| Breakthrough Antibodies for Obesity and Cardiometabolic Diseases Enabled by an AI-Platform Scalable for Future High-Value Indications Corporate Presentation January 2025 |

| Certain statements in this presentation constitute "forward -looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Words such as "may," "might," "will," "should," "believe," "expect," "anticipate," "estimate," "continue," "predict," "forecast," "project," "plan," "intend" or similar expressions, or statements regarding intent, belief, or current expectations, are forward -looking statements. These forward - looking statements are based upon current estimates and includes statements regarding near term catalysts. While iBio, Inc., a Delaware corporation (including its consolidated subsidiaries, “iBio,” the “Company,” “we,” “us” or “our”) believes these forward -looking statements are reasonable, undue reliance should not be placed on any such forward - looking statements, which are based on information available to us on the date of this presentation. These forward -looking statements are subject to various risks and uncertainties, many of which are difficult to predict that could cause actual results to differ materially from current expectations and assumptions from those set forth or implied by any forward -looking statements. Important factors that could cause actual results to differ materially from current expectations include, among others, the Company’s ability to obtain regulatory approvals for commercialization of its product candidates, or to comply with ongoing regulatory requirements, regulatory limitations relating to its ability to promote or commercialize its product candidates for specific indications, acceptance of its product candidates in the marketplace and the successful development, marketing or sale of products, its ability to attain license agreements, the continued maintenance and growth of its patent estate, its ability to establish and maintain collaborations, its ability to obtain or maintain the capital or grants necessary to fund its research and development activities, competition, its ability to retain its key employees or maintain its NYSE American listing, and the other factors discussed in the Company’s most recent Annual Report on Form 10-K and the Company’s subsequent filings with the SEC, including subsequent periodic reports on Forms 10-Q and 8-K. The information in this presentation is provided only as of today, and we undertake no obligation to update any forward -looking statements contained in this presentation on account of new information, future events, or otherwise, except as required by law. Forward looking statements 2 |

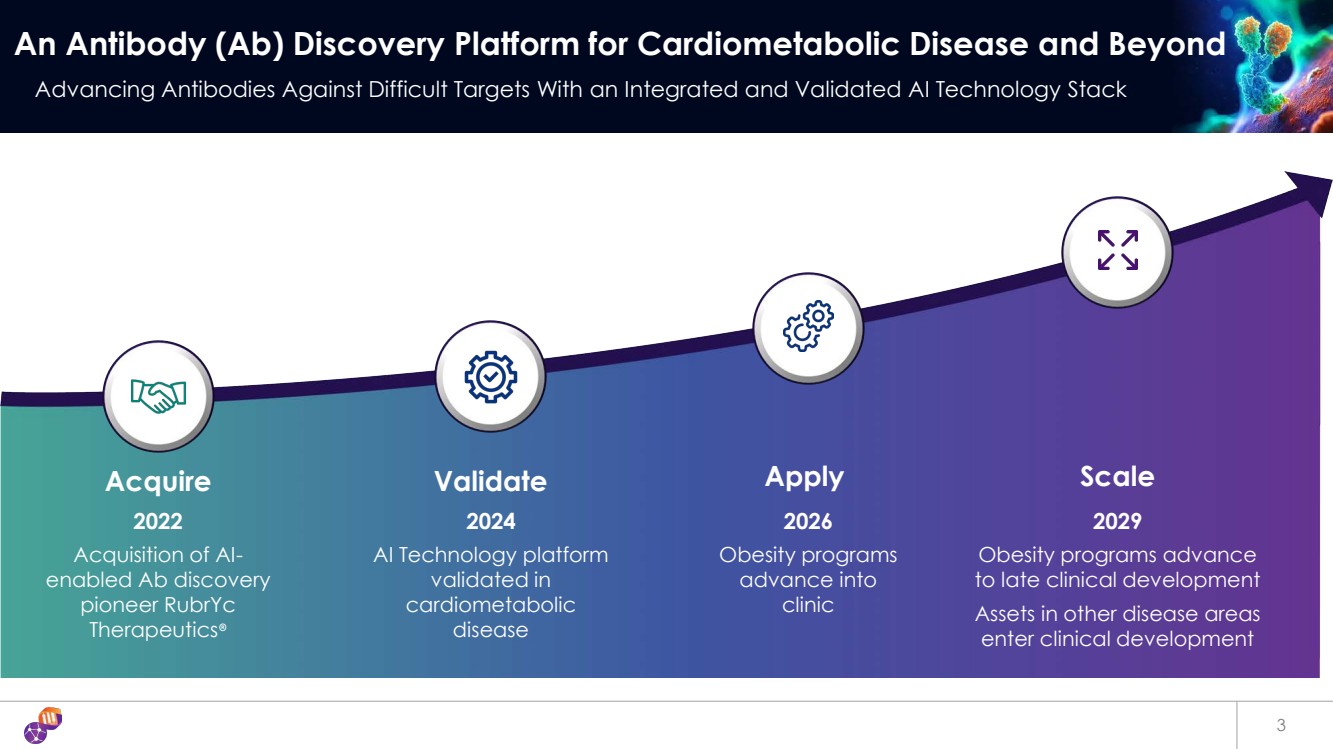

| 3 An Antibody (Ab) Discovery Platform for Cardiometabolic Disease and Beyond Advancing Antibodies Against Difficult Targets With an Integrated and Validated AI Technology Stack Apply 2026 Obesity programs advance into clinic Scale 2029 Obesity programs advance to late clinical development Assets in other disease areas enter clinical development Acquire 2022 Acquisition of AI-enabled Ab discovery pioneer RubrYc Therapeutics® Validate 2024 AI Technology platform validated in cardiometabolic disease |

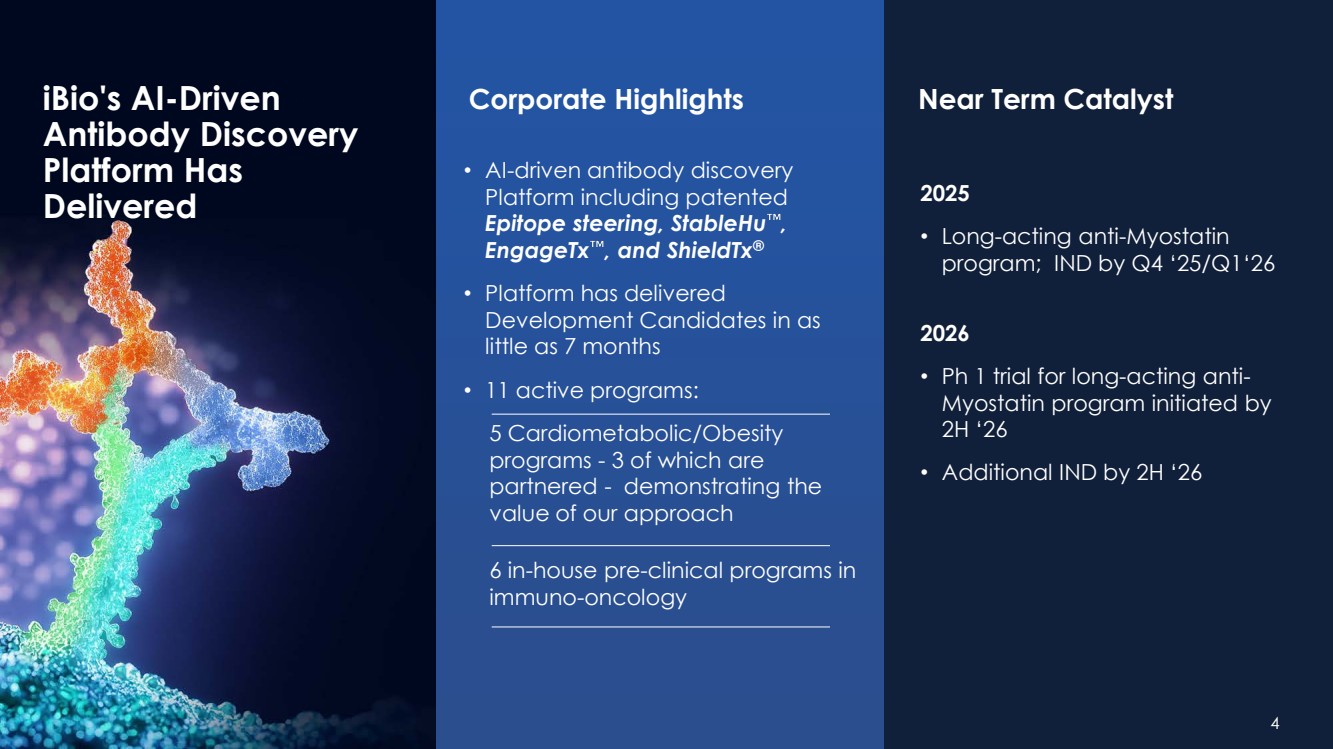

| iBio's AI-Driven Antibody Discovery Platform Has Delivered Corporate Highlights • AI-driven antibody discovery Platform including patented Epitope steering, StableHu , EngageTx , and ShieldTx® • Platform has delivered Development Candidates in as little as 7 months • 11 active programs: 5 Cardiometabolic/Obesity programs - 3 of which are partnered - demonstrating the value of our approach 6 in-house pre-clinical programs in immuno-oncology Near Term Catalyst 2025 • Long-acting anti-Myostatin program; IND by Q4 ‘25/Q1‘26 2026 • Ph 1 trial for long-acting anti-Myostatin program initiated by 2H ‘26 • Additional IND by 2H ‘26 4 |

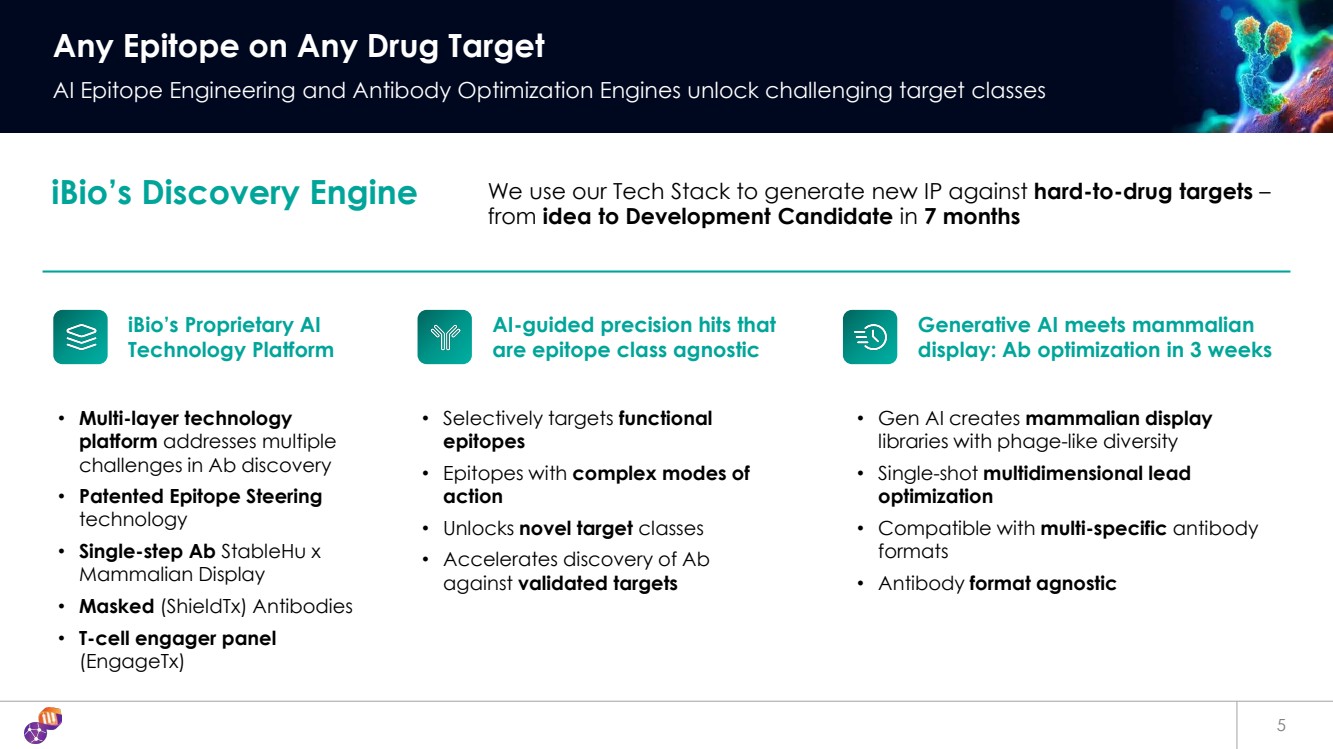

| Any Epitope on Any Drug Target AI Epitope Engineering and Antibody Optimization Engines unlock challenging target classes • Multi-layer technology platform addresses multiple challenges in Ab discovery • Patented Epitope Steering technology • Single-step Ab StableHu x Mammalian Display • Masked (ShieldTx) Antibodies • T-cell engager panel (EngageTx) iBio’s Discovery Engine iBio’s Proprietary AI Technology Platform We use our Tech Stack to generate new IP against hard-to-drug targets – from idea to Development Candidate in 7 months • Selectively targets functional epitopes • Epitopes with complex modes of action • Unlocks novel target classes • Accelerates discovery of Ab against validated targets AI-guided precision hits that are epitope class agnostic • Gen AI creates mammalian display libraries with phage-like diversity • Single-shot multidimensional lead optimization • Compatible with multi-specific antibody formats • Antibody format agnostic Generative AI meets mammalian display: Ab optimization in 3 weeks 5 |

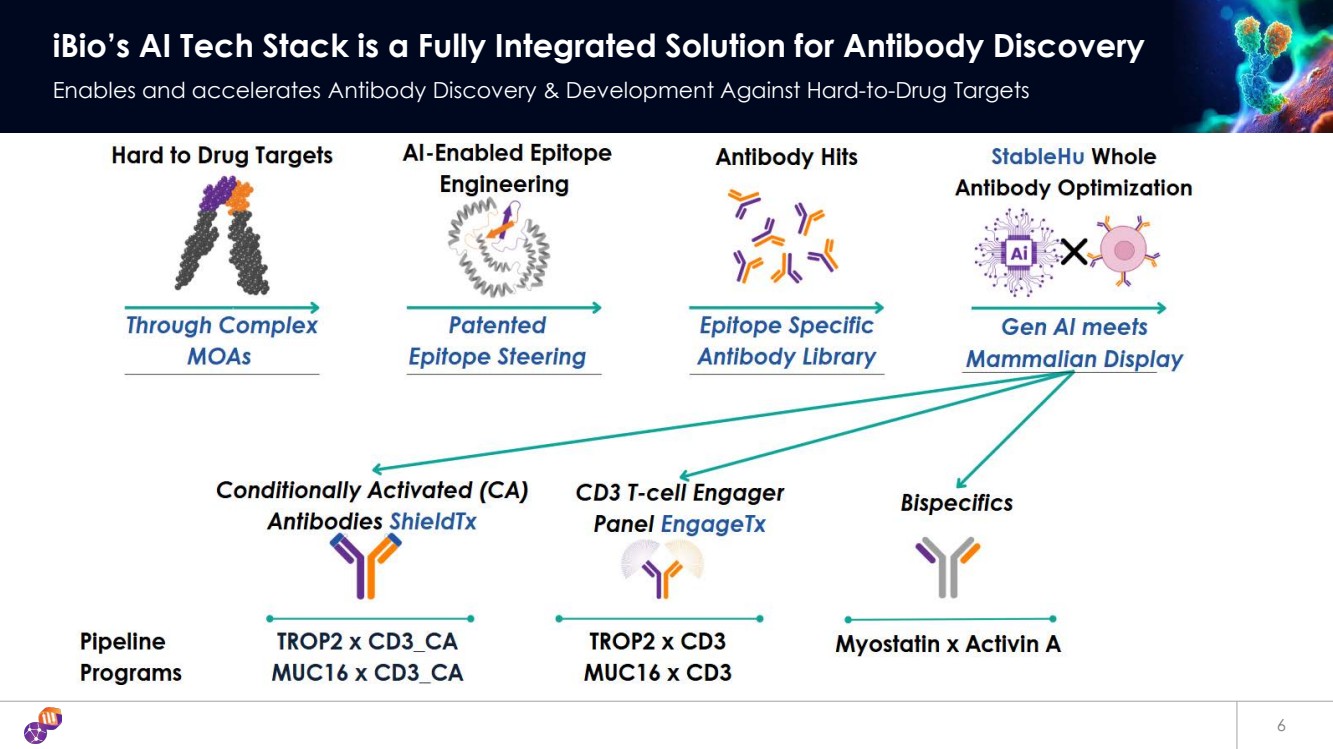

| 6 iBio’s AI Tech Stack is a Fully Integrated Solution for Antibody Discovery Enables and accelerates Antibody Discovery & Development Against Hard-to-Drug Targets |

| Transition slide – Harnessing the Power of Our Platform to Address Challenges in Cardio-metabolic Disease |

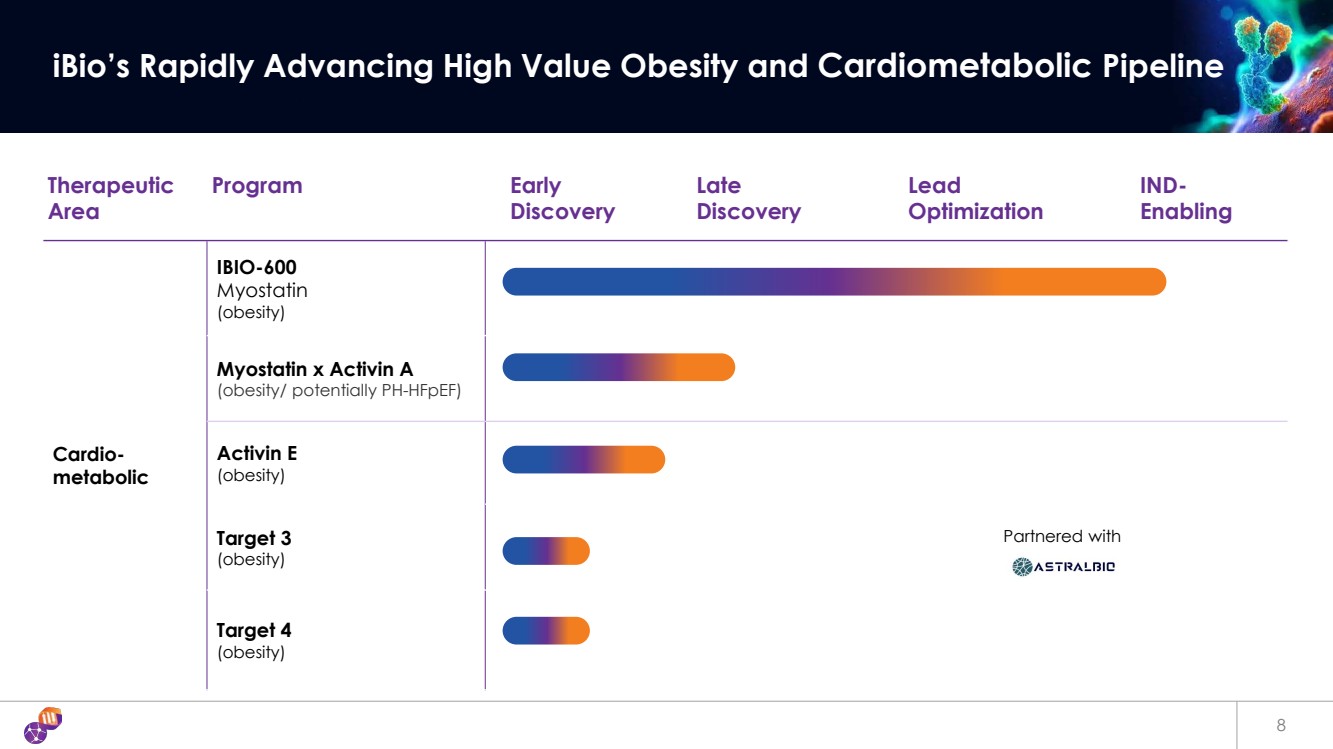

| 8 iBio’s Rapidly Advancing High Value Obesity and Cardiometabolic Pipeline Therapeutic Area Program Early Discovery Late Discovery Lead Optimization IND-Enabling Cardio-metabolic IBIO-600 Myostatin (obesity) Myostatin x Activin A (obesity/ potentially PH-HFpEF) Activin E (obesity) Target 3 (obesity) Target 4 (obesity) Partnered with |

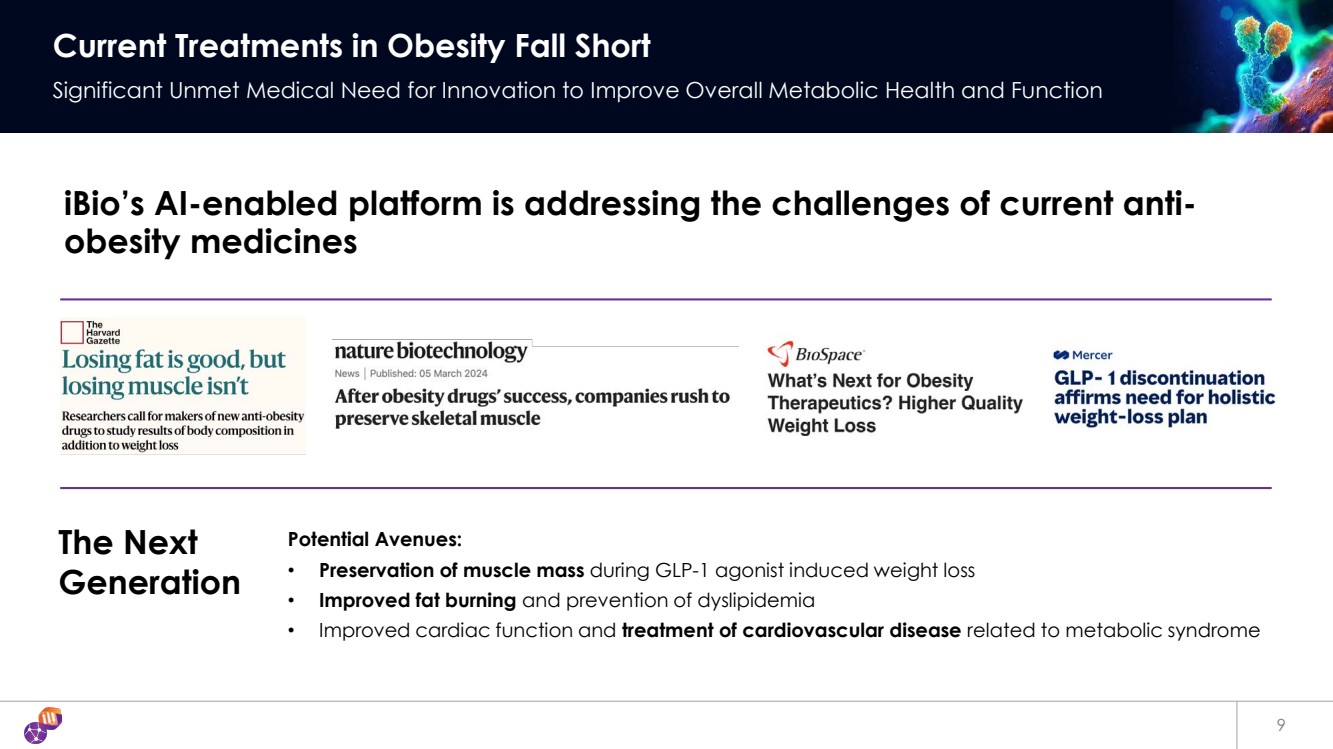

| 9 Current Treatments in Obesity Fall Short Significant Unmet Medical Need for Innovation to Improve Overall Metabolic Health and Function The Next Generation Potential Avenues: • Preservation of muscle mass during GLP-1 agonist induced weight loss • Improved fat burning and prevention of dyslipidemia • Improved cardiac function and treatment of cardiovascular disease related to metabolic syndrome iBio’s AI-enabled platform is addressing the challenges of current anti-obesity medicines |

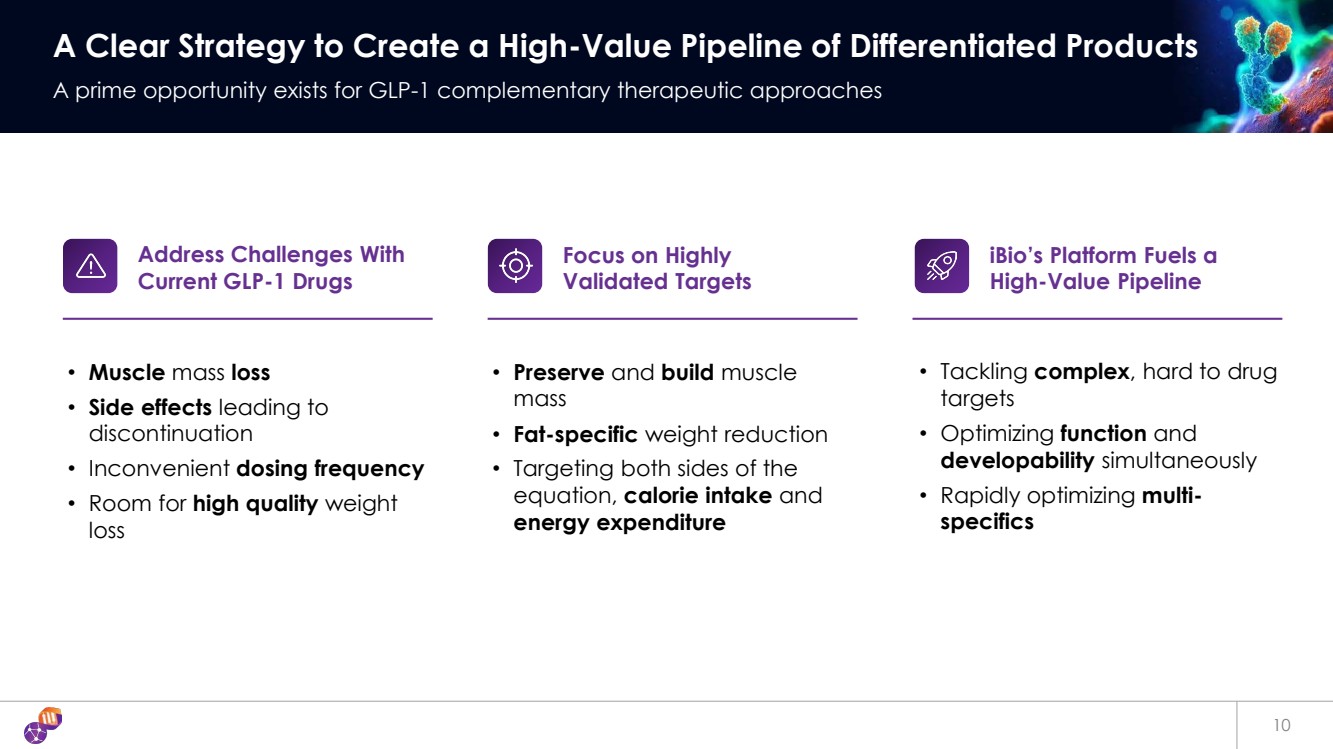

| 10 A Clear Strategy to Create a High-Value Pipeline of Differentiated Products A prime opportunity exists for GLP-1 complementary therapeutic approaches • Muscle mass loss • Side effects leading to discontinuation • Inconvenient dosing frequency • Room for high quality weight loss Address Challenges With Current GLP-1 Drugs • Preserve and build muscle mass • Fat-specific weight reduction • Targeting both sides of the equation, calorie intake and energy expenditure Focus on Highly Validated Targets • Tackling complex, hard to drug targets • Optimizing function and developability simultaneously • Rapidly optimizing multi-specifics iBio’s Platform Fuels a High-Value Pipeline |

| Transition slide – IBIO-600 Long-Acting Anti-Myostatin Antibody |

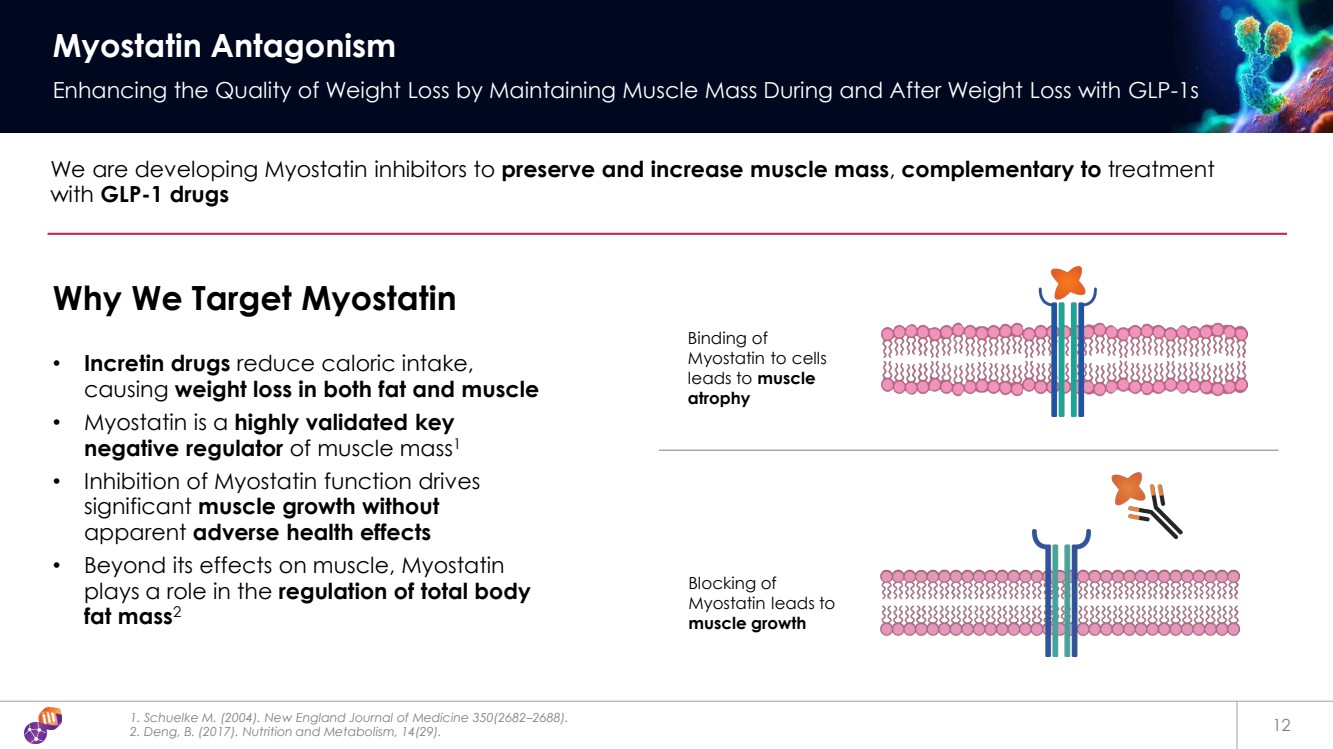

| 1. Schuelke M. (2004). New England Journal of Medicine 350(2682–2688). 2. Deng, B. (2017). Nutrition and Metabolism, 14(29). 12 Myostatin Antagonism Enhancing the Quality of Weight Loss by Maintaining Muscle Mass During and After Weight Loss with GLP-1s We are developing Myostatin inhibitors to preserve and increase muscle mass, complementary to treatment with GLP-1 drugs Why We Target Myostatin • Incretin drugs reduce caloric intake, causing weight loss in both fat and muscle • Myostatin is a highly validated key negative regulator of muscle mass1 • Inhibition of Myostatin function drives significant muscle growth without apparent adverse health effects • Beyond its effects on muscle, Myostatin plays a role in the regulation of total body fat mass2 Binding of Myostatin to cells leads to muscle atrophy Blocking of Myostatin leads to muscle growth |

