iBio, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1. Nature of Business

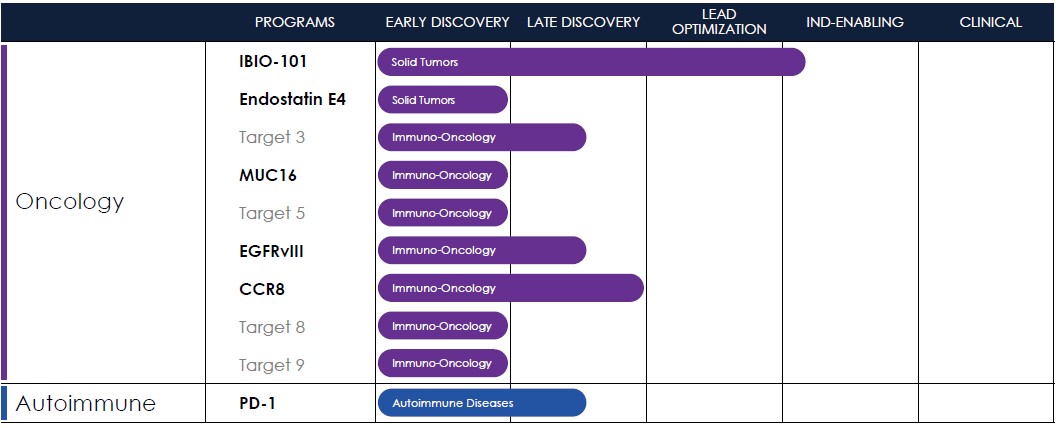

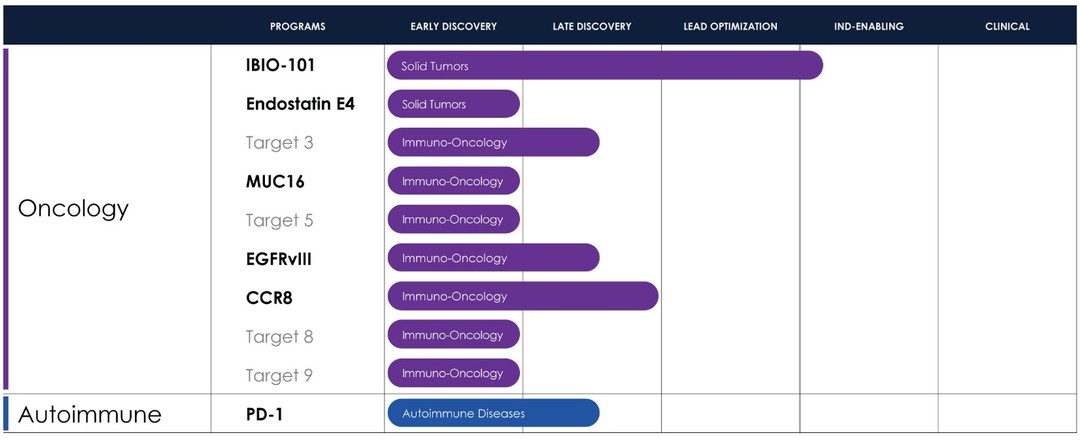

iBio, Inc. (“we”, “us”, “our”, “iBio”, “iBio, Inc” or the “Company”) is an Artificial Intelligence (“AI”)-driven innovator of precision antibody immunotherapies. The Company has a pipeline of innovative primarily immuno-oncology antibodies against hard-to-drug targets where we may face reduced competition and with antibodies that may be more selective. The Company plans to use its AI-driven discovery platform to continue adding antibodies against hard-to-drug targets or to work with partners on AI-driven drug development.

Therapeutics Pipeline

IBIO-101: an anti-CD25 molecule that works by depletion of immunosuppressive T-regulatory cells (“Tregs”) via antibody-dependent cellular cytotoxicity (“ADCC”), without disrupting activation of effector T-cells (“Teffs”) in the tumor microenvironment. IBIO-101 could potentially be used to treat solid tumors, hairy cell leukemia, relapsed multiple myeloma, lymphoma, or head and neck cancer. IBIO-101 is currently in the Investigational New Drug (“IND”) enabling stage. We have contracted with a contract research organization (CRO) to assist with the development of the manufacturing process, which includes but not limited to process and cell line development for the production of the drug substance and drug product. As we continue with the development of the manufacturing process for IBIO-101, as a fast-follower to a competing drug candidate, we have decided to pause the IND enabling studies until our competitor releases clinical data. Due to the decision to pause the IND enabling studies, we expect the IND filing for IBIO-101 will be delayed from the first half of 2024 to the first half of 2025. This delay will allow us to thoroughly evaluate the market potential and optimize our financial resources and the development plan for IBIO-101 to maximize its potential for success.

EGFRvIII: binds a tumor-specific mutation of EGFR variant III with an afucosylated antibody for high ADCC. Because of its specificity binding to the tumor-specific mutation, it could potentially reduce toxicity and/or expand the therapeutic window compared to simple broad EGFR-targeted alternatives. EGFRvIII is constantly “switched on” which can lead to the development of a range of different cancers. An EGFRvIII antibody could potentially be used to treat glioblastoma, head and neck cancer or non-small cell lung cancer.

CCR8: targets depletion of highly immunosuppressive CCR8+ Tregs in the tumor microenvironment via an ADCC mechanism with selective binding to CCR8 over its closely related cousin, CCR4, to avoid off-target effects. A CCR8 program could potentially be broadly applicable in solid tumors and/or as a prospective combination therapy.

MUC16: a highly expressed target on ovarian cancer cells and an attractive tumor associated target for therapeutic antibodies. However, antibodies targeting MUC16 are prone to tumor resistance via epitope shedding and dysregulated glycosylation. Epitope-steered antibodies that bind to an epitope that avoids both of these tumor resistance mechanisms could potentially be used to treat MUC16 positive tumors, particularly those tumors that are resistant to other MUC16 antibodies.

9