S-3: Registration statement under Securities Act of 1933

Published on January 30, 2026

As filed with the Securities and Exchange Commission on January 30, 2026

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

IBIO, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 26-2797813 | |

|

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification Number) |

11750 Sorrento Valley Road, Suite 200

San Diego, California 92121

(979) 446-0027

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Dr. Martin Brenner

Chief Executive Officer and

Chief Scientific Officer

11750 Sorrento Valley Road, Suite 200

San Diego, California 92121

(979) 446-0027

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Leslie Marlow, Esq.

Melissa Murawsky, Esq.

Blank Rome LLP

1271 Avenue of the Americas

New York, New York 10020

Telephone: (212) 885-5000

Facsimile: (212) 885-5001

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer x | Smaller reporting company x |

| Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ¨

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The Selling Stockholders named in this prospectus may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and the Selling Stockholders named in this prospectus is not soliciting offers to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to completion, dated January 30, 2026

PRELIMINARY PROSPECTUS

11,061,738 Shares of Common Stock

This prospectus relates to the resale from time to time of up to 11,061,738 shares of common stock, par value $0.001 per share (the “Common Stock”) of iBio, Inc. (the “Company” or “iBio”), consisting of: (i) an aggregate of 1,408,481 shares (the “Common Shares”) of Common Stock, and (ii) up to 9,653,257 shares of Common Stock (the “Pre-Funded Warrant Shares” and, together with the Common Shares, the “Shares”) issuable upon the exercise of pre-funded warrants (the “Pre-Funded Warrants”) to purchase up to an aggregate of 9,653,257 shares of Common Stock, held by the Selling Stockholders identified in this prospectus (the “Selling Stockholders”), including their pledgees, assignees, donees, transferees or its respective successors-in-interest.

The Common Shares and the Pre-Funded Warrants held by the Selling Stockholders were sold to the Selling Stockholders by us in a private placement that was completed on January 13, 2026 pursuant to the terms of a securities purchase agreement, dated as of January 8, 2026 (the “Purchase Agreement”), by and between us and each of the Selling Stockholders. Pursuant to that private placement, we issued to the Selling Stockholders an aggregate of 1,408,481 Common Shares and Pre-Funded Warrants to purchase up to 9,653,257 shares of Common Stock. The Pre-Funded Warrants have an exercise price of $0.001 per share, were immediately exercisable upon issuance and will not expire until exercised in full. The private placement was effected pursuant to the exemptions provided in Section 4(a)(2) under the Securities Act of 1933, as amended, or the Securities Act, and Rule 506(b) of Regulation D promulgated thereunder.

The Selling Stockholders identified in this prospectus, or its pledgees, assignees, donees, transferees or their respective successors-in-interest, from time to time may offer and sell through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices held by them directly or through underwriters, agents or broker-dealers on terms to be determined at the time of sale, as described in more detail in this prospectus, the 1,408,481 Common Shares and up to 9,653,257 Pre-Funded Warrant Shares underlying the Pre-Funded Warrants held by them in one or more offerings under this prospectus, for their own account. We are not offering any Shares under this prospectus and will not receive any of the proceeds from the sale of the Shares by the Selling Stockholders. See “Plan of Distribution” beginning on page 12 of this prospectus for more information about how the Selling Stockholders may sell their respective Shares.

We are filing the registration statement on Form S-3, of which this prospectus forms a part, to fulfill our contractual obligations with the Selling Stockholders to provide for the resale by the Selling Stockholders of the Shares offered hereby. See “Selling Stockholders” beginning on page 9 of this prospectus for more information about the Selling Stockholders. The registration of the Shares to which this prospectus relates does not require the Selling Stockholders to sell any of their Shares.

We have agreed to bear all of the expenses in connection with the registration of the Shares pursuant to this prospectus. The Selling Stockholders will pay or assume all commissions, discounts, fees of underwriters, selling brokers or dealer managers and similar expenses, if any, attributable to their sales of the Shares.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

Our Common Stock is listed on The Nasdaq Capital Market (“Nasdaq”) under the symbol “IBIO.” On January 26, 2026, the last reported sale price of our Common Stock on Nasdaq was $2.15 per share.

An investment in shares of our Common Stock involves risks. See the “Risk Factors” beginning on page 5 and in our filings with the Securities and Exchange Commission.

i

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2026.

ii

TABLE OF CONTENTS

The registration statement containing this prospectus, including the exhibits to the registration statement, provides additional information about us and the Common Stock offered under this prospectus. The registration statement, including the exhibits, can be read on our website and the website of the Securities and Exchange Commission. See “Where You Can Find More Information.”

Information contained in, and that can be accessed through our web site, www.ibioinc.com., shall not be deemed to be part of this prospectus or incorporated herein by reference and should not be relied upon by any prospective investors for the purposes of determining whether to purchase the Common Stock offered hereunder.

Unless the context otherwise requires, the terms ““we,” “us,” “our,” “the Company,” “iBio” and “our business” refer to iBio, Inc. and “this offering” refers to the offering contemplated in this prospectus.

iii

This prospectus is part of a registration statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission (the “SEC”). Under this registration process, the Selling Stockholders may, from time to time, sell the securities offered by them described in this prospectus. We will not receive any proceeds from the sale by the Selling Stockholders of the Shares offered by them described in this prospectus.

This prospectus provides you with a general description of the Shares the Selling Stockholders may offer. A prospectus supplement and/or amendment may also add, update or change information contained in this prospectus. To the extent that any statement made in a prospectus supplement and/or amendment is inconsistent with statements made in this prospectus, the statements made in this prospectus will be deemed modified or superseded by those made in the prospectus supplement and/or amendment. You should read both this prospectus and any prospectus supplement and/or amendment together with the additional information described under the headings “Where You Can Find More Information and “Incorporation of Certain Information by Reference.”

Neither we nor the Selling Stockholders have authorized anyone to provide you with any information or to make any representations other than those contained, or incorporated by reference, in this prospectus, any post-effective amendment, or any applicable prospectus supplement or free-writing prospectus prepared by or on behalf of us or to which we have referred you. We and the Selling Stockholders take no responsibility for and can provide no assurance as to the reliability of any other information that others may give you. This prospectus is an offer to sell only the Shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should not assume that the information contained in this prospectus or any applicable prospectus supplement is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus or any applicable prospectus supplement is delivered, or securities are sold, on a later date.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find More Information.”

This prospectus and the information incorporated herein by reference include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus, any applicable prospectus supplement or any related free writing prospectus are the property of their respective owners.

iv

This summary highlights about us and selected information contained elsewhere in this prospectus and in the documents we incorporate by reference. This summary does not contain all of the information you should consider before investing in our Common Stock. You should read this entire prospectus and the documents incorporated by reference carefully, especially the risks of investing in our Common Stock discussed under and incorporated by reference in “Risk Factors” on page 5 of this prospectus, along with our consolidated financial statements and notes to those consolidated financial statements and the other information incorporated by reference in this prospectus, before making an investment decision.