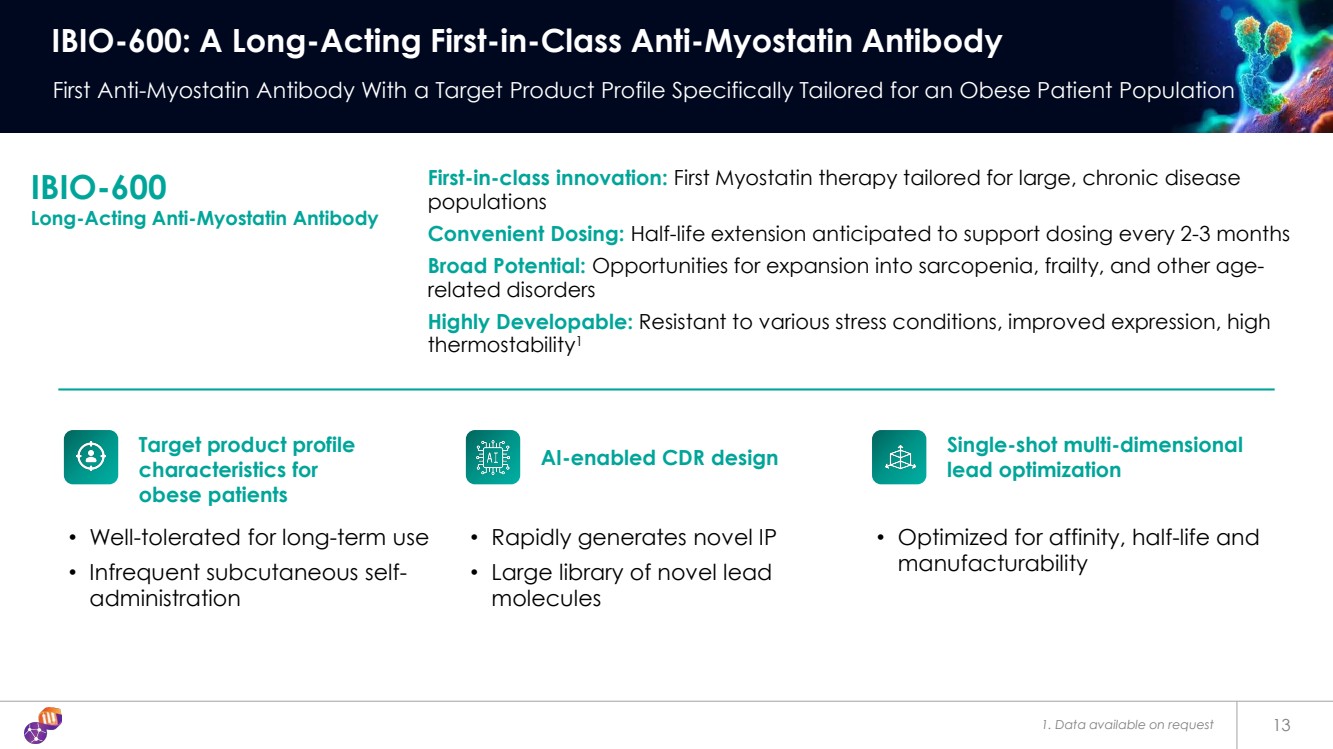

| 1. Data available on request IBIO-600: A Long-Acting First-in-Class Anti-Myostatin Antibody First Anti-Myostatin Antibody With a Target Product Profile Specifically Tailored for an Obese Patient Population IBIO-600 Long-Acting Anti-Myostatin Antibody First-in-class innovation: First Myostatin therapy tailored for large, chronic disease populations Convenient Dosing: Half-life extension anticipated to support dosing every 2-3 months Broad Potential: Opportunities for expansion into sarcopenia, frailty, and other age-related disorders Highly Developable: Resistant to various stress conditions, improved expression, high thermostability1 • Well-tolerated for long-term use • Infrequent subcutaneous self-administration Target product profile characteristics for obese patients • Rapidly generates novel IP • Large library of novel lead molecules AI-enabled CDR design • Optimized for affinity, half-life and manufacturability Single-shot multi-dimensional lead optimization 13 |

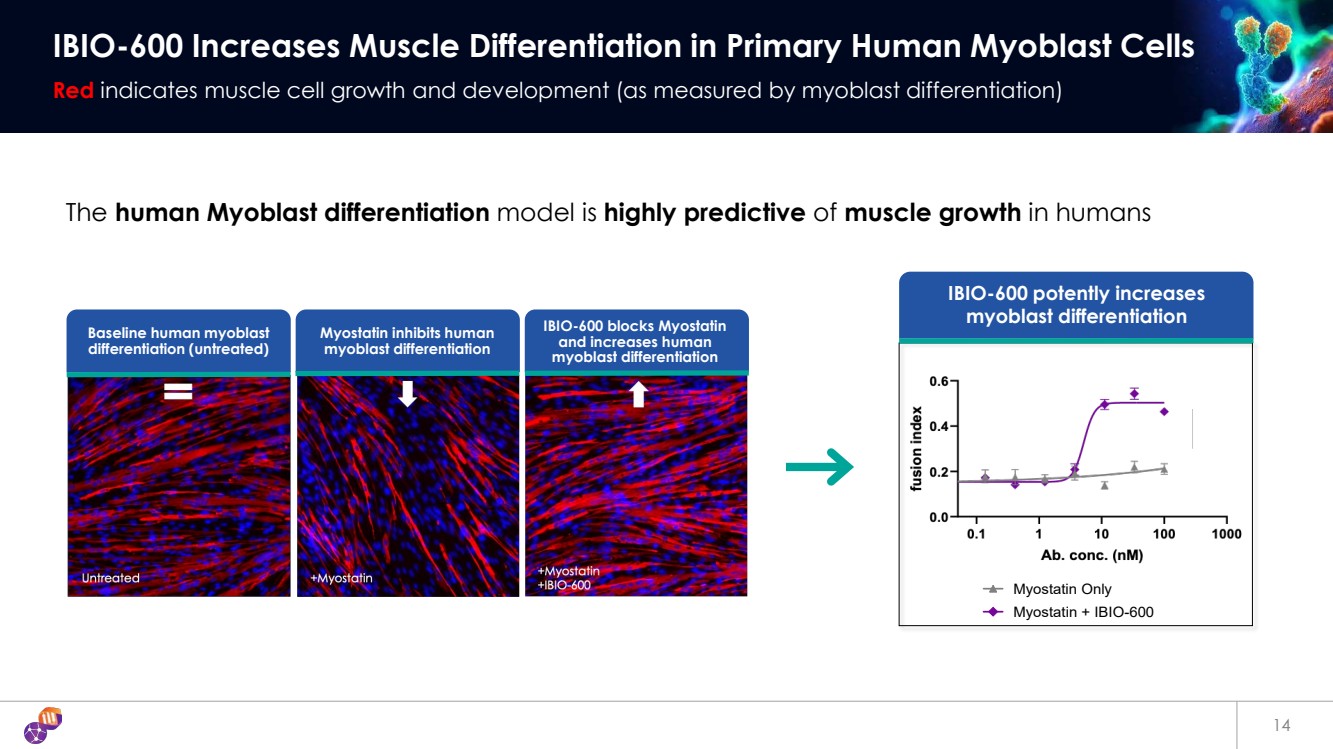

| 14 IBIO-600 Increases Muscle Differentiation in Primary Human Myoblast Cells Red indicates muscle cell growth and development (as measured by myoblast differentiation) Myostatin Only Myostatin + IBIO-600 IBIO-600 potently increases myoblast differentiation Baseline human myoblast differentiation (untreated) Myostatin inhibits human myoblast differentiation IBIO-600 blocks Myostatin and increases human myoblast differentiation The human Myoblast differentiation model is highly predictive of muscle growth in humans |

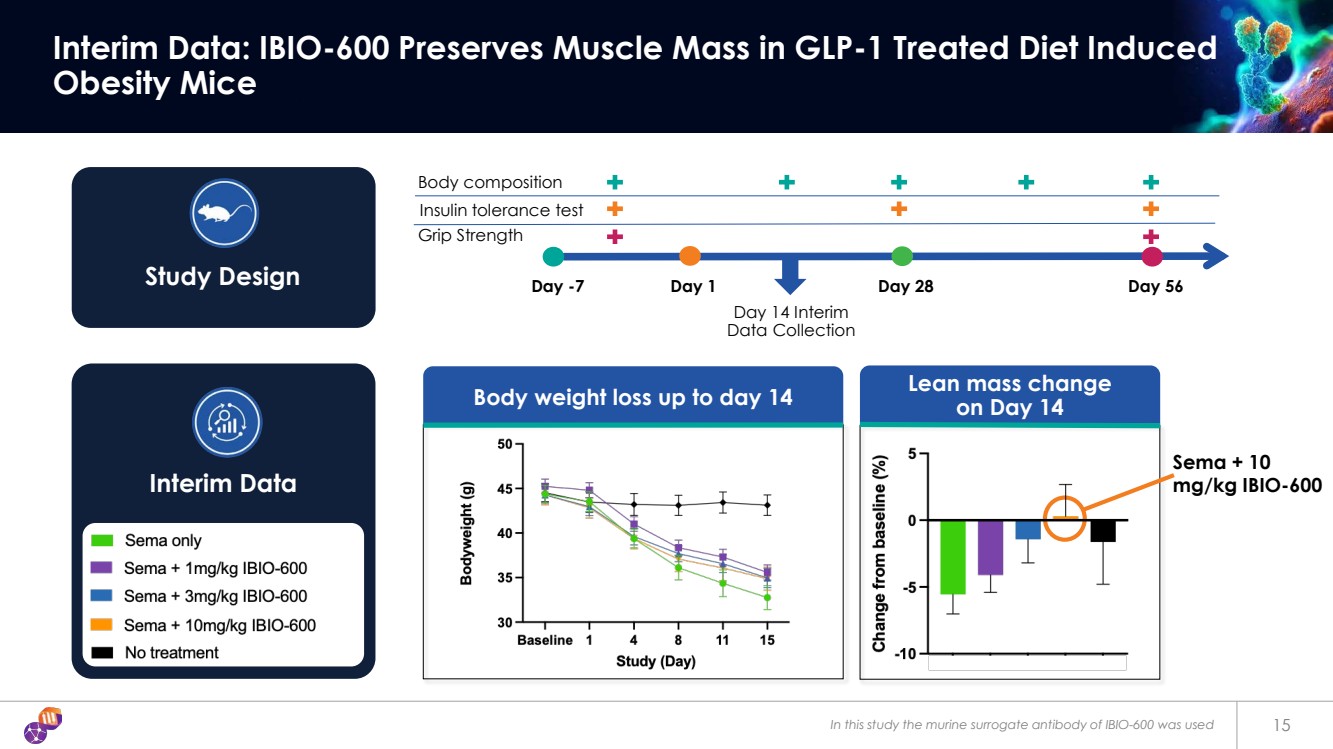

| Body weight loss up to day 14 In this study the murine surrogate antibody of IBIO-600 was used 15 Interim Data: IBIO-600 Preserves Muscle Mass in GLP-1 Treated Diet Induced Obesity Mice Day 14 Interim Data Collection Day -7 Day 1 Day 28 Day 56 Body composition Insulin tolerance test Grip Strength Study Design Interim Data Lean mass change on Day 14 Sema + 10 mg/kg IBIO-600 |

| Transition slide – Anti-Myostatin x Activin A Bispecific Antibody |

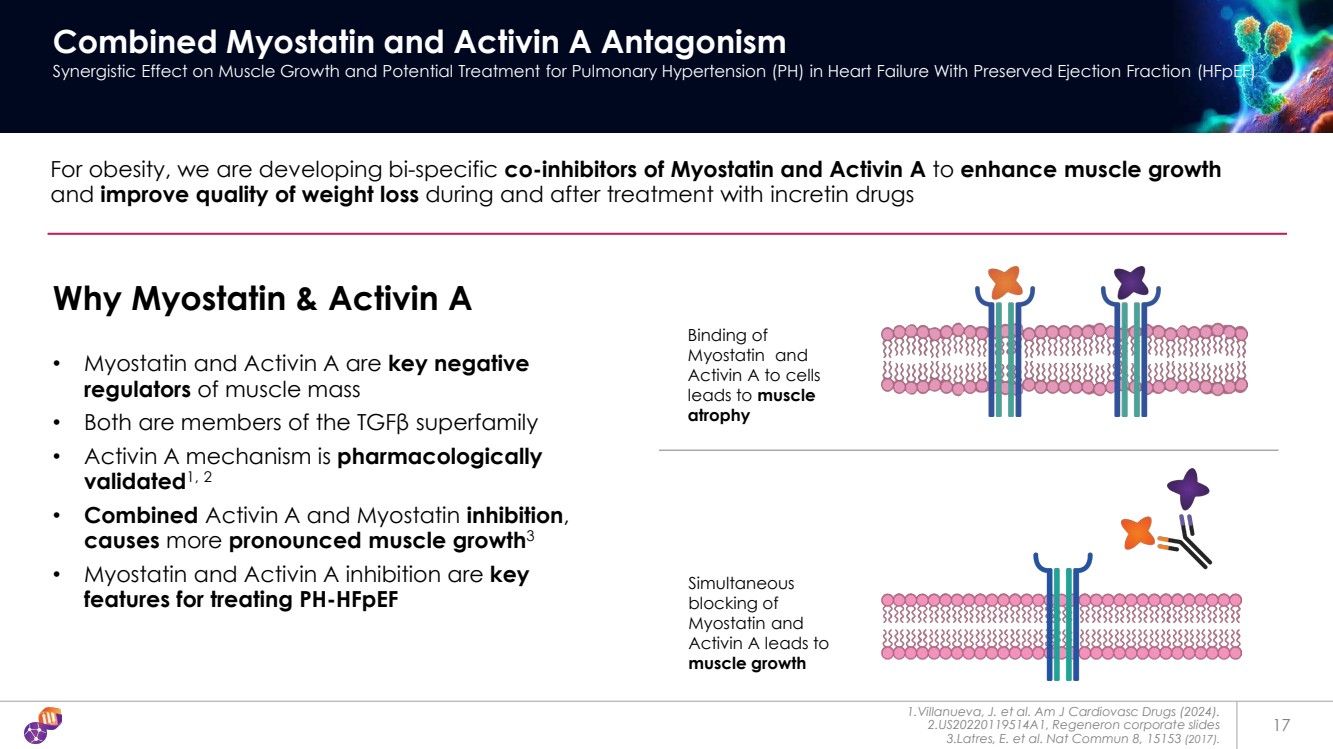

| 17 Combined Myostatin and Activin A Antagonism Synergistic Effect on Muscle Growth and Potential Treatment for Pulmonary Hypertension (PH) in Heart Failure With Preserved Ejection Fraction (HFpEF) For obesity, we are developing bi-specific co-inhibitors of Myostatin and Activin A to enhance muscle growth and improve quality of weight loss during and after treatment with incretin drugs Why Myostatin & Activin A • Myostatin and Activin A are key negative regulators of muscle mass • Both are members of the TGFβ superfamily • Activin A mechanism is pharmacologically validated1, 2 • Combined Activin A and Myostatin inhibition, causes more pronounced muscle growth3 • Myostatin and Activin A inhibition are key features for treating PH-HFpEF 1.Villanueva, J. et al. Am J Cardiovasc Drugs (2024). 2.US20220119514A1, Regeneron corporate slides 3.Latres, E. et al. Nat Commun 8, 15153 (2017). Binding of Myostatin and Activin A to cells leads to muscle atrophy Simultaneous blocking of Myostatin and Activin A leads to muscle growth |

| • Well-tolerated for long-term use • Infrequent subcutaneous self-administration *Bone Morphogenetic Proteins A Long-Acting First-in-Class Anti-Myostatin x Activin A Bispecific Antibody Myostatin x Activin A Bi-specific Target product profile for obese and potentially Ph-HFpEF patients First-in-class innovation: Myostatin x Activin A bispecific antibody with unique therapeutic potential Convenient Dosing: Half-life extension potentially enables dosing every 2-3 months Optimize Potency: Higher-valency antibody format might increase potency and reduce dose Potential Advantage: May avoid BMP* inhibition, minimizing bleeding risks associated with ligand traps • Generates novel IP • Large library of novel lead molecules AI-enabled CDR design • Bi-specific optimized for affinity, half-life and manufacturability Single-shot multi-dimensional lead optimization 18 |

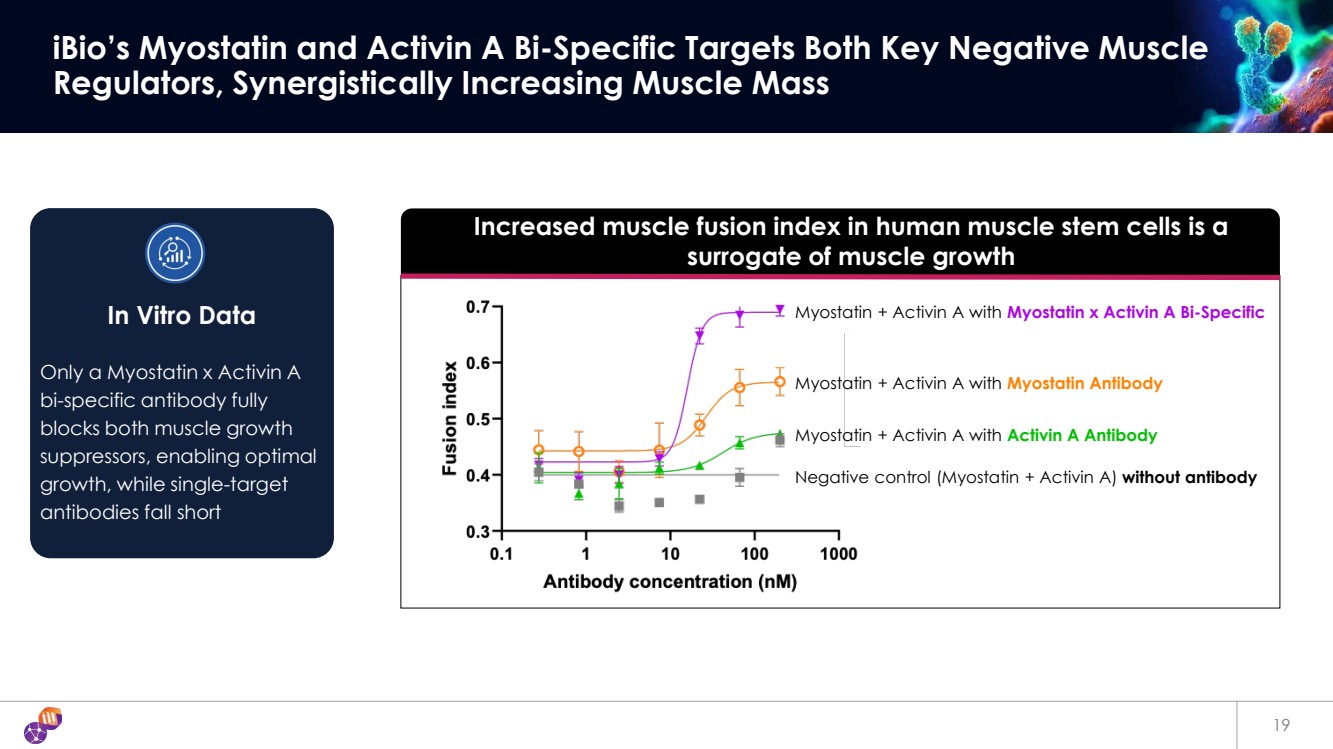

| 19 iBio’s Myostatin and Activin A Bi-Specific Targets Both Key Negative Muscle Regulators, Synergistically Increasing Muscle Mass Increased muscle fusion index in human muscle stem cells is a surrogate of muscle growth Negative control (Myostatin + Activin A) without antibody Myostatin + Activin A with Activin A Antibody Myostatin + Activin A with Myostatin Antibody Myostatin + Activin A with Myostatin x Activin A Bi-Specific Only a Myostatin x Activin A bi-specific antibody fully blocks both muscle growth suppressors, enabling optimal growth, while single-target antibodies fall short In Vitro Data |

| Anti-Activin E Antibody |

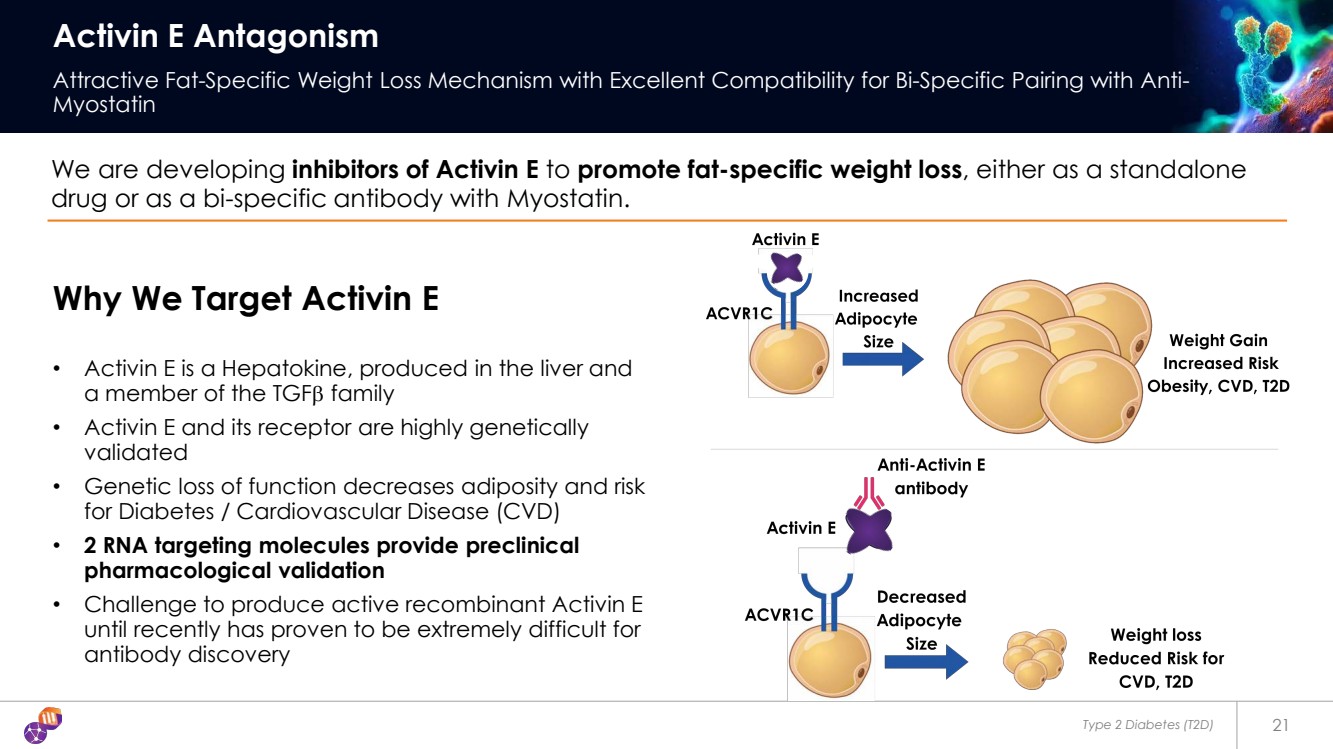

| Type 2 Diabetes (T2D) 21 Activin E Antagonism Attractive Fat-Specific Weight Loss Mechanism with Excellent Compatibility for Bi-Specific Pairing with Anti-Myostatin We are developing inhibitors of Activin E to promote fat-specific weight loss, either as a standalone drug or as a bi-specific antibody with Myostatin. Why We Target Activin E • Activin E is a Hepatokine, produced in the liver and a member of the TGFβ family • Activin E and its receptor are highly genetically validated • Genetic loss of function decreases adiposity and risk for Diabetes / Cardiovascular Disease (CVD) • 2 RNA targeting molecules provide preclinical pharmacological validation • Challenge to produce active recombinant Activin E until recently has proven to be extremely difficult for antibody discovery |

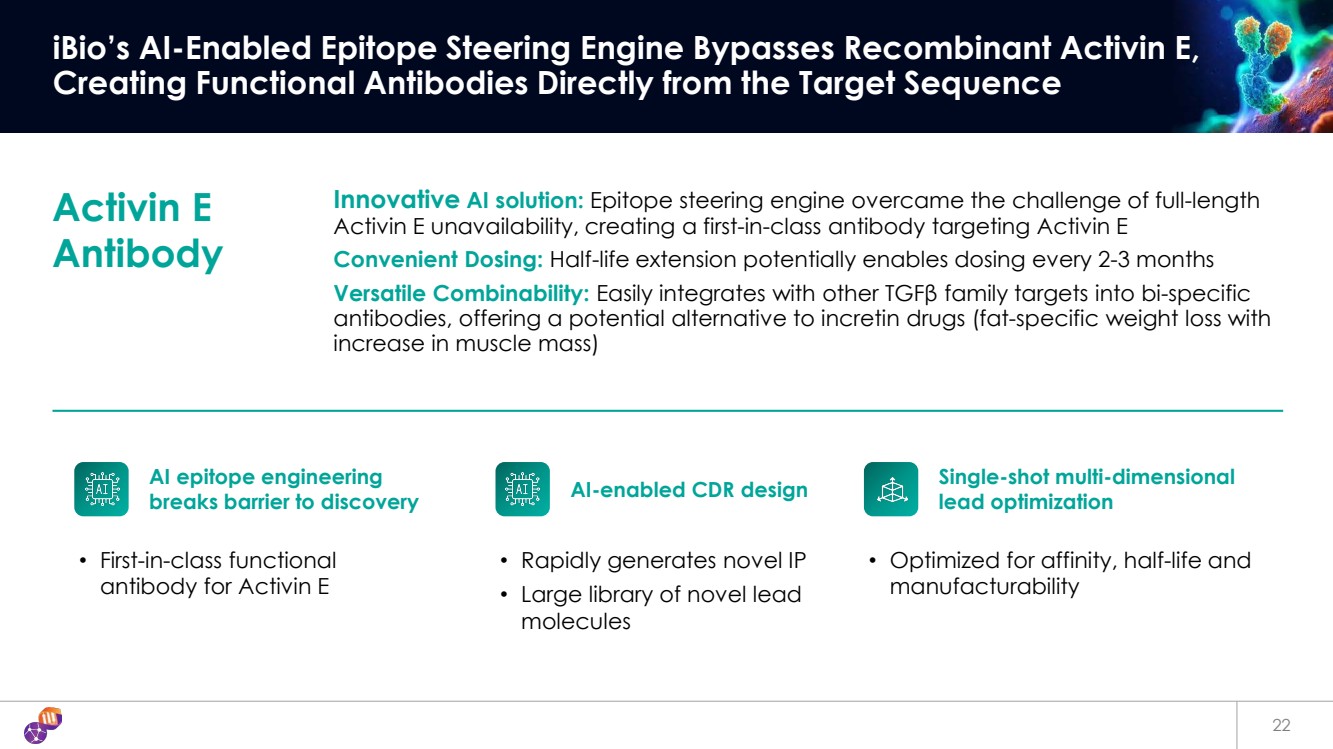

| • First-in-class functional antibody for Activin E iBio’s AI-Enabled Epitope Steering Engine Bypasses Recombinant Activin E, Creating Functional Antibodies Directly from the Target Sequence Activin E Antibody AI epitope engineering breaks barrier to discovery Innovative AI solution: Epitope steering engine overcame the challenge of full-length Activin E unavailability, creating a first-in-class antibody targeting Activin E Convenient Dosing: Half-life extension potentially enables dosing every 2-3 months Versatile Combinability: Easily integrates with other TGFβ family targets into bi-specific antibodies, offering a potential alternative to incretin drugs (fat-specific weight loss with increase in muscle mass) • Rapidly generates novel IP • Large library of novel lead molecules AI-enabled CDR design • Optimized for affinity, half-life and manufacturability Single-shot multi-dimensional lead optimization 22 |

