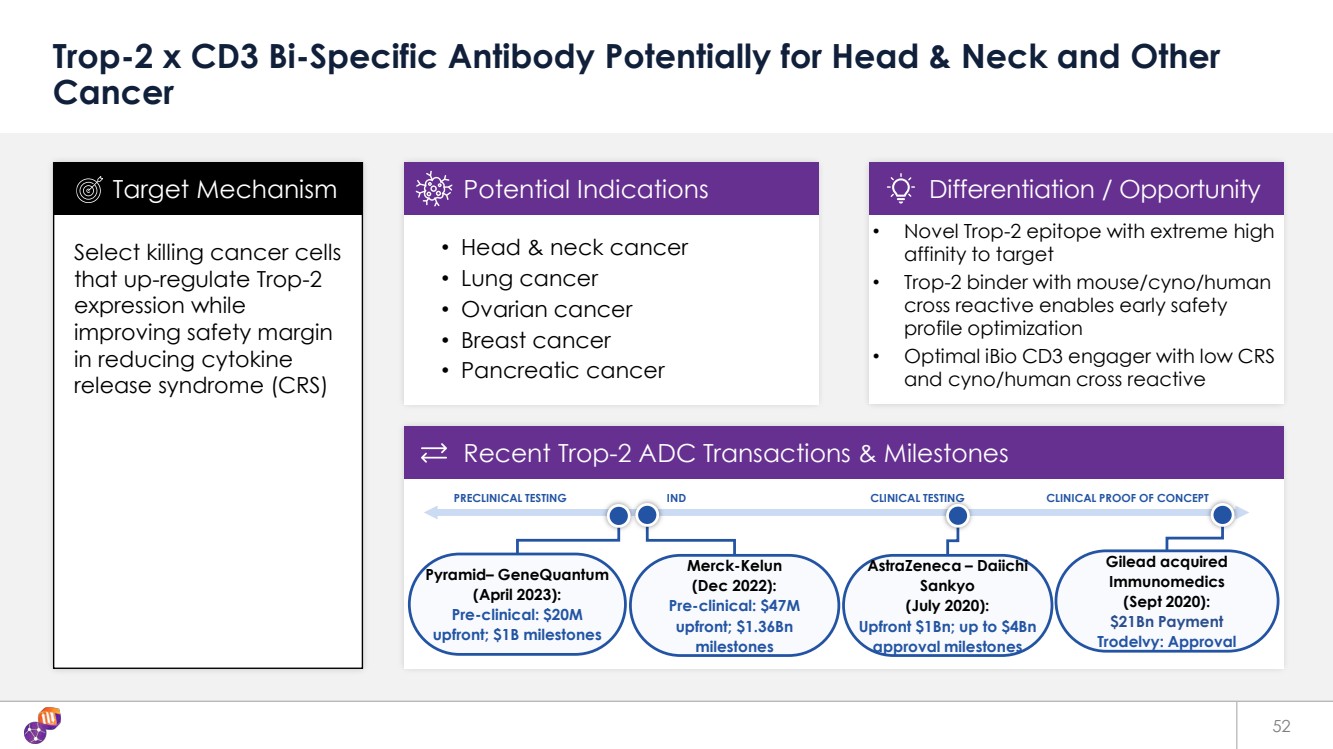

| Recent transactions Target mechanism Potential indications Differentiation / opportunity Gilead acquired Immunomedics (Sept 2020): $21Bn Payment Trodelvy: Approval 52 Trop-2 x CD3 Bi-Specific Antibody Potentially for Head & Neck and Other Cancer Select killing cancer cells that up-regulate Trop-2 expression while improving safety margin in reducing cytokine release syndrome (CRS) • Head & neck cancer • Lung cancer • Ovarian cancer • Breast cancer • Pancreatic cancer Target Mechanism Potential Indications • Novel Trop-2 epitope with extreme high affinity to target • Trop-2 binder with mouse/cyno/human cross reactive enables early safety profile optimization • Optimal iBio CD3 engager with low CRS and cyno/human cross reactive Differentiation / Opportunity Recent Trop-2 ADC Transactions & Milestones PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT AstraZeneca – Daiichi Sankyo (July 2020): Upfront $1Bn; up to $4Bn approval milestones Pyramid– GeneQuantum (April 2023): Pre-clinical: $20M upfront; $1B milestones Merck-Kelun (Dec 2022): Pre-clinical: $47M upfront; $1.36Bn milestones |