The Company

We are a preclinical stage biotechnology company leveraging the power of Artificial Intelligence (“AI”) for the development of hard-to-drug precision antibodies in the cardiometabolic and obesity space. Our core mission is to harness the potential of AI and machine learning (“ML”) to unveil novel biologics which other scientists have been unable to develop. Through our innovative AI Drug Discovery Platform, it has been able to identify differentiated molecules aimed to address unmet needs by current approved interventional therapies.

We believe the future treatment for obesity lies not just in overall weight loss—but in targeted weight loss. Current interventional therapies, such as glucagon-like peptide-1 (“GLP-1”) receptor agonists have ushered in a breakthrough era, yet challenges remain: muscle loss, fat regain after treatment cessation, and long-term tolerability. We are developing second-generation therapies to meet these unmet needs, using the power of AI-guided antibody design and advanced screening technologies.

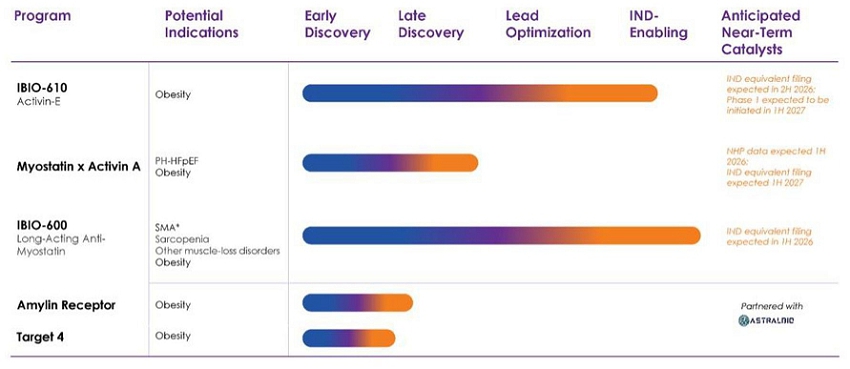

Our obesity strategy is built on three key principles. First, we aim to develop next-generation antibody therapeutics addressing limitations of currently approved treatments, offering options with a goal to preserve muscle mass, target fat selectively, and provide durable weight loss with improved tolerability. Second, we are focusing on targets with strong human validation, which we believe both helps reduce development risk and increase the likelihood of clinical success. Lastly, we are applying our integrated AI Drug Discovery Platform and deep scientific expertise to rapidly generate development-ready biologics, enabling it to move with speed and precision in a competitive and fast-evolving field. Our current therapeutics are all in preclinical development and we have not completed any clinical trials in humans for any therapeutic protein product candidate produced using our technology and there is a risk we will be unsuccessful in developing or commercializing any product candidates. With shifting our focus to IBIO-610, potentially the first antibody inhibiting Activin E, we anticipate the commencement of our first human clinical trials in early 2027.

Our discovery and development work is conducted at our San Diego research and development (“R&D”) laboratory space, where our AI and ML scientists and biopharma researchers operate side by side. This close integration of disciplines enables rapid iteration between in silico design and wet-lab validation, compressing the timeline from hypothesis to lead selection. With our robust platform, focused pre-clinical pipeline, and growing scientific and leadership team, we are building a durable and differentiated position in obesity therapeutics—one designed to outlast the first wave and define what comes next.

Our approach to the evolving needs in obesity treatment is facilitated on a fully integrated antibody discovery platform, designed from the ground up for precision, speed and developability. At the core of our AI Drug Discovery Platform is an AI-enabled epitope steering engine enabling us to precisely direct antibodies to functional hotspots on even the most challenging targets—often considered “undruggable.” When combined with our antibody optimization platform, which deeply integrates generative AI tools with mammalian display technology, we can progress from concept to development-ready antibody in as little as seven months.

Our strategic approach to fulfilling our mission is outlined as follows:

| · | Disease area strategy rests on three pillars: |

| · | Therapeutic Focus: Focusing on potential therapies complementing or following GLP-1 treatment, or that offer well-tolerated monotherapy alternatives for patients who cannot or will not stay on GLP-1s. |

| · | Target Selection: Pursuing targets with strong human validation — either genetic or pharmacologic. This reduces development risk and increases the likelihood of generating first- or best-in-class molecules. |

| · | Competitive Edge: Creating a competitive edge by tying together our platform capabilities, our team, and our pre-clinical pipeline. |

| · | Capital efficient business approach: Our strategic business approach is structured around the following pillars of value creation: |

| · | Developing and Advancing our In-House Pre-Clinical Programs Cost Effectively: Drug discovery and clinical advancement of our pre-clinical pipeline is crucial for our success. We continue to develop our pre-clinical pipeline for obesity and cardiometabolic diseases with the goal of becoming a clinical stage company. |

| · | Strategic Collaborations: We are leveraging our platform and pipeline to selectively form strategic partnerships. By tapping into our infrastructure, and expertise, partners have the potential to streamline timelines, reduce costs tied to biologic drug discovery applications and cell line process development, and expedite preclinical programs with efficiency. |

| · | Out-Licensing in Diverse Therapeutic Areas: In pursuit of adding value, we are exploring partnerships in diverse therapeutic domains such as immunology and inflammation, pain or vaccines. Our intention is to license the AI and screening tech stack, extending its benefits to our partners and amplifying its impact on other disease areas. This strategic approach enables us to capitalize on the value of our meticulously curated data while empowering collaborations and innovations, while at the same time allowing us to focus on our core therapeutic areas, obesity and cardiometabolic diseases. |

In essence, we believe we are sculpting a future where cutting-edge AI-driven biotechnology propels the discovery of intricate biologics, fostering partnerships, accelerating innovation, and propelling the advancement of science.

The Company’s current pre-clinical product candidate pipeline is set forth below.

Recent Developments

Private Placement

On January 8, 2026, we entered into the Purchase Agreement with the Selling Stockholders, pursuant to which we issued and sold to the Selling Stockholders, in a private placement priced at-the-market consistent with the rules of the Nasdaq Stock Market LLC (the “January 2026 Private Placement”) an aggregate of 1,408,481 Common Shares and, in lieu of Common Shares, Pre-Funded Warrants to purchase up to an aggregate of 9,653,257 Pre-Funded Warrant Shares. The purchase price per Common Share was $2.35. The purchase price per Pre-Funded Warrant was $2.349, which is equal to the purchase price per Common Share, minus the exercise price of $0.001 for each Pre-Funded Warrant. The January 2026 Private Placement closed on January 13, 2026 (the “Closing Date”) and we received aggregate gross proceeds of approximately $26 million, before deducting the placement agent commissions and estimated offering expenses payable by us.

The Pre-Funded Warrants are exercisable, at the exercise price of $0.001 per share, at any time after their date of issuance and will not expire until exercised in full. The exercise price and number of Pre-Funded Warrant Shares are subject to appropriate adjustment in the event of stock dividends, stock splits, reorganizations or similar events.