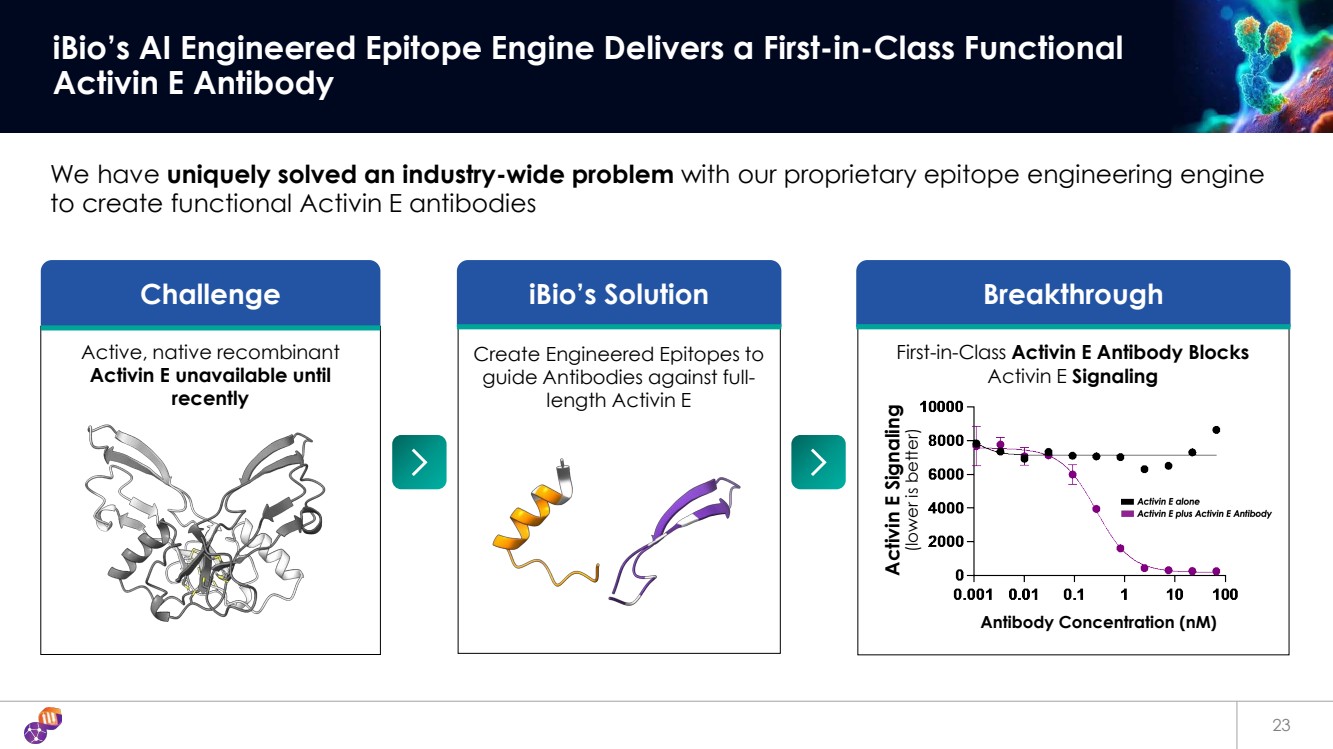

| 23 iBio’s AI Engineered Epitope Engine Delivers a First-in-Class Functional Activin E Antibody Challenge We have uniquely solved an industry-wide problem with our proprietary epitope engineering engine to create functional Activin E antibodies iBio’s Solution Breakthrough Activin E Signaling (lower is better) Antibody Concentration (nM) Active, native recombinant Activin E unavailable until recently First-in-Class Activin E Antibody Blocks Activin E Signaling Create Engineered Epitopes to guide Antibodies against full-length Activin E |

| Immuno-Oncology |

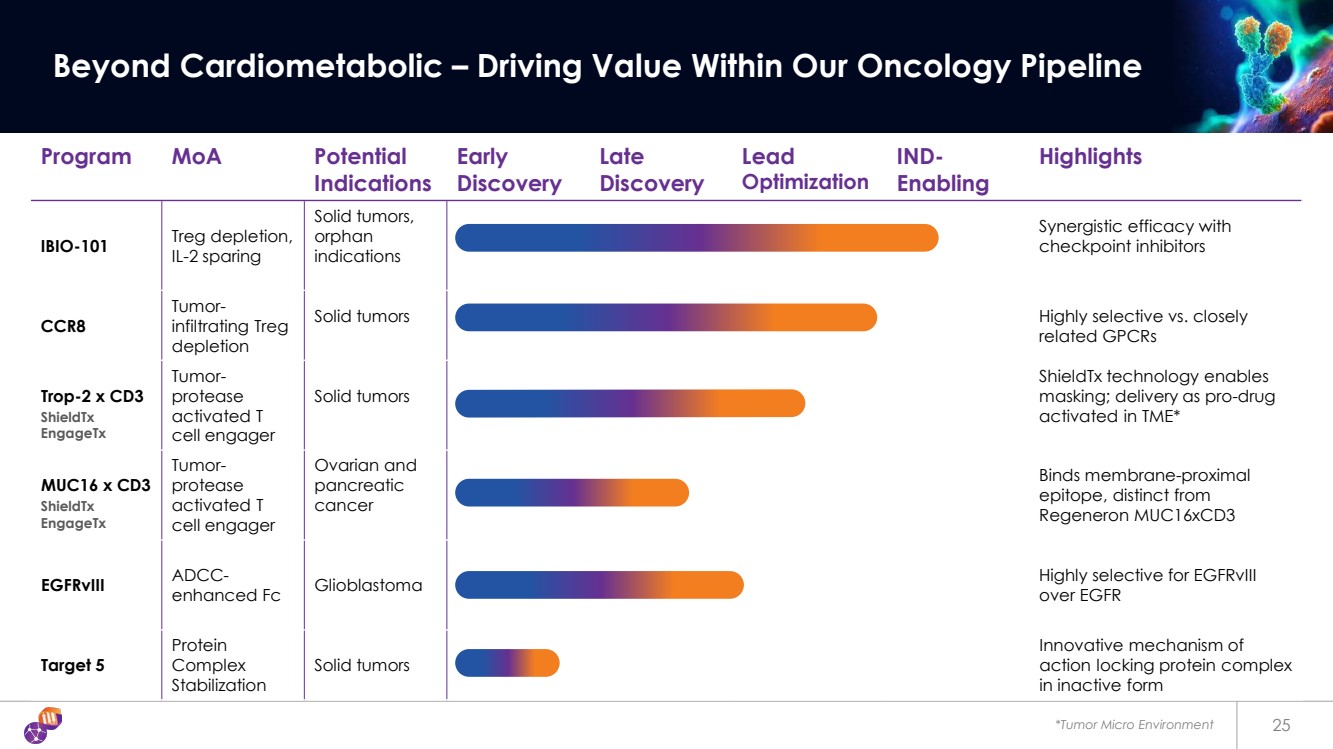

| *Tumor Micro Environment 25 Beyond Cardiometabolic – Driving Value Within Our Oncology Pipeline Program MoA Potential Indications Early Discovery Late Discovery Lead Optimization IND-Enabling Highlights IBIO-101 Treg depletion, IL-2 sparing Solid tumors, orphan indications Synergistic efficacy with checkpoint inhibitors CCR8 Tumor-infiltrating Treg depletion Solid tumors Highly selective vs. closely related GPCRs Trop-2 x CD3 Tumor-protease activated T cell engager Solid tumors ShieldTx technology enables masking; delivery as pro-drug activated in TME* MUC16 x CD3 Tumor-protease activated T cell engager Ovarian and pancreatic cancer Binds membrane-proximal epitope, distinct from Regeneron MUC16xCD3 EGFRvIII ADCC-enhanced Fc Glioblastoma Highly selective for EGFRvIII over EGFR Target 5 Protein Complex Stabilization Solid tumors Innovative mechanism of action locking protein complex in inactive form ShieldTx EngageTx ShieldTx EngageTx |

| 26 A Leadership Team with Deep Industry Experience Deep expertise in cardiometabolic disorders Marc Banjak CLO Martin Brenner, DVM, Ph.D. CEO & CSO Kristi Sarno Senior VP BD Felipe Duran CFO |

| Executive Summary Corporate Highlights • Patented AI-driven Discovery Tech Stack which can: • Rapidly advance a highly developable pre-clinical pipeline • Solve hard-to-drug problems • Pipeline of cardio/obesity rapidly progressing • Pipeline of immuno-oncology molecules ready for strategic partners Financial Highlights • $11.3M in Cash and Restricted cash as of September 30, 2024 • Cash runway into Q1 FY26 • 9.1M shares outstanding as of November 21, 2024 27 |

| Appendix |

| 29 Technology Platform & Preclinical Pipeline |

| 30 Technology Stack |

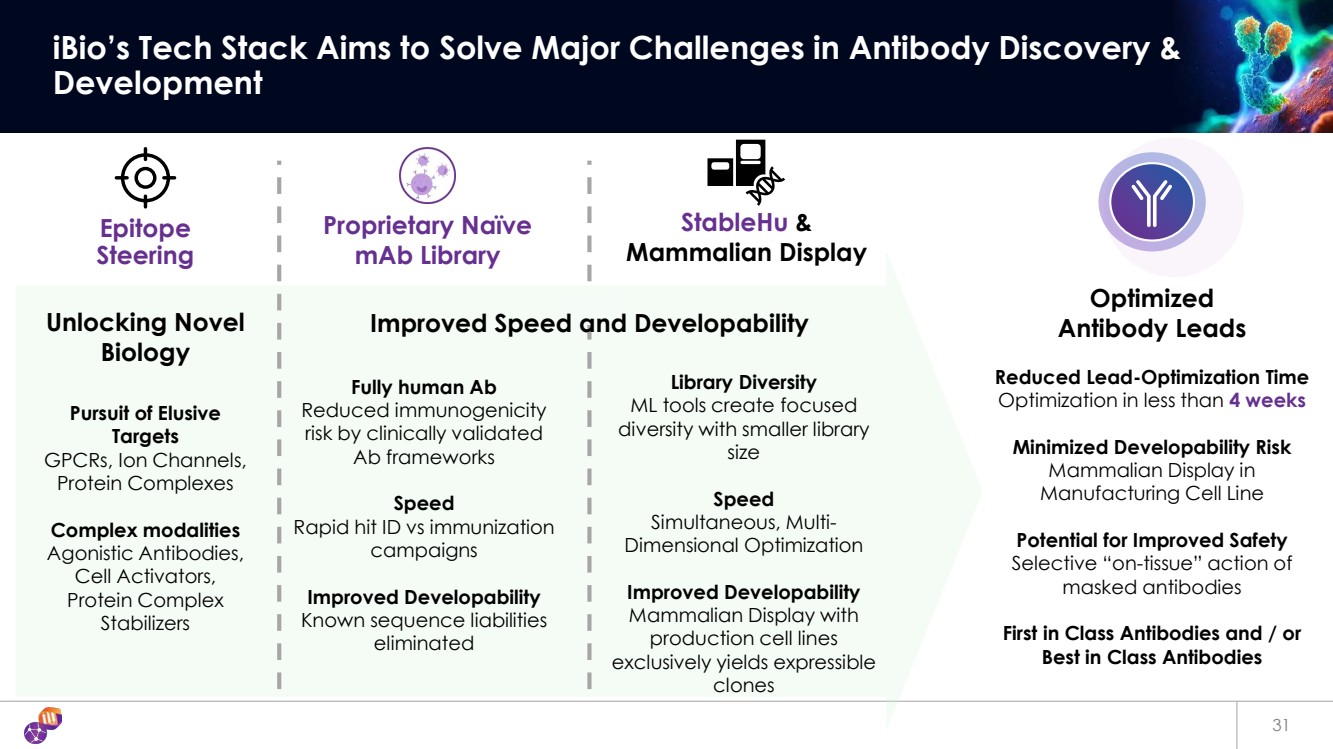

| 31 iBio’s Tech Stack Aims to Solve Major Challenges in Antibody Discovery & Development Epitope Steering StableHu & Mammalian Display Unlocking Novel Biology Reduced Lead-Optimization Time Optimization in less than 4 weeks Minimized Developability Risk Mammalian Display in Manufacturing Cell Line Potential for Improved Safety Selective “on-tissue” action of masked antibodies First in Class Antibodies and / or Best in Class Antibodies Pursuit of Elusive Targets GPCRs, Ion Channels, Protein Complexes Complex modalities Agonistic Antibodies, Cell Activators, Protein Complex Stabilizers Fully human Ab Reduced immunogenicity risk by clinically validated Ab frameworks Speed Rapid hit ID vs immunization campaigns Improved Developability Known sequence liabilities eliminated Optimized Antibody Leads Proprietary Naïve mAb Library Library Diversity ML tools create focused diversity with smaller library size Speed Simultaneous, Multi-Dimensional Optimization Improved Developability Mammalian Display with production cell lines exclusively yields expressible clones Improved Speed and Developability |

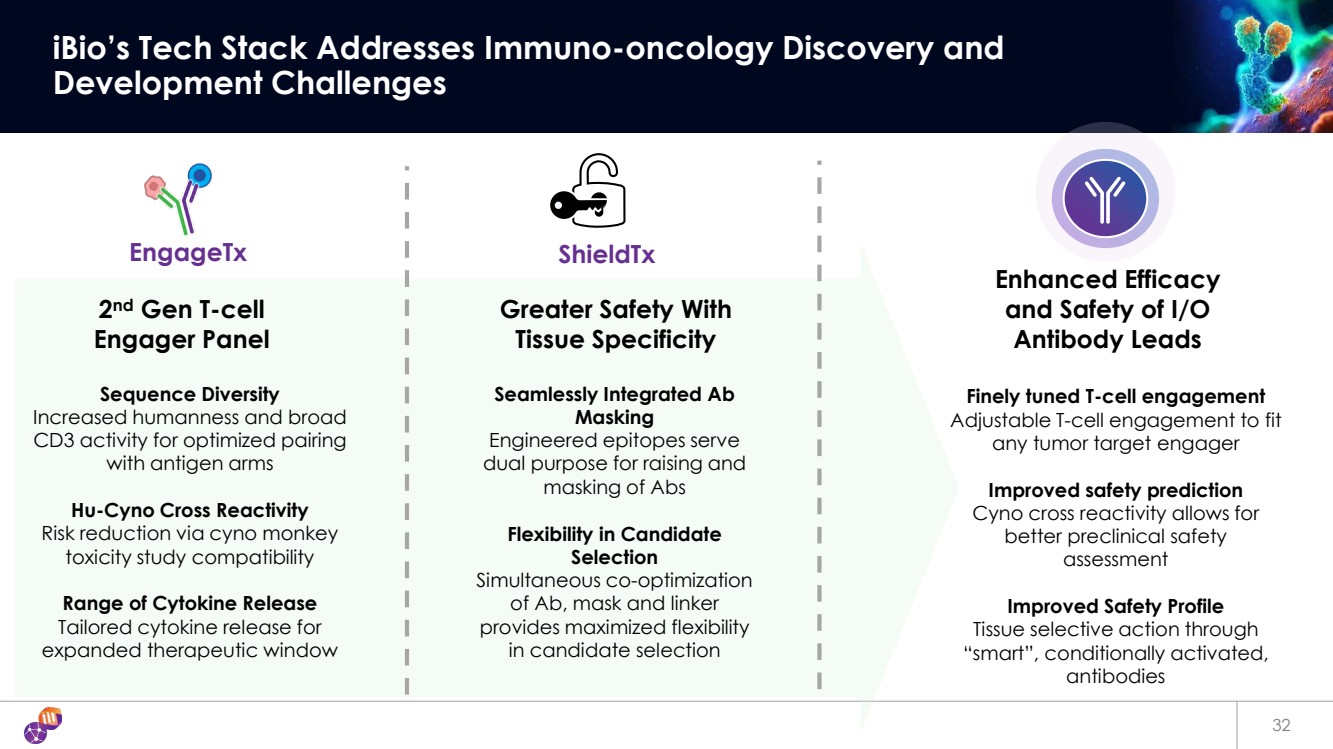

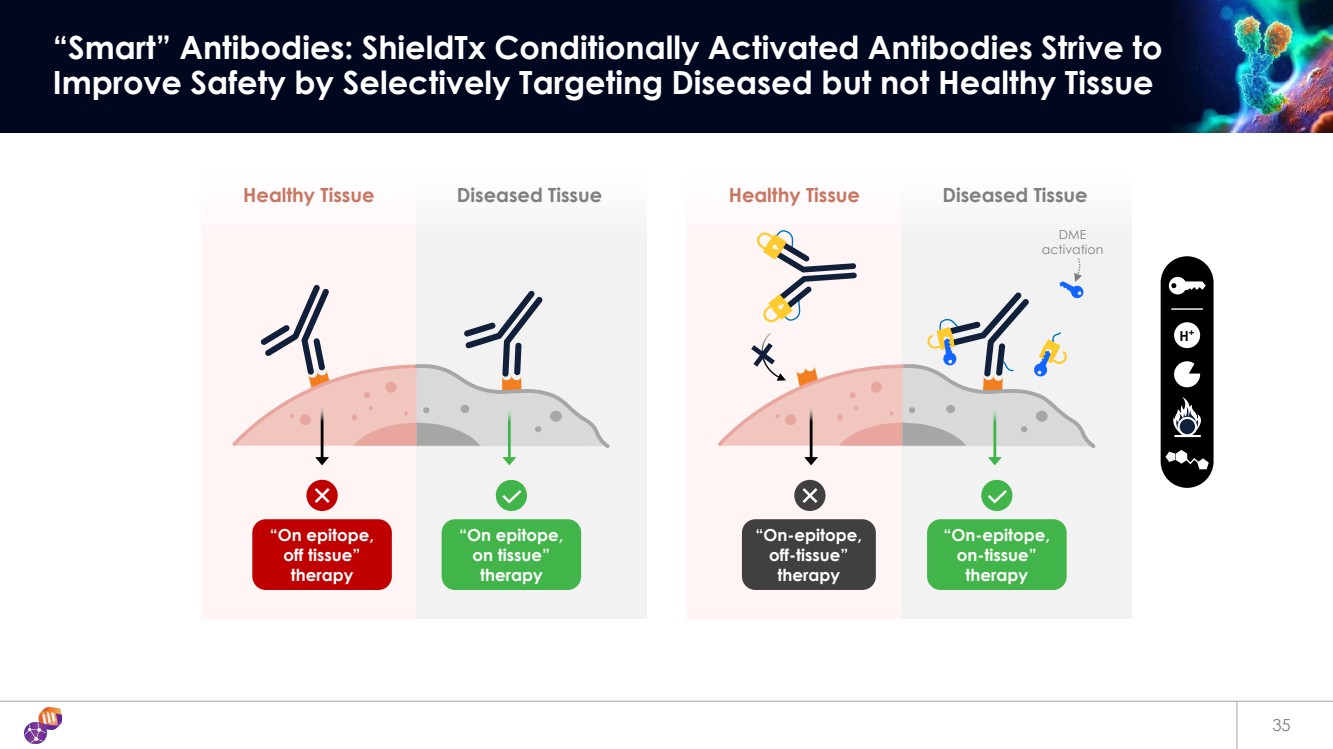

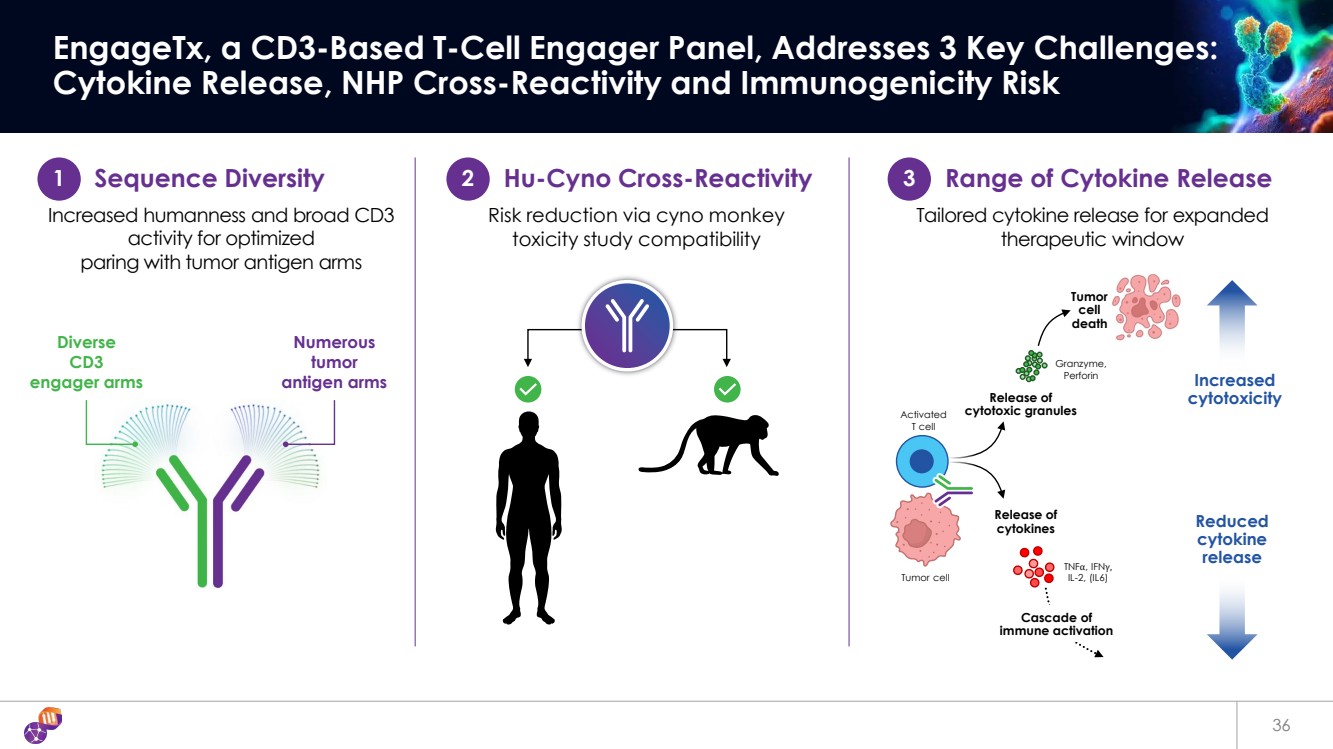

| 32 iBio’s Tech Stack Addresses Immuno-oncology Discovery and Development Challenges ShieldTx 2nd Gen T-cell Engager Panel Finely tuned T-cell engagement Adjustable T-cell engagement to fit any tumor target engager Improved safety prediction Cyno cross reactivity allows for better preclinical safety assessment Improved Safety Profile Tissue selective action through “smart”, conditionally activated, antibodies Sequence Diversity Increased humanness and broad CD3 activity for optimized pairing with antigen arms Hu-Cyno Cross Reactivity Risk reduction via cyno monkey toxicity study compatibility Range of Cytokine Release Tailored cytokine release for expanded therapeutic window Enhanced Efficacy and Safety of I/O Antibody Leads EngageTx Greater Safety With Tissue Specificity Seamlessly Integrated Ab Masking Engineered epitopes serve dual purpose for raising and masking of Abs Flexibility in Candidate Selection Simultaneous co-optimization of Ab, mask and linker provides maximized flexibility in candidate selection |

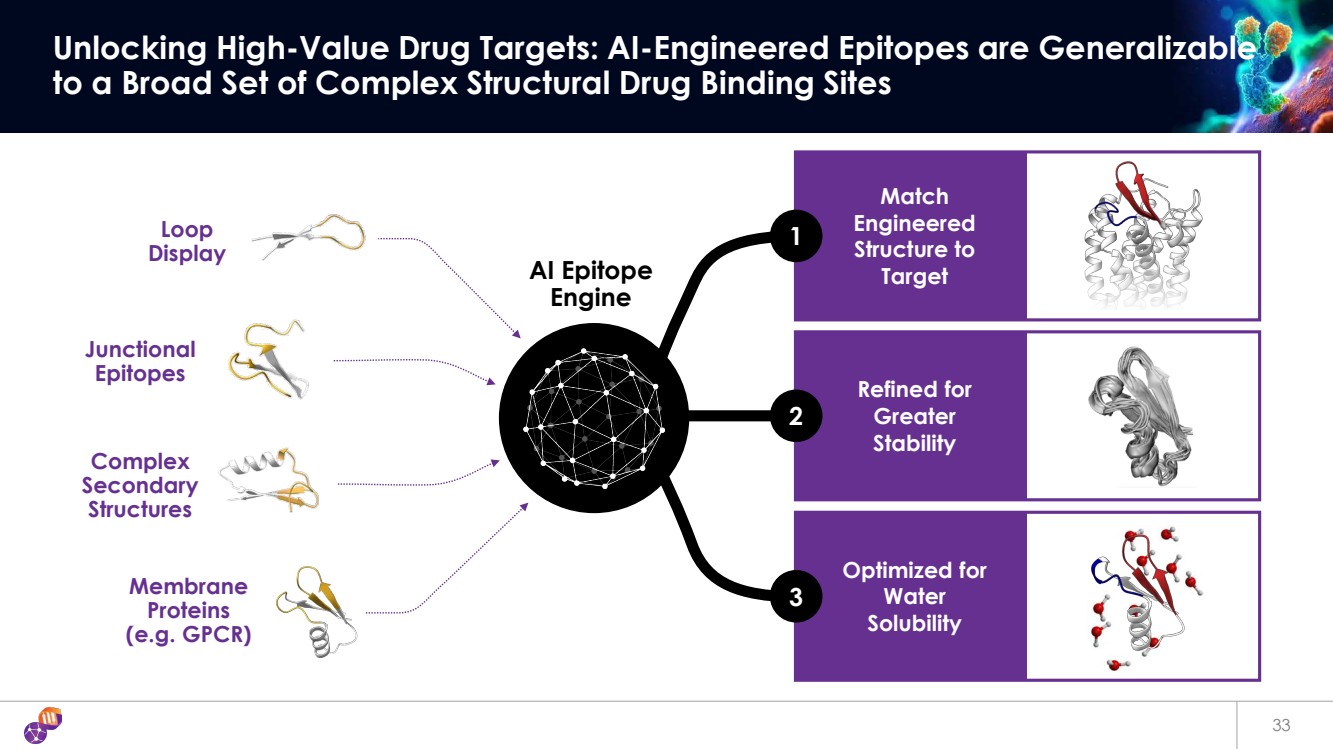

| Match Engineered Structure to Target Refined for Greater Stability Optimized for Water Solubility 33 Unlocking High-Value Drug Targets: AI-Engineered Epitopes are Generalizable to a Broad Set of Complex Structural Drug Binding Sites Junctional Epitopes Complex Secondary Structures Membrane Proteins (e.g. GPCR) Loop Display 1 2 3 AI Epitope Engine |