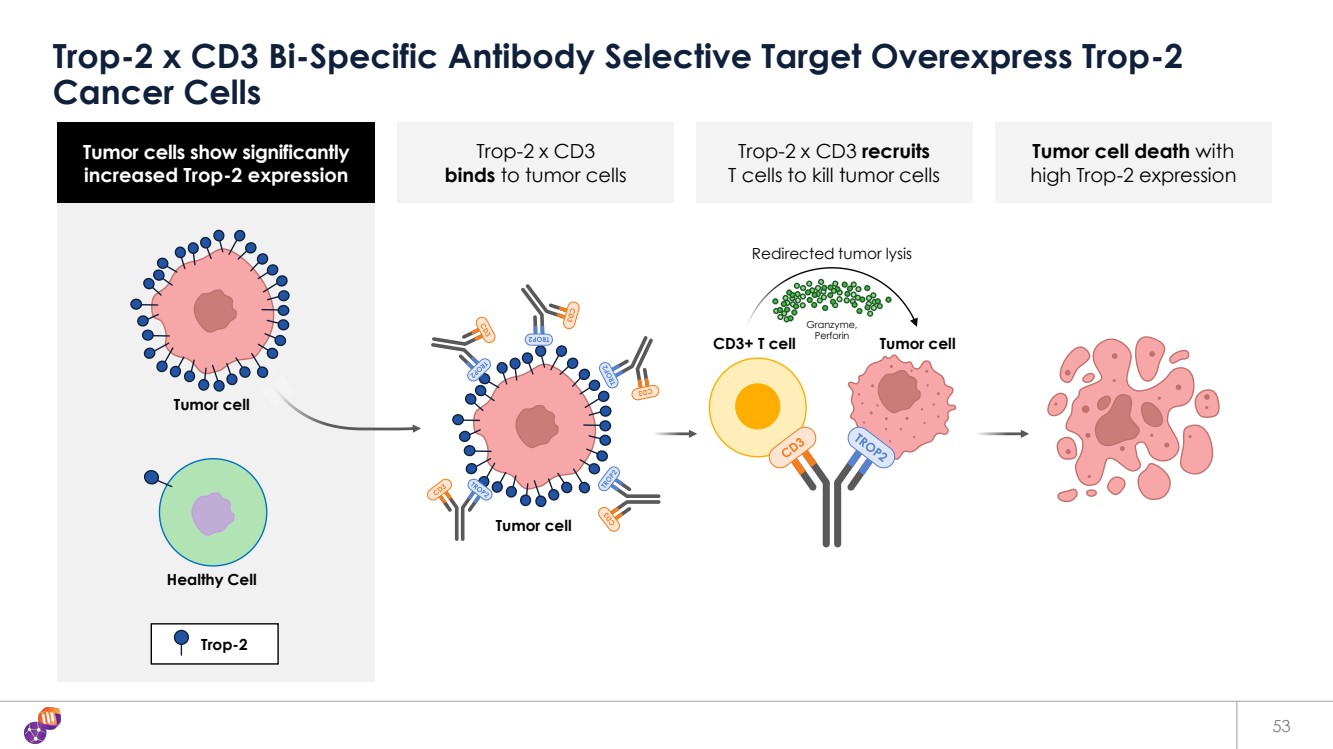

| Tumor cells show significantly increased Trop-2 expression Tumor cell death with high Trop-2 expression Trop-2 x CD3 binds to tumor cells Trop-2 x CD3 recruits T cells to kill tumor cells 53 Trop-2 x CD3 Bi-Specific Antibody Selective Target Overexpress Trop-2 Cancer Cells Trop-2 Tumor cell Healthy Cell Tumor cell Tumor cell Redirected tumor lysis CD3+ T cell Granzyme, Perforin |

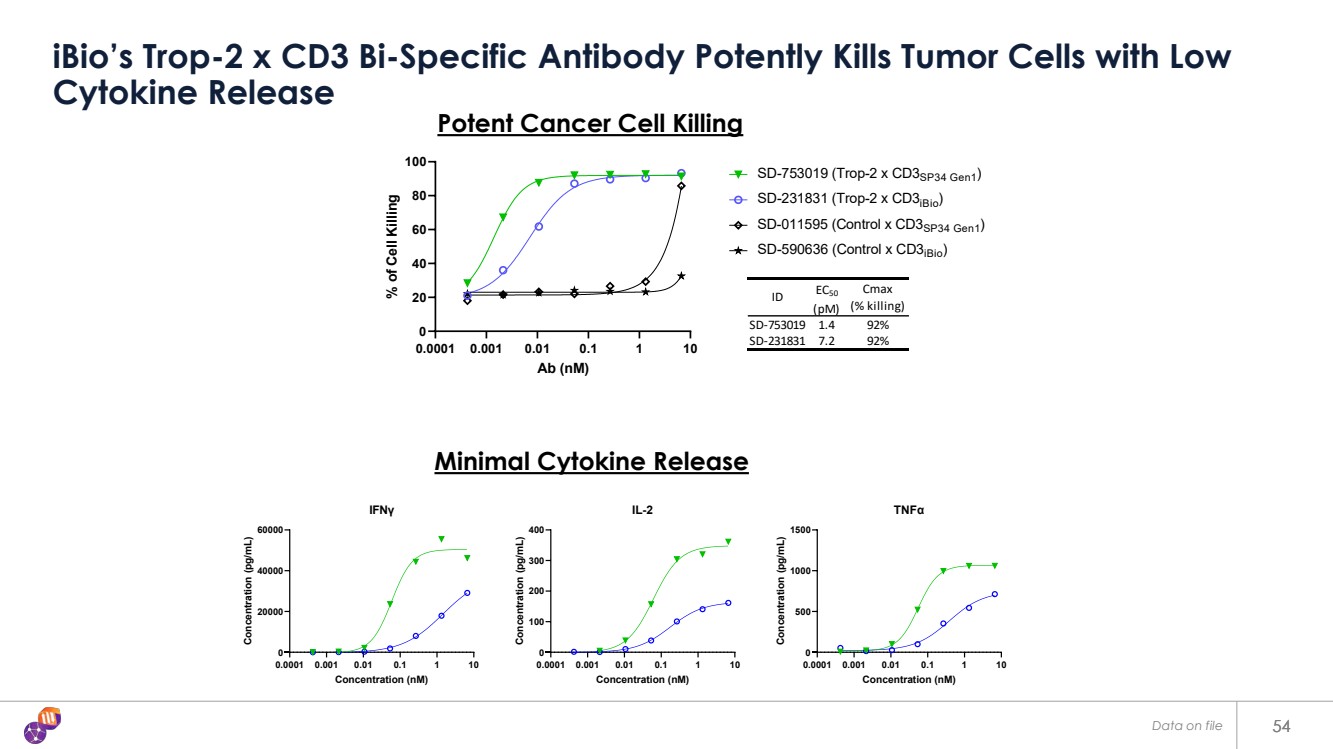

| 54 iBio’s Trop-2 x CD3 Bi-Specific Antibody Potently Kills Tumor Cells with Low Cytokine Release 54 0.0001 0.001 0.01 0.1 1 10 0 20 40 60 80 100 Ab (nM) % of Cell Killing ID EC50 (pM) Cmax (% killing) SD-753019 1.4 92% SD-231831 7.2 92% SD-753019 (Trop-2 x CD3SP34 Gen1) SD-231831 (Trop-2 x CD3iBio) SD-011595 (Control x CD3SP34 Gen1) SD-590636 (Control x CD3iBio) 0.0001 0.001 0.01 0.1 1 10 0 20000 40000 60000 IFNγ Concentration (nM) Concentration (pg/mL) 0.0001 0.001 0.01 0.1 1 10 0 100 200 300 400 IL-2 Concentration (nM) Concentration (pg/mL) 0.0001 0.001 0.01 0.1 1 10 0 500 1000 1500 TNFα Concentration (nM) Concentration (pg/mL) Minimal Cytokine Release Potent Cancer Cell Killing Data on file |