In connection with the January 2026 Private Placement, we entered into a registration rights agreement (the “Registration Rights Agreement”) with the Selling Stockholders, dated January 8, 2026, pursuant to which we agreed to file a registration statement (the “Resale Registration Statement”) registering for resale the Common Shares and the Pre-Funded Warrant Shares held by the Selling Stockholders (the “Registrable Securities”) as promptly as reasonably practicable and in any event no later than 60 days after the Closing Date, to use commercially reasonable efforts to cause the Resale Registration Statement to become effective at the earliest possible date but no later than the earlier of: (a) the 75th calendar day following the initial filing date of the Resale Registration Statement if the SEC notifies us that it will “review” the Resale Registration Statement and (b) the fifth business day after the date we are notified by the SEC that the Resale Registration Statement will not be “reviewed” or will not be subject to further review, and to use reasonable best efforts to keep the Resale Registration Statement continuously effective until the Selling Stockholders have resold all of the Registrable Securities covered thereby or the Registrable Securities may be resold pursuant to Rule 144 without restriction. We are filing the registration statement of which this prospectus forms a part in order to satisfy our obligations under the Registration Rights Agreement.

Leerink Partners LLC acted as the lead placement agent for the January 2026 Private Placement. LifeSci Capital LLC and Oppenheimer & Co. Inc. acted as co-placement agents in connection with the January 2026 Private Placement. We expect to use the net proceeds from the January 2026 Private Placement to advance our preclinical cardiometabolic programs, including IBIO-610, IBIO-600 and the myostatin and activin A bispecific programs, through key development milestones, as well as to continue to progress our other preclinical pipeline assets, and the balance, if any, to fund our working capital requirements and for other general corporate purposes.

| 2 |

General Corporate Information

We were incorporated under the laws of the State of Delaware on April 17, 2008, under the name iBioPharma, Inc. We engaged in a merger with InB:Biotechnologies, Inc., a New Jersey corporation on July 25, 2008, and changed our name to iBio, Inc. on August 10, 2009.

Our principal executive offices are located at 11750 Sorrento Valley Road, Suite 200, San Diego, California 92121 and our telephone number is (979) 446-0027. Our website address is www.ibioinc.com. The information contained on, or accessible through, our website does not constitute part of this Registration Statement. We have included our website address in this Registration Statement solely as an inactive textual reference.

| 3 |

This prospectus relates to the resale or other disposition from time to time by the Selling Stockholders identified in this prospectus of up to 11,061,738 Shares. None of the Shares registered hereby are being offered for sale by us.

| Shares of Common Stock outstanding prior to this offering | 32,540,942 shares of Common Stock |

| Shares of Common Stock offered by the Selling Stockholders | 11,061,738 Shares, consisting of 1,408,481 Common Shares and up to 9,653,257 Pre-Funded Warrant Shares |

| Terms of the offering | The Selling Stockholders and any of their pledgees, assignees and successors-in-interest will determine when and how they sell the Shares offered in this prospectus and may, from time to time, sell any or all of their shares covered hereby on Nasdaq or any other stock exchange, market or trading facility on which the shares are traded or in privately negotiated transactions. These sales may be at fixed or negotiated prices. See “Plan of Distribution.” |

| Common Stock outstanding after this offering | 42,194,199, including the 9,653,257 Pre-Funded Warrant Shares, which are assumed to be issued upon exercise of the Pre-Funded Warrants for purposes of the registration statement of which this prospectus forms a part |

| Use of Proceeds | The Selling Stockholders will receive all of the proceeds from the sale of any Shares sold by them pursuant to this prospectus. We will not receive any proceeds from the sale of the Shares by the Selling Stockholders. See “Use of Proceeds” in this prospectus. |

| Risk Factors | You should read the “Risk Factors” section of this prospectus and in the documents incorporated by reference in this prospectus for a discussion of factors to consider before deciding to purchase shares of our Common Stock. |

| Nasdaq symbol | Our Common Stock is listed on Nasdaq under the symbol “IBIO.” |

Except as otherwise indicated, the number of shares of Common Stock to be outstanding immediately after this offering is based on 32,540,942 shares of our Common Stock outstanding as of January 30, 2026, and excludes:

| · | 1,542,294 shares of Common Stock issuable upon the exercise of stock options outstanding at a weighted average exercise price of $4.64 per share; | |

| · | 126,030,667 shares of Common Stock issuable upon the exercise of warrants outstanding at a weighted average exercise price of $0.28 per share; and | |

| · | 1,532,086 shares of Common Stock reserved for future issuance under the 2023 Omnibus Equity Incentive Plan. |

| 4 |

Investing in our shares of Common Stock involves a high degree of risk. Before deciding whether to invest in our Common Stock, you should consider carefully the risks and uncertainties described below, together with all of the other information included or incorporated by reference in this prospectus, including the risks and uncertainties discussed under “Risk Factors” in our most recent Annual Report on Form 10-K and our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, which are incorporated by reference in this prospectus, as well as any updates thereto contained in subsequent filings with the SEC or any free writing prospectus, before deciding whether to purchase our Common Stock in this offering. All of these risk factors are incorporated herein in their entirety. The risks described below and incorporated by reference are material risks currently known, expected or reasonably foreseeable by us. However, the risks described below and incorporated by reference are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business, operating results, prospects or financial condition. If any of these risks actually materialize, our business, prospects, financial condition, and results of operations could be seriously harmed. This could cause the trading price of our Common Stock to decline, resulting in a loss of all or part of your investment. For more information, see the section entitled “Where You Can Find More Information.”

Risks Related to this Offering

Resales of our Common Stock in the public market by our stockholders as a result of this offering may cause the market price of our Common Stock to fall.

We are registering for resale shares of Common Stock. The price per share of our Common Stock in this offering may result in an immediate decrease in the market price of our Common Stock. This decrease may continue after the completion of this offering. Sales of substantial amounts of our Common Stock in the public market, or the perception that such sales might occur, could adversely affect the market price of our Common Stock. The issuance of new shares of Common Stock could result in resales of our Common Stock by our current stockholders concerned about the potential ownership dilution of their holdings. Furthermore, in the future, we may issue additional shares of Common Stock or other equity or debt securities exercisable or convertible into Common Stock. Any such issuance could result in substantial dilution to our existing stockholders and could cause our stock price to decline.

Investors who buy Shares at different times will likely pay different prices.

Investors who purchase Shares in this offering at different times will likely pay different prices, and so may experience different levels of dilution and different outcomes in their investment results. The Selling Stockholders may sell such Shares at different times and at different prices.

We have additional securities available for issuance, which, if issued, could adversely affect the rights of the holders of our Common Stock.

We may from time-to-time issue additional shares of Common Stock or preferred stock. In addition, as opportunities present themselves, we may enter into financing or similar arrangements in the future, including the issuance of debt securities, Common Stock or preferred stock. Any future issuances of Common Stock or securities convertible into Common Stock, would further dilute the percentage ownership of us held by holders of Common Stock. In addition, the issuance of certain securities, may be used as an “anti-takeover” device without further action on the part of our stockholders, and may adversely affect the holders of the Common Stock.