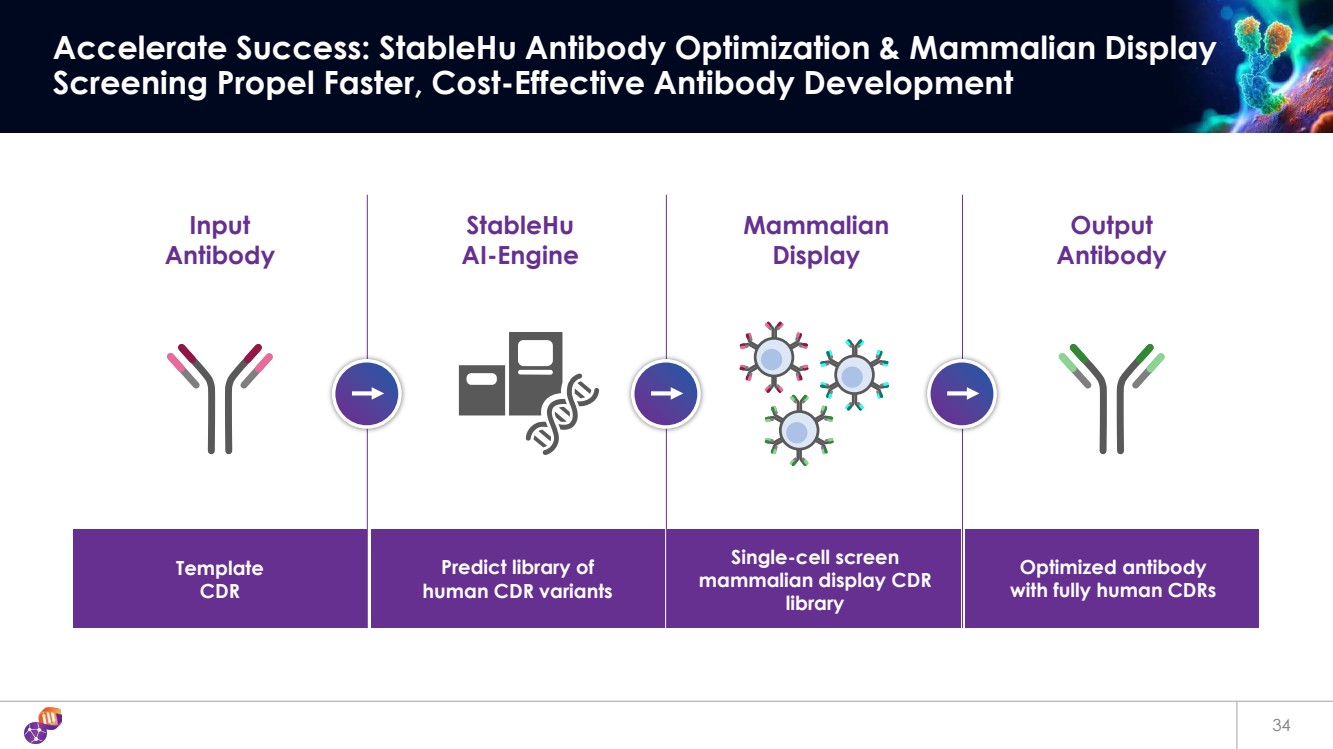

| Input Antibody StableHu AI-Engine Mammalian Display Output Antibody Template CDR Predict library of human CDR variants Single-cell screen mammalian display CDR library Optimized antibody with fully human CDRs 34 Accelerate Success: StableHu Antibody Optimization & Mammalian Display Screening Propel Faster, Cost-Effective Antibody Development |

| 35 “Smart” Antibodies: ShieldTx Conditionally Activated Antibodies Strive to Improve Safety by Selectively Targeting Diseased but not Healthy Tissue H+ Diseased Tissue “On-epitope, off-tissue” therapy Healthy Tissue “On-epitope, on-tissue” therapy DME activation Diseased Tissue “On epitope, on tissue” therapy Healthy Tissue “On epitope, off tissue” therapy |

| 36 EngageTx, a CD3-Based T-Cell Engager Panel, Addresses 3 Key Challenges: Cytokine Release, NHP Cross-Reactivity and Immunogenicity Risk Numerous tumor antigen arms Diverse CD3 engager arms 1 Sequence Diversity 2 Hu-Cyno Cross-Reactivity 3 Range of Cytokine Release Increased humanness and broad CD3 activity for optimized paring with tumor antigen arms Risk reduction via cyno monkey toxicity study compatibility Tailored cytokine release for expanded therapeutic window Release of cytokines TNFα, IFNγ, IL-2, (IL6) Increased cytotoxicity Reduced cytokine release Release of cytotoxic granules Granzyme, Perforin Cascade of immune activation Tumor cell death Activated T cell Tumor cell |

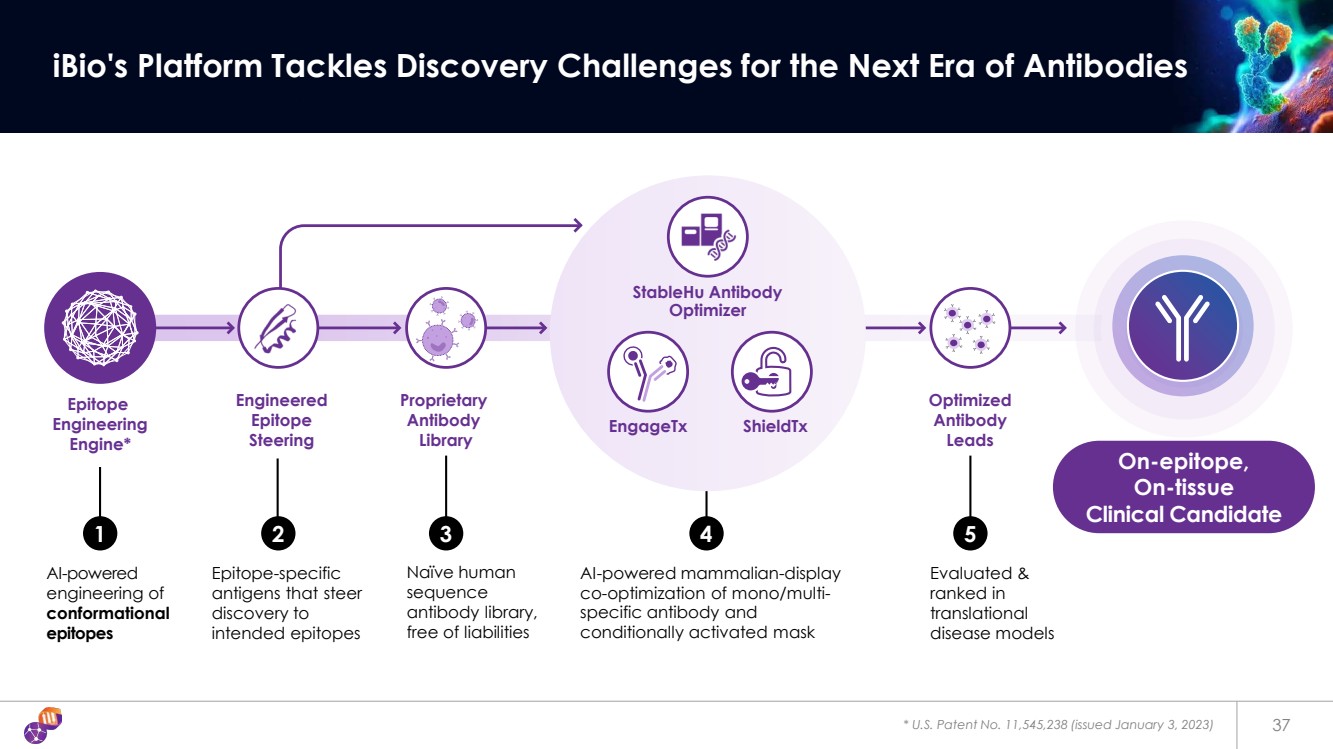

| Epitope Engineering Engine* Proprietary Antibody Library AI-powered mammalian-display co-optimization of mono/multi-specific antibody and conditionally activated mask Engineered Epitope Steering AI-powered engineering of conformational epitopes Epitope-specific antigens that steer discovery to intended epitopes 1 2 3 4 Naïve human sequence antibody library, free of liabilities Optimized Antibody Leads 5 Evaluated & ranked in translational disease models * U.S. Patent No. 11,545,238 (issued January 3, 2023) 37 iBio's Platform Tackles Discovery Challenges for the Next Era of Antibodies EngageTx ShieldTx StableHu Antibody Optimizer On-epitope, On-tissue Clinical Candidate |

| 38 IBIO-101 IL-2 Sparing Anti-CD25 |

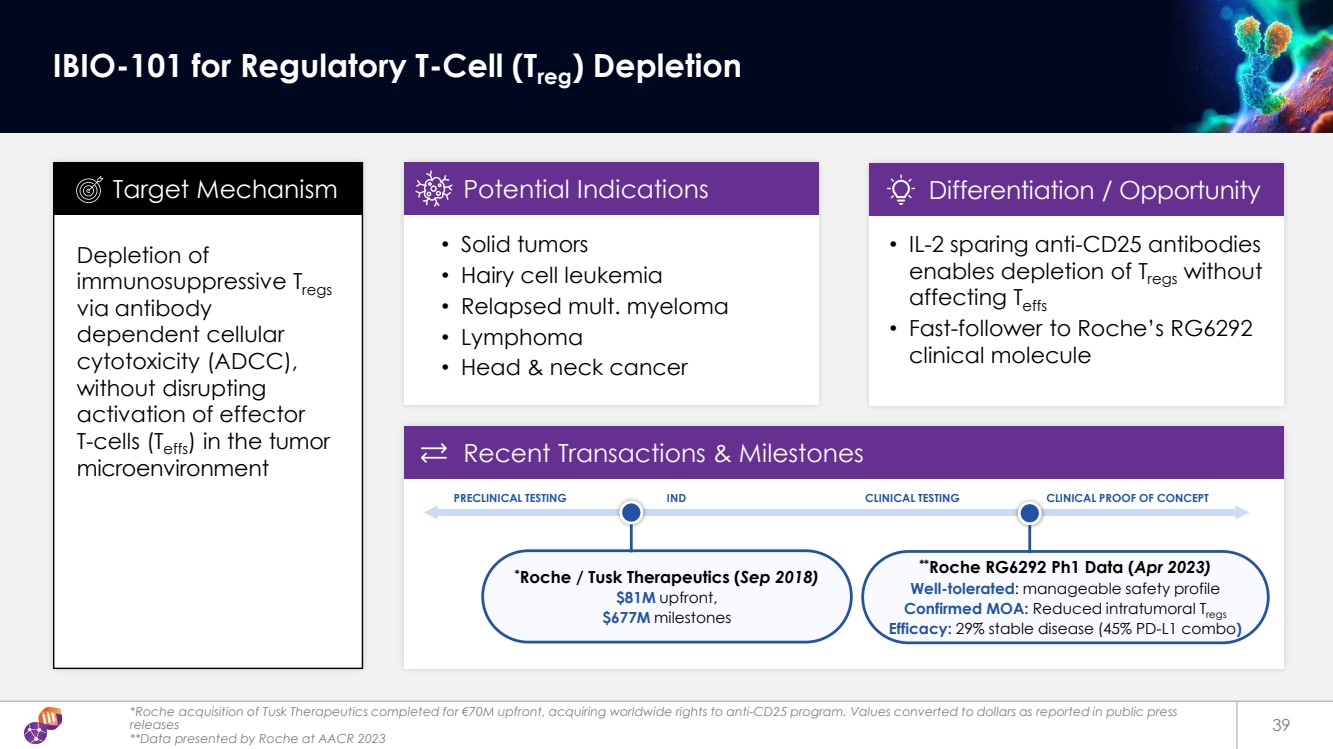

| Recent Transactions & Milestones *Roche acquisition of Tusk Therapeutics completed for €70M upfront, acquiring worldwide rights to anti-CD25 program. Values converted to dollars as reported in public press releases **Data presented by Roche at AACR 2023 39 IBIO-101 for Regulatory T-Cell (Treg) Depletion Depletion of immunosuppressive Tregs via antibody dependent cellular cytotoxicity (ADCC), without disrupting activation of effector T-cells (Teffs) in the tumor microenvironment • Solid tumors • Hairy cell leukemia • Relapsed mult. myeloma • Lymphoma • Head & neck cancer * Roche / Tusk Therapeutics (Sep 2018) $81M upfront, $677M milestones • IL-2 sparing anti-CD25 antibodies enables depletion of Tregs without affecting Teffs • Fast-follower to Roche’s RG6292 clinical molecule Target Mechanism Potential Indications Differentiation / Opportunity PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT **Roche RG6292 Ph1 Data (Apr 2023) Well-tolerated: manageable safety profile Confirmed MOA: Reduced intratumoral Tregs Efficacy: 29% stable disease (45% PD-L1 combo) |

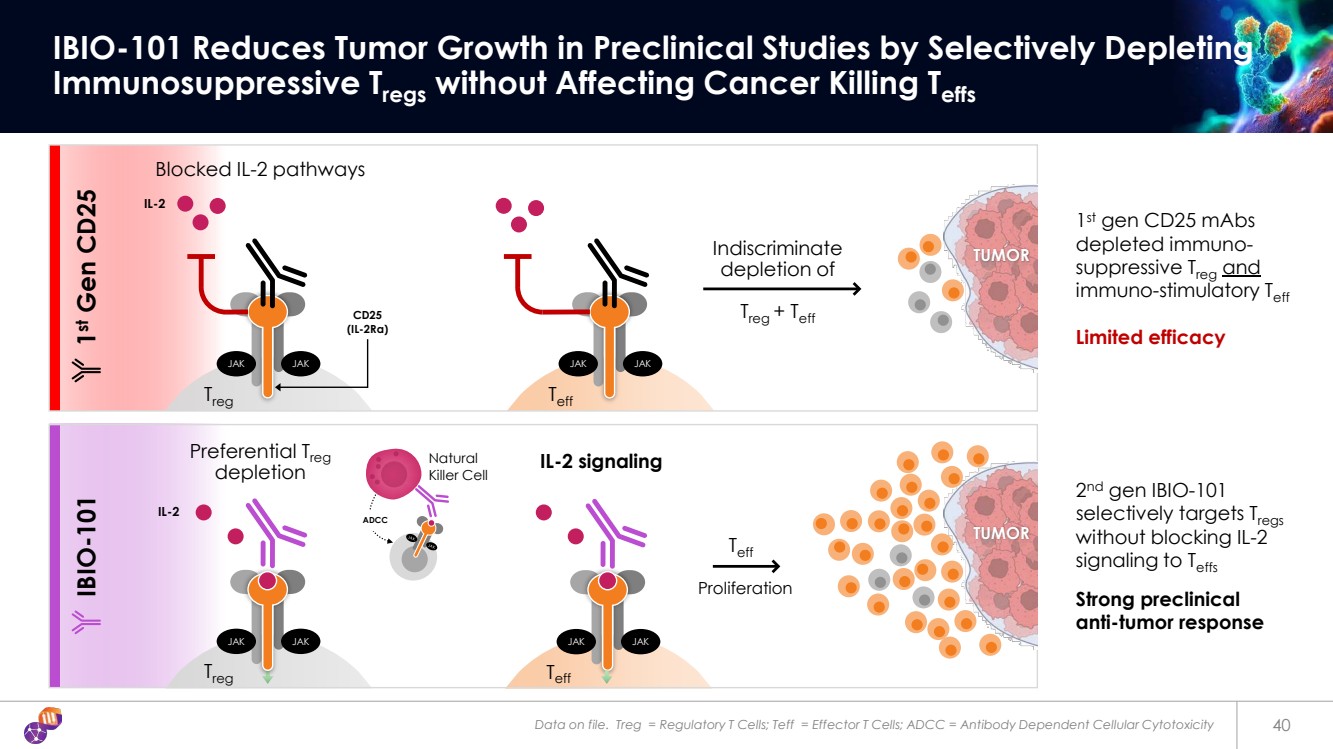

| Data on file. Treg = Regulatory T Cells; Teff = Effector T Cells; ADCC = Antibody Dependent Cellular Cytotoxicity 40 IBIO-101 Reduces Tumor Growth in Preclinical Studies by Selectively Depleting Immunosuppressive Tregs without Affecting Cancer Killing Teffs Indiscriminate depletion of Treg + Teff TUMOR Teff 1st gen CD25 mAbs depleted immuno-suppressive Treg and immuno-stimulatory Teff Limited efficacy 2nd gen IBIO-101 selectively targets Tregs without blocking IL-2 signaling to Teffs Strong preclinical anti-tumor response IBIO-101 Proliferation Natural Killer Cell Preferential Treg depletion ADCC 1st Gen CD25 TUMOR IL-2 CD25 (IL-2Rα) JAK JAK Treg JAK JAK Teff JAK JAK Treg JAK JAK Teff IL-2 signaling Blocked IL-2 pathways IL-2 |

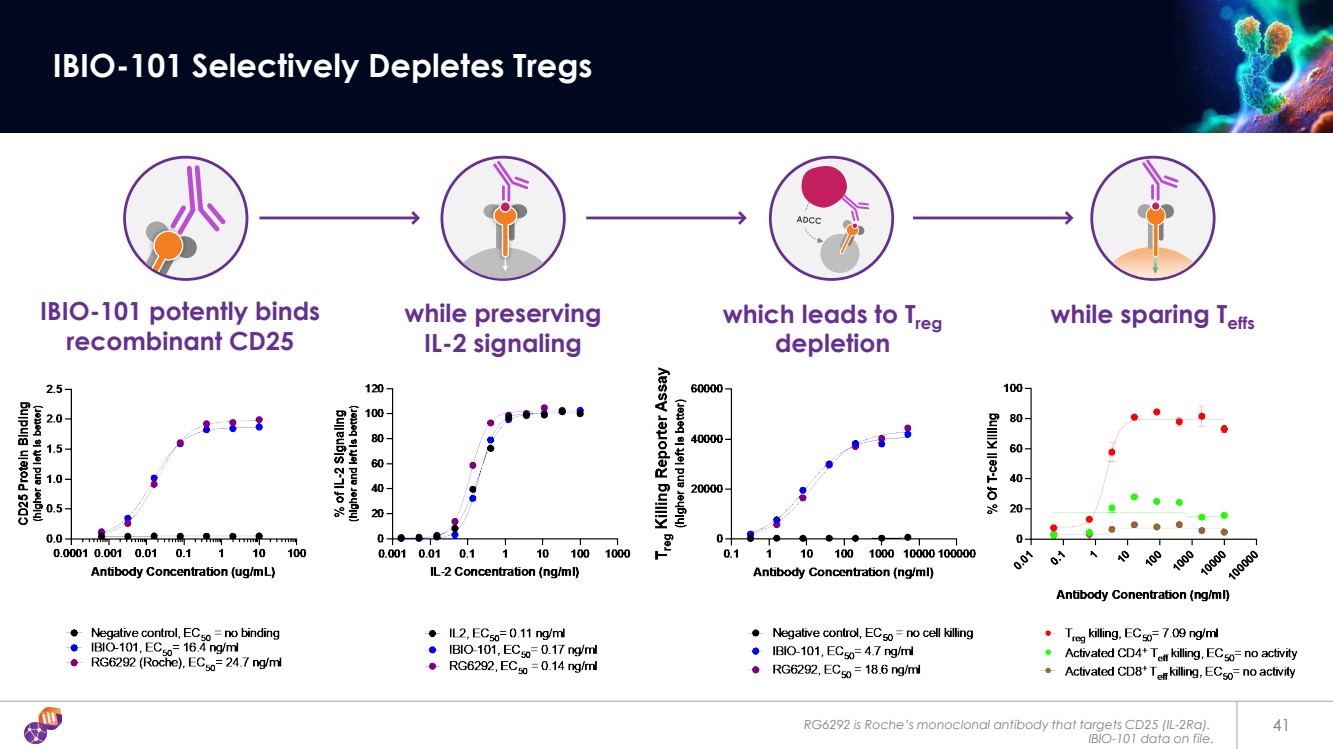

| RG6292 is Roche’s monoclonal antibody that targets CD25 (IL-2Rα). IBIO-101 data on file. 41 IBIO-101 Selectively Depletes Tregs while preserving IL-2 signaling IBIO-101 potently binds recombinant CD25 which leads to Treg depletion while sparing Teffs |

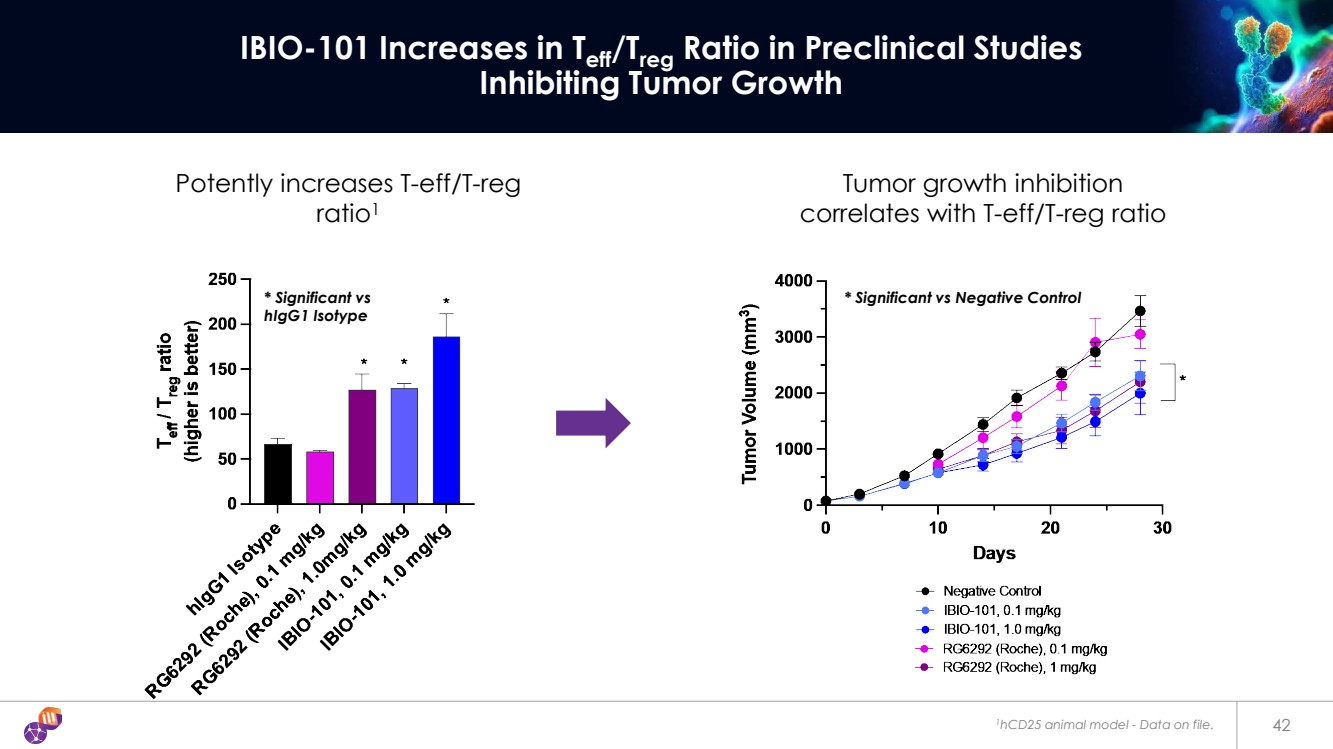

| 1hCD25 animal model - Data on file. 42 IBIO-101 Increases in Teff/Treg Ratio in Preclinical Studies Inhibiting Tumor Growth Tumor growth inhibition correlates with T-eff/T-reg ratio Potently increases T-eff/T-reg ratio1 * Significant vs * Significant vs Negative Control hIgG1 Isotype |

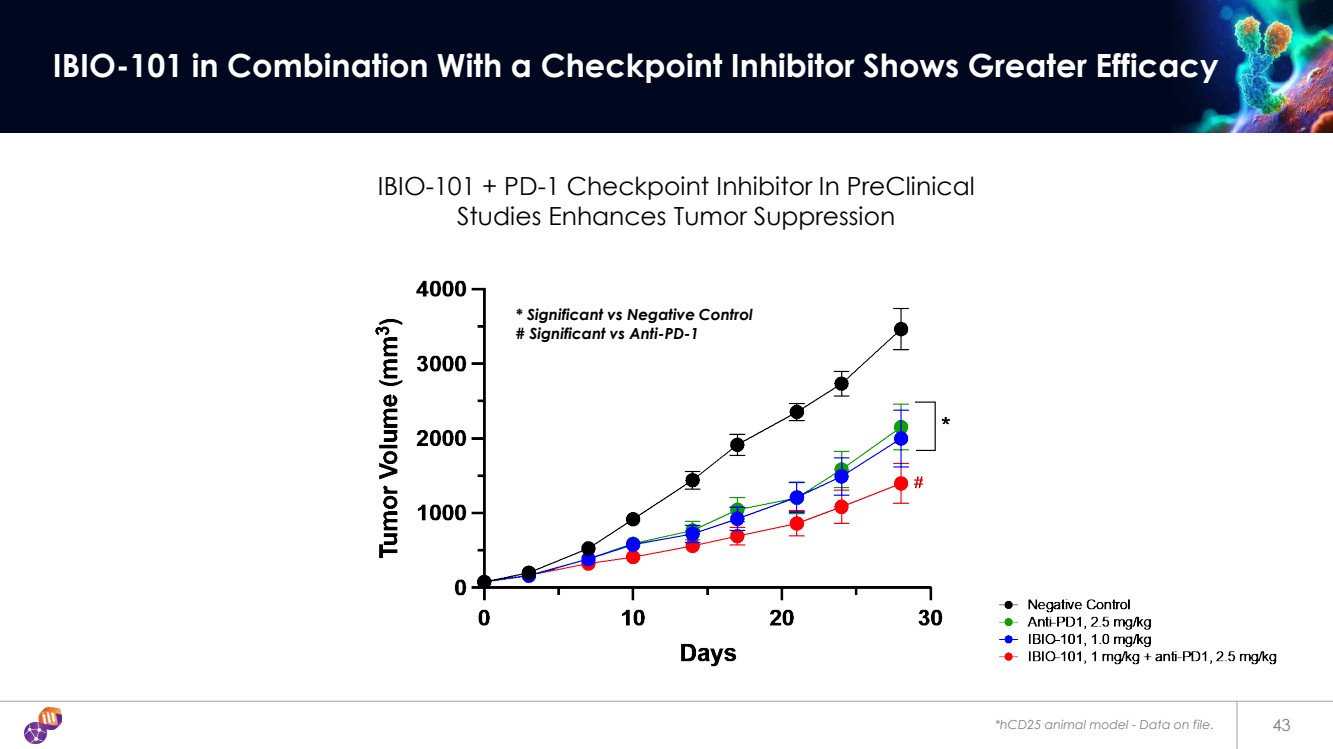

| *hCD25 animal model - Data on file. 43 IBIO-101 in Combination With a Checkpoint Inhibitor Shows Greater Efficacy IBIO-101 + PD-1 Checkpoint Inhibitor In PreClinical Studies Enhances Tumor Suppression * Significant vs Negative Control # Significant vs Anti-PD-1 |

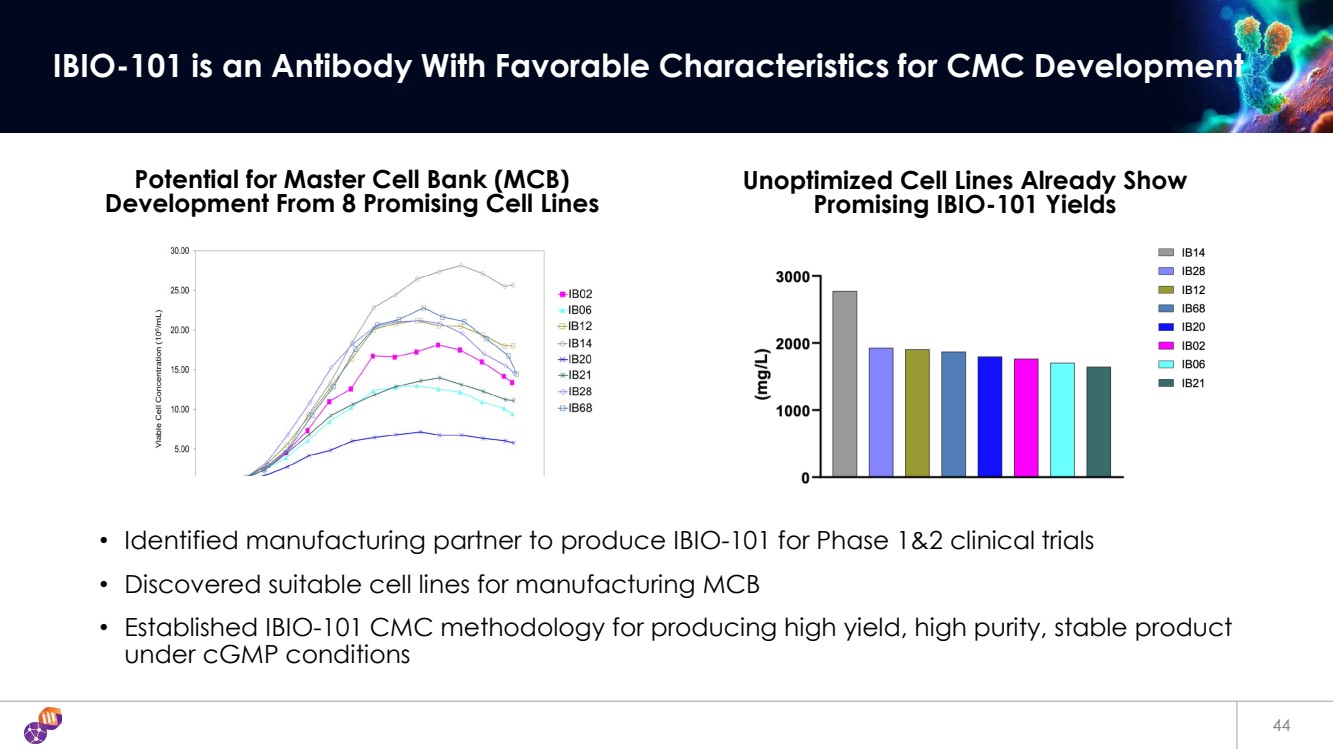

| 44 IBIO-101 is an Antibody With Favorable Characteristics for CMC Development • Identified manufacturing partner to produce IBIO-101 for Phase 1&2 clinical trials • Discovered suitable cell lines for manufacturing MCB • Established IBIO-101 CMC methodology for producing high yield, high purity, stable product under cGMP conditions Potential for Master Cell Bank (MCB) Development From 8 Promising Cell Lines Unoptimized Cell Lines Already Show Promising IBIO-101 Yields |

| 45 Anti-CCR8 High ADCC Anti -CCR8 for the Depletion of T-regulatory Cells |

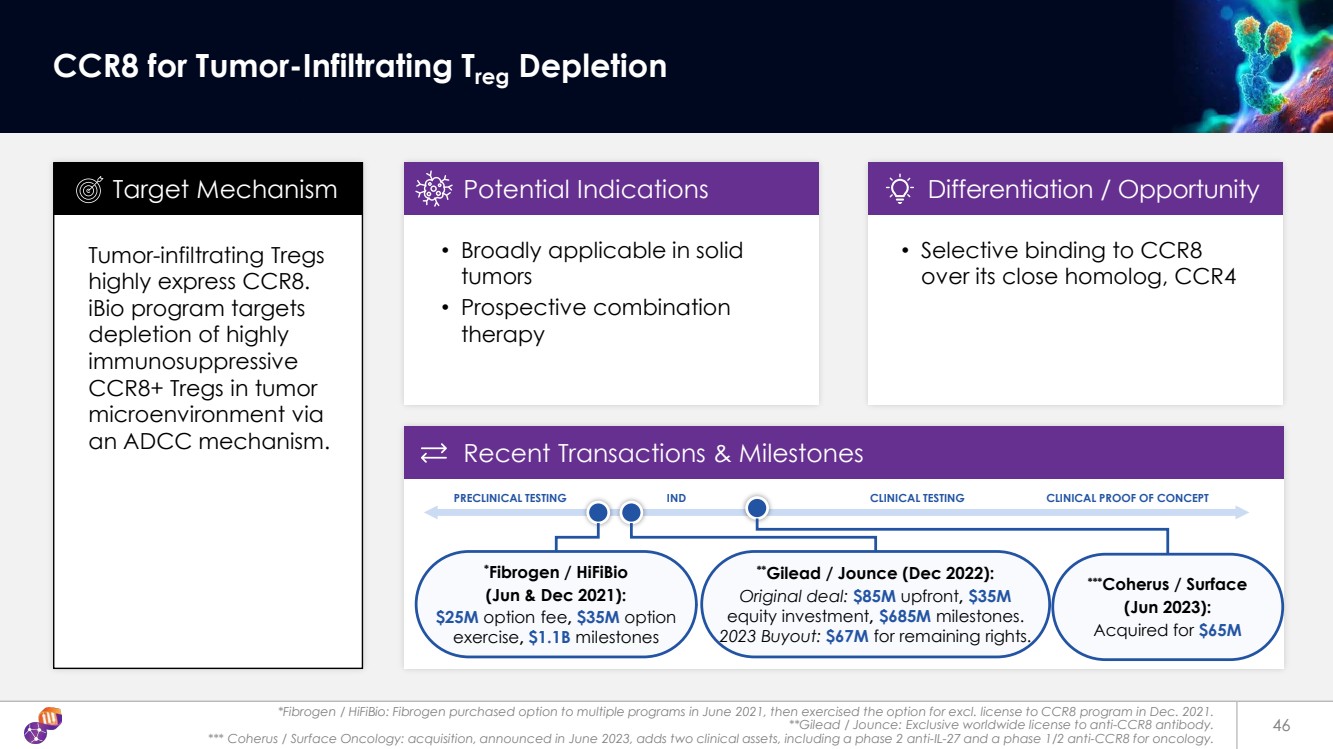

| *Fibrogen / HiFiBio: Fibrogen purchased option to multiple programs in June 2021, then exercised the option for excl. license to CCR8 program in Dec. 2021. **Gilead / Jounce: Exclusive worldwide license to anti-CCR8 antibody. *** Coherus / Surface Oncology: acquisition, announced in June 2023, adds two clinical assets, including a phase 2 anti-IL-27 and a phase 1/2 anti-CCR8 for oncology. 46 CCR8 for Tumor-Infiltrating Treg Depletion Tumor-infiltrating Tregs highly express CCR8. iBio program targets depletion of highly immunosuppressive CCR8+ Tregs in tumor microenvironment via an ADCC mechanism. • Broadly applicable in solid tumors • Prospective combination therapy Target Mechanism Potential Indications Differentiation / Opportunity Recent Transactions & Milestones • Selective binding to CCR8 over its close homolog, CCR4 **Gilead / Jounce (Dec 2022): Original deal: $85M upfront, $35M equity investment, $685M milestones. 2023 Buyout: $67M for remaining rights. * Fibrogen / HiFiBio (Jun & Dec 2021): $25M option fee, $35M option exercise, $1.1B milestones PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT ***Coherus / Surface (Jun 2023): Acquired for $65M |