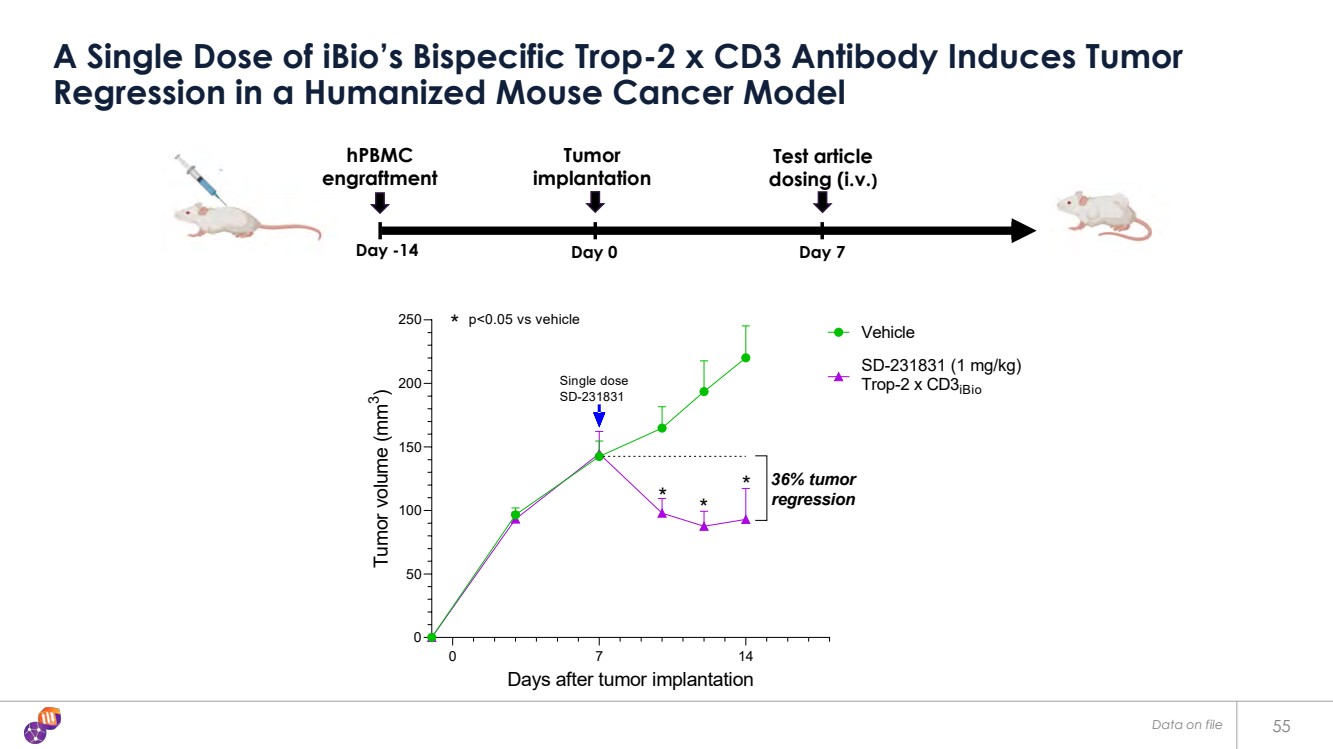

| 55 A Single Dose of iBio’s Bispecific Trop-2 x CD3 Antibody Induces Tumor Regression in a Humanized Mouse Cancer Model 0 7 14 0 50 100 150 200 250 Days after tumor implantation Tumor volume (mm 3 ) Vehicle SD-231831 (1 mg/kg) Trop-2 x CD3iBio * * * * p<0.05 vs vehicle Single dose SD-231831 36% tumor regression Day -14 Day 0 Day 7 hPBMC engraftment Test article dosing (i.v.) Tumor implantation Data on file |

| 56 Anti-EGFRvIII High ADCC mAb Against Tumor-Specific EGFRvIII Cells |

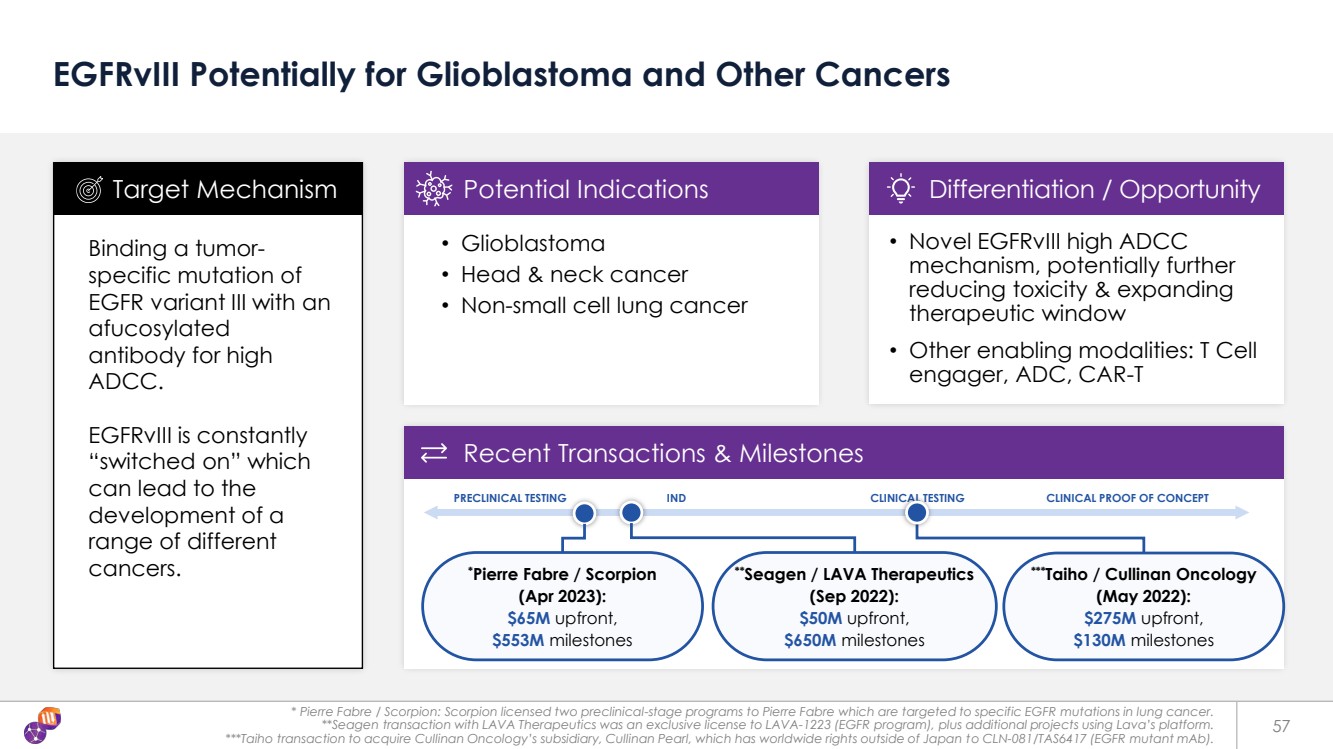

| **Seagen / LAVA Therapeutics (Sep 2022): $50M upfront, $650M milestones ***Taiho / Cullinan Oncology (May 2022): $275M upfront, $130M milestones * Pierre Fabre / Scorpion: Scorpion licensed two preclinical-stage programs to Pierre Fabre which are targeted to specific EGFR mutations in lung cancer. **Seagen transaction with LAVA Therapeutics was an exclusive license to LAVA-1223 (EGFR program), plus additional projects using Lava’s platform. ***Taiho transaction to acquire Cullinan Oncology’s subsidiary, Cullinan Pearl, which has worldwide rights outside of Japan to CLN-081/TAS6417 (EGFR mutant mAb). 57 EGFRvIII Potentially for Glioblastoma and Other Cancers Binding a tumor-specific mutation of EGFR variant III with an afucosylated antibody for high ADCC. EGFRvIII is constantly “switched on” which can lead to the development of a range of different cancers. • Glioblastoma • Head & neck cancer • Non-small cell lung cancer Target Mechanism Potential Indications • Novel EGFRvIII high ADCC mechanism, potentially further reducing toxicity & expanding therapeutic window • Other enabling modalities: T Cell engager, ADC, CAR-T Differentiation / Opportunity Recent Transactions & Milestones PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT *Pierre Fabre / Scorpion (Apr 2023): $65M upfront, $553M milestones |