Because we will not declare cash dividends on our Common Stock in the foreseeable future, stockholders must rely on appreciation of the value of our Common Stock for any return on their investment.

We have never declared or paid cash dividends on our Common Stock. We currently anticipate that we will retain all available funds and future earnings, if any, to fund the development and growth of our business and will not declare or pay any cash dividends in the foreseeable future. As a result, only appreciation of the price of our Common Stock, if any, will provide a return to investors in this offering.

Stockholders may experience significant dilution as a result of potential future financings that we may effect.

Purchasers of the Shares in this offering, as well as our existing Stockholders, will experience significant dilution if we sell additional shares of Common Stock at prices significantly below the price at which they invested. In addition, we may issue additional shares of Common Stock or other equity securities exercisable for shares of Common Stock in connection with, among other things, future acquisitions of additional companies or assets, or under our equity incentive plans, in certain cases without shareholder approval. Our existing Stockholders may experience significant dilution if we issue shares of Common Stock in the future at prices below the price at which previous Stockholders invested.

| 5 |

Our issuance of additional shares of Common Stock or other common stock equivalents would have the following effects:

| ● | our existing Stockholders’ proportionate ownership interest in us will decrease; | |

| ● | the relative voting strength of each previously outstanding ordinary share may be diminished; and | |

| ● | the market price of our Common Stock may decline. |

Investors may experience significant dilution as a result of this offering.

The exercise of the Pre-Funded Warrants and the issuance of up to 9,653,257 Pre-Funded Warrant Shares underlying such Pre-Funded Warrants could cause our existing stockholders to experience dilution. The Selling Stockholders identified herein are selling from time to time up to 11,061,738 Shares, which constitutes approximately 34% of our issued and outstanding shares of Common Stock prior to the offering pursuant to this prospectus. Sales of such Shares could cause the market price of our Common Stock to decline. Purchasers of the Shares, as well as our existing stockholders, will experience dilution if the Selling Stockholders identified herein sell the Pre-Funded Warrant Shares upon the exercise of the Pre-Funded Warrants.

Future issuances or sales, or the potential for future issuances or sales, of our shares of Common Stock may cause the trading price of our Common Stock to decline and could impair our ability to raise capital through subsequent equity offerings.

We have issued a significant number of shares of Common Stock and we may do so in the future. Shares of Common Stock to be issued in future equity offerings could cause the market price of our Common Stock to decline and could have an adverse effect on our earnings per share if and when we become profitable. In addition, future sales of our shares of Common Stock or other securities in the public markets, or the perception that these sales may occur, could cause the market price of our Common Stock to decline, and could materially impair our ability to raise capital through the sale of additional securities.

The market price of our Common Stock could decline due to sales, or the announcements of proposed sales, of a large number of shares of Common Stock in the market, including sales of shares of Common Stock by our large Stockholders, or the perception that these sales could occur. These sales or the perception that these sales could occur could also depress the market price of our Common Stock and impair our ability to raise capital through the sale of additional equity securities or make it more difficult or impossible for us to sell equity securities in the future at a time and price that we deem appropriate. We cannot predict the effect that future sales of shares of Common Stock or other equity-related securities would have on the market price of our Common Stock.

Our Certificate of Incorporation, as amended, authorizes our board of directors to, among other things, issue additional shares of Common Stock or securities convertible or exchangeable into Common Stock, without stockholder approval. We may issue such additional shares of Common Stock or convertible securities to raise additional capital. The issuance of any additional shares of Common Stock or convertible securities could be substantially dilutive to our Stockholders. Moreover, to the extent that we issue restricted share units, stock appreciation rights, options or warrants to purchase our shares of Common Stock in the future and those stock appreciation rights, options or warrants are exercised, or as the restricted share units settle, our Stockholders may experience further dilution. Holders of our Common Stock have no preemptive rights that entitle such holders to purchase their pro rata share of any offering of shares or equivalent securities and, therefore, such sales or offerings could result in increased dilution to our stockholders.

An active trading market for our Common Stock may not be sustained.

Although our Common Stock is listed on Nasdaq, the market for our Common Stock has demonstrated varying levels of trading activity. Furthermore, the current level of trading may not be sustained in the future. The lack of an active market for our Common Stock may impair investors’ ability to sell their shares of Common Stock at the time they wish to sell them or at a price that they consider reasonable, may reduce the fair market value of their shares of Common Stock and may impair our ability to raise capital to continue to fund operations by selling shares and may impair our ability to utilize our shares as consideration in any licensing or other collaboration transactions with third parties.

Our share price may be subject to substantial volatility, and stockholders may lose all or a substantial part of their investment.

Our Common Stock is currently traded on Nasdaq. The market price for our Common Stock may not necessarily be a reliable indicator of our fair market value. The price at which our Common Stock trades may fluctuate as a result of a number of factors, including the number of shares available for sale in the market, quarterly variations in our operating results, actual or anticipated announcements of new releases by us or competitors, the gain or loss of sources of revenues, changes in the estimates of our operating performance, market conditions in our industry and the economy as a whole.

| 6 |

This prospectus, including the documents that we incorporate by reference herein, contain, and any applicable prospectus supplement or free writing prospectus including the documents we incorporate by reference therein may contain, forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements regarding our future financial condition, business strategy and plans and objectives of management for future operations. Forward-looking statements include all statements that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “believe,” “will,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “might,” “approximately,” “expect,” “predict,” “could,” “potentially” or the negative of these terms or other similar expressions. Forward-looking statements appear in a number of places throughout this prospectus and include statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things:

| · | our plans to develop and commercialize our product candidates; | |

| · | the timing of our planned clinical trials for our product candidates; | |

| · | the timing of and our ability to obtain and maintain regulatory approvals for our product candidates; | |

| · | our commercialization, marketing and manufacturing capabilities and strategy; | |

| · | Results of and our expectations regarding clinical trial data; | |

| · | our intellectual property position; | |

| · | our competitive position and the development of and projections relating to our competitors or our industry; | |

| · | our ability to identify, recruit and retain key personnel; | |

| · | the impact of laws and regulations; | |

| · | our plans to identify additional product candidates with significant commercial potential that are consistent with our commercial objectives; | |

| · | our estimates regarding future revenue, expenses and needs for additional financing; and | |

| · | the industry in which we operate and the trends that may affect the industry or us. |

Discussions containing these forward-looking statements may be found, among other places, in the sections entitled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in the documents incorporated by reference herein, including our most recent Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q, as well as any amendments thereto.

