existing immune-oncology pre-clinical pipeline, the Company also is seeking strategic partners with the capabilities to more rapidly advance these programs towards the clinic.

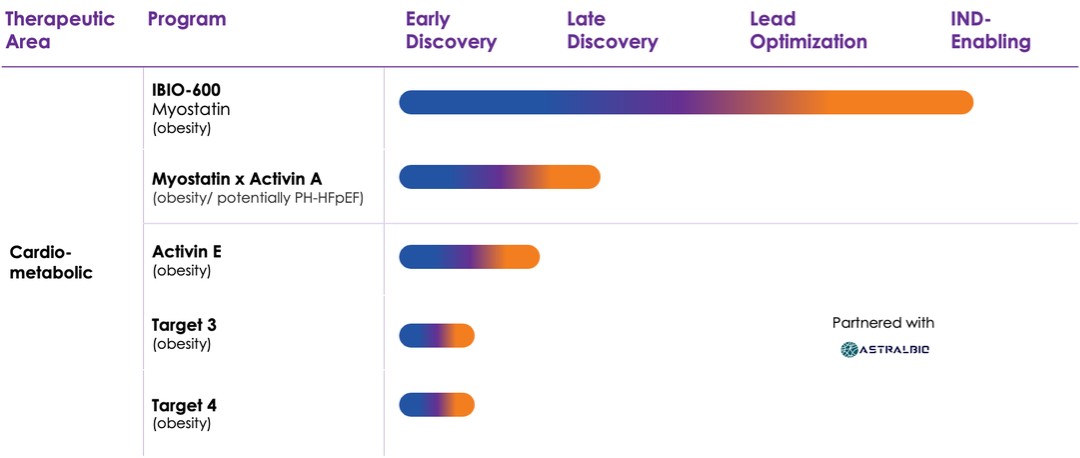

Cardiometabolic/Obesity Pipeline:

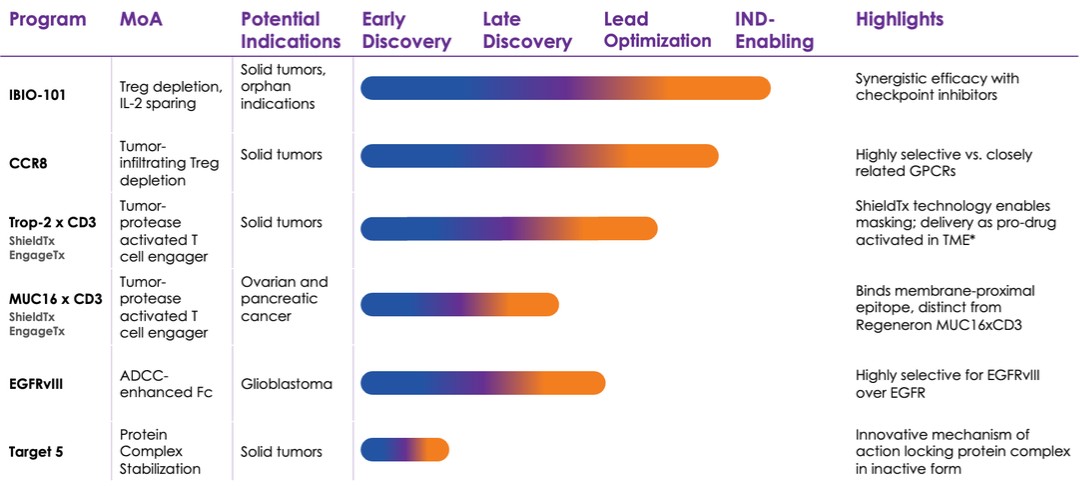

Immuno-Oncology Pipeline:

8

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___ to ___

Commission File Number

(Exact name of registrant as specified in its charter)

| ||

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

| ||

(Address of principal executive offices) |

| (Zip Code) |

(

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading symbol(s) |

| Name of each exchange on which registered |

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large, accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large, accelerated filer,” “accelerated filer” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated Filer ☐ |

|

|

| Accelerated Filer ☐ | ||

Smaller reporting company | ||||||

|

|

|

|

|

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

Shares of Common Stock outstanding as of February 7, 2025:

iBio, Inc.

TABLE OF CONTENTS

2

PART I - FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements (Unaudited).

iBio, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(In thousands, except share and per share amounts)

December 31, | June 30, | |||||

2024 | 2024 | |||||

(Unaudited) | ||||||

Assets | ||||||

Current assets: | ||||||

Cash and cash equivalents | $ | | $ | | ||

Subscription receivable | | — | ||||

Promissory note receivable and accrued interest | — | | ||||

Prepaid expenses and other current assets |

| |

| | ||

Total Current Assets |

| |

| | ||

|

|

|

| |||

Restricted cash | | | ||||

Promissory note receivable | | | ||||

Finance lease right-of-use assets, net of accumulated amortization |

| |

| | ||

Operating lease right-of-use asset | | | ||||

Fixed assets, net of accumulated depreciation |

| |

| | ||

Intangible assets, net of accumulated amortization | | | ||||

Prepaid expenses - noncurrent | | — | ||||

Security deposits | | | ||||

Total Assets | $ | | $ | | ||

|

|

|

| |||

Liabilities and Stockholders' Equity |

|

|

|

| ||

Current liabilities: |

|

|

|

| ||

Accounts payable | $ | | $ | | ||

Accrued expenses |

| |

| | ||

Finance lease obligations - current portion | | | ||||

Operating lease obligation - current portion | | | ||||

Equipment financing payable - current portion | | | ||||

Term promissory note - current portion | | | ||||

Insurance premium financing payable | | | ||||

Contract liabilities | | | ||||

Total Current Liabilities |

| |

| | ||

|

|

|

| |||

Finance lease obligations - net of current portion | — | | ||||

Operating lease obligation - net of current portion | | | ||||

Equipment financing payable - net of current portion | — | | ||||

Term promissory note - net of current portion | | | ||||

Total Liabilities |

| |

| | ||

|

|

|

| |||

Stockholders' Equity |

|

|

|

| ||

Series 2022 Convertible Preferred Stock - $ |

| — |

| — | ||

Common stock - $ |

| | | |||

Additional paid-in capital |

| | | |||

Accumulated deficit | ( | ( | ||||

Total Stockholders’ Equity |

| |

| | ||

Total Liabilities and Stockholders' Equity | $ | | $ | | ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

3

iBio, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(Unaudited; in thousands, except per share amounts)

|

| Three Months Ended | Six Months Ended | |||||||||

| December 31, | December 31, | ||||||||||

|

| 2024 |

| 2023 | 2024 |

| 2023 | |||||

| ||||||||||||

Revenue | $ | | $ | — | $ | | $ | | ||||

|

|

|

|

|

| |||||||

Operating expenses: |

|

|

| |||||||||

Research and development |

| | |

| |

| | |||||

General and administrative |

| | |

| |

| | |||||

Total operating expenses |

| |

| |

| |

| | ||||

|

|

|

|

|

|

|

|

| ||||

Operating loss |

| ( |

| ( |

| ( |

| ( | ||||

|

|

|

|

|

| |||||||

Other income (expense): |

|

|

|

|

|

| ||||||

Interest expense | ( | ( | ( | ( | ||||||||

Interest income |

| | | | | |||||||

Total other income |

| |

| | |

| | |||||

|

|

|

|

|

| |||||||

Net loss from continuing operations | ( | ( | ( | ( | ||||||||

Loss from discontinued operations | — | ( | — | ( | ||||||||

|

|

|

|

|

|

| ||||||

Net loss | $ | ( | $ | ( | $ | ( | $ | ( | ||||

Loss per common share attributable to iBio, Inc. stockholders - basic and diluted - continuing operations | ( | ( | ( | ( | ||||||||

Loss per common share attributable to iBio, Inc. stockholders - basic and diluted - discontinued operations | ( | — | ( | |||||||||

Loss per common share attributable to iBio, Inc. stockholders - basic and diluted - total | ( | ( | ( | ( | ||||||||

|

|

|

|

|

|

|

|

| ||||

Weighted-average common shares outstanding - basic and diluted |

| |

| |

| | | |||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

4

iBio, Inc. and Subsidiaries

Condensed Consolidated Statements of Stockholders’ Equity

(Unaudited; in thousands)