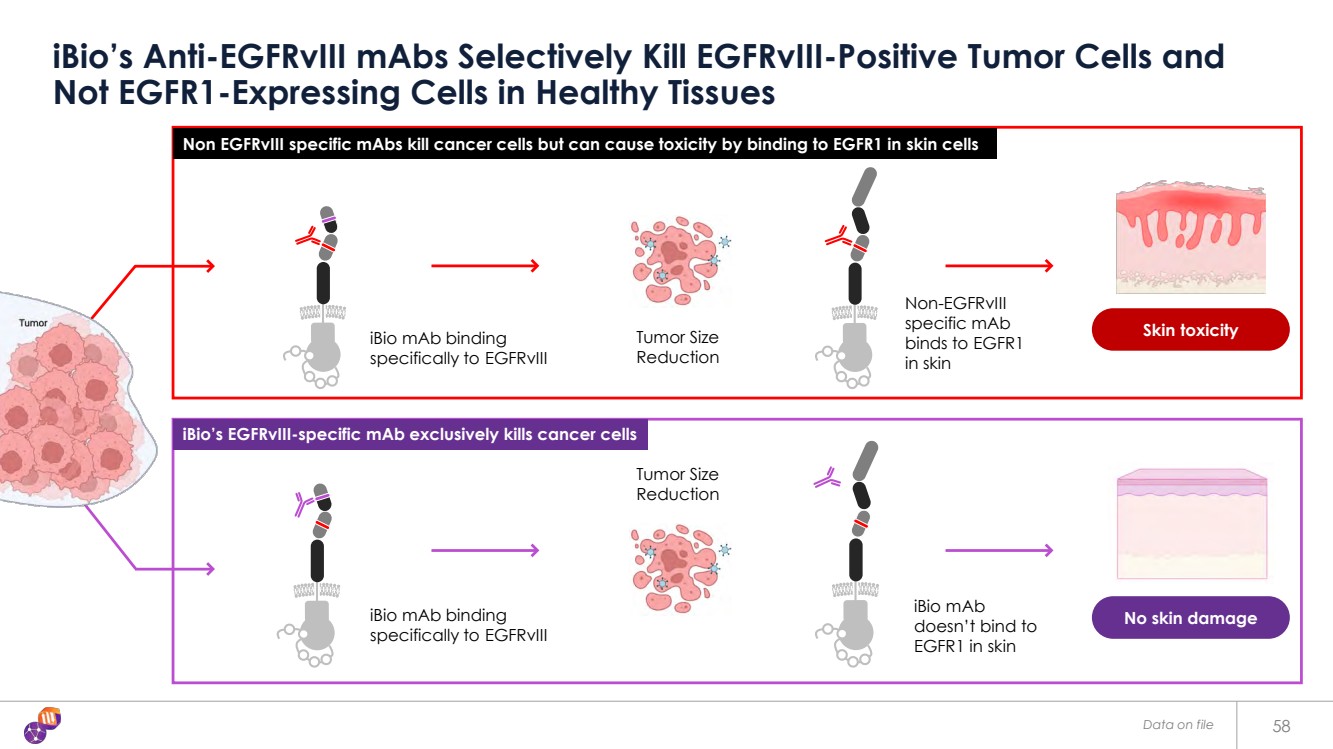

| Skin toxicity No skin damage 58 iBio’s Anti-EGFRvIII mAbs Selectively Kill EGFRvIII-Positive Tumor Cells and Not EGFR1-Expressing Cells in Healthy Tissues iBio mAb binding specifically to EGFRvIII Tumor Size Reduction iBio mAb doesn’t bind to EGFR1 in skin Non-EGFRvIII specific mAb binds to EGFR1 in skin iBio mAb binding specifically to EGFRvIII Tumor Size Reduction Non EGFRvIII specific mAbs kill cancer cells but can cause toxicity by binding to EGFR1 in skin cells iBio’s EGFRvIII-specific mAb exclusively kills cancer cells Data on file |