These forward-looking statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that could cause our actual results, levels of activity, performance or achievement to differ materially from those expressed or implied by these forward-looking statements. We discuss in greater detail, and incorporate by reference into this prospectus in their entirety, many of these risks and uncertainties under the heading “Risk Factors” contained in the documents incorporated by reference herein. These forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements are qualified in their entirety by this cautionary statement.

| 7 |

The Selling Stockholders will receive all of the proceeds of the sale of Shares offered from time to time pursuant to this prospectus. Accordingly, we will not receive any proceeds from the sale of the Shares that may be sold from time to time pursuant to this prospectus. See “Plan of Distribution” elsewhere in this prospectus for more information.

| 8 |

This prospectus relates to the sale of up to 11,061,738 Shares that the Selling Stockholders may sell in one or more offerings, consisting of 1,408,481 Common Shares and up to 9,653,257 Pre-Funded Warrant Shares issuable upon exercise of some or all of Pre-Funded Warrants that the Selling Stockholders received from us in the January 2026 Private Placement described above. The table below sets forth information about the maximum number of Shares that may be offered from time to time by the Selling Stockholders under this prospectus. The Selling Stockholders identified below may currently hold or acquire shares of Common Stock in addition to those registered hereby. In addition, the Selling Stockholders identified below may sell, transfer, assign or otherwise dispose of some or all of their Shares registered hereunder in private placement transactions exempt from or not subject to the registration requirements of the Securities Act. We may amend or supplement this prospectus from time to time in the future to update or change the Selling Stockholders list and the securities that may be resold.

The following table sets forth, to our knowledge, information concerning the beneficial ownership of shares of our Common Stock by the Selling Stockholders as of January 30, 2026. The information in the table below with respect to the Selling Stockholders has been obtained from the Selling Stockholders and we have prepared the following table based on the information supplied to us by the Selling Stockholders on or prior to January 30, 2026. When we refer to the “Selling Stockholders” in this prospectus, or, if required, a post-effective amendment to the registration statement of which this prospectus is a part, we mean the Selling Stockholders listed in the table below as offering shares of Common Stock, as well as their respective pledgees, assignees, donees, transferees or successors-in-interest. Throughout this prospectus, when we refer to the Shares being registered on behalf of the Selling Stockholders, we are referring to the Common Shares issued to the Selling Stockholders pursuant to the Purchase Agreement and the Pre-Funded Warrant Shares issuable upon exercise of the Pre-Funded Warrants issued to the Selling Stockholders pursuant to the Purchase Agreement. The Selling Stockholders may sell all, some or none of the Shares subject to this prospectus. See “Plan of Distribution” below as it may be supplemented and amended from time to time.

The Shares reported under the column “Shares of Common Stock Beneficially Owned Prior to the Offering” includes all shares of our Common Stock beneficially owned by the Selling Stockholders as of January 30, 2026, without regard to any limitations on exercises. The Shares reported under the column “Maximum Number of Shares of Being Offered for Resale” consist of the maximum number of Shares being offered by this prospectus by the Selling Stockholders, also without regard to any limitations on exercises. The numbers and percentages under the column “Shares of Common Stock To Be Owned Immediately Following the Sale of the Shares Offered For Resale” are based on 42,194,199 shares of Common Stock outstanding, assuming the issuance of 9,653,257 Pre-Funded Warrant Shares upon the exercise of the Pre-Funded Warrants.

This prospectus generally covers the resale of all of the Common Shares and the maximum number of Pre-Funded Warrant Shares issuable upon exercise of the Pre-Funded Warrants, determined as if the outstanding Pre-Funded Warrants were exercised in full as of the trading day immediately preceding the date this registration statement was initially filed with the SEC, each as of the trading day immediately preceding the applicable date of determination and all subject to adjustment as provided in the Registration Rights Agreement, without regard to any limitations on the exercise of the Pre-Funded Warrants. The number and percentage set forth under the fourth and fifth columns titled “Shares of Common Stock To Be Beneficially Owned Immediately Following the Sale of the Shares Offered for Resale” assume the sale of all of the Shares offered by the Selling Stockholders pursuant to this prospectus and gives effect to all applicable beneficial ownership limitations, if any.

Under the terms of the Pre-Funded Warrants, the Selling Stockholders may not exercise the Pre-Funded Warrants to the extent such exercise would cause such Selling Stockholders, together with their affiliates and attribution parties, to beneficially own a number of shares of Common Stock that would exceed 4.99% (or, at the option of each Selling Stockholder, 9.99%), of our then outstanding Common Stock following such exercise, excluding for purposes of such determination shares of Common Stock issuable upon exercise of such warrants which have not been exercised. The Selling Stockholders may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

Certain of the Selling Stockholders have purchased our securities in our underwritten public offering consummated in August 2025 (the “August 2025 Public Offering”) in addition to participating in the January 2026 Private Placement. See “Relationships with Selling Stockholders” below. In addition, to our knowledge, none of the Selling Stockholders is an affiliate of a broker-dealer and there are no participating broker-dealers. To the extent a Selling Stockholder would be an affiliate of a broker-dealer, or if there would be any participating broker-dealer, such Selling Stockholder and/or participating broker-dealer would be deemed to be an “underwriter” within the meaning of the Securities Act, and any commissions or discounts given to any such Selling Stockholder or broker-dealer could be regarded as underwriting commissions or discounts under the Securities Act.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to our Common Stock. Generally, a person “beneficially owns” shares of our Common Stock if the person has or shares with others the right to vote those shares or to dispose of them, or if the person has the right to acquire voting or disposition rights within 60 days. The inclusion of any shares in this table does not constitute an admission of beneficial ownership for the Selling Stockholders named below.

Relationships with Selling Stockholders

To our knowledge, except for the Selling Stockholders’ participation in the January 2026 Private Placement and as set forth below, the Selling Stockholders do not have, and have not had within the past three years, any position, office or other material relationship with us or any of our predecessors or affiliates.

Cormorant Global Healthcare, Point72 Associates, LLC, Atlas Private Holdings (Cayman) Ltd. and Affinity Healthcare Fund, LP were investors in our August 2025 Public Offering and acquired pre-funded warrants (the “August 2025 PFW”) to purchase shares of our Common Stock and accompanying Series G warrants (the “Series G Warrants”) to purchase: (i) shares of Common Stock (or, pre-funded warrants in lieu thereof) and (ii) Series H warrants to purchase shares of Common Stock (or pre-funded warrants in lieu thereof). Each Series G Warrant is exercisable to purchase (i) one-half of a share of Common Stock (or a pre-funded warrant to purchase one-half of a share of Common Stock in lieu thereof) and (ii) a Series H warrant to purchase one-half of a share of Common Stock (or a pre-funded warrant to purchase one-half of a share of Common Stock in lieu thereof ). The combined public offering price of one August 2025 PFW and accompanying Series G Warrant was $0.699.

| 9 |

| Shares of Common Stock | ||||||||||||||||

| Shares of | Maximum | To Be Beneficially Owned | ||||||||||||||

| Common Stock | Number | Immediately Following | ||||||||||||||

| Beneficially | of Shares | the Sale of the Shares | ||||||||||||||

| Owned Prior | Being Offered | Offered for Resale | ||||||||||||||

| Selling Stockholders | to the Offering | for Resale | Number | Percentage | ||||||||||||

| Frazier Life Sciences Public Fund, L.P. (1) | 10,467,728 | 7,557,258 | 1,953,467 | 4.63 | % | |||||||||||

| Frazier Life Sciences XI, L.P. (1) | 70,688 | 70,668 | 0 | – | ||||||||||||

| Frazier Life Sciences XII, L.P. (1) | 886,335 | 886,335 | 0 | – | ||||||||||||

| Cormorant Global Healthcare Master Fund, LP (2) | 11,586,340 | 876,340 | 4,683,035 | 9.99 | % | |||||||||||

| Point72 Associates, LLC (3) | 11,586,340 | 876,340 | 4,683,035 | 9.99 | % | |||||||||||

| Atlas Private Holdings (Cayman) Ltd. (4) | 532,141 | 532,141 | 0 | – | ||||||||||||

| Affinity Healthcare Fund, LP (5) | 5,729,856 | 262,656 | 4,432,514 | 9.99 | % | |||||||||||