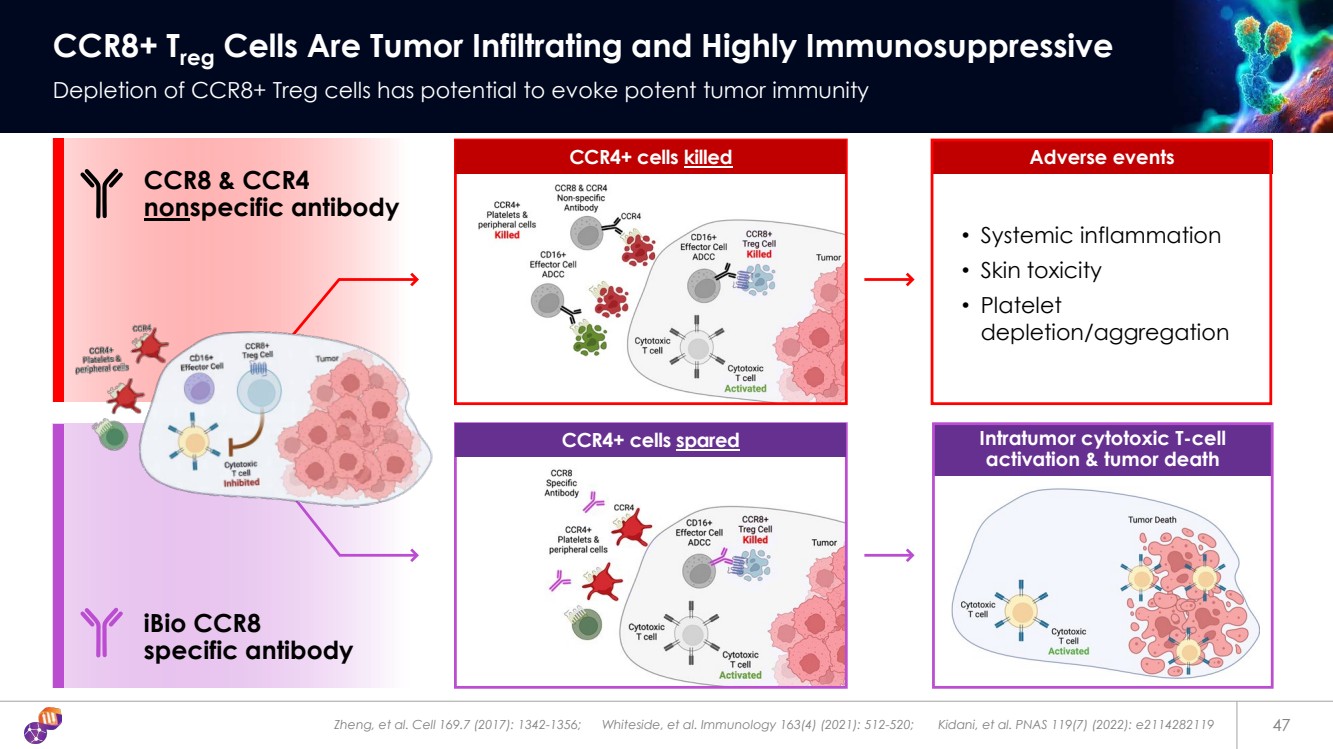

| Zheng, et al. Cell 169.7 (2017): 1342-1356; Whiteside, et al. Immunology 163(4) (2021): 512-520; Kidani, et al. PNAS 119(7) (2022): e2114282119 47 CCR8+ Treg Cells Are Tumor Infiltrating and Highly Immunosuppressive Depletion of CCR8+ Treg cells has potential to evoke potent tumor immunity • Systemic inflammation • Skin toxicity • Platelet depletion/aggregation Intratumor cytotoxic T-cell activation & tumor death Adverse events iBio CCR8 specific antibody CCR8 & CCR4 nonspecific antibody CCR4+ cells killed CCR4+ cells spared |

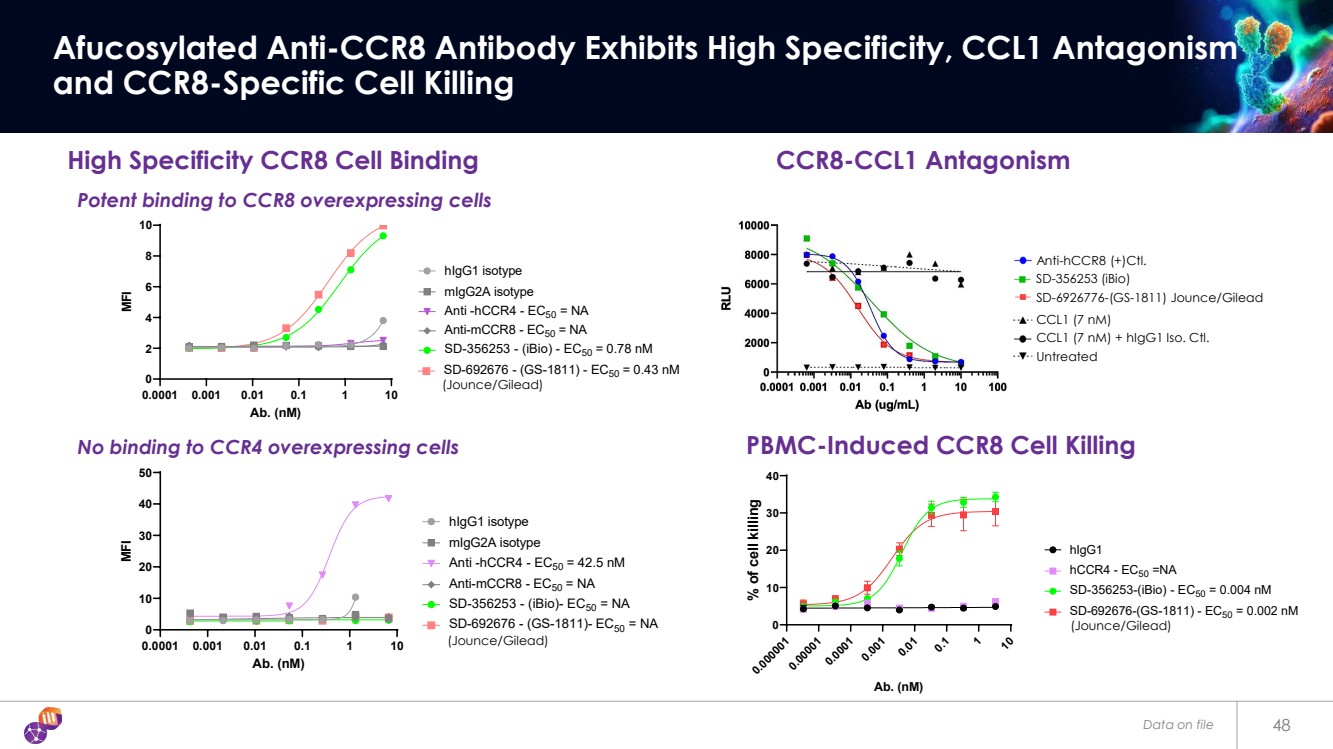

| Data on file 48 Afucosylated Anti-CCR8 Antibody Exhibits High Specificity, CCL1 Antagonism and CCR8-Specific Cell Killing High Specificity CCR8 Cell Binding 0.0001 0.001 0.01 0.1 1 10 0 2 4 6 8 10 hCCR8 overexpressed cells Ab. (nM) MFI hIgG1 isotype mIgG2A isotype Anti -hCCR4 - EC50 = NA Anti-mCCR8 - EC50 = NA SD-356253 - (iBio) - EC50 = 0.78 nM SD-692676 - (GS-1811) - EC50 = 0.43 nM 0.0001 0.001 0.01 0.1 1 10 0 10 20 30 40 50 hCCR4 overexpressed cells Ab. (nM) MFI hIgG1 isotype mIgG2A isotype Anti -hCCR4 - EC50 = 42.5 nM Anti-mCCR8 - EC50 = NA SD-356253 - (iBio)- EC50 = NA SD-692676 - (GS-1811)- EC50 = NA 0.000001 0.00001 0.0001 0.001 0.01 0.1 1 10 0 10 20 30 40 CCR8 overexpressed cell Ab. (nM) % of cell killing hIgG1 hCCR4 - EC50 =NA SD-356253-(iBio) - EC50 = 0.004 nM SD-692676-(GS-1811) - EC50 = 0.002 nM PBMC-Induced CCR8 Cell Killing Potent binding to CCR8 overexpressing cells No binding to CCR4 overexpressing cells (Jounce/Gilead) (Jounce/Gilead) (Jounce/Gilead) Untreated CCL1 (7 nM) CCL1 (7 nM) + hIgG1 Iso. Ctl. Anti-hCCR8 (+)Ctl. SD-6926776-(GS-1811) Jounce/Gilead SD-356253 (iBio) CCR8-CCL1 Antagonism |

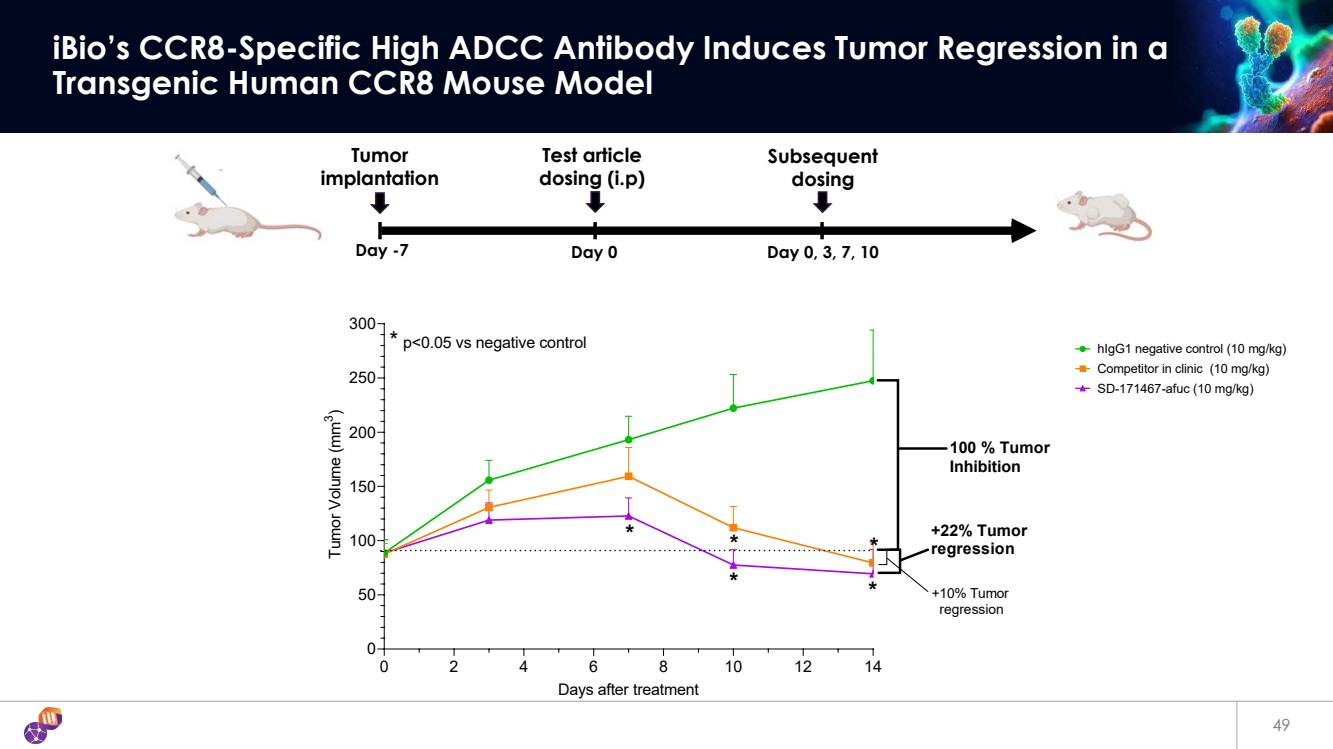

| 49 iBio’s CCR8-Specific High ADCC Antibody Induces Tumor Regression in a Transgenic Human CCR8 Mouse Model Day -7 Day 0 Day 0, 3, 7, 10 Tumor implantation Subsequent dosing Test article dosing (i.p) 0 2 4 6 8 10 12 14 0 50 100 150 200 250 300 Days after treatment Tumor Volume (mm3 ) * * * * p<0.05 vs negative control * * +22% Tumor regression +10% Tumor regression 100 % Tumor Inhibition hIgG1 negative control (10 mg/kg) Competitor in clinic (10 mg/kg) SD-171467-afuc (10 mg/kg) |

| 50 Unlocking the Power of Bi-Specific Antibodies with EngageTx, Our Versatile CD3 mAb Panel Wide Range of Affinities, NHP Cross Reactivity, High Developability |

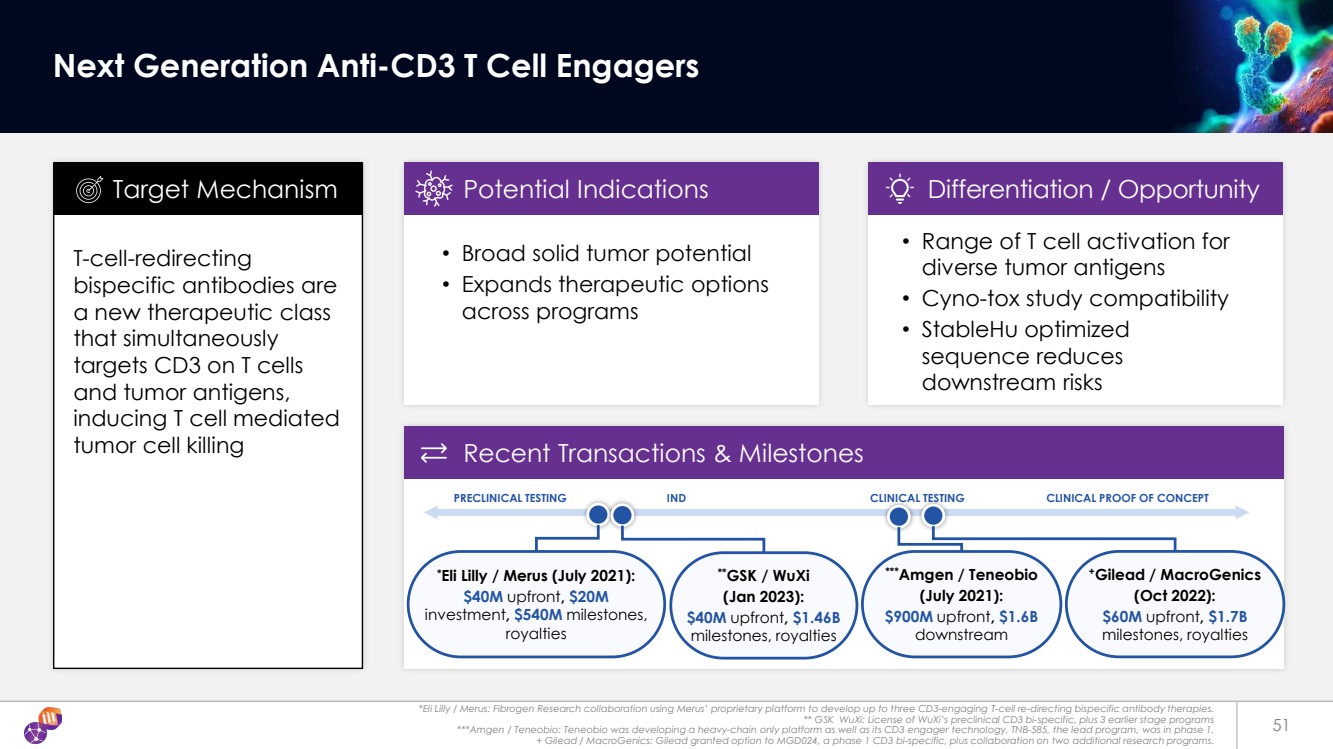

| *Eli Lilly / Merus: Fibrogen Research collaboration using Merus’ proprietary platform to develop up to three CD3-engaging T-cell re-directing bispecific antibody therapies. ** GSK WuXi: License of WuXi’s preclinical CD3 bi-specific, plus 3 earlier stage programs ***Amgen / Teneobio: Teneobio was developing a heavy-chain only platform as well as its CD3 engager technology. TNB-585, the lead program, was in phase 1. + Gilead / MacroGenics: Gilead granted option to MGD024, a phase 1 CD3 bi-specific, plus collaboration on two additional research programs. 51 Next Generation Anti-CD3 T Cell Engagers T-cell-redirecting bispecific antibodies are a new therapeutic class that simultaneously targets CD3 on T cells and tumor antigens, inducing T cell mediated tumor cell killing • Broad solid tumor potential • Expands therapeutic options across programs Target Mechanism Potential Indications Differentiation / Opportunity Recent Transactions & Milestones • Range of T cell activation for diverse tumor antigens • Cyno-tox study compatibility • StableHu optimized sequence reduces downstream risks * Eli Lilly / Merus (July 2021): $40M upfront, $20M investment, $540M milestones, royalties PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT ***Amgen / Teneobio (July 2021): $900M upfront, $1.6B downstream +Gilead / MacroGenics (Oct 2022): $60M upfront, $1.7B milestones, royalties **GSK / WuXi (Jan 2023): $40M upfront, $1.46B milestones, royalties |

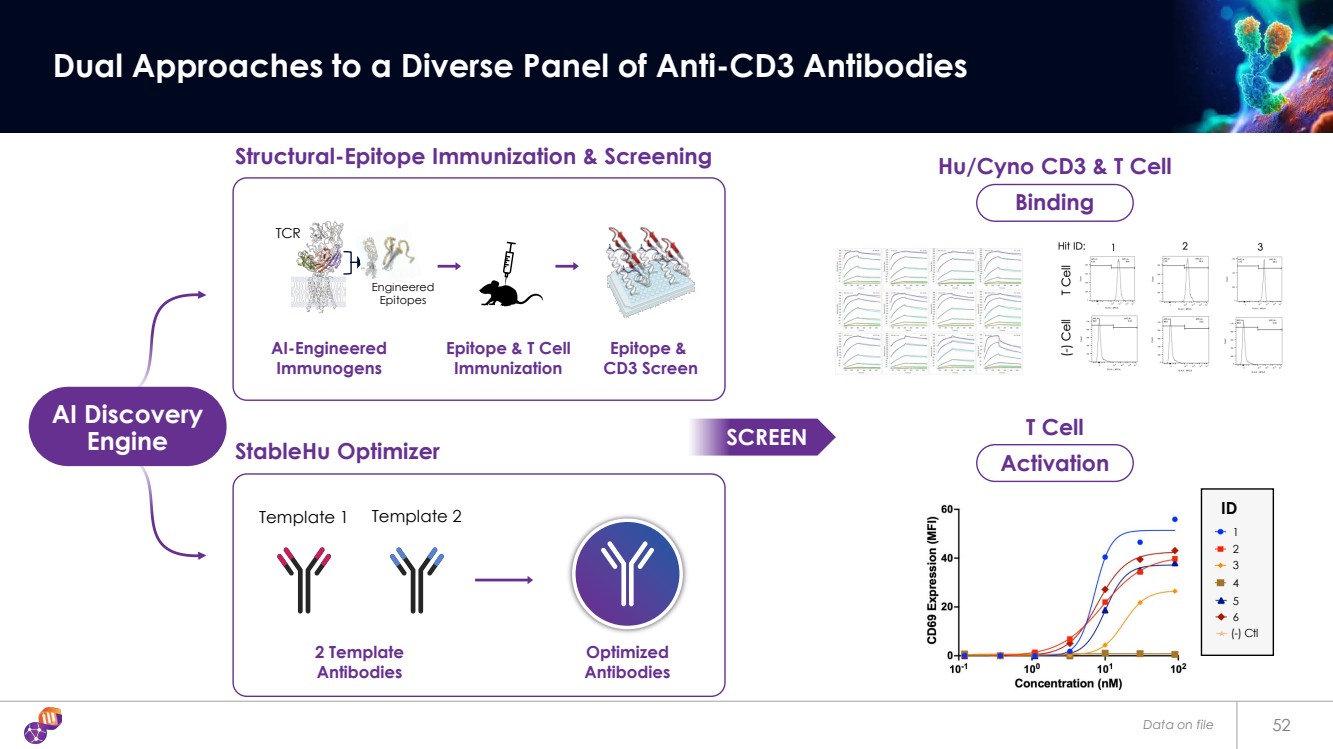

| Data on file 52 Dual Approaches to a Diverse Panel of Anti-CD3 Antibodies Hu/Cyno CD3 & T Cell TCR CD3 Engineered Epitopes T Cell Template 1 Template 2 Structural-Epitope Immunization & Screening StableHu Optimizer AI Discovery Engine AI-Engineered Immunogens Epitope & T Cell Immunization Epitope & CD3 Screen 2 Template Antibodies Optimized Antibodies SCREEN Activation Binding 1 2 3 4 5 6 (-) Ctl ID |

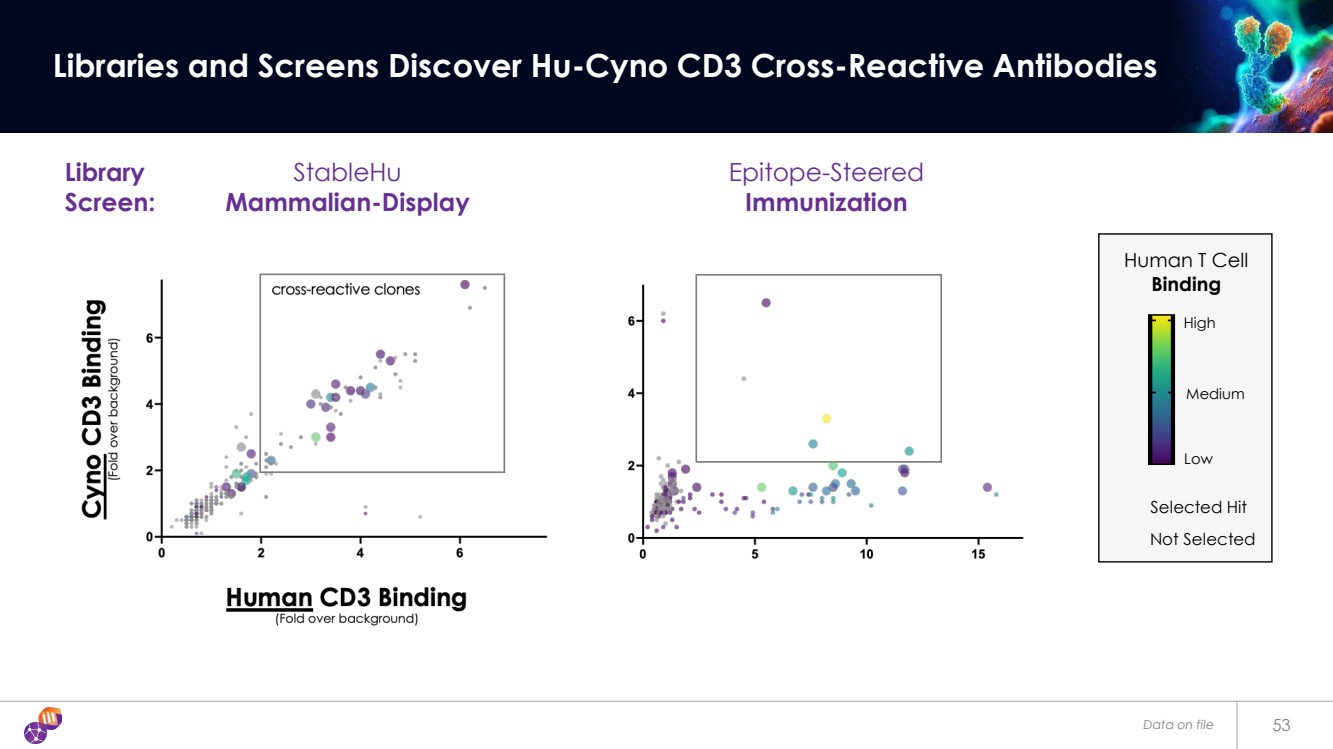

| Data on file 53 Libraries and Screens Discover Hu-Cyno CD3 Cross-Reactive Antibodies Epitope-Steered Immunization Human T Cell Binding Selected Hit Low Medium High StableHu Mammalian-Display Not Selected Library Screen: |