Six Months Ended December 31, 2024

| ||||||||||||||

| Additional | |||||||||||||

| Common Stock | Paid-In | Accumulated | |||||||||||

|

| Shares |

| Amount |

| Capital |

| Deficit |

| Total | ||||

Balance as of July 1, 2024 | | $ | | $ | | $ | ( | $ | | |||||

Common stock issued | | * | | — | | |||||||||

Vesting of RSUs | | * | — | — | — | |||||||||

Share-based compensation | — | — | | — | | |||||||||

Net loss | — |

| — |

| — |

| ( |

| ( | |||||

Balance as of September 30, 2024 | | $ | | $ | | $ | ( | $ | | |||||

Common stock issued | | * | ( | — |

| ( | ||||||||

Exercise of stock options | | * | | — | | |||||||||

Vesting of RSUs | | * | — | — | — | |||||||||

Share-based compensation | — | — | | — |

| | ||||||||

Net loss | — | — | — | ( | ( | |||||||||

Balance as of December 31, 2024 | | $ | | $ | | $ | ( | $ | | |||||

* Represents amount less than 0.5 thousand. | ||||||||||||||

Six Months Ended December 31, 2023

| ||||||||||||||

| Additional | |||||||||||||

| Common Stock | Paid-In | Accumulated | |||||||||||

|

| Shares |

| Amount |

| Capital |

| Deficit |

| Total | ||||

Balance as of July 1, 2023 | | $ | | $ | | $ | ( | $ | | |||||

Common stock issued | | * | | — | | |||||||||

Vesting of RSUs | | * | — | — | — | |||||||||

Share-based compensation |

| — |

|

| — |

|

| |

|

| — |

|

| |

Net loss | — |

| — |

| — |

| ( |

| ( | |||||

Balance as of September 30, 2023 |

| |

| $ | |

| $ | |

| $ | ( |

| $ | |

Common stock issued | |

| |

| |

| — |

| | |||||

Payment for fractional shares after reverse stock split | ( |

| * |

| ( |

| — |

| ( | |||||

Vesting of RSUs | |

| * |

| — |

| — |

| — | |||||

Share-based compensation | — | — | | — | | |||||||||

Unrealized loss on debt securities | — | — | — | — | — | |||||||||

Net loss | — |

| — |

| — |

| ( |

| ( | |||||

Balance as of December 31, 2023 | | $ | | $ | | $ | ( | $ | | |||||

* Represents amount less than 0.5 thousand. | ||||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

5

iBio, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited; in thousands)

|

| Six Months Ended | ||||

| December 31, | |||||

|

| 2024 |

| 2023 | ||

Cash flows from operating activities: | ||||||

Consolidated net loss | $ | ( | $ | ( | ||

Adjustments to reconcile consolidated net loss to net cash used in operating activities: |

|

| ||||

Share-based compensation |

| |

| | ||

Amortization of intangible assets |

| |

| | ||

Amortization of finance lease right-of-use assets | | | ||||

Amortization of operating lease right-of-use assets | | | ||||

Depreciation of fixed assets |

| |

| | ||

Gain on sale of fixed assets | — | ( | ||||

Accrued interest receivable on promissory note receivable | ( | ( | ||||

Amortization of deferred financing costs | — | | ||||

Impairment of fixed assets | — | | ||||

Accrued payment in kind on Term Loan | — | ( | ||||

Changes in operating assets and liabilities: |

|

| ||||

Prepaid expenses and other current assets |

| ( |

| | ||

Prepaid expenses - noncurrent | ( | | ||||

Accounts payable |

| |

| | ||

Accrued expenses |

| ( |

| ( | ||

Operating lease obligations |

| ( |

| ( | ||

Contract liabilities |

| |

| | ||

Net cash used in operating activities |

| ( |

| ( | ||

|

|

| ||||

Cash flows from investing activities: |

|

| ||||

Payment received for interest and principal on promissory note receivable | | | ||||

Purchases of fixed assets |

| ( | | |||

Sales proceeds for fixed assets | — | | ||||

Net cash provided by investing activities |

| |

| | ||

|

| |||||

Cash flows from financing activities: |

|

| ||||

Proceeds from sales of common stock | | | ||||

Payments for fractional shares after reverse stock split | — | ( | ||||

Proceeds from the exercise of stock options | | | ||||

Subscription receivable | — | | ||||

Payment of equipment financing loan | ( | ( | ||||

Payment of term promissory note | ( | | ||||

Payment of term note payable | — | ( | ||||

Payment of finance lease obligation |

| ( | ( | |||

Net cash (used in) provided by financing activities |

| ( |

| | ||

|

|

| ||||

Net decrease in cash, cash equivalents and restricted cash |

| ( |

| ( | ||

Cash, cash equivalents and restricted cash - beginning |

| |

| | ||

Cash, cash equivalents and restricted cash - end | $ | | $ | | ||

Supplemental cash flow information: |

|

| ||||

Cash paid during the period for interest | $ | | $ | | ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

6

iBio, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1. Nature of Business

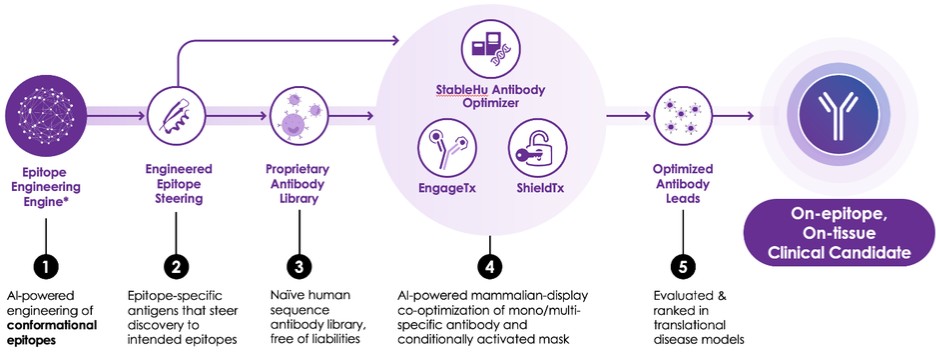

iBio, Inc. (also referred to as "iBio", or the "Company") is a preclinical stage biotechnology company leveraging the power of Artificial Intelligence (AI) and Machine Learning (ML) for the development of hard-to-drug precision antibodies. The Company’s proprietary technology stack is designed to minimize downstream development risks by employing AI-guided epitope-steering and monoclonal antibody (mAb) optimization.

Since September 2022, iBio has focused on utilizing AI and ML to discover and design antibodies against hard-to-drug targets upon the acquisition of substantially all of the assets of RubrYc Therapeutics, Inc. ("RubrYc"). This acquisition commenced the Company’s transition from a Contract Development and Manufacturing Organization (CDMO) to an AI-enabled biotech company. iBio’s transition concluded in May 2024 upon the closing of the sale of the CDMO facility in Texas. These strategic decisions the Company executed enable it to solely focus resources on the development of AI-powered precision antibodies, positioning iBio at the forefront of this exciting field.

One of the key features of iBio’s technology stack is the patented epitope-steering AI-engine. This advanced technology allows the Company to target specific regions of proteins with precision enabling the creation of antibodies highly specific to therapeutically relevant regions within large target proteins, potentially improving their efficacy and safety profile. Another integral part of iBio’s technology stack is the ML based antibody-optimizing StableHu™ technology. When coupled with the Company’s mammalian display technology, StableHu has been shown to accelerate the Lead Optimization process and potentially reduces downstream risks, making the overall development process faster, more efficient and cost-effective.

iBio also developed the EngageTx™ platform, which provides an optimized next-generation CD3 T-cell engager antibody panel. This panel is characterized by a wide spectrum of potencies, Non-Human Primate (NHP) cross-reactivity, enhanced humanness of the antibodies, and a maintained tumor cell killing capacity, all while reducing cytokine release. These attributes are meticulously designed to fine-tune the efficacy, safety, and tolerability of the Company’s antibody products. By incorporating EngageTx into iBio’s own development initiatives, the Company’s internal pre-clinical pipeline reaps the benefits of the same cutting-edge technology extended to its potential partners.

iBio’s technology stack also includes ShieldTx™, an antibody masking technology enabling the creation of conditionally activated antibodies. These masks keep antibodies inactive until they reach diseased tissue, where the masks are removed, and the antibodies are activated. This mechanism is thought to broaden the therapeutic window, potentially improving efficacy and safety of treatments. Conditionally activated antibodies are also believed to enable the use of drug combinations that are otherwise considered too toxic, and they open the door to pursuing targets which, due to their expression in multiple tissues, would otherwise raise safety concerns.

iBio’s scientific team, comprised of experienced AI/ML scientists and biopharmaceutical scientists, located side-by-side in its San Diego laboratory, possess the skills and capabilities to rapidly advance antibodies in house from concept to in vivo proof-of-concept (POC). This multidisciplinary expertise allows the Company to efficiently create a preclinical portfolio and rapidly advance preclinical pipeline programs towards clinical development.