* Represents less than one percent (1%) of the outstanding Common Stock

| (1) |

The Shares reported under “Maximum Number of Shares Being Offered for Resale” for Frazier Life Sciences Public Fund, L.P.consist of 7,557,258 Pre-Funded Warrant Shares issuable upon exercise of Pre-Funded Warrants held by Frazier Life Sciences Public Fund, L.P. The Shares reported under “Maximum Number of Shares Being Offered for Resale” and “Shares of Common Stock Beneficially Owned Prior to the Offering” for Frazier Life Sciences XI, L.P. consist of 70,668 Pre-Funded Warrant Shares issuable upon exercise of Pre-Funded Warrants held by Frazier Life Sciences XI, L.P. The Shares reported under “Maximum Number of Shares Being Offered for Resale” and “Shares of Common Stock Beneficially Owned Prior to the Offering” for Frazier Life Sciences XII, L.P. consist of 886,335 Pre-Funded Warrant Shares issuable upon exercise of Pre-Funded Warrants held by Frazier Life Sciences XII, L.P. The Pre-Funded Warrants are subject to a beneficial ownership limitation of 9.99%, which limitation restricts Frazier Life Sciences Public Fund, L.P., Frazier Life Sciences XI, L.P., and Frazier Life Sciences XII, L.P. from exercising that portion of the Pre-Funded Warrants that would result in such entities and their affiliates owning, after exercise, a number of shares of Common Stock in excess of the beneficial ownership limitation. The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” for Frazier Life Sciences Public Fund, L.P. consist of the aforementioned 7,557,258 Pre-Funded Warrant Shares issuable upon exercise of Pre-Funded Warrants held by Frazier Life Sciences Public Fund, L.P., as well as 1,953,467 shares of Common Stock owned by Frazier Life Sciences Public Fund, L.P. The shares reported under “Shares of Common Stock To Be Beneficially Owned Immediately Following the Sale of the Shares Offered for Resale” for Frazier Life Sciences Public Fund, L.P. consist of 1,953,467 shares of Common Stock owned by Frazier Life Sciences Public Fund, L.P.

FHMLSP, L.P. is the general partner of Frazier Life Sciences Public Fund, L.P. and the general partner of FHMLSP, L.P. is FHMLSP, L.L.C., which is managed by an investment committee of four that acts by majority vote. Accordingly, no members of such committee are attributed beneficial ownership of the securities directly held by Frazier Life Sciences Public Fund, L.P.

FHMLS XI, L.P. is the general partner of Frazier Life Sciences XI, L.P. and the general partner of FHMLS XI, L.P. is FHMLS XI, L.L.C., which is managed by an investment committee of three that acts by majority vote. Accordingly, no members of such committee are attributed beneficial ownership of the securities directly held by Frazier Life Sciences XI, L.P.

FHMLS XII, L.P. is the general partner of Frazier Life Sciences XII, L.P. and the general partner of FHMLS XII, L.P. is FHMLS XII, L.L.C., which is managed by an investment committee of three that acts by majority vote. Accordingly, no members of such committee are attributed beneficial ownership of the securities directly held by Frazier Life Sciences XII, L.P.

The address of Frazier Life Sciences Public Fund, L.P., Frazier Life Sciences XI, L.P., and Frazier Life Sciences XII, L.P. is c/o Frazier Life Sciences Management, L.P., 1001 Page Mill Rd, Building 4, Suite B, Palo Alto, CA 94304.

| |

| (2) | The Shares reported under “Maximum Number of Shares Being Offered for Resale” consist of 876,340 Pre-Funded Warrant Shares issuable upon exercise of Pre-Funded Warrants held by Cormorant Global Healthcare Master Fund, LP. The Pre-Funded Warrants are subject to a beneficial ownership limitation of 9.99%, which limitation restricts Cormorant Global Healthcare Master Fund, LP from exercising that portion of the Pre-Funded Warrants that would result in Cormorant Global Healthcare Master Fund, LP and its affiliates owning, after exercise, a number of shares of Common Stock in excess of the beneficial ownership limitation. The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” include the aforementioned 876,340 Pre-Funded Warrant Shares, as well as: (i) 7,140,000 shares of Common Stock issuable upon the exercise of August 2025 PFWs, and (ii) 3,570,000 shares of Common Stock issuable upon the exercise of Series G Warrants, all of which are held by Cormorant Global Healthcare Master Fund, LP, which does not give effect to limitations on exercisability of the Pre-Funded Warrants, the August 2025 PFWs or the Series G Warrants. The shares reported under “Shares of Common Stock To Be Beneficially Owned Immediately Following the Sale of the Shares Offered for Resale” consists of an aggregate of 4,683,035 shares of Common Stock issuable upon the exercise of August 2025 PFWs and Series G Warrants, but such number of shares does not include an aggregate of 6,026,965 shares of Common Stock issuable upon exercise of August 2025 PFWs and Series G Warrants because Cormorant Global Healthcare Master Fund, LP is prohibited from exercising such August 2025 PFWs and Series G Warrants, if, as a result of such exercise, it and its affiliates would beneficially own more than 9.99% of the total number of shares of Common Stock then issued and outstanding immediately after giving effect to the exercise. Cormorant Global Healthcare GP, LLC serves as the general partner of Cormorant Global Healthcare Master Fund, LP. Bihua Chen serves as the managing member of Cormorant Global Healthcare GP, LLC. Each of Cormorant Global Healthcare GP, LLC and Ms. Chen disclaim beneficial ownership of such shares except to the extent of any pecuniary interest therein. Ms. Chen, as the managing member of Cormorant Global Healthcare GP, LLC, has sole voting and investment control over the shares of Common Stock held by Cormorant Global Healthcare Master Fund, LP. The address for Cormorant Global Healthcare Master Fund, LP is 200 Clarendon Street, 52nd Floor, Boston, MA 02116. |

