effects on non-targeted tissues. ShieldTx is designed to address this challenge by rendering antibodies inactive until they reach a specific environment unique to diseased tissues. Upon contact with this environment, the masking element is detached, activating the antibody. This strategy aims to minimize or eliminate unintended effects on healthy tissues, thereby improving the safety profile and reducing the immunogenicity risks associated with bispecific antibodies.

Modalities

Epitope steering, a technology the Company is pioneering, has the potential to positively impact various areas of medicine. In the field of immuno-oncology, it can be used to develop antibodies targeting specific cancer antigens, potentially enhancing the efficacy of treatments like checkpoint inhibitors and CAR-T therapies.

The technology also holds promise in the realm of systemic secreted and cell-surface therapeutics. Epitope steering can be applied to the development of antibodies, circulating immune modulation factors, secreted enzymes, and transmembrane proteins. This could be particularly beneficial in treating diseases such as heart failure, infectious diseases, and rare genetic conditions. In the context of localized regenerative therapeutics, epitope steering could potentially be used to develop treatments that target specific damaged or diseased tissues. This approach could be particularly beneficial in the treatment of cardiovascular diseases. Intratumoral immuno-oncology is another area where epitope steering could make a significant impact. It could potentially be used to develop treatments that alter the tumor microenvironment to favor an immune response against tumors, potentially enhancing the efficacy of treatments that use immune-stimulatory proteins. The potential of epitope steering extends to cancer vaccine development as well. The ability to target specific epitopes could be beneficial in the development of vaccines, particularly those that aim to increase the number and antitumor activity of a patient's T cells. Finally, epitope steering could be used to develop treatments for a wide range of diseases, including those in the immune-oncology space, immunology, pain, and potentially in vaccine development. This is particularly relevant for complex and hard-to-drug protein structures.

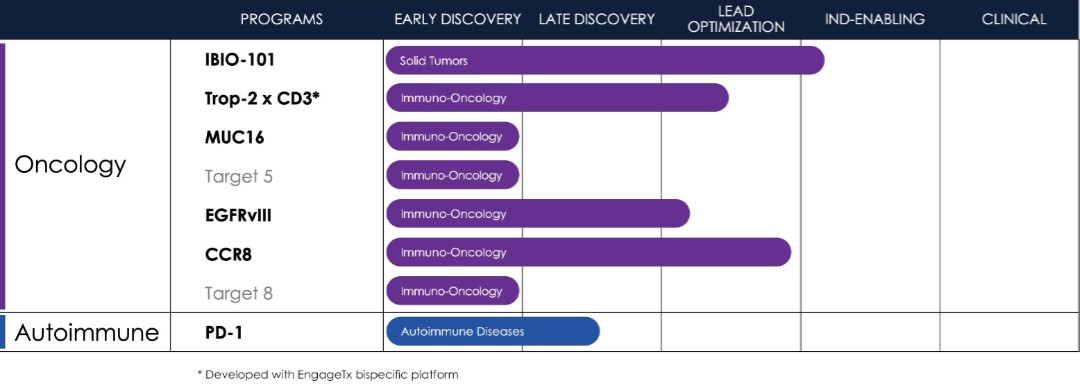

Pipeline

The Company is currently in the process of building and advancing its pipeline. The focus of the Company’s pipeline is primarily on immuno-oncology, with one program also dedicated to the immunology space. By leveraging its technology stack, the pipeline is geared towards hard-to-drug targets and molecules offering differentiation. To mitigate target risk and capitalize on the learnings of competitors, the Company’s programs are primarily adopting a fast follower strategy. This approach allows the Company to focus on targets that have to some extent been validated and learn from the advancements of those ahead in the field.

Therapeutics

Immuno-Oncology

IBIO-101

In August 2021, the Company signed a worldwide exclusive licensing agreement with RubrYc to develop and commercialize RTX-003 (now referred to as IBIO-101), an anti-CD25 monoclonal antibody [mAb]. In September 2022, the Company acquired exclusive ownership rights to IBIO-101. IBIO-101 is a second-generation anti-CD25 mAb that has demonstrated in preclinical models of disease the ability to bind and deplete immunosuppressive regulatory T [Treg] cells to inhibit the growth of solid tumors.

11