Artificial Intelligence in Antibody Discovery and Development

iBio is leveraging its AI-powered technology stack to enhance the success rate of identifying antibodies for challenging target proteins, expedite the process of antibody optimization, improve developability, and engineer finely calibrated bi-specifics. By continually refining the Company’s AI algorithms, incorporating new data sources, and developing robust experimental validation processes, iBio is paving the way for groundbreaking advancements in antibody design and drug discovery.

Pre-Clinical Pipeline

iBio is currently in the process of building and advancing its preclinical pipeline by leveraging its technology stack focused on hard-to-drug targets and molecules offering differentiation in both obesity and cardiometabolic disease space, as well as immune-oncology. The Company’s current therapeutics being developed are all in preclinical development and it has not completed any clinical trials in humans for any therapeutic protein product candidate produced using iBio technology and there is a risk that the Company will be unsuccessful in developing or commercializing any product candidates. As the Company continues to leverage its technology stack and develop its

7

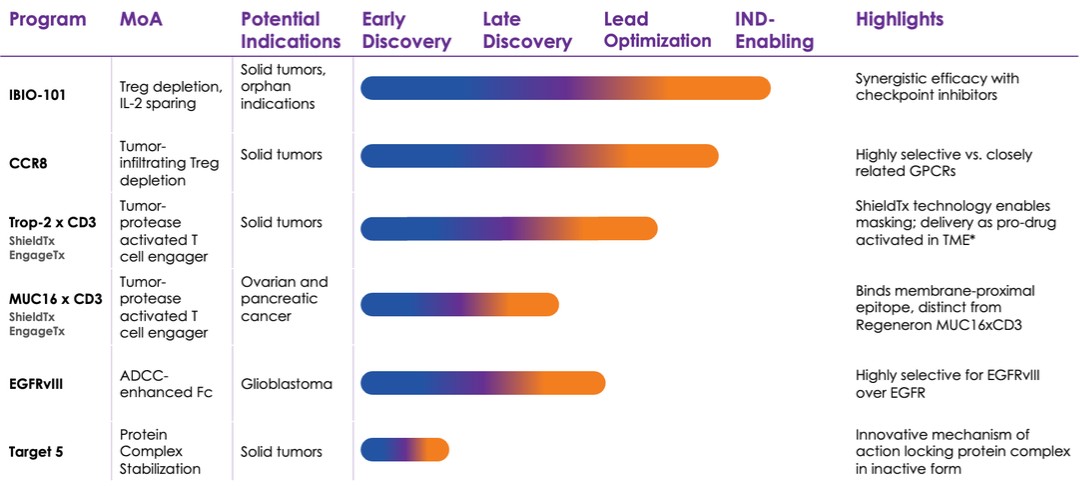

existing immune-oncology pre-clinical pipeline, the Company also is seeking strategic partners with the capabilities to more rapidly advance these programs towards the clinic.

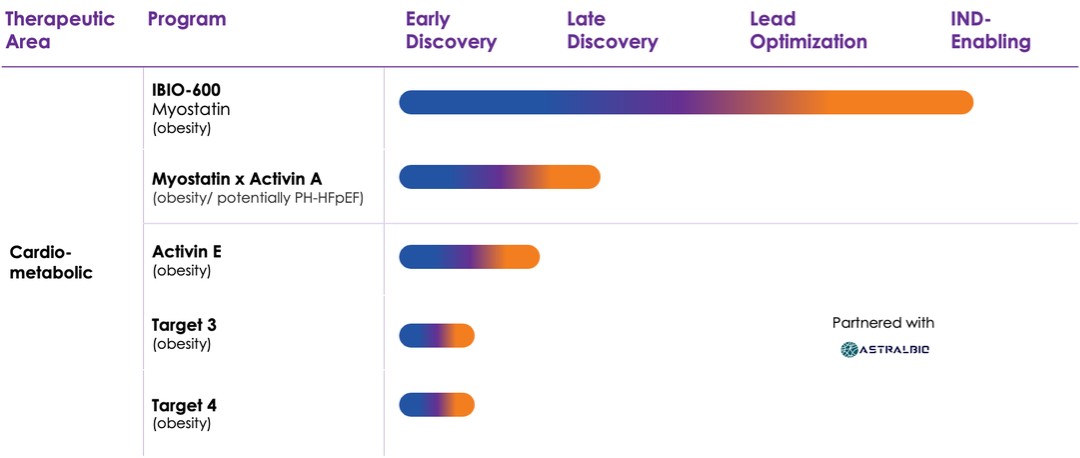

Cardiometabolic/Obesity Pipeline:

Immuno-Oncology Pipeline:

8

2. Basis of Presentation

Interim Condensed Consolidated Financial Statements

The accompanying unaudited condensed consolidated financial statements have been prepared from the books and records of the Company and include all normal and recurring adjustments which are necessary for a fair presentation in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for interim consolidated financial information and Rule 8-03 of Regulation S-X promulgated by the U.S. Securities and Exchange Commission (the “SEC”). Accordingly, these interim financial statements do not include all of the information and footnotes required for complete annual consolidated financial statements. Interim results are not necessarily indicative of the results that may be expected for the full year. Interim unaudited condensed consolidated financial statements should be read in conjunction with the audited financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K/A for the prior year ended June 30, 2024, filed with the SEC on September 24, 2024 (the “Annual Report”), from which the accompanying condensed consolidated balance sheet dated June 30, 2024 was derived.

In the opinion of management, the accompanying unaudited condensed consolidated financial statements contain all adjustments necessary to present fairly the financial position of the Company as of December 31, 2024 and the results of its operations and its cash flows for the periods presented. The results of operations for the three and six months ended December 31, 2024 are not necessarily indicative of the results that may be achieved for a full fiscal year and cannot be used to indicate financial performance for the entire year.

Principles of Consolidation

The condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries. All intercompany balances and transactions have been eliminated as part of the consolidation.

Going Concern

In accordance with ASU No. 2014-15, Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern (Subtopic 205-40), the Company has evaluated whether there are conditions and events, considered in the aggregate, that raise substantial doubt about its ability to continue as a going concern within one year after the date that the condensed consolidated financial statements are issued.

The Company generated negative cash flows from operations of approximately $

The history of significant losses, the negative cash flow from operations, the limited cash resources on hand and the dependence by the Company on its ability to obtain additional financing to fund its operations after the current cash resources are exhausted raise substantial doubt about the Company's ability to continue as a going concern. Management’s current financing and business plans have not mitigated such substantial doubt about the Company’s ability to continue as a going concern for at least 12 months from the date of filing this Quarterly Report on Form 10-Q for the quarterly period ended December 31, 2024 (the “Quarterly Report”).

In an effort to mitigate the substantial doubt about continuing as a going concern and increase cash reserves, the Company has raised funds from time to time through equity offerings or other financing alternatives, entered into a collaboration agreement to discover and develop novel antibodies for obesity and other cardiometabolic diseases and sold certain intellectual property rights. Potential options being considered to further increase liquidity include focusing product development on a select number of product candidates, the sale or out-licensing of certain product candidates, raising money from the capital markets, grant revenue or collaborations, or a combination thereof. However, the Company anticipates that its expenses will increase as it continues its research and development activities and conducts clinical trials.

On July 3, 2024, the Company entered into an At Market Issuance Sales Agreement (the “ATM Agreement”) with Chardan Capital Markets, LLC and Craig-Hallum Capital Group LLC (collectively, the “Sales Agents”) providing for the issuance and sale by the Company of its common stock, par value $

9

included in the Registration Statement is currently $

On January 10, 2025, the Company entered into a securities purchase agreement (the “2025 Purchase Agreement”) with certain of its officers and directors (the “Investors”), pursuant to which the Company agreed to issue and sell to the Investors, in a private placement priced at-the-market (the “2025 Private Placement”) consistent with the rules of the NYSE American LLC (“NYSE American”), an aggregate of

The 2025 Private Placement closed on January 10, 2025. The Company received aggregate gross proceeds from the 2025 Private Placement of approximately $

In January 2025,

The accompanying condensed consolidated financial statements do not include any adjustments to the carrying amounts and classification of assets, liabilities, and reported expenses that may be necessary if the Company were unable to continue as a going concern.