| (3) | The Shares reported under “Maximum Number of Shares Being Offered for Resale” consist of 876,340 Common Shares held by Point72 Associates, LLC. The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” include the aforementioned 876,340 Common Shares, as well as (i) 7,140,000 shares of Common Stock issuable upon the exercise of August 2025 PFWs, and (ii) 3,570,000 shares of Common Stock issuable upon the exercise of Series G Warrants, all of which are held by Point72 Associates, LLC, which does not give effect to limitations on exercisability of the August 2025 PFWs or the Series G Warrants. The shares reported under “Shares of Common Stock To Be Beneficially Owned Immediately Following the Sale of the Shares Offered for Resale” consists of an aggregate of 4,683,035 shares of Common Stock issuable upon the exercise of August 2025 PFWs and Series G Warrants, but such number of shares does not include an aggregate of 6,026,965 shares of Common Stock issuable upon exercise of August 2025 PFWs and Series G Warrants because Point72 Associates, LLC is prohibited from exercising such August 2025 PFWs and Series G Warrants, if, as a result of such exercise, it and its affiliates would beneficially own more than 9.99% of the total number of shares of Common Stock then issued and outstanding immediately after giving effect to the exercise. Pursuant to an investment management agreement, Point72 Asset Management, L.P. maintains voting and investment power with respect to the securities held by certain investment funds it manages, including Point72 Associates, LLC. Point72 Capital Advisors, Inc. is the general partner of Point72 Asset Management, L.P. Mr. Steven A. Cohen controls each of Point72 Asset Management, L.P. and Point72 Capital Advisors, Inc. By reason of the provisions of Rule 13d-3 of the Exchange Act, each of Point72 Asset Management, L.P., Point72 Capital Advisors, Inc., and Mr. Cohen may be deemed to beneficially own the securities held by Point72 Associates, LLC reflected herein. Each of Point72 Asset Management, L.P., Point72 Capital Advisors, Inc., and Mr. Cohen disclaims beneficial ownership of any such securities. The address of Point72 Associates, LLC is c/o Point72 Asset Management, 72 Cummings Point Road, Stamford, CT 06902. |

| 10 |

| (4) |

The Shares reported under “Maximum Number of Shares Being Offered for Resale” and “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of 532,141 Common Shares held by Atlas Private Holdings (Cayman) Ltd. Does not include: (i) 1,221,063 shares of Common Stock; (ii) 16,500,000 shares of Common Stock issuable upon exercise of August 2025 PFWs, and (iii) 8,250,000 shares of Common Stock issuable upon the exercise of Series G Warrants, all of which are held by Atlas Diversified Master Fund, Ltd., which is an affiliate of, but such securities are not beneficially owned by, Atlas Private Holdings (Cayman) Ltd. Atlas Diversified Master Fund, Ltd. is prohibited from exercising such August 2025 PFWs and Series G Warrants, if, as a result of such exercise, it and its affiliates would beneficially own more than 4.99% of the total number of shares of Common Stock then issued and outstanding immediately after giving effect to the exercise. Pursuant to an investment management agreement, Balyasny Asset Management L.P. (the “Investment Advisor”), of which Dmitry Balyasny is the ultimate beneficial owner, provides investment management services to Atlas Private Holdings (Cayman) Ltd. and Atlas Diversified Master Fund, Ltd. Mr. Balyasny maintains sole voting and investment power with respect to the securities held by Atlas Private Holdings (Cayman) Ltd. and Atlas Diversified Master Fund, Ltd., as the beneficial owner of the Investment Advisor. The address for Atlas Private Holdings (Cayman) Ltd. is 444 West Lake Street, 50th Floor, Chicago, IL 60606.

| |

| (5) | The Shares reported under “Maximum Number of Shares Being Offered for Resale” consist of 262,656 Pre-Funded Warrant Shares issuable upon exercise of Pre-Funded Warrants held by Affinity Healthcare Fund, LP. The Pre-Funded Warrants are subject to a beneficial ownership limitation of 9.99%, which limitation restricts Affinity Healthcare Fund, LP from exercising that portion of the Pre-Funded Warrants that would result in Affinity Healthcare Fund, LP and its affiliates owning, after exercise, a number of shares of Common Stock in excess of the beneficial ownership limitation. The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” include the aforementioned 262,656 Pre-Funded Warrant Shares, as well as (i) 2,257,200 shares of Common Stock, (ii) 2,140,000 shares of Common Stock issuable upon exercise of August 2025 PFWs, and (iii) 1,070,000 shares of Common Stock issuable upon the exercise of Series G Warrants, all of which are held by Affinity Healthcare Fund, LP, which does not give effect to limitations on exercisability of the Pre-Funded Warrants, August 2025 PFWs or Series G Warrants. The shares reported under “Shares of Common Stock To Be Beneficially Owned Immediately Following the Sale of the Shares Offered for Resale” consist of: (i) 2,257,200 shares of Common Stock, and (ii) an aggregate of 2,175,314 shares of Common Stock issuable upon the exercise of August 2025 PFWs and Series G Warrants, but such number of shares does not include 1,034,686 shares of Common Stock issuable upon exercise of August 2025 PFWs and Series G Warrants because Affinity Healthcare Fund, LP is prohibited from exercising such August 2025 PFWs and Series G Warrants, if, as a result of such exercise, it and its affiliates would beneficially own more than 9.99% of the total number of shares of Common Stock then issued and outstanding immediately after giving effect to the exercise. Affinity Asset Advisors, LLC (the “Advisor”) is the investment manager of Affinity Healthcare Fund, LP and exercises investment discretion with regard to the securities reported herein. Michael Cho is the managing partner of the Advisor. The Advisor and Mr. Cho may be deemed to be the beneficial owners of the securities reported herein owned by Affinity Healthcare Fund, LP by virtue of their positions as investment manager of Affinity Healthcare Fund, LP and managing partner of the Advisor respectively. Affinity Healthcare Fund, LP and the Advisor have the shared power to vote or to direct the vote and to dispose or direct the disposition of the securities reported herein. The address for Affinity Healthcare Fund, LP is 450 Park Avenue, Suite 1403 New York, NY 10022. |

| 11 |

The Selling Stockholders, which as used herein includes donees, pledgees, transferees or other successors in-interest selling shares of Common Stock or interests in shares of common stock received after the date of this prospectus from a Selling Stockholder as a gift, pledge, partnership distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of Common Stock or interests in shares of Common Stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The Selling Stockholders may use any one or more of the following methods when disposing of shares or interests therein:

| · | distributions to members, partners, stockholders or other equityholders of the Selling Stockholders; | |

| · | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; | |

| · | block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction; | |

| · | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; | |

| · | an exchange distribution in accordance with the rules of the applicable exchange; | |

| · | privately negotiated transactions; | |

| · | short sales and settlement of short sales entered into after the effective date of the registration statement of which this prospectus is a part; | |

| · | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; | |

| · | broker-dealers may agree with the Selling Stockholders to sell a specified number of such | |

| · | shares at a stipulated price per share; | |

| · | a combination of any such methods of sale; and | |

| · | any other method permitted pursuant to applicable law. |

The Selling Stockholders may, from time to time, pledge or grant a security interest in some or all of the shares of Common Stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of Common Stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act, amending the list of Selling Stockholders to include the pledgee, transferee or other successors in interest as Selling Stockholders under this prospectus. The Selling Stockholders also may transfer the shares of Common Stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the Selling Stockholders for purposes of this prospectus.

