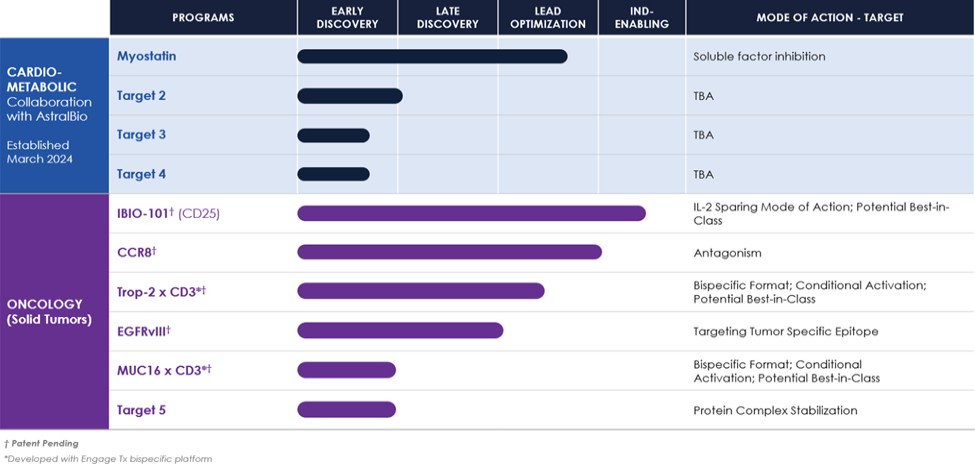

AstralBio collaboration to add obesity and cardiometabolic programs into its pre-clinical pipeline. Under this strategic collaboration with AstraBio, it affords iBio the opportunity to expand the Company’s pipeline and build a presence in the cardiometabolic disease space.

2. Basis of Presentation

Interim Condensed Consolidated Financial Statements

The accompanying unaudited condensed consolidated financial statements have been prepared from the books and records of the Company and include all normal and recurring adjustments which are necessary for a fair presentation in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for interim consolidated financial information and Rule 8-03 of Regulation S-X promulgated by the U.S. Securities and Exchange Commission (the “SEC”). Accordingly, these interim financial statements do not include all of the information and footnotes required for complete annual consolidated financial statements. Interim results are not necessarily indicative of the results that may be expected for the full year. Interim unaudited condensed consolidated financial statements should be read in conjunction with the audited financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K/A for the prior year ended June 30, 2024, filed with the SEC on September 24, 2024 (the “Annual Report”), from which the accompanying condensed consolidated balance sheet dated June 30, 2024 was derived.

In the opinion of management, the accompanying unaudited condensed consolidated financial statements contain all adjustments necessary to present fairly the financial position of the Company as of September 30, 2024 and the results of its operations and its cash flows for the periods presented. The results of operations for the three months ended September 30, 2024 are not necessarily indicative of the results that may be achieved for a full fiscal year and cannot be used to indicate financial performance for the entire year.

Principles of Consolidation

The condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries. All intercompany balances and transactions have been eliminated as part of the consolidation.

Going Concern

In accordance with ASU No. 2014-15, Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern (Subtopic 205-40), the Company has evaluated whether there are conditions and events, considered in the aggregate, that raise substantial doubt about its ability to continue as a going concern within one year after the date that the condensed consolidated financial statements are issued.

The Company generated negative cash flows from operations of approximately $

8