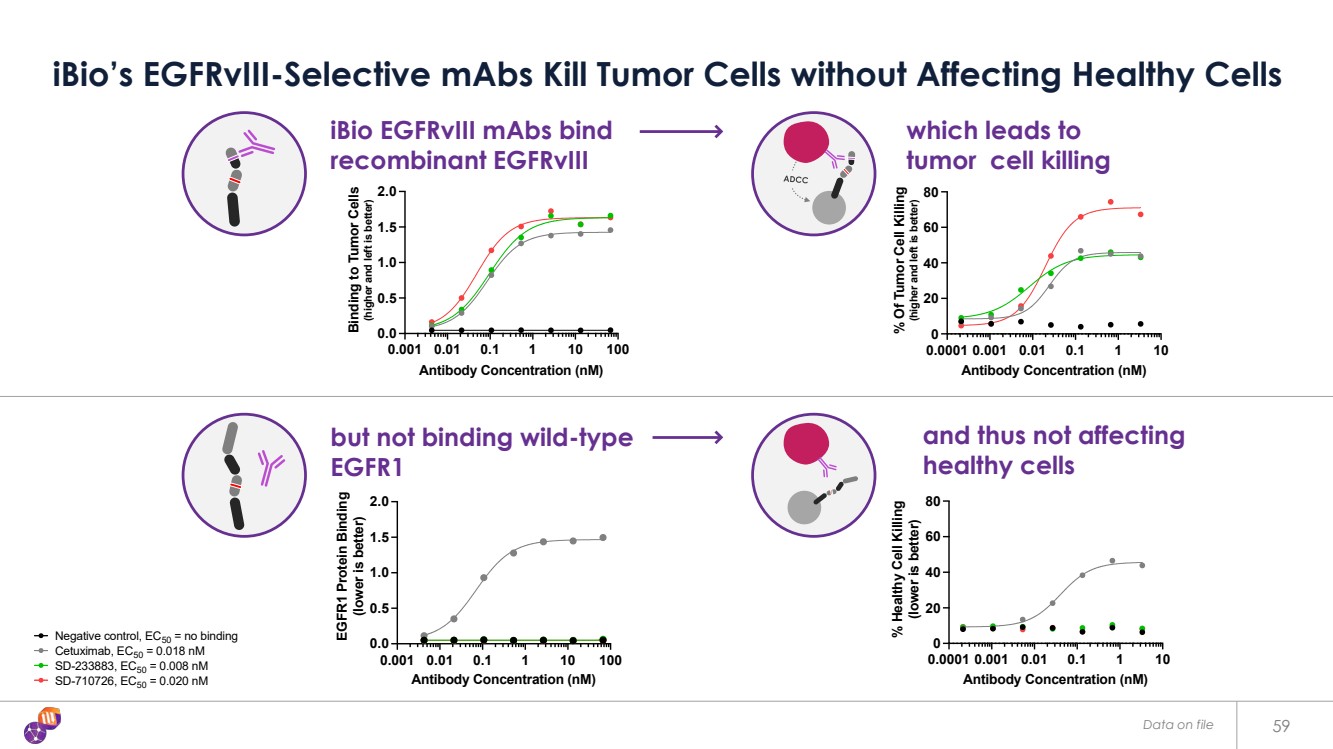

| 59 iBio’s EGFRvIII-Selective mAbs Kill Tumor Cells without Affecting Healthy Cells Negative control, EC50 = no binding Cetuximab, EC50 = 0.018 nM SD-233883, EC50 = 0.008 nM SD-710726, EC50 = 0.020 nM 0.0001 0.001 0.01 0.1 1 10 0 20 40 60 80 Antibody Concentration (nM) % Of Tumor Cell Killing (higher and left is better) Negative control, EC50 = no binding Cetuximab, EC50 = 0.018 nM SD-233883, EC50 = 0.008 nM SD-710726, EC50 = 0.020 nM iBio EGFRvIII mAbs bind recombinant EGFRvIII 0.001 0.01 0.1 1 10 100 0.0 0.5 1.0 1.5 2.0 Antibody Concentration (nM) Binding to Tumor Cells (higher and left is better) Negative control, EC50 = no binding Cetuximab, EC50 = 0.12 nM SD-233883, EC50 = 0.12 nM SD-710726, EC50 = 0.05 nM which leads to tumor cell killing 0.0001 0.001 0.01 0.1 1 10 0 20 40 60 80 Antibody Concentration (nM) % Healthy Cell Killing (lower is better) Negative control, EC50 = no binding Cetuximab, EC50 = 0.029 nM SD-233883, EC50 = no binding SD-710726, EC50 = no binding but not binding wild-type EGFR1 0.001 0.01 0.1 1 10 100 0.0 0.5 1.0 1.5 2.0 Antibody Concentration (nM) EGFR1 Protein Binding (lower is better) Negative control, EC50 = no binding Cetuximab, EC50 = 0.08 nM SD-233883, EC50 = no binding SD-710726, EC50 = no binding and thus not affecting healthy cells Data on file |

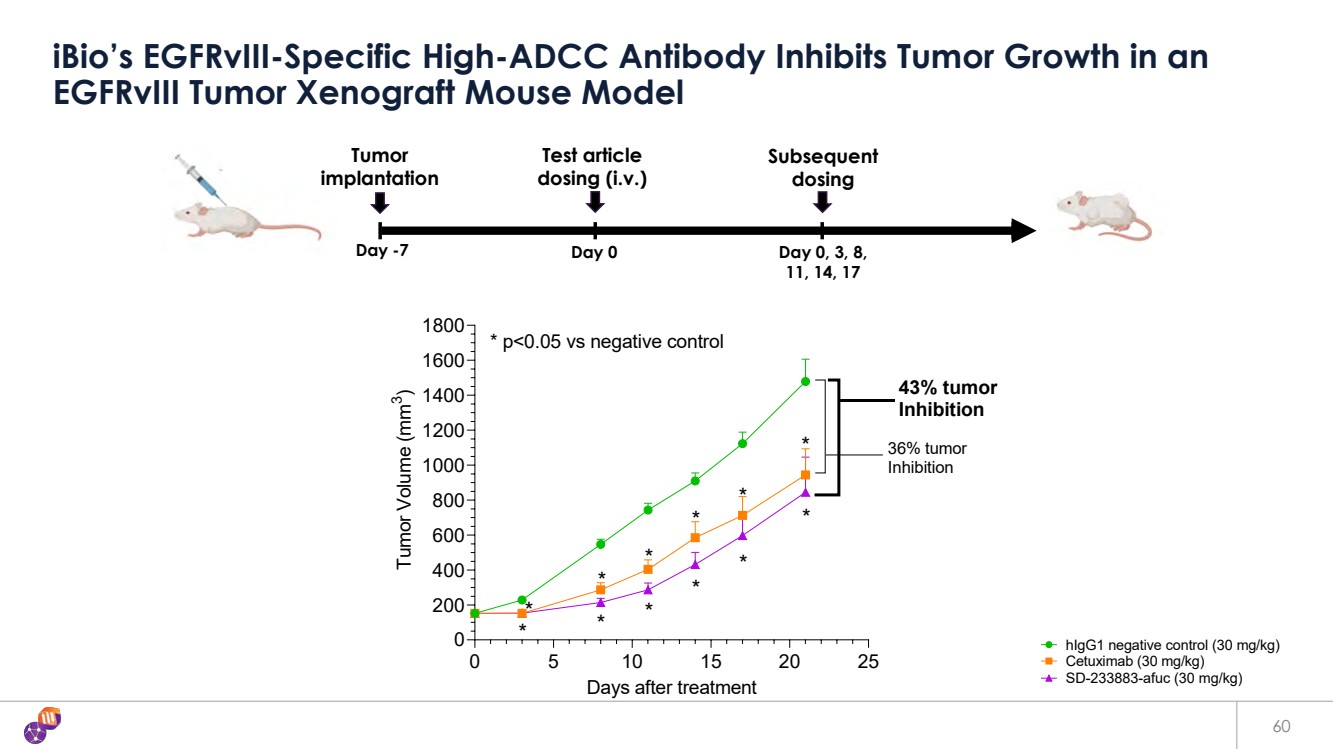

| 60 iBio’s EGFRvIII-Specific High-ADCC Antibody Inhibits Tumor Growth in an EGFRvIII Tumor Xenograft Mouse Model Day -7 Day 0 Day 0, 3, 8, 11, 14, 17 Tumor implantation Subsequent dosing Test article dosing (i.v.) 0 5 10 15 20 25 0 200 400 600 800 1000 1200 1400 1600 1800 Days after treatment Tumor Volume (mm 3 ) hIgG1 negative control (30 mg/kg) Cetuximab (30 mg/kg) SD-233883-afuc (30 mg/kg) * * * * * * * * * * * * * p<0.05 vs negative control 36% tumor Inhibition 43% tumor Inhibition 0 5 10 15 20 25 0 200 400 600 800 1000 1200 1400 1600 1800 Days after treatment Tumor Volume (mm 3 ) hIgG1 negative control (30 mg/kg) Cetuximab (30 mg/kg) SD-233883-afuc (30 mg/kg) * * * * * * * * * * * * * p<0.05 vs negative control 36% tumor Inhibition 43% tumor Inhibition |

| 61 PD-1 Agonist Supports Restoration of Homeostasis for Inflammatory Diseases |