In connection with the sale of our Common Stock or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the Common Stock in the course of hedging the positions they assume. The Selling Stockholders may also sell shares of our Common Stock short and deliver these securities to close out their short positions, or loan or pledge the Common Stock to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the Selling Stockholders from the sale of the Common Stock offered by them will be the purchase price of the Common Stock less discounts or commissions, if any. Each of the Selling Stockholders reserves the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of Common Stock to be made directly or through agents. We will not receive any of the proceeds from this offering. Upon any exercise of the Pre-Funded Warrants by payment of cash, however, we will receive the exercise price of the Pre-Funded Warrants.

The Selling Stockholders also may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided that they meet the criteria and conform to the requirements of that rule, or another available exemption from the registration requirements under the Securities Act.

The Selling Stockholders and any underwriters, broker-dealers or agents that participate in the sale of the Common Stock or interests therein may be “underwriters” within the meaning of Section 2(a)(11) of the Securities Act (it being understood that the Selling Stockholders shall not be deemed to be underwriters solely as a result of their participation in this offering). Any discounts, commissions, concessions or profit they earn on any resale of the shares may be underwriting discounts and commissions under the Securities Act. Selling stockholders who are “underwriters” within the meaning of Section 2(a)(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act.

To the extent required, the shares of our Common Stock to be sold, the names of the Selling Stockholders, the respective purchase prices and public offering prices, the names of any agent, dealer or underwriter, and any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

In order to comply with the securities laws of some states, if applicable, the Common Stock may be sold in these jurisdictions only through registered or licensed brokers or dealers. In addition, in some states the Common Stock may not be sold unless it has been registered or qualified for sale or an exemption from registration or qualification requirements is available and is complied with.

We have advised the Selling Stockholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities of the Selling Stockholders and their affiliates. In addition, to the extent applicable, we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the Selling Stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The Selling Stockholders may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

We have agreed to indemnify the Selling Stockholders against liabilities, including liabilities under the Securities Act and state securities laws, relating to the registration of the shares offered by this prospectus.

We have agreed with the Selling Stockholders to use commercially reasonable efforts to cause the registration statement of which this prospectus constitutes a part to become effective and to remain continuously effective until the earlier of: (i) the date on which the Selling Stockholders shall have resold or otherwise disposed of all the Shares covered by this prospectus and (ii) the date on which the Shares covered by this prospectus no longer constitute “Registrable Securities” as such term is defined in the Registration Rights Agreement, such that they may be resold by the Selling Stockholders without registration and without regard to any volume or manner-of-sale limitations and without current public information pursuant to Rule 144 under the Securities Act or any other rule of similar effect.

| 12 |

The validity of the Shares offered hereby will be passed upon for us by Blank Rome LLP.

The consolidated financial statements of iBio Inc. and Subsidiaries for the two years ended June 30, 2025 have been audited by Grassi & Co., CPAs, P.C., independent registered public accounting firm, as set forth in their report thereon appearing in iBio Inc. and Subsidiaries Annual Report on Form 10-K for the year ended June 30, 2025, and incorporated by reference herein. Such consolidated financial statements are incorporated by reference herein in reliance upon such report, given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of a registration statement we filed with the SEC. This prospectus does not contain all of the information set forth in the registration statement and the exhibits to the registration statement. For further information with respect to us and the Shares being offered under this prospectus, we refer you to the registration statement and the exhibits and schedules filed as a part of the registration statement. Neither we, the Selling Stockholders nor any agent, underwriter or dealer has authorized any person to provide you with different information. Neither we nor the Selling Stockholders are making an offer of these securities in any state where the offer is not permitted. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front page of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities offered by this prospectus.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public at the SEC’s website at www.sec.gov. Additional information about iBio, Inc. is contained at our website, www.ibioinc.com. Information on our website is not incorporated by reference into this prospectus. We make available on our website our SEC filings as soon as reasonably practicable after those reports are filed with the SEC.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The SEC file number for the documents incorporated by reference in this prospectus is 001-35023. The documents incorporated by reference into this prospectus contain important information that you should read about us.

The following documents are incorporated by reference into this prospectus:

| · | Our Annual Report on Form 10-K for the fiscal year ended June 30, 2025 filed with the SEC on September 5, 2025; | |

| · | Our Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2025, filed with the SEC on November 12, 2025, as amended November 17, 2025; | |

| · | Our Current Reports on Form 8-K filed with the SEC on August 1, 2025, August 18, 2025 (other than information furnished under Item 2.02), August 21, 2025, (other than information furnished under Item 7.01 and exhibits related thereto), October 30, 2025 (other than information furnished under Item 7.01 and exhibits related thereto), November 4, 2025, November 17, 2025 (other than information furnished under Item 7.01 and exhibits related thereto), November 21, 2025 and January 12, 2026; and | |

| · | The description of our Common Stock set forth in: (i) our registration statement on Form 8-A filed with the SEC on December 29, 2010, including any amendments thereto or reports filed for the purposes of updating this description, and (ii) Exhibit 4.2 to our Annual Report on Form 10-K for the fiscal year ended June 30, 2025 filed with the SEC on September 5, 2025. |

We also incorporate by reference into this prospectus all documents (other than portions of those documents not deemed filed) that are filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (Commission File Number 001-35023) (i) on or after the date of the initial filing of the registration statement of which this prospectus forms a part and prior to effectiveness of such registration statement, and (ii) on or after the date of this prospectus but prior to the termination of the offering (i.e., until the earlier of the date on which all of the securities registered hereunder have been sold or the registration statement of which this prospectus forms a part has been withdrawn). These documents include periodic reports, such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as proxy statements.

| 13 |

We will provide to each person, including any beneficial owner, to whom a prospectus is delivered, without charge upon written or oral request, a copy of any or all of the documents that are incorporated by reference into this prospectus but not delivered with this prospectus, including exhibits that are specifically incorporated by reference into such documents. You can request a copy of these filings, at no cost, by writing or telephoning us at the following address or telephone number:

iBio, Inc.

11750 Sorrento Valley Road, Suite 200

San Diego, California 92121

(979) 446-0027

Any statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes that statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

| 14 |

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth the expenses in connection with this registration statement. All of such expenses are estimates, other than the filing fee payable to the Securities and Exchange Commission.

| Amount | ||||

| SEC registration fee | $ | 3,606 | ||

| Legal fees and expenses | 40,000 | |||

| Accounting fees and expenses | 10,000 | |||

| Miscellaneous | 6,394 | |||

| Total: | $ | 60,000 | ||

Item 15. Indemnification of Directors and Officers.

Section 145 of the Delaware General Corporation Law (the “DGCL”), empowers a corporation to indemnify its directors and officers and to purchase insurance with respect to liability arising out of their capacity or status as directors and officers, provided that the person acted in good faith and in a manner the person reasonably believed to be in our best interests, and, with respect to any criminal action, had no reasonable cause to believe the person’s actions were unlawful. The DGCL further provides that the indemnification permitted thereunder shall not be deemed exclusive of any other rights to which the directors and officers may be entitled under the corporation’s bylaws, any agreement, a vote of stockholders or otherwise.