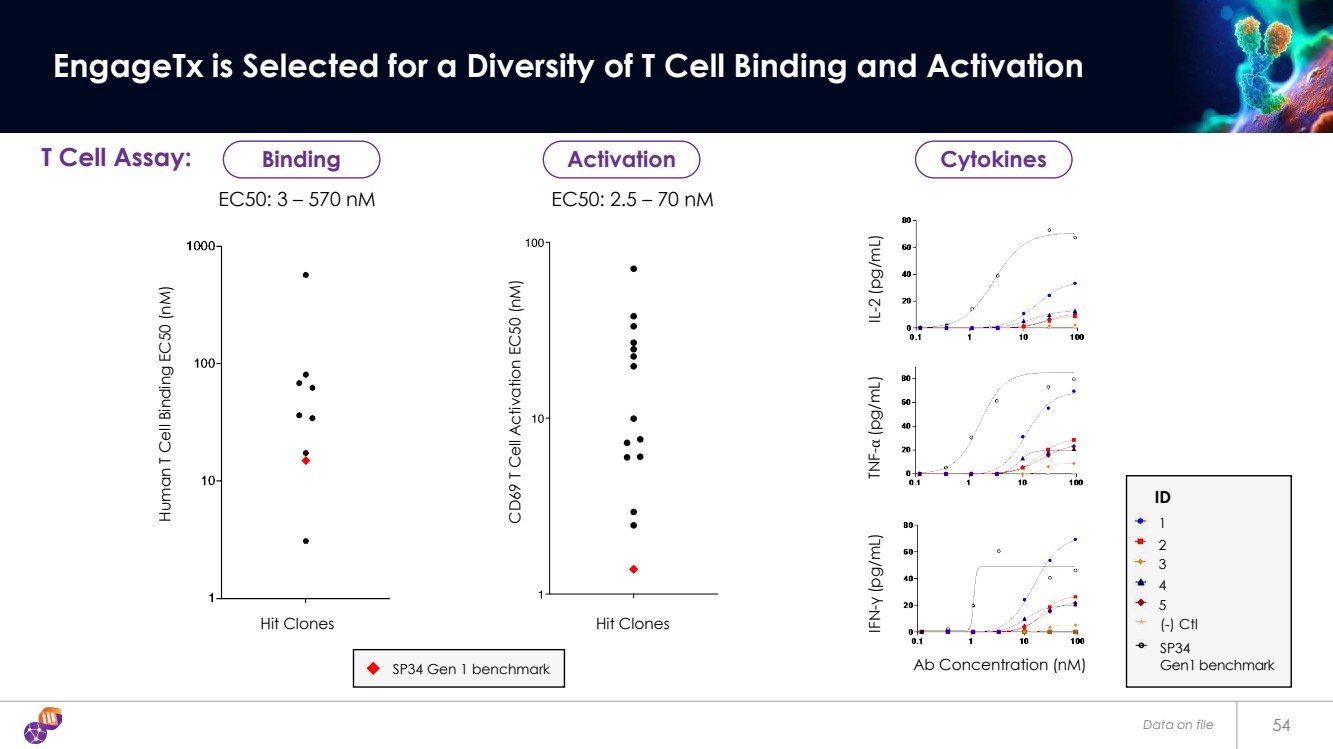

| Data on file 54 EngageTx is Selected for a Diversity of T Cell Binding and Activation EC50: 3 – 570 nM EC50: 2.5 – 70 nM Human T Cell Binding EC50 (nM) CD69 T Cell Activation EC50 (nM) Hit Clones Hit Clones T Cell Assay: Ab Concentration (nM) IFN-γ (pg/mL) TNF-⍺ (pg/mL) IL-2 (pg/mL) ID 1 2 3 5 (-) Ctl 4 SP34 Gen1 benchmark SP34 Gen 1 benchmark Binding Activation Cytokines |

| 55 ShieldTx Antibody masking technology for delivering on-epitope, on-tissue clinical candidates with enhanced safety and developability |

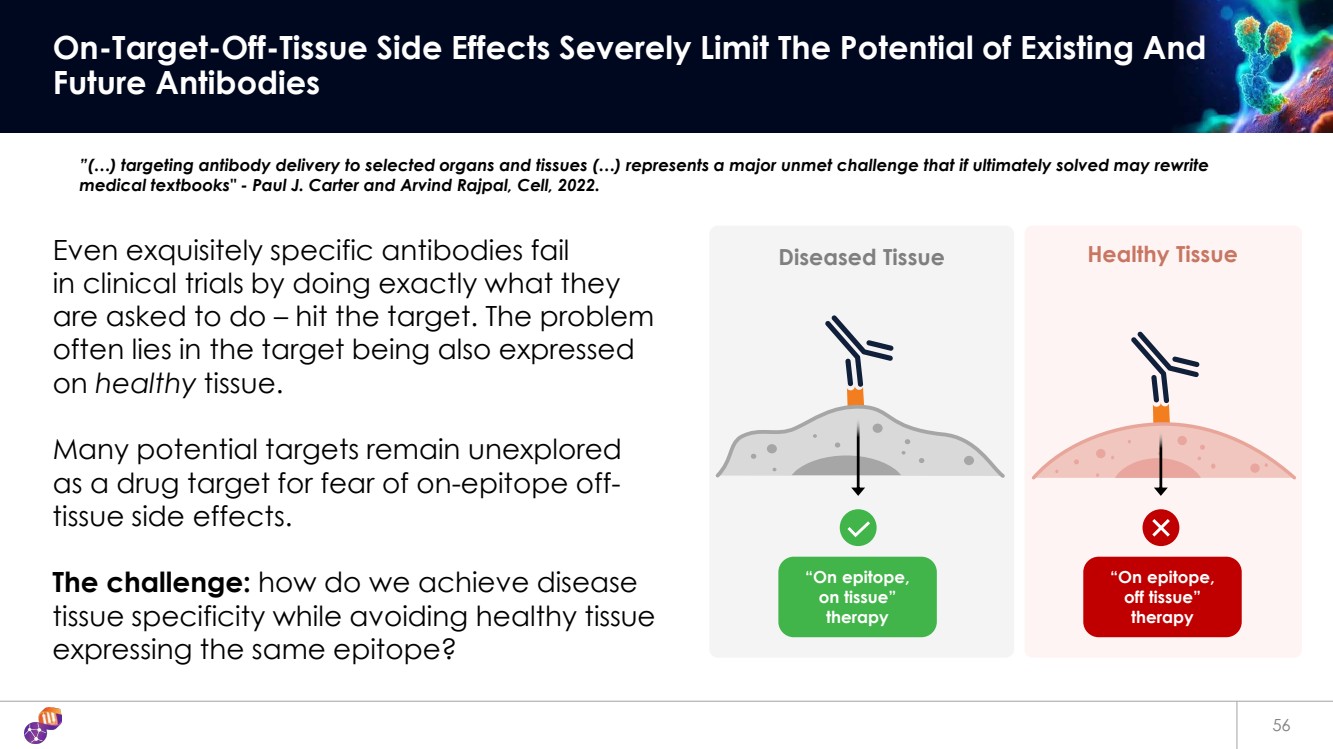

| Diseased Tissue Healthy Tissue 56 On-Target-Off-Tissue Side Effects Severely Limit The Potential of Existing And Future Antibodies Even exquisitely specific antibodies fail in clinical trials by doing exactly what they are asked to do – hit the target. The problem often lies in the target being also expressed on healthy tissue. Many potential targets remain unexplored as a drug target for fear of on-epitope off-tissue side effects. The challenge: how do we achieve disease tissue specificity while avoiding healthy tissue expressing the same epitope? “On epitope, on tissue” therapy “On epitope, off tissue” therapy ”(…) targeting antibody delivery to selected organs and tissues (…) represents a major unmet challenge that if ultimately solved may rewrite medical textbooks" - Paul J. Carter and Arvind Rajpal, Cell, 2022. |

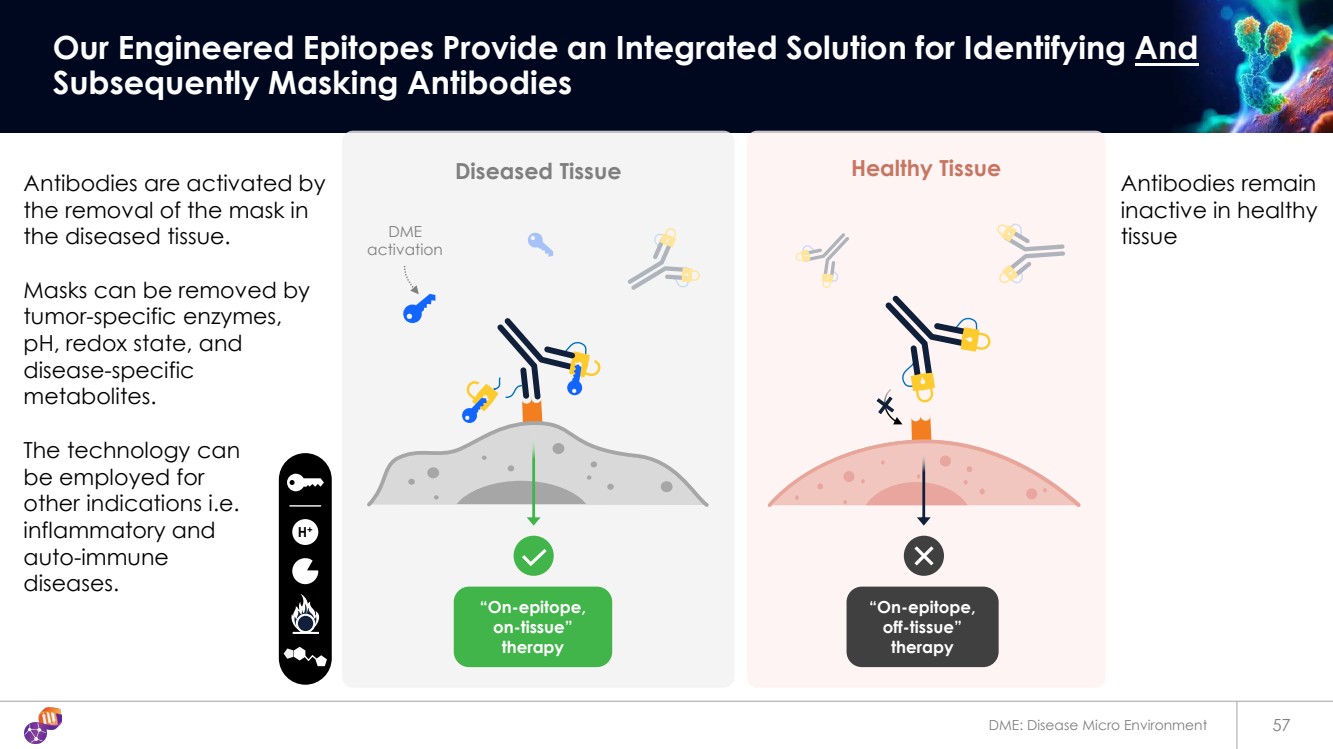

| 57 Our Engineered Epitopes Provide an Integrated Solution for Identifying And Subsequently Masking Antibodies Diseased Tissue “On-epitope, off-tissue” therapy Healthy Tissue DME activation “On-epitope, on-tissue” therapy H+ DME: Disease Micro Environment Antibodies are activated by the removal of the mask in the diseased tissue. Masks can be removed by tumor-specific enzymes, pH, redox state, and disease-specific metabolites. The technology can be employed for other indications i.e. inflammatory and auto-immune diseases. Antibodies remain inactive in healthy tissue |

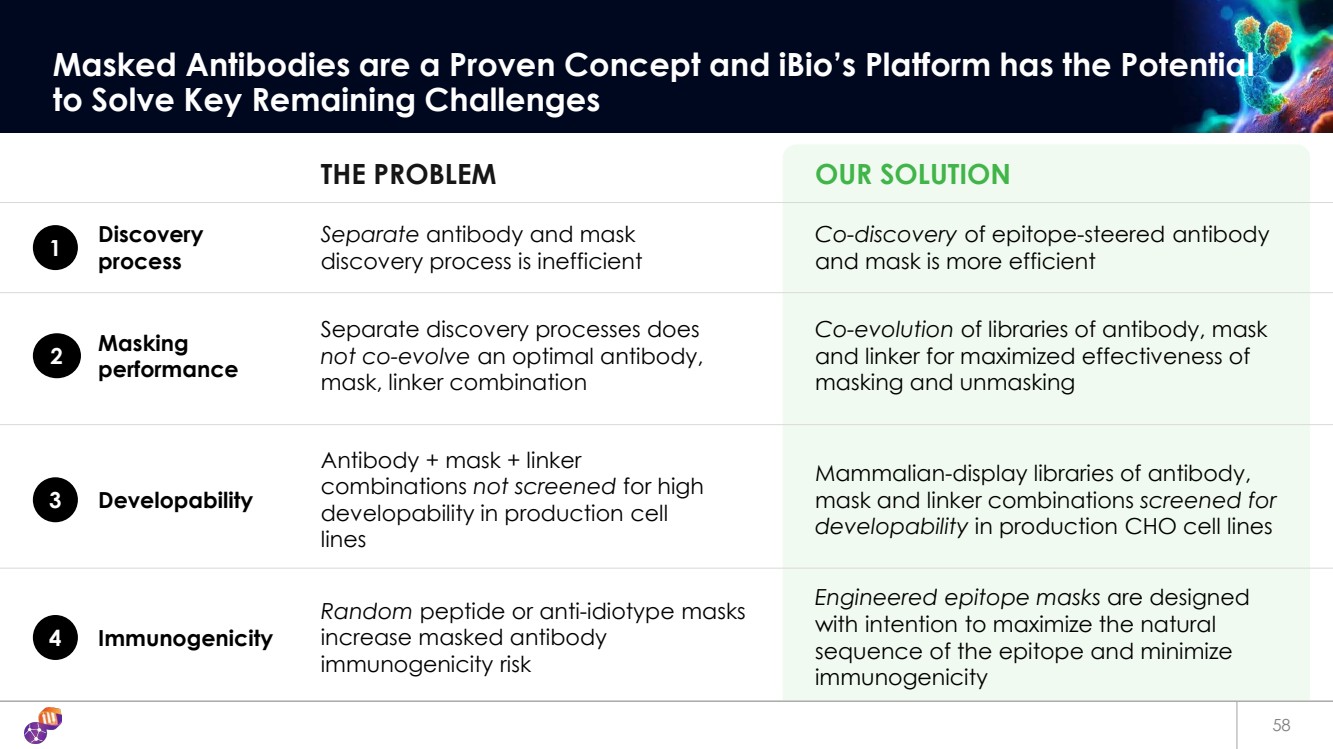

| 58 Masked Antibodies are a Proven Concept and iBio’s Platform has the Potential to Solve Key Remaining Challenges THE PROBLEM OUR SOLUTION 1 Separate antibody and mask discovery process is inefficient Co-discovery of epitope-steered antibody and mask is more efficient Discovery process 2 Separate discovery processes does not co-evolve an optimal antibody, mask, linker combination Co-evolution of libraries of antibody, mask and linker for maximized effectiveness of masking and unmasking Masking performance 3 Antibody + mask + linker combinations not screened for high developability in production cell lines Mammalian-display libraries of antibody, mask and linker combinations screened for developability in production CHO cell lines Developability 4 Random peptide or anti-idiotype masks increase masked antibody immunogenicity risk Engineered epitope masks are designed with intention to maximize the natural sequence of the epitope and minimize immunogenicity Immunogenicity |

| 59 Anti-Trop-2 x CD3 Bi-Specific Antibody against Tumor-Specific Trop-2 Cancer Cells |

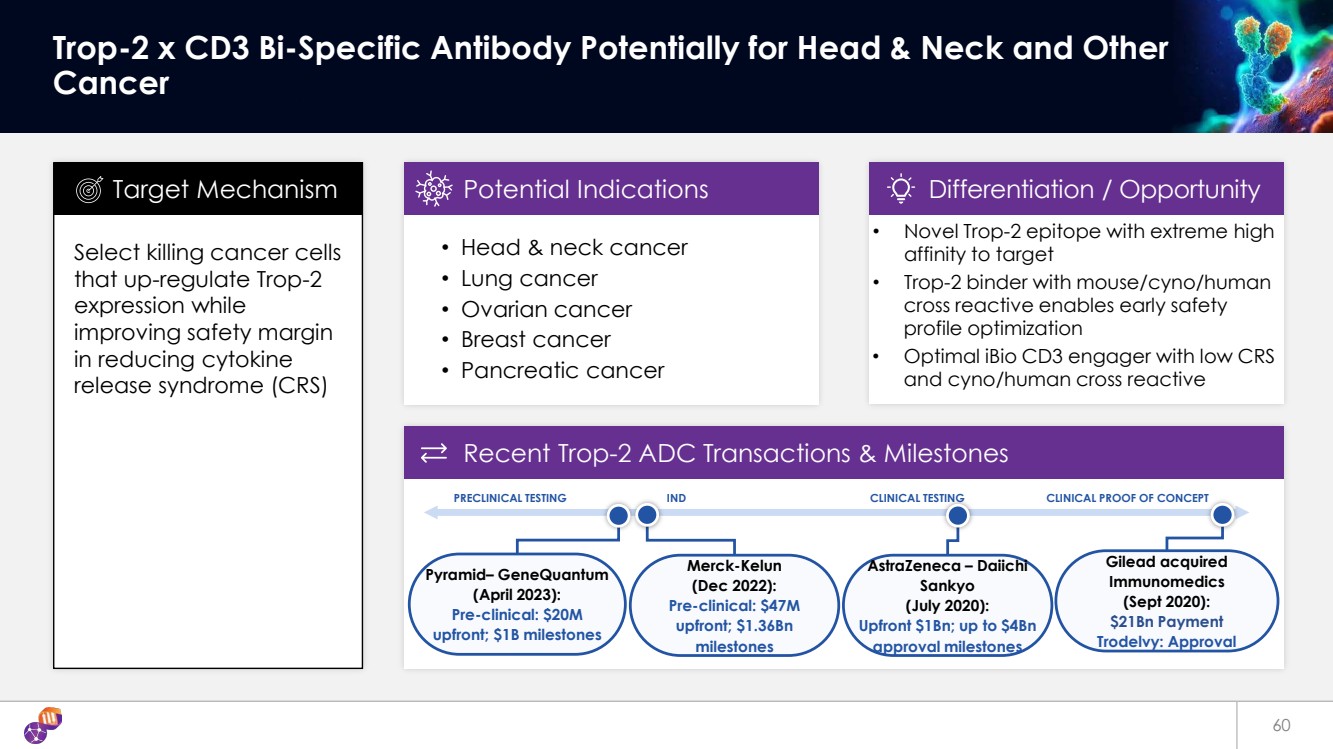

| Gilead acquired Immunomedics (Sept 2020): $21Bn Payment Trodelvy: Approval 60 Trop-2 x CD3 Bi-Specific Antibody Potentially for Head & Neck and Other Cancer Select killing cancer cells that up-regulate Trop-2 expression while improving safety margin in reducing cytokine release syndrome (CRS) • Head & neck cancer • Lung cancer • Ovarian cancer • Breast cancer • Pancreatic cancer Target Mechanism Potential Indications • Novel Trop-2 epitope with extreme high affinity to target • Trop-2 binder with mouse/cyno/human cross reactive enables early safety profile optimization • Optimal iBio CD3 engager with low CRS and cyno/human cross reactive Differentiation / Opportunity Recent Trop-2 ADC Transactions & Milestones PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT AstraZeneca – Daiichi Sankyo (July 2020): Upfront $1Bn; up to $4Bn approval milestones Pyramid– GeneQuantum (April 2023): Pre-clinical: $20M upfront; $1B milestones Merck-Kelun (Dec 2022): Pre-clinical: $47M upfront; $1.36Bn milestones |

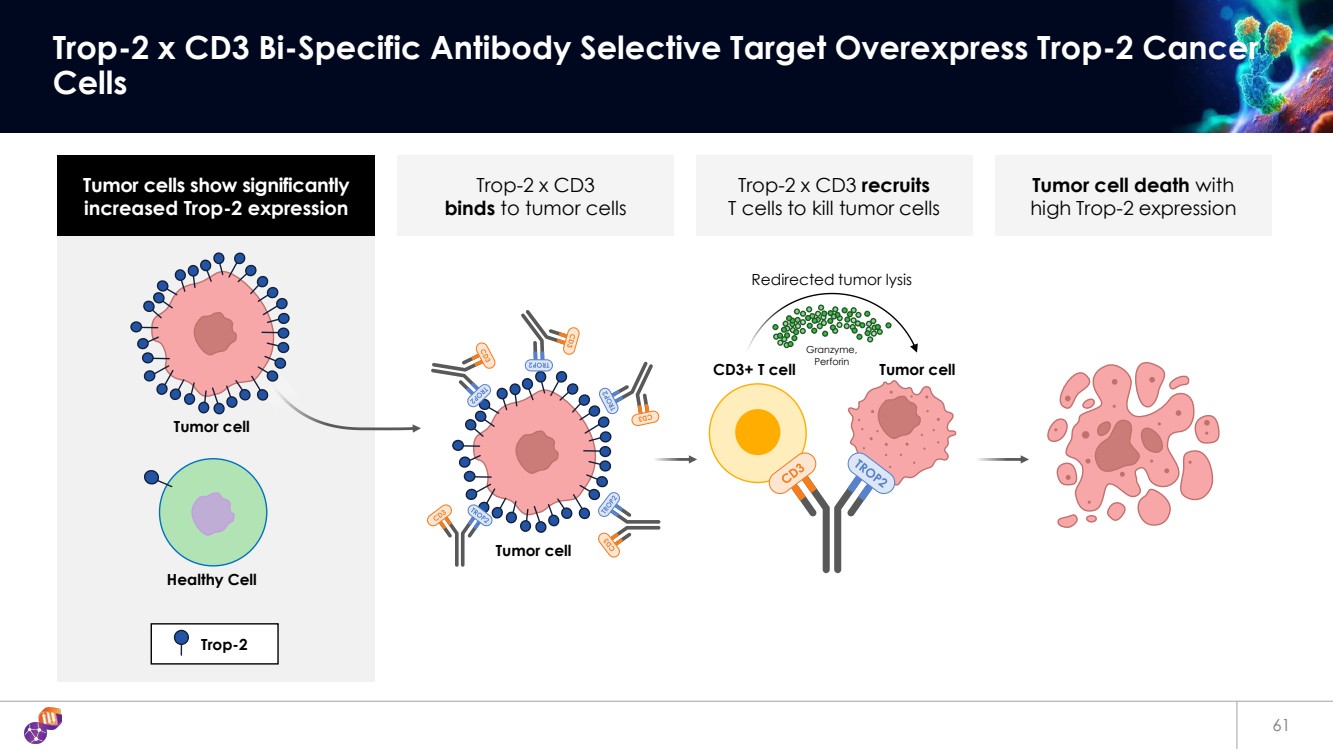

| Tumor cells show significantly increased Trop-2 expression Tumor cell death with high Trop-2 expression Trop-2 x CD3 binds to tumor cells Trop-2 x CD3 recruits T cells to kill tumor cells 61 Trop-2 x CD3 Bi-Specific Antibody Selective Target Overexpress Trop-2 Cancer Cells Trop-2 Tumor cell Healthy Cell Tumor cell Tumor cell Redirected tumor lysis CD3+ T cell Granzyme, Perforin |

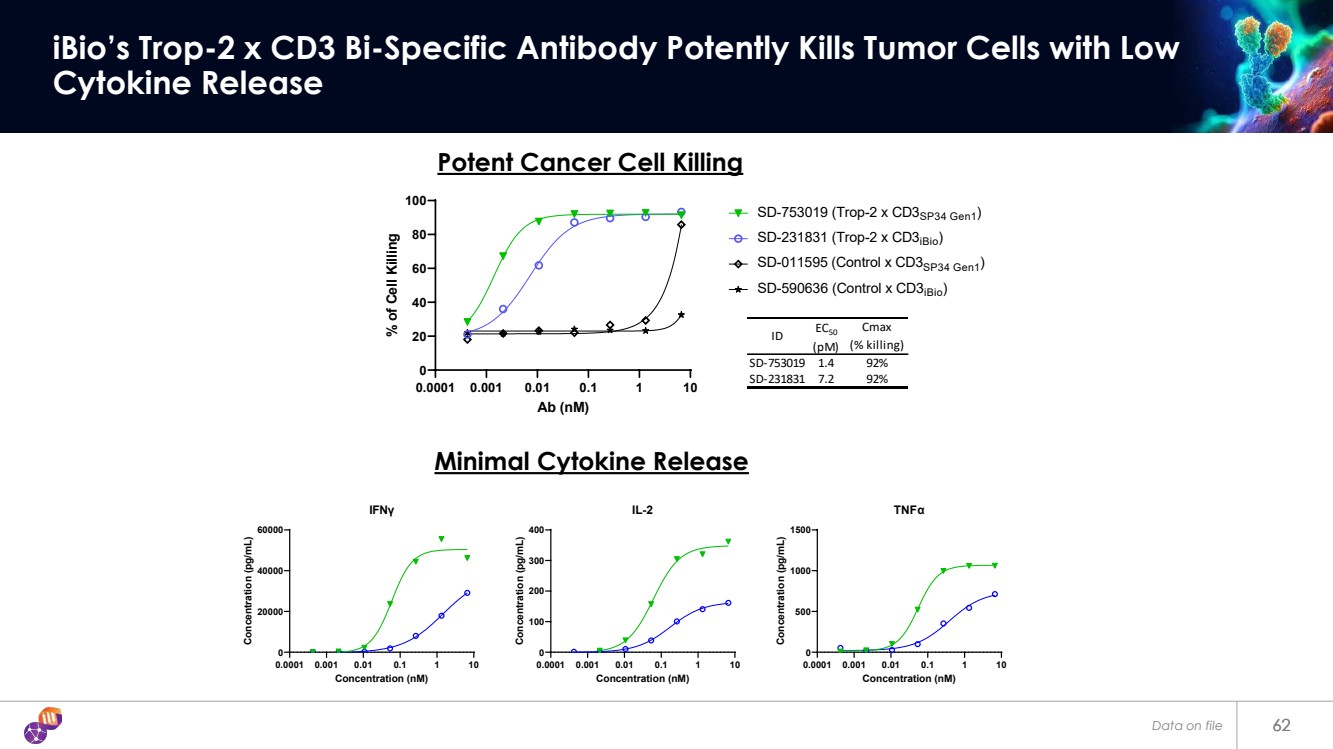

| 62 iBio’s Trop-2 x CD3 Bi-Specific Antibody Potently Kills Tumor Cells with Low Cytokine Release 62 0.0001 0.001 0.01 0.1 1 10 0 20 40 60 80 100 Ab (nM) % of Cell Killing ID EC50 (pM) Cmax (% killing) SD-753019 1.4 92% SD-231831 7.2 92% SD-753019 (Trop-2 x CD3SP34 Gen1) SD-231831 (Trop-2 x CD3iBio) SD-011595 (Control x CD3SP34 Gen1) SD-590636 (Control x CD3iBio) 0.0001 0.001 0.01 0.1 1 10 0 20000 40000 60000 IFNγ Concentration (nM) Concentration (pg/mL) 0.0001 0.001 0.01 0.1 1 10 0 100 200 300 400 IL-2 Concentration (nM) Concentration (pg/mL) 0.0001 0.001 0.01 0.1 1 10 0 500 1000 1500 TNFα Concentration (nM) Concentration (pg/mL) Minimal Cytokine Release Potent Cancer Cell Killing Data on file |

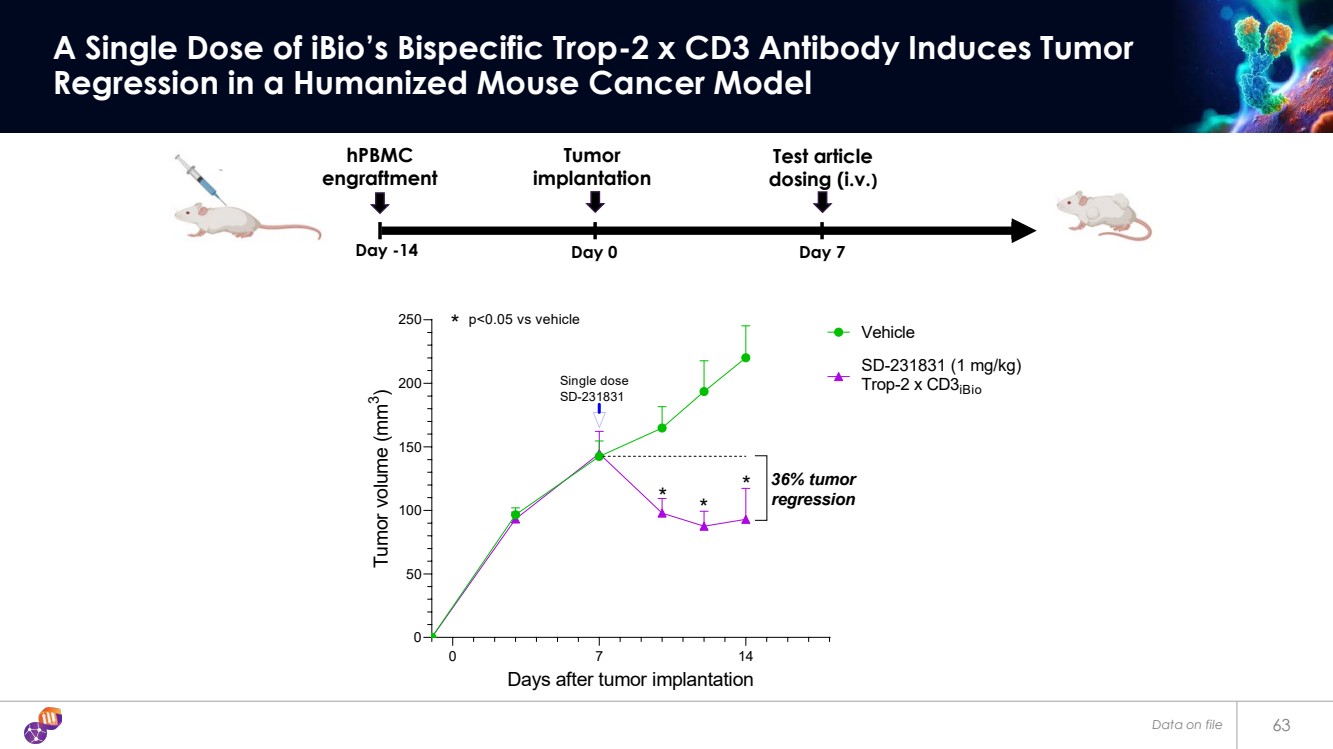

| 63 A Single Dose of iBio’s Bispecific Trop-2 x CD3 Antibody Induces Tumor Regression in a Humanized Mouse Cancer Model 0 7 14 0 50 100 150 200 250 Days after tumor implantation Tumor volume (mm 3 ) Vehicle SD-231831 (1 mg/kg) Trop-2 x CD3iBio * * * * p<0.05 vs vehicle Single dose SD-231831 36% tumor regression Day -14 Day 0 Day 7 hPBMC engraftment Test article dosing (i.v.) Tumor implantation Data on file |

| 64 Conditionally Activated Anti -MUC16 x CD3 Bispecific Antibodies Targeting the Non -Shed MUC16 Region Leveraging iBio’s Epitope Steering, ShieldTx, and EngageTx Technologies |