Reverse Stock Split

On November 27, 2023, the Company’s Board approved the implementation of a reverse stock split (the “2023 Reverse Split”) at a ratio of one-for-twenty (:

3. Discontinued Operations

On November 3, 2022, the Company announced it was seeking to divest its contract development and manufacturing organization (iBio CDMO) in order to complete its transformation into an antibody discovery and development company. In conjunction with the divestment, the Company reduced its workforce and sold at public auction equipment and other tangible personal property located at the 130,000 square foot cGMP facility located in Bryan, Texas (the “Facility”).

On May 17, 2024, iBio CDMO entered into a purchase and sale agreement, dated as of May 17, 2024 (the “2024 Purchase and Sale Agreement”) with The Board of Regents of the Texas A&M University System (“The Board of Regents”) pursuant to which iBio CDMO agreed to terminate the Ground Lease Agreement (the “Ground Lease Agreement) with The Board of Regents, dated March 8, 2010, as amended by an Estoppel Certificate and Amendment to Ground Lease Agreement, dated as of December 22, 2015 (together with the Ground Lease Agreement, the “Ground Lease”), related to 21.401 acres in Brazos County, Texas (the “Land”) and completed the sale to The Board of Regents of: (i) the buildings, parking areas, improvements, and fixtures situated on the Land (the “Improvements”); (iii) all iBio CDMO’s right, title, and interest in and to furniture, personal property, machinery, apparatus, and equipment owned and currently used in the operation, repair and maintenance of the Land and Improvements and situated thereon (collectively, the “Personal Property”); (iii) all iBio CDMO’s rights under the contracts and agreements relating to the operation or maintenance of the Land, Improvements or Personal Property which extend beyond the closing date (the “Contracts”); and (iv) all iBio CDMO’s rights in intangible assets of any nature relating to any or all of the Land, the Improvements and the Personal Property (the “Intangibles”; and together with the Ground Lease, Improvements and Personal Property, collectively, the “Property”). The purchase price was $

In connection with the purchase of the Facility, iBio CDMO entered into a Credit Agreement, dated November 1, 2021 (the “Credit Agreement”), with Woodforest National Bank (“Woodforest”) pursuant to which Woodforest had provided iBio CDMO a $

On May 31, 2024, in accordance with the terms of the Settlement Agreement in consideration of the payment in full of all Obligations (as such term is defined under the Credit Agreement) (a) iBio CDMO paid to Woodforest (i) $

10

of the Property under the 2024 Purchase and Sale Agreement, and (ii) approximately $

Pursuant to the Settlement Agreement, the Credit Agreement, the Guaranty dated November 1, 2021 and the other Loan Documents (each as defined in the Credit Agreement) were terminated and Woodforest released the Company and iBio CDMO from any and all claims, debts, liabilities or causes of action it may have against them prior to May 31, 2024, and the Company and iBio CDMO released Woodforest and its related parties from any and all claims, debts, liabilities or causes of action it may have against them prior to May 31, 2024.

During the fiscal year ended June 30, 2024, the Company recorded an additional fixed asset impairment charge of $

The results of iBio CDMO's operations ceased in the fiscal year ended June 30, 2024 and were reported as discontinued operations for the year ended June 30, 2024. No assets or liabilities associated with the discontinued operations of the CDMO remained on the balance sheet as of June 30, 2024. The Company had chosen not to segregate the cash flows of iBio CDMO in the consolidated statement of cash flow for the year ended June 30, 2024 and accordingly, supplemental disclosures related to discontinued operations for the statements of cash flows have been provided below. Unless noted otherwise, discussion in the Notes to the Consolidated Financial Statements refers to the Company's continuing operations.

The following table presents a reconciliation of the major financial lines constituting the results of operations for discontinued operations to the loss from discontinued operations presented separately in the condensed consolidated statements of operations and comprehensive loss (in thousands):

Three Months Ended | Six Months Ended | |||||

December 31, 2023 | December 31, 2023 | |||||

Operating expenses: | ||||||

General and administrative | | | ||||

Fixed asset impairments | | | ||||

Gain on sale of fixed assets | — | ( | ||||

Total operating expenses | | | ||||

Other expenses: | ||||||

Interest expense - term note payable | ( | ( | ||||

Total other expenses | | ( | ( | |||

Loss from discontinued operations | | $ | ( | $ | ( | |

The following table presents the supplemental disclosures related to discontinued operations for the condensed consolidated statements of cash flows (in thousands):

Six Months Ended | |||

December 31, 2023 | |||

Amortization of finance lease right-of-use assets | | $ | |

Fixed asset impairments | | ||

Supplemental cash flow information: | |||

Cash paid during the period for interest | | ||

4. Summary of Significant Accounting Policies

The Company’s significant accounting policies are described in Note 4 of the Notes to Consolidated Financial Statements in the Annual Report on Form 10-K/A for the year ended June 30, 2024.

11

Use of Estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect reported amounts of assets and liabilities, disclosures of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. These estimates include liquidity assertions, the valuation of intellectual property and fixed assets held for sale, the incremental borrowing rate utilized in the finance and operating lease calculations, legal and contractual contingencies, the valuation of the pre-funded warrants issued related to the extinguishment of the Term Loan and share-based compensation. Although management bases its estimates on historical experience and various other assumptions that are believed to be reasonable under the circumstances, actual results could differ from these estimates.

Accounts Receivable

Accounts receivable are reported at their outstanding unpaid principal balances net of allowances for uncollectible accounts. The Company provides for allowances for uncollectible receivables based on its estimate of uncollectible amounts considering age, collection history, and any other factors considered appropriate. Management’s policy is to write off accounts receivable against the allowance for credit losses when a balance is determined to be uncollectible. At December 31, 2024 and June 30, 2024, the Company determined that an for credit losses was

Subscription Receivable

The Company accounts for any subscription receivable as a current asset. Subscription receivables represent funds related to the sale of Common Stock in which the funds have not yet been delivered to the Company. The funds are generally held in escrow on behalf of the Company and are delivered within a few days.

Revenue Recognition

The Company accounts for its revenue recognition under Accounting Standards Codification (“ASC”) 606, Revenue from Contracts with Customers. A contract with a customer exists only when: (i) the parties to the contract have approved it and are committed to perform their respective obligations, (ii) the Company can identify each party’s rights regarding the distinct goods or services to be transferred (“performance obligations”), (iii) the Company can determine the transaction price for the goods or services to be transferred, (iv) the contract has commercial substance and (v) it is probable that the Company will collect the consideration to which it will be entitled in exchange for the goods or services that will be transferred to the customer. The Company recognizes revenue when it satisfies its performance obligations by transferring control of a promised good or service to the customer. In addition, the standard requires disclosure of the nature, amount, timing, and uncertainty of revenue and cash flows arising from customer contracts.

The Company analyzes its contracts to determine whether the elements can be separately identifiable and accounted for individually or as a bundle of goods or services. Allocation of revenue to individual elements that qualify for performance obligations is based on the separate selling prices determined for each component, and total contract consideration is then allocated pro rata across the components of the arrangement. If separate selling prices are not available, the Company will use its best estimate of such selling prices, consistent with the overall pricing strategy and after consideration of relevant market factors.

If a loss on a contract is anticipated, such loss is recognized in its entirety when the loss becomes evident. When the current estimates of the amount of consideration that is expected to be received in exchange for transferring promised goods or services to the customer indicates a loss will be incurred, a provision for the entire loss on the contract is made. At December 31, 2024 and June 30, 2024, the Company had

The Company generates contract revenue under the following types of contracts:

Fixed-Fee

Under a fixed-fee contract, the Company charges a fixed agreed upon amount for a deliverable. Fixed-fee contracts have fixed deliverables upon completion of the project. Typically, the Company recognizes revenue for fixed-fee contracts after projects are completed, delivery is made and title transfers to the customer, and collection is reasonably assured.

Revenue can be recognized either 1) over time or 2) at a point in time.

Collaborations/Partnerships

The Company may enter into research and discovery collaborations with third parties that involve a joint operating activity, typically a research and/or development effort, where both parties are active participants in the activity and are exposed to the significant risks and

12

rewards of the activity. The Company’s rights and obligations under its collaboration agreements vary and typically include milestone payments, contingent upon the occurrence of certain future events linked to the success of the asset in development, as well as expense reimbursements from or payments to the collaboration partner.

The Company considers the nature and contractual terms of agreements and assesses whether an agreement involves a joint operating activity pursuant to which the Company is an active participant and is exposed to significant risks and rewards dependent on the commercial success of the activity as described under ASC 808, Collaborative Arrangements (“ASC 808”). For arrangements determined to be within the scope of ASC 808 where a collaborative partner is not a customer for certain research and development activities, the Company accounts for payments received for the reimbursement of research and development costs as a contra-expense in the period such expenses are incurred. If payments from the collaborative partner to the Company represent consideration from a customer in exchange for distinct goods and services provided, then the Company accounts for those payments within the scope of ASC 606, Revenue from Contracts with Customers (“ASC 606”).

