| ● | AI Epitope Steering Technology |

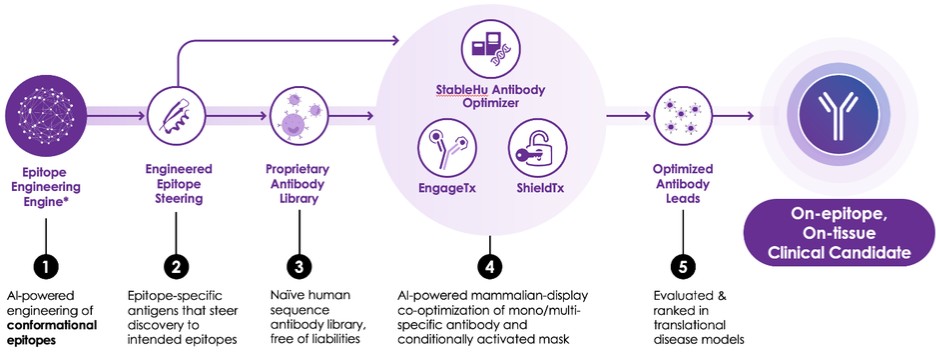

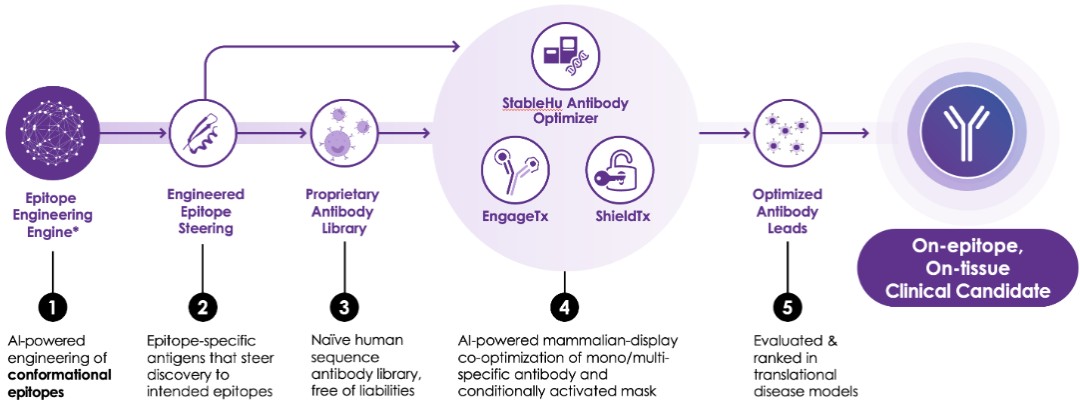

The Company’s epitope steering technology is designed to address these issues by guiding antibodies exclusively against the desired regions of the target protein. By focusing on these specific regions, the Company can overcome the limitations of traditional methods and significantly improve the efficiency and effectiveness of its antibody discovery process. The Company’s AI engine creates engineered epitopes, which are small embodiments of epitopes on the target protein. The engine is trained to match the epitope structure as closely as possible and refine the designs for greater stability and water solubility, which are critically important factors. The optimized engineered epitope is then used to identify antibodies from naïve or immunized libraries.

| ● | Naïve Human Antibody Library |

The fully human antibody library is built upon clinically validated, entirely human antibody frameworks. By leveraging public databases, the Company has extracted a diverse array of Complementarity-Determining Region (“CDR”) sequences. Subsequently, it has meticulously eliminated a range of sequence liabilities. Such careful curation process could potentially significantly reduce the development risk for antibodies identified from the Company’s library.

| ● | StableHuTM AI Antibody-Optimizing Technology |

The Company’s proprietary StableHu technology is instrumental in the optimization process. StableHu is an AI-powered tool designed to predict a library of antibodies with fully human CDR variants based on an input antibody. This input can range from an early, unoptimized molecule to an approved drug. The model has been trained utilizing a set of over 1 billion human antibodies, progressively masking known amino acids within CDRs until the algorithm could predict the correct human sequence.

While phage display libraries are often used in antibody optimization due to their vast diversity, they can increase developability risks such as low expression, instability, or aggregation of antibodies. Mammalian display libraries, on the other hand, offer significantly improved developability but reduced diversity due to the smaller library size they can handle. StableHu overcomes this limitation by utilizing a machine learning algorithm generating focused library diversity within the capacity of mammalian display.

Mammalian display is a technology that presents antibodies on the surface of mammalian cells, allowing for the direct screening and selection of antibodies in a mammalian cell environment. This approach is advantageous as antibodies that express well on the mammalian cells used in the display are more likely to express well in the production cell line. Moreover, single-cell sorting of antibody-displaying cells allows rapid selection of desired antibodies based on multiple dimensions, such as potency, selectivity, and cross-species selectivity.

10