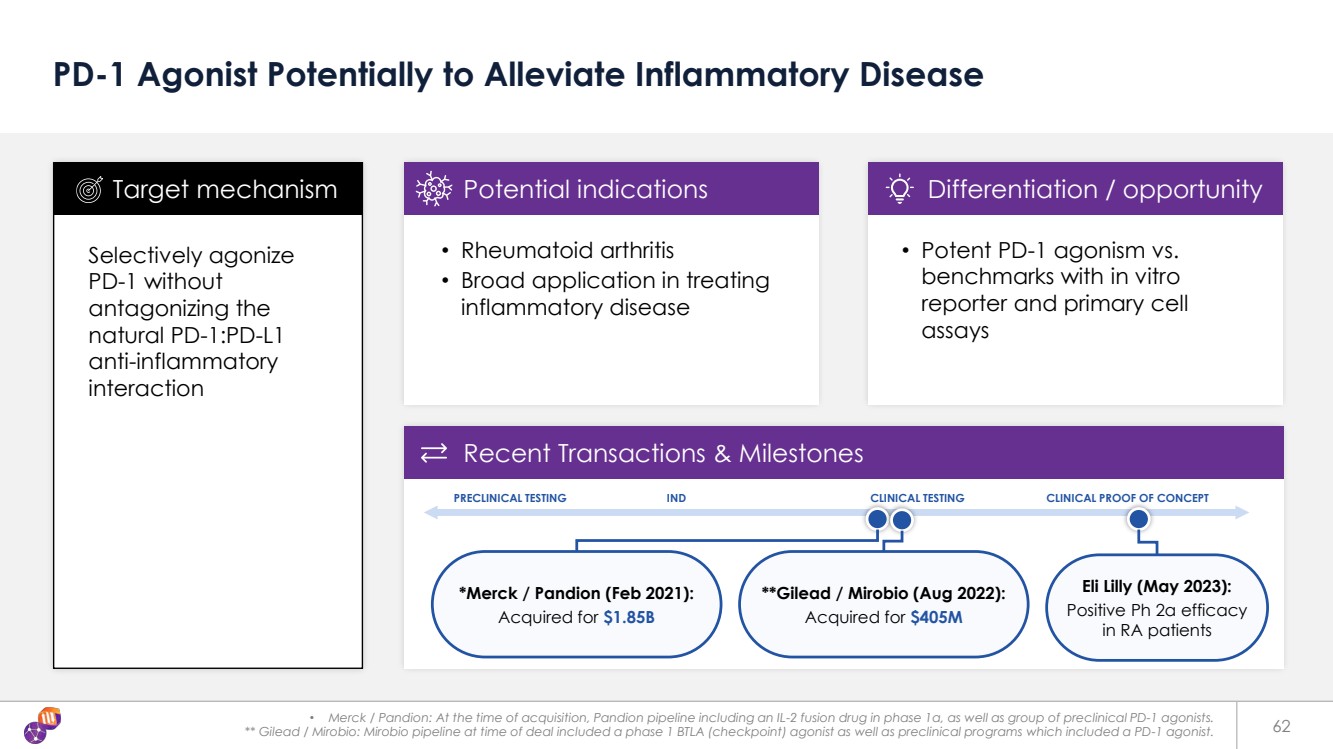

| 62 PD-1 Agonist Potentially to Alleviate Inflammatory Disease Selectively agonize PD-1 without antagonizing the natural PD-1:PD-L1 anti-inflammatory interaction • Rheumatoid arthritis • Broad application in treating inflammatory disease Target mechanism Potential indications Differentiation / opportunity Recent Transactions & Milestones • Potent PD-1 agonism vs. benchmarks with in vitro reporter and primary cell assays **Gilead / Mirobio (Aug 2022): Acquired for $405M *Merck / Pandion (Feb 2021): Acquired for $1.85B PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT Eli Lilly (May 2023): Positive Ph 2a efficacy in RA patients • Merck / Pandion: At the time of acquisition, Pandion pipeline including an IL-2 fusion drug in phase 1a, as well as group of preclinical PD-1 agonists. ** Gilead / Mirobio: Mirobio pipeline at time of deal included a phase 1 BTLA (checkpoint) agonist as well as preclinical programs which included a PD-1 agonist. |

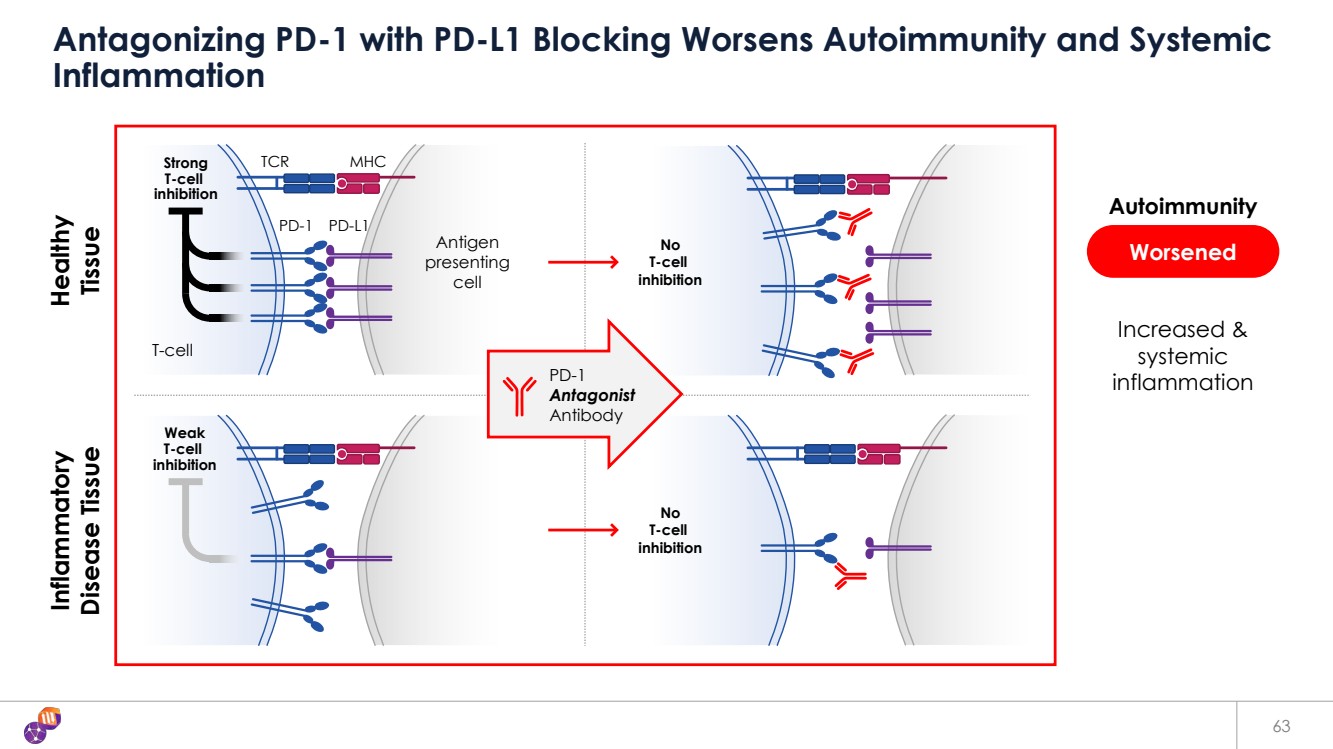

| PD-1 PD-L1 TCR MHC T-cell Antigen presenting cell 63 Antagonizing PD-1 with PD-L1 Blocking Worsens Autoimmunity and Systemic Inflammation Inflammatory Disease Tissue Healthy Tissue Increased & systemic inflammation No T-cell inhibition No T-cell inhibition Worsened Strong T-cell inhibition Weak T-cell inhibition Autoimmunity PD-1 Antagonist Antibody |

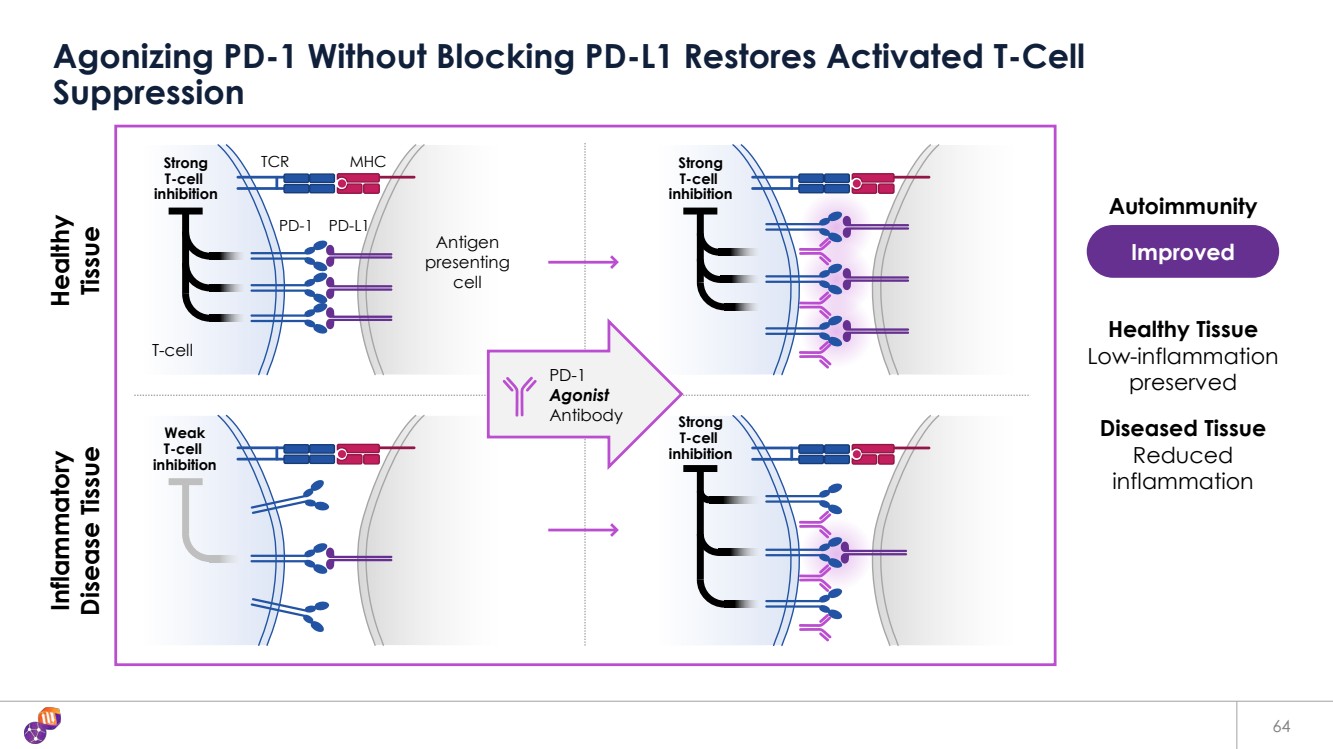

| 64 Agonizing PD-1 Without Blocking PD-L1 Restores Activated T-Cell Suppression Diseased Tissue Reduced inflammation Healthy Tissue Low-inflammation preserved PD-1 PD-L1 Strong TCR MHC T-cell inhibition T-cell Inflammatory Disease Tissue Healthy Tissue Weak T-cell inhibition Strong T-cell inhibition Strong T-cell inhibition Improved Autoimmunity Antigen presenting cell PD-1 Agonist Antibody |

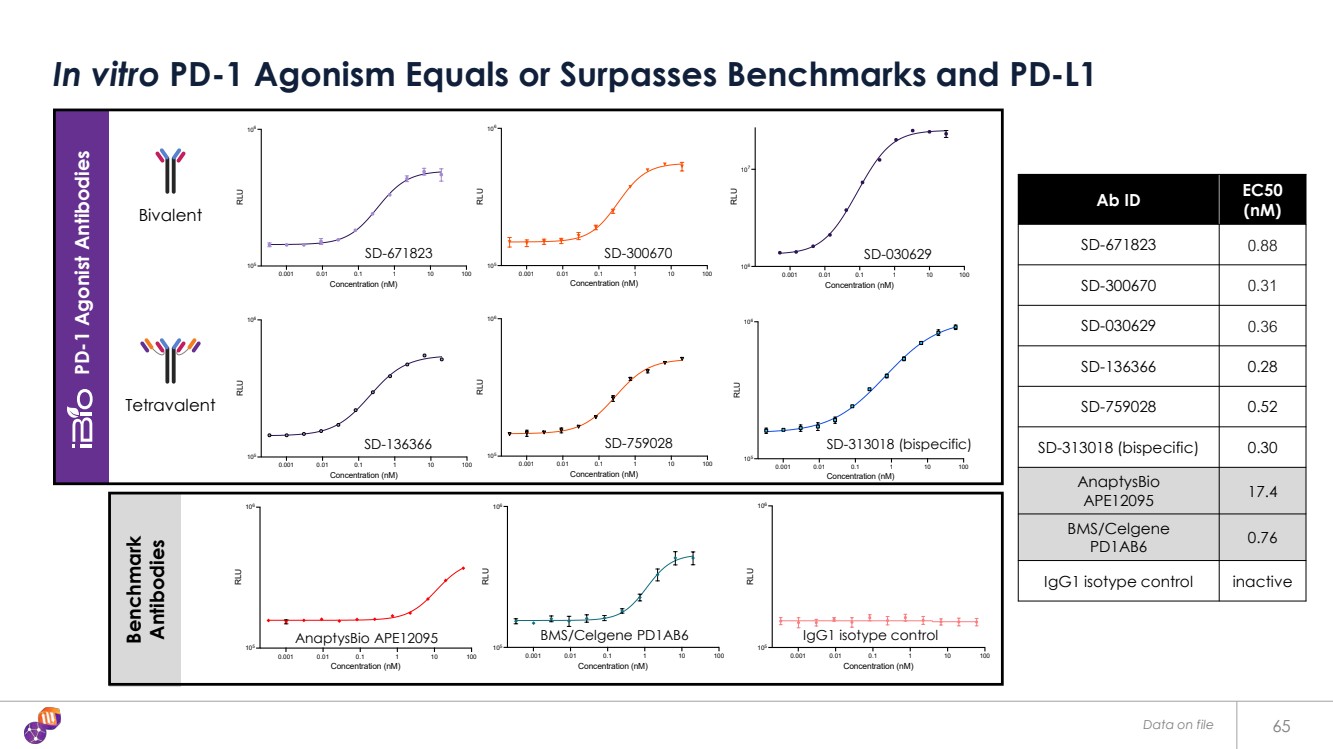

| Benchmark Antibodies PD-1 Agonist Antibodies 65 In vitro PD-1 Agonism Equals or Surpasses Benchmarks and PD-L1 Ab ID EC50 (nM) SD-671823 0.88 SD-300670 0.31 SD-030629 0.36 SD-136366 0.28 SD-759028 0.52 SD-313018 (bispecific) 0.30 AnaptysBio APE12095 17.4 BMS/Celgene PD1AB6 0.76 IgG1 isotype control inactive 0.001 0.01 0.1 1 10 100 105 106 Concentration (nM) RLU PD-1 Agonism Reporter Assay 07 bivalent 0.001 0.01 0.1 1 10 100 105 106 Concentration (nM) RLU PD-1 Agonism Reporter Assay H01 bivalent 0.001 0.01 0.1 1 10 100 106 107 Concentration (nM) RLU D4-A7-7_201 EC50: 0.36 ± 0.11 nM D4_A7_7 IgG SD-671823 SD-300670 SD-030629 0.001 0.01 0.1 1 10 100 105 106 Concentration (nM) RLU PD-1 Agonism Reporter Assay 07 + H01 Tandem bispecific 0.001 0.01 0.1 1 10 100 105 106 Concentration (nM) RLU PD-1 Agonism Reporter Assay 07 Tandem tetravalent 0.001 0.01 0.1 1 10 100 105 106 Concentration (nM) RLU PD-1 Agonism Reporter Assay H01 Tandem tetravalent SD-136366 SD-759028 SD-313018 (bispecific) 0.001 0.01 0.1 1 10 100 105 106 Concentration (nM) RLU PD-1 Agonism Reporter Assay AnaptysBio APE12095 0.001 0.01 0.1 1 10 100 105 106 Concentration (nM) RLU PD-1 Agonism Reporter Assay BMS/Celgene PD1AB6 0.001 0.01 0.1 1 10 100 105 106 Concentration (nM) RLU PD-1 Agonism Reporter Assay IgG1 Isotype control AnaptysBio APE12095 BMS/Celgene PD1AB6 IgG1 isotype control Tetravalent Bivalent x x Data on file |

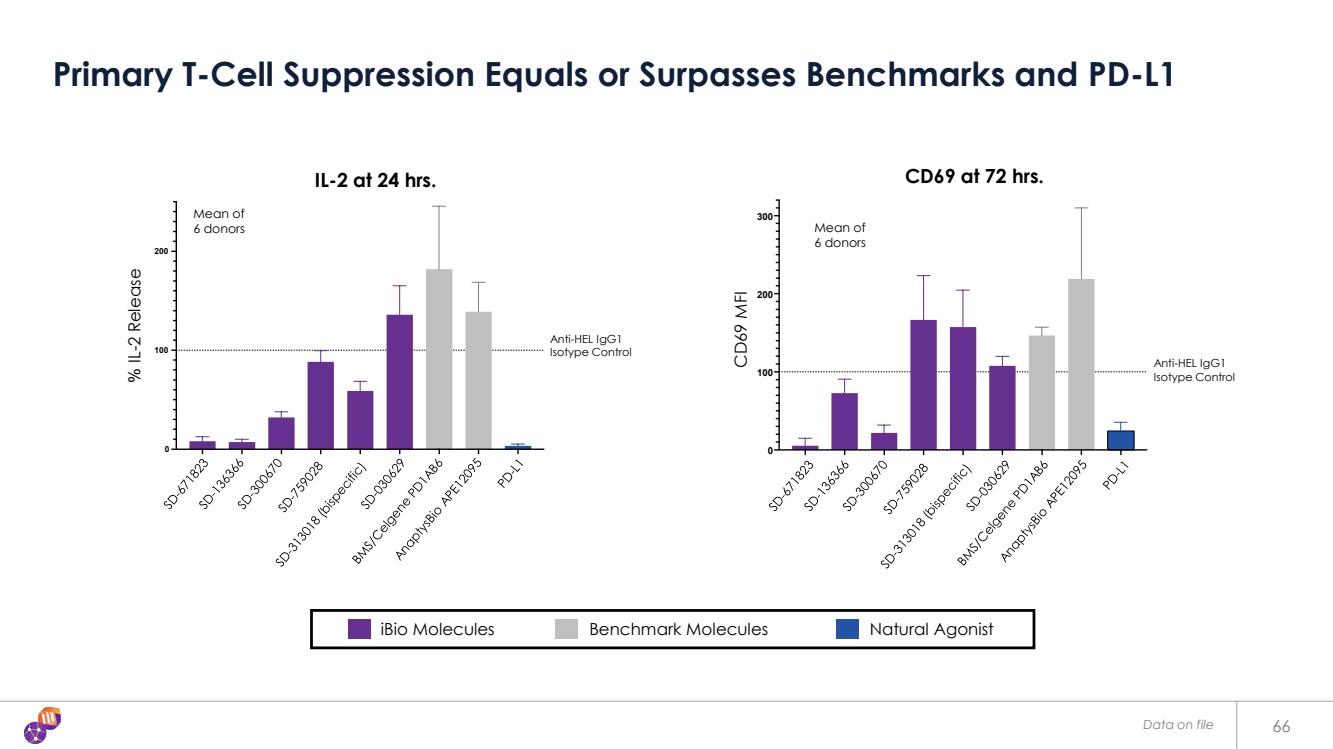

| Data on file 66 Primary T-Cell Suppression Equals or Surpasses Benchmarks and PD-L1 IL-2 at 24 hrs. % IL-2 Release Mean of 6 donors 0 100 200 Anti-HEL IgG1 Isotype Control CD69 at 72 hrs. CD69 MFI Mean of 6 donors 0 100 200 300 Anti-HEL IgG1 Isotype Control iBio Molecules Benchmark Molecules Natural Agonist |