Collaborative revenues generated typically include payment to the Company related to one or more of the following: non-refundable upfront license fees, development and commercial milestones, and partial or complete reimbursement of research and development costs.

For the three and six months ended December 31, 2024, revenue in the amount of $

Contract Assets

A contract asset is an entity’s right to payment for goods and services already transferred to a customer if that right to payment is conditional on something other than the passage of time. Generally, an entity will recognize a contract asset when it has fulfilled a contract obligation but must perform other obligations before being entitled to payment.

Contract assets consist primarily of the cost of project contract work performed by third parties whereby the Company expects to recognize any related revenue at a later date, upon satisfaction of the contract obligations. At December 31, 2024 and June 3

Contract Liabilities

A contract liability is an entity’s obligation to transfer goods or services to a customer at the earlier of (1) when the customer prepays consideration or (2) the time that the customer’s consideration is due for goods and services the entity will yet provide. Generally, an entity will recognize a contract liability when it receives a prepayment.

Contract liabilities consist primarily of consideration received, usually in the form of payment, on project work to be performed whereby the Company expects to recognize any related revenue at a later date, upon satisfaction of the contract obligations. At December 31, 2024, June 30, 2024 and June 30, 2023 contract liabilities were $

Leases

The Company accounts for leases under the guidance of ASC 842, Leases (“ASC 842”). The standard established a right-of-use (“ROU”) model requiring a lessee to record a ROU asset and a lease liability on the balance sheet for all leases with terms longer than 12 months and classified as either an operating or finance lease. The adoption of ASC 842 had a significant effect on the Company’s balance sheet, resulting in an increase in noncurrent assets and both current and noncurrent liabilities.

In accordance with ASC 842, at the inception of an arrangement, the Company determines whether the arrangement is or contains a lease based on the unique facts and circumstances present and the classification of the lease including whether the contract involves the use of a distinct identified asset, whether the Company obtains the right to substantially all the economic benefit from the use of the asset, and whether the Company has the right to direct the use of the asset. Leases with a term greater than one year are recognized on the balance sheet as ROU assets, lease liabilities and, if applicable, long-term lease liabilities. The Company has elected not to recognize on the balance sheet leases with terms of one year or less under practical expedient in paragraph ASC 842-20-25-2. For contracts with lease and non-lease components, the Company has elected not to allocate the contract consideration and to account for the lease and non-lease components as a single lease component.

13

The lease liability and the corresponding ROU assets are recorded based on the present value of lease payments over the expected remaining lease term. The implicit rate within the Company’s existing finance (capital) lease was determinable and, therefore, used at the adoption date of ASC 842 to determine the present value of lease payments under the finance lease. The implicit rate within the Company’s operating lease was not determinable and, therefore, the Company used the incremental borrowing rate at the lease commencement date to determine the present value of lease payments. The determination of the Company’s incremental borrowing rate requires judgement. The Company will determine the incremental borrowing rate for each new lease using its estimated borrowing rate.

An option to extend the lease is considered in connection with determining the ROU asset and lease liability when it is reasonably certain the Company will exercise that option. An option to terminate is considered unless it is reasonably certain the Company will not exercise the option.

Cash, Cash Equivalents and Restricted Cash

The Company considers all highly liquid instruments purchased with an original maturity of three months or less to be cash equivalents. Cash equivalents at December 31, 2024 and June 30, 2024 consisted of money market accounts. Restricted cash at December 31, 2024 includes a letter of credit obtained related to the San Diego operating lease (see Note 14 – Operating Lease Obligations) and a Company purchasing card. The Company’s bank requires an additional

The following table summarizes the components of total cash, cash equivalents and restricted cash in the condensed consolidated statements of cash flows (in thousands):

December 31, | June 30, | |||||

2024 | 2024 | |||||

Cash and equivalents | | $ | | $ | | |

Collateral held for letter of credit - San Diego lease | | | ||||

Collateral held for Company purchasing card | | | | |||

Total cash, cash equivalents and restricted cash | | $ | | $ | | |

The collateral held for the letters of credit for the San Diego lease and the Company purchasing card are classified as long-term on the condensed consolidated balance sheets at December 31, 2024 and June 30, 2024.

Research and Development

The Company accounts for research and development costs in accordance with the Financial Accounting Standards Board (“FASB”) ASC 730-10, Research and Development (“ASC 730-10”). Under ASC 730-10, all research and development costs must be charged to expense as incurred. Accordingly, internal research and development costs are expensed as incurred. Third-party research and development costs are expensed when the contracted work has been performed or as milestone results have been achieved. Research and development expense was reported in continuing operations for the three and six months ended December 31, 2024 and 2023.

Right-of-Use Assets

Assets held under the terms of finance (capital) leases are amortized on a straight-line basis over the terms of the leases or the economic lives of the assets. Obligations for future lease payments under finance (capital) leases are shown within liabilities and are analyzed between amounts falling due within and after one year. See Note 8 – Finance Lease ROU Assets and Note 13 – Finance Lease Obligations for additional information.

Fixed Assets

Fixed assets are stated at cost net of accumulated depreciation. Depreciation is calculated using the straight-line method over the estimated useful lives of the assets ranging from to

The Company monitors fixed assets for impairment indicators throughout the year. When necessary, charges for impairments of long-lived assets are recorded for the amount by which the fair value is less than the carrying value of these assets. Changes in the Company’s business strategy or adverse changes in market conditions could impact impairment analyses and require the recognition of an

14

impairment charge. Although management bases its estimates on historical experience and various other assumptions that are believed to be reasonable under the circumstances, actual results could differ from these estimates.

See Note 10 – Fixed Assets for additional information.

Intangible Assets

Identifiable intangible assets are comprised of definite life intangible assets and indefinite life intangible assets.

The Company accounts for definite life intangible assets at either their historical cost or allocated purchase price at asset acquisition and records amortization utilizing the straight-line method based upon their estimated useful lives. Intellectual property is amortized over . The Company reviews the carrying value of its definite life intangible assets for impairment whenever events or changes in business circumstances indicate the carrying amount of such assets may not be fully recoverable. The carrying value is not recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the asset. An impairment loss is measured as the amount by which the carrying amount exceeds it fair value.

For indefinite life intangible assets, the Company performs an impairment test annually and whenever events or changes in circumstances indicate the carrying value of an asset may not be recoverable. The Company determines the fair value of the asset annually or when triggering events are present, based on discounted cash flows and records an impairment loss if book value exceeds fair value.

Evaluating for impairment requires judgment, including the estimation of future cash flows, future growth rates and profitability and the expected life over which cash flows will occur. Changes in the Company’s business strategy or adverse changes in market conditions could impact impairment analyses and require the recognition of an impairment charge. Although management bases its estimates on historical experience and various other assumptions that are believed to be reasonable under the circumstances, actual results could differ from these estimates.

See Note 11 – Intangible Assets for additional information.

Share-based Compensation

The Company recognizes the cost of all share-based payment transactions at fair value. Compensation cost, measured by the fair value of the equity instruments issued, adjusted for estimated forfeitures, is recognized in the financial statements as the respective awards are earned over the performance period. The Company uses historical data to estimate forfeiture rates.

The impact that share-based payment awards will have on the Company’s results of operations is a function of the number of shares awarded, the trading price of the Company’s stock at the date of grant or modification, the vesting schedule and forfeitures. Furthermore, the application of the Black-Scholes option pricing model employs weighted-average assumptions for expected volatility of the Company’s stock, expected term until exercise of the options, the risk-free interest rate, and dividends, if any, to determine fair value.