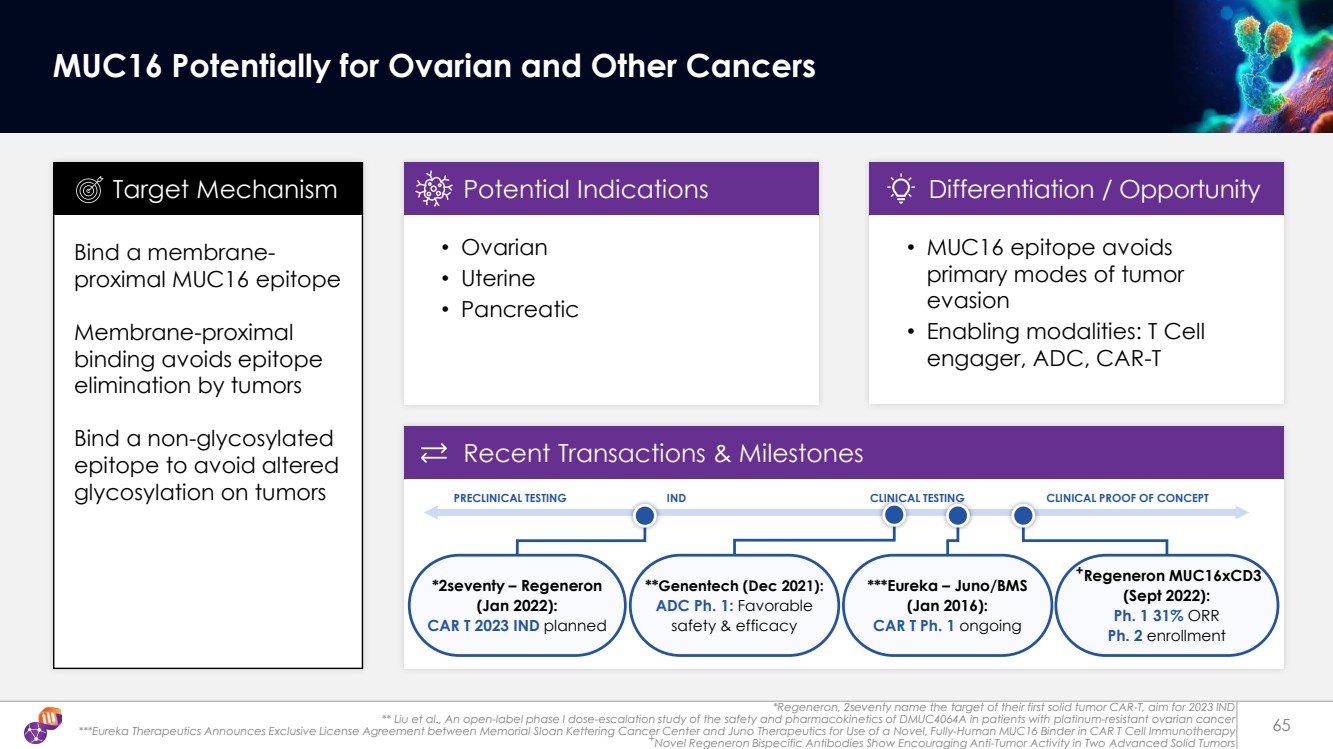

| +Regeneron MUC16xCD3 (Sept 2022): Ph. 1 31% ORR Ph. 2 enrollment *Regeneron, 2seventy name the target of their first solid tumor CAR-T, aim for 2023 IND ** Liu et al., An open-label phase I dose-escalation study of the safety and pharmacokinetics of DMUC4064A in patients with platinum-resistant ovarian cancer ***Eureka Therapeutics Announces Exclusive License Agreement between Memorial Sloan Kettering Cancer Center and Juno Therapeutics for Use of a Novel, Fully-Human MUC16 Binder in CAR T Cell Immunotherapy +Novel Regeneron Bispecific Antibodies Show Encouraging Anti-Tumor Activity in Two Advanced Solid Tumors 65 MUC16 Potentially for Ovarian and Other Cancers Bind a membrane-proximal MUC16 epitope Membrane-proximal binding avoids epitope elimination by tumors Bind a non-glycosylated epitope to avoid altered glycosylation on tumors • Ovarian • Uterine • Pancreatic Target Mechanism Potential Indications • MUC16 epitope avoids primary modes of tumor evasion • Enabling modalities: T Cell engager, ADC, CAR-T Differentiation / Opportunity Recent Transactions & Milestones PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT ***Eureka – Juno/BMS (Jan 2016): CAR T Ph. 1 ongoing *2seventy – Regeneron (Jan 2022): CAR T 2023 IND planned **Genentech (Dec 2021): ADC Ph. 1: Favorable safety & efficacy |

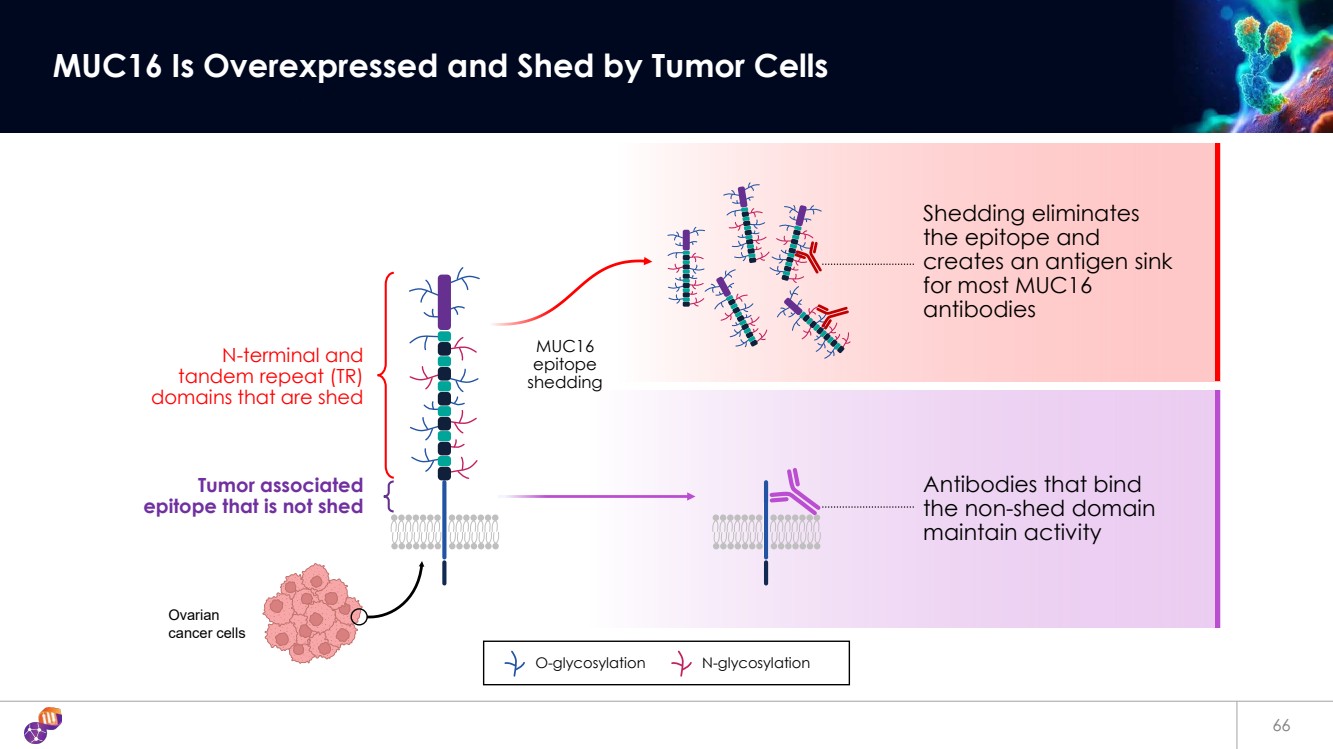

| 66 MUC16 Is Overexpressed and Shed by Tumor Cells O-glycosylation N-glycosylation MUC16 epitope shedding Shedding eliminates the epitope and creates an antigen sink for most MUC16 antibodies Antibodies that bind the non-shed domain maintain activity N-terminal and tandem repeat (TR) domains that are shed Tumor associated epitope that is not shed Ovarian cancer cells |

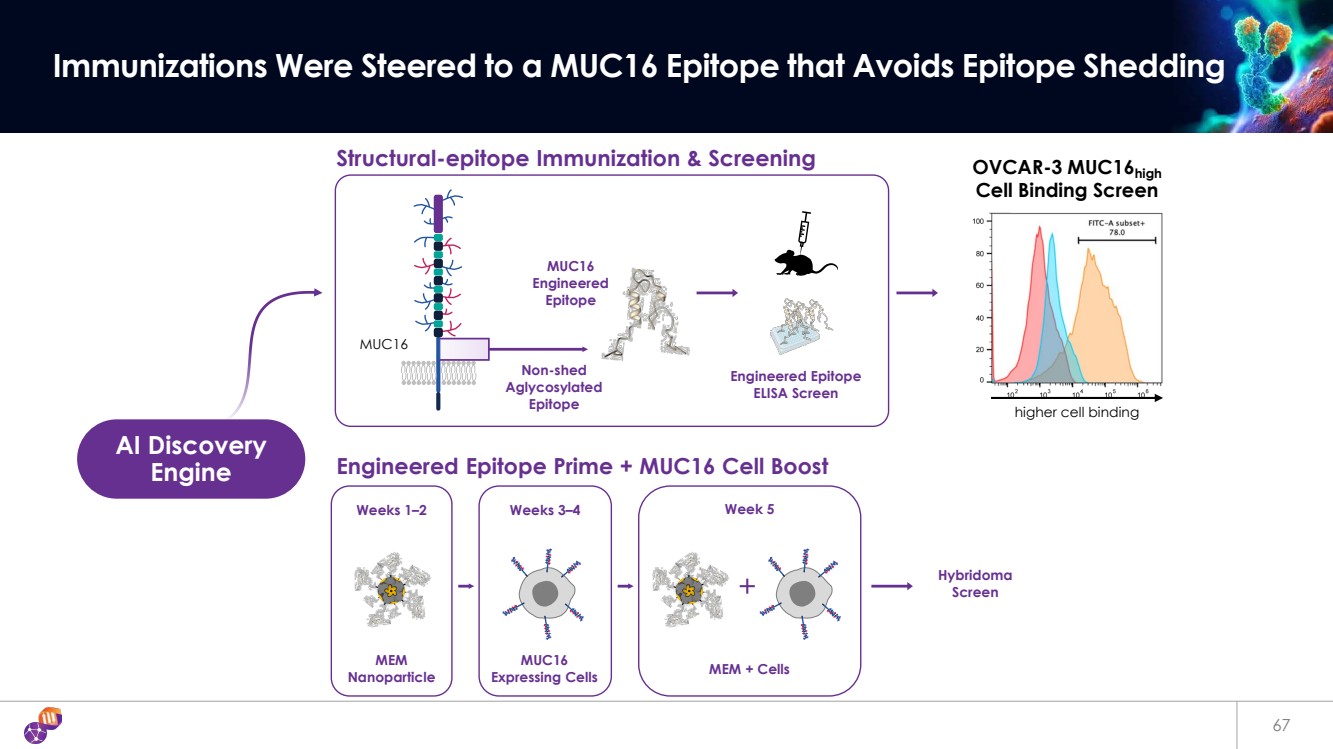

| Weeks 1–2 Weeks 3–4 Week 5 67 Immunizations Were Steered to a MUC16 Epitope that Avoids Epitope Shedding Engineered Epitope Prime + MUC16 Cell Boost AI Discovery Engine MUC16 Engineered Epitope Structural-epitope Immunization & Screening Engineered Epitope ELISA Screen MUC16 OVCAR-3 MUC16high Cell Binding Screen higher cell binding MEM Nanoparticle MUC16 Expressing Cells MEM + Cells Hybridoma Screen Non-shed Aglycosylated Epitope |

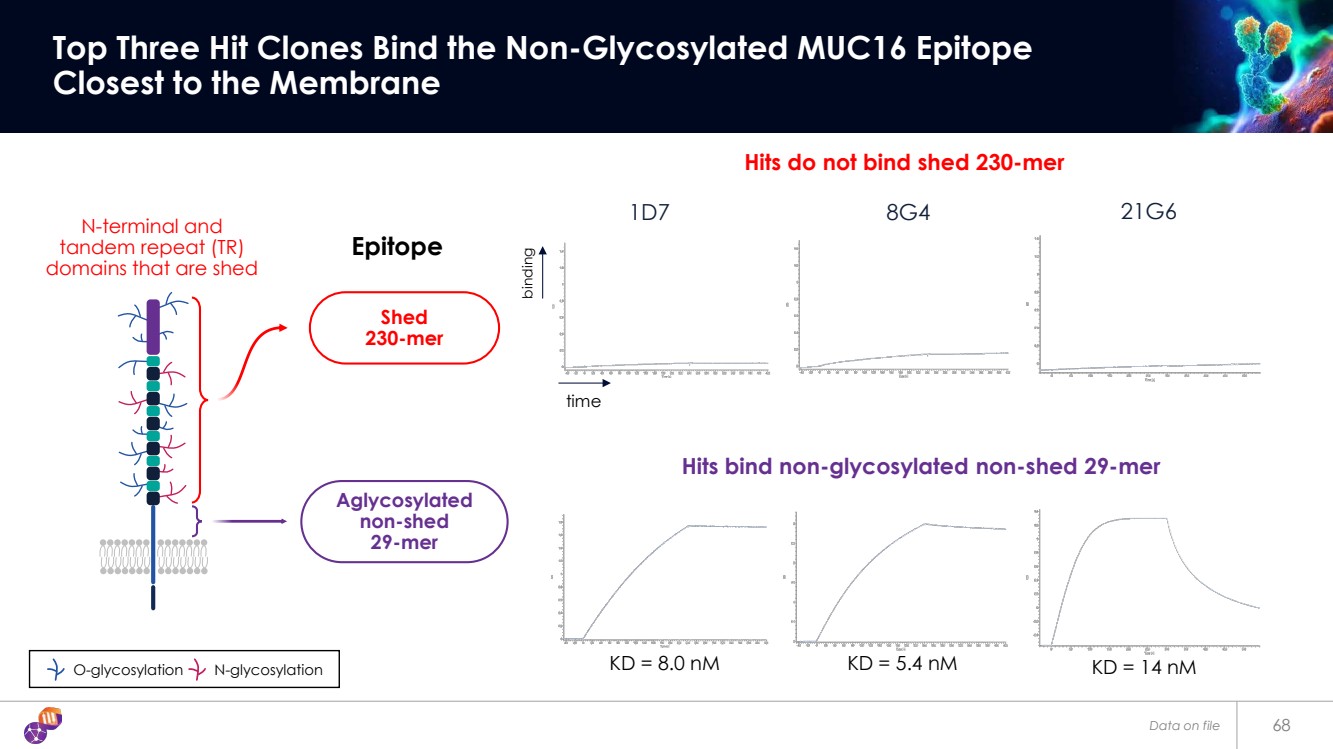

| 68 Top Three Hit Clones Bind the Non-Glycosylated MUC16 Epitope Closest to the Membrane 1D7 8G4 21G6 Hits do not bind shed 230-mer Hits bind non-glycosylated non-shed 29-mer binding time O-glycosylation N-glycosylation N-terminal and tandem repeat (TR) domains that are shed Epitope KD = 8.0 nM KD = 5.4 nM KD = 14 nM Aglycosylated non-shed 29-mer Shed 230-mer Data on file |

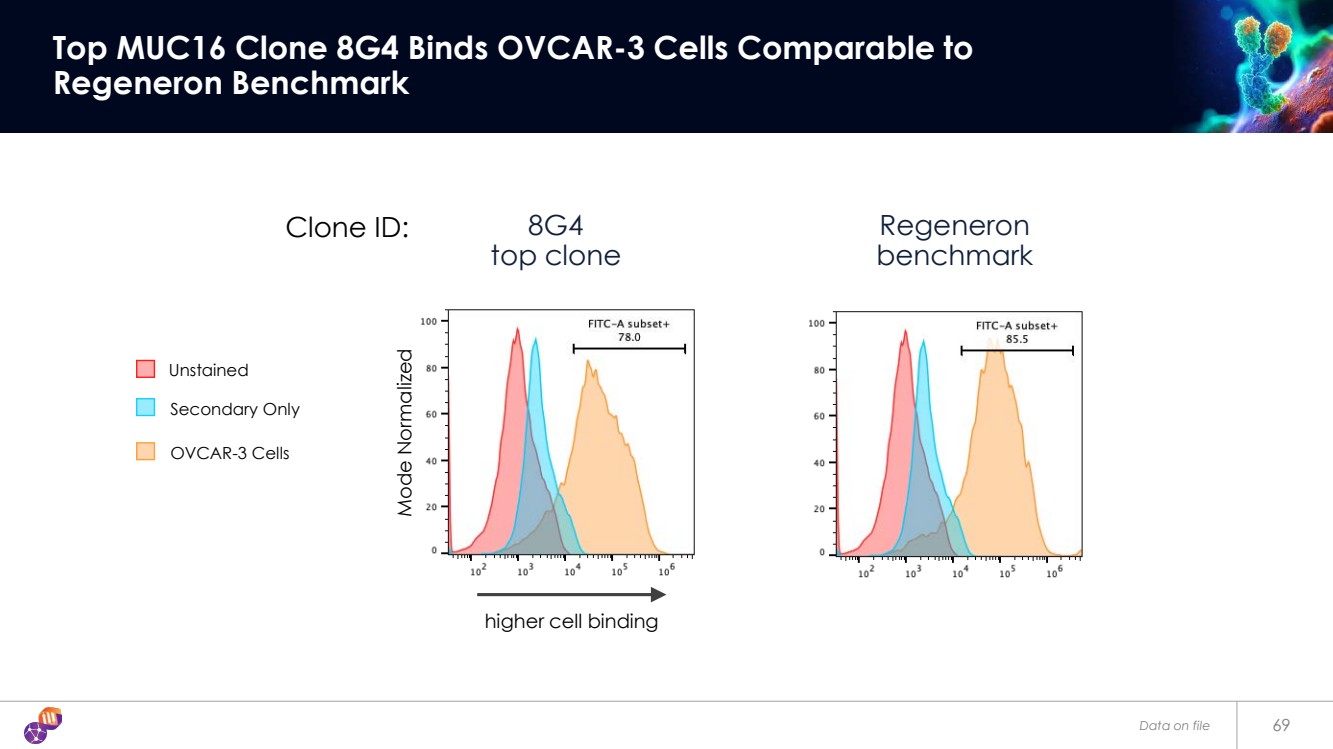

| 69 Top MUC16 Clone 8G4 Binds OVCAR-3 Cells Comparable to Regeneron Benchmark Regeneron benchmark Clone ID: Secondary Only Unstained OVCAR-3 Cells 8G4 top clone higher cell binding Mode Normalized Data on file |

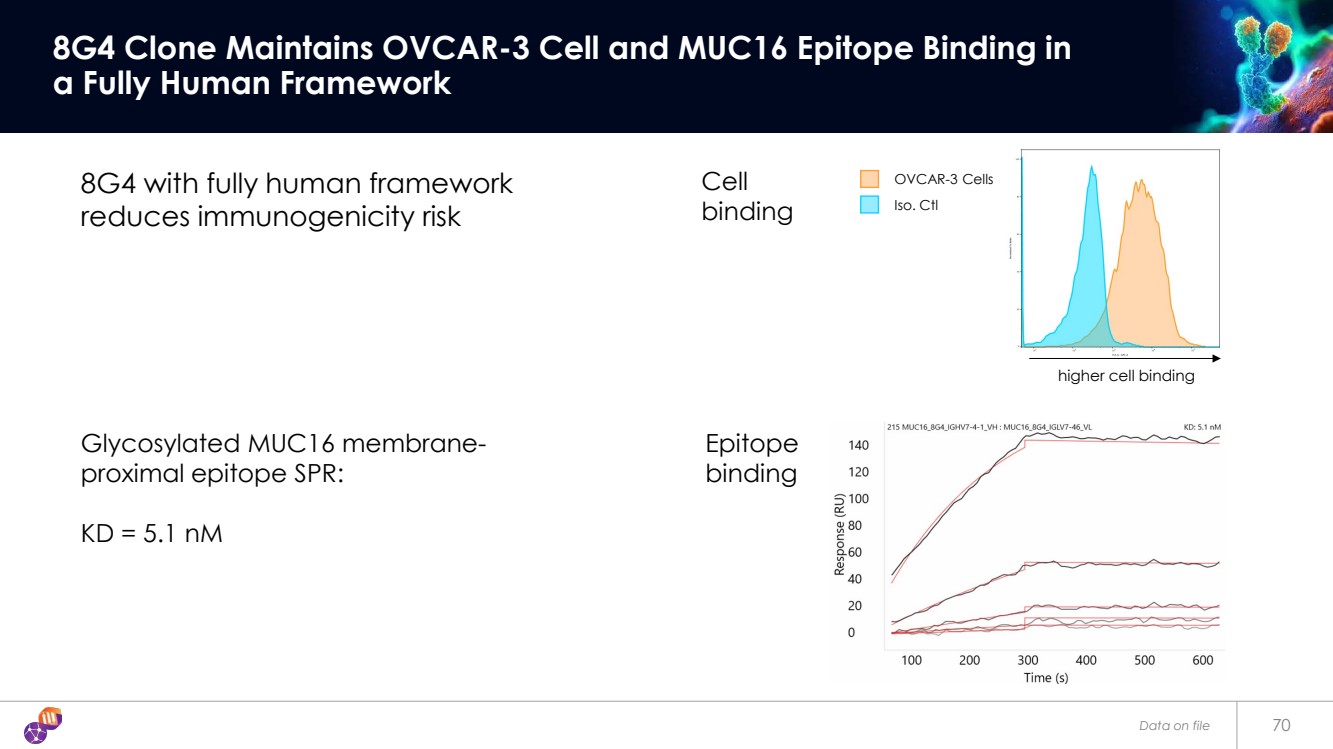

| 70 8G4 Clone Maintains OVCAR-3 Cell and MUC16 Epitope Binding in a Fully Human Framework 8G4 with fully human framework reduces immunogenicity risk Glycosylated MUC16 membrane-proximal epitope SPR: KD = 5.1 nM Iso. Ctl OVCAR-3 Cells Epitope binding Cell binding higher cell binding Data on file |

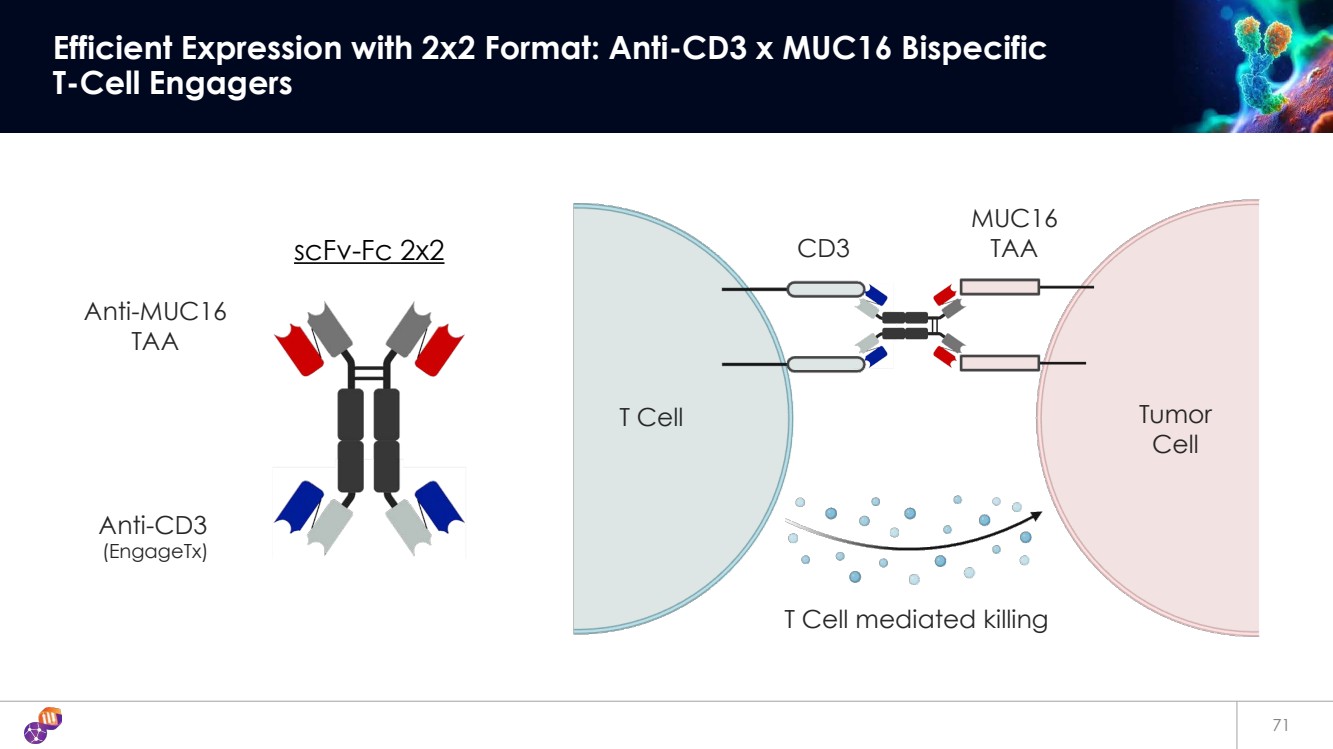

| 71 Efficient Expression with 2x2 Format: Anti-CD3 x MUC16 Bispecific T-Cell Engagers scFv-Fc 2x2 Anti-MUC16 TAA Anti-CD3 (EngageTx) CD3 MUC16 TAA T Cell Tumor Cell T Cell mediated killing |

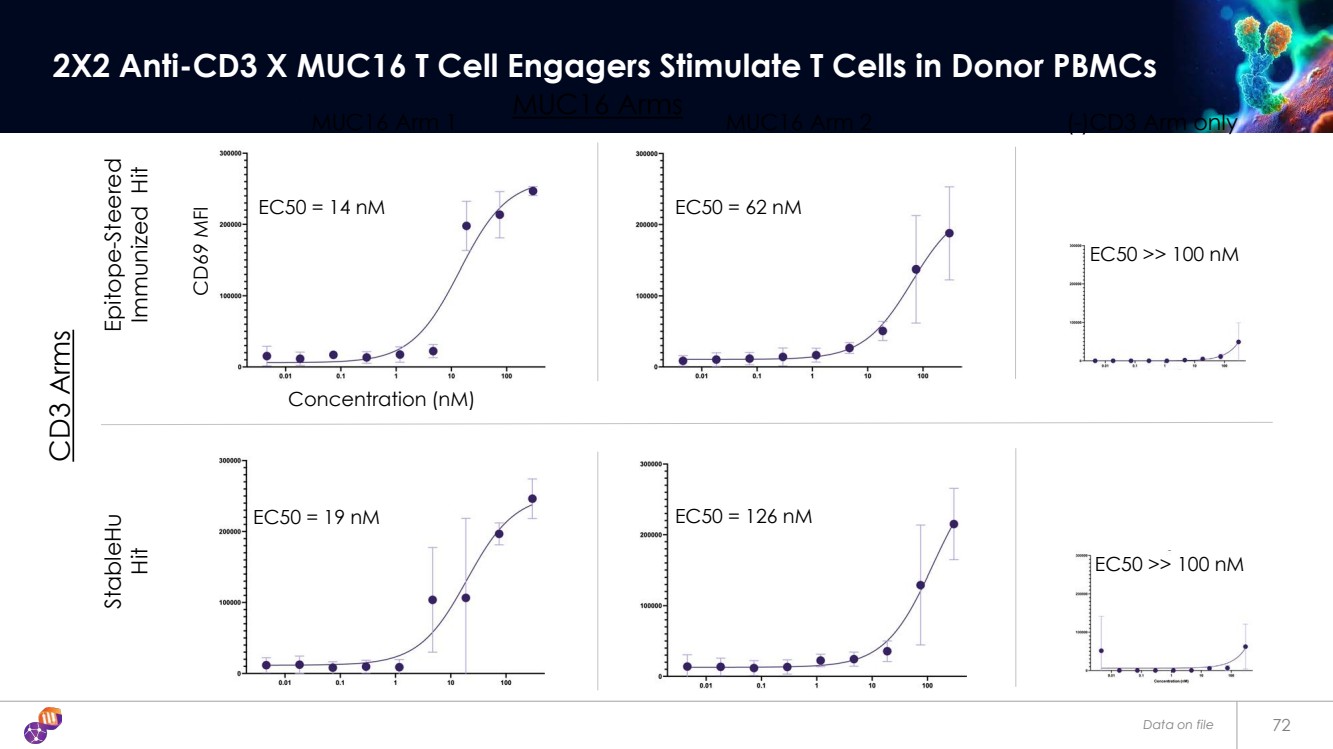

| EC50 = 14 nM EC50 = 62 nM EC50 = 19 nM EC50 = 126 nM Data on file 72 2X2 Anti-CD3 X MUC16 T Cell Engagers Stimulate T Cells in Donor PBMCs EC50 >> 100 nM EC50 >> 100 nM MUC16 Arm 1 (-)CD3 Arm only Epitope-Steered Immunized Hit StableHu Hit CD69 MFI Concentration (nM) MUC16 Arm 2 CD3 Arms MUC16 Arms |

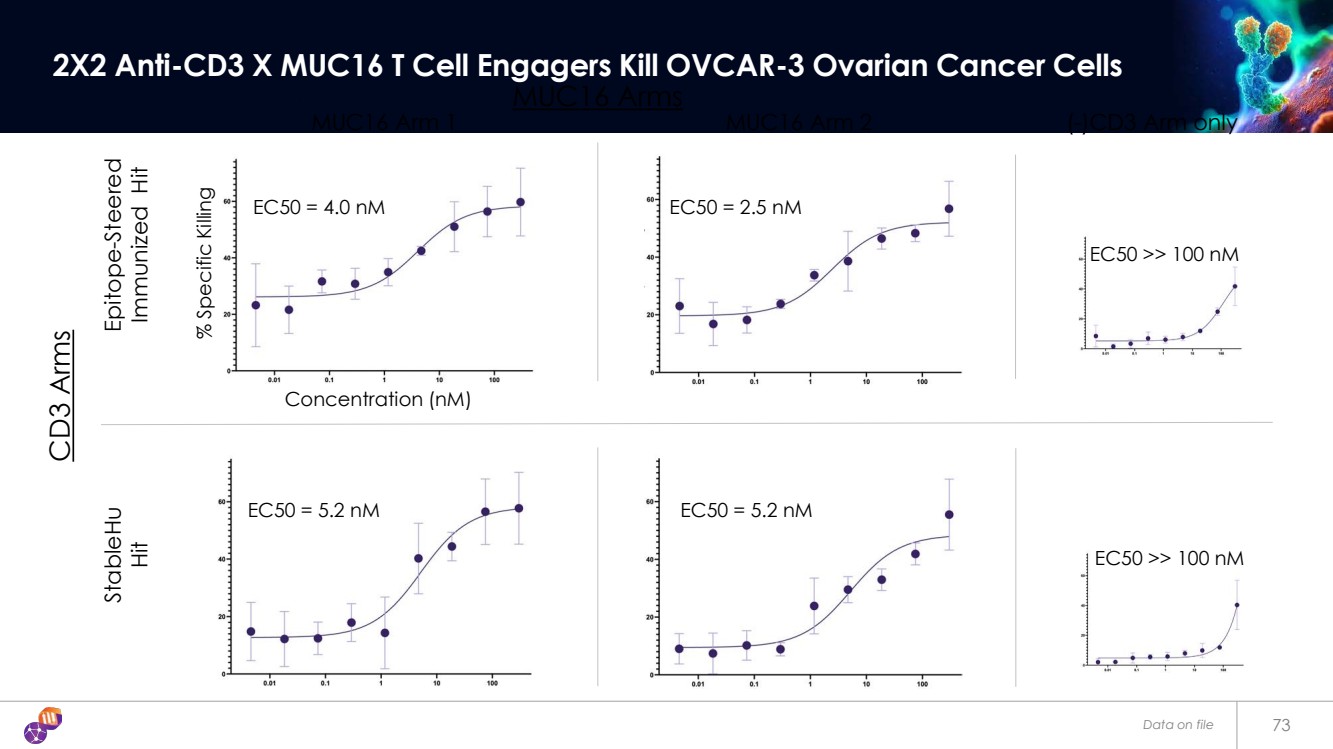

| EC50 = 4.0 nM EC50 = 2.5 nM EC50 = 5.2 nM EC50 = 5.2 nM Data on file 73 2X2 Anti-CD3 X MUC16 T Cell Engagers Kill OVCAR-3 Ovarian Cancer Cells EC50 >> 100 nM EC50 >> 100 nM MUC16 Arm 1 (-)CD3 Arm only Epitope-Steered Immunized Hit StableHu Hit Concentration (nM) MUC16 Arm 2 CD3 Arms MUC16 Arms % Specific Killing |

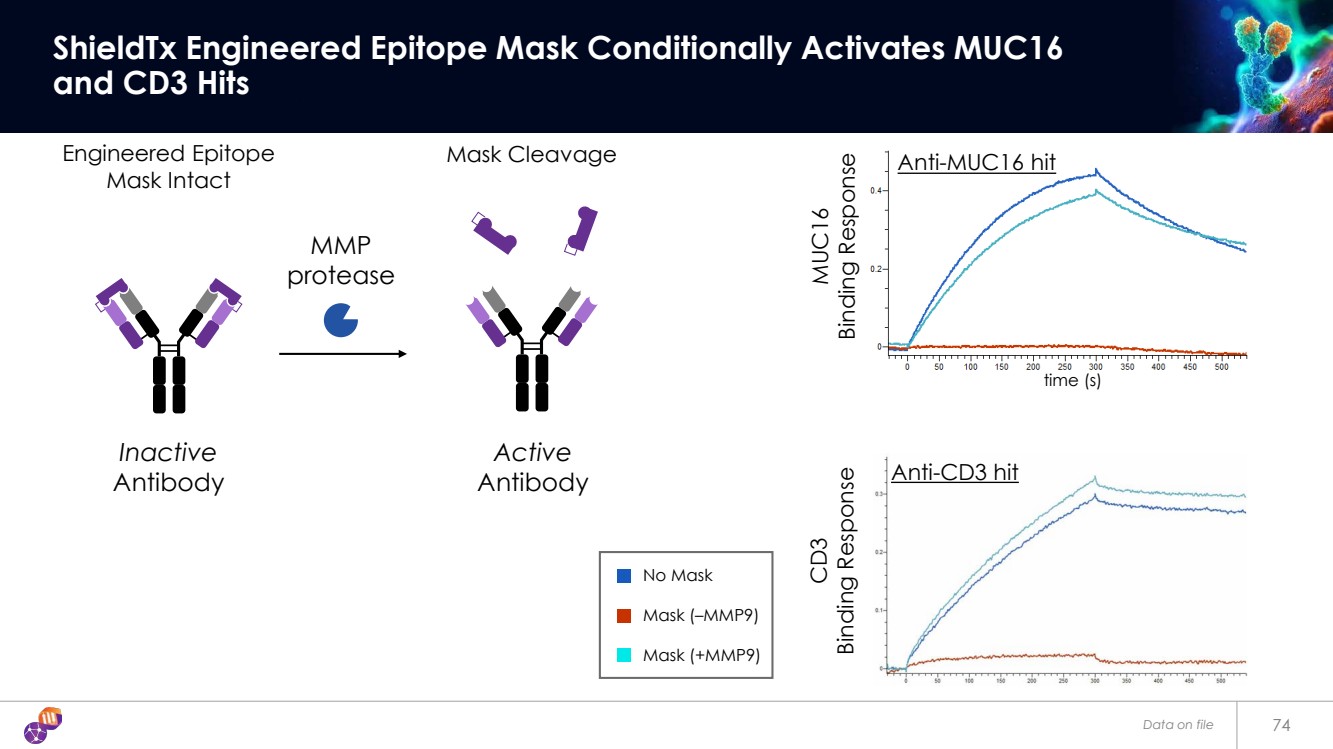

| Data on file 74 ShieldTx Engineered Epitope Mask Conditionally Activates MUC16 and CD3 Hits Mask Cleavage No Mask Mask (–MMP9) Mask (+MMP9) MMP protease Engineered Epitope Mask Intact Inactive Antibody Active Antibody Anti-MUC16 hit Anti-CD3 hit MUC16 Binding Response CD3 Binding Response time (s) |

| 75 Anti-EGFRvIII High ADCC mAb Against Tumor-Specific EGFRvIII Cells |

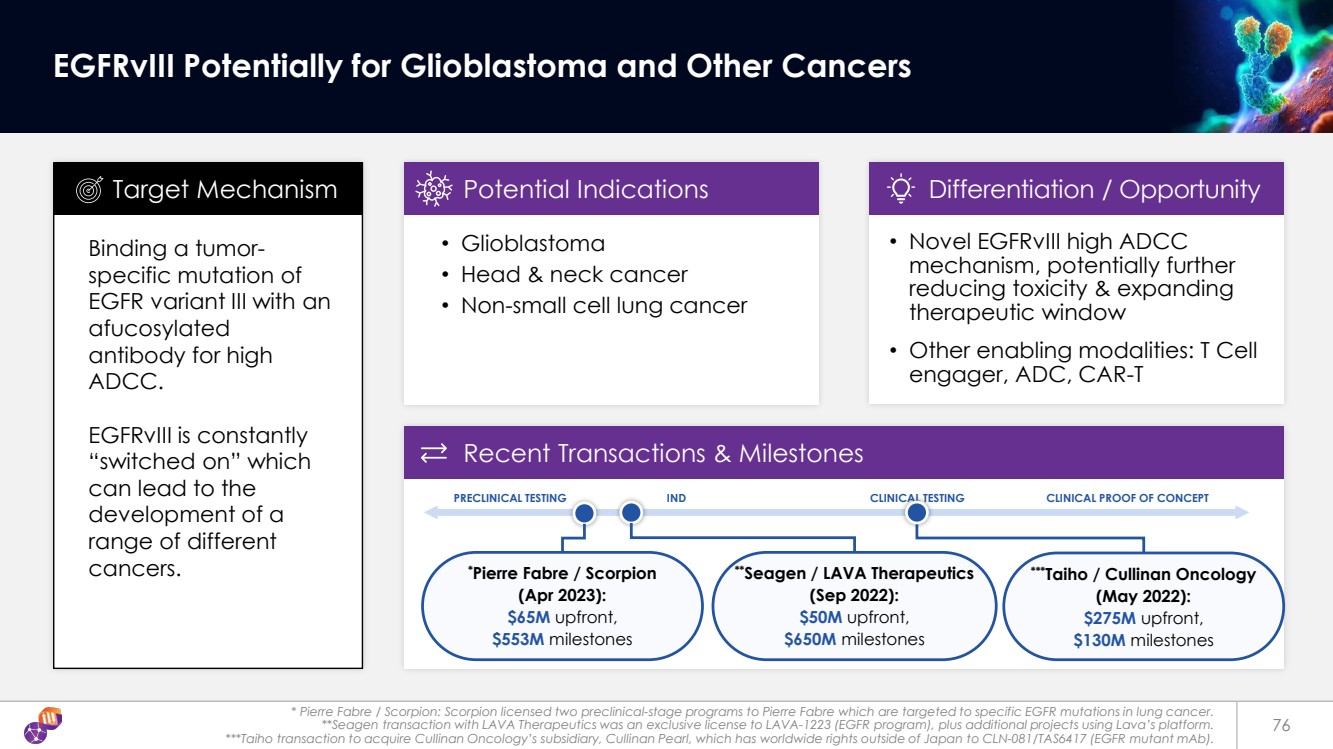

| **Seagen / LAVA Therapeutics (Sep 2022): $50M upfront, $650M milestones ***Taiho / Cullinan Oncology (May 2022): $275M upfront, $130M milestones * Pierre Fabre / Scorpion: Scorpion licensed two preclinical-stage programs to Pierre Fabre which are targeted to specific EGFR mutations in lung cancer. **Seagen transaction with LAVA Therapeutics was an exclusive license to LAVA-1223 (EGFR program), plus additional projects using Lava’s platform. ***Taiho transaction to acquire Cullinan Oncology’s subsidiary, Cullinan Pearl, which has worldwide rights outside of Japan to CLN-081/TAS6417 (EGFR mutant mAb). 76 EGFRvIII Potentially for Glioblastoma and Other Cancers Binding a tumor-specific mutation of EGFR variant III with an afucosylated antibody for high ADCC. EGFRvIII is constantly “switched on” which can lead to the development of a range of different cancers. • Glioblastoma • Head & neck cancer • Non-small cell lung cancer Target Mechanism Potential Indications • Novel EGFRvIII high ADCC mechanism, potentially further reducing toxicity & expanding therapeutic window • Other enabling modalities: T Cell engager, ADC, CAR-T Differentiation / Opportunity Recent Transactions & Milestones PRECLINICAL TESTING IND CLINICAL TESTING CLINICAL PROOF OF CONCEPT * Pierre Fabre / Scorpion (Apr 2023): $65M upfront, $553M milestones |

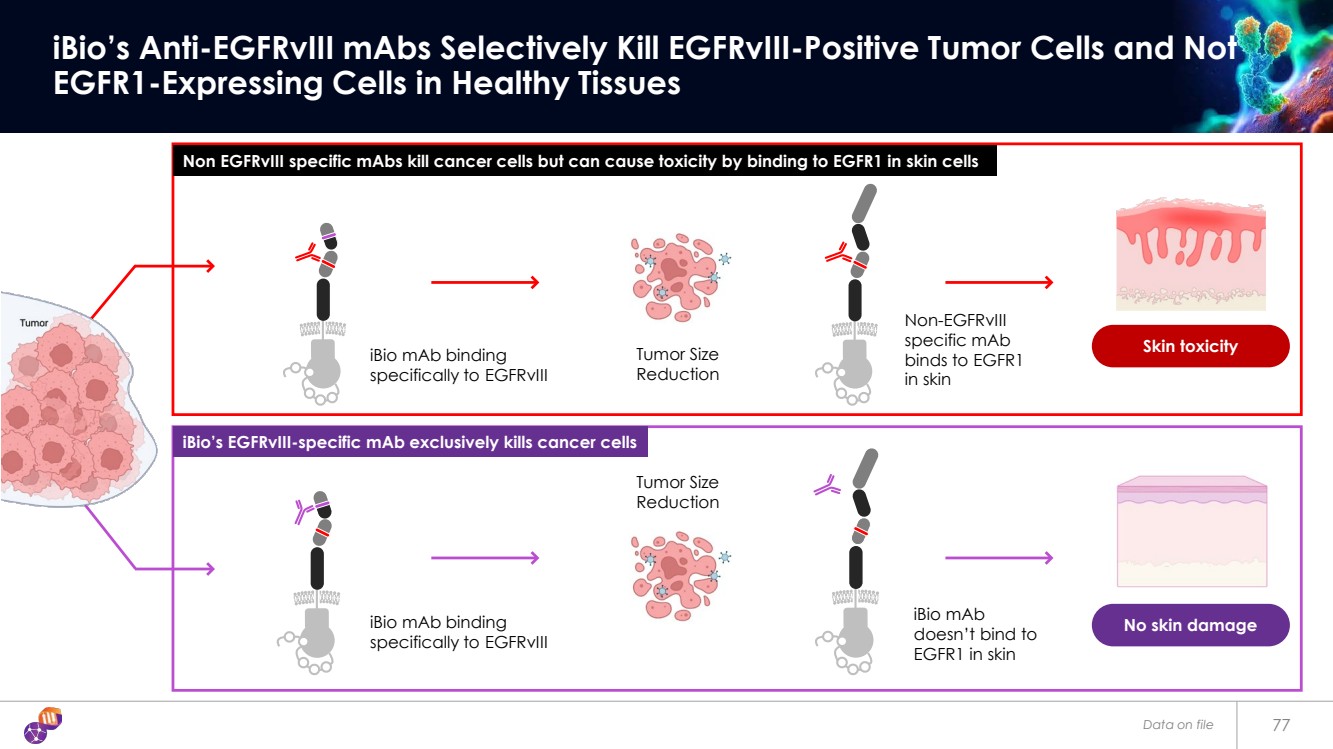

| Skin toxicity No skin damage Data on file 77 iBio’s Anti-EGFRvIII mAbs Selectively Kill EGFRvIII-Positive Tumor Cells and Not EGFR1-Expressing Cells in Healthy Tissues iBio mAb binding specifically to EGFRvIII Tumor Size Reduction iBio mAb doesn’t bind to EGFR1 in skin Non-EGFRvIII specific mAb binds to EGFR1 in skin iBio mAb binding specifically to EGFRvIII Tumor Size Reduction Non EGFRvIII specific mAbs kill cancer cells but can cause toxicity by binding to EGFR1 in skin cells iBio’s EGFRvIII-specific mAb exclusively kills cancer cells |

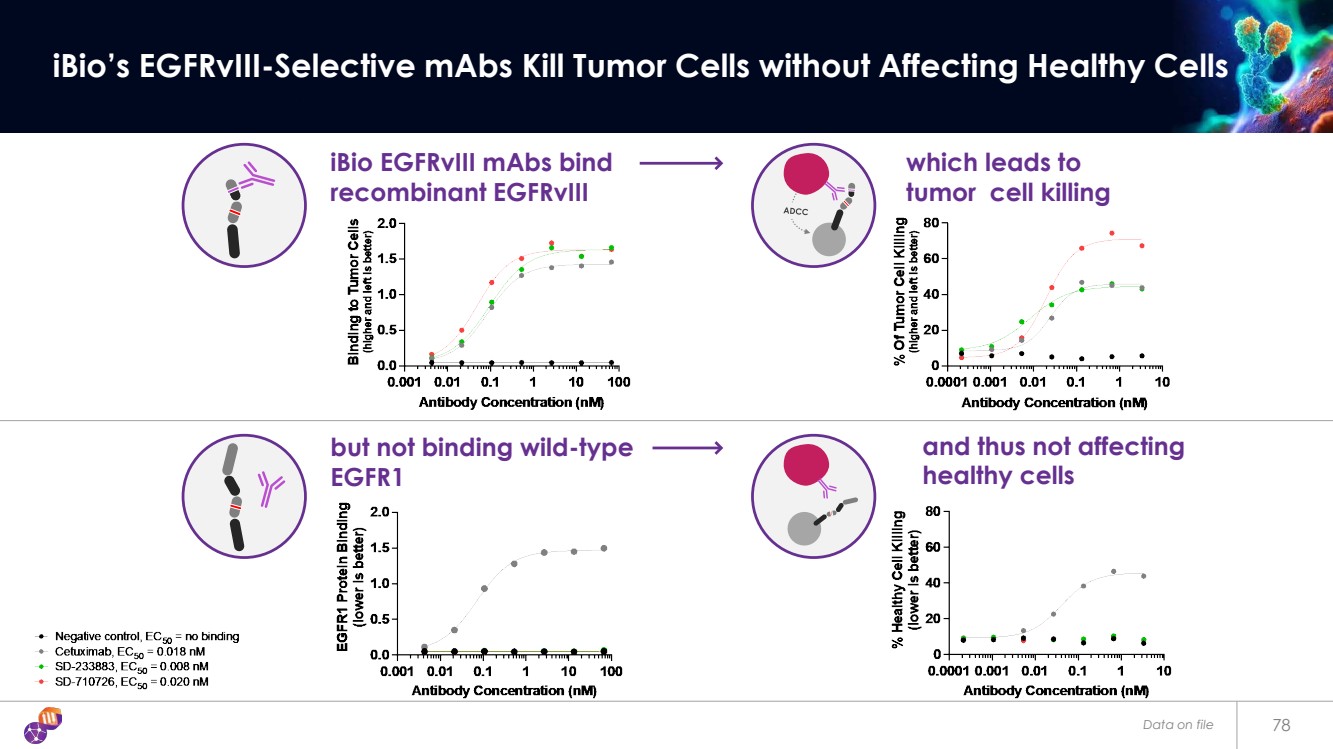

| Data on file 78 iBio’s EGFRvIII-Selective mAbs Kill Tumor Cells without Affecting Healthy Cells iBio EGFRvIII mAbs bind recombinant EGFRvIII which leads to tumor cell killing but not binding wild-type EGFR1 and thus not affecting healthy cells |

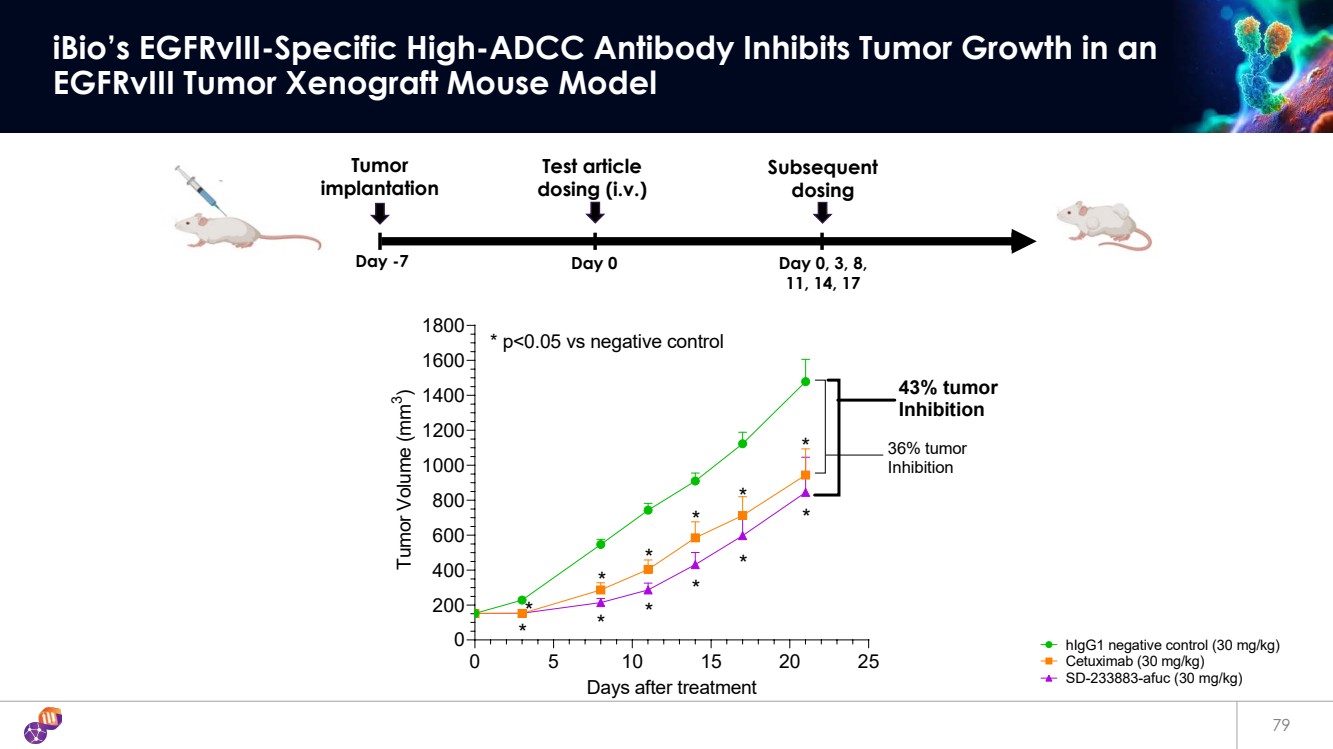

| 79 iBio’s EGFRvIII-Specific High-ADCC Antibody Inhibits Tumor Growth in an EGFRvIII Tumor Xenograft Mouse Model Day -7 Day 0 Day 0, 3, 8, 11, 14, 17 Tumor implantation Subsequent dosing Test article dosing (i.v.) 0 5 10 15 20 25 0 200 400 600 800 1000 1200 1400 1600 1800 Days after treatment Tumor Volume (mm 3 ) * * * * * * * * * * * * * p<0.05 vs negative control 36% tumor Inhibition 43% tumor Inhibition hIgG1 negative control (30 mg/kg) Cetuximab (30 mg/kg) SD-233883-afuc (30 mg/kg) |

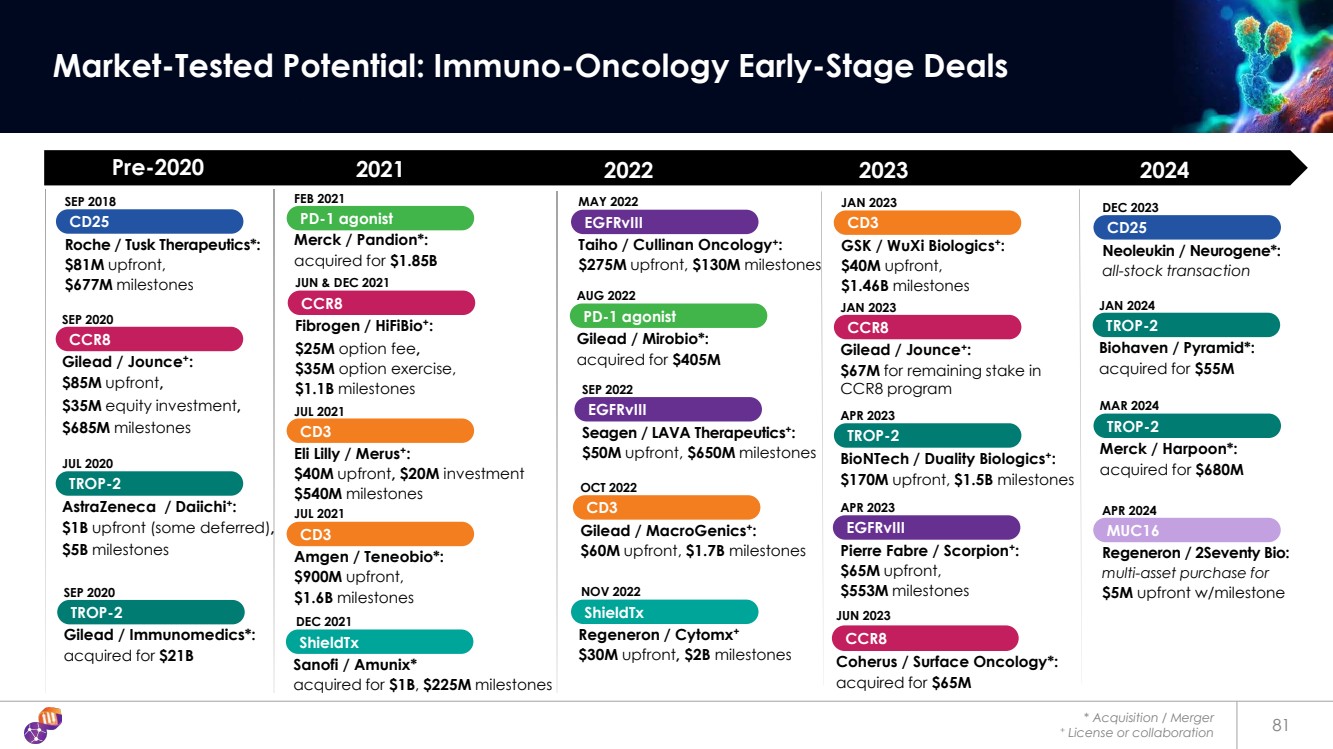

| 80 Market-Tested Potential in Immuno-Oncology Competitor Early-Stage Deals Signal Promising Opportunities |

| * Acquisition / Merger + License or collaboration 81 Market-Tested Potential: Immuno-Oncology Early-Stage Deals CCR8 Coherus / Surface Oncology*: acquired for $65M JUN 2023 Pre-2020 2021 2022 2023 CCR8 Gilead / Jounce+: $85M upfront, $35M equity investment, $685M milestones SEP 2020 FEB 2021 PD-1 agonist Merck / Pandion*: acquired for $1.85B SEP 2018 Roche / Tusk Therapeutics*: $81M upfront, $677M milestones CD25 JUN & DEC 2021 CCR8 Fibrogen / HiFiBio+: $25M option fee, $35M option exercise, $1.1B milestones SEP 2022 EGFRvIII Seagen / LAVA Therapeutics+: $50M upfront, $650M milestones AUG 2022 PD-1 agonist Gilead / Mirobio*: acquired for $405M MAY 2022 EGFRvIII Taiho / Cullinan Oncology+: $275M upfront, $130M milestones OCT 2022 CD3 Gilead / MacroGenics+: $60M upfront, $1.7B milestones JUL 2021 CD3 Eli Lilly / Merus+: $40M upfront, $20M investment $540M milestones JUL 2021 CD3 Amgen / Teneobio*: $900M upfront, $1.6B milestones 2024 JAN 2023 CD3 GSK / WuXi Biologics+: $40M upfront, $1.46B milestones CCR8 Gilead / Jounce+: $67M for remaining stake in CCR8 program JAN 2023 TROP-2 Gilead / Immunomedics*: acquired for $21B SEP 2020 TROP-2 AstraZeneca / Daiichi+: $1B upfront (some deferred), $5B milestones JUL 2020 APR 2023 EGFRvIII Pierre Fabre / Scorpion+: $65M upfront, $553M milestones ShieldTx Sanofi / Amunix* acquired for $1B, $225M milestones DEC 2021 ShieldTx Regeneron / Cytomx+ $30M upfront, $2B milestones NOV 2022 APR 2024 Regeneron / 2Seventy Bio: multi-asset purchase for $5M upfront w/milestone MUC16 TROP-2 BioNTech / Duality Biologics+: $170M upfront, $1.5B milestones APR 2023 TROP-2 Merck / Harpoon*: acquired for $680M MAR 2024 TROP-2 Biohaven / Pyramid*: acquired for $55M JAN 2024 DEC 2023 Neoleukin / Neurogene*: all-stock transaction CD25 |