Expected volatility is based on historical volatility of the Common Stock; the expected term until exercise represents the weighted-average period of time that options granted are expected to be outstanding giving consideration to vesting schedules and the Company’s historical exercise patterns; and the risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant for periods corresponding with the expected life of the option. The Company has not paid any dividends since its inception and does not anticipate paying any dividends for the foreseeable future, so the dividend yield is assumed to be

Concentrations of Credit Risk

Cash

The Company maintains principally all cash balances in two financial institutions which, at times, may exceed the amount insured by the Federal Deposit Insurance Corporation. The exposure to the Company is solely dependent upon daily bank balances and the strength of the financial institution. The Company has not incurred any losses on these accounts. At December 31, 2024 and June 30, 2024, amounts in excess of insured limits were approximately $

15

Revenue

During the three and six months ended December 31, 2024, the Company reported revenue from continuing operations from one collaborative partner. During the three months ended December 31, 2023, the Company reported

Segment Reporting

The Company operates as one reportable segment, which is that of a preclinical stage biotechnology company leveraging AI and ML for the development of hard-to-drug precision antibodies. In accordance with Accounting Standards Codification (“ASC”) 280, Segment Reporting (“Segment Reporting”), the Company’s chief operating decision maker has been identified as the Chief Executive Officer, who reviews operating results to make decisions about allocating resources and assessing performance for the entire Company. Existing guidance, which is based on a management approach to segment reporting, establishes requirements to report selected segment information quarterly and to report annually entity-wide disclosures about products and services, major customers, and the countries in which the entity holds material assets and reports revenue. All material operating units qualify for aggregation under Segment Reporting due to their similar customer base and similarities in: economic characteristics; nature of products and services; and procurement, manufacturing and distribution processes. Since the Company operates in one segment, all financial information required by Segment Reporting can be found in the accompanying consolidated financial statements.

Recently Adopted Accounting Pronouncements

In June 2016, the FASB issued ASU 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”), which requires an entity to assess impairment of its financial instruments based on its estimate of expected credit losses. As the Company is a smaller reporting company, the provisions of ASU 2016-13 and the related amendments are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2022 (quarter ending September 30, 2023, for the Company). Entities are required to apply these changes through a cumulative-effect adjustment to retained earnings as of the beginning of the first reporting period in which the guidance is effective. The adoption of ASU 2016-13 did not impact the Company’s condensed consolidated financial statements.

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): “Improvements to Reportable Segment Disclosures” (“ASU 2023-07”) to update reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses and information used to assess segment performance. This update is effective beginning with the Company’s 2025 fiscal year annual reporting period, with early adoption permitted. The adoption of ASU 2023-07 did not have a significant impact on the Company’s condensed consolidated financial statements.

Recently Issued Accounting Pronouncements

In October 2023, the Financial Accounting Standards Board (“FASB”) issued ASU 2023-06, “Disclosure Improvements: Codification Amendments in Response to the SEC’s Disclosure Update and Simplification Initiative” (“ASU 2023-06”). This ASU incorporates certain SEC disclosure requirements into the FASB ASC. The amendments in the ASU are expected to clarify or improve disclosure and presentation requirements of a variety of ASC Topics, allow users to more easily compare entities subject to the SEC’s existing disclosures with those entities that were not previously subject to the requirements, and align the requirements in the ASC with the SEC’s regulations. The ASU has an unusual effective date and transition requirements since it is contingent on future SEC rule setting. If the SEC fails to enact required changes by June 30, 2027, this ASU is not effective for any entities. Early adoption is not permitted. The Company is currently evaluating the impact that the adoption of this standard will have on its consolidated financial statements.

In December 2023, the FASB issued ASU 2023-09, “Improvements to Income Tax Disclosures” (“ASU 2023-09”) to enhance the transparency and decision-usefulness of income tax disclosures, particularly in the rate reconciliation table and disclosures about income taxes paid. This ASU applies to all entities subject to income taxes. This ASU will be effective for public companies for annual periods beginning after December 15, 2024. The Company does not expect the adoption of ASU 2023-09 will have a significant impact on its consolidated financial statements.

In November 2024, the FASB issued ASU 2024-03, “Income Statement: Reporting Comprehensive Income— Expense Disaggregation Disclosures,” which requires more detailed information about specified categories of expenses (purchases of inventory, employee compensation, depreciation, amortization, and depletion) included in certain expense captions presented on the face of the income statement, as well as disclosures about selling expenses. This ASU is effective for fiscal years beginning after December 15, 2026 and for interim periods within fiscal years beginning after December 15, 2027. Early adoption is permitted. The amendments may be applied either (1) prospectively to financial statements issued for reporting periods after the effective date of this ASU or (2) retrospectively to all prior periods presented in the financial statements. The Company is currently evaluating this guidance to determine the impact it may have on its consolidated financial statements disclosures.

16

Management does not believe that any other recently issued, but not yet effective, accounting standard if currently adopted would have a material effect on the accompanying condensed consolidated financial statements.

5. Financial Instruments and Fair Value Measurement

The carrying values of cash and cash equivalents, restricted cash, accounts receivable, accounts payable and equipment financing payable in the Company’s condensed consolidated balance sheets approximated their fair values as of December 31, 2024 and June 30, 2024 due to their short-term nature. The carrying value of the promissory note receivable, term promissory note payable and finance lease obligations approximated fair value as of December 31, 2024 and June 30, 2024 as the interest rates related to the financial instruments approximated market.

The following provides a description of the three levels of inputs that may be used to measure fair value under the standard, the types of plan investments that fall under each category, and the valuation methodologies used to measure these investments at fair value:

| • | Level 1 – Quoted prices in active markets for identical assets or liabilities. |

| • | Level 2 – Quoted prices for similar assets and liabilities in active markets or inputs that are observable. |

| • | Level 3 – Inputs that are unobservable (for example, cash flow modeling inputs based on assumptions). |

6. Significant Transactions

AstralBio Exclusive License Agreement

On December 31, 2024, the Company entered into an exclusive agreement (the “License Agreement”) with AstralBio, Inc. (“AstralBio”), pursuant to which AstralBio has licensed to the Company, on an worldwide exclusive basis and with the right to grant sublicenses, under the AstralBio Licensed Patents (as defined in the License Agreement) and AstralBio Licensed Know-How (as defined in the License Agreement) to develop, manufacture and commercialize and otherwise exploit any product directed to GDF8 (myostatin) that contains the licensed antibody targeting myostatin, now named IBIO-600, for research, diagnosis, treatment, prevention, or management of any disease or medical condition (the “Licensed Product”). iBio continues to assess its options rights to license the remaining three assets under the AstralBio collaboration to add additional obesity and cardiometabolic programs into its pre-clinical pipeline.

The Company will be solely responsible for all decisions related to the launch, sales and marketing and promotion of the Licensed Products in its discretion, subject to the terms of the License Agreement, and for all costs for all activities related to, the development, manufacture and commercialization of the Licensed Product worldwide. In consideration for the rights and licenses granted by AstralBio to the Company in the License Agreement, the Company has agreed to pay AstralBio (i) an upfront license fee in the amount of $

The License Agreement will remain in effect at all times and thereafter, unless and until terminated earlier pursuant to the License Agreement. The License Agreement can be terminated (i) by the Company for any reason or no reason upon

The Licensed Product, IBIO-600, was identified by AstralBio using the Company’s proprietary technology stack and was designed for subcutaneous administration with the potential for an extended half-life. In parallel, the Company initiated a bispecific antibody program

17

targeting myostatin/activin A to treat obesity and cardiometabolic disorders, leveraging its proprietary technology stack as well as the technology of IBIO-600.

The Company recorded an indefinite-lived intangible asset for the exclusive license in the amount of $

Otsuka

On February 25, 2024, the Company entered into an asset purchase agreement (the “PD-1 Purchase Agreement”) with Otsuka Pharmaceutical Co., Ltd. (“Otsuka”) pursuant to which the Company sold and assigned to Otsuka, and Otsuka purchased and assumed, all intellectual property rights directly related to the Company’s PD-1 Assets (as defined in the PD-1 Purchase Agreement) developed or held for development. The Company received an upfront payment of $

Affiliates of Eastern Capital Limited

On November 1, 2021, the Company and its subsidiary, iBio CDMO LLC (“iBio CDMO”, and collectively with the Company, the “Purchaser”) entered into a series of agreements (the “Transaction”) with College Station Investors LLC (“College Station”), and Bryan Capital Investors LLC (“Bryan Capital” and, collectively with College Station, “Seller”), each affiliates of Eastern Capital Limited (“Eastern,” a former significant stockholder of the Company) described in more detail below whereby in exchange for a certain cash payment and a warrant the Company:

| (i) | acquired both the Facility where iBio CDMO at that time and currently conducts business and also the rights as the tenant in the Facility’s ground lease; |

| (ii) | acquired all of the equity owned by one of the affiliates of Eastern in the Company and iBio CDMO; and |

| (iii) | otherwise terminated all agreements between the Company and the affiliates of Eastern. |

The Facility is a life sciences building located on land owned by the Board of Regents of the Texas A&M University System (“Texas A&M”) and is designed and equipped for the manufacture of plant-made biopharmaceuticals. iBio CDMO had held a sublease for the Facility through 2050, subject to extension until 2060 (the “Sublease”) until the consummation of the sale of the Facility.

The Purchase and Sale Agreement

On November 1, 2021, the Purchaser entered into a purchase and sale agreement (the “PSA”) with the Seller pursuant to which: (i) the Seller sold to Purchaser all of its rights, title and interest as the tenant in the Ground Lease Agreement that it entered into with Texas A&M (the “Landlord’’) related to the land at which the Facility is located together with all improvements pertaining thereto (the “Ground Lease Property”), which previously had been the subject of the Sublease; (ii) the Seller sold to Purchaser all of its rights, title and interest to any tangible personal property owned by Seller and located on the Ground Lease Property including the Facility; (iii) the Seller sold to Purchaser all of its rights, title and interest to all licensed, permits and authorization for use of the Ground Lease Property; and (iv) College Station and iBio CDMO terminated the Sublease. The total purchase price for the Ground Lease Property, the termination of the Sublease and other agreements among the parties, and the equity described below is $

As discussed above, iBio CDMO is being accounted for as a discontinued operation. In the fiscal year ended June 30, 2024, the assets acquired were sold and the asset lease was terminated. These assets were classified as assets held for sale on the June 30, 2023 consolidated balance sheet.

18

The Credit Agreement

In connection with the PSA, iBio CDMO entered into a Credit Agreement, dated November 1, 2021, with Woodforest pursuant to which Woodforest provided iBio CDMO a $

The Warrant

As part of the consideration for the purchase and sale of the rights set forth above, the Company issued to Bryan Capital a Warrant to purchase

RubrYc

On August 23, 2021, the Company entered into a series of agreements with RubrYc Therapeutics, Inc. (“RubrYc”) described in more detail below:

Collaboration and License Agreement

The Company entered into a collaboration and licensing agreement (the “RTX-003 License Agreement”) with RubrYc to further develop RubrYc’s immune-oncology antibodies in its RTX-003 campaign. Under the terms of the agreement, the Company is solely responsible for worldwide research and development activities for development of the RTX-003 antibodies for use in pharmaceutical products in all fields. RubrYc was also entitled to receive royalties in the mid-single digits on net sales of RTX-003 antibodies, subject to adjustment under certain circumstances. The RTX-003 License Agreement was terminated when the Company acquired substantially all of the assets of RubrYc in September 2022.

Collaboration, Option and License Agreement

The Company entered into an agreement with RubrYc (the “Collaboration, Option and License Agreement”) to collaborate for up to

Stock Purchase Agreement

In connection with the entry into the Collaboration, Option and License Agreement and RTX-003 License Agreement, the Company also entered into a Stock Purchase Agreement (“Stock Purchase Agreement”) with RubrYc whereby the Company purchased a total of

The Company accounted for the agreements as an asset purchase and allocated the purchase price of $

Preferred stock | | $ | |

Intangible assets | | ||

Prepaid expenses | | | |

| $ | |

19

On September 16, 2022, the Company entered an asset purchase agreement with RubrYc (the “Asset Purchase Agreement”) pursuant to which it acquired substantially all of the assets of RubrYc. The Company issued

Subsequently after the Company acquired substantially all of the assets of RubrYc in September 2022, RubrYc ceased its operations and dismissed bankruptcy proceedings in June 2023. The Company recorded an impairment of the investment in the amount of $

The Company accounted for the agreements as an asset purchase and allocated the purchase price of approximately $

Intangible assets | | $ | |

Fixed assets | | | |

| $ | |

In addition, the Company assumed

Former CEO Departure

Effective December 1, 2022, the Company and Mr. Thomas F. Isett, the former Chief Executive Officer (the “CEO”) and former Chairman of the Board, agreed for Mr. Isett to resign as a member of the Board and relinquish his duties, rights and obligations as the CEO of the Company.

Separation Agreement and General Release

In connection with Mr. Isett’s resignation, the Company entered into a separation agreement and general release with Mr. Isett effective December 1, 2022 (the “Agreement”). Pursuant to the Agreement, Mr. Isett resigned as CEO of the Company effective December 1, 2022, and remained an employee of the Company until termination of his employment on December 31, 2022. Pursuant to the Agreement, Mr. Isett received the severance benefits set forth in his employment agreement, including (i) an amount equal to his base salary in equal bi-monthly installments for

7. Promissory Note Receivable

On June 19, 2023, the Company was issued a promissory note (the “Note”) with Safi Biosolutions, Inc. (“Safi”) in the principal amount of $

20

On August 29, 2024, the Company received a payment from Safi of approximately $

For the three months ended December 31, 2024 and 2023, interest income amounted to $

8. Finance Lease ROU Assets

The Company assumed

The following table summarizes by category the gross carrying value and accumulated amortization of finance lease ROU (in thousands):

| December 31, |

| June 30, | |||

2024 | 2024 | |||||

ROU - Equipment | $ | | $ | | ||

Accumulated amortization |

| ( |

| ( | ||

Net finance lease ROU assets | $ | | $ | | ||

Amortization of finance lease ROU assets was approximately $

9. Operating Lease ROU Assets

San Diego, California

On September 10, 2021, the Company entered into a lease for approximately

Bryan, Texas

On November 1, 2021, iBio CDMO acquired the Facility and became the tenant under the Ground Lease Agreement upon which the Facility is located. This lease was terminated on May 31, 2024.

10. Fixed Assets

The following table summarizes by category the gross carrying value and accumulated depreciation of fixed assets (in thousands):

| December 31, |

| June 30, | |||

2024 | 2024 | |||||

Building and improvements | $ | | $ | | ||

Machinery and equipment |

| |

| | ||

Office equipment and software | | | ||||

Construction in progress |

| |

| — | ||

| | |||||

Accumulated depreciation | ( | ( | ||||

Net fixed assets | $ | | $ | | ||

21

Depreciation expense reported in continuing operations was approximately $

11. Intangible Assets

On August 23, 2021, the Company entered into a series of agreements with RubrYc (see Note 6 – Significant Transactions) whereby the Company in exchange for a $

On September 16, 2022, the Company entered into an asset purchase agreement with RubrYc pursuant to which it acquired substantially all of the assets of RubrYc. The assets acquired include the patented AI drug discovery platform, all rights with no future milestone payments or royalty obligations, to IBIO-101, in addition to CCR8, EGFRvIII, MUC16, CD3, and one additional immuno-oncology candidate.

On December 31, 2024, the Company entered into the License Agreement with AstralBio (see Note 6 – Significant Transactions) pursuant to which AstralBio has licensed to the Company, on an worldwide exclusive basis and with the right to grant sublicenses, under the AstralBio Licensed Patents and AstralBio Licensed Know-How to Develop, Manufacture and Commercialize and otherwise exploit any product directed to GDF8 (myostatin) that contains the licensed antibody targeting myostatin for research, diagnosis, treatment, prevention, or management of any disease or medical condition. The License Agreement will remain in effect at all times and thereafter, unless and until terminated earlier pursuant to the License Agreement. The Company accounted for this license as an indefinite-lived intangible asset.

The following table summarizes by category the gross carrying value and accumulated amortization of intangible assets (in thousands):

|

| June 30, |

|

|

|

| December 31, | ||||||||

2024 | Amortization | Additions | Impairments | 2024 | |||||||||||

Intellectual property – gross carrying value | $ | | $ | — | $ | — | $ | — | $ | | |||||

Intellectual property – accumulated amortization |

| ( |

| ( |

| — |

| — |

| ( | |||||

Total definite lived intangible assets | | $ | ( | — | $ | — | | ||||||||

Intellectual property – indefinite lived | | — | — | | |||||||||||

License – indefinite lived | — | | — | | |||||||||||

Total net intangibles | $ | | $ | | $ | | |||||||||

Amortization expense was approximately $

See Note 4 - Summary of Significant Accounting Policies and Note 5 – Financial Instruments and Fair Value Measurement for more information.

12. Debt

The Credit Agreement

In connection with the PSA, iBio CDMO entered into a Credit Agreement, dated November 1, 2021, with Woodforest pursuant to which Woodforest provided iBio CDMO a $

22

to early termination upon events of default. The Term Loan provided that it may be prepaid by iBio CDMO at any time and provided for mandatory prepayment upon certain circumstances.

Throughout the term of the Term Loan, the Company and Woodforest entered into amendments which, among other things, amended the maturity date, interest rate and liquidity covenant. (Refer to the Company’s Annual Report for more information.)

On May 17, 2024, iBio CDMO, the Company and Woodforest entered into the Settlement Agreement which provided that iBio CDMO pay to Woodforest the proceeds of the sale of the Property under the 2024 Purchase and Sale Agreement when received, determine in consultation with Woodforest the Indebtedness Deficiency Amount and thereafter the Company issued to Woodforest upon receipt of NYSE American LLC approval a Pre-Funded Warrant that expires upon full exercise thereof and is exercisable at a nominal exercise price equal to $

On May 31, 2024, in accordance with the terms of the Settlement Agreement entered into on May 17, 2024 with Woodforest in consideration of the payment in full of all Obligations (as such term is defined under the Credit Agreement) (a) iBio CDMO paid to Woodforest (i) $

Pursuant to the Settlement Agreement, the Credit Agreement, the Guaranty dated November 1, 2021 and the other Loan Documents (as defined in the Credit Agreement) were terminated and Woodforest released the Company and iBio CDMO from any and all claims, debts, liabilities or causes of action it may have against them prior to May 31, 2024, and the Company and iBio CDMO released Woodforest and its related parties from any and all claims, debts, liabilities or causes of action it may have against them prior to May 31, 2024.

At December 31, 2024 and June 30, 2024, the balance of the Term Loan was $

Equipment Financing

On October 12, 2022, the Company entered into an equipment financing master lease agreement and a lease supplement whereby $

Future minimum payments under the equipment financing obligation are due as follows (in thousands):

Fiscal period ending on December 31: |

| Principal |

| Interest |

| Total | |||

2025 | $ | | $ | | $ | | |||

Credit and Security Agreement

On January 16, 2024, the Company entered into a credit and security agreement (the “Credit and Security Agreement”) with Loeb Term Solutions LLC, an Illinois limited liability company (“Lender”), for a term loan or equipment line of credit loan (the “Loan”) pursuant to which the Company issued to Lender a term promissory note in the principal amount of $

The 2024 Term Note provides for monthly payments of principal and interest based on a four-year amortization period, with a balloon payment of all principal, accrued interest and any other amounts due on the two year anniversary of the 2024 Term Note. The Credit and Security Agreement granted to Lender a security interest in substantially all of the Company’s assets other than any intellectual property related to any of the Company’s filed patents (the “Loeb Collateral”) to secure the Company’s obligations under the 2024 Term

23

Note. The 2024 Term Note is subject to a prepayment fee of:

The Credit and Security Agreement provides that the Company may request that Lender make further loan advances to the Company subject to certain conditions, including that the Company is not otherwise in default under the Credit and Security Agreement and its obligations and liabilities to Lender do not exceed a borrowing base equal to the lesser of: (a) eighty percent (

The Company’s obligations to Lender under the 2024 Term Note and Credit Security Agreement are further secured by an validity guarantee, dated January 16, 2024 (the “Validity Guarantee”), executed by Dr. Martin Brenner and Felipe Duran in their individual capacity (the “Indemnitors”) for the benefit of Lender. The Validity Guarantee provides that the Indemnitors will indemnify the Lender from any loss or damage, including any actual, consequential or incidental loss or damage, suffered by Lender as a result of, or arising out of, among other things, any willful or intentional misrepresentation or gross negligence by the Company in connection with the Loan and any acts of fraud, conversion, misappropriation or misapplication of funds or proceeds of any Loeb Collateral by the Company or the Indemnitors.

The Credit and Security Agreement contains customary events of default. If an event of default occurs, the 2024 Term Note provides that regardless of whether the Lender elects to accelerate the maturity of the 2024 Term Note, the entire principal remaining unpaid hereunder shall thereafter bear interest at the rate equal to the Effective Rate plus

The financing is payable in monthly installments of $

Future minimum payments under the term promissory note obligation are due as follows (in thousands):

Fiscal period ending on December 31: |

| Principal |

| Interest |

| Total | |||

2025 | $ | | $ | | $ | | |||

2026 |

| |

| |

| | |||

|

|

|

|

|

| ||||

Total minimum term promissory note payments |

| | $ | | $ | | |||

Less: current portion |

| ( |

|

|

|

| |||

Long-term portion of minimum term promissory note obligation | $ | |

|

|

|

| |||

Insurance Premium Financing

On October 30, 2023, the Company entered into an insurance premium financing agreement with FIRST Insurance Funding, a division of Lake Forest Bank & Trust Company, N.A., whereby approximately $

On October 30, 2024, the Company entered into an insurance premium financing agreement with FIRST Insurance Funding, a division of Lake Forest Bank & Trust Company, N.A., whereby approximately $

Fiscal period ending on December 31: |

| Principal |

| Interest |

| Total | |||

2025 | $ | | $ | | $ | | |||

24

13. Finance Lease Obligations

Equipment

As discussed above, the Company assumed

The following tables present the components of lease expense and supplemental balance sheet information related to the finance lease obligation (in thousands).

| Three Months Ended | Three Months Ended | ||||

December 31, | December 31, | |||||

2024 | 2023 | |||||

Finance lease cost: |

|

|

| |||

Amortization of ROU assets | $ | | $ | | ||

Interest on lease liabilities |

| |

| | ||

Total lease cost | $ | | $ | | ||

|

|

|

| |||

Other information: |

|

|

|

| ||

Cash paid for amounts included in the measurement lease liabilities: |

|

|

|

| ||

Financing cash flows from finance lease obligations | $ | | $ | | ||

| Six Months Ended | Six Months Ended | ||||

December 31, | December 31, | |||||

2024 | 2023 | |||||

Finance lease cost: |

|

|

| |||

Amortization of ROU assets | $ | | $ | | ||

Interest on lease liabilities |

| |

| | ||

Total lease cost | $ | | $ | | ||

|

|

|

| |||

Other information: |

|

|

|

| ||

Cash paid for amounts included in the measurement lease liabilities: |

|

|

|

| ||

Financing cash flows from finance lease obligations | $ | | $ | | ||

December 31, | June 30, | |||||||

2024 | 2024 | |||||||

Finance lease ROU assets | $ | | $ | | ||||

Finance lease obligation - current portion | $ | | $ | | ||||

Finance lease obligation - noncurrent portion | $ | — | $ | | ||||

Weighted-average remaining lease term - finance lease |

| years |

| years | ||||

Weighted-average discount rate - finance lease obligation |

| | % |

| | % | ||

Future minimum payments under the finance lease obligation are as follows (in thousands):

Fiscal year ending on December 31: |

| Principal |

| Interest |

| Total | |||

2025 | $ | | $ | | $ | | |||

25

14. Operating Lease Obligation

San Diego

On September 10, 2021, the Company entered into a lease for

| ● | The length of term of the lease is |

| ● | The lease commencement date is September 1 |

| ● | The monthly rent for the first year of the lease is $ |

| ● | The lease provides for a base rent abatement for months two through five in the first year of the lease. |

| ● | The landlord provided a tenant improvement allowance of $ |

| ● | The Company is responsible for other expenses such as electric, janitorial, etc. |

| ● | The Company opened an irrevocable letter of credit in the amount of $ |

As discussed above, the lease provides for scheduled increases in base rent and scheduled rent abatements. Rent expense is charged to operations using the straight-line method over the term of the lease which results in rent expense being charged to operations at inception of the lease in excess of required lease payments. This excess (formerly classified as deferred rent) is shown as a reduction of the operating lease ROU asset in the accompanying condensed consolidated balance sheets. Rent expense for the San Diego facility commenced in fiscal year 2022, when the Company began making improvements to the facility.

The following tables present the components of lease expense and supplemental balance sheet information related to the operating lease obligation (in thousands).

Three Months Ended | Three Months Ended | |||||

December 31, | December 31, | |||||

2024 | 2023 | |||||

Operating lease cost: | $ | | $ | | ||

Total lease cost | $ | | $ | | ||

|

|

|

| |||

Other information: |

|

|

|

| ||

Cash paid for amounts included in the measurement lease liability: |

|

|

|

| ||

Operating cash flows from operating lease | $ | | $ | | ||

Operating cash flows from operating lease obligation | $ | | $ | | ||

Six Months Ended | Six Months Ended | |||||

December 31, | December 31, | |||||

2024 | 2023 | |||||

Operating lease cost: | $ | | $ | | ||

Total lease cost | $ | | $ | | ||

|

|

| ||||

Other information: |

|

|

|

| ||

Cash paid for amounts included in the measurement lease liability: |

|

|

|

| ||

Operating cash flows from operating lease | $ | | $ | | ||

Operating cash flows from operating lease obligation | $ | | $ | | ||

26

Future minimum payments under the operating lease obligation are as follows (in thousands):

Fiscal year ending on December 31: |

| Principal |

| Imputed Interest |

| Total | |||

2025 | $ | | $ | | $ | | |||

2026 | | | | ||||||

2027 |

| |

| |

| | |||

2028 |

| |

| |

| | |||

2029 |

| |

| |

| | |||

|

|

|

|

